REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 17

September 2019

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Horse

of the Year (Hawke's Bay) Limited Annual Report for the year ended 31 May 2019

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to update the Committee on the performance of the

Horse of the Year (Hawke’s Bay) Limited (HOYHB) for the year ended 31 May

2019.

1.2 This

report arises from the receipt of the HOYHB’s Annual Report for the year

ended 31 May 2019.

1.3 This

report contributes to the purpose of local government by primarily promoting social wellbeing and more specifically

through the Council’s strategic objective to support a major Hastings

event that contributes to the provision of good local services by increasing

economic activity, contributing to a resilient job rich district while also

contributing to an appealing visitor destination.

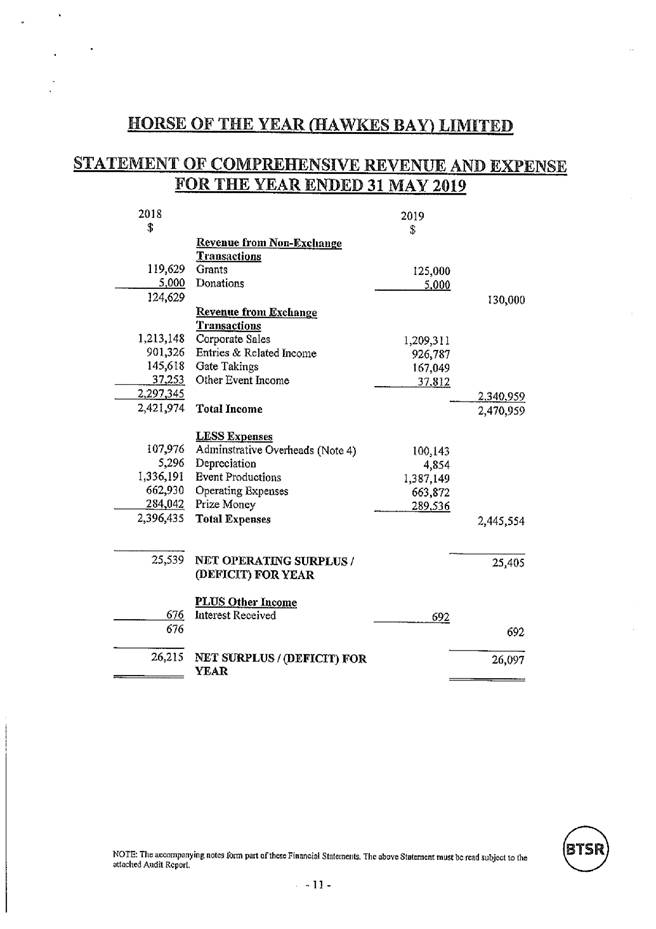

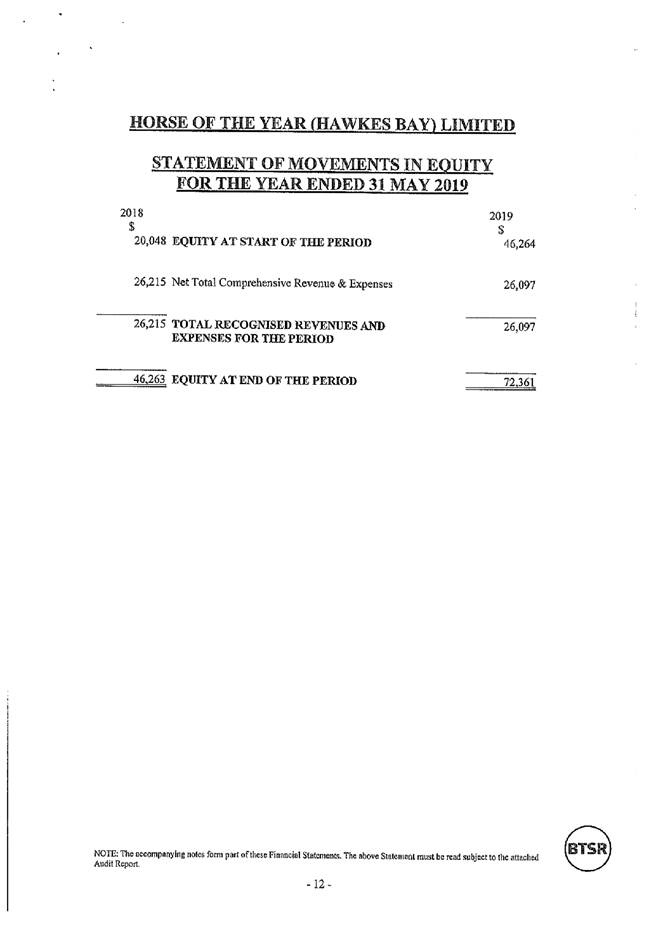

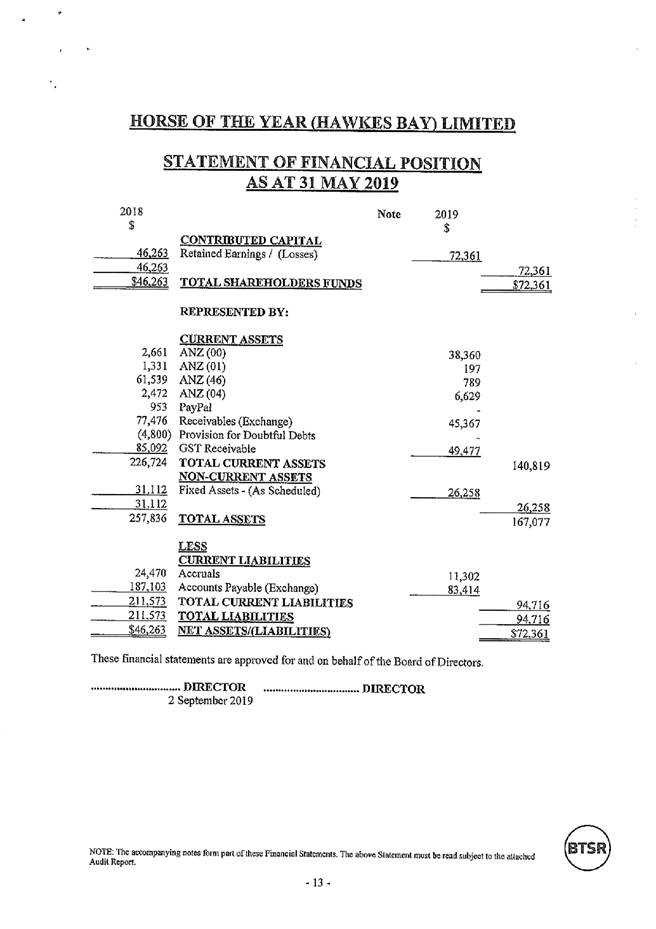

1.4 HOYHB’s

financial statements show a surplus for the year of $26,097 which is similar to

the previous year’s result of $26,215.

1.5 HOYHB

has minimal cash reserves of $45,975 and shareholders equity of $72,361 as at

31 May 2019.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Horse of the Year (Hawke's Bay)

Limited Annual Report for the year ended 31 May 2019

|

3.0 BACKGROUND – TE HOROPAKI

3.1 The

annual Land Rover Horse of the Year show is New Zealand’s premier

equestrian competition, featuring a range of horse and rider combinations from multiple

disciplines. With over 1600 riders and 1800 horses competing for lucrative

titles and prize money, the show is a feature on all equestrian calendars.

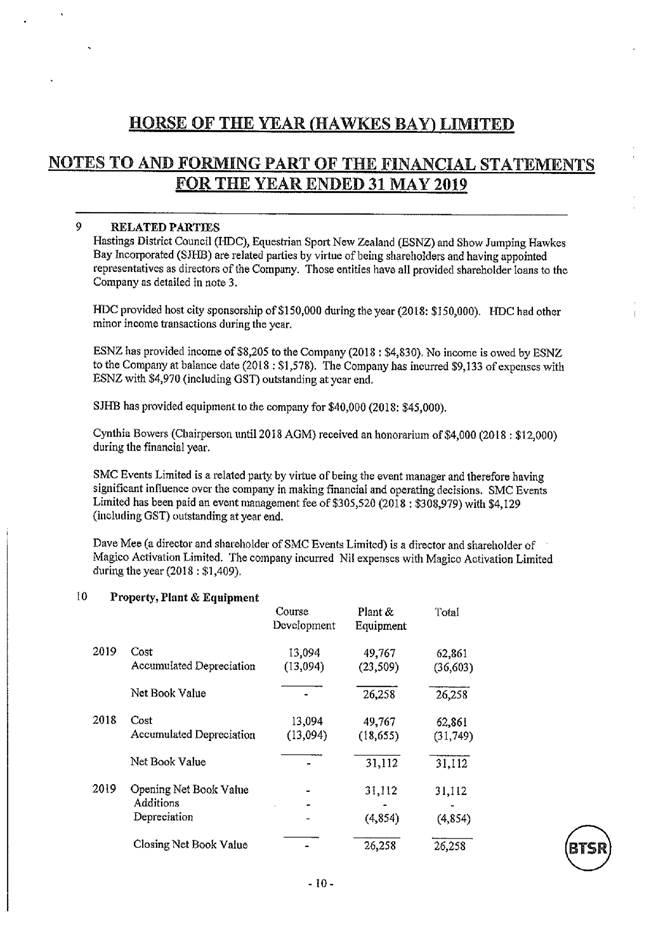

3.2 The

shareholding of HOYHB is made up of Hastings District Council, Equestrian Sport

New Zealand (ESNZ) and Show Jumping Hawke's Bay (SJHB) with each entity holding

one third of the allotted shares. Each shareholder has advanced $30,000

as shareholder loans.

3.3 Each

shareholder is allowed up to 2 shareholder appointed directors. The current

Board is as follows:

· Tim Aitken HDC

appointment

· William Moffett SHB

appointment

· Dirk Waldin SHB

appointment

· Vicki Glynn ESNZ

appointment

· Richard Sutherland ESNZ appointment

· Craig Foss Independent

3.4 While

there is a resolution of Council to appoint a second director to the Board,

Council was very mindful that any appointment needed to have the required

skills to complement the existing board and fill any gaps that may be evident.

Council has yet to make an appointment and with the resignation of Cynthia

Bowers there is also a vacancy for a second independent director.

3.5 The

executed Shareholders Agreement provides the following in regard to the Annual

Report:

"Annual

Report: Within 90 days after the end of the each financial year, the

Company will deliver to the shareholders an annual report which will consist

of:

· A Chairman's report, containing a review of the Company operations

with specific attention to the performance against the key performance

indicators established in the respective Statement of Intent.

· A comparison of actual performance with targeted performance.

· Annual audited financial accounts to be completed in accordance with

general accepted accounting standards and to include:

- Statement of

Financial Position

- Statement of

Financial Performance

- Auditor's

Report"

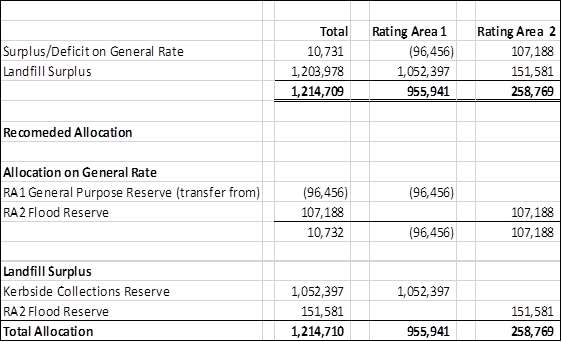

4.0 DISCUSSION - TE MATAPAKITANGA

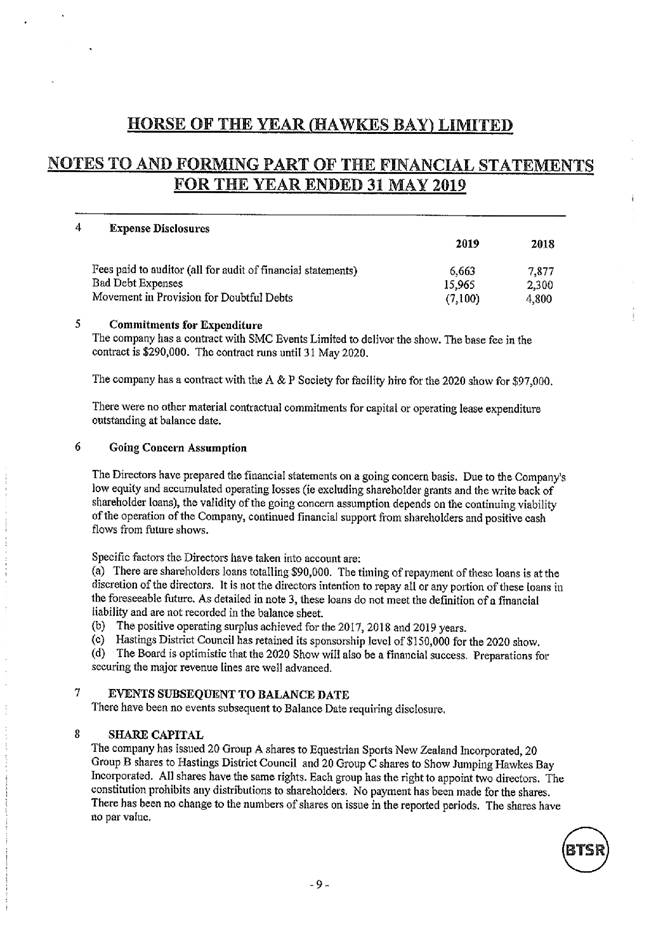

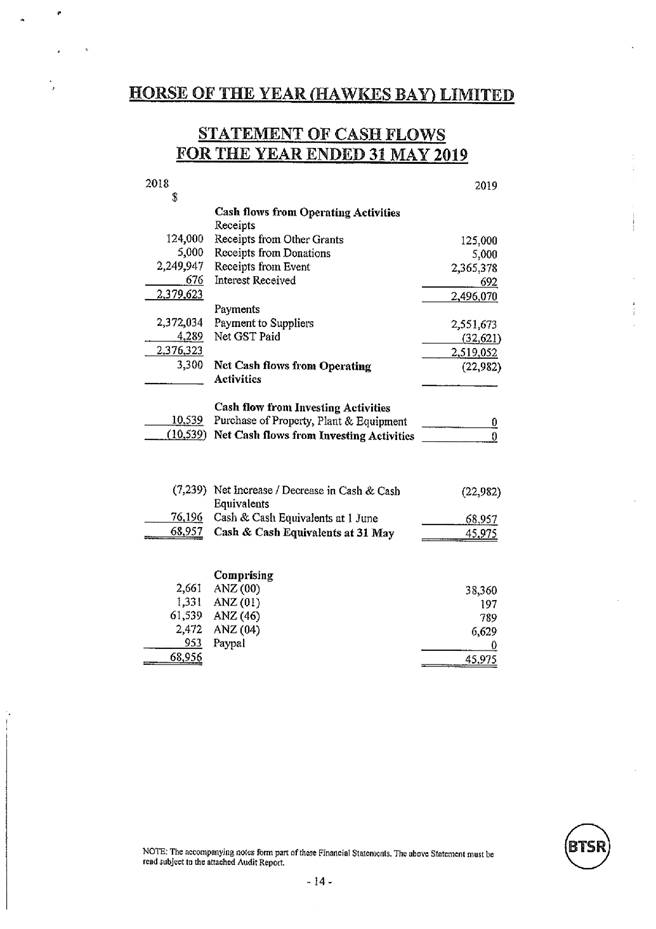

4.1 HOYHB’s

financial statements show a surplus for the year of $26,097 ($26,215: 2018).

This result was achieved on revenues of $2,470,959 which was 2% up on the

previous year. These in turn funded expenses of $2,445,554 which were also 2%

up on last year.

4.2 At

balance date HOYHB held cash reserves of $45,975 which is minimal for an

organisation with an annual turnover of $2.4m.

4.3 For

this reason note 6 to the accounts refers to HOYHB as being a going concern by

virtue of the support of its shareholders (in the form of shareholder loans),

and Hastings District Council’s continued sponsorship. It notes that

HOYHB doesn’t have sufficient resources in its own right to underwrite

the possibility of a future under-performing annual show.

5.0 OPTIONS

- NGĀ KŌWHIRINGA

Option One -

Recommended Option - Te Kōwhiringa Tuatahi – Te Kōwhiringa

Tūtohunga

5.1 Council

can receive HOYHB’s annual financial statements for the year ended 31 May

2019.

6.0 NEXT STEPS - TE ANGA

WHAKAMUA

6.1 No

further action is required.

Attachments:

|

1⇩

|

HOY 2019 Annual Report

|

EXT-10-20-19-92

|

|

|

SUMMARY

OF CONSIDERATIONS - HE WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose of Local

Government - E noho hāngai pū ai ki te

Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future

This report contributes to the

purpose of local government by primarily promoting social wellbeing and more

specifically through the Council’s strategic objective to support a

major Hastings event that contributes to the provision of good local services

by increasing economic activity, contributing to a resilient job rich

district while also contributing to an appealing visitor destination.

|

|

Link to the Council’s

Community Outcomes - E noho hāngai pū ai ki te rautaki matua

This proposal promotes the Social and Economic well-being of communities in the present and

for the future.

|

|

Māori Impact Statement - Te

Tauākī Kaupapa Māori

There are

no known impacts for Tangata Whenua.

|

|

Sustainability - Te

Toitūtanga

There are no

implications for sustainability.

|

|

Financial considerations - Ngā

Whaiwhakaaro Ahumoni

There are no

financial implications.

|

|

Significance and Engagement - Te

Hiranga me te Tūhonotanga

This report has been assessed

under the Council's Significance and Engagement Policy as being of minor significance.

|

|

Consultation – internal

and/or external - Whakawhiti Whakaaro-ā-roto, ā-waho

|

|

Risks: Legal/ Health and

Safety - Ngā Tūraru: Ngā Ture / Hauora me te Haumaru

There are no

legal or health and safety risks arising from this report

|

|

Rural Community Board - Ngā

Poari-ā-hapori

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 17

September 2019

FROM: Financial Controller

Aaron

Wilson

SUBJECT: Draft

Financial Year End Result - 30 June 2019

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

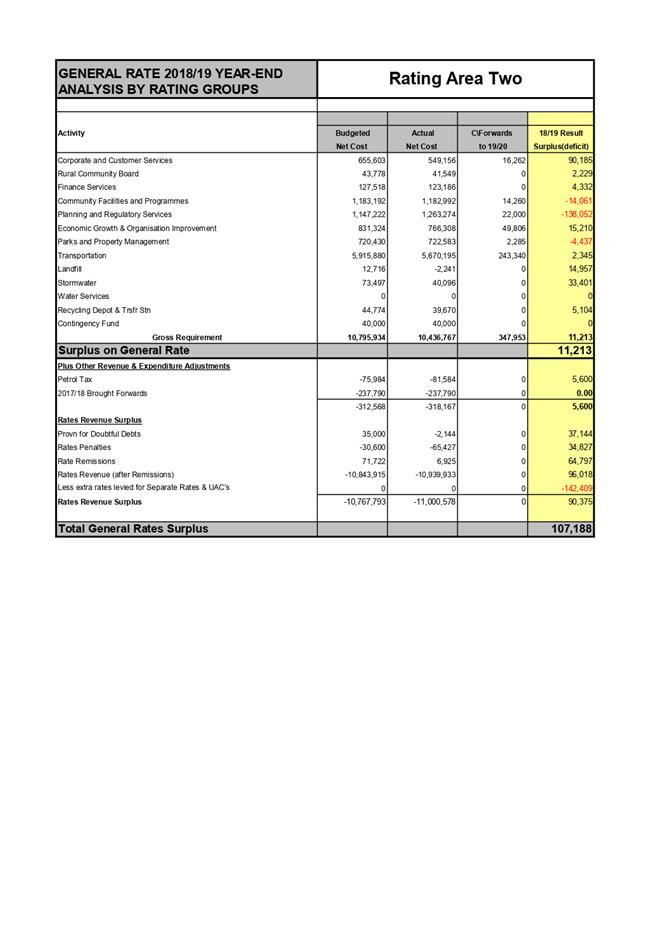

1.1 The purpose of this report is to inform the Council of the unaudited

accounting and rating result for the year ended 30 June 2019 and for the

Council to approve the allocation of the rating result. It also seeks the

approval from Council to carry forward project budgets. This report has been

prepared on the basis that the Hastings District Rural Community Board has

approved the recommendations submitted to it on 9 September 2019 relating to

the year-end rating result for Rating Area 2.

1.2 The rating

result is a small surplus to budget. The deficit in RA1 is a

consequence of interest rate savings and offset by increasing cost pressures

within areas of Council along with a number of approved but unbudgeted spends

in the financial year. RA2 has benefited from favourable budgeted rates

remissions, penalties and rates revenues.

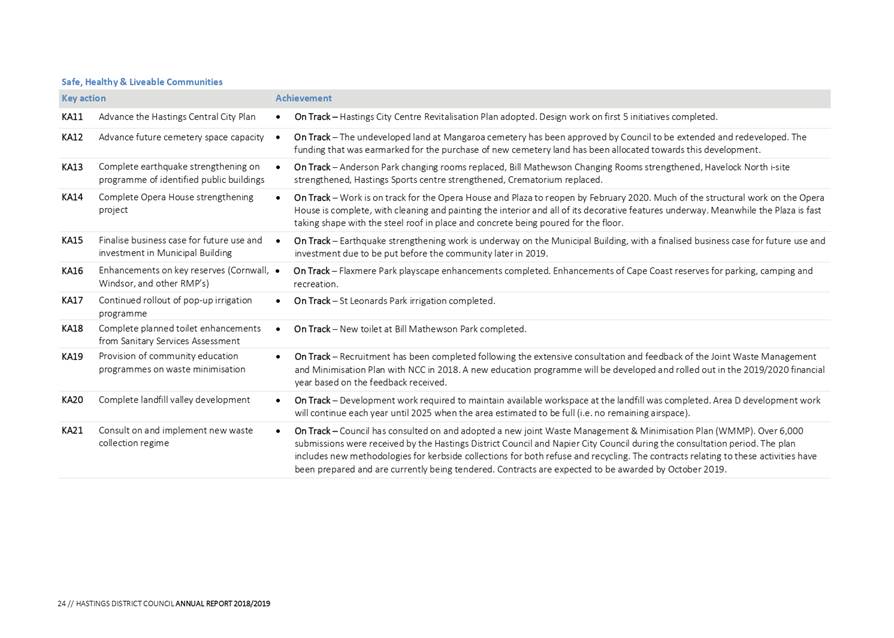

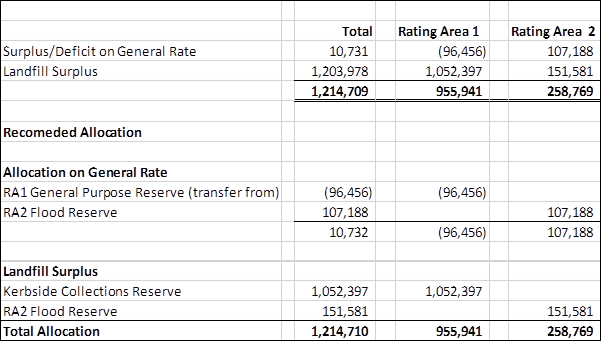

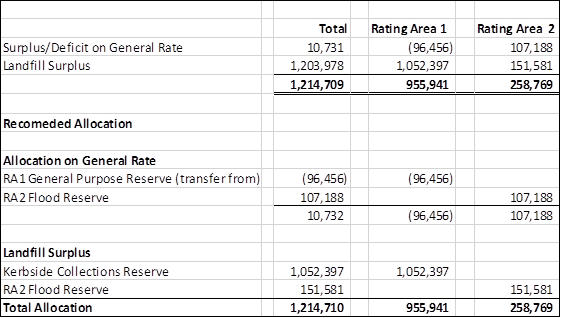

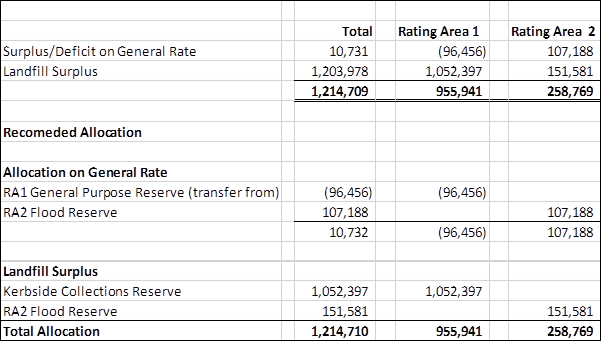

1.3 The

unaudited rating result for the 2018/19 year is as follows:

|

Rating Area 1

|

$(96,456)

|

Deficit

|

|

Rating Area 2

|

$107,188

|

Surplus

|

|

Total for the District

|

$10,732

|

Surplus

|

1.4 In addition

to the Rating Result, Council also generated a surplus from the Landfill

operation, the report recommends that these surpluses be allocated as follows:

1.5 The report also

recommends that budget allocations proposed to be carried forward from 2018/19

to 2019/20 to enable project completion be approved.

1.6 Council

is provided with quarterly financial reports during the year with the unaudited

year-end result presented annually at the September Finance and Risk Committee

meeting.

1.7 Officers

report on the operating financial result (operating surplus/deficit) as well as

the rating result. The operating (accounting) financial result is reported on

quarterly during the year and, at year end, a report is prepared on the rating

result in addition to the accounting result.

1.8 The

rating result differs from the accounting result in respect of non-cash items

such as depreciation, gains or losses on interest rate swaps, vested assets,

impairment of assets and investments and development contributions income which

have no impact on setting rates and are therefore excluded from the rates

calculations. The rating result is also affected by the extent of rates-funded

carry forwards that are approved. The rating result reports on the variance of

rates collected and net total expenditure (including capital and reserve

transfers) for Council.

1.9 The

Financial Reports attached to supplement this report include:

Attachment 1 – Interim Rating Result for the year ended 30 June 2019

Attachment

2 – Dash Board Summary of Financial Performance

Attachment

3 – Draft Unaudited Financial Statements

Attachment

4 – Carry Forwards 2019/20

1.10 The financial reports

contain summarised information. Please feel free to contact the report

writer or the Chief Financial Officer directly on any specific questions from

the reports before the meeting. This will ensure that complete answers can

be given at the meeting on the detail that forms the basis for these reports.

2.0 Current

Situation

2.1 The

2018/19 financial year has seen a continuation of a strong Hawke’s Bay

economy. In terms of Council’s performance, there are a number of areas

that have experienced cost pressures in responding to these strong economic

conditions.

2.2 Since

the financial quarterly report for the year to 31st March was presented in May,

most of the issues and trends identified have remained on the same track to the

end of the financial year. This report sets out the financial performance

(accounting result) and the rating result for the year ended 30 June 2019.

These results are unaudited and may be subject to minor adjustments.

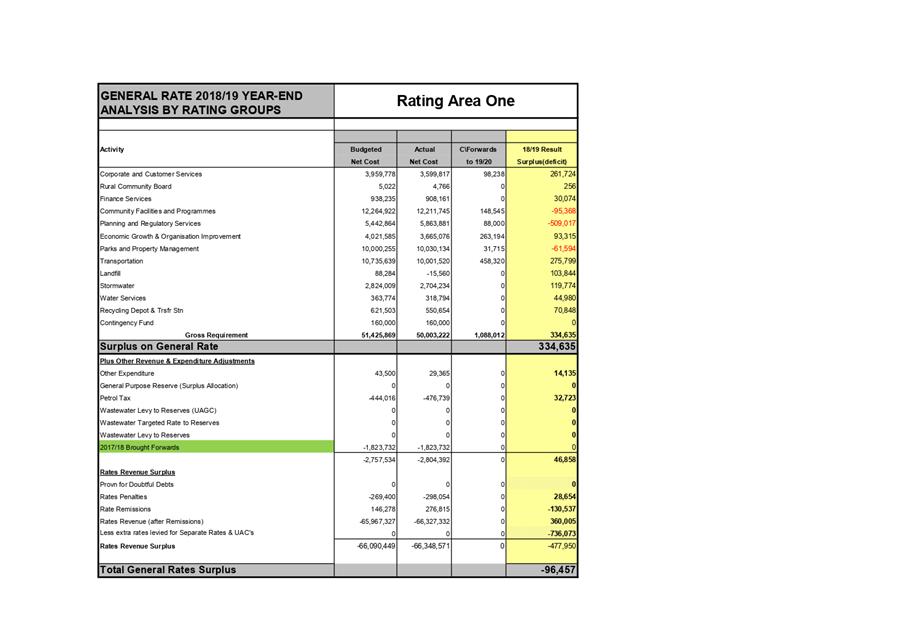

3.0 THE

RATING RESULT

3.1 Council

adopts strong financial management practices and prepares a balanced budget to

deliver Council’s desired programme, including high levels of fiscal tensioning

and stretch targets.

3.2 This

year the overall general rating result for 2018/19 is a small surplus to

budget, which is lower than the previous year’s surplus in 2017/18 of

$942,713.

|

Rating Area 1

|

$(96,456)

|

Deficit

|

|

Rating

Area 2

|

$107,188

|

Surplus

|

|

Total

for the District

|

$10,732

|

Surplus

|

3.3 In

addition to the general rating result, the Council’s share of the surplus

from the Landfill operations is $1.2m. Previously, the Landfill surpluses were

used to repay Landfill debt. The remaining debt was extinguished by application

of the surplus from the 2015/16 financial year. Landfill surpluses from the

last two years have been used to fund the water supply targeted rate account,

helping fund the response to the waster change programme.

3.4 Council

resolved last year to apply the 2017/18 landfill surplus of $2.2m to the water

supply targeted rate account ($1.09m), and stormwater debt repayment both in

RA1 whilst allocating $284k to the capital reserve for RA 2. This now leaves

the Council with a decision on how to allocate the 2018/19 Landfill surplus.

3.5 In

addition to the above, which is after all necessary reserve transfers have been

made, there are a number of significant activities where surpluses or deficits

are ring fenced and/or transferred to reserves and include water supply, waste

water and refuse & recycling.

3.6 In

allocating surpluses and reserves, Council’s prudent financial policy

approach has traditionally focused on debt repayment or borrowing reduction. In

Rating Area 2, priority has been given to replenishing the Rural Flood and Emergency

Event Reserve.

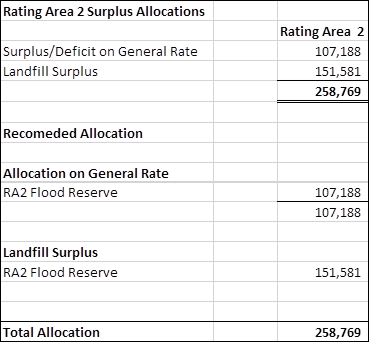

3.7 Given

Rating Area 1 is in a rates deficit position for 2018/19, a transfer from the

RA1 General Purpose Reserve is required to offset this deficit of $96,456.

3.8 It is

recommended that Council contribute all of the RA1 share of the Landfill

surplus, $1,052,397, to the Kerbside Collections Reserve. The implementation of

the Waste Management Plan requires significant upfront expenditure and this

reserve can help smooth the impact of this implementation on the refuse

collection and recycling target rates.

3.9 In

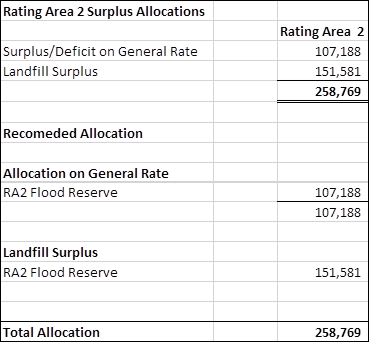

determining priorities for the Rating Area 2 general rate surplus and

Council’s share of the Landfill surplus, officers recommend the following

allocations:

1. Contribute the RA2 Surplus of $107,188 to the

RA2 Flood and Emergency Event Reserve.

2. Contribute all of the RA2 share of the Landfill

surplus, $151,581, to the RA2 Flood and Emergency Event Reserve.

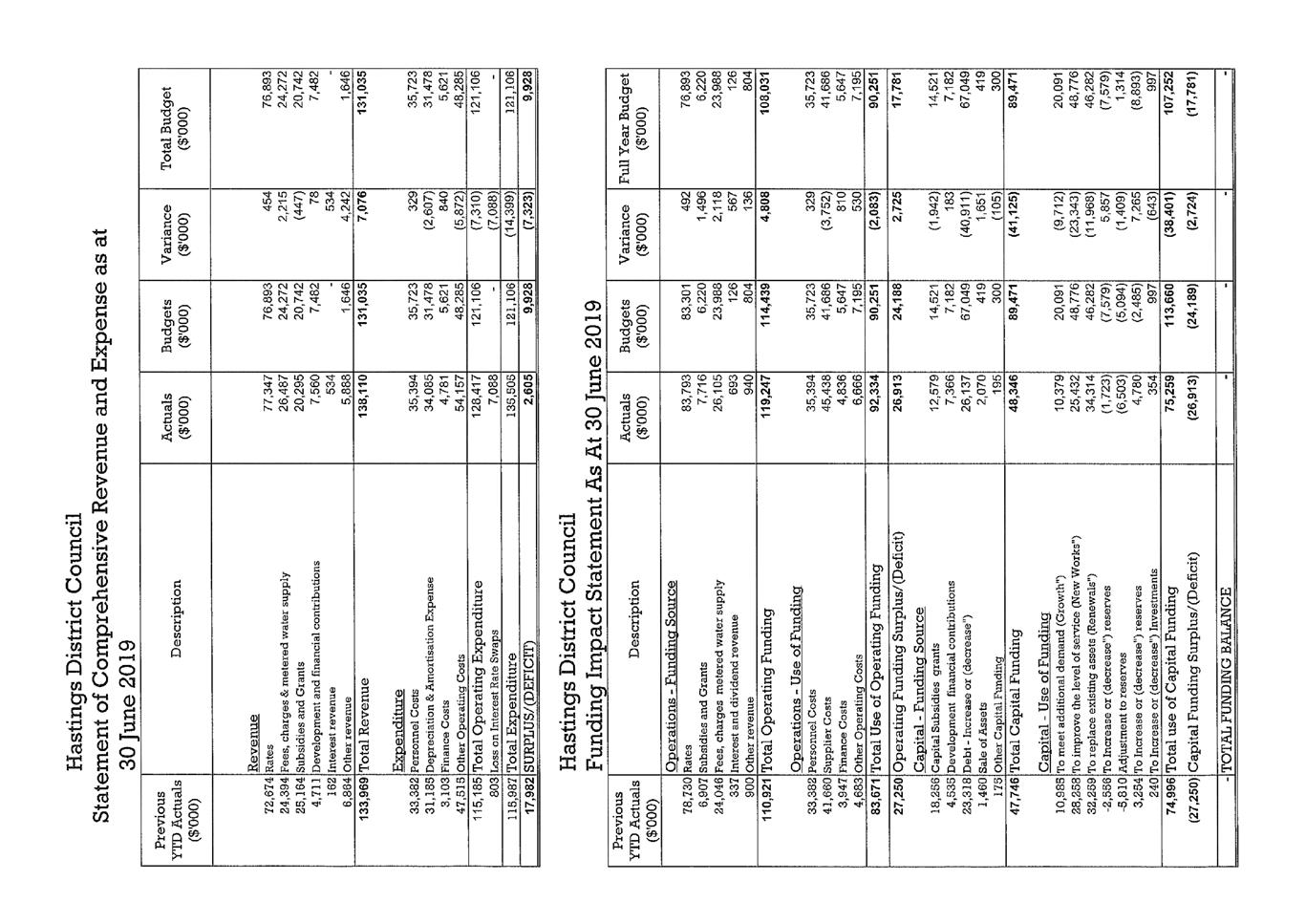

4.0 THE

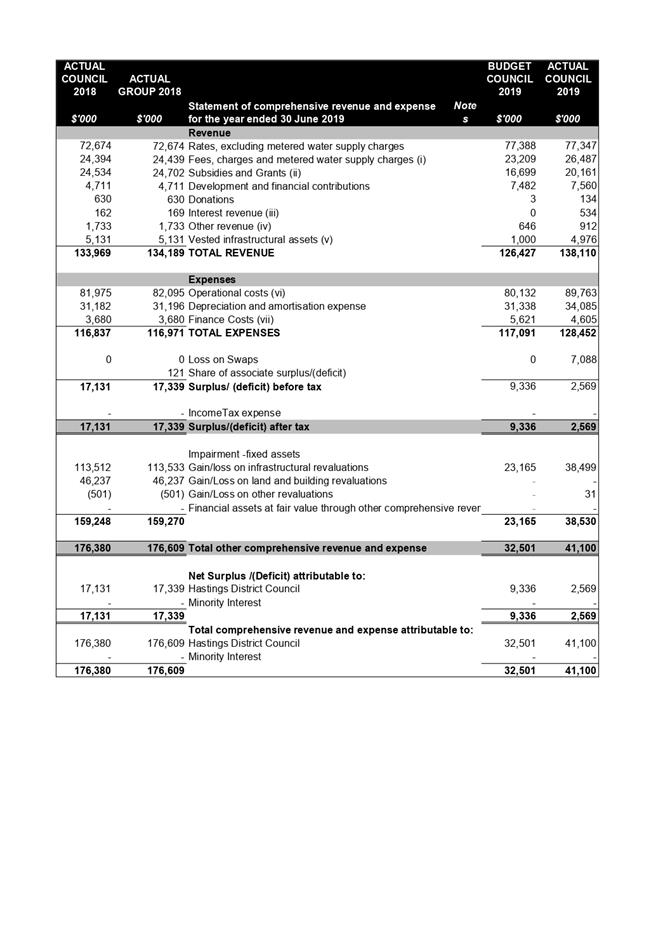

unaudited ACCOUNTING RESULT

4.1 Draft

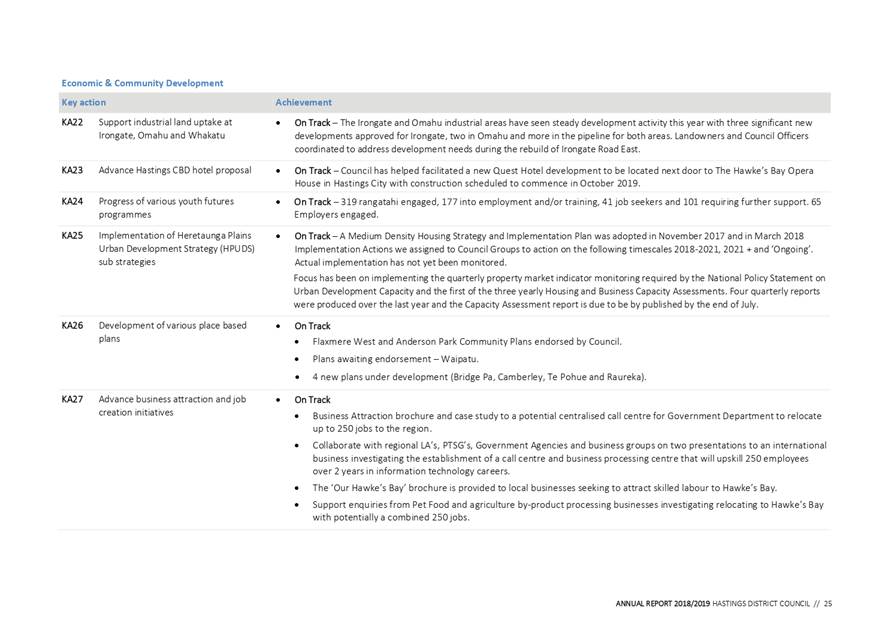

Unaudited Operating Accounting Result

Set out below is a summary of the 2018/19 financial year. Please note

that this is not the same as the rating result.

4.2 The

draft unaudited financial result for the year ended 30 June 2019 before gains

or losses on revaluations and losses on interest rate swaps is a surplus of $9.7m

with a favourable variance to the budget of $0.3m.

4.3 It is

important to note that budget variances noted in the table above, refer to

variances against the Annual Plan excluding carry forwards or any other budget

adjustments as this is what Council is required to report against in the Annual

Report. By comparison the attached dashboard reports include budgeted

information that includes all budget adjustments including carry forwards from

previous year.

4.4 The

unrealised losses on interest rate swaps of $7m is an accounting entry and

reflects the potential cost to Council of replacing all of its interest rate

swaps at the prevailing swap interest rates on 30 June 2019. Council is, however,

extremely unlikely to be put in that situation and the loss is therefore

recognised as an ‘unrealised loss’.

4.5 Council

has interest rate swaps in place to hedge against interest rate exposure by

reducing uncertainty of future cashflows. This is in line with Councils

prudent financial approach and meets the requirements of Councils treasury

policy. Market conditions have changed from several years ago when many

of these swaps were taken out.

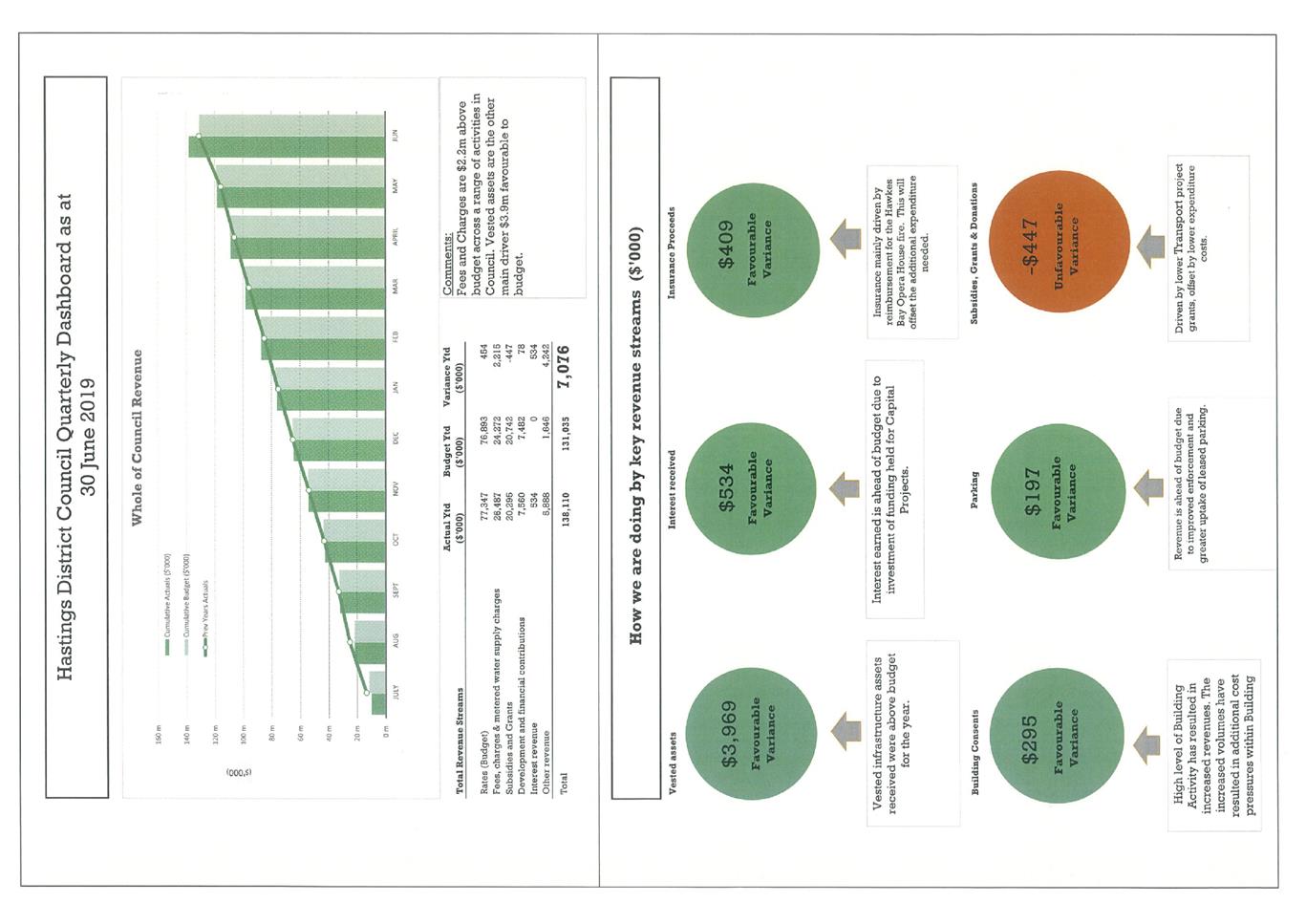

5.0 Revenue

5.1 Revenue

has a favourable variance to revised budget of $7.08m. The increase in revenue

compared to budget is made up of the following activities:

5.2 Subsidies

and grants are $447k unfavourable to revised budget, this is made up of lower

NZTA subsidies that are reimbursements for capital work done, offset by higher grants

across the community facilities and Economic and Social Development areas.

5.3 Fees

and Charges are above budget by $2.2m. This increased revenue has been achieved

across a wide range of Council activities - Water Meter revenue ($437k),

Parking ($316k), along with Building Consent fees ($295k) and Environmental

Consents ($176k). There was also a number of one-off revenues received for

insurance reimbursement ($408k) and other projects.

5.4 Interest

revenue earned is favourable to budget by $534k due to investment of funding

held for capital projects.

5.5 Infrastructure

vested assets are above budget by $3.97m.

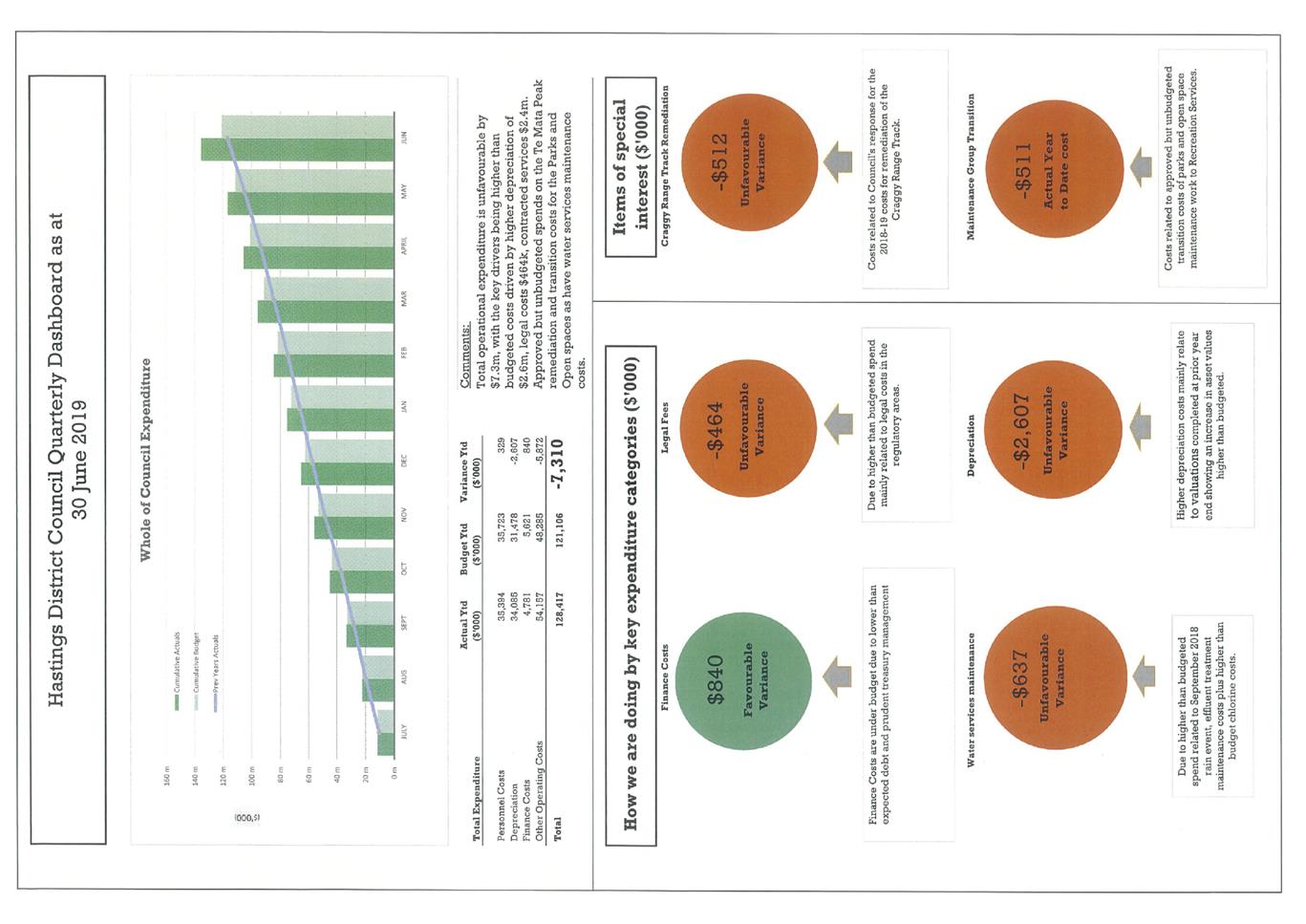

6.0 Expenditure

6.1 Operational

Expenditure against revised budget before swaps is higher than budgeted by $7.3m.

Key drivers are:

6.2 Contracted

services are $2.4m above budget. This is primarily in the areas of

infrastructure where there have been and are large capital projects underway,

with Planning and Regulatory and Parks also being impacted.

6.3 Three

Water services operational expenditure is $637K above YTD budget. This is

mainly due to higher than budgeted spend related to the September rain event,

effluent treatment maintenance costs plus higher than budget chlorine costs.

6.4 Legal

fees are $464k above budget mainly due to compliance costs across a range of

cost centres.

6.5 Depreciation

is $2.7m above budget due to the higher revaluation of assets at the end of the

2017/18 year.

6.6 The

unrealised loss on swaps of $7.088m. As mentioned in paragraph 4.4, this is an

unrealised accounting entry that has no effect on cash.

7.0 Unbudgeted

but approved expenditure:

7.1 There

have been a number of events and decisions made that have resulted in approved

but unbudgeted expenditure. The added spend has directly impacted on the

overall financial position for the 2018/19 year.

7.2 Craggy

Range Track

7.3 Since

the original resource consent was granted incorrectly at the end of 2017,

Council has been engaged in a process with stakeholder parties to understand

and undertake remedial works to remove the Craggy Range track. The approved but

unbudgeted costs for the current year 2018/19 is $512k; total project spend

over the life of the project up until July 2019 is $570k.

7.4 Maintenance

Group Transition Costs

7.5 In

February 2019, the parks and open space maintenance work was contracted out to

Recreation Services, and this was a transition from the work being done

internally through Maintenance Group.

7.6 In

transitioning the process over to an external contract, there were a number of

significant one-off transition costs that were incurred in the development of

the contract and the outsourcing to the new external supplier, Recreational

services. The impact of this approved but unbudgeted spend was $512k.

Long term efficiency savings have been built into the new contract.

7.7 Flood

Damage

7.8 Costs

associated with the 2018 floods have continued to impact on this financial year,

with the total overspend to budget for the YTD $661K for the local share.

The Rating area 2 flood reserve, will fund the majority of the local share. The

current balance of the RA2 Flood reserve after funding the local share is $1.12M.

7.9 The

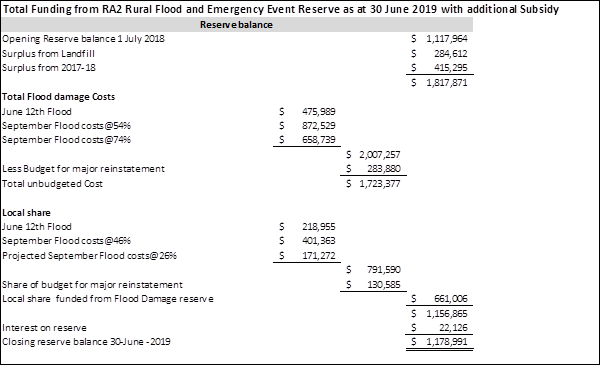

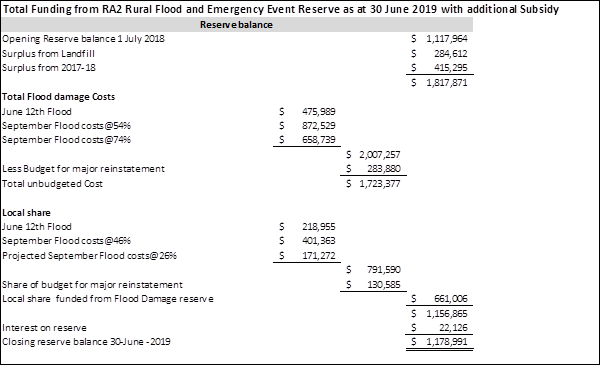

following table summarises the cost of the flood events and how they were

funded:

7.10 Museum Trust Grant

7.11 An increase to the

operational grant paid to the Museum Trust that was approved by Council. The

impact of this approved but unbudgeted spend was $132k.

8.0 Summary

by Areas of Activity of Council

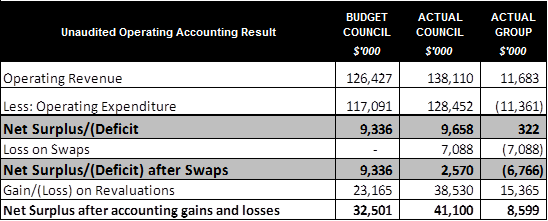

8.1 Economic

Growth and Organisational Improvement

8.2 Economic

Growth and Organisational Improvement (EGOI) Group had an overall group result

of $339k favourable to budget. The key drivers were in lower expenditure, with

underspends in expert advice $111k, electricity and fuel $42k across a number

of operational cost centres.

8.3 Governance

and Support Services

8.4 Included

in this group of activities are the support services of Finance, HR, Democratic

Support, Leadership and the Chief Executive’s Office. There have been a

number of cost pressures within this group, significantly within HR, primarily

due to the increasing requirements of health and safety which has contributed

to an operational overspend.

8.5 Community

Facilities & Programmes

8.6 This

group of activities has a favourable variance against budget of $252k primarily

driven by favourable revenue lines in fees and charges such as Splash Planet

($72k) and Housing for the Elderly ($125k). In addition, insurance proceeds for

the Opera House claim ($389k) were received. Subsidies and grants were also

received for the Crime Prevention Programme ($362k) along capital grants for

the Opera House ($259k). Offsetting this were higher personnel costs of $875k

along with higher maintenance costs of ($603k). Some of these costs are offset

by the grants and subsidy revenue received to fund them.

8.7 Planning

& Regulatory Services

8.8 Planning

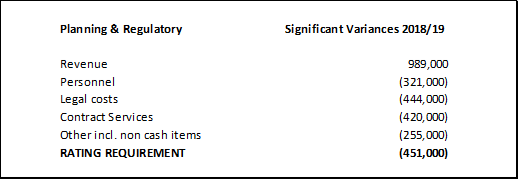

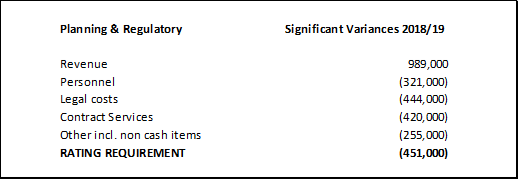

and Regulatory had an overall group result of ($451k) unfavourable to budget. Revenue

was $989k favourable to budget. Fees and charges across the group have been the

main driver - parking $316k, building control $295k along with environmental

consents $176k. Offsetting this was higher expenditure of $1.4m driven by

higher personnel and contracting costs required to deliver the increased

volumes. The consent area is facing significant volume and complexity pressures

going forward and is likely to be an area exposed to ongoing financial risk.

8.9 Summarised

below are key variance drivers in Planning and Regulatory.

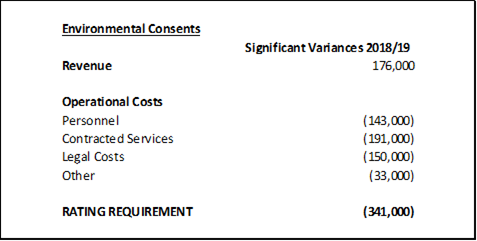

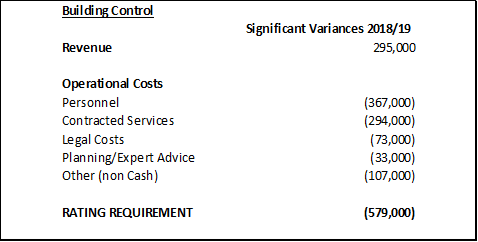

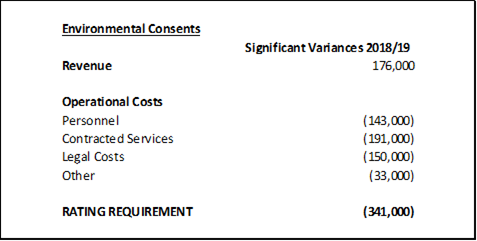

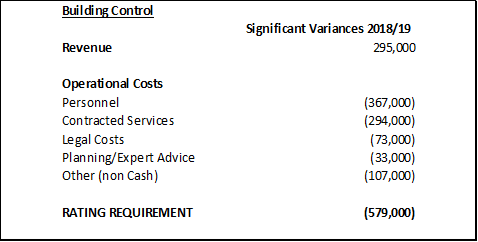

8.10 Within

the Planning & Regulatory Group, the Environmental and Building Consent

activities have been most affected by the increase economic activity with

increased costs incurred to meet the additional demands. The following tables

present the individual financial results for those activities. While some of

the increased activity is recovered by user charges, both these activities

require a percentage of their funding to come from rates, increased activity

requires by default increased rates.

8.11 Asset

Management

8.12 Landfill revenue was

favourable to budget by $1.2m, with higher volumes contributing to the

favourable revenue variance along with lower than budgeted spend. This

increased revenue has translated into a HDC share of the surplus of $1.2m.

8.13 The surpluses

generated from the Landfill are released to the shareholding Councils and it is

up to the two Councils as to what they decide to do with those funds. In

previous years, HDC has decided to repay landfill debt with those surpluses,

however, with all landfill debt now repaid Council can decide how it wishes to

allocated those funds.

8.14 Parks operational

expenditure was $355k unfavourable with the main driver being the transition

costs of outsourcing the work previously undertaken by the Maintenance Group to

Recreation Services. This is further outlined in approved but unbudgeted

expenditure.

8.15 Building Service costs were $911k favourable

due to lower than planned maintenance and services costs; these funds have been

retained in the building reserve.

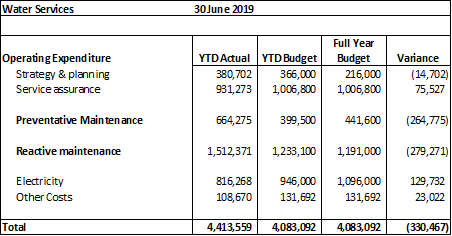

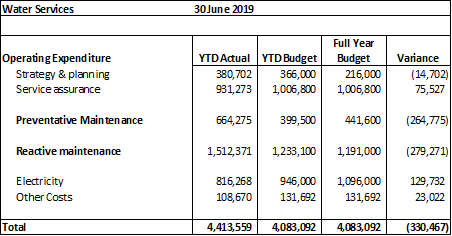

8.16 Water Services

8.17 Council continued to respond to the water change programme with

elevated expenditure supply activity through 2018/19 including both Capital and

Operational expenditure. This activity is funded by way

of a targeted rate and accounted for in a separate water account which is

designed to either accumulate reserves or run in deficit depending on

expenditure needs and Council decision making. This allows Council to spread

the impact of “lumpy” expenditure in this activity.

8.18 Below shows a summary

table of spend to budget in this area:

8.19 The Three Water

services operational expenditure is $637K above YTD budget. This is mainly due

to higher than budgeted spend related to the September rain event, effluent

treatment maintenance costs plus higher than budget chlorine costs.

8.20 Water Supply

operational expenditure when split out shows an unfavourable variance to budget

of $330K, with the higher strategy and planning costs along with reactive and

preventative maintenance offset by savings in electricity and service

assurance.

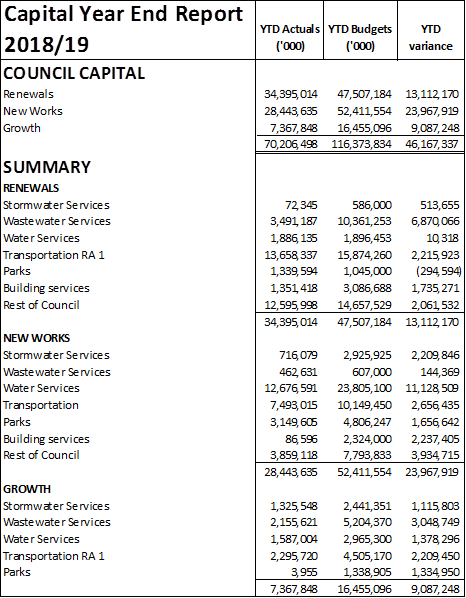

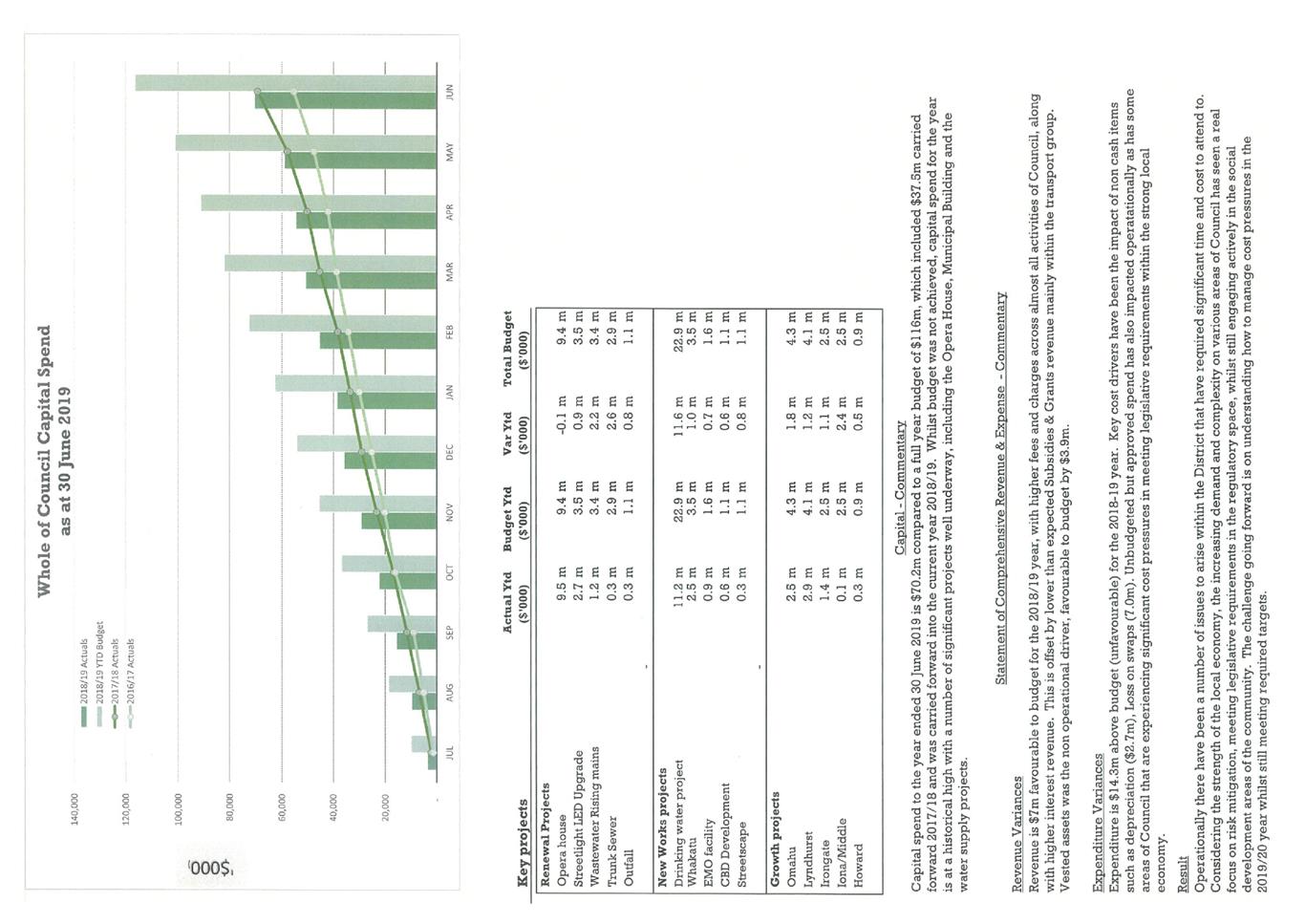

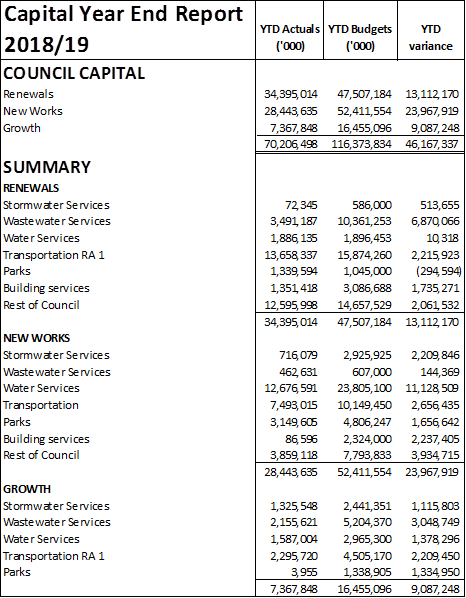

9.0 Capital

Expenditure

9.1 Capital

spend to the year ended 30 June 2019 is $70.2m compared to a full year budget

of $116m, which included $37.5m carried forward into the 2018/19 year. Whilst

budget was not achieved, capital spend for the year is at a historical high

with a number of significant projects well underway, including the Opera House,

Municipal Building and the water supply projects.

9.2 New

Works

9.3 Water

service projects account for 47% of the under spend in new works with some

delays along with a challenging contractor market meaning a delayed start to

these projects. With the Booster Pump station and small

communities’ project now underway, budget has been applied for to be

carried forward for those projects. Buildings services and transport have had

projects delayed due to changes in scope of some projects along with delays in

receiving NZTA funding approval.

9.4 Renewals

9.5 Wastewater

projects account for 52% of the under spend in renewals with the Park Road

system upgrade, rising mains and trunk sewer starting later than budgeted.

Building services under spend is driven primarily by delay on Heretaunga House

renewals whilst a decision whether to sell or keep the property was made.

9.6 Growth

9.7 Growth projects such as Iona have been delayed into the

2019/2020 year. Lyndhurst, Irongate and Omahu are underway with

completion expected in 2019/2020.

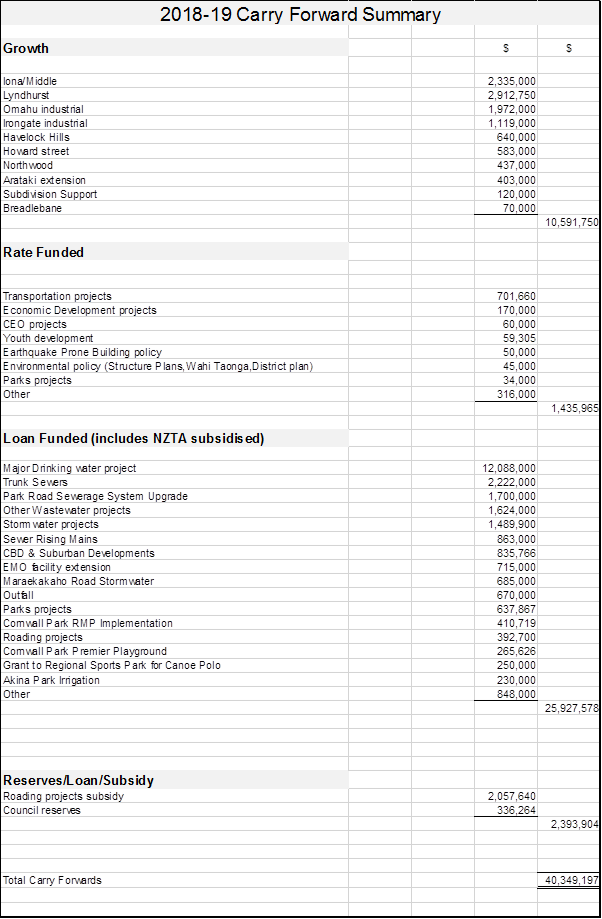

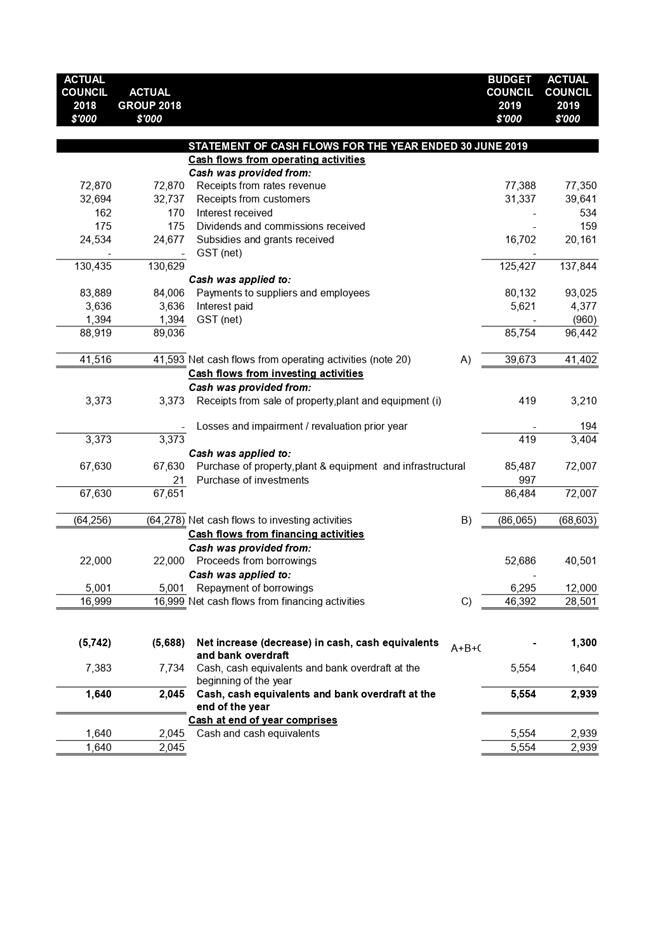

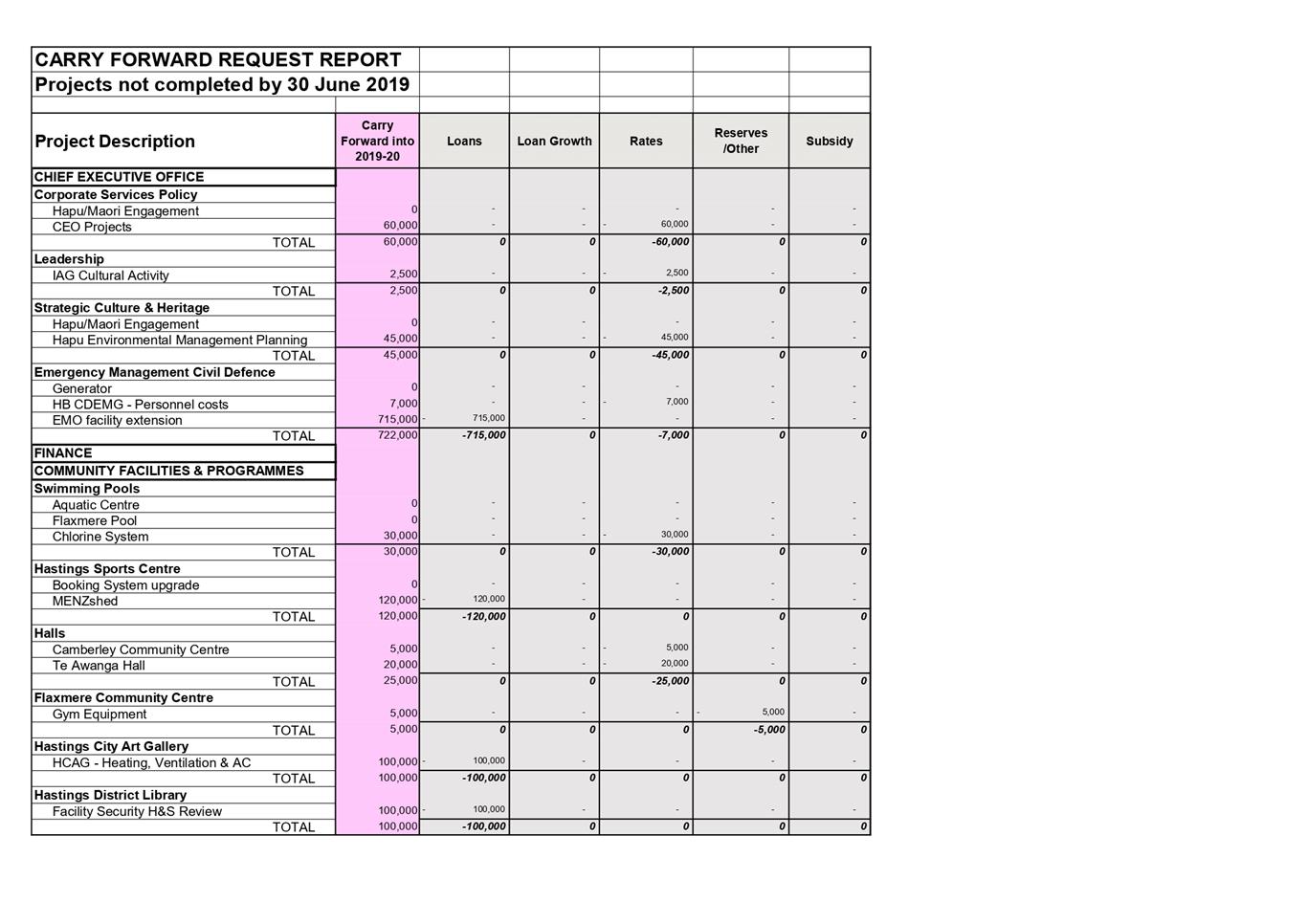

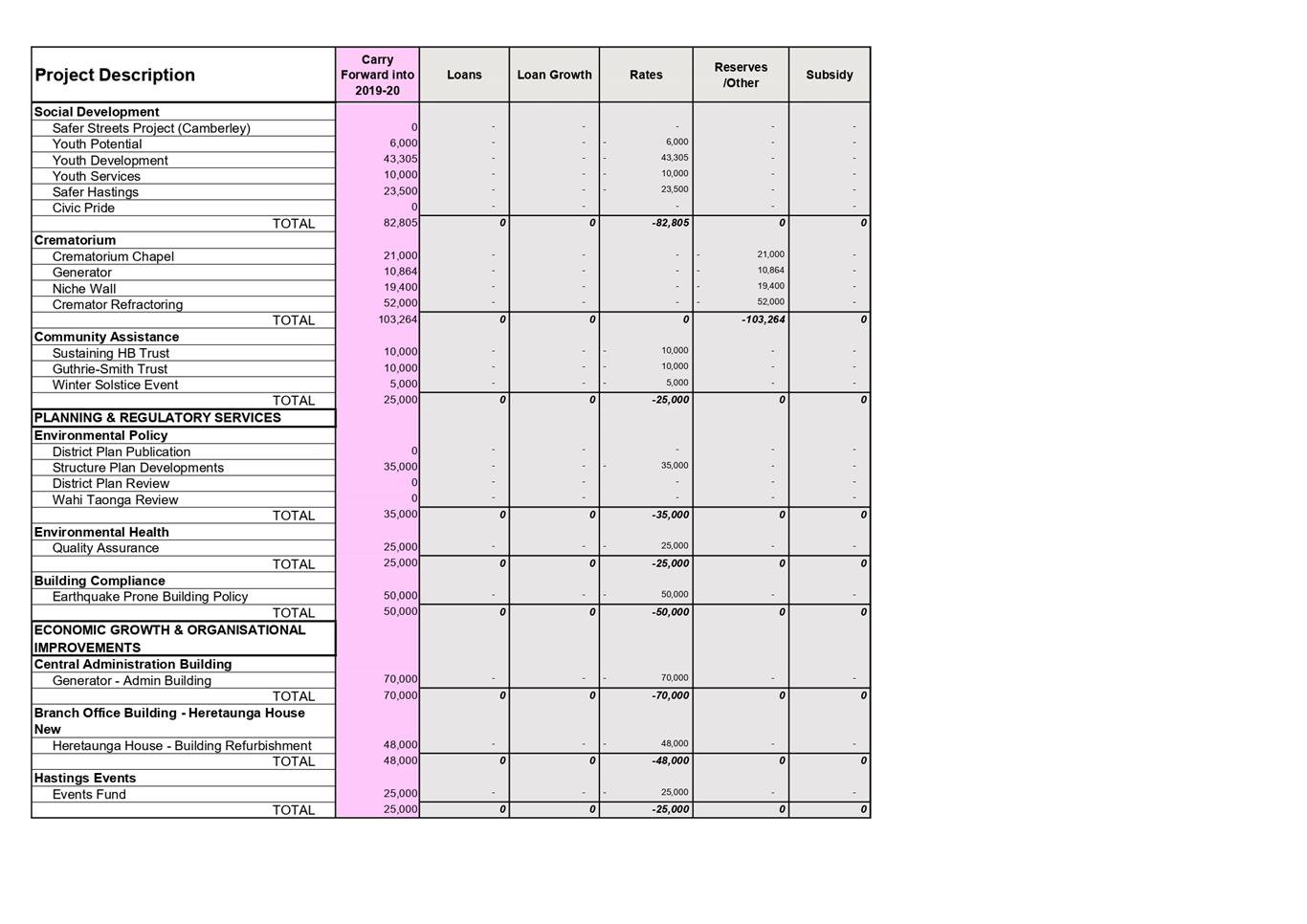

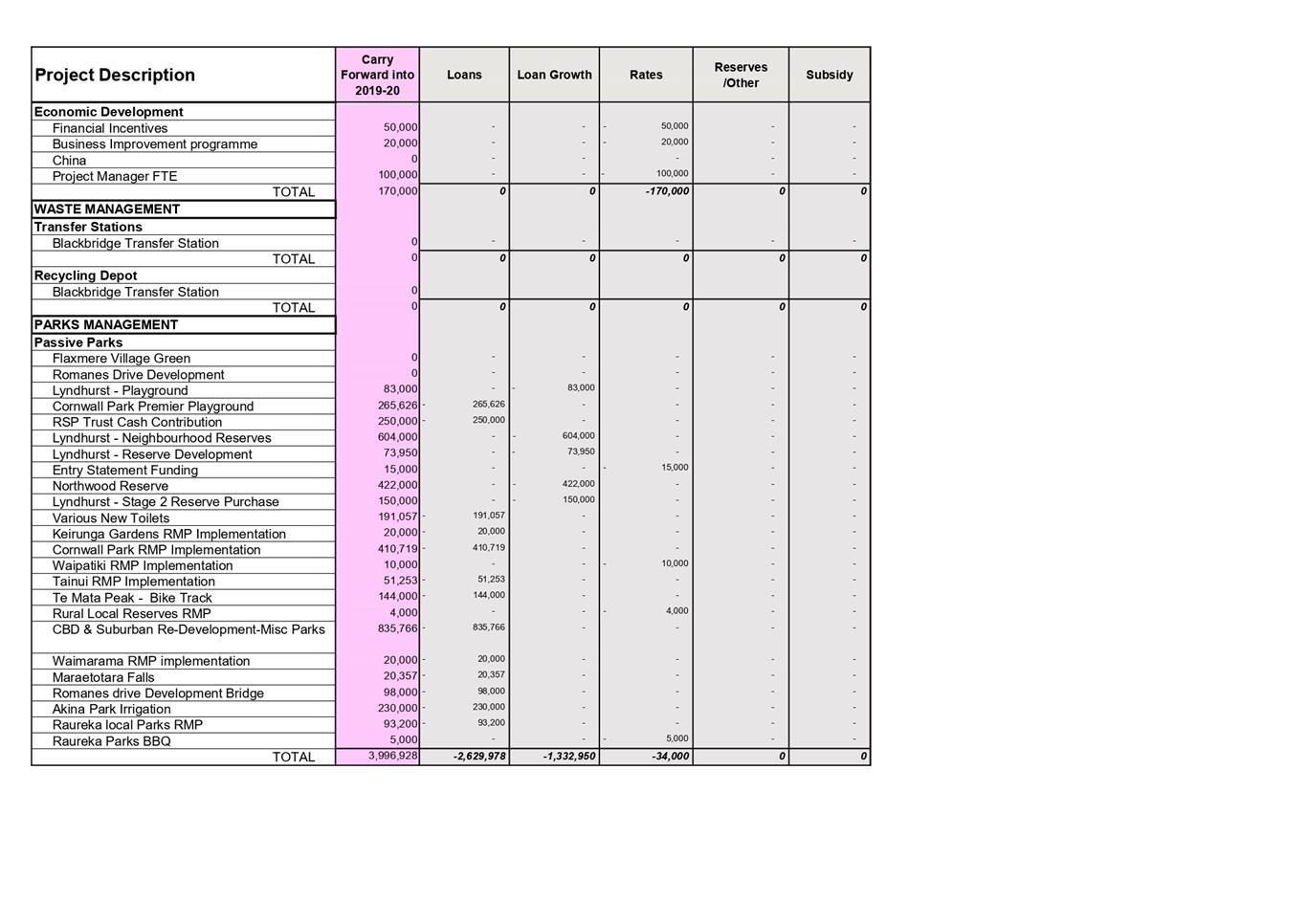

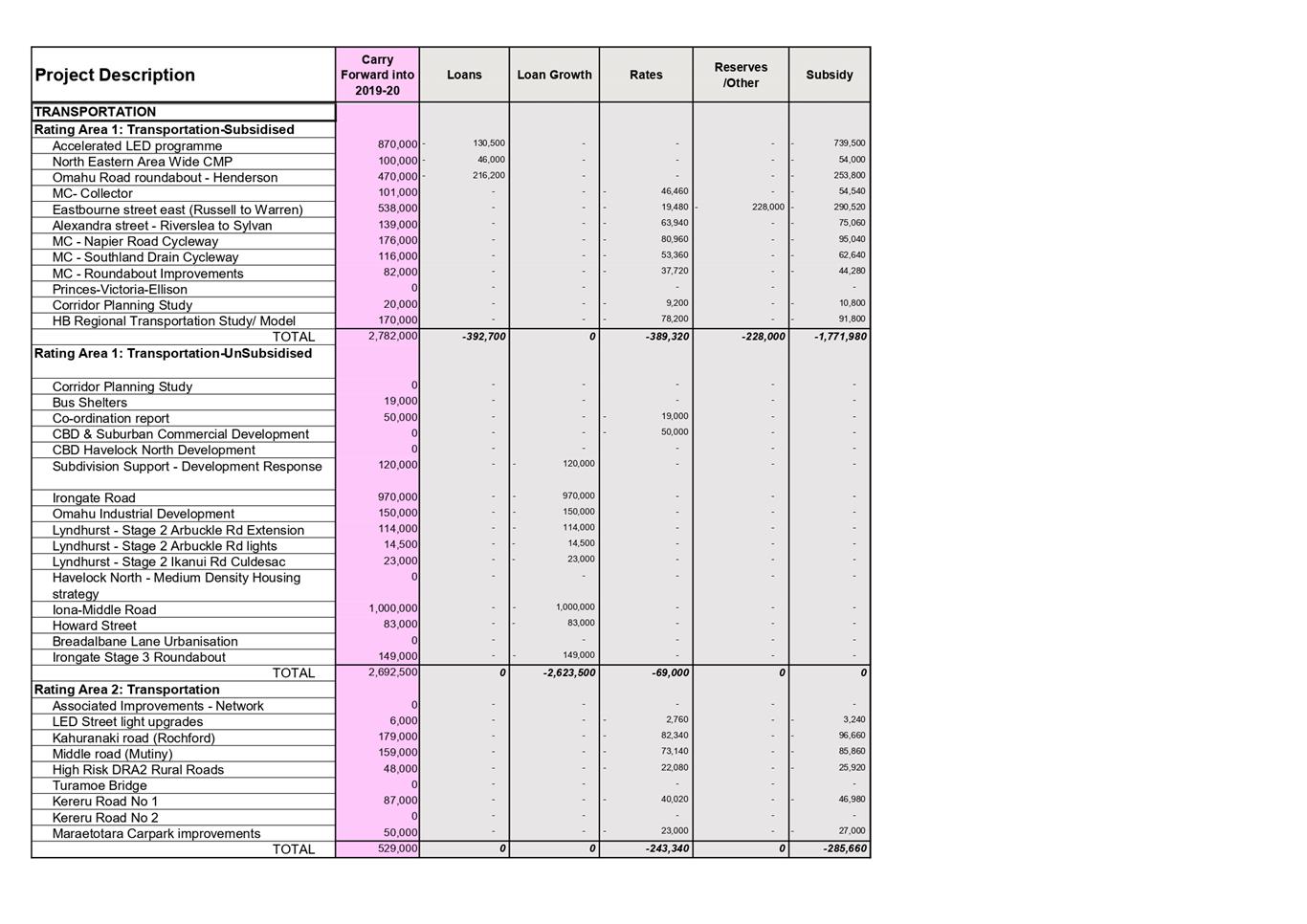

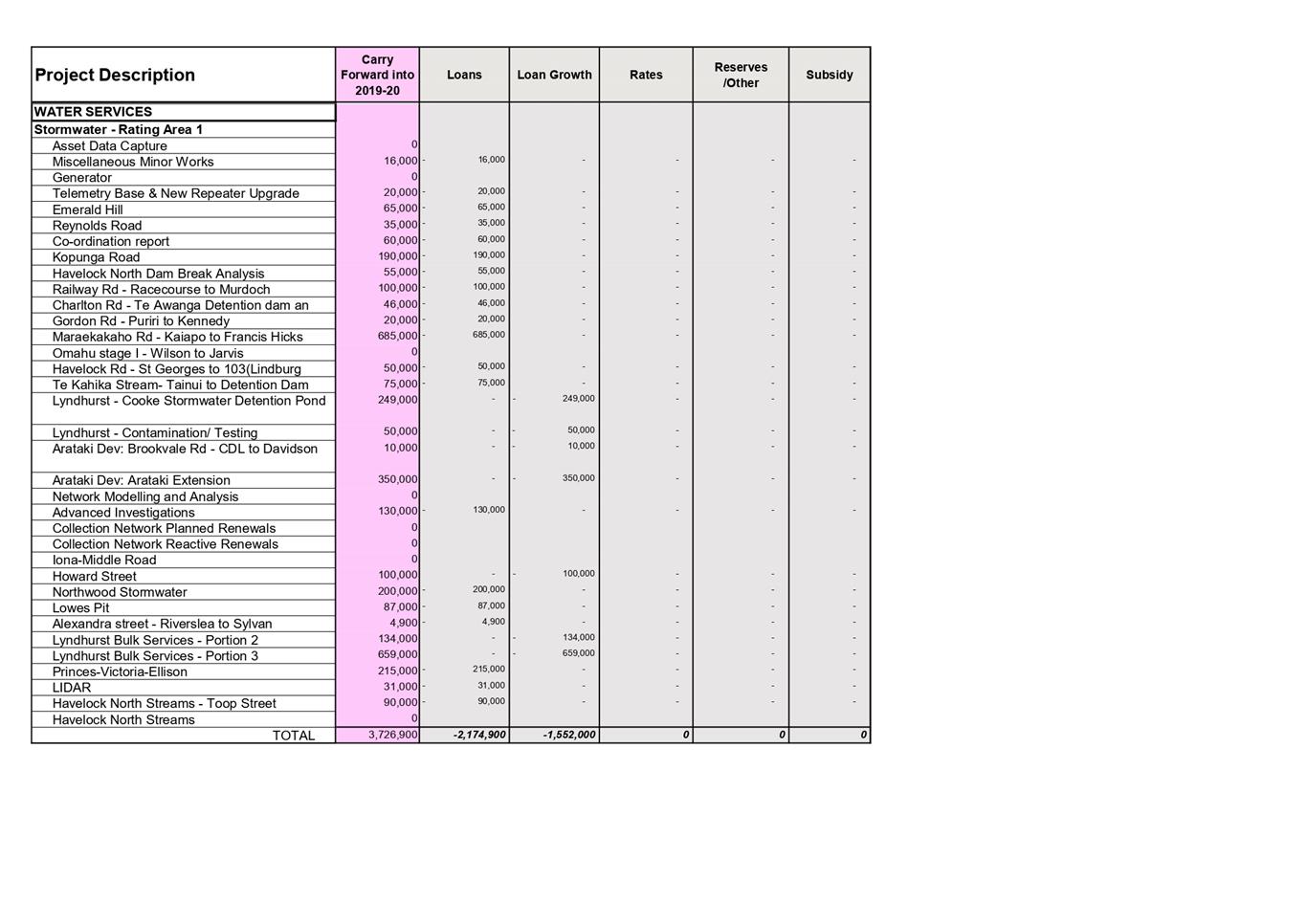

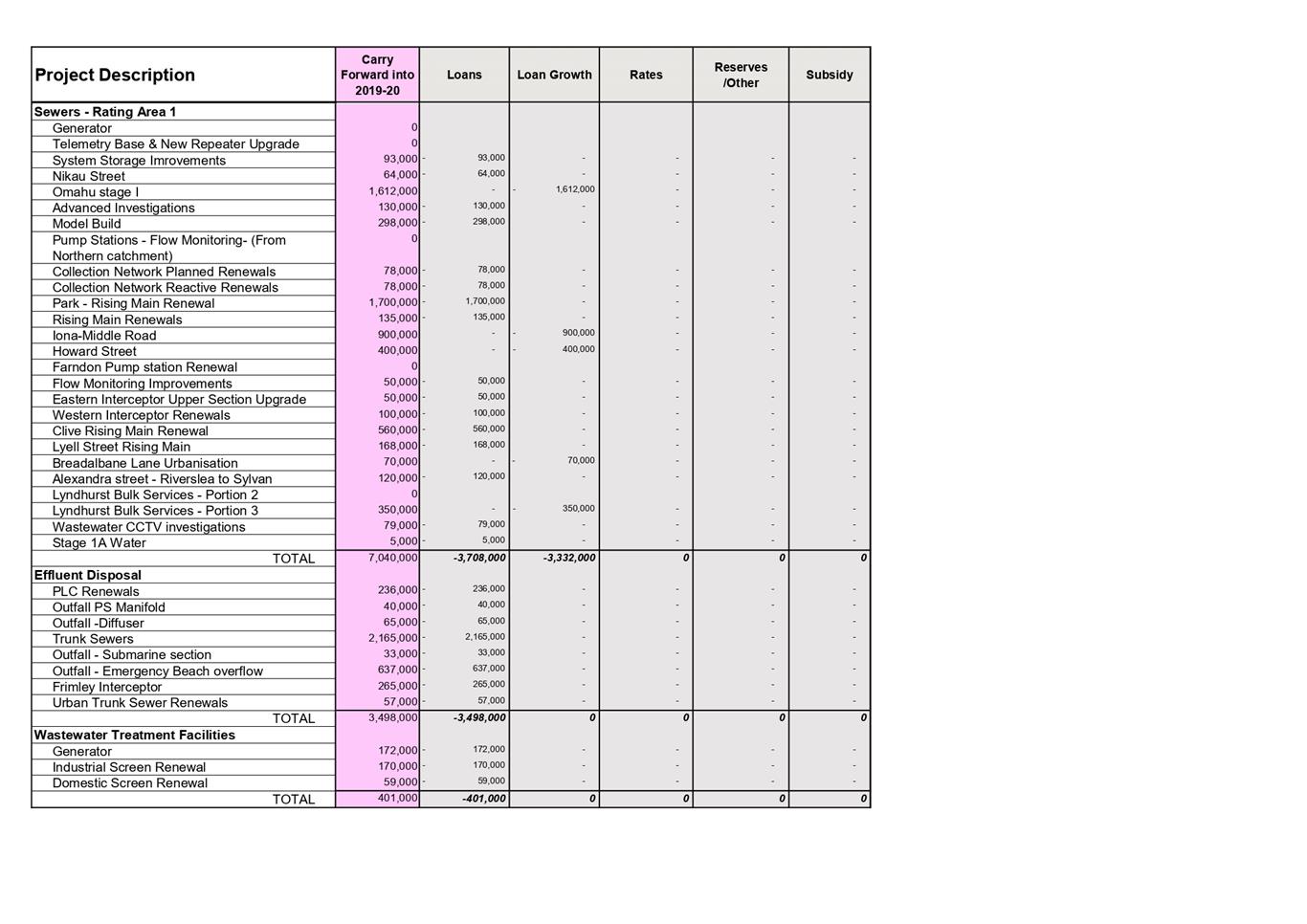

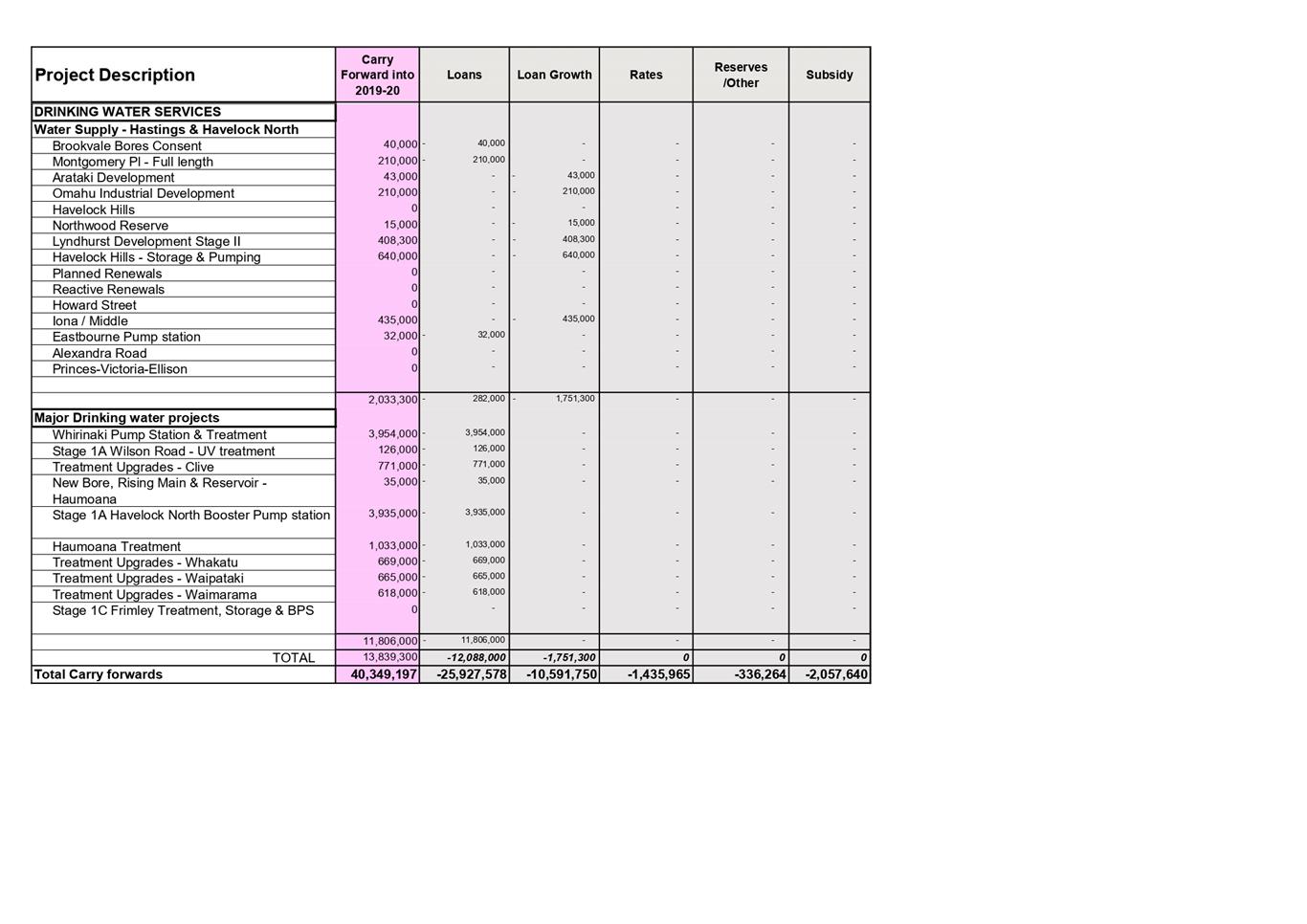

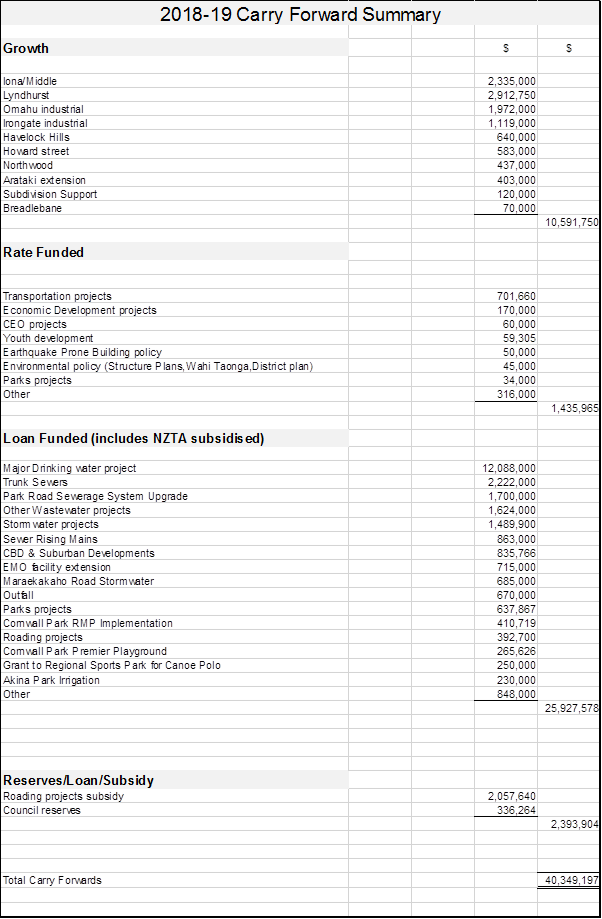

10.0 CARRY FORWARD SCHEDULE

10.1 Included

in Attachment 4 is a Schedule of Projects and budget amounts that

officers have requested to be carried forward to the 2019/20 year. Management

has reviewed these requests and also compared them to project budgets in the

2019/20 year to ensure that the appropriate amount is being carried forward.

10.2 The level of carry

forwards requested at $40.3m is similar to last year’s carry forwards of

$37.6m. Whilst this number when compared to last year has not decreased,

prioritisation of what projects are already “in train” have been

looked at closely, with those not likely to be delivered in 2019/20 to be

rebudgeted within the next two years.

10.3 In addition $29m of 2019/20

budgeted projects have now been rebudgeted into future years in order to provide

capacity for the proposed carried forward projects to be completed, this work

will be completed over the following two years. As a result, the capital

programme for the 2019/20 year has therefore been reduced to $98m from $130m.

10.4 The effect of this 2019/20

capital budget adjustment will be a reduced level of debt funding required to

be carried forward into 2019/20 with budgeted funding reprioritised for 2018/19

carry forwards.

10.5 The level of carry

forwards from rates funding is $1.43m ($2.06m last year). While the table

provides a summary of the major carry forward items, the $0.316m of rates carry

forwards classified as other is made up of a number of smaller carry forward

projects across Council groups.

10.6 Included in the Loan

Funded carry forwards is $12m for the major drinking water projects. In

addition, there is a range of carry forwards across a number of Council

activities, from the trunk sewer project ($2.2m) through to the Akina Park

irrigation of $0.23m.

10.7 The following table is

a summary of 2018/19 Carry Forwards recommended for approval. Details of all

these projects are included in Attachment 4.

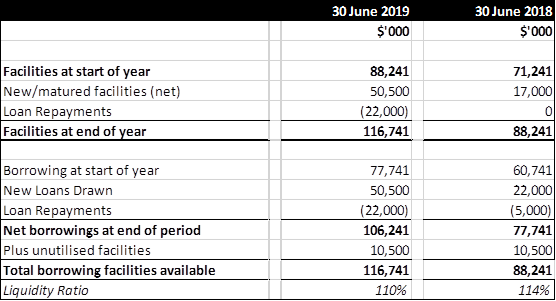

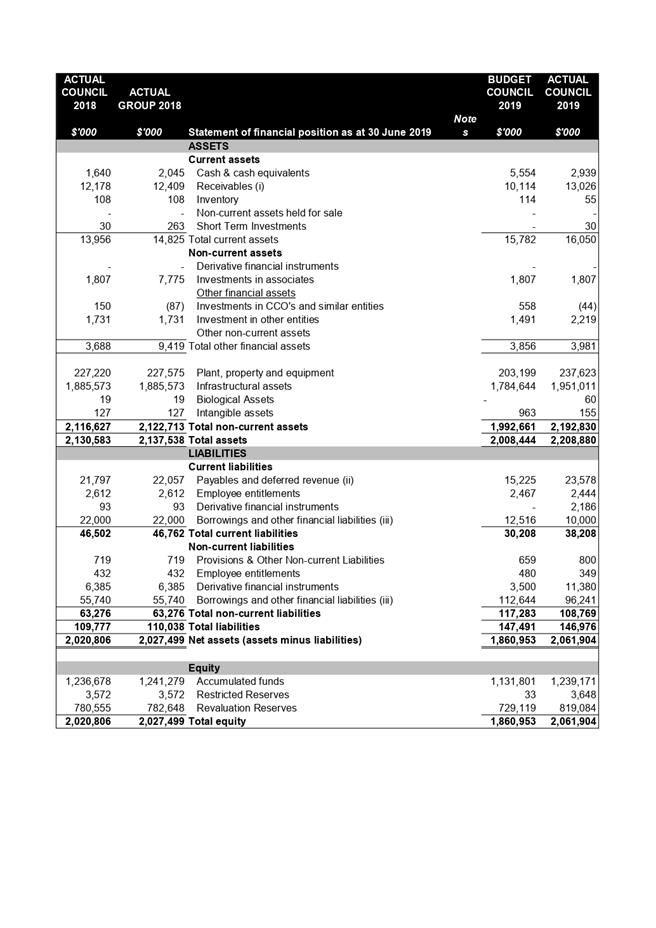

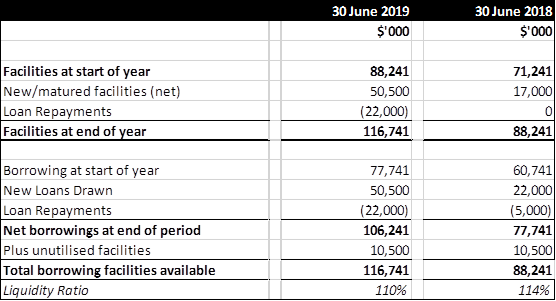

11.0 EXTERNAL DEBT

11.1 Total net borrowing as

at the end of June 2019 is $106.2m, an increase from last year ($77.7m). This

is lower than projected in the 2018-28 Long Term Plan (LTP) which had forecast

debt levels of $125.3m at this time. Committed borrowing facilities in place

are $116.7m, providing headroom of $10.5m. The liquidity ratio is at 110% in

line with the policy minimum of 110%.

11.2 Subsequent to 30 June

2019, Council increased unutilised facilities by an additional $5m, increasing

the liquidity ratio to 114%.

11.3 While

there are higher debt levels when compared to the LTP, it also needs to be

noted that there is a significant increase in debt levels when compared to the

previous year’s actuals. This is reflective of the large number of

projects well underway, including the Opera House and Municipal Building

projects along with completed projects in the prior year such as the Whakatu

Arterial and the new Havelock North water main.

12.0 ALLOCATION OF RATING

SURPLUS

12.1 Council’s

Treasury Policy states the following on the allocation of surpluses:

“The funds from all asset sales

and operating surpluses will be applied to the reduction of debt and/or a

reduction in borrowing requirements, unless the Council specifically directs

that the funds will be put to another use.”

12.2 Whilst

Rating Area 2 currently has debt of $802k, incurred for capital works, the

specific resolution by Council to build the Rural Flood and Emergency Event

Reserve up to a level of $2m is considered a prudent one given the recent flood

events.

12.3 Two

significant rain events in the second half of 2017/18 have reduced the balance

of the Rating Area 2 Rural Flood and Emergency Event Reserve to $1.178m and it

has been recommended to the Hastings Rural Community Board that the Rating Area

2 surplus be used to contribute to the Rural Flood and Emergency Event Reserve.

12.4 The

Rating Area 1 deficit ($96,456) is recommended to be funded from the RA1

General Purpose Reserve and is the result of increasing cost pressures faced by

the high levels of demand especially in the regulatory area along with a number

of unforeseen and unbudgeted but approved spends across Council as outlined

earlier in this report.

12.5 Landfill

additional surplus allocation

12.6 Council

has previously used any surpluses generated from the Landfill operations to

repay Landfill debt. Debt associated with the Landfill was repaid in 2015/16,

providing Council with a decision as to how future surpluses are to be

utilised. Last year, Council’s share of the Landfill surplus was

allocated based on the approved rating splits to the Rating Area 1 Water Supply

targeted rate account, as well as to the repayment of RA1 debt along with an

allocation to the Rating Area 2 Capital Reserve.

12.7 It is recommended that

Council contribute all of the RA1 share of the Landfill surplus, $1,052,397, to

the Kerbside Collections Reserve. The implementation of the Waste Management

Plan requires significant upfront expenditure and this reserve can help smooth

the impact of this implementation on the refuse collection and recycling target

rates.

12.8 It

has also been recommended that the RA2 share of the Landfill surplus, $151,581,

be transferred to the RA2 Flood and Emergency Event Reserve.

12.9 The

recommendation of this report, taking into consideration the recommendations to

the Hastings District Rural Community Board, is to allocate the rating

surplus/deficit as per the table below:

|

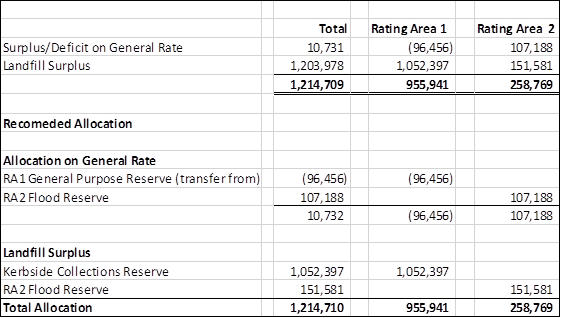

13.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Council/Committee receives the report titled Draft Financial Year End Result - 30

June 2019

B) That the

funds arising from the Rating Area 2 surplus for the 2018/19 financial year,

as recommended by the Hastings Rural Community Board, be allocated as

follows:

C) That the rating allocation be allocated

as per the following table:

D) That the budgets as per the schedule of

Carry Forwards funded by rates and loans be approved to be carried forward to

the 2019/20 financial year.

E) That $29m of loan and reserve

funded capital expenditure projects from the 2019/20 budget be approved to be

rebudgeted into future years.

|

Attachments:

|

1⇩

|

Rating Surplus RA1 & RA2 for 2019 reports

Attachment 1

|

FIN-09-01-19-177

|

|

|

2⇩

|

Attachment 2 Quarterly Dashboard June 2019

|

CG-14-71-00044

|

|

|

3⇩

|

Attachment 3 Unaudited Financial Statements to year

ended 30 June 2019

|

CG-14-71-00042

|

|

|

4⇩

|

Attachment 4 Carry Forwards 2019 20

|

CG-14-71-00043

|

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 17

September 2019

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Omarunui

LFG Generation Limited Partnership 2018-19 Annual Report

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to present to Council the Annual Report for the year

ending 31 March 2019 for the Omarunui LFG (Landfill Gas) Generation Limited

Partnership (Gas Generation Partnership).

1.2 This arises from the receipt of the Omarunui LFG (Landfill Gas)

Generation Limited Partnership’s Annual Report.

1.3 This report contributes to the purpose of local government by

primarily promoting economic and environmental wellbeing and more specifically

through the Council’s strategic objective of providing local

infrastructure that protects the natural environment

(by not flaring landfill gas) while sustainability using resource available to

it (the landfill gas).

1.4 In

the year the partnership generated 3,245 mw/h of electricity utilising

1,889m³ of landfill gas that would have been

flared and not utilised.

1.5 Total

revenue for the 2018/19 Financial Year was $303k resulting in an EBITDAF loss

of $21k.

1.6 Due

to the continued poor financial performance of the asset over time, the

decision has been made to impair investment to reflect lower expected returns.

The Gas Partnership has taken a $150k impairment of which Hastings District

Councils share is $60k.

|

2.0 RECOMMENDATIONS - NGĀ

TŪTOHUNGA

A) That the Committee receives the report titled Omarunui LFG Generation Limited

Partnership 2018-19 Annual Report

|

3.0 BACKGROUND – TE HOROPAKI

3.1 Pioneer

Generation Limited and Hastings District Council established the Gas Generation

Partnership for the purpose of purchasing landfill gas from the Omarunui

Landfill to generate electricity using the energy facility and to sell the

electricity.

3.2 Pioneer

Generation Limited (the General Partner) operates and maintains the plant in

accordance with the shareholder agreement for the plant and also holds the off

take agreement for the electricity supplied. Hastings District Council,

through contracts with the Omarunui Refuse Landfill, supplies gas to the energy

facility and leases the land occupied by the gas to energy plant.

3.3 Pioneer

Generation Limited (PGL) hold 60% of the Limited Partnership shares with

Hastings District Council holding 40%. Council’s investment in the

Partnership was $744k.

3.4 The

current advisory committee board members of the Gas Generation Partnership are:

Andrew Williamson,

PGL appointment (Chairman)

Jamie Aitken,

PGL appointment

Bruce Allan, HDC

appointment

Brett Chapman,

HDC appointment

4.0 DISCUSSION - TE MATAPAKITANGA

4.1 2018/19

Annual Report to the Limited Partners is attached in Attachment 1.

The Annual report includes a report from the Chairman.

4.2 In

the year the partnership generated 3,245 mw/h of electricity (5,019 mw/h last

year) compared to 6,000 mw/h budgeted, utilising 1,889m³ (3,010m³

last year) of landfill gas that would have been flared and not utilised.

4.3 It

has been another challenging year for the partnership with ongoing problems

with the plant and inconsistent gas extraction. Significant investment has been

made at the landfill to ensure the gas from Valley D in particular is able to

be extracted and transported to the plant. This work was undertaken during June

2018 and October 2018 (which covers the winter period when electricity returns

are normally at their highest due to the higher consumer consumption).

4.4 Since

this work was undertaken gas collection and engine performance has improved

(the financial results for the last quarter of the 2018/19 financial year and

for the first quarter of this financial year are much improved).

4.5 Total

revenue for the 2018/19 Financial Year was $303k (2018: $402k) resulting in an

EBITDAF loss of $21k (2018: $38k), a significant variance to the budgeted

profit of $81k for the year.

4.6 The

average sales price per mw/h of electricity during the year was $72.12 ($66.62

last year), whereas the budget was set at $73.04 per mw/h.

4.7 Due

to the continued poor financial performance of the asset over time, the

decision has been made to impair the investment to reflect lower expected

returns. The Gas Partnership has taken a $150k impairment of which Hastings

District Councils share is $60k. This has been reflected in Hastings District

Council’s annual accounts.

4.8 Whilst

the Landfill Gas plant is not meeting the financial goals set out in the

business plan, it is achieving the goal of turning previously flared off gas

into electricity.

5.0 OPTIONS

- NGĀ KŌWHIRINGA

Option One -

Recommended Option - Te Kōwhiringa Tuatahi – Te Kōwhiringa

Tūtohunga

5.1 That

the committee receives the Gas Partnership’s Annual Report.

6.0 NEXT STEPS - TE ANGA

WHAKAMUA

6.1 No further action is required.

Attachments:

|

1⇩

|

Omarunui Annual Report March 2019

|

SW-6-19-48

|

|

|

SUMMARY

OF CONSIDERATIONS - HE WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose of Local

Government - E noho hāngai pū ai ki te

Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future

This report contributes to the

purpose of local government by primarily promoting economic and environmental

wellbeing and more specifically through the Council’s strategic

objective of providing local infrastructure that protects the natural

environment (by not flaring landfill gas) while sustainability using resource

available to it (the landfill gas).

|

|

Link to the Council’s

Community Outcomes - E noho hāngai pū ai ki te rautaki matua

This proposal promotes the economic and environmental well-being of communities in the

present and for the future by turning landfill gas into electricity rather

than flaring it into the atmosphere.

|

|

Māori Impact Statement - Te

Tauākī Kaupapa Māori

There are no

known impacts for Tangata Whenua.

|

|

Sustainability - Te

Toitūtanga

This report

supports sustainability by ulitising previously unused landfill gas to

generate electricity.

|

|

Financial considerations - Ngā

Whaiwhakaaro Ahumoni

Apart for the

lower financial returns than contained in the original business case there

are no new financial implications for Council.

|

|

Significance and Engagement - Te

Hiranga me te Tūhonotanga

This decision/report has been

assessed under the Council's Significance and Engagement Policy as being of

minor significance.

|

|

Consultation – internal

and/or external - Whakawhiti Whakaaro-ā-roto, ā-waho

There has been

no external consultation undertaken.

|

|

Risks: Legal/ Health and

Safety - Ngā Tūraru: Ngā Ture / Hauora me te Haumaru

There have been

no legal or health and safety risks identified in this report.

|

|

Rural Community Board - Ngā

Poari-ā-hapori

There are no

implications for the rural community board in this report.

|

Hastings District

Council

Hastings District

Council