Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Risk and Audit Subcommittee MEETING

|

Meeting Date:

|

Monday,

12 February 2018

|

|

Time:

|

10.00am

|

|

Venue:

|

Landmarks

Room

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Subcommittee Members

|

Chair: Mr J

Nichols

Mayor Hazlehurst

Deputy Mayor Kerr

Councillors

Nixon and Travers

(Quorum=3)

|

|

Officer

Responsible

|

Chief Financial Officer, Bruce Allan

|

|

Committee

Secretary

|

Christine Hilton (Ext 5633)

|

Risk and Audit Subcommittee – Terms of Reference

A subcommittee of

the Finance and Monitoring Committee

Fields of

Activity

The Risk and Audit Subcommittee is responsible for

assisting Council in its general overview of financial management, risk

management and internal control systems that provide:

·

Effective management of

potential risks, opportunities and adverse effects; and

·

Reasonable assurance as to

the integrity and reliability of the financial reporting of Council; and

·

Monitoring of the Council’s

requirements under the Treasury Policy

Membership

Chairman

appointed by the Council

The Mayor

Deputy Mayor

2

Councillors

An

independent member appointed by the Council.

Quorum – 3 members

DELEGATED

POWERS

Authority to consider and make recommendations on all matters detailed

in the Fields of Activity and such other matters referred to it by the Council

or the Finance and Monitoring Committee

The

subcommittee reports to the Finance and Monitoring Committee.

HASTINGS DISTRICT COUNCIL

Risk and Audit Subcommittee MEETING

Monday, 12 February 2018

|

VENUE:

|

Landmarks Room

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

10.00am

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the Chief Executive or Executive Advisor/Manager:

Office of the Chief Executive (preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Risk and Audit Subcommittee Meeting held Tuesday 28 November 2017.

(Previously circulated)

4. Treasury Activity and Funding 5

5. 2018-28 Long Term Plan 15

6. Enterprise Risk Management

Update 23

7. General Update Report and

Status of Actions 37

8. Additional

Business Items

9. Extraordinary

Business Items

1.

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 12 February

2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Treasury

Activity and Funding

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on treasury activity and

funding issues.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost effective to households and businesses. Good quality

infrastructure means infrastructure, services and performance that are

efficient and effective and appropriate to present and anticipated future

requirements.

1.3 This

report concludes by recommending that the report on treasury activity and

funding is received.

2.0 BACKGROUND

2.1 The

Hastings District Council has a Treasury Policy which forms part of the 2015-25

Long Term Plan and a Treasury Management Policy. Under these policy documents

responsibility for monitoring treasury activity is delegated to the Risk and

Audit Subcommittee.

2.2 Council

is provided with independent treasury advice by Stuart Henderson of

PricewaterhouseCoopers and receives weekly and monthly updates on market

conditions.

2.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in depth treasury reporting is provided for the Risk and Audit

Subcommittee.

3.0 CURRENT SITUATION

3.1 Council’s

debt portfolio is managed within the macro limits set out in the Treasury

Policy. It is recognised that from time to time Council may fall out of policy

due to timing issues as debt moves closer to maturity and shifts from one time

band to another. The treasury policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

3.2 The

following table sets out Council’s overall compliance with Treasury

Management Policy as at 31 January 2018:

|

Measure

|

Compliance

|

Actual

|

Min

|

Max

|

|

Liquidity

|

ü

|

115%

|

110%

|

170%

|

|

Fixed debt

|

ü

|

84%

|

55%

|

95%

|

|

Funding profile:

0 – 3 years

3 – 5 years

5 years +

|

ü

ü

ü

|

46%

26%

27%

|

10%

20%

10%

|

50%

60%

60%

|

|

Net Debt as % Equity

Net Debt as % Income

Net Interest as % Income

Net Interest as % Rates

|

ü

ü

ü

ü

|

4%

47%

3%

5%

|

0%

0%

0%

0%

|

20%

150%

15%

20%

|

Council is currently compliant with

Treasury Management Policy.

As requested at November’s Risk and

Audit Subcommittee meeting, the above list of reported KPI’s has been

expanded to include the Net Debt % and Net Interest % ratios.

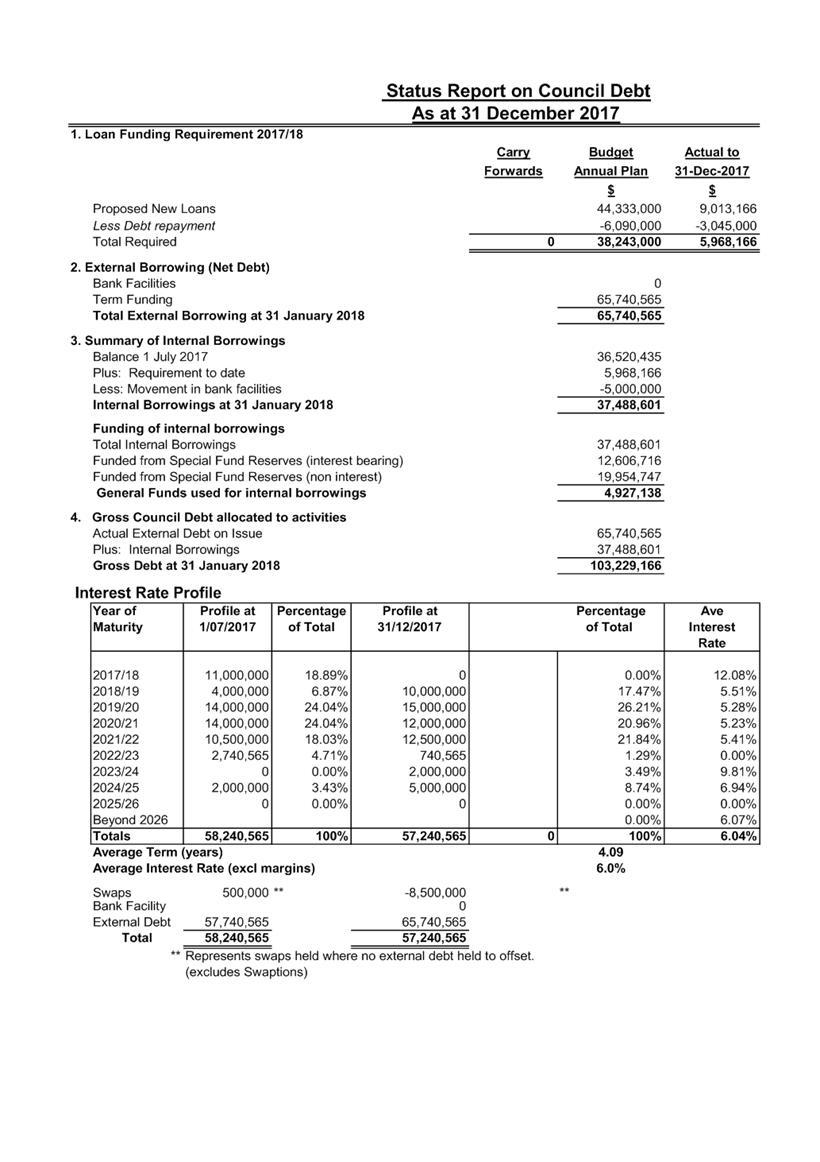

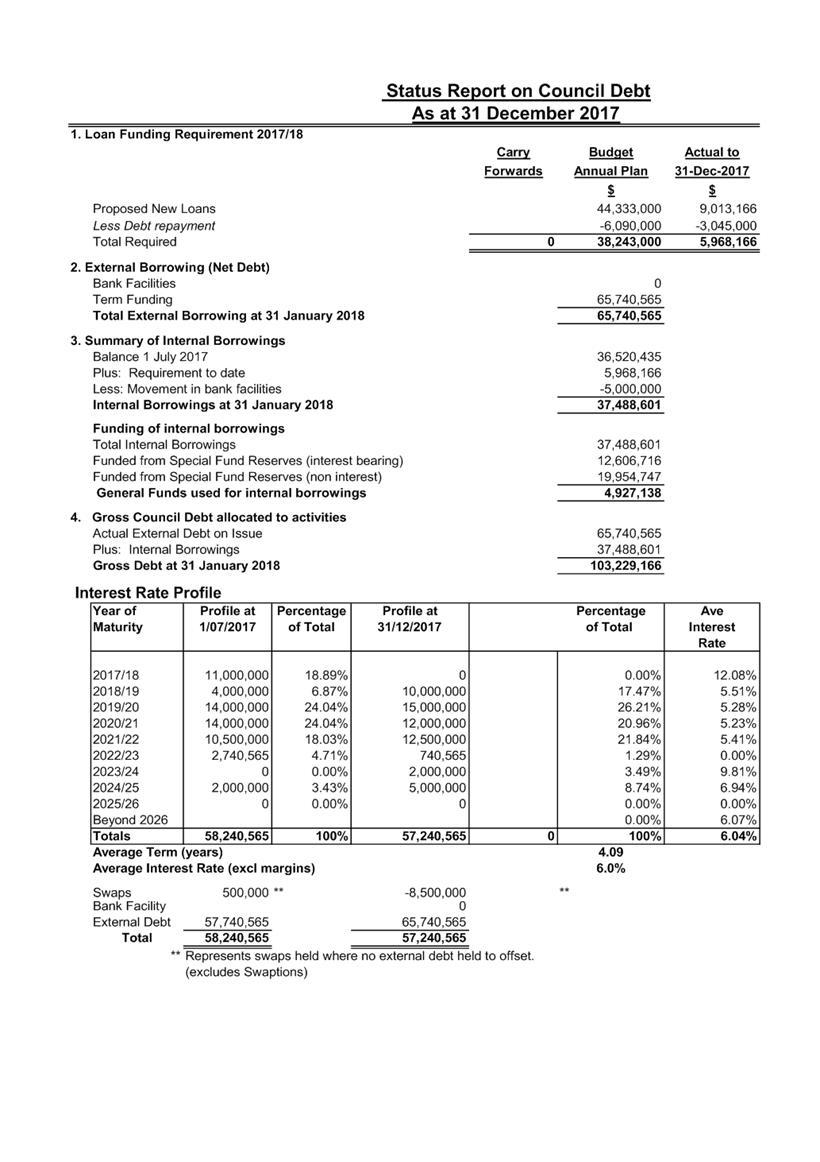

3.3 The

current total core net external debt is $65.7m as at 31 December 2017. This is

supported by the Debt Status Report as at 31 December 2017 (Attachment 1).

Core external debt has increased $5m from the November 2017 report.

3.4 The

additional $5m was required to fund the current capital spend program being

undertaken. It was borrowed from LGFA for a period of 110 days to align the

maturity date with the second LGFA funding round of 2018, at an interest rate

of 2.066% pa. By the maturity date our external credit rating will be confirmed

allowing the debt to be refinanced with longer term debt at preferential

interest rates.

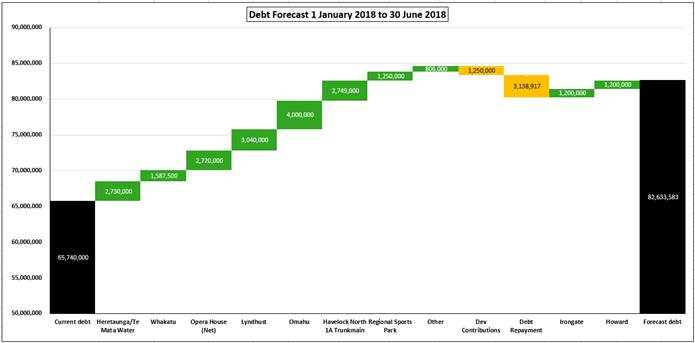

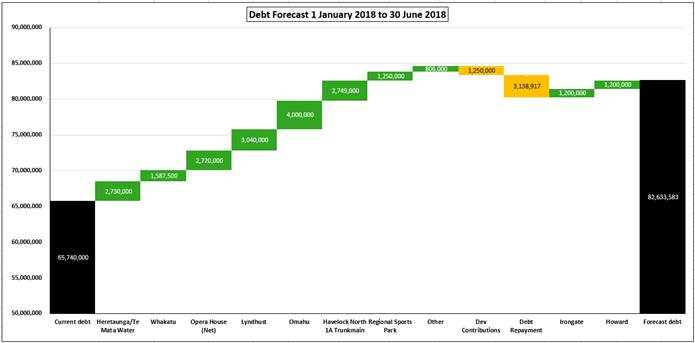

3.5 The chart below

shows the key drivers of the expected movement in borrowings over the next

year. This is based on projects that have started already, or are highly likely

to commence before 30 June 2018 and indicates a forecast debt position of

$82.6m.

The chart identifies the major projects

underway, however the smaller renewal projects have been aggregated into the

“Other” heading.

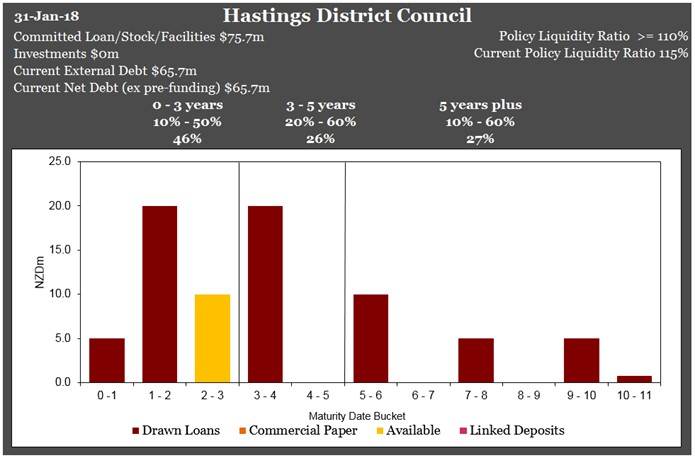

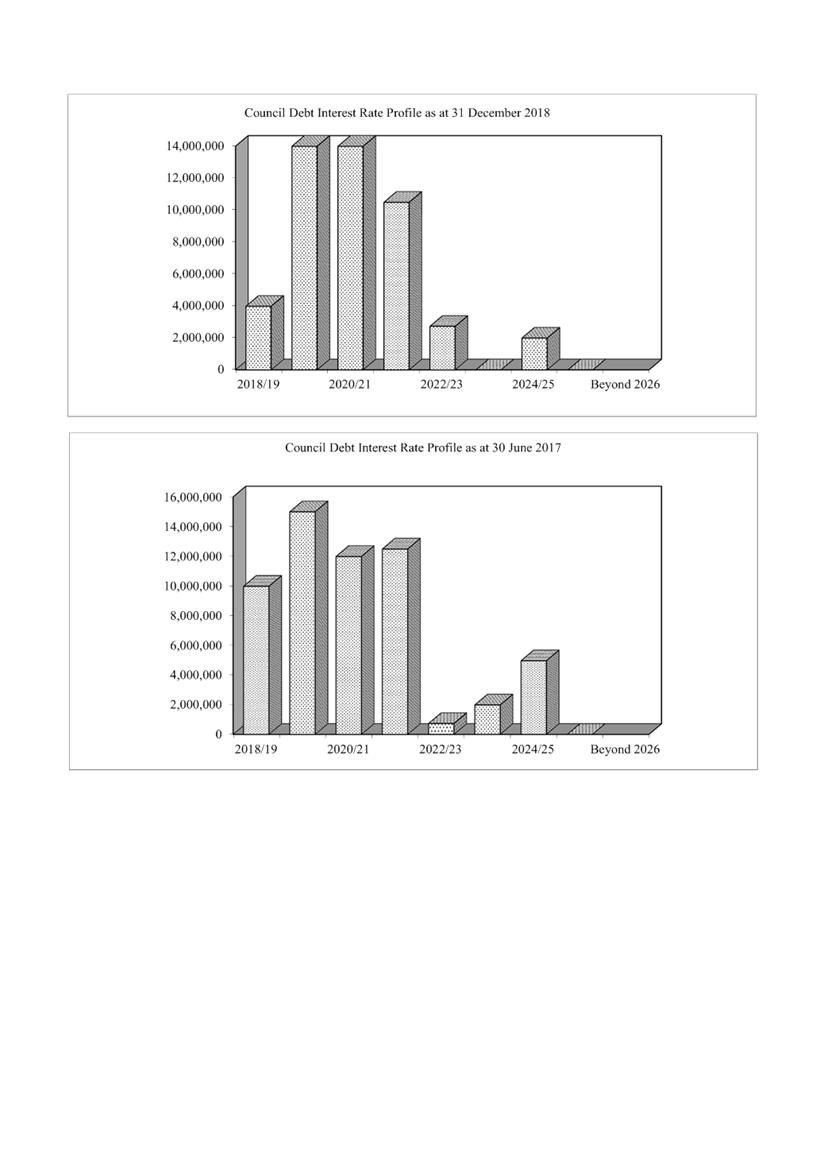

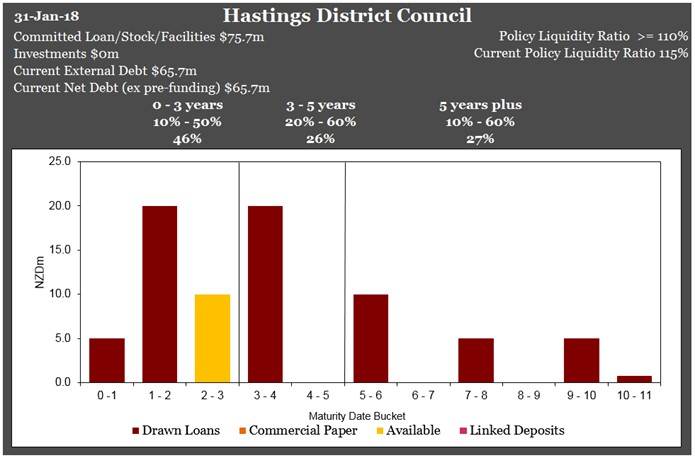

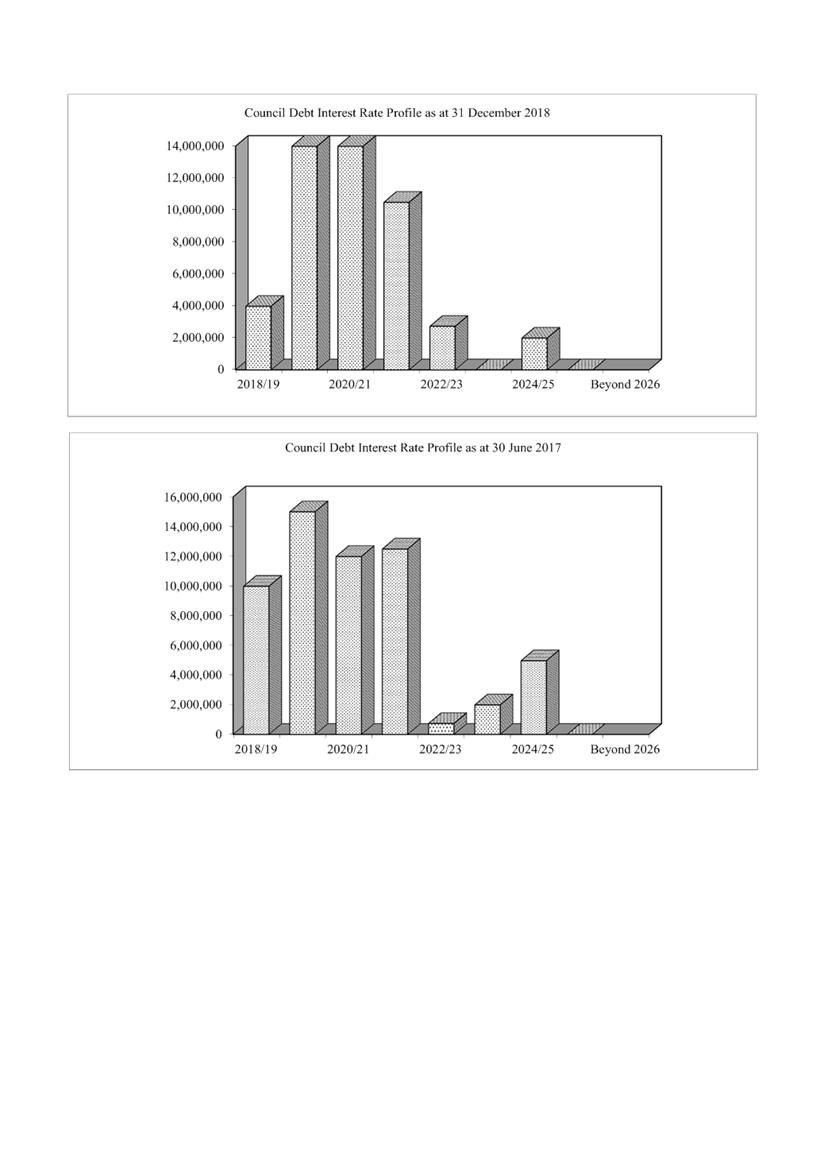

3.6 The

graph below shows the Council’s position for funding risk with $65.7

million of financing facilities as at 31 January 2018. The current liquidity

ratio of 115% within the policy band of 110% - 170%. Council’s current

debt profile is within policy, with good treasury management practices in

place.

3.7 Council Officers

and the Mayor met with two Analysts from Standard and Poor’s on the 19th

December as part of the Credit Rating assessment process. They wished to

explore the key factors that affect the management, economic and financial risk

profiles of Council and an agenda of what they wanted to cover had been

previously circulated to help with preparations. Feedback was positive from the

Analysts who will take the information presented and prepare a report for

consideration to a ratings committee. The ratings committee’s results

will be known in late February.

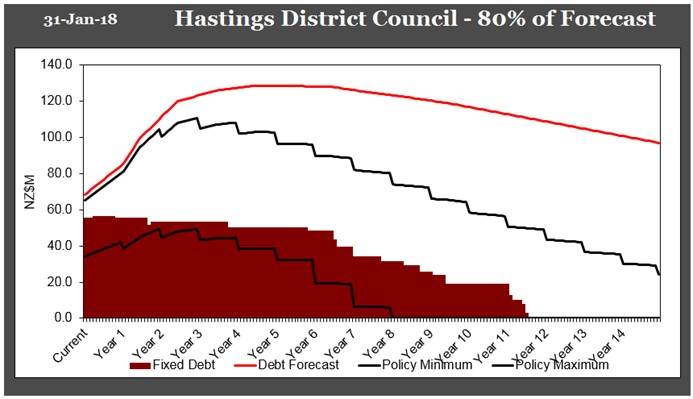

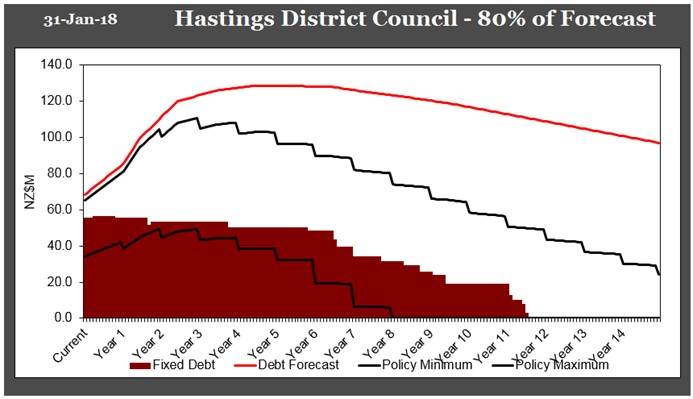

3.8 The following graph shows Council’s fixed debt is within the

policy minimum and policy maximum set out in Council’s Treasury

Management Policy. This graph also incorporates Council’s forecast debt

over the long term (discounted to 80% of projections). The projected external

debt requirement for the next 12 months is forecast to increase which will

provide Council with the opportunity to take advantage of funding longer term

debt at historically low levels of interest.

Officers are currently working with PWC on

reviewing its interest rate strategy with the view of adding some more forward

start swaps beginning from year 2 onwards. PWC are currently recommending a

target level of 3.75% for retail swaps at the longer end of the yield curve

(swaps of 5 to 10 years in length).

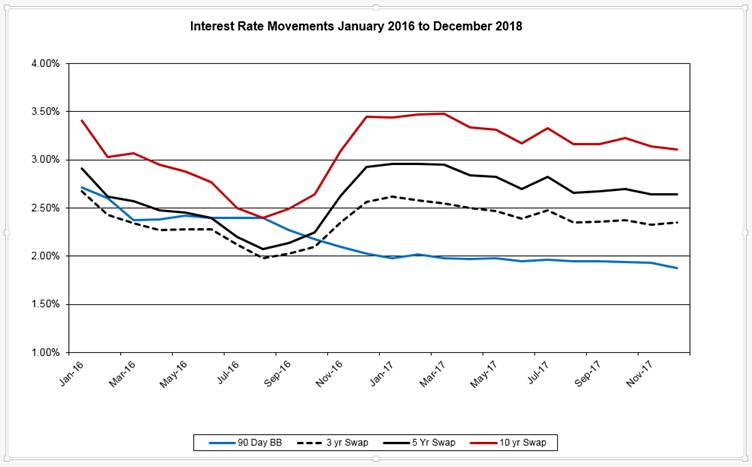

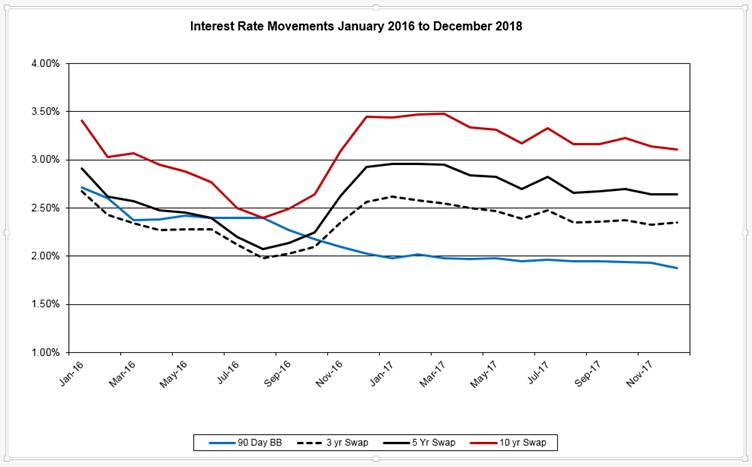

3.9 The

graph below shows what wholesale 10 year swap rates over the past 12 months. In

recent months interest rates have been drifting in a narrow range between 3.1%

and 3.3% pa. While the Reserve Bank has indicated that it doesn’t plan to

increase the OCR rate until 2019 at the earliest, economists are still picking

an increase in interest rates of 0.5% pa over 2018.

3.10 Any

new debt will be considered along with Council’s working capital

requirements and liquidity ratios.

4.0 MARKET COMMENTARY

4.1 The

Reserve Bank of New Zealand (RBNZ) last issued a Monetary Policy Statement on 9

November 2017 where the Official Cash Rate was held at 1.75% and the statement

issued at that time was reported to the Subcommittee at its last meeting. The

next RBNZ statement is due on 8 February 2018 and is therefore not released in

time for any commentary to be included in this report, however below is

ASB’s commentary following the weak Q4’s CPI figure’s

announced on the 25th January:

“The CPI rose by 0.1% qoq in Q4,

taking the annual rate of inflation down to 1.6%, well below ASB’s,

RBNZ’s and the market’s expectations. The weak result was largely

driven by an unexpected fall in tradable inflation, despite a 6.1% lift in

petrol prices over the quarter. Core measures of inflation reinforced that

underlying inflation pressures are weak.

This release suggests that inflation has

yet to stage a convincing comeback in NZ, outside of the housing sector. And,

with this release raising numerous questions about the strength of inflation

moving forward (especially when considering the stronger-than-thought economic

backdrop of recent years) it reinforces that there is no need for the RBNZ to

raise interest rates anytime soon. We will revisit our CPI forecasts in the

wake of this release and what it means for our RBNZ call. But for now, it seems

appropriate that the RBNZ to leave to OCR on hold over 2018.”

4.2 The

graph below shows how the NZ interest rate curve has moved over the past 24

months.

The PWC Treasury Advisory Team believe that

both short-term (although not till after mid 2018) and long-term interest rates

could move higher due to additional inflation caused by increased government

election spending promises, lower NZ dollar exchange rates causing more

expensive imports, and a lower immigration policy combined with higher minimum

wage rates leading to higher wages expectations. This may cause the Reserve

Bank to raise the OCR earlier than originally thought.

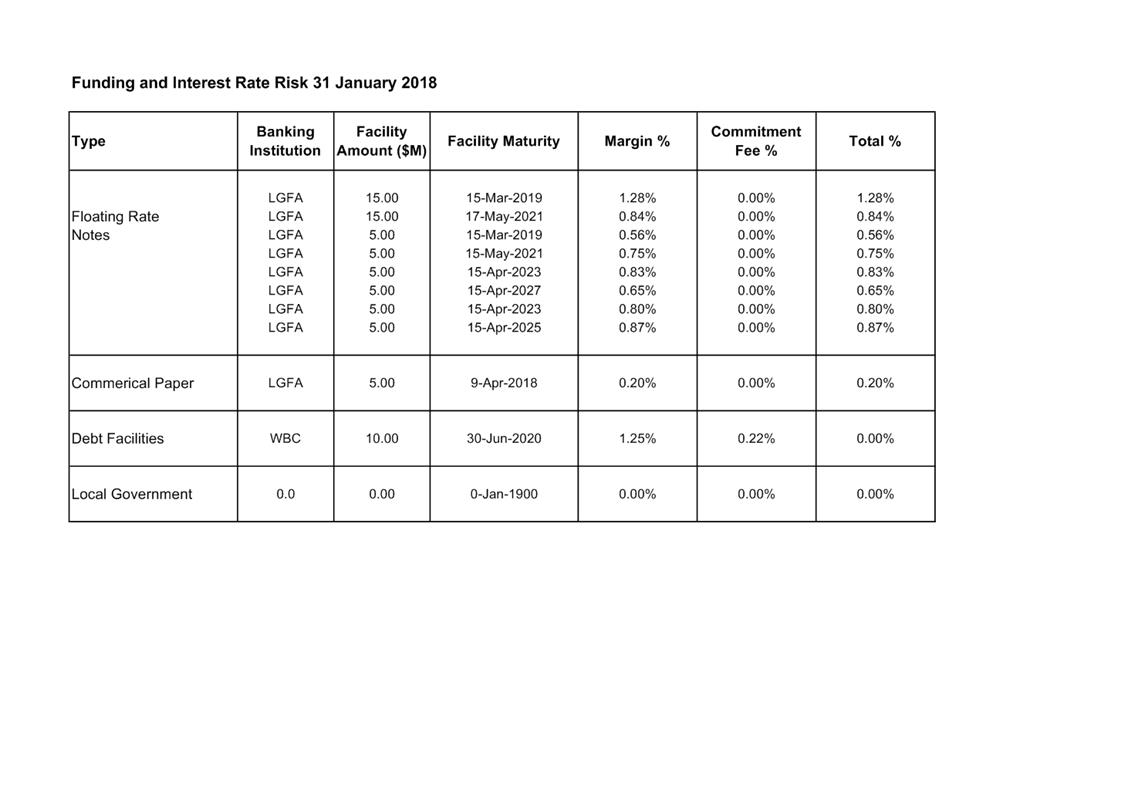

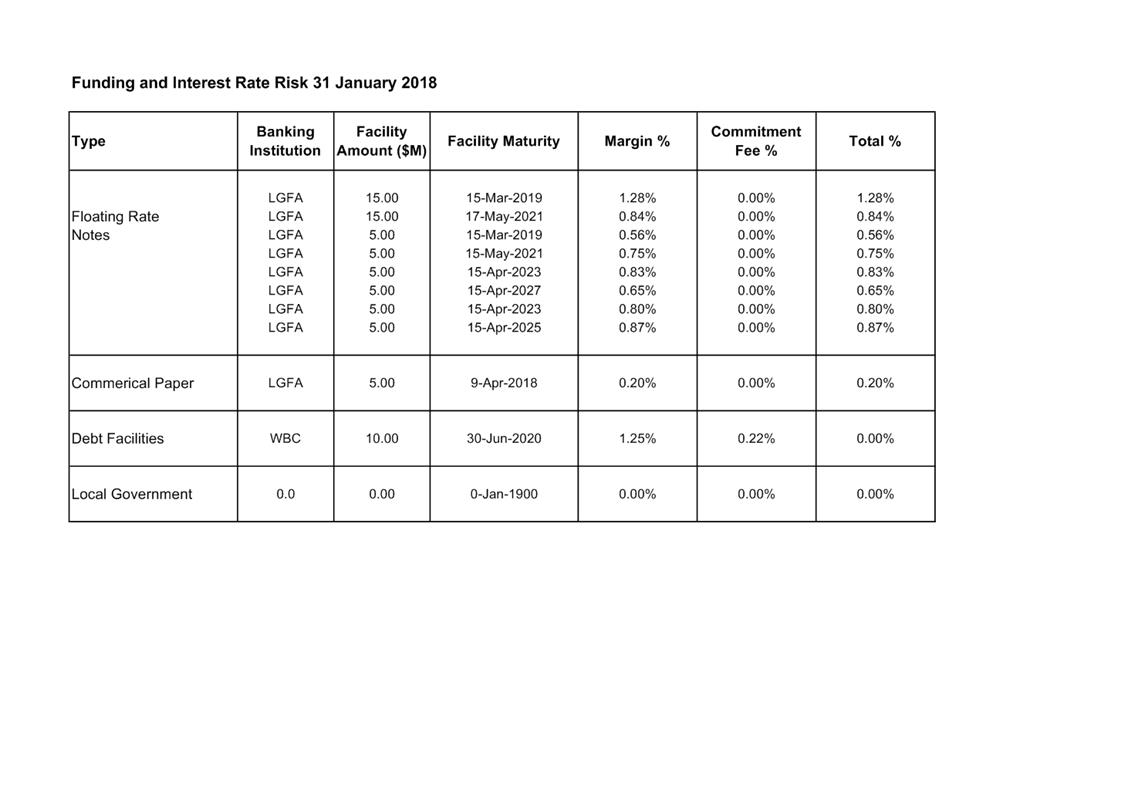

5.0 FUNDING FACILITIES

5.1 Attachment

2 shows details of Council’s current debt facilities together with

details of expiry dates and margins.

5.2 Council’s

liquidity ratio of 115% at 31 January 2018 (based on net external debt of

$65.7m and total debt facilities of $75.7m) is within policy (policy 110% -

170%). Officers are comfortable with this ratio because of continued

uncertainty on debt forecasts and the ability to increase debt from the LGFA at

relatively short notice.

|

6.0 Recommendations

That the

report of the Manager Strategic Finance titled

Treasury Activity and Funding dated 12/02/2018 be received.

|

Attachments:

|

1

|

Public Debt Status 31 December 2017

|

18/70

|

|

|

2

|

Funding and Interest Rate Risk 31 Jan 18

|

18/69

|

|

|

Public Debt Status 31 December 2017

|

Attachment 1

|

|

Funding and Interest Rate Risk 31 Jan 18

|

Attachment 2

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 12 February

2018

FROM: Chief Financial Officer

Bruce Allan

Strategy Manager

Lex

Verhoeven

SUBJECT: 2018-28

Long Term Plan

1.0 SUMMARY

1.1 The purpose of this report is to update the Subcommittee about progress

being made on the development of the 2018-2028 Long Term Plan, with particular

focus on financial management and risk management considerations.

1.2 This issue arises

from the legislative requirement to have in place a Long Term Plan by 30 June

2018.

1.3 The Council is

required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the

current and future needs of communities for good quality local infrastructure,

local public services, and performance of regulatory functions in a way that is

most cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.4 This matter

relates to the decision making, financial management and consultative

requirements of the Local Government Act 2002.

1.5 This report

concludes by recommending that the report be received and that feedback from

the Subcommittee be incorporated into the Long Term Planning process as

appropriate.

2.0 BACKGROUND

2.1 The Local

Government Act 2002 sets out the requirement for a local authority to have a

Long Term Plan in place for its community. Whilst it has a 10 year view,

the Infrastructure Strategy (a requirement of the plan) looks out 30 years and

beyond recognising the life of our infrastructural assets and the long-run

maintenance, renewal and replacement needs of those assets. Each 3 years

a new plan has to be produced recognising that the context within which a local

authority operates can change.

2.2 During 2017 the

Council considered the key aspects of the 2018 Long Term Plan with a final

workshop held on 13 December finalising the key remaining components of the

plan.

2.3 In summary, the

plan builds on the key strategic directions previously set by the Council, with

emphasis on:

§ Investment

in drinking water infrastructure as our first priority to meet community

expectation and new standards around safe drinking water;

§ Ensuring

that a range of housing options are available to meet the

needs of a changing community whilst protecting our valuable soils;

§ Ensuring

industrial development opportunities are easily accessible in Omahu, Irongate,

Whakatu and Tomoana to meet our target of increased jobs and investment;

§ Investment

in the Hastings Central City to increase its vibrancy and to meet the

challenges of changing retail patterns and the function and form of the central

city;

§ Investment

in our core infrastructure to look after our assets prudently and to meet

new challenges in bridge strengthening, changing environmental standards and

climate change;

§ Continuing

to enhance our parks, recreational and cultural facilities to make the

Hastings District a place where talent wants to live and people want to work,

live and play;

§ Working

together with communities and others to build civic pride, develop our

youth and uplift people and communities.

2.4 The focus of this

report is on the financial management and risk management implications of the

work programme, along with some of the key assumptions which underpin the Long

Term Plan.

3.0 CURRENT SITUATION

3.1 The Council will

at its meeting of 22 February be considering some final remaining matters which

will not have a consequential impact on the plan, before adopting the plan for

community consultation on 22 March 2018.

3.2 The month of

February is largely dedicated to the external audit process, conducted by Audit

New Zealand. An audited Long Term Plan is a legal requirement. A

further central audit is then also undertaken by the Office of the Auditor

General to ensure a consistent standard is achieved across the country.

3.3 The Hastings

District Council has consistently achieved a compliant Long Term Plan since the

long term planning requirements become mandatory in 2004.

KEY INPUTS INTO THE PLAN

3.4 Asset

Management Plans (AMPs) – These plans set out the long term approach

to managing our various infrastructure assets. AMP’s are in place

for the following activities:

§ Water

Supply

§ Wastewater

§ Stormwater

§ Transportation

§ Park

and Reserves

§ Council

Owned Buildings

§ Solid Waste

3.4.1 Asset

Management is forever evolving as we obtain better information on our assets

and new challenges emerge, be they environmental, legislative or through level

of service expectations of our community. Importantly the Council’s

plans have evolved and been audited on numerous occasions. The Council

has also engaged external expertise and peer review. The

latest independent review of our asset management plans was undertaken during

2014 by Waugh Infrastructure Management, with continual follow-up on

improvement items since that time. The Transportation AMP also has

external review via our co-investor, the New Zealand Transport Agency.

3.4.2 The

various audit processes described above have assessed our AMP’s as fit

for purpose. A focus is on lifting the maturity of the Parks and Reserves

AMP, which has included the transfer of asset data into the Council’s

main data repository allowing for better management and decision making.

3.4.3 The

AMP’s are currently being further refined with the improvement items

identified from the 2014 Peer Review being the focus for the asset

managers. It is envisaged that the audited AMP summaries will be

presented to Risk and Audit at their May 2018 meeting where a more detailed

update can be provided. Following Risk and Audit’s review, the AMPs

will be presented to Council for adoption.

3.5 Infrastructure

Strategy – the purpose of the Infrastructure Strategy is to identify

the significant infrastructure issues for the Council and how they will be

managed. The Councils approach to the renewal and replacement of assets,

its response to growth or decline in demand for service, planned increases or

decreases in levels of service, maintaining health and environmental outcomes

and its approach to risk and resilience are all aspects of the strategy.

The strategy is drawn from the various matters within the AMP’s, but

means that the community gets a snapshot of key matters without having to read

large and technical documents. A significant part of the audit process is

focused on the underlying integrity of asset information and its connection

with what’s presented in the Infrastructure Strategy.

3.6 Financial

Strategy – the purpose of the financial strategy is to facilitate

prudent financial management by providing a guide for the Council to consider

proposals for funding and expenditure against, and to provide a context for

consultation on the funding and expenditure proposals within the Long Term

Plan. The Financial Strategy has a number of subcomponents which are not

covered in detail here (as only minor change has been proposed) which include

the following:

§ Revenue

and Financing Policy

§ Liability

Management Policy

§ Investment

Policy

§ Development

Contributions Policy

§ Various

Rating Policies

3.6.1 Funding Depreciation

– The Financial Strategy and Infrastructure Strategy are intertwined and

another important focus of the audit process. Assurance that our assets

are being looked after appropriately, being optimised and that adequate funding

is in place to achieve these outcomes is a fundamental part of a good Long Term

Plan. The Council plans its asset renewal programme around the detailed

knowledge it has on the condition of its assets, to ensure it is optimising its

investment. However, it is also useful to compare this approach with

generally accepted accounting practice to the depreciation of assets and the

investment requirements which are indicated via this methodology. As part of

the development of this Long term Plan external expertise was commissioned to

undertake a full review of our investment approach and to obtain assurance on

that question “whether the level of investment is appropriate”.

That review by and large affirmed that we are on track, but made two

recommendations in respect of our stormwater activity and wastewater

activities. Those recommendations have been actioned and additional

funding allowance has been built into forward budget forecasts.

3.6.2 Balanced Budget –

A key legislative financial benchmark within the Financial Strategy is the

“Balanced Budget”. That benchmark assesses whether operating

revenue has been set at a level to cover operating expenses in any one year as

an indicator of the fiscal sustainability of the Long Term Plan. The

draft budget meets this fiscal benchmark, however a point to note for

the Subcommittee is that the budget is under stress to achieve this

in the first three years of the plan. The reason for this is the

comprehensive water investment programme, consisting of $47.8 million in capital

expenditure and a new operating environment with an operating expense

that is $2 million higher than 2017/18. To assist the community through

funding this, a longer term view has been taken with the setting of the water

targeted rate, which sees the rate increase by $250 (smoothed over the first 3

years) with smaller increases in the years after that. This approach does

put the water account in deficit for several years before paying its way by the

end of the 10 year period.

3.6.3 Rates – Limits

on rate increases is another fundamental aspect of the Financial

Strategy. The Council has worked within these limits in setting

expenditure priorities within the plan. The key rates benchmark is to set

rates in any one year within 4% plus the movement in the Local Government Cost

index for that year – this is a limit and not a target. Further to

this the Council set a LTP budget target of 3% or less for its forecast budget

(with the exception of the water investment programme – which is required

to deliver safe water to our community). The draft budget has been set

within the financial limits in the Councils Financial Strategy, and includes an

escalated debt repayment strategy in the latter years. The forecast budget is

inflation adjusted as required by the Local Government Act 2002. Maintaining

financial headroom is one of Council’s key resilience strategies.

3.6.4 Debt - Forecast debt

does increase markedly over that forecast in the 2015 LTP. The water

investment programme and bridge investment programmes being the key drivers.

An aggressive debt repayment discipline will be important in decreasing debt

levels over the next 10 years, as will assessing expenditure priorities and the

value for money of competing priorities. The Council’s policy of

using any surpluses to repay debt is part of that strategy as is a strategy of

maintaining rate increases at 3% with additional funds used for debt

repayment. The Financial Strategy acknowledges the need to reduce debt in

order to provide Council with the capacity to respond to adverse events should

the need arise.

3.6.5 Assumptions –

Disclosure of the assumptions made in setting a Long Term Plan is another

important aspect and focus for the audit process. The key assumptions are

attached.

3.7 Risk and

Resilience - Key risks and resilience issues have been addressed as

follows:

3.7.1 Completion of programme

– The Long Term Plan contains a significant programme of work in the

first 3 years. Sufficient internal and external contractor capacity to

deliver the programme is an important consideration. In the parks and

public space area (where community level of service expectations continue to

rise) an additional project manager has recently started which will alleviate

some of the pressure being felt in this area. The programme of work is

still reasonably aspirational but the programme of key works has been spread

across the first 5 years to help manage this. The other key areas are in

the delivery of the water investment programme and our roading programme.

3.7.2 It is evident that there

are escalating capital work programmes across the local government sector and

Hawkes Bay is no different with Napier City Council also likely to have a large

capital programme throughout the term of this LTP. Officers have undertaken a

review of what contactors are available to undertake the various types of work

proposed in the plan and assigned projects to those contractors in an attempt

to assess capacity in the market, and while this does demonstrate sufficient

capacity, it does not fully understand what requirements will be placed on the

market by other agencies like Napier City Council and the Hawkes Bay District Health

Board.

3.7.3 Prices – With

the increasing pressure on contractors to complete the projected capital

programme, comes pressures on price and the risk for Council is that the

capital programme cannot be delivered for the budget provided. While budgets

are inflation adjusted beyond year one of the plan, Officers will be monitoring

closely any cost escalations that are occurring and managing this risk where

possible.

3.7.4 Asset Approach – In the asset management area the distinction between

critical v non-critical assets is an important way of managing risk. Critical asset renewal strategies

aim to ensure assets are replaced prior to asset failure and or loss of

customer level of service. Critical assets have robust operation, maintenance

and inspection programmes to ensure high levels of operational performance. Non

critical assets are less critical to ensuring overall asset performance. Non

critical asset renewal strategies aim to optimise asset life and investment.

Condition assessment is less frequent and intensive than with critical assets.

Review and assessment of faults trends is an important activity that helps predict

declining asset performance and condition. Maintenance activities involves

scheduled activities in areas with known issues and reactive maintenance in

response to reported faults.

3.7.5 The subcommittee

have already had reports detailing the corporate risks associated with water

contamination and asset failure, these are not detailed further here.

3.7.6 Insurance –

The Subcommittee will be familiar with the Councils approach to insurance and

risk and that is not detailed further here.

3.7.7 Unknown/Unplanned Events

– The one certainty with long term planning is that you cannot

predict every future eventuality. Whilst the Council has provided

for the build-up of funds in a number of reserve accounts (i.e. rural flood

damage reserve for example) and contingency allowances in some parts of the

budget to meet reasonably unforeseen circumstances, the reality is that a

significant event impacting on our community (i.e. major earthquake) would be

met by a combination of reprioritising non critical works and utilising the

financial headroom the Council has to get the community through such an event.

Retaining financial headroom therefore is a critical part of the

Council’s financial strategy.

3.8 Long Term Plan

Process – Key elements within the budget process are detailed below:

3.8.1 Budget Process

– A Budget Review Board consisting of a range of senior officers has

scrutinised budget bids and refined the plan over the last 5 months. In

addition the Key Growth Projects Review Board has assessed the optimal growth

development programme and made recommendations to Council. External

market intelligence has assisted the Board to arrive at is conclusions.

3.8.2 Staff and Community

input – The Long Term Plan and the priorities within it is based on

many levels of intelligence. In addition to asset management planning

community aspirations are captured via the community planning process which is

continually being rolled out and via the Reserve Management Process. The

non-asset areas of Council have also input into the process through the

development of activity management plans which detail where the activity is

heading and any implications for council.

3.8.3 Management and

Governance Oversight – The LTP project sponsor is the Leadership

Management team headed by the Chief Executive. This is considered a best

practice approach and ensures that the necessary resources and strategic

oversight are applied to this key planning process. Regular reporting

through the team has occurred over the last 7 months. Elected members

have also formed a critical part of the plan development process to ensure

ownership of the plan and understanding of the priorities, trade-offs and

risks. Four workshops have methodically taken elected members through the key

matters and sought there guidance on these. The Rural Community Board and

Maori Joint Committee have also had presentations and input into the plan.

3.8.4 Audit Update –

The Subcommittee will be updated at the meeting on the progress of the LTP

audit and any matters of consequence should there be any.

4.0 SIGNIFICANCE AND ENGAGEMENT

4.1 This matter is

significant and the Council will be following the legislative provisions in

respect of engagement with its community on the 2018-28 Long Term Plan.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That the

report of the Chief Financial Officer titled “2018-28

Long Term Plan” dated 12/02/2018 be received.

B) That feedback from the Subcommittee be incorporated into the Long

Term Planning process as appropriate.

|

Attachments:

There are no

attachments for this report.

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 12 February

2018

FROM: Risk and Corporate Services Manager

Regan Smith

District Customer Services Manager

Greg

Brittin

SUBJECT: Enterprise

Risk Management Update

1.0 SUMMARY

1.1 The purpose of

this report is to update the Subcommittee on analysis

of the strategic risks adopted by Council by presenting the initial Bow Tie

analysis for; Water Supply Contamination, Adverse

Environmental Change, and Procurement Failure, and present recommendations to

change Investment Failure risk to Inadequate Available Funds, and to include an

amended risk matrix for Water Safety Plans in the HDC Risk Management Policy

and Framework.

1.2 This issue arises

from adoption of the Strategic Risk Register by Council.

The Council is

required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the

current and future needs of communities for good quality local infrastructure,

local public services, and performance of regulatory functions in a way that is

most cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.3 This report

concludes by recommending that the report be received.

2.0 BACKGROUND

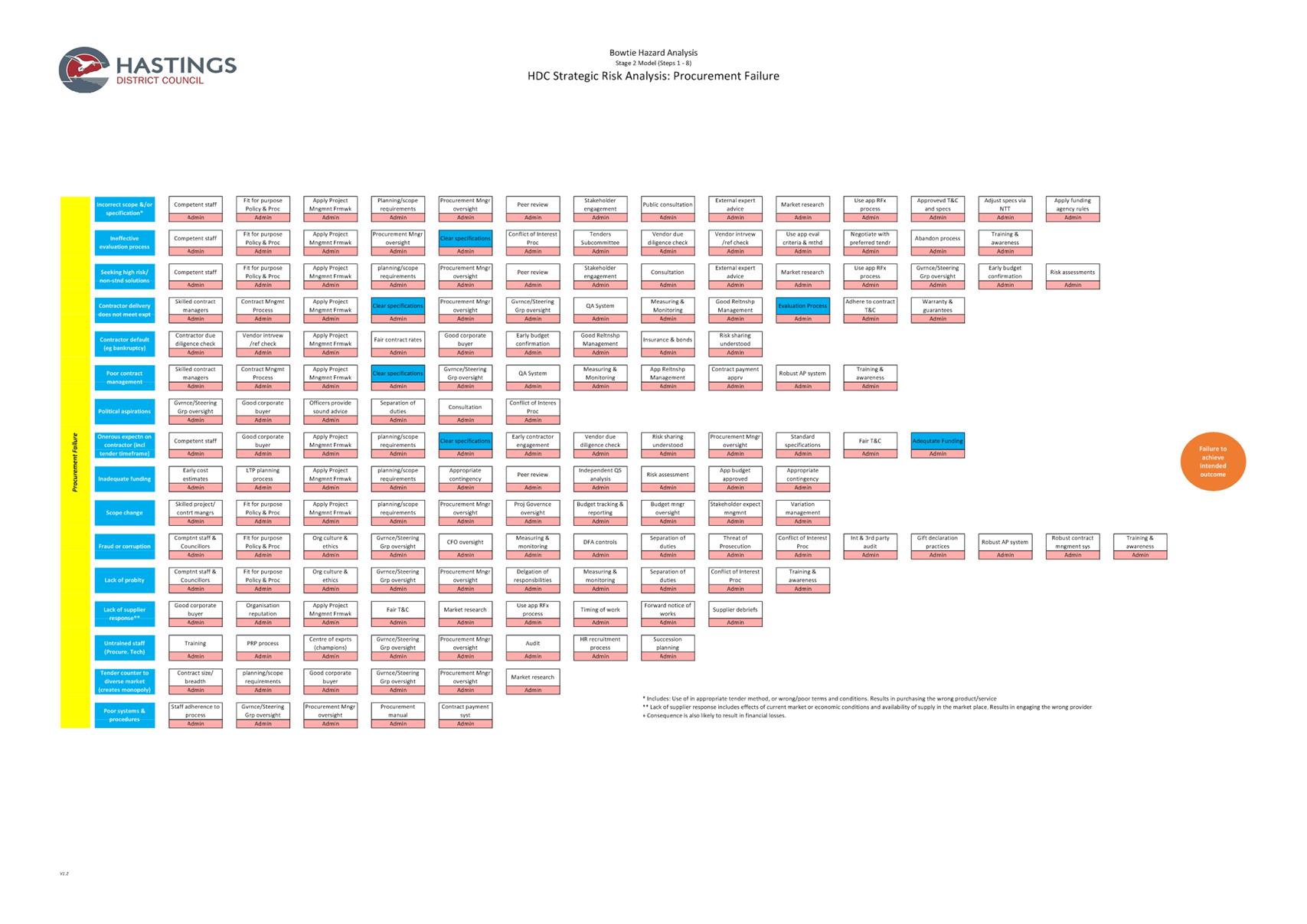

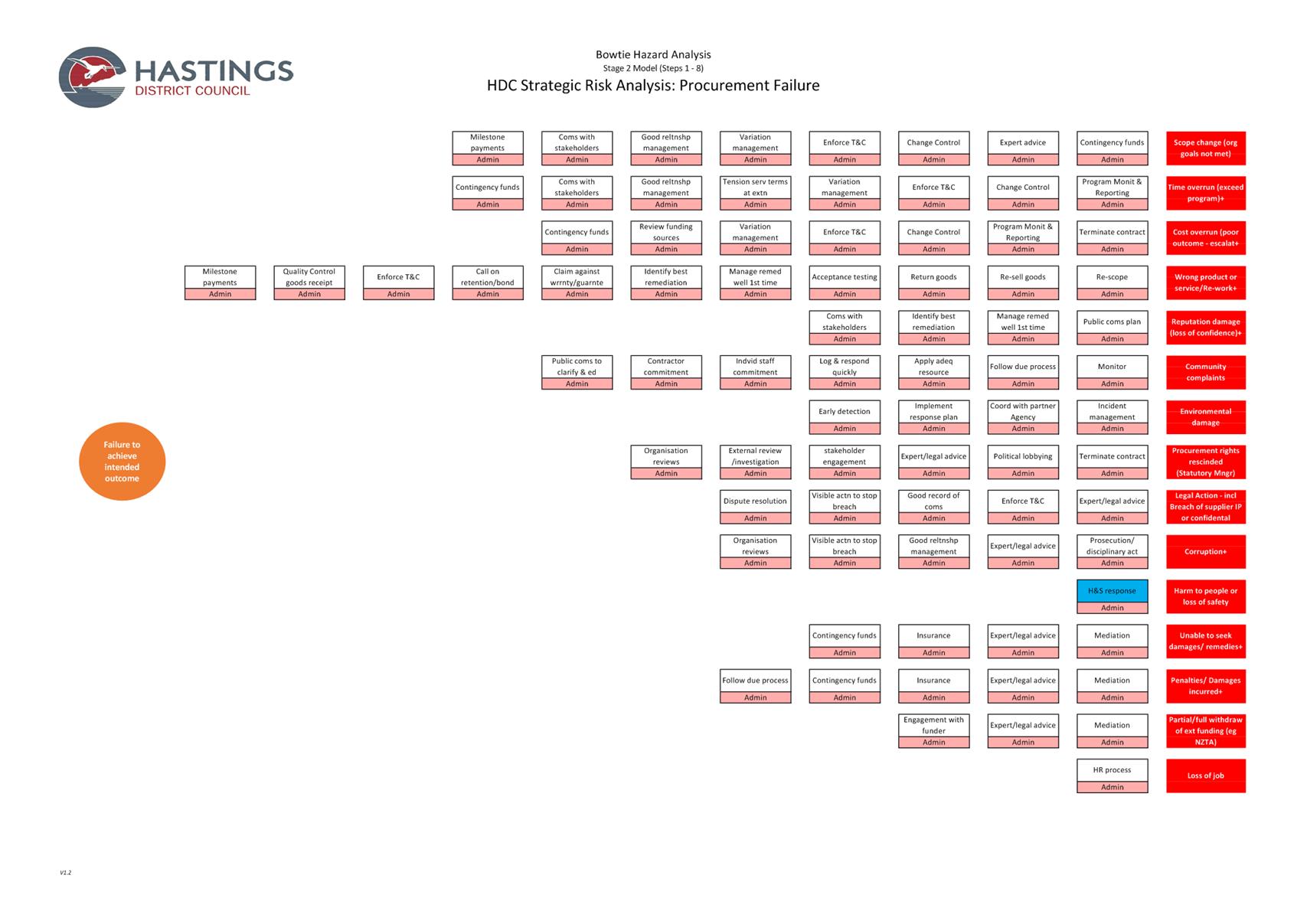

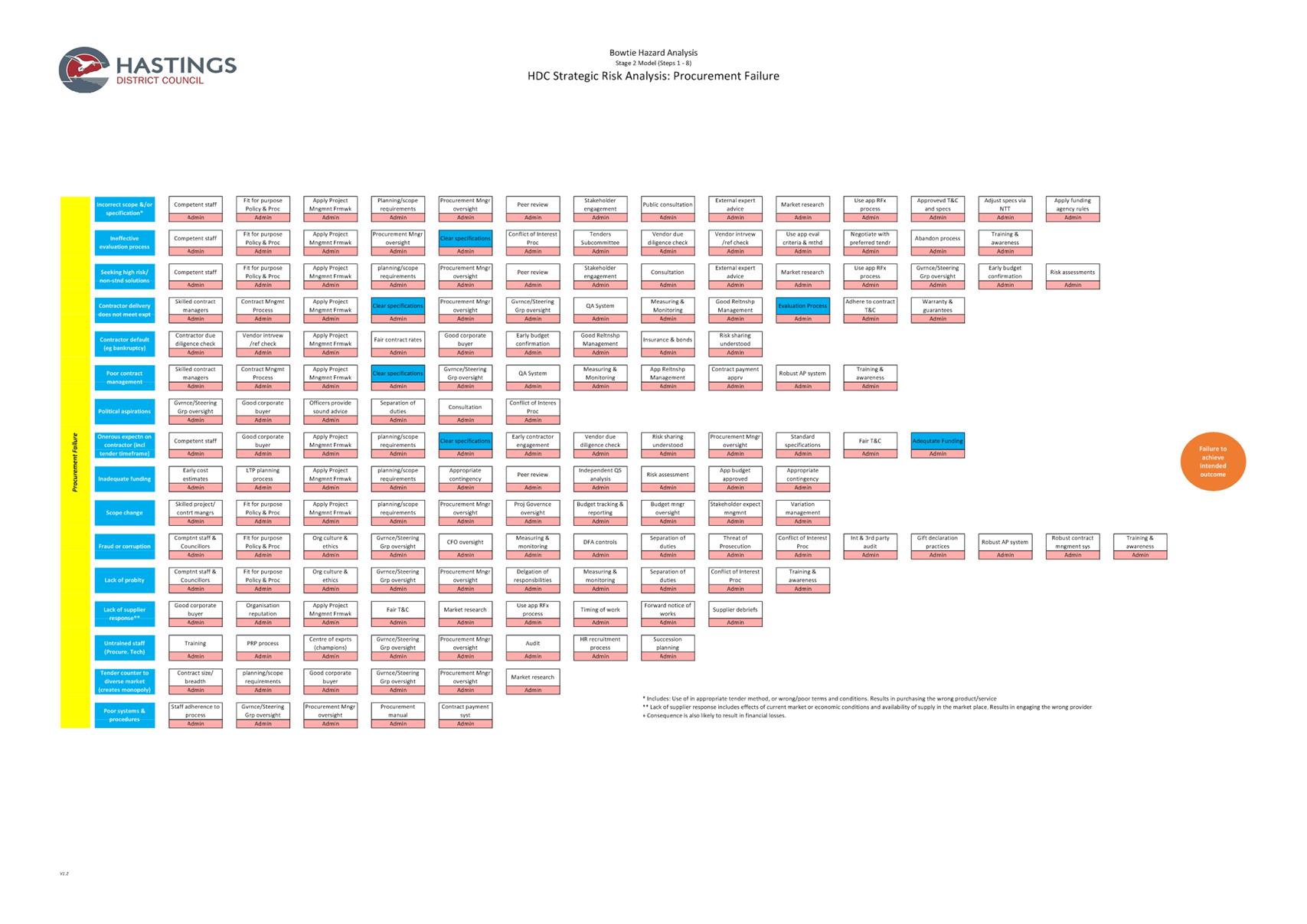

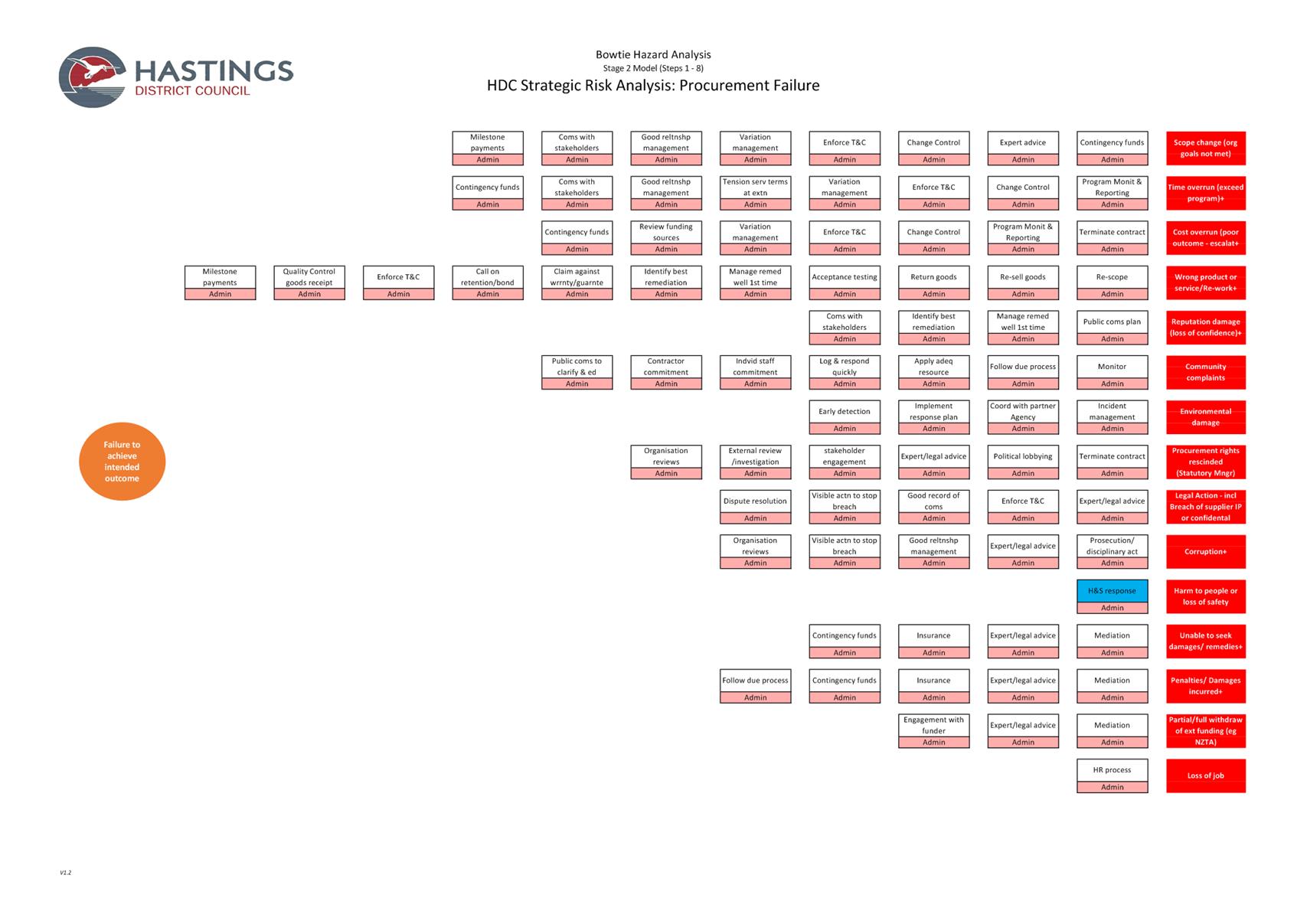

2.1 Council has used the Bow Tie risk assessment method to analyse the

strategic risks listed on the Strategic Risk Register adopted by Council on 31

July 2017.

2.2 The Bow Tie risk assessment method was selected by Council as it is

an effective tool to demonstrate causal relationships

in complex systems. A Bowtie diagram does two things. First of all, it gives a

visual summary of all plausible accident scenarios that could exist around a

certain Hazard. Second, by identifying control measures the Bowtie displays

what the organisation does to control those scenarios.

2.3 The Bow Tie analysis covering the key risk event and associated

threats, consequences and control barriers have already been provided to the

Subcommittee for the following risks:

· Civil Defence Emergency (Risk #2).

· Health & Safety Incident (Risk #3).

· Infrastructure Service Failure (Risk #4)

· Ineffective Regulatory Oversight (Risk #5)

· Demographic Change (Risk #7)

· Information Security Failure (Risk #8)

2.4 The 1-page summary for these risks have also been reported to

Council on 1 February 2018.

3.0 CURRENT RISK

ANLAYSIS

3.1 Initial Bow Tie risk

analysis have been completed for the following additional strategic risks:

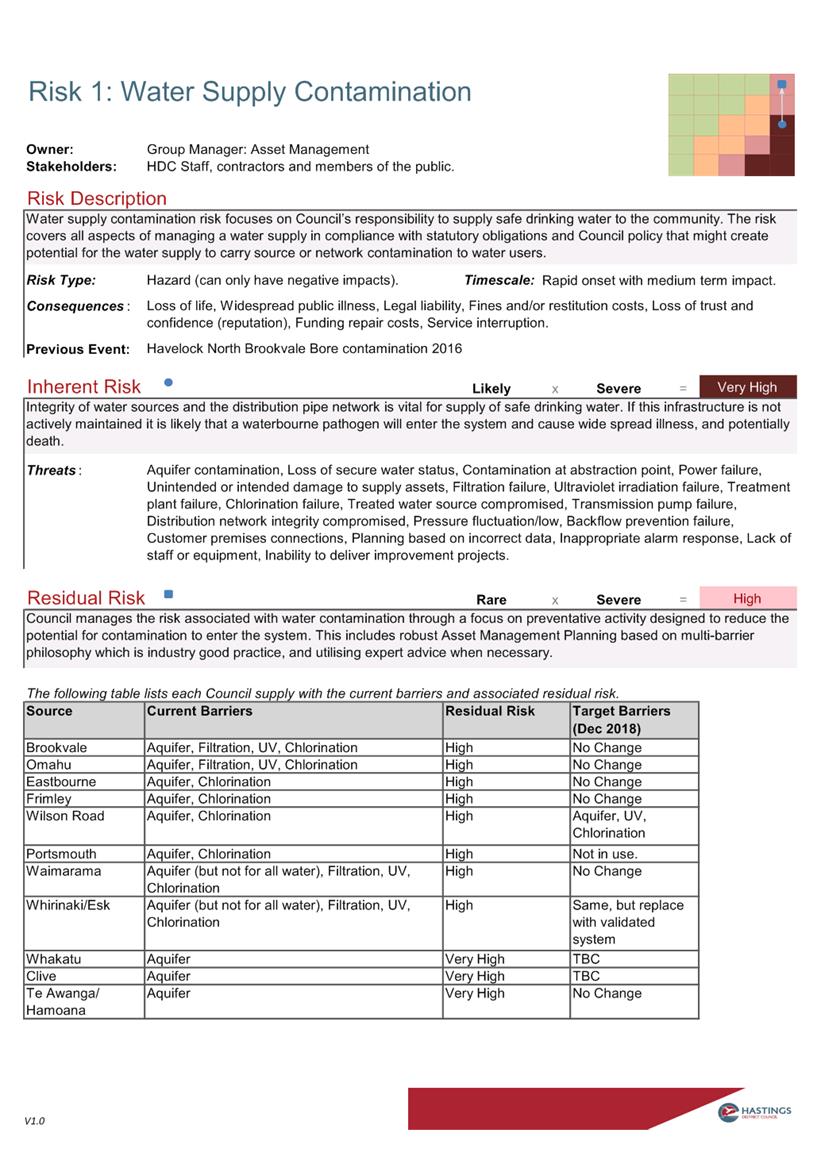

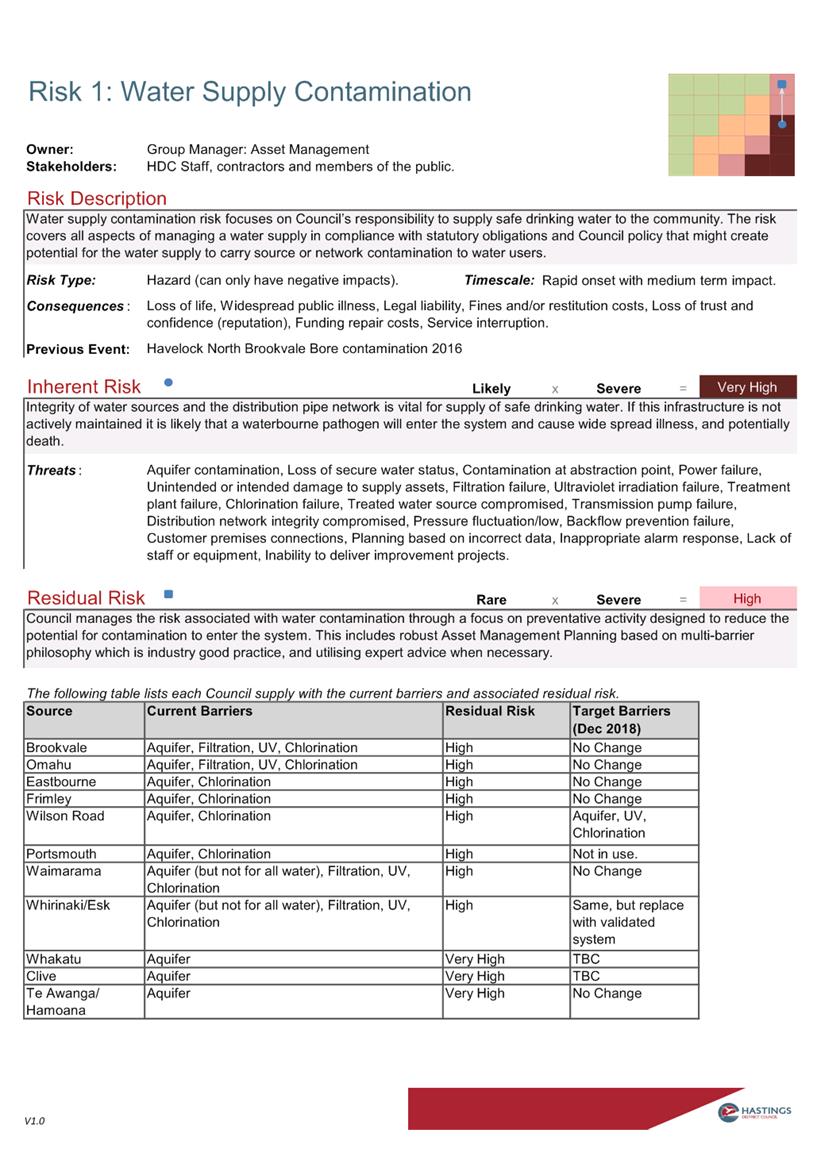

3.1.1 Water

supply contamination (Risk #1): A first draft of the Bow Tie analysis has

been completed, but requires further work before it is ready for submission to

the Subcommittee. However, sufficient information has been gathered to present

the risk summary at this time.

3.1.2 Water

supply contamination risk focuses on Council’s responsibility to supply

safe drinking water to the community. The risk covers all aspects of managing a

water supply in compliance with statutory obligations and Council policy that

might create potential for the water supply to carry source or network

contamination to water users.

3.1.3 Risk

assessment: Council manages the risk associated with water contamination

through a focus on preventative activity designed to reduce the potential for

contamination to enter the system. This includes catchment management and robust

Asset Management Planning based on multi-barrier philosophy which is industry good

practice, and utilising expert advice when necessary.

3.1.4 Adverse

Environmental Change (Risk #6): Environmental change encompasses the

disturbance of the environment resulting from human influences or natural

ecological processes that have adverse impacts on the community’s ability

to function effectively (e.g. changes in climate, human impacts, infestation of

invasive species etc).

3.1.5 Risk

assessment: While there is little that Council can do to control macro

environmental change drivers such as global warming, Council does have a role

to play in creating resilient communities that have a managed exposure to

environmental change threats. These outcomes are achieved primarily through

inter-agency collaboration, generation of pathway options, and Council land use

and infrastructure planning. Acknowledging the policy role Council has to play

and identifying potential funding options for possible interventions are key

steps that need attention.

3.1.6 Procurement

Failure (Risk #12): Procurement risk covers failures in the process of

identifying business needs, engaging with the market to obtain good value for

money, and poor management of contract implementation or tracking.

3.1.7 Risk

assessment: The risk assessment workshop identified that Council has procurement

policies and practices that follow government best practice documented in the

Council Procurement Manual, which is supported by robust templates and overseen

by Council's Procurement Manager and Procurement Steering Group. Existing

practices are in place for tender publication, opening and approval to ensure

adequate separation of duties and control over decision making.

3.2 Investment

Failure (Risk #9)

3.3 In the strategic risk register Investment

Failure (Risk number 9) is currently defined as a failure

of Council investment resulting in loss of funds. However, when considering

this definition for the risk assessment it became evident that the focus on

failure of Council investments was possibly not the real risk.

3.4 The workshop team

held the view that Council had few investments that were intended to put funds

at risk to achieve a gain. Instead, the key risk for Council was the ability to

access sufficient funds to meet immediate commitments.

3.5 Therefore, the

workshop made the recommendation that consideration be given to changing

strategic risk #9 from Investment Failure to Inadequate Available Funds, which

could be defined as “loss of access to sufficient funds to meet Council

commitments”.

4.0 AMENDMENT TO THE

HDC RISK MANAGEMENT POLICY & FRAMEWORK

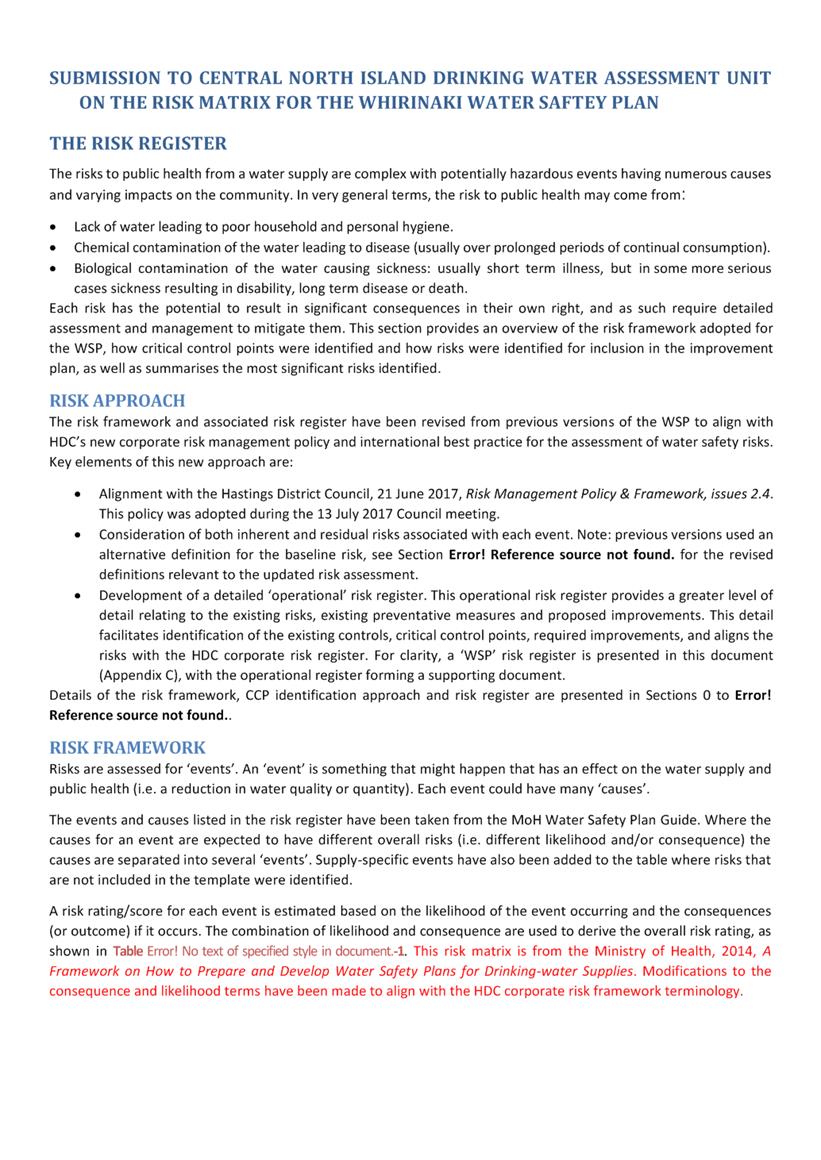

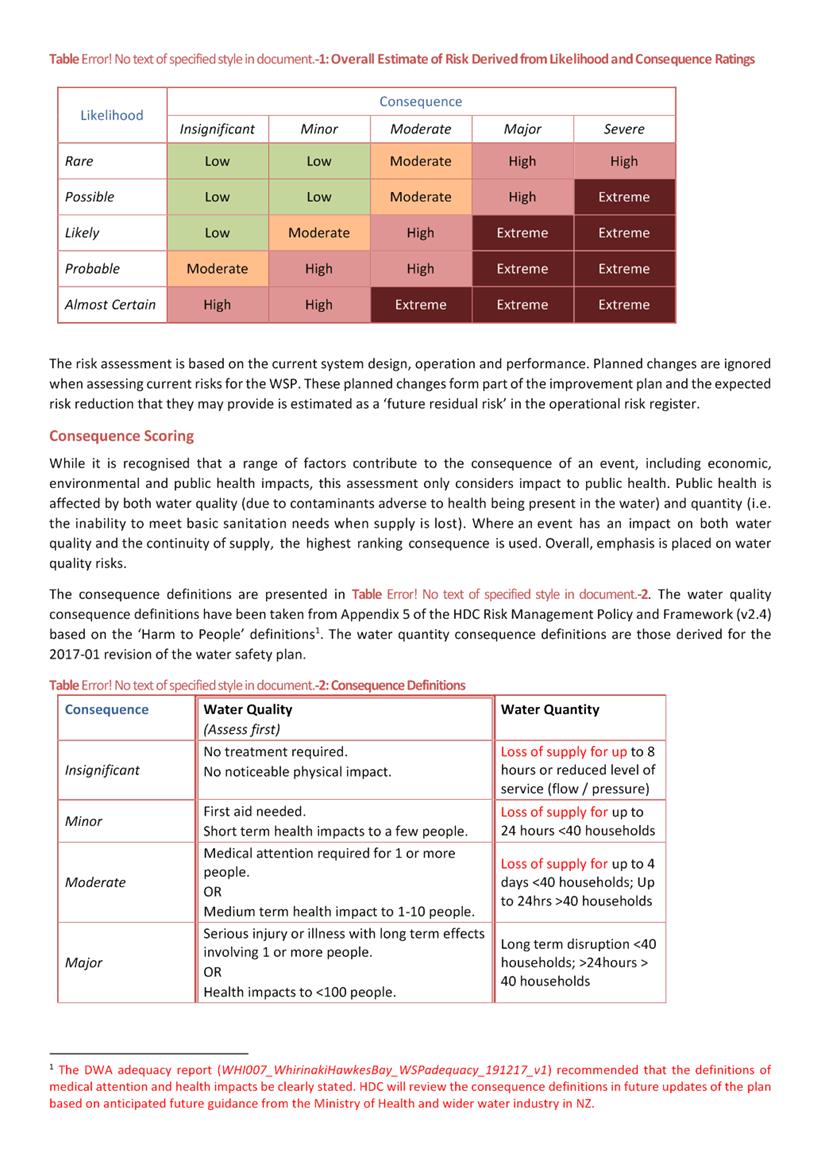

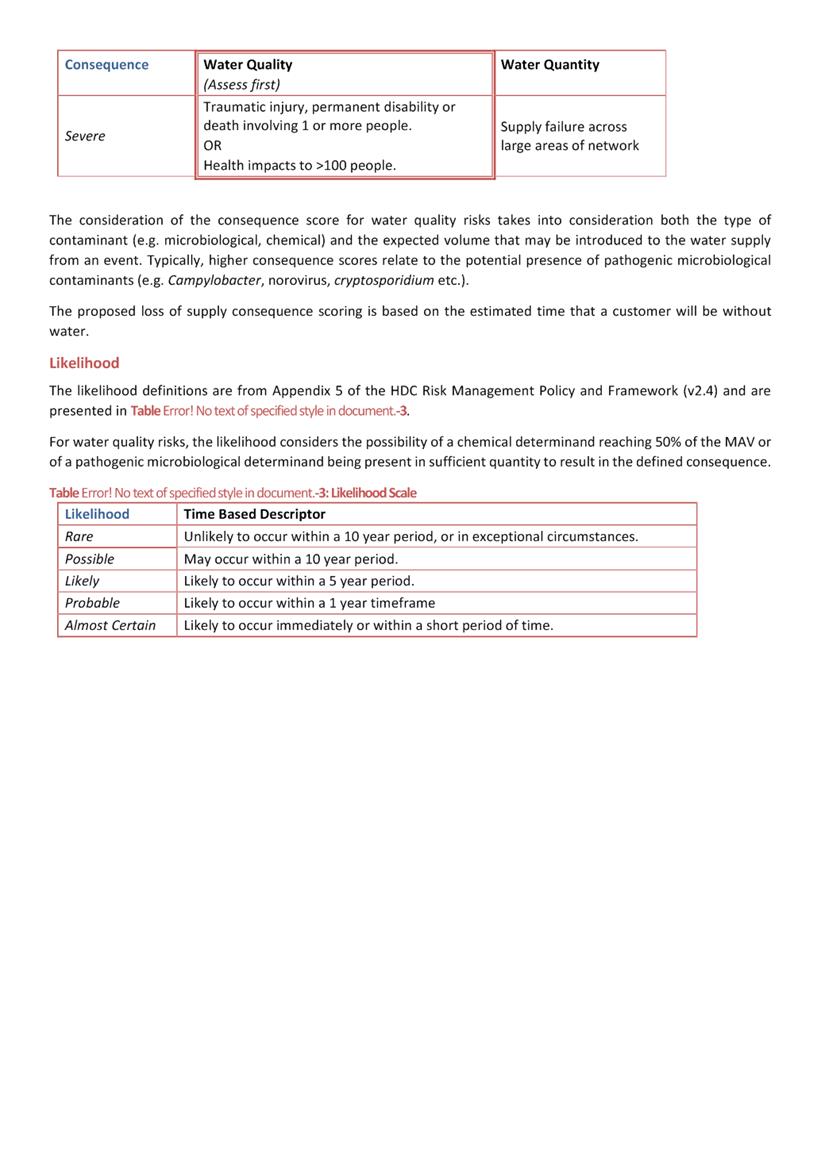

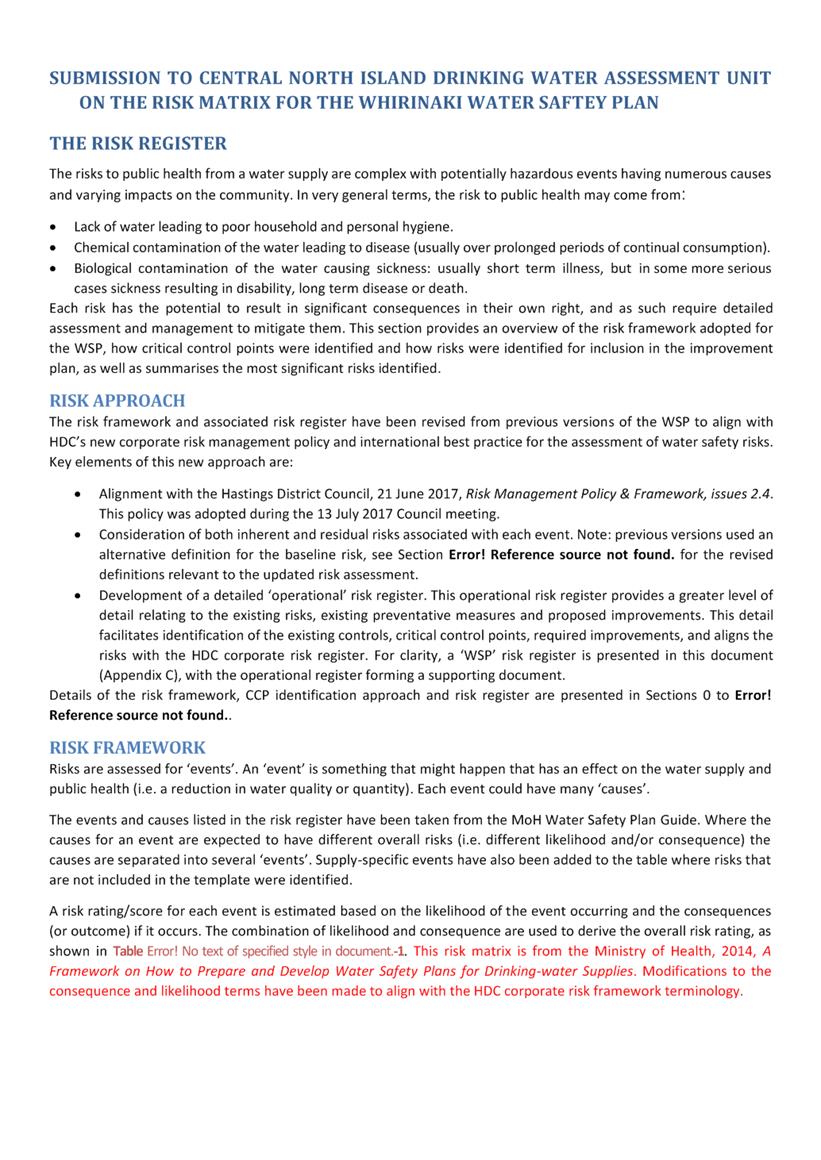

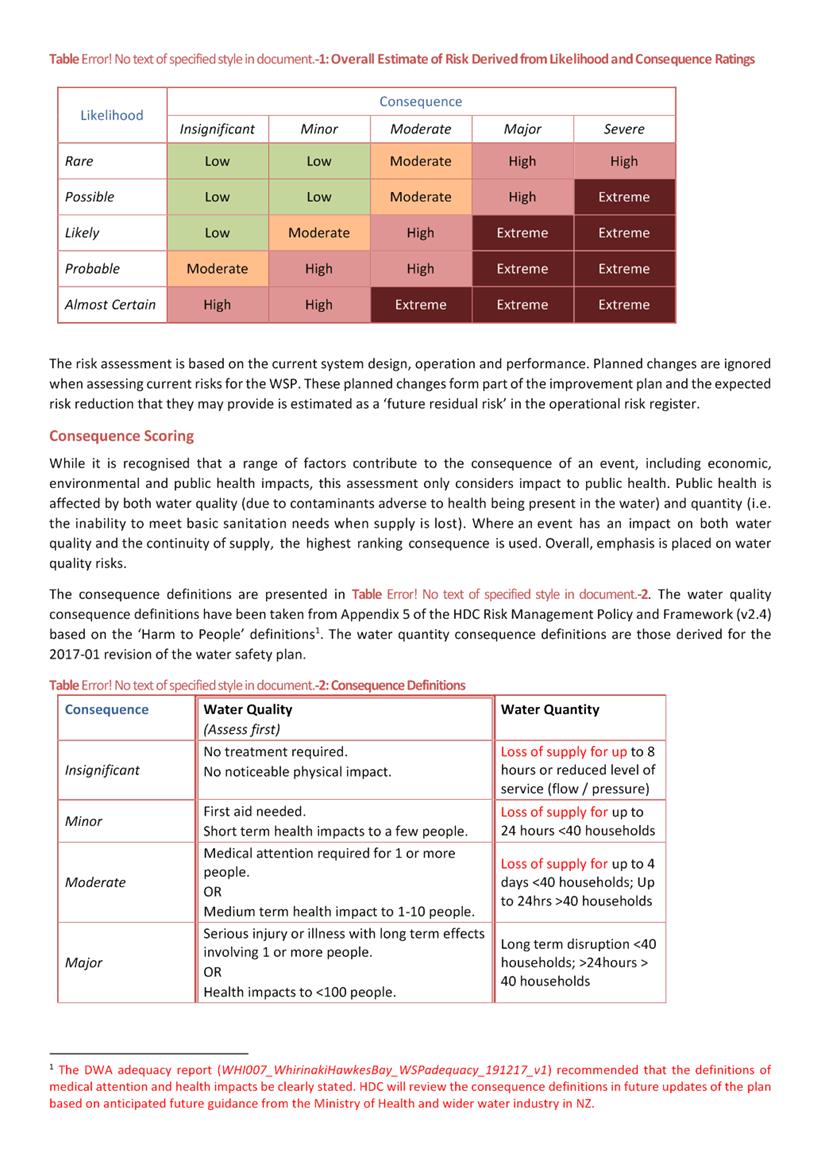

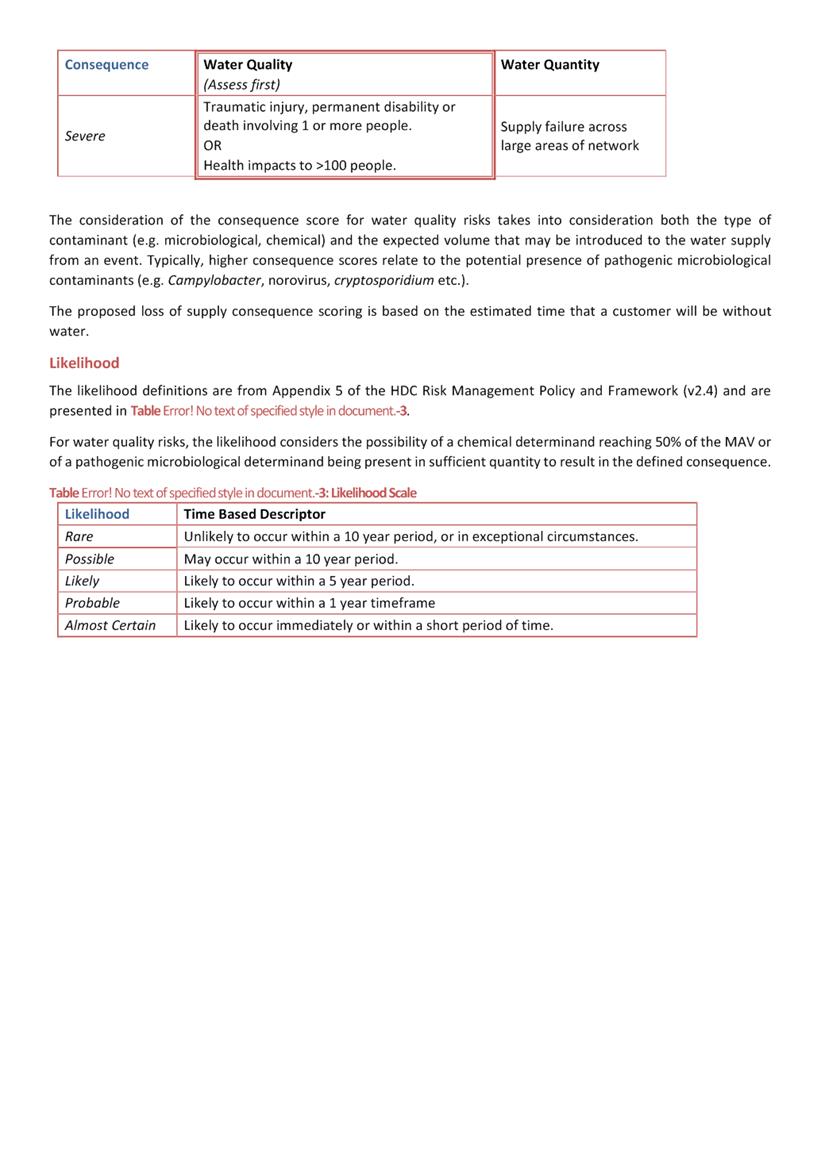

4.1 The Central North

Island Drinking Water Assessment Unit (CNIDWAU) Report on adequacy of Drinking

Water Supply’s Water Safety Plan for Whirinaki Esk Water Supply dated

22/12/2017 identified concerns with the use of the Council’s corporate

risk matrix and associated consequence and likelihood scales in the Water

Safety Plan (WSP).

4.2 Recommendation 1

from the report required Council to “Review the consequence scoring

and likelihood definitions used to determine the overall estimate of risk table

to ensure the overall risk ratings are accurate and appropriate for this water

supply” (WHI007_WhirinakiHawkesBay_WSPadequacy_191217_v1, Page 4).

4.3 After discussion

with CNIDWAU regarding the need for changing from Council’s corporate

standard, an amended risk matrix has been submitted for approval. The revised

risk matrix follows a similar patter to the HDC corporate matrix with the bands

for Very High and High pushed further down the matrix with a resulting

reduction in the area defined as Low risk (refer attachment). The Consequence

and likelihood scales remain in-line with the definitions in the HDC risk

framework.

4.4 Considering that

the Drinking Water Assessors consider the revised risk matrix important for

certification of the WSP, it is recommended that an amendment be made to the

HDC Risk Management Policy and Framework to acknowledge the water supply risk

matrix as an approved variation for this purpose only.

5.0 NEXT STEPS

5.1 To provide

confidence that adequate controls exist for the remaining 11 strategic risks,

further risk analysis will be undertaken to develop 1-page summaries. To

progress this in a timely fashion an abbreviated risk analysis process will be

used.

5.2 The purpose of

the abbreviated risk assessment process is to enable time to be spent on

confirming the integrity of critical controls identified for higher risk items.

|

6.0 RECOMMENDATIONS

AND REASONS

A) That the

report of the Risk and Corporate Services Manager titled “Enterprise

Risk Management Update” dated 12/02/2018 be

received.

B) Council be recommended that the strategic risk number 9 be changed

from Investment Failure to Inadequate Available Funds, which is defined as a

“loss of access to sufficient funds to meet Council commitments”.

C) Council be recommended that the HDC Risk Management Policy and

Framework be amended to include the Whirinaki Water Safety Plan risk matrix

as an approved variation for use only within Council Water Safety Plans.

With the reasons for this decision

being that the objective of the decision will contribute to meeting the

current and future needs of communities for good quality local

infrastructure, local public services and performance of regulatory functions

in a way that is most cost-effective for households and business by:

i) Validating risks in core business processes are effectively

managed.

|

Attachments:

|

1

|

Governance Strategic Risk Summary Water Supply

Contamination for Risk and Audit Subcommittee 12 February 2018

|

PMD-03-81-18-121

|

|

2

|

Governance Strategic Risk Summary Adverse

Environmental Change

|

PMD-03-81-18-122

|

|

3

|

Strategic Risk Visualisation Adverse Environmental

Change

|

PMD-03-81-18-123

|

|

4

|

Governance Strategic Risk Summary Procurement

Failure

|

PMD-03-81-18-120

|

|

5

|

Governance Strategic Risk Bow Tie Procurement

Failure Page 1

|

PMD-03-81-18-119

|

|

6

|

Governance Strategic Risk Bow Tie Procurement

Failure Page 2

|

PMD-03-81-18-118

|

|

7

|

Revised Risk Matrix for Whirinaki Water Safety Plan

|

PMD-03-81-18-124

|

|

Governance Strategic Risk Summary

Water Supply Contamination for Risk and Audit Subcommittee 12 February 2018

|

Attachment 1

|

|

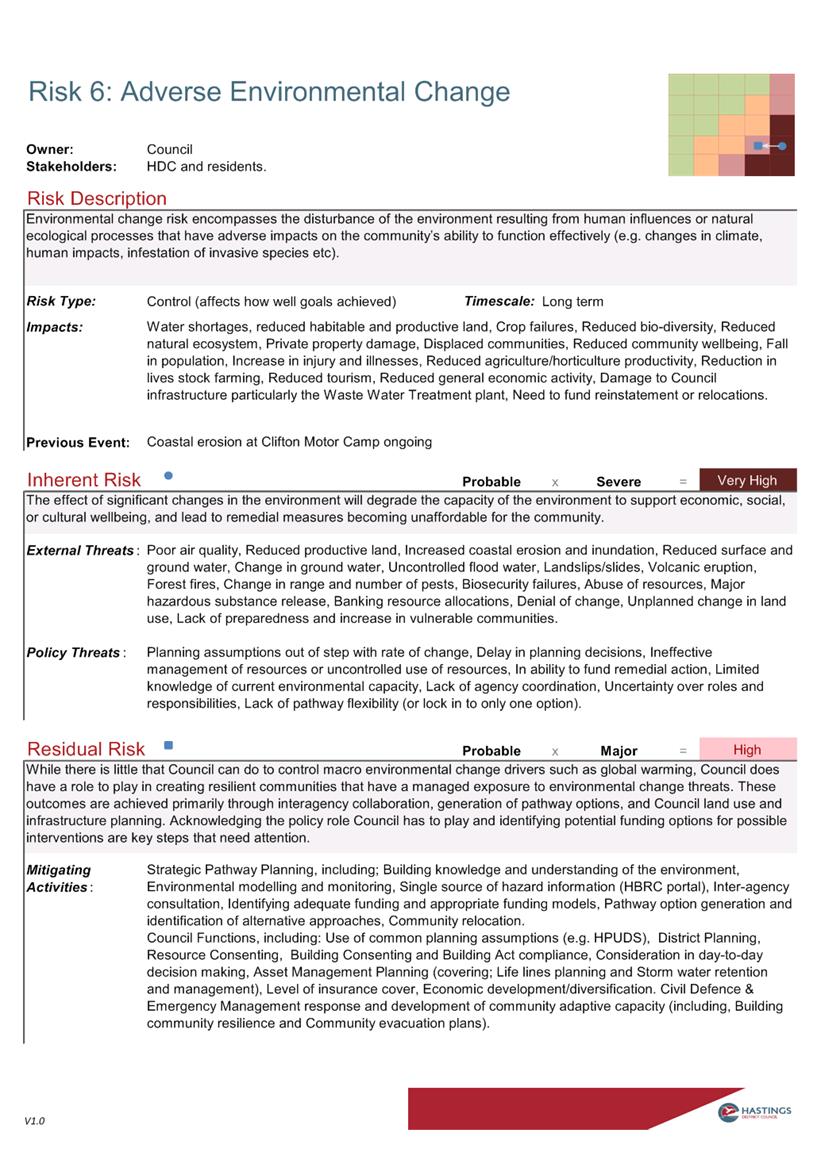

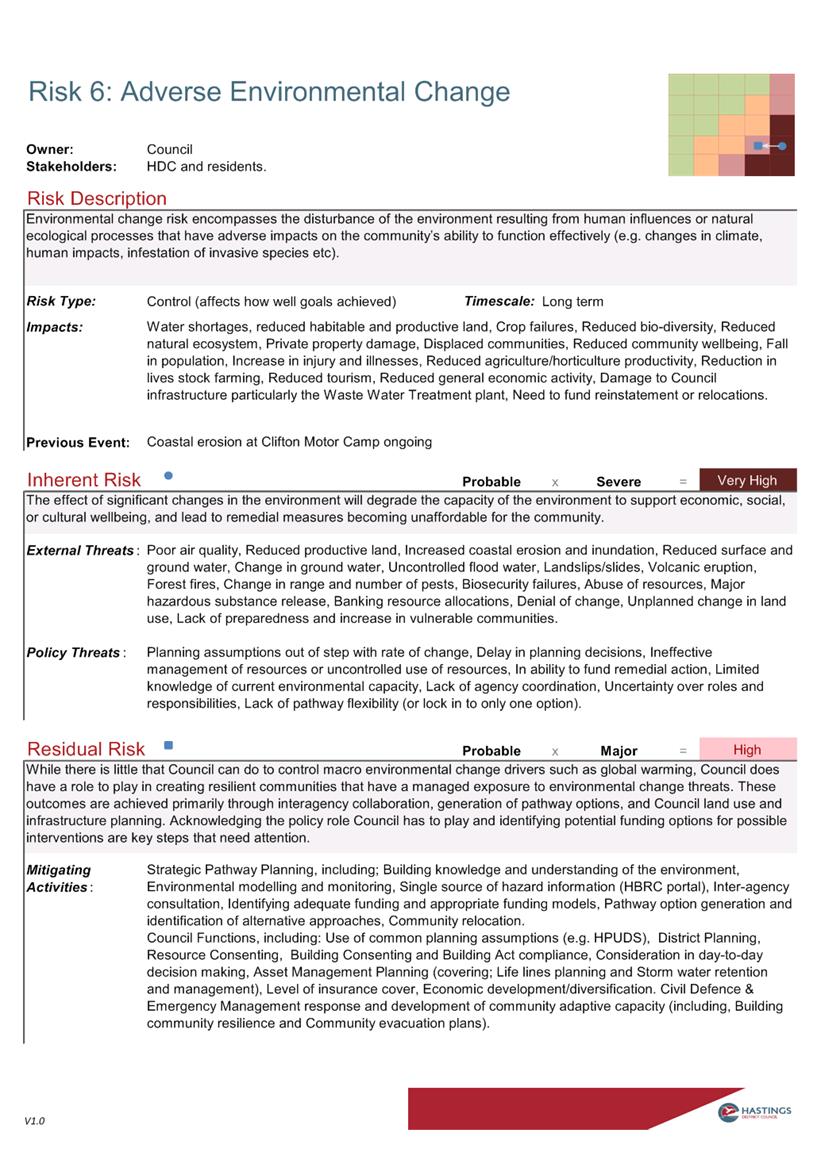

Governance Strategic Risk Summary Adverse Environmental

Change

|

Attachment 2

|

|

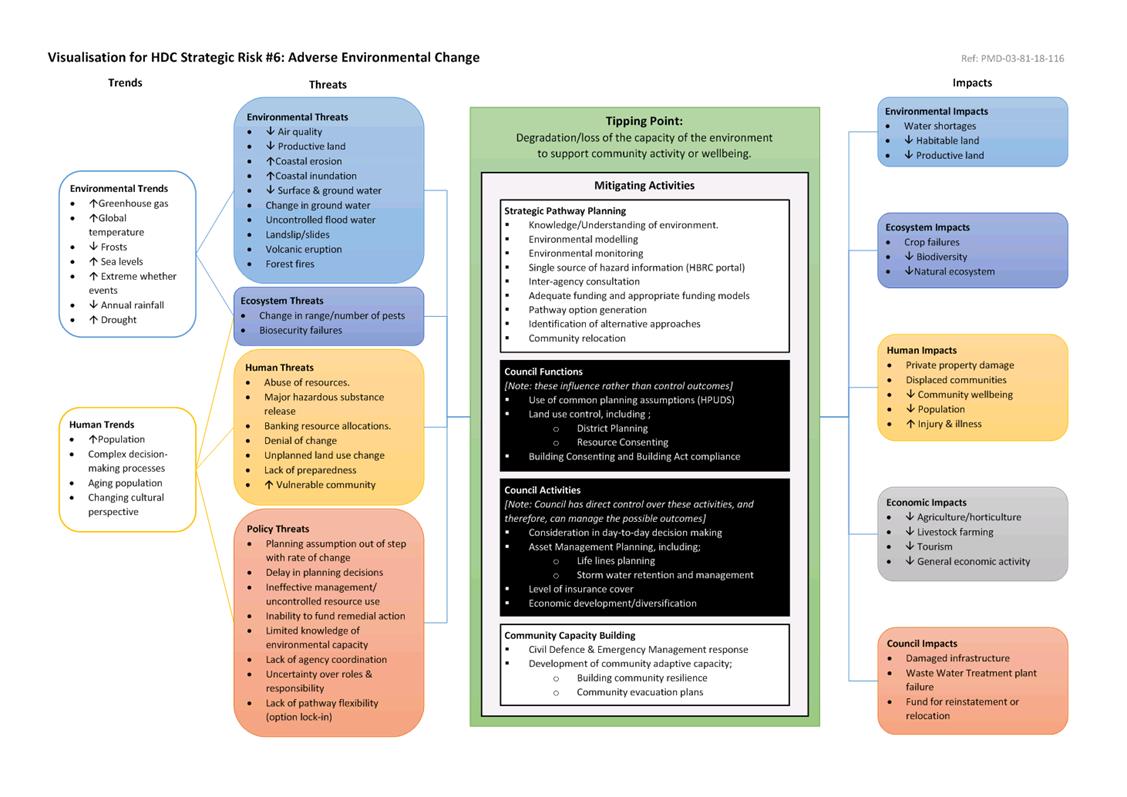

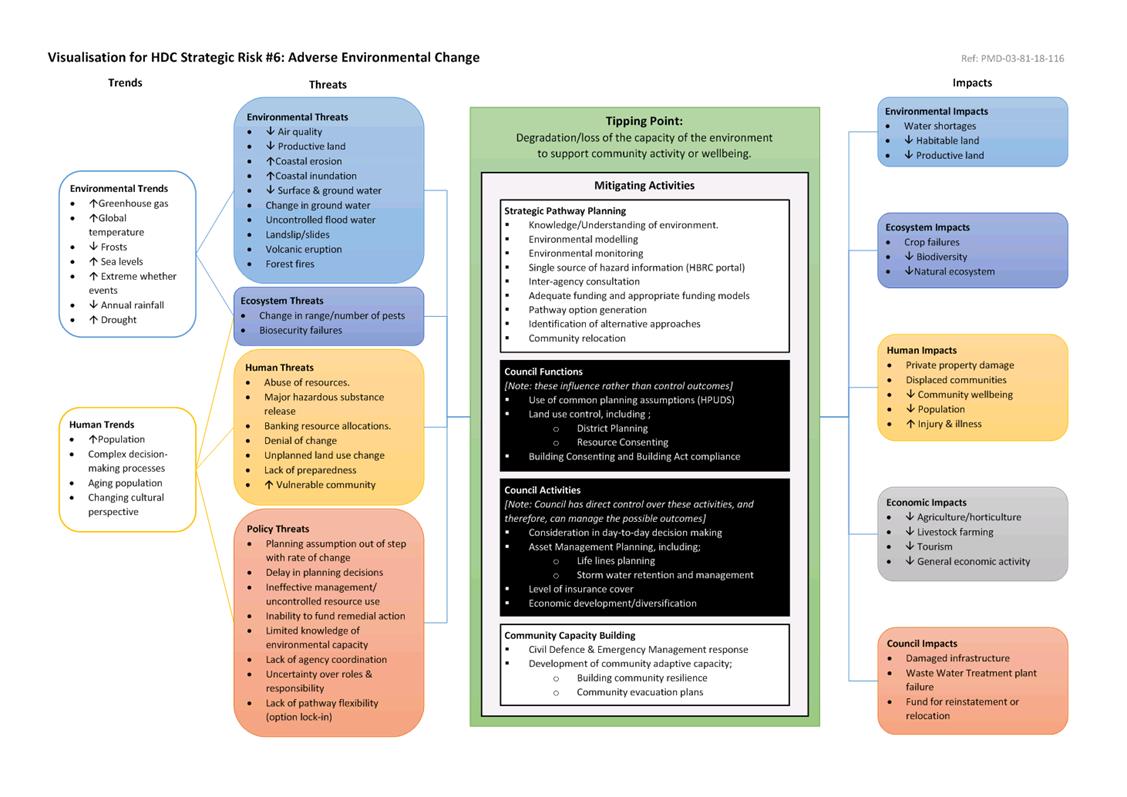

Strategic Risk Visualisation Adverse Environmental

Change

|

Attachment 3

|

|

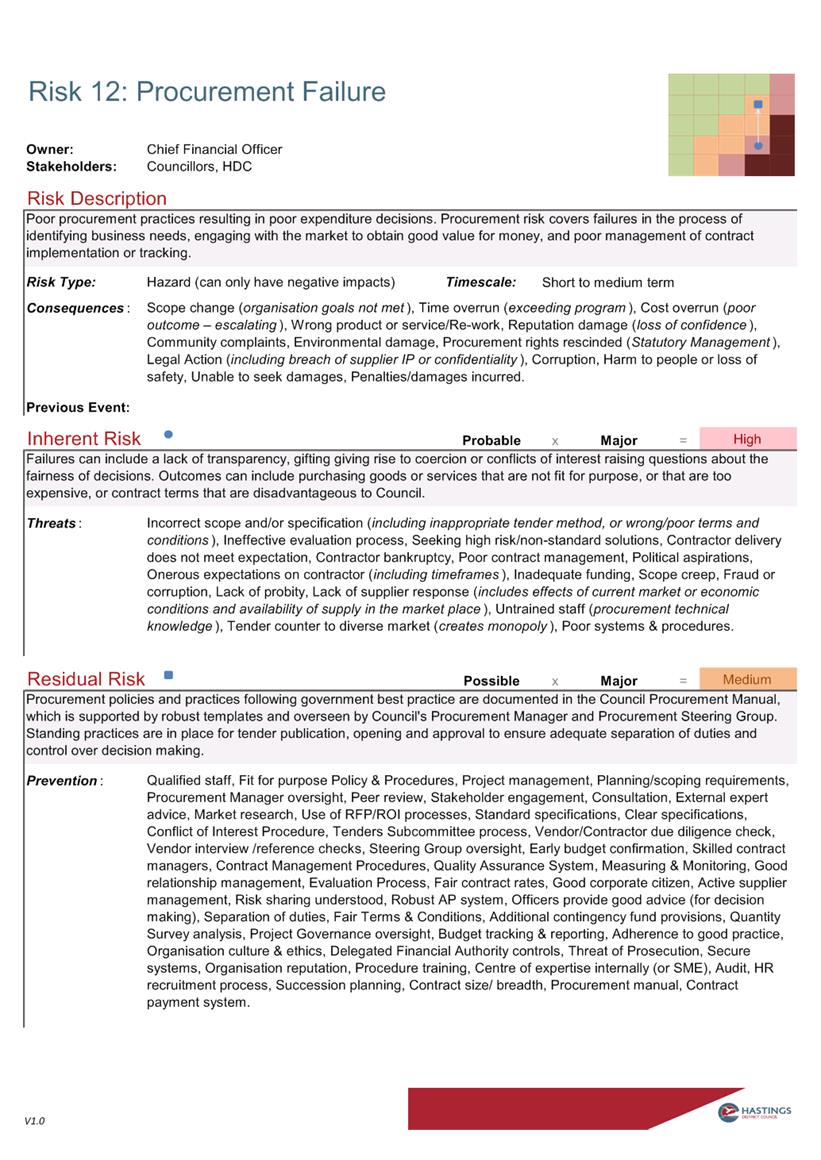

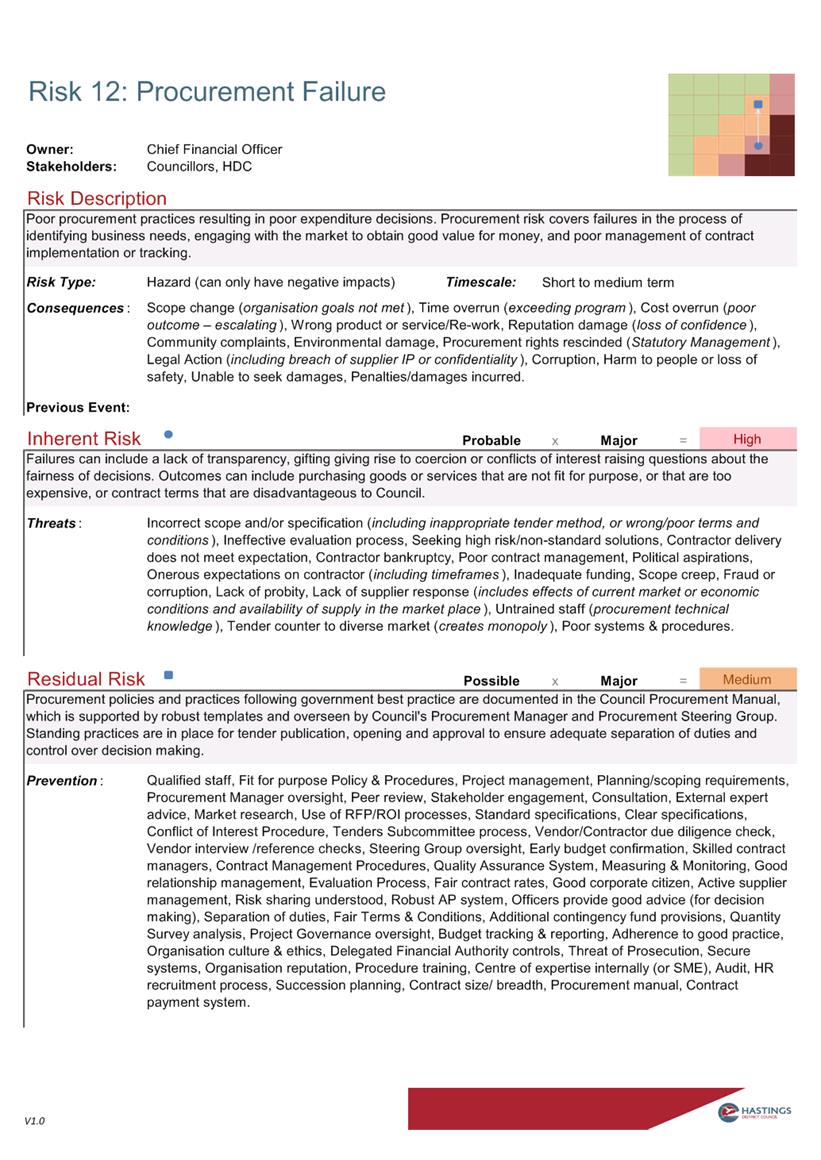

Governance Strategic Risk Summary Procurement Failure

|

Attachment 4

|

|

Governance Strategic Risk Bow Tie Procurement Failure

Page 1

|

Attachment 5

|

|

Governance Strategic Risk Bow Tie Procurement Failure

Page 2

|

Attachment 6

|

|

Revised Risk Matrix for Whirinaki Water Safety Plan

|

Attachment 7

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 12 February

2018

FROM: Manager Strategic Finance

Brent Chamberlain

Chief Financial Officer

Bruce

Allan

SUBJECT: General

Update Report and Status of Actions

1.0 SUMMARY

1.1 The purpose of

this report is to update the Subcommittee on various matters including actions

raised at previous meetings.

1.2 The Council is required to give effect to the

purpose of local government as prescribed by Section 10 of the Local Government

Act 2002. That purpose is to meet the current and future needs of communities

for good quality local infrastructure, local public services, and performance

of regulatory functions in a way that is most cost–effective for

households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.3 This report

concludes by recommending that the report titled “General Update Report

and Status of Actions” from the Manager Strategic Finance be received.

2.0 BACKGROUND

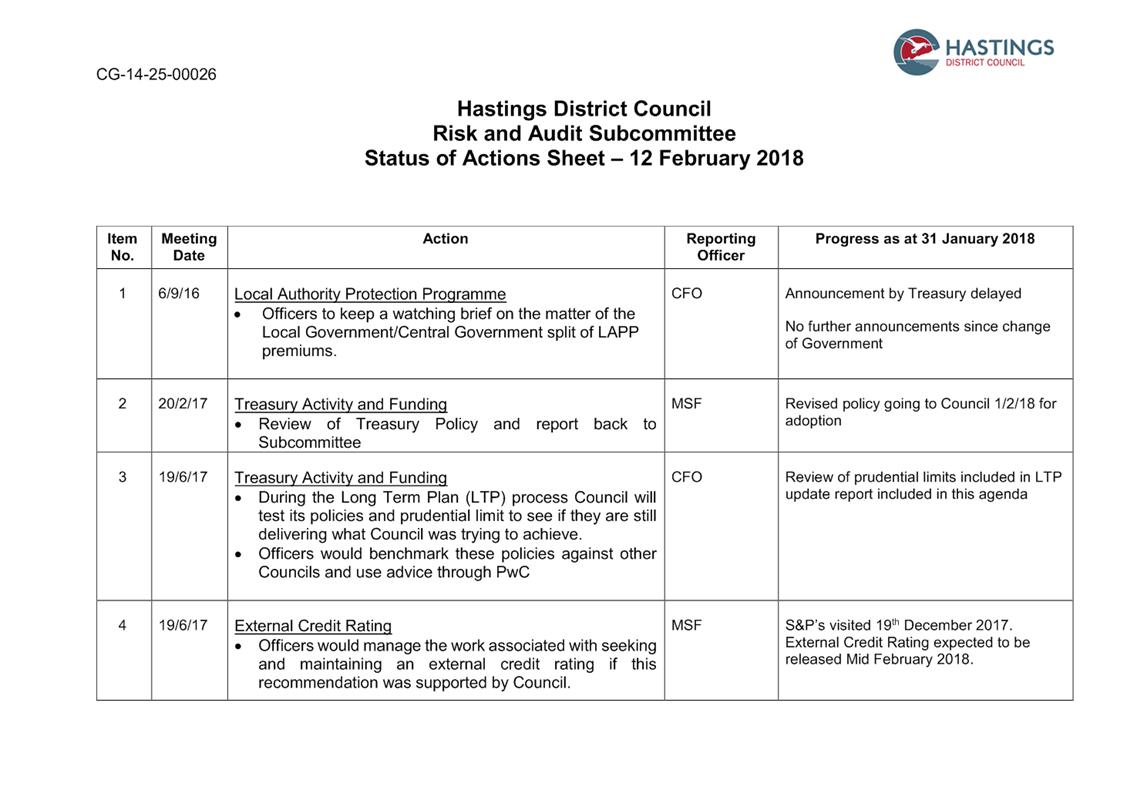

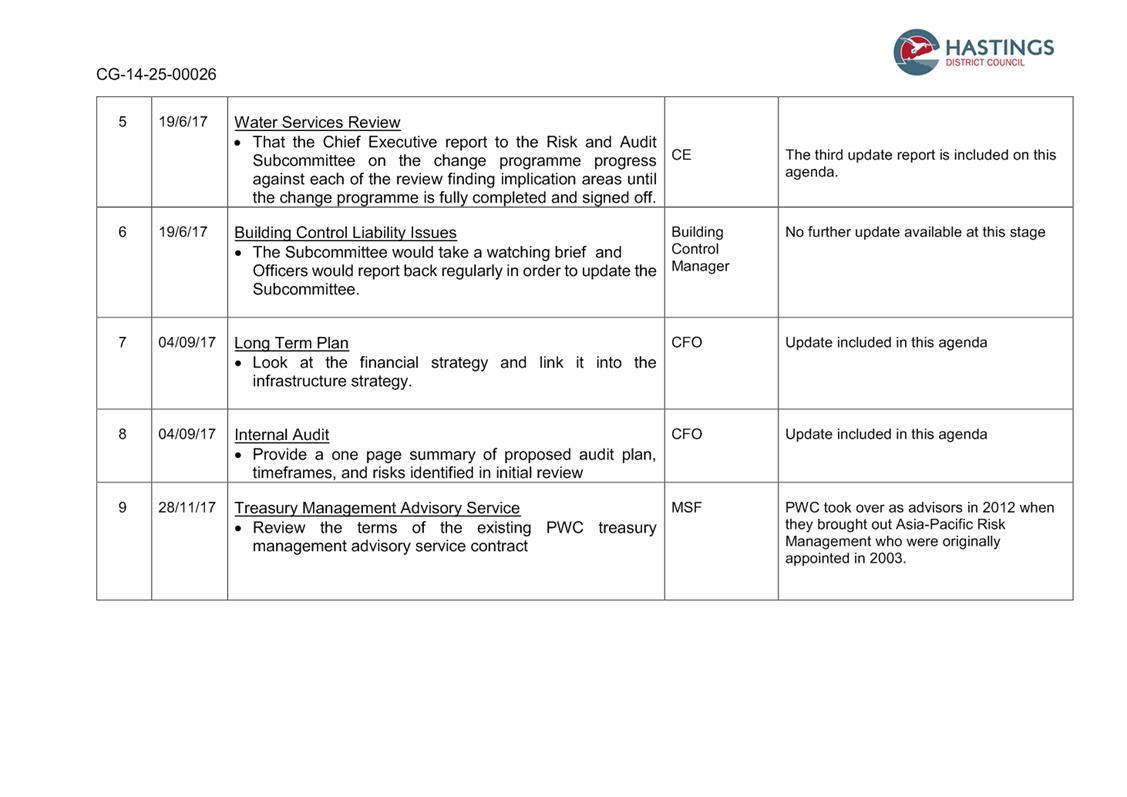

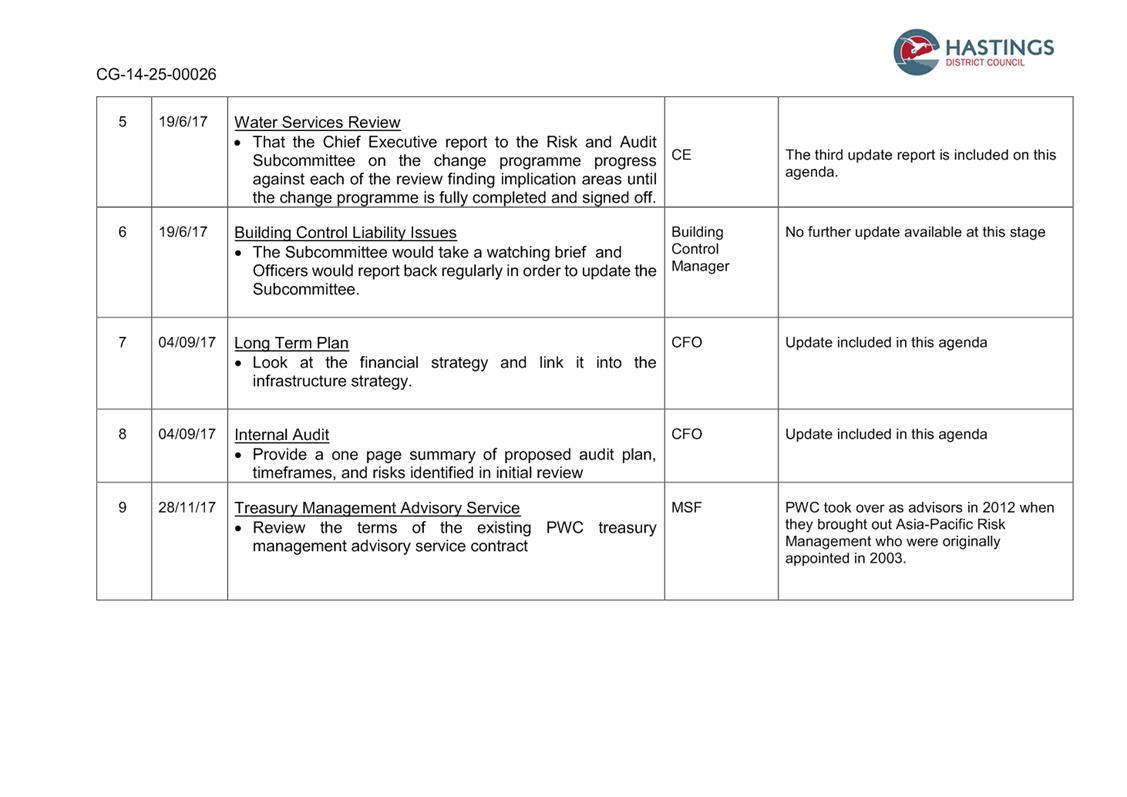

2.1 The Audit &

Risk Subcommittee members requested that officer’s report back at each

meeting with progress that has been made on actions that have arisen from the

Audit & Risk Subcommittee meetings. Attached as Attachment 1 is the

Audit & Risk Subcommittee Action Schedule as at 12 February 2018.

3.0 CURRENT SITUATION

3.1 Tech One

Upgrade

3.1.1 Work undertaken by staff to

review the scope and nature of the upgrade to the Technology One Finance Module

has taken place and has resulted in a plan with stage 1 significantly

“down-sized” which has minimised risk and cost while still achieving

much of what was considered necessary when the project was first

initiated.

3.1.2 Stage 1 will:

· Upgrade the TechOne Finance module to latest version

· Adjust the general ledger chart structure

· Automate opening balances

· Adjust how the Landfill is currently integrated within

Council’s accounts

This will lead to

overall efficiencies with reporting timelines, increased transparency through

the in ledgers and position Council to take advantage of future enhancements.

3.1.3 Future stages will look to

build on the improved stability of the general ledger and will include:

Stage 2 –

Procure to Pay upgrades which will include the implementation of electronic

purchase orders and will:

· create more robust internal controls around delegated financial

authorities and approval processes

· shorten month-end process by a number of days, thereby shortening

reporting process

· provide more automation of invoice and purchase order processes,

less intervention meaning more accuracy

· allow further enhancements to be easily implemented e.g. supplier

cataloguing

3.1.4 The need to move to

electronic purchase orders is an improvement which has been identified in

internal and external audit reviews and is a necessary improvement. Electronic

purchase orders will improve control systems ensuring amongst other things that

approvals are required prior to expenditure being committed rather than at the

payment stage. Stage 2 will commence in October 2018 after all year-end

and annual report workloads have eased.

3.1.5 Stage 3 – Contract

Management System – the implementation of a contract management system is

also an improvement that has been identified through the external audit. A

contract management system is closely linked to the procure to pay improvements

and can follow on from those improvements. In the meantime, Officers are

developing a contract management spreadsheet where all current contracts are

being collated.

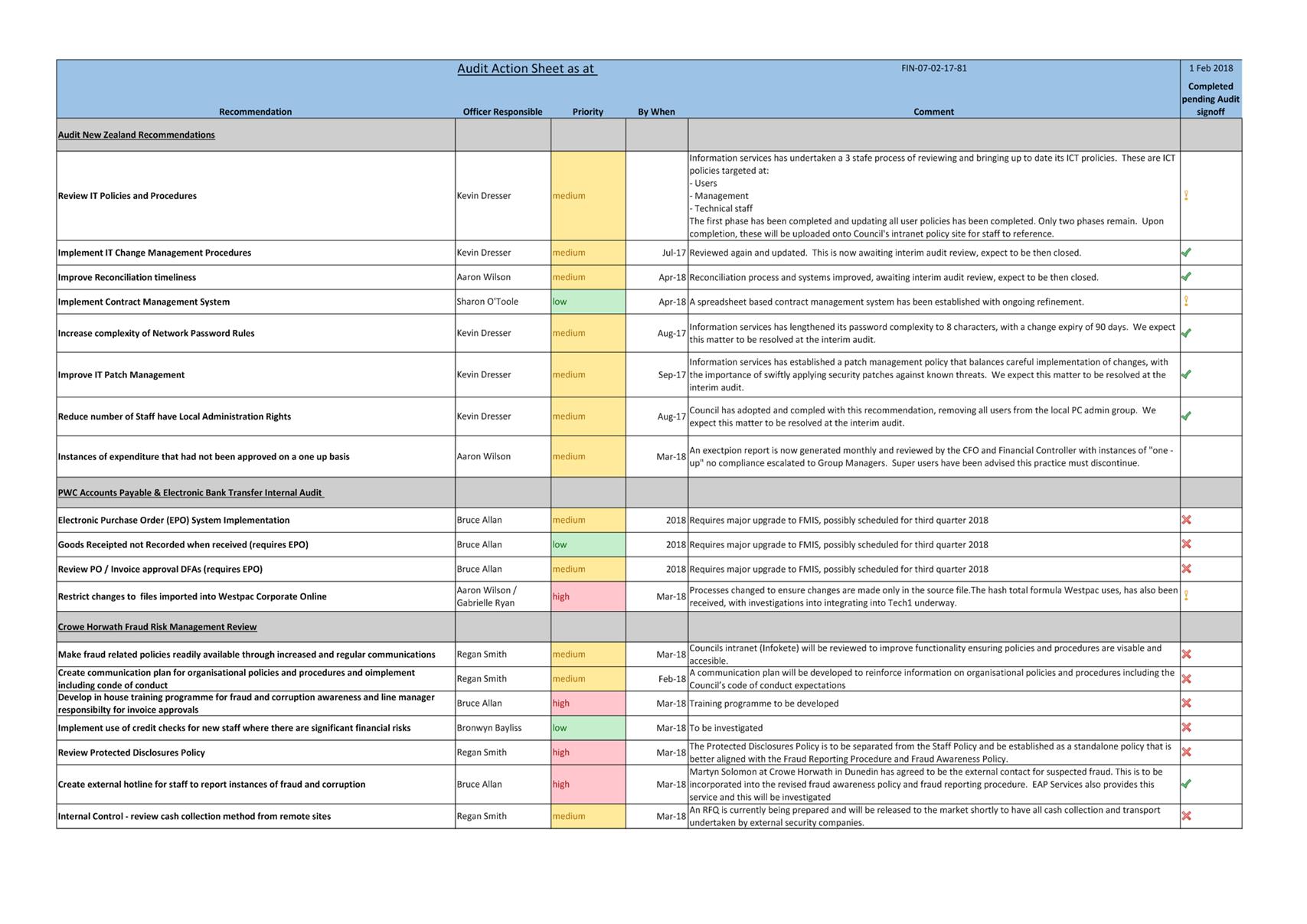

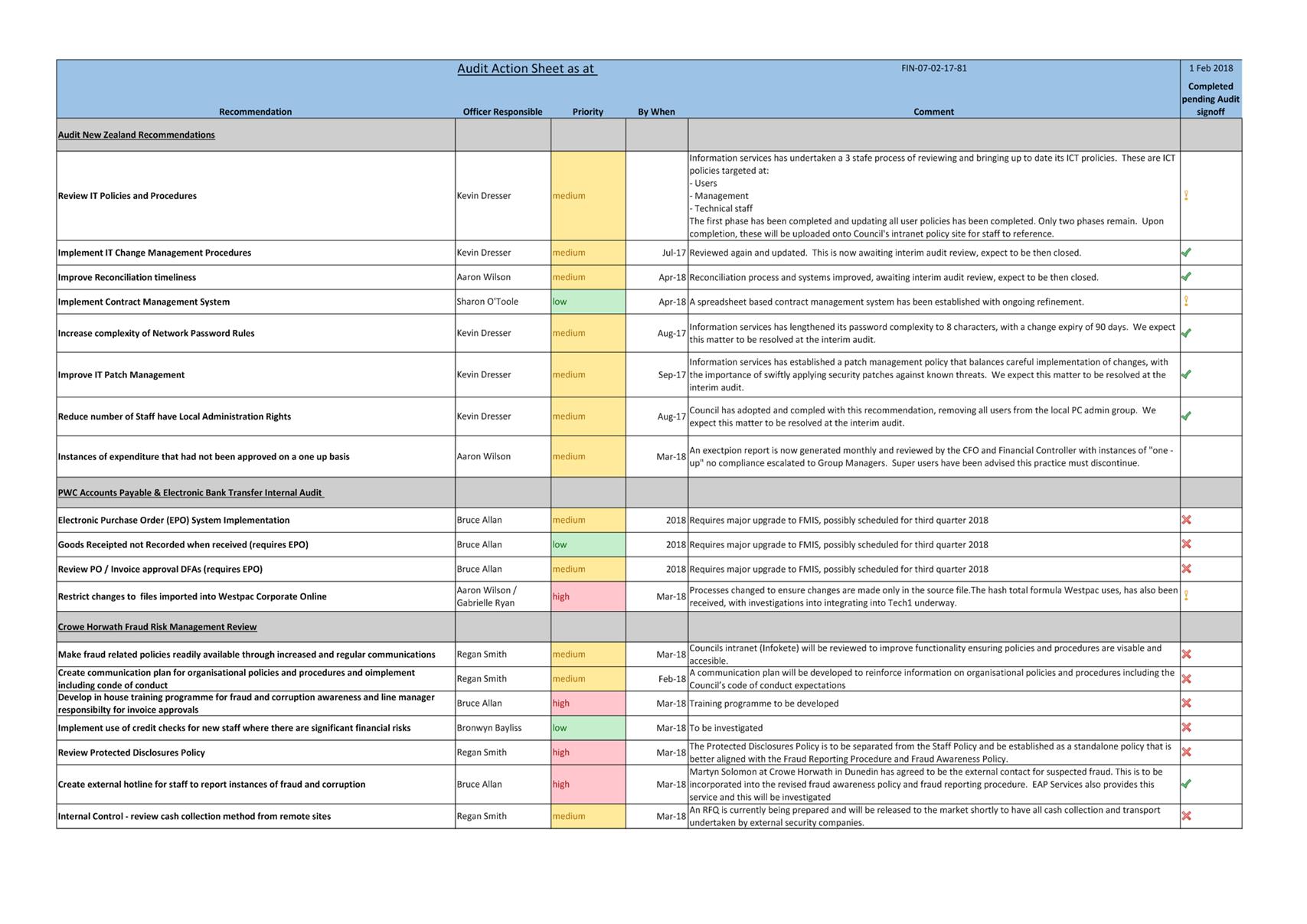

3.2 Audit Action

Plan

3.2.1 Attached as Attachment 2

is an updated Audit Action sheet providing the Subcommittee with a view of the

status of recommendations made from previous internal and external audits. Good

progress has been made on addressing recommendations and the new

recommendations from the recent audit work have now been included.

4.0 SIGNIFICANCE AND

ENGAGEMENT

4.1 This report does

not trigger Council’s Significance and Engagement Policy and no

consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

That the report of the Manager

Strategic Finance titled “General Update Report and Status of

Actions” dated 12/02/2018 be received.

|

Attachments:

|

1

|

Action Sheet 12 February 2018

|

CG-14-25-00026

|

|

|

Audit Action Sheet - 12 February 2018

|

CG-14-25-00028

|

|

Audit Action Sheet - 12 February 2018

|

Attachment 2

|

Hastings District

Council

Hastings District

Council