Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Operations and Monitoring

Committee MEETING

|

Meeting Date:

|

Thursday,

27 February 2020

|

|

Time:

|

1.00pm

|

|

Venue:

|

Council

Chamber

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Committee

Members

|

Councillor Travers (Chair)

Mayor Hazlehurst

Councillors Barber, Corban, Dixon,

Harvey, Kerr (Deputy Chair), Lawson, Nixon, O’Keefe, Oli, Redstone,

Schollum, Siers and Watkins

Quorum=8

|

|

Officers

Responsible

|

Group Manager: Economic Growth &

Organisation Improvement – Mr C Cameron

Group Manager: Asset Management –

Mr C Thew

Chief Financial Officer – Mr B

Allan

Chief Information Officer – Mr A

Smith

Financial Controller – Mr A Wilson

|

|

Democracy & Governance Advisor

|

Mrs C Hilton (Extn 5633)

|

Operations and Monitoring Committee – Terms of Reference

Fields of Activity

The purpose of the Operations and Monitoring

Committee is to ensure consolidated and complete reporting and monitoring of

all financial and non-financial information and performance measures against

the Annual Plan, Long-Term Plan and Council Strategies, Goals and Priorities.

Membership

·

(Mayor and 14 Councillors).

·

Chair appointed by Council.

·

Deputy Chair appointed by Council.

·

1 Heretaunga Takoto Noa Māori Standing

Committee Member appointed by Council.

Quorum –

8 members

Delegated

Powers

1)

Authority to exercise all of Council’s

powers, functions and authorities (except where prohibited by law or otherwise

delegated to another committee) in relation to all matters detailed in the

Fields of Activity.

2)

Authority to exercise all of Council’s

powers, functions and authorities (except where prohibited by law) at any time

when the Chief Executive certifies in a report that;

·

the matter is of such urgency that it requires

to be dealt with

·

the matter is required to be dealt with, prior

to the next ordinary meeting of the Council.

3)

Monitor the performance of Council in terms of

the organisational targets set in the Long Term Plan and Annual Plan –

both financial and nonfinancial.

4)

Monitor operational performance and

benchmarking.

5)

Undertake quarterly financial performance

reviews.

6)

Develop the Draft Annual Report and carry

forwards.

7)

Monitor and review the performance of Council

Controlled Organisations and other organisations that Council has an interest

in.

8)

Monitor and review tender and procurement

processes.

9)

Monitor major capital projects.

10) Recommend to Council on matters concerning project decisions where

these are identified as a result of the committee’s project monitoring

responsibilities.

11) Writing off outstanding accounts for amounts exceeding $6,000 and

the remission of fees and charges of a similar sum.

12) Settlement of uninsured claims for compensation or damages where the

amount exceeds the amounts delegated to the Chief Executive.

13) Guarantee loans for third parties such as local recreational

organisations provided such guarantees are within the terms of Council policy.

14) Authority to exercise the Powers and Remedies of the General

Conditions of Contract in respect of the Principal taking possession of,

determining, or carrying out urgent repairs to works covered by the contract.

15) Grant of easement or right of way over Council property.

16)

Approve insurance – if significant change

to Council’s current policy of insuring all its assets.

HASTINGS DISTRICT COUNCIL

Operations and Monitoring

Committee MEETING

Thursday, 27 February 2020

|

VENUE:

|

Council Chamber

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

1.00pm

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the General Counsel or the Democratic Support Manager

(preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a conflict

exists rests with the member.

3. Confirmation

of Minutes

There are no minutes to confirm

4. Presentation - Hawke's

Bay Tourism 5

5. Financial Quarterly

Report for the Six Months Ended 31 December 2019 7

6. Financial Summary as at

31st December 2019 19

7. Half Year Progress

report 27

8. Track Upgrades of

Tainui, Tanner Street, Hikanui and Tauroa Road Reserves – Request for

Additional Funds 35

9. Building Consent

Authority Accreditation Update 45

10. Waste Levy Consultation Submission 49

11. Annual Report Animal Control Section

10A 77

12. Hawke's Bay Civil Defence Emergency

Management Group - Annual Report 2018-19 85

13. Requests Received Under the Local

Government Official Information and Meetings Act (LGOIMA) Monthly Update 87

14. Additional

Business Items

15. Extraordinary

Business Items

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Project Advisor

Annette

Hilton

SUBJECT: Presentation

- Hawke's Bay Tourism

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The purpose

of this report is to introduce Hamish Saxton, the new General Manager of

Hawke’s Bay Tourism to the Council.

1.2 Mr Saxton

is an accomplished professional with broad strategic leadership, business

development and brand building expertise in the tourism and marketing

industries

1.3 Mr Saxton

has a strong tourism background and more specifically has extensive experience

in managing a regional tourism entity.

1.4 He will be

updating the Council on HB Tourism and his direction for it.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Council/Committee receives the report titled Presentation - Hawke's Bay Tourism

|

Attachments:

There are no

attachments for this report.

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Financial Controller

Aaron

Wilson

SUBJECT: Financial

Quarterly Report for the Six Months Ended 31 December 2019

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to inform the Committee of the financial result for

the six months ended 31st December 2019.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This

report concludes by recommending that the report for the 6 Months ended 31st

December 2019 be received.

2.0 BACKGROUND

– TE HOROPAKI

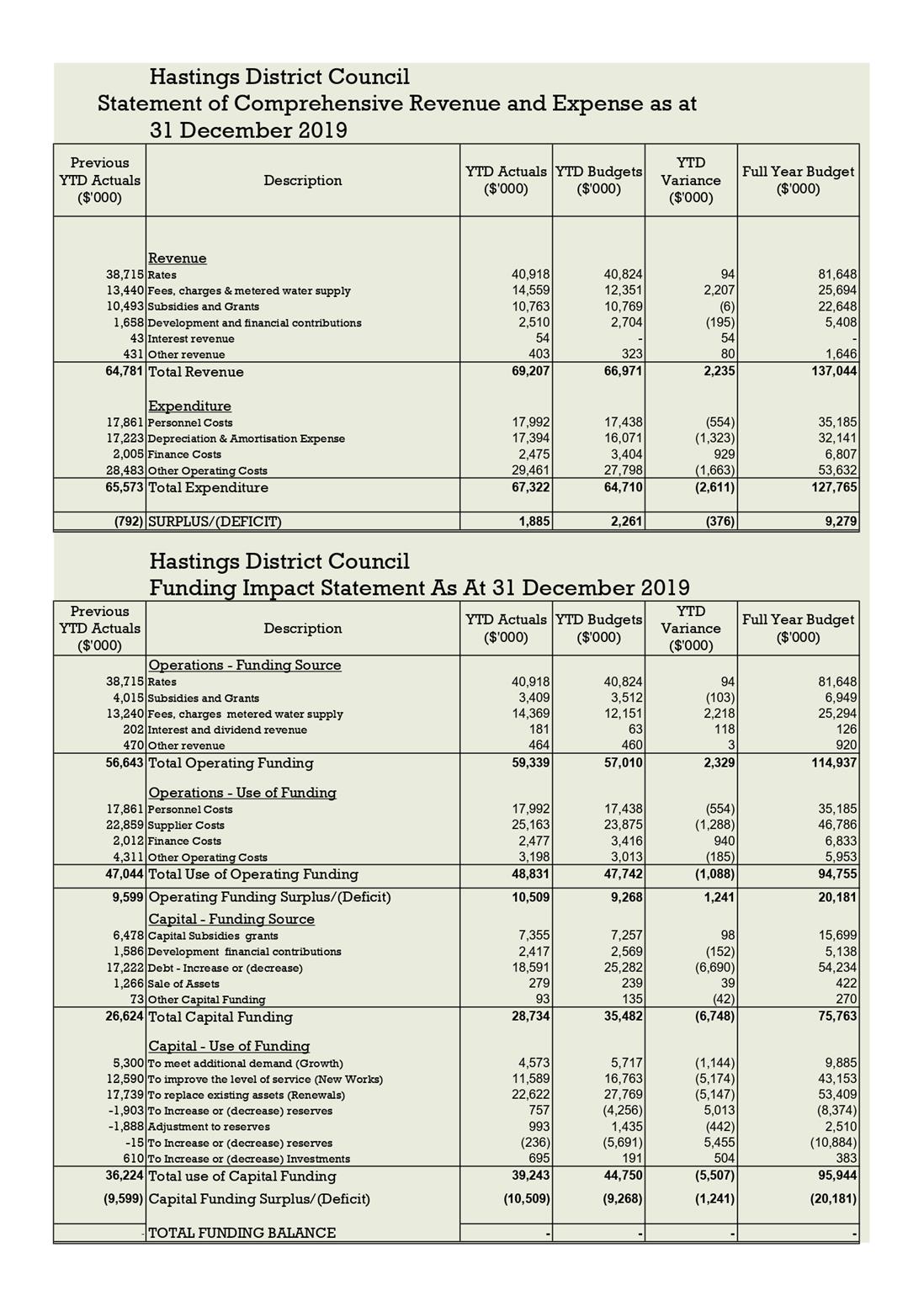

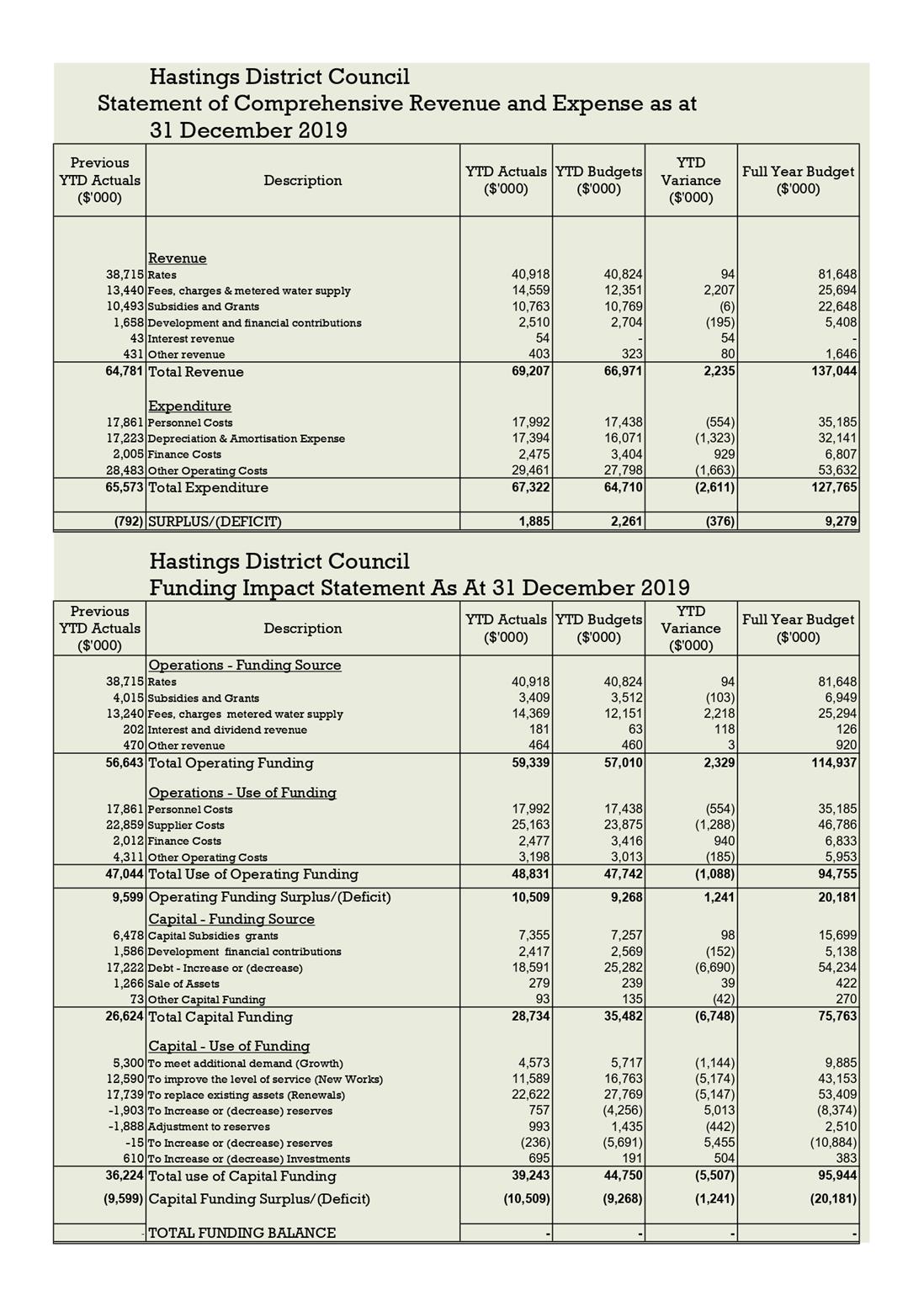

2.1 The accounting operating financial result is

reported on quarterly during the year and at year end a report is prepared on

the financial as well as the rating result. The rating result differs from

the accounting result in respect of non-cash items such as depreciation, vested

assets and development contributions that are not included.

2.2 This financial

report is governance focussed and allows significant variances to be

highlighted with explanations provided in a way this is easy to read and

understand through dashboard analytics and commentary.

2.3 If

Councillors require clarification on any points, please contact the writer prior to the meeting to ensure complete

answers can be given at the meeting on the detail in these reports.

3.0 DISCUSSION

- TE MATAPAKITANGA

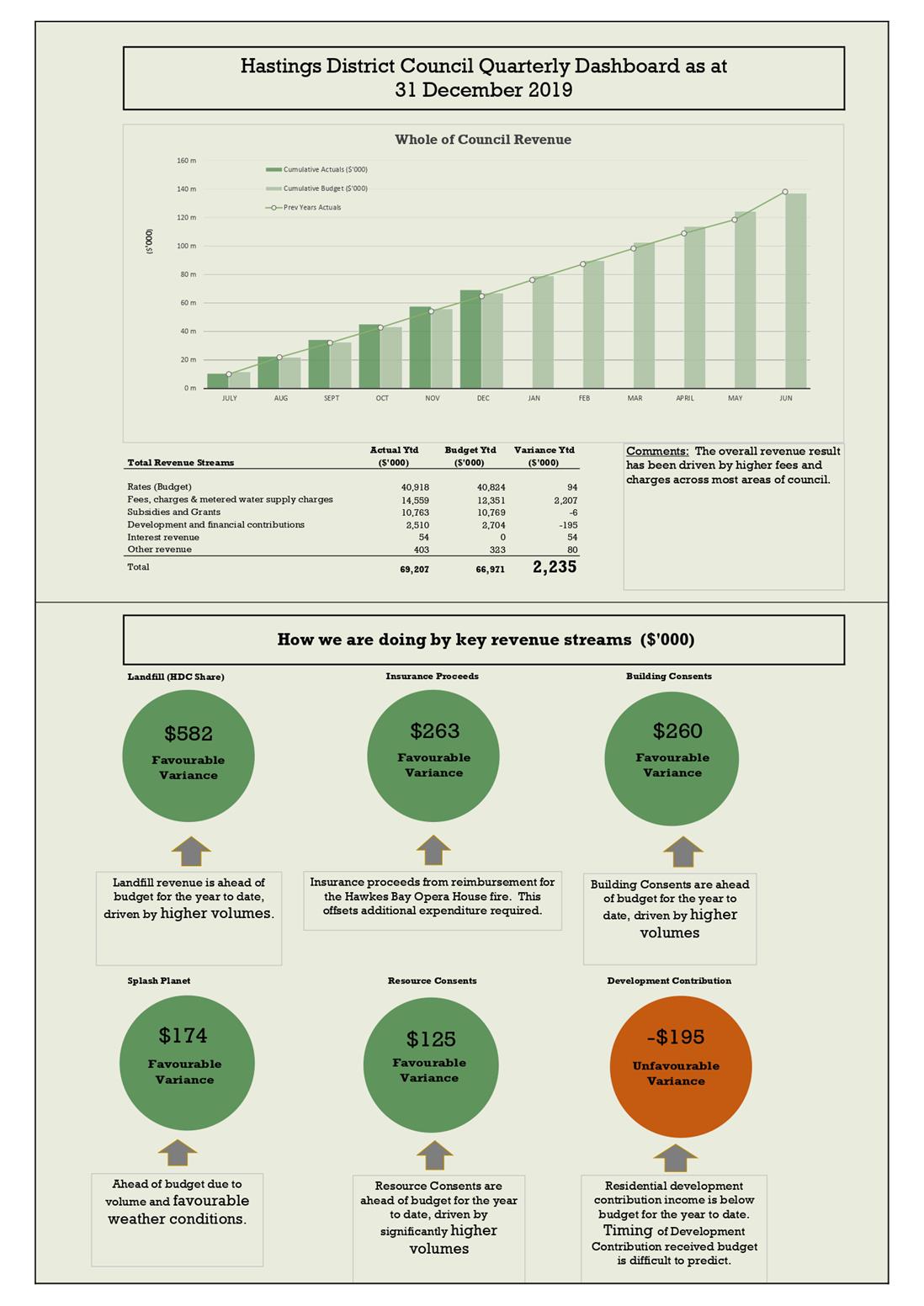

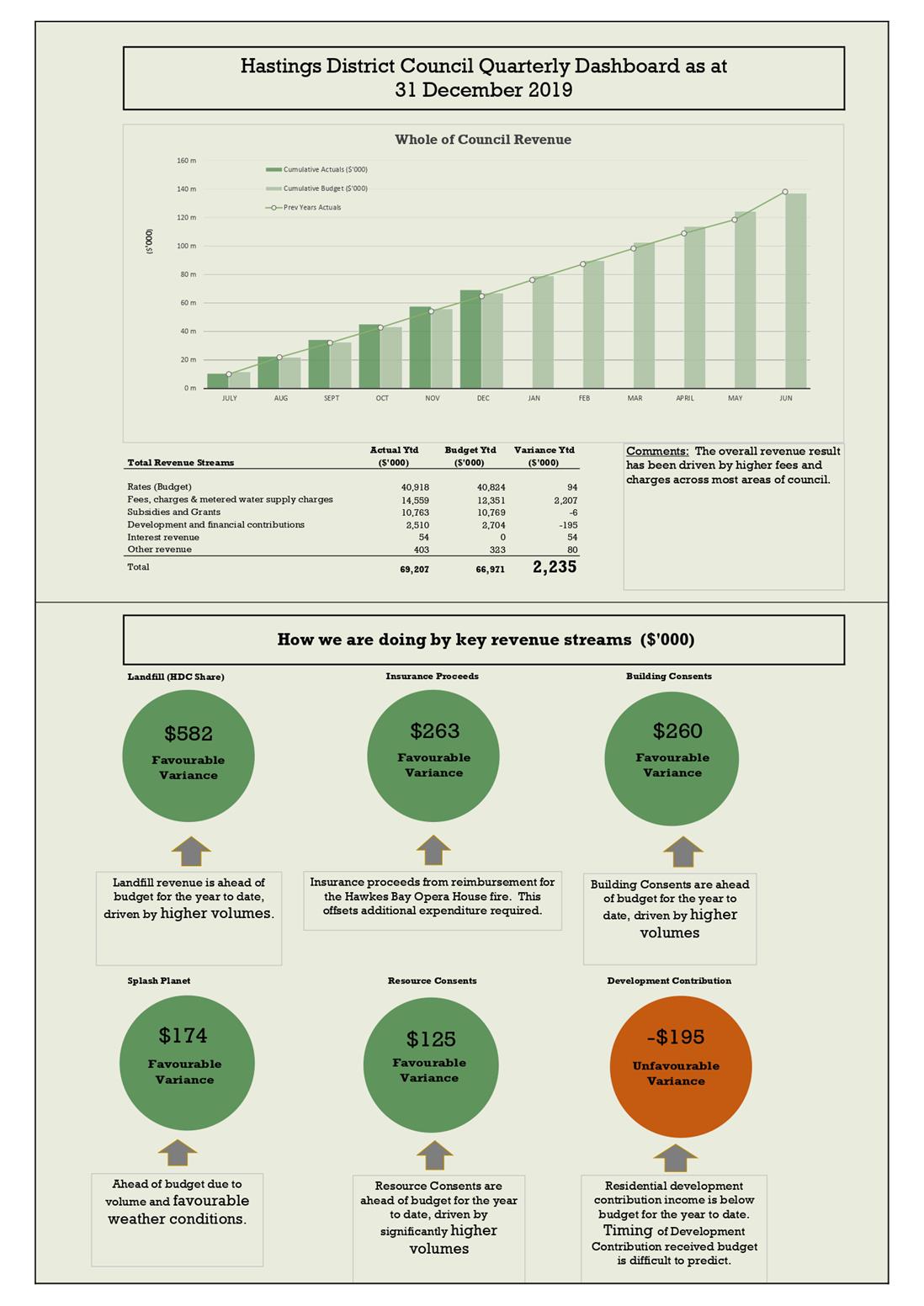

3.1 Set out below is a summary of the operating

financial result year to date. The financial results detailed below

represent the accounting view and does not reflect the potential rating result

for 2019/20:

|

$’000

|

$’000

|

$’000

|

Full year

Revised Budget*

|

|

2019/20

|

YTD Actual

|

YTD Revised Budget

|

YTD Variance

|

|

Operating

Revenue

|

69,207

|

66,971

|

2.235

|

137,044

|

|

Operating

Expenditure

|

67,322

|

64,710

|

(2,611)

|

127,765

|

|

Net

Surplus/(Deficit)

|

1,885

|

2,261

|

(376)

|

9,279

|

* Revised budget

includes the Annual budget, Brought Forwards and surplus allocations from 18/19

financial year

3.2 The

result above is presented

against the revised budget. The revised budget includes changes and

decisions made during the year on Council budgets which includes carry forwards

from 2018/19.

3.3 Council’s

overall financial performance is $0.376m behind YTD budget for the quarter

ended 31 December 2019. Revenue is favourable to budget and expenditure

is unfavourable budget.

3.4 Overall revenue is $2.2m ahead of YTD budget and expenditure is $2.6m, unfavourable

to YTD budget.

Revenue

3.5 Fees

and charges revenue across Council are favourable by $2.2m with the main

drivers being:

· Planning

and Regulatory services are favourable to budget by $414k driven by higher

environmental ($125k), and building consents ($260k) revenue along with higher

than budgeted licences and registrations ($43k).

· Community

services are favourable to budget by $510k, with higher than budgeted revenue

in Splash Planet (174k), along with Opera House fire insurance reimbursement of

$263k the main drivers.

· Waste

services are favourable by $702k, with the main drivers being Council’s

share of Landfill revenue (582k), Transfer station (123k), due to higher than

budgeted volumes.

· Water

services are favourable by $383k, with the main drivers being increased water

meter charges (242k), along with subsidy received for the Bridge Pa Booster

station (204k).

3.6 Development

contributions are unfavourable to YTD budget by $195k. Phasing of budgets in

relation to when contributions occur is difficult, and creates timing

differences as it is not always known in advance in what month a payment will

occur when the budget is being set.

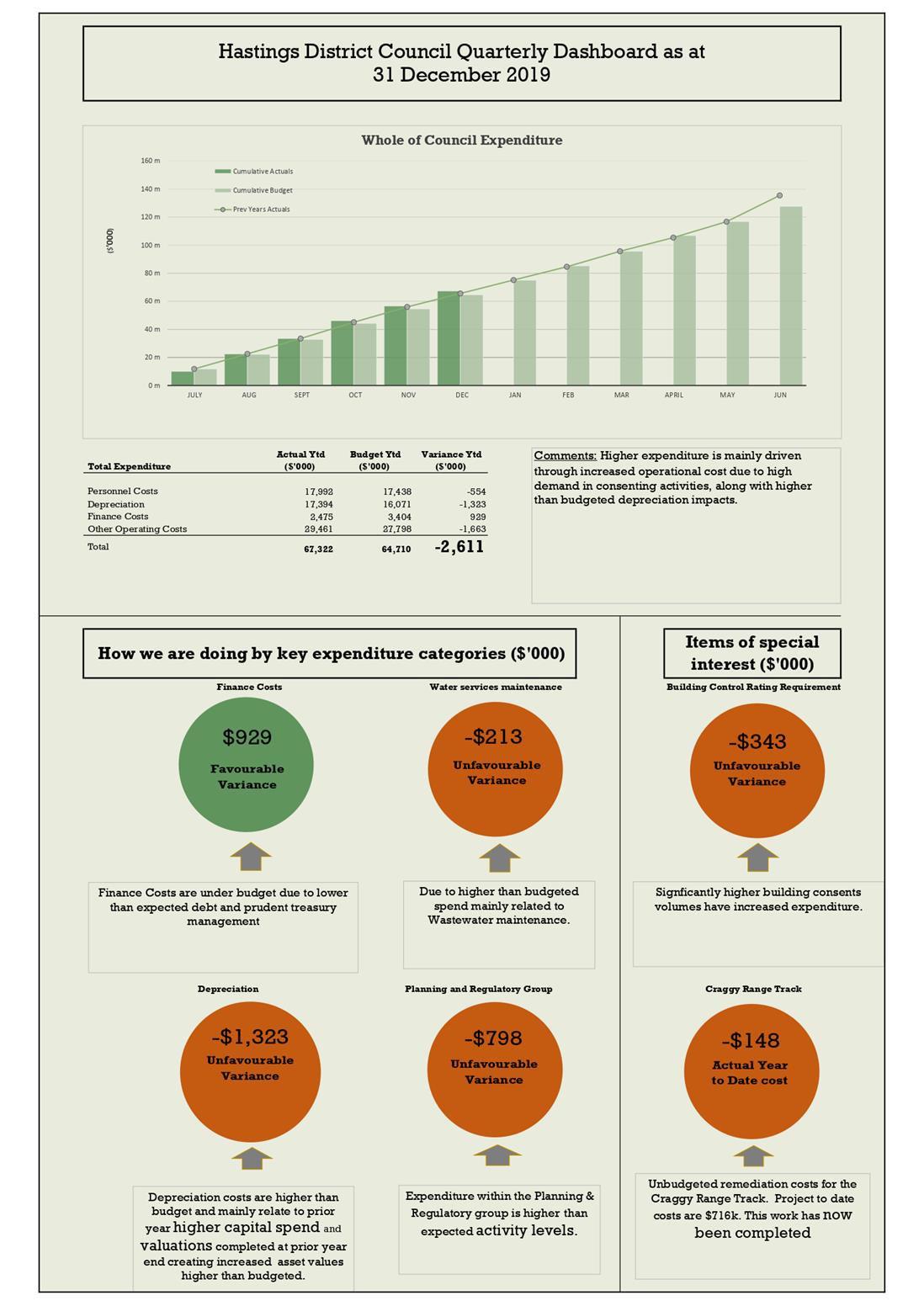

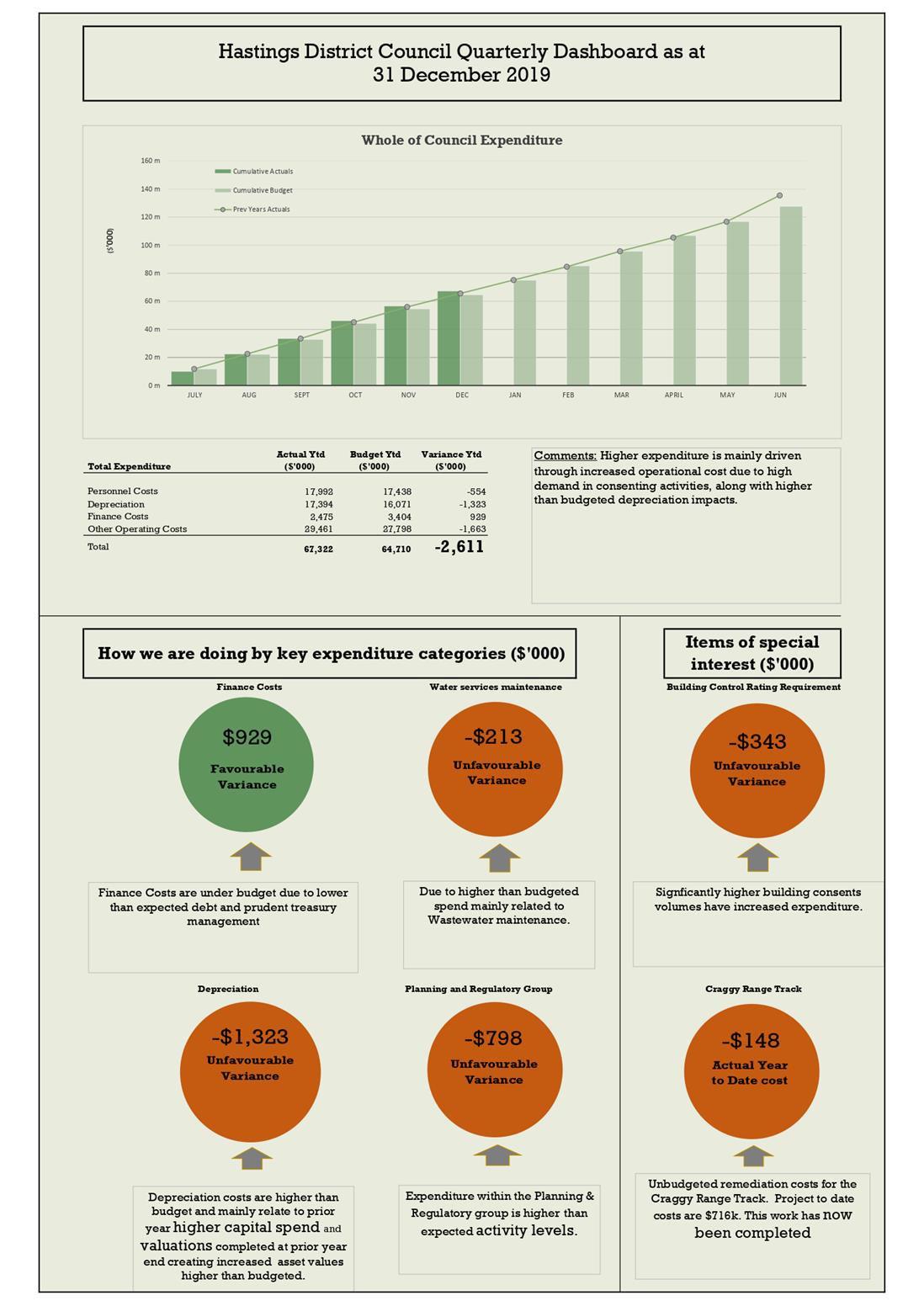

Expenditure

3.7 Overall expenditure is tracking unfavourable to year to date budget as at 31st December

2019 by $2.6m or 4.0% of total budgeted expenditure year to date. Main drivers

include:

3.8 The

negative variance to budget for non-cash entries in terms of Depreciation

($1.3m) are driven by higher asset values due to prior year revaluations in

Parks, along with increased spend in infrastructure projects in water and

roading.

3.9 Finance

costs are favourable by $929k which is a reflection of lower levels of debt

than phased in the budget and lower actual interest rates compared with those

assumed in the budget.

3.10 Other

operating costs are unfavourable to budget by $1.66m, and are driven by:

· Asset

Management group are unfavourable by $1.29m. Areas driving this variance are:

o Parks $591k

unfavourable driven by parks maintenance with December being the busiest month

of the year, some scale back may be necessary over the second half of the year

to ensure this area remains within budget.

o

Transportation $297k unfavourable, with maintenance costs above budget year to

date, however these costs along with renewals will be managed to ensure

transportation comes in on budget.

o Effluent

disposal $558k unfavourable with higher preventative maintenance costs (284k),

in terms of pump and fan work and Outfall maintenance. Other additional costs

were incurred with service assurance and planning expenditure.

· Planning

and Regulatory - $404k unfavourable, with high contracted services costs in the

consenting areas due to the high levels of activity.

· Toitoi

building maintenance is 254k unfavourable due to the costs associated with the

Opera house fire late in the previous financial year. This is offset by

the additional insurance reimbursement in the revenue line.

· Drinking

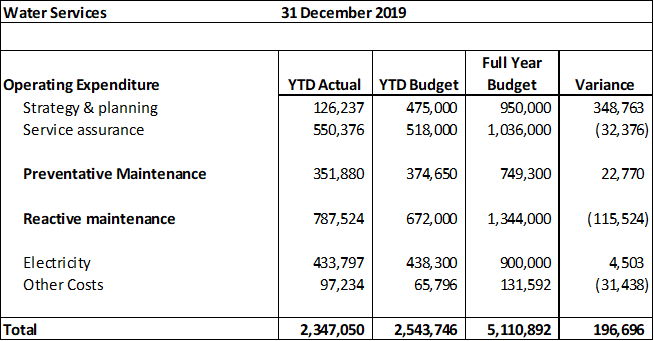

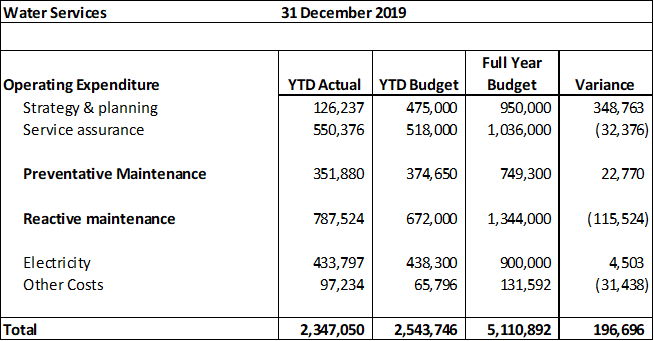

water services operational expenditure when split out shows a favourable

variance to budget of $197k. Below shows a summary table of spend to

budget in this area:

Areas of Interest

3.11 Craggy Range Track Project:

Council has spent

$148k in the current financial year, ($716k in total) on the Craggy Range Te

Mata Peak Track with the current years spend focused on remediation. The track

remediation has now been completed with costs coming in under that estimated.

3.12 Building consents:

As was

highlighted in the 2018/19 year end overview to Council, this is an area that

has seen a large increase in volumes, with a corresponding increase in

expenditure outstripping additional revenues.

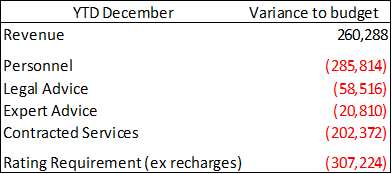

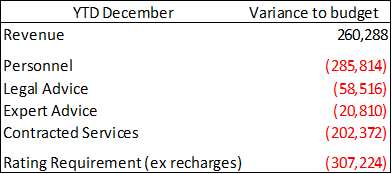

3.13 This

trend has continued in this current financial year, and as previously highlighted

the revenues are ahead on last year’s actuals that were already very

strong. The impact of the higher volumes however is also reflected in

higher than budgeted expenditure as shown in the table below, with the

contracted services and personnel costs the main drivers in the rating

requirement budget to actuals variance deficit of ($307K).

3.14 While

Council is keeping up with demand the pressures of doing so are coming at

additional cost that is not currently recoverable through the current fees and

charges schedule.

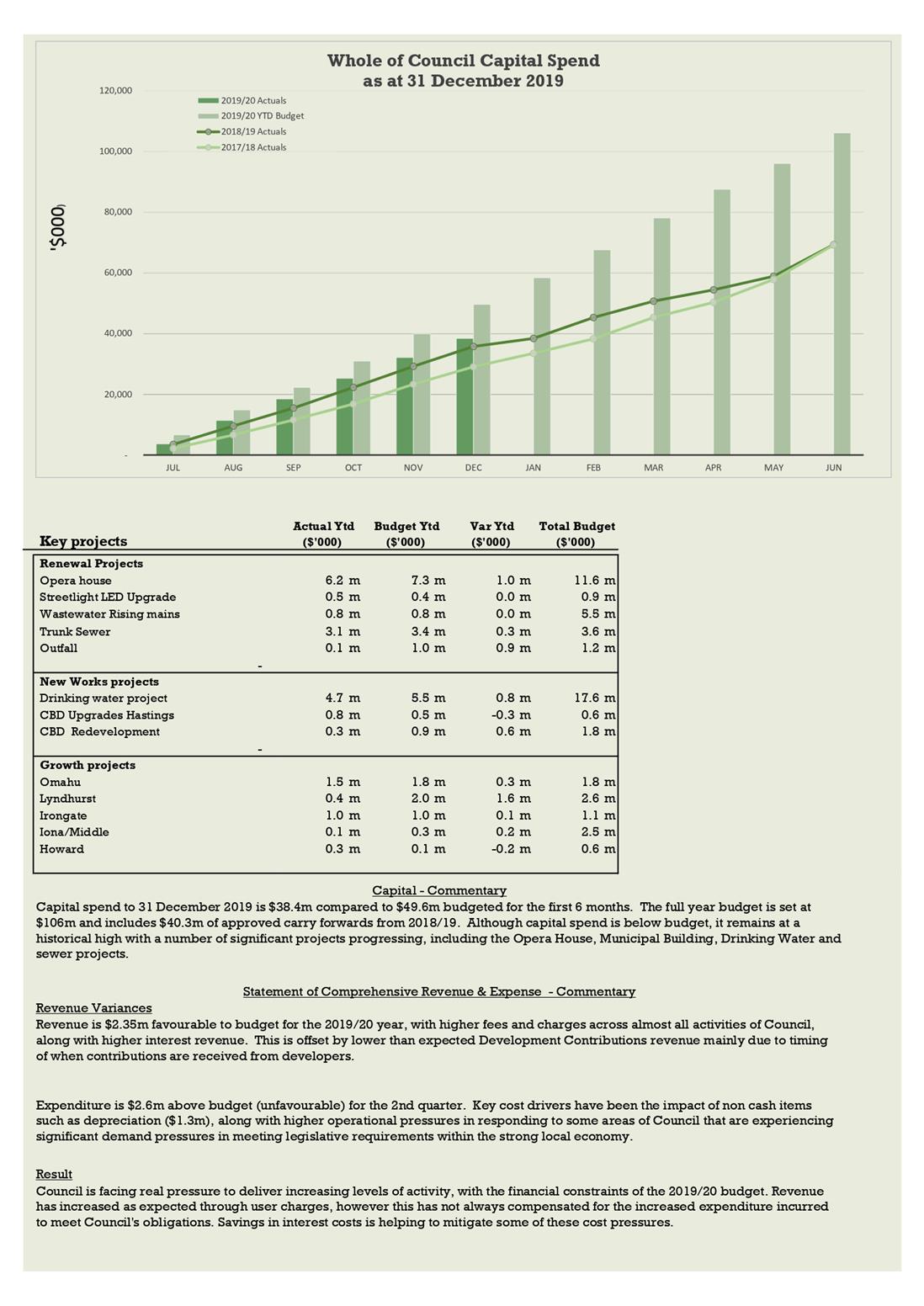

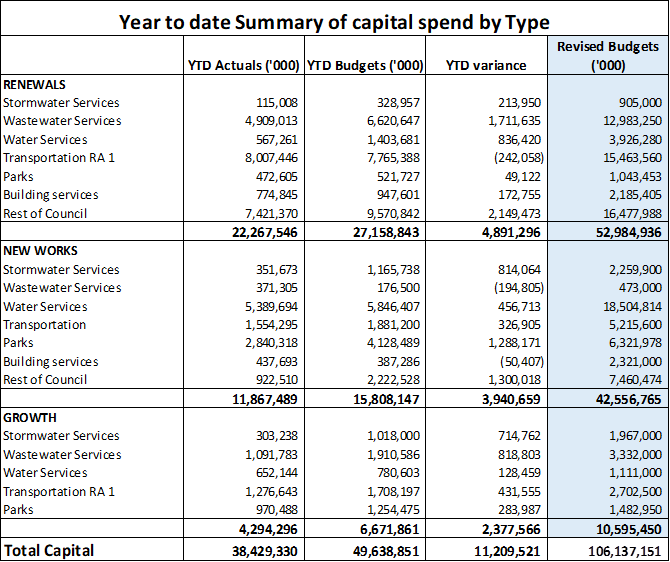

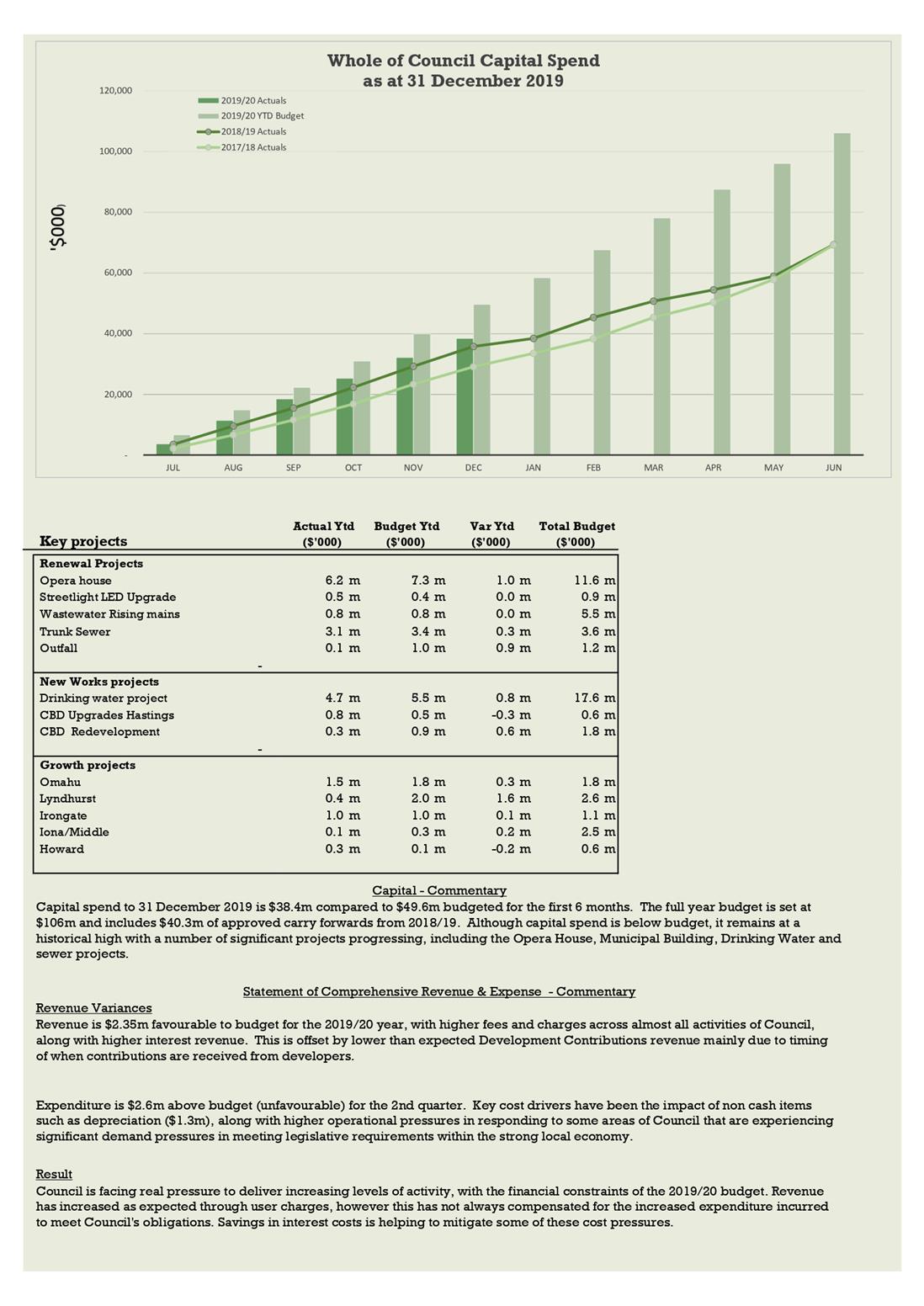

Capital Spend

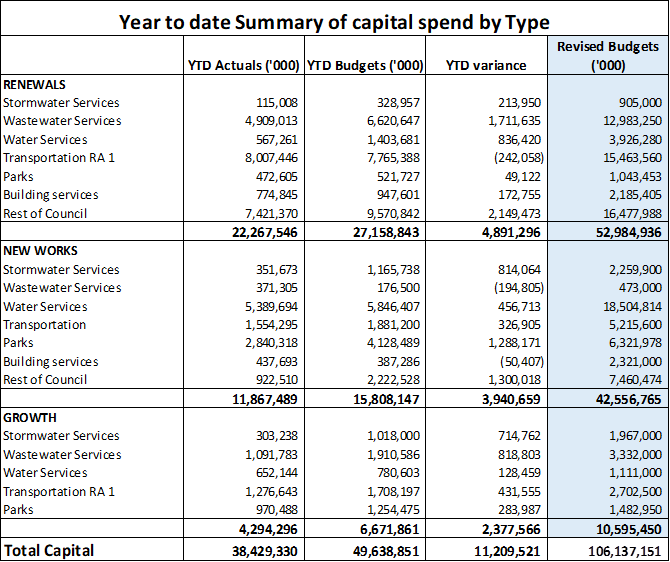

3.15 Council’s

total capital budget (including carry forwards, renewals, new works, and growth

projects) for 2019/20 is $106m. This level of expenditure is a

significant increase on what has been delivered previously by Council and there

is some risk associated with the ability of Council to deliver on this

programme. Helping to offset some of this risk is a much more detailed

programme of the works budgeted.

3.16 Capital

spend for the year to date is $38.4m. Whilst this is behind current year to

date budget of $49.6m it is $3m ahead of last year’s actuals for the same

period.

3.17 Projects

by Activity within the three types of capital spend are shown below:

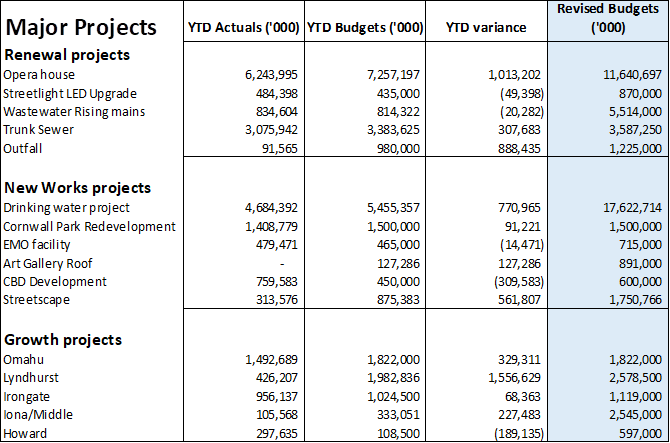

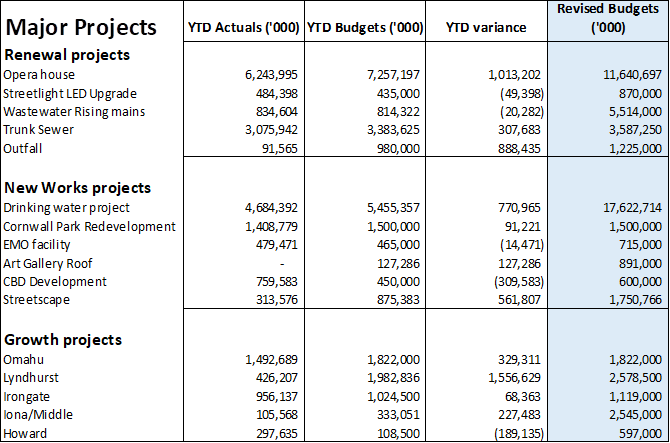

3.18 Major

projects currently underway within the three types of capital spend are shown

below:

Treasury

Council’s

total gross debt position is $149.7m which includes $22m of prefunded capital

expenditure and debt refinancing which is currently held on deposit.

|

|

|

31-Dec-19

|

|

|

$'000

|

|

|

|

|

Borrowing at start of

year

|

|

106,241

|

|

New Loans Drawn

|

|

46,400

|

|

Loan Repayments

|

|

(2,900)

|

|

|

|

|

Borrowings as at 31 December 2019

|

|

149,741

|

|

Less Term Deposits held

|

|

(22,000)

|

|

Total

Net borrowings

|

|

127,741

|

|

|

|

Council

is currently compliant with Treasury Management Policy. The Risk and

Assurance Subcommittee is responsible for reviewing Council’s treasury

performance and policy with advice from Bancorp Treasury Services.

|

4.0 RECOMMENDATIONS - NGĀ

TŪTOHUNGA

A) That the Council/Committee receives the report titled Financial Quarterly Report for the Six

Months Ended 31 December 2019.

|

Attachments:

|

1⇩

|

Quarterly Dashboard December 2019

|

FIN-09-01-20-184

|

|

|

Quarterly Dashboard December 2019

|

Attachment 1

|

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Chief Financial Officer

Bruce

Allan

SUBJECT: Financial

Summary as at 31st December 2019

1.0 PURPOSE

AND EXECUTIVE SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

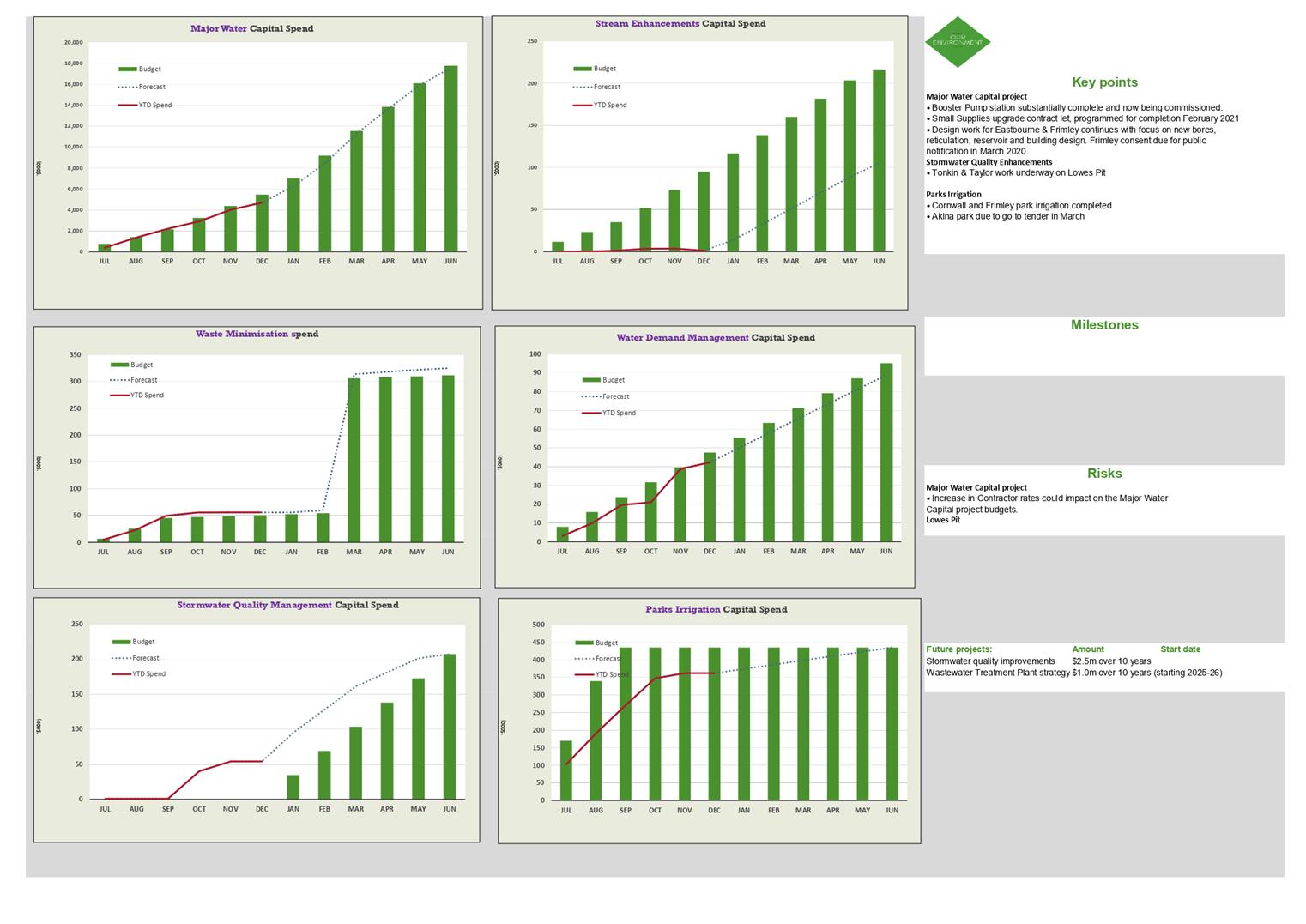

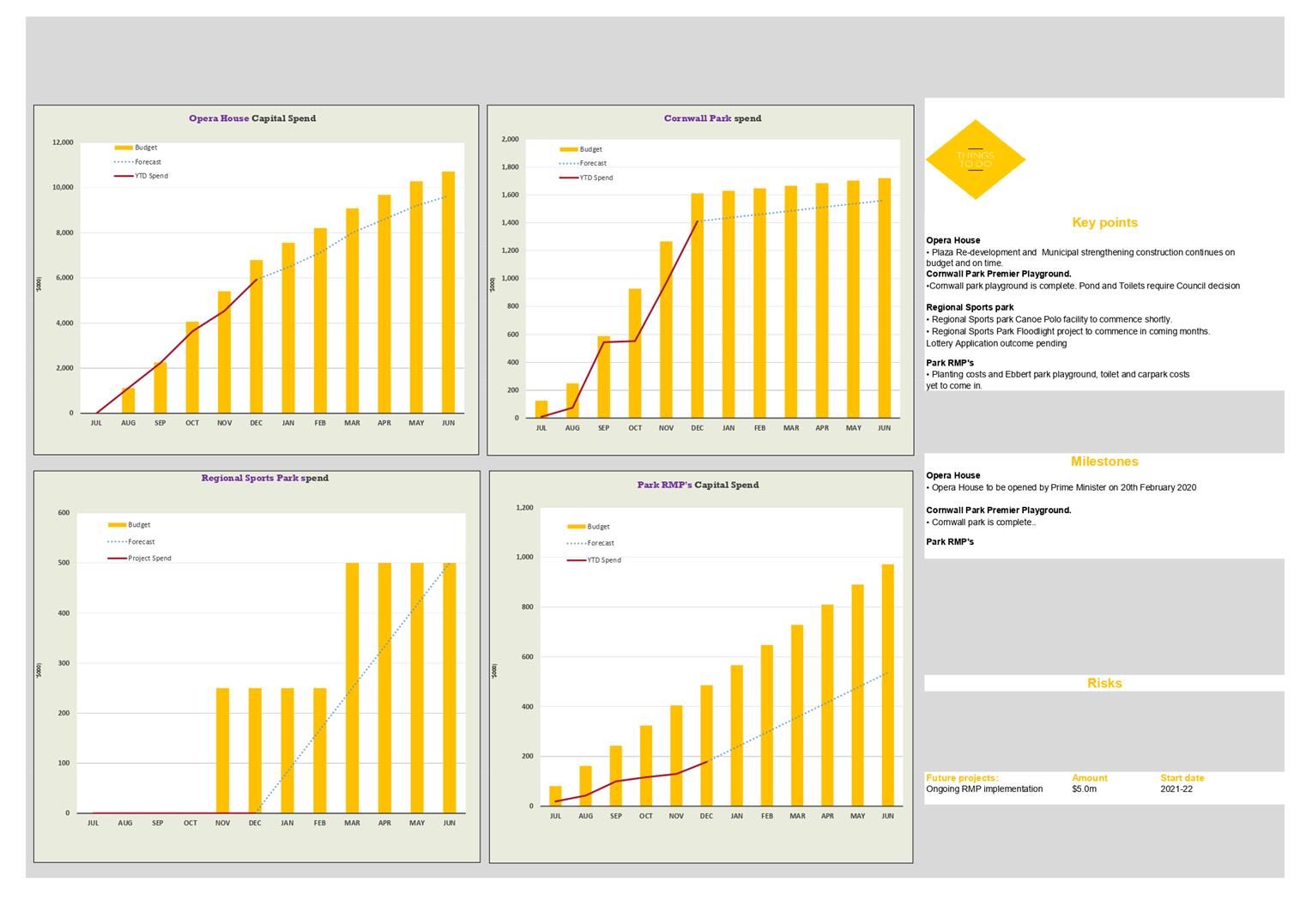

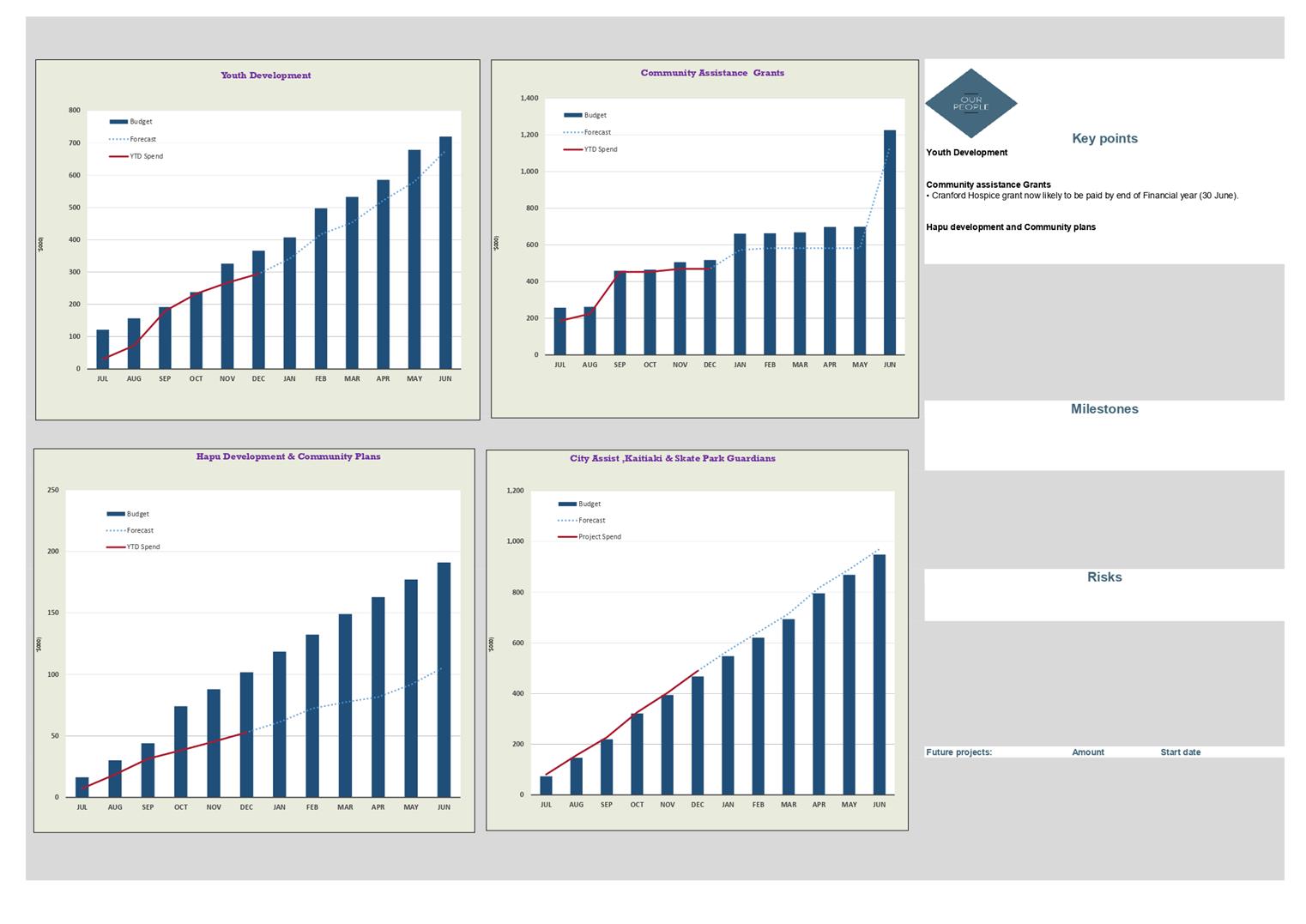

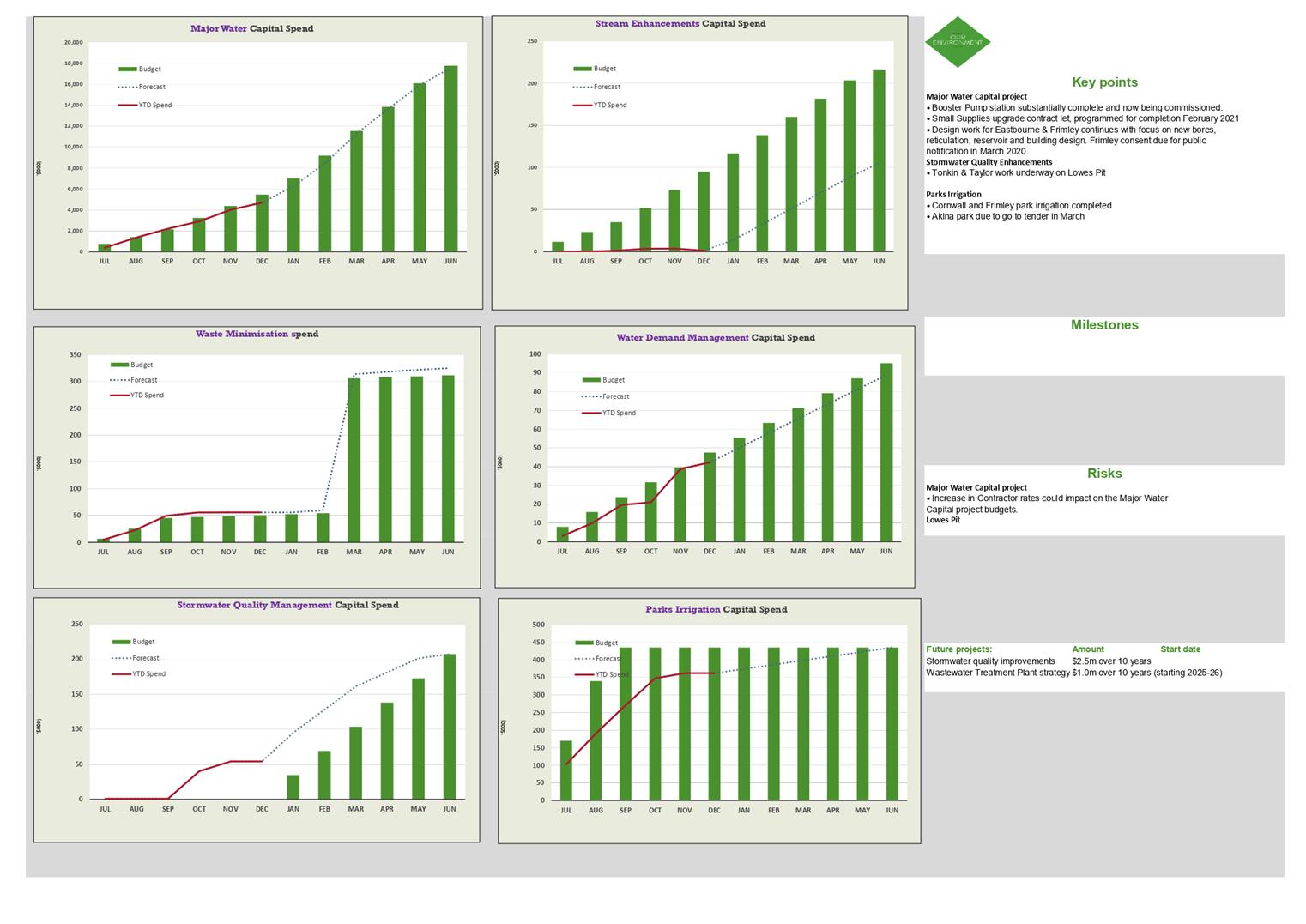

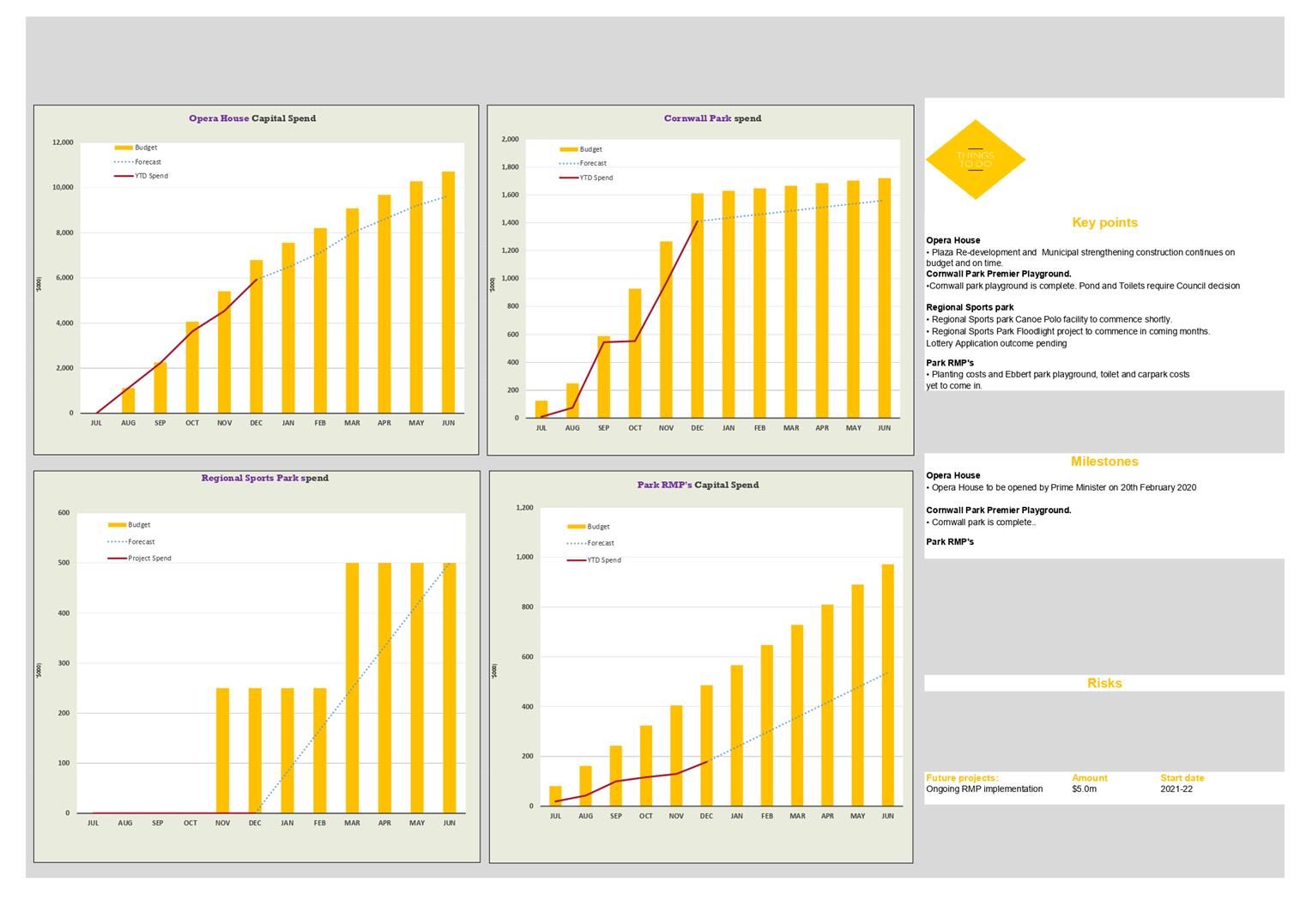

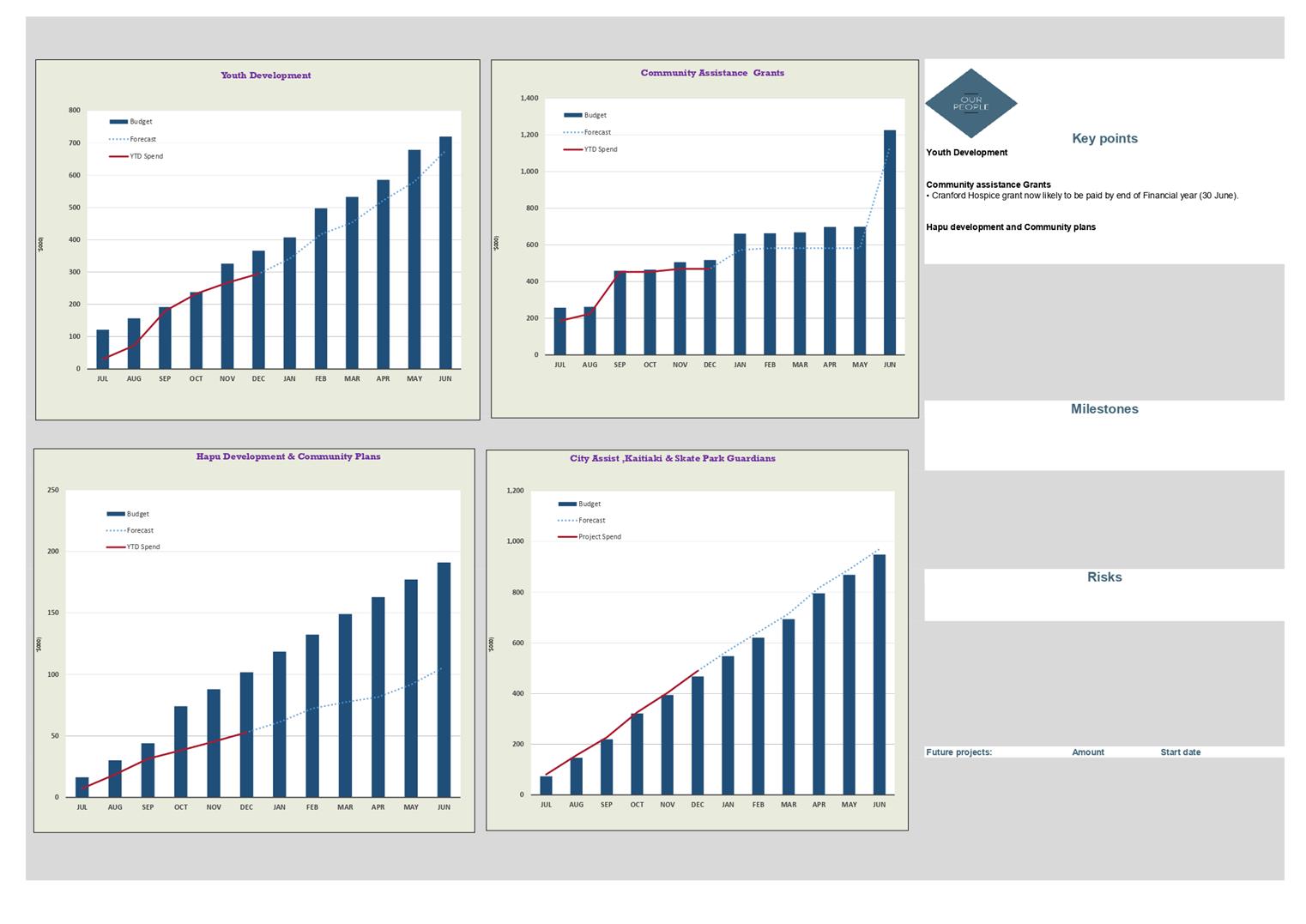

1.1 Attached

as Attachment 1 is the monthly financial report year to date December

2019.

1.2 The

report provides Council with a direct link back to the Long Term Plan. The

strategic framework of the 2018-28 Long Term Plan has 6 broad areas of focus

and this new report is designed to link back to those 6 areas of focus which

are:

1. Our Environment

2. Moving Around

3. Our Economy

4. Where we Live

5. Things to Do

6. Our People

1.3 The one

page report on each area of focus concentrates on a programme of work rather

than individual projects with each graph focussing on the current year

expenditure. Included in the right hand column are some high level commentary.

It is important to note that the scale of each programme of work varies

significantly and this needs to be considered when analysing the impact of any

programme spend against budget.

|

2.0 RECOMMENDATION

- NGĀ TŪTOHUNGA

That the Council receives the report titled Financial Summary as at 31st

December 2019

|

Attachments:

|

1⇩

|

FInancial Summary December 2019

|

FIn-09-01-20-185

|

|

|

FInancial Summary December 2019

|

Attachment 1

|

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Group Manager: Asset Management

Craig

Thew

SUBJECT: Half

Year Progress report

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The purpose

of this report is to provide the committee with a summary of performance for

the first half of the year. This report is not intended to repeat detail

provided in previous weekly and monthly updates.

1.2 It is

expected that this report will develop as the new committee structure and

specific programme focus areas are confirmed.

1.3 Following

the meeting committee members will be provided with a brief overview and

demonstration of the monthly reporting portal which is under development. This

report has been structured in alignment to this tool.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Half Year Progress report.

|

3.0 BACKGROUND

– TE HOROPAKI

3.1 This is the

first summary report to this new committee, replacing previous reports such as

works and services updates, major projects, and other council service area

updates.

3.2 It is

expected that the nature and focus of update reports to this committee will

mature and adapt to specific needs and focus areas over time.

3.3 It is not

currently intended for these reports to replicate detail such as has been provided

in weekly update reports, nor to fully reproduce items included in the new

monthly reporting tool.

4.0 DISCUSSION - TE MATAPAKITANGA

5.0 Compliance

Summary of key activity areas

5.1 Drinking

Water compliance

Updated Water Safety Plan (WSP) for the main

water supply has been submitted to Health officials for assessment. The

assessment by the drinking water assessors is still underway. The WSP

incorporates the major improvements Council has approved as well as a

significant list of smaller improvements proposed to continuously improve

controls of identified hazards.

Extensive testing and monitoring continues.

5.2 Council

Consenting performance

As

previously reported current resourcing levels are inadequate to enable Council

to meeting statutory response times during this time of high economic activity.

This issue is occurring across both Building and the Regulatory consenting

areas. Council’s recent decision to increase resourcing will take time to

reverse this situation. Further to the building and planning staff demands the

increased activity also creates demands on development engineering resources.

The actual scale of effect does depend on the complexity of applications and

the quality/completeness of applications. We will need to monitor and adjust

resourcing inputs to ensure engineering inputs can meet processing requirements

as well.

5.2.2 Asset Management Consent

management system. Over the first half of the year a new consent management

initiative has been progressively implemented to manage, firstly consents that

Council has with other entities, and secondly where Council issues consents to

others (i.e. Trade Waste). To date in the order of 80 consents and their

various conditions have been loaded. Progress on this business improvement

initiative is being reported to the Assurance and Risk committee. The system

will enable consolidated reporting across consents and to provide improved

oversight performance against conditions.

6.0 LTP

Priorities:

6.1 Our

Environment

6.1.1 Waste programme changes:

The works in preparation to deliver on the changes to kerbside recycling and

refuse services is well on the way with contracts let (Smart Environmental as

the kerbside recycling provider, and JJ Richards as the kerbside refuse

provider). The associated preparation tasks (e.g. audit of serviced area,

communications strategy, funding models for annual plan) are also progressing

to schedule. The Waste minimisation team are also progressing waste

minimisation initiatives programmed in the plan.

6.1.2 Landfill: The strong

economy has also seen increasing tonnages of material to the landfill. This has

also included increased special waste, in particular material related to

potential asbestos contamination and contaminated soil. Officers are monitoring

and making operational adjustments to manage this increase. There may also be a

need to have discussions with industry as to the need for some of the material

to be dumped verses additional checks/cleaning.

6.1.3 Renewal of Leachate Pond

liner: this work has been completed. The pond liner was fully renewed along

with some minor improvements to aid in the operation. HBRC officers were

involved as this work progressed.

6.1.4 Drinking Water Upgrade

works: Design and contract negotiations have been progressing and Council

has received recent reports on budget and contract status. Some of the key

risks to the programme that the team are managing are in the areas of

consenting, supplier capacity and interest, land agreements. Delivery of this

programme of improvements to the schedule set in the LTP and agreed with the

Drinking water assessors is critical to meeting Councils requirements under the

Health Act, in particular the implementation of the remaining water treatment

upgrade works at both the main urban supply bore field in the Frimley park and

Eastbourne areas.

6.1.5 Wastewater improvements:

Upgrades to the Park Road rising main continue, this is a multi-stage multi

year project to increase capacity and reduce wet weather overflows in the Akina

and Parkvale area. This capital works will be supported by further ‘on

property’ inspection to reduce inflow and infiltration effects that

contribute to increased wet weather flows in the wastewater system.

6.1.6 Lowes Pit improvements:

This project was accelerated by a Council decision at the end of 2019. A budget

provision to implement a suite of initiatives to reduce environmental risks has

also been included in the draft 20/21 Annual plan. The actual improvement

initiatives are to be finalised following further detail investigations and

analysis of treatment effectiveness. Testing has been occurring, however some

tests cannot be completed until there is enough rain in the area to monitor and

trace source areas.

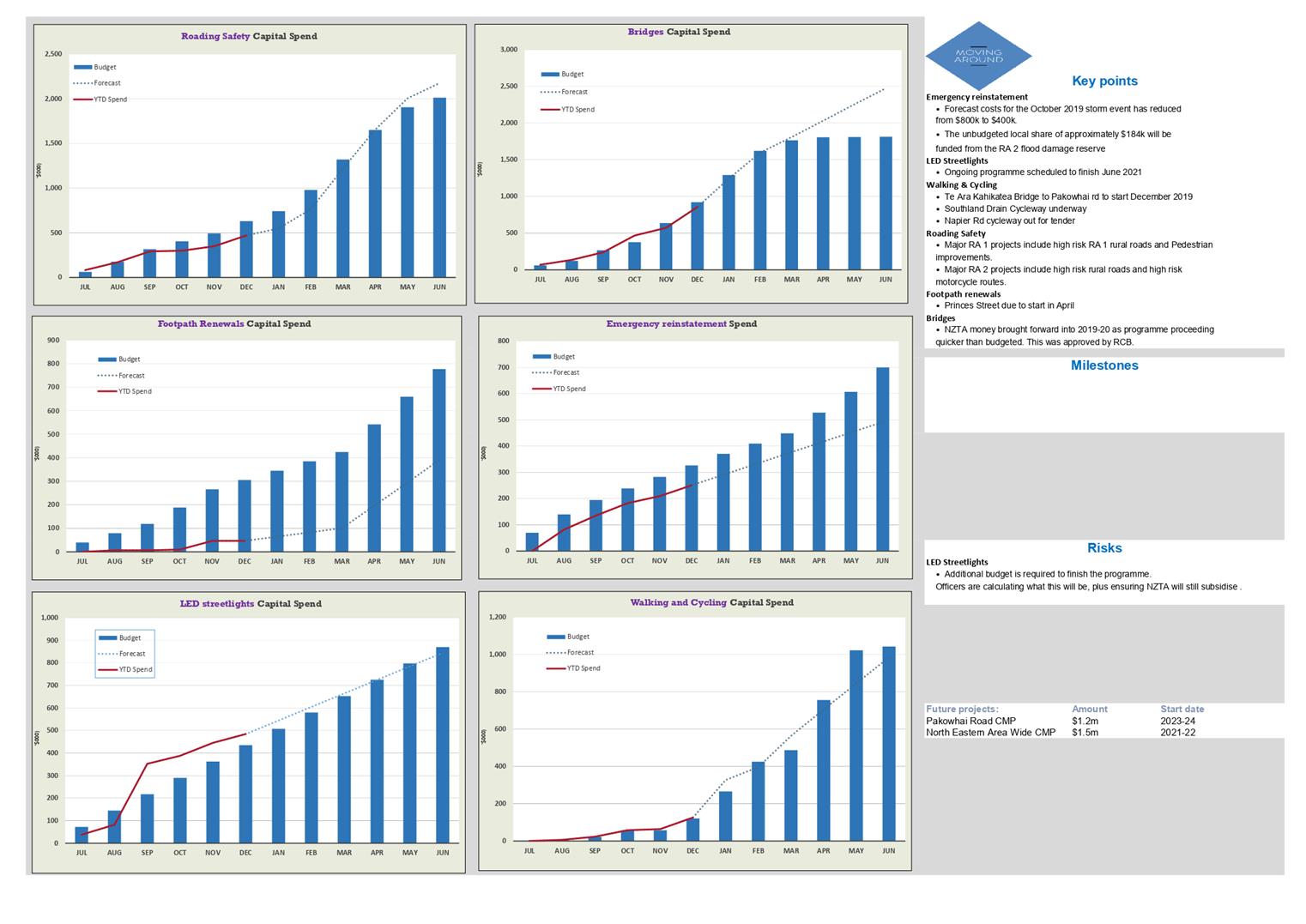

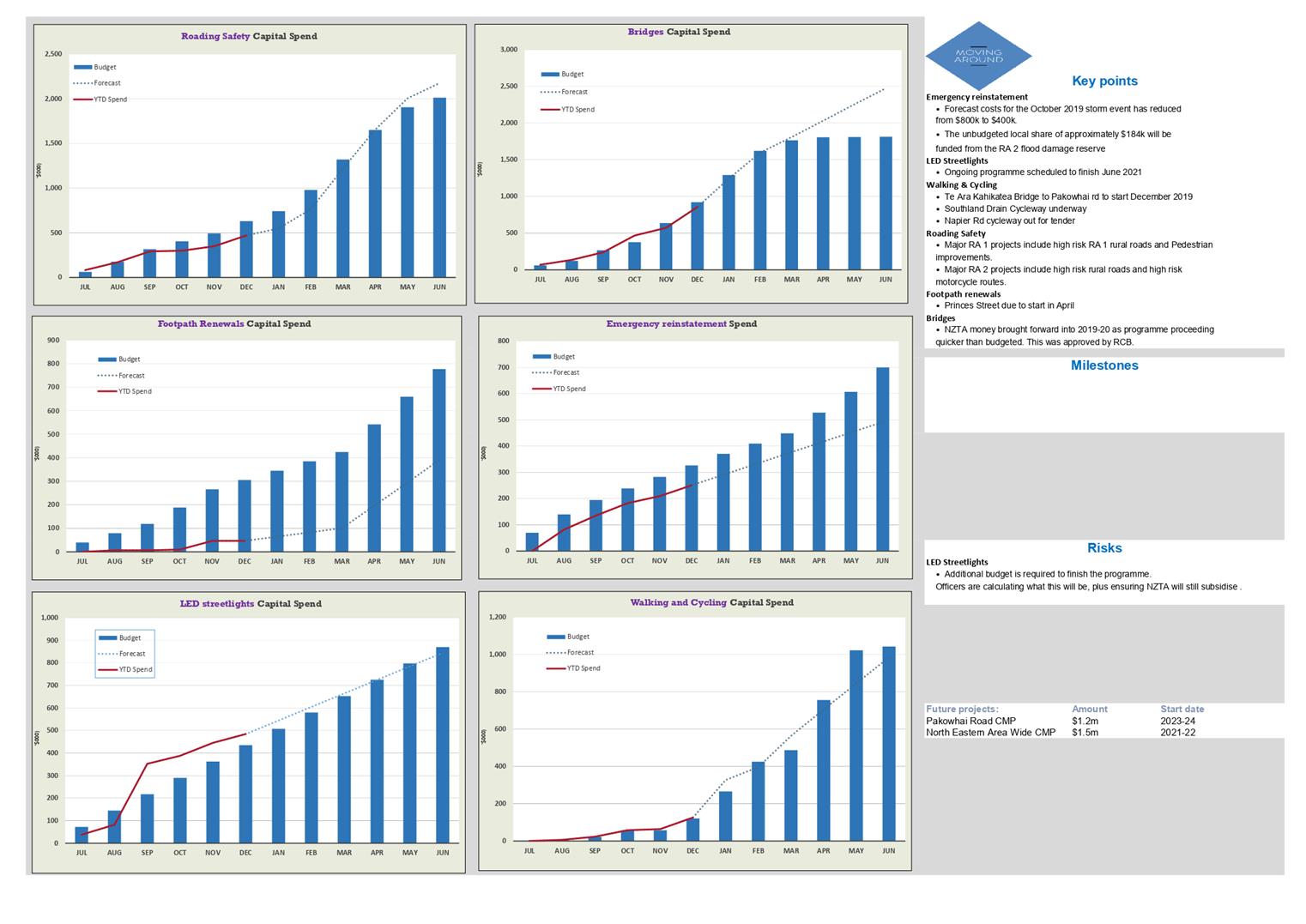

6.2 Moving

Around

6.2.1 Speed limit review:

Officers are compiling the assessments of the draft sites to be taken through

to the public consultation process assessment processes. This draft proposal is

scheduled to be presented to a meeting in March. NZTA are also working to consider

the speed limits on SH51 (old SH2) at a similar time.

6.2.2 Bridge Programme:

improvement works is ahead of schedule and Council has approved the

acceleration of works and funding from 2020/21.

6.2.3 Road Safety requests:

There has been an increasing trend from household/community for reviews of road

safety at numerous locations. The quantity of these along with delivery of

business as usual is creating resourcing (staff capacity and available budget)

and delivery challenges which is of increasing concern. If the level of

requests continues we will need to increasingly manage expectations and

priorities.

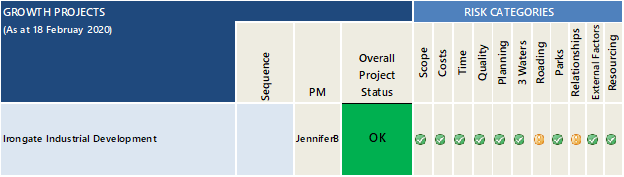

6.3 Our Economy

6.3.1 CBD Programme:

various projects have been completed, in particular the improvement works along

Eastbourne Street. What is less obvious is the work the team have been doing in

preparation for further works and in discussions with adjacent and potential

CBD businesses. Next key upgrade is the delivery of upgrade works to Karamu

Road 100 North block (works schedule to start week of this meeting), and the

enabling works for landmarks square enhancements.

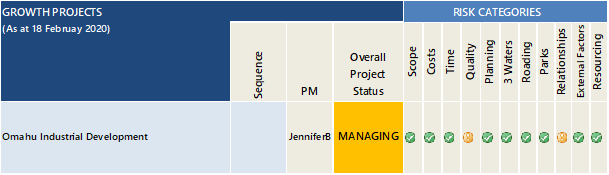

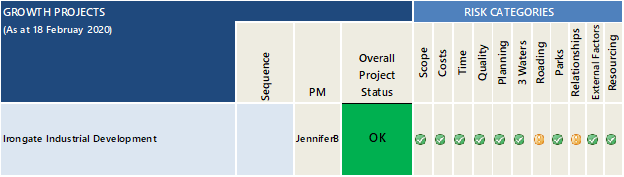

6.3.2 Industrial Growth Summary

– works on the delivery of infrastructure to enable industrial growth in

Irongate and Omahu continues in line with the budgeted programme.

6.3.3 Irongate Industrial

Growth: The capital works for water infrastructure is complete. Road

improvements for Irongate Road East are effectively complete and final design

for the roundabout at Maraekakaho Road is underway. Council received

Development Contributions for 27.44 Ha in the second half of 2019.

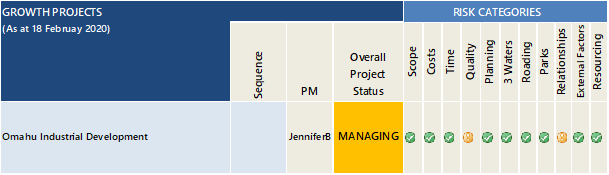

6.3.4 Omahu Industrial Growth:

Contractor completed work on Separable Portion 6 and nears completion on

Separable Portion 5 of the Omahu (North) infrastructure corridor. Design works

are underway to address overflow issue involving swale serving a large

development on Omahu Road. Acquisition of land for the roundabout at Omahu and

Henderson is ongoing. The timing of the roundabouts is under review. We are

>95% complete with the designed bulk water services works to date for the

corridor.

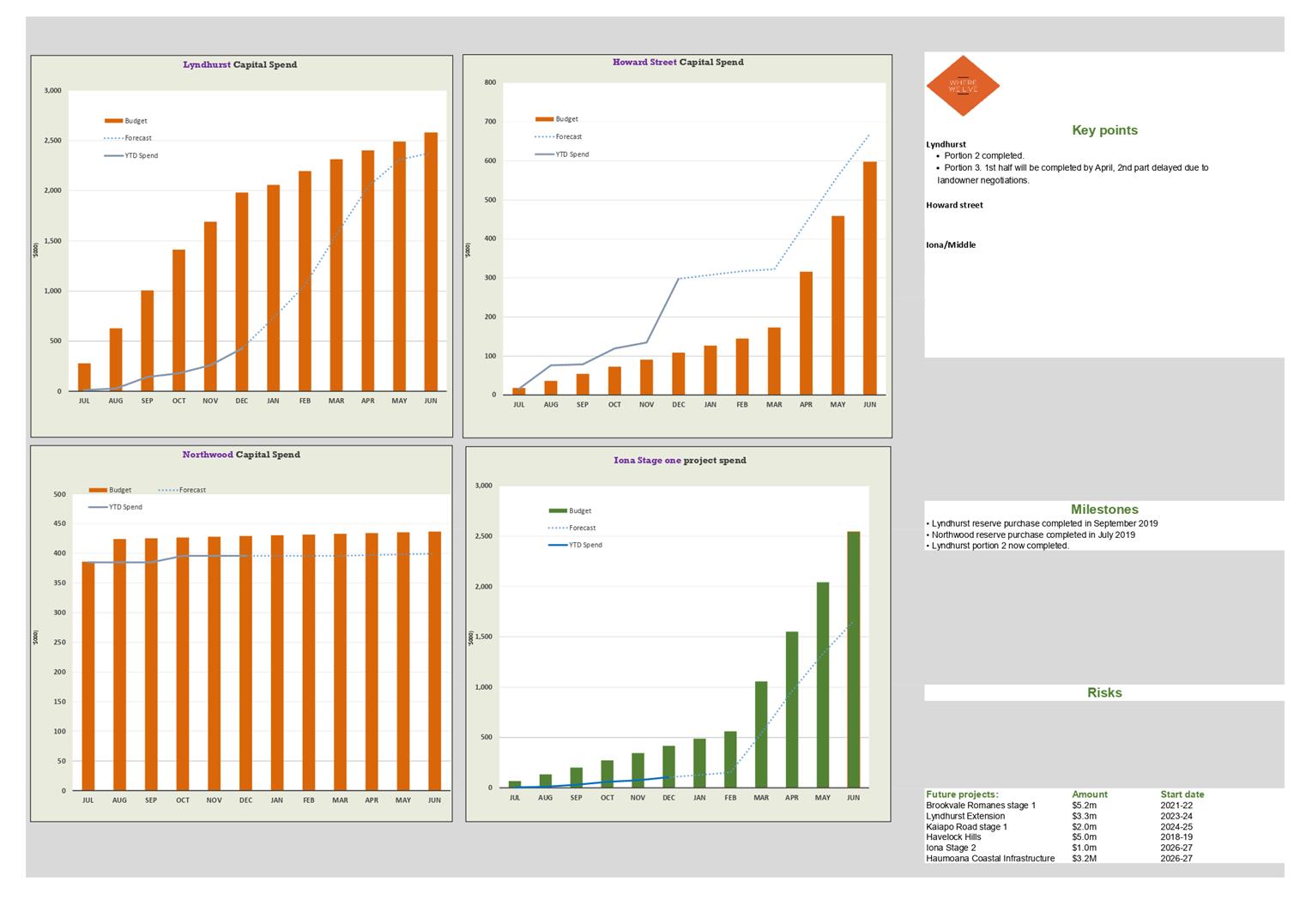

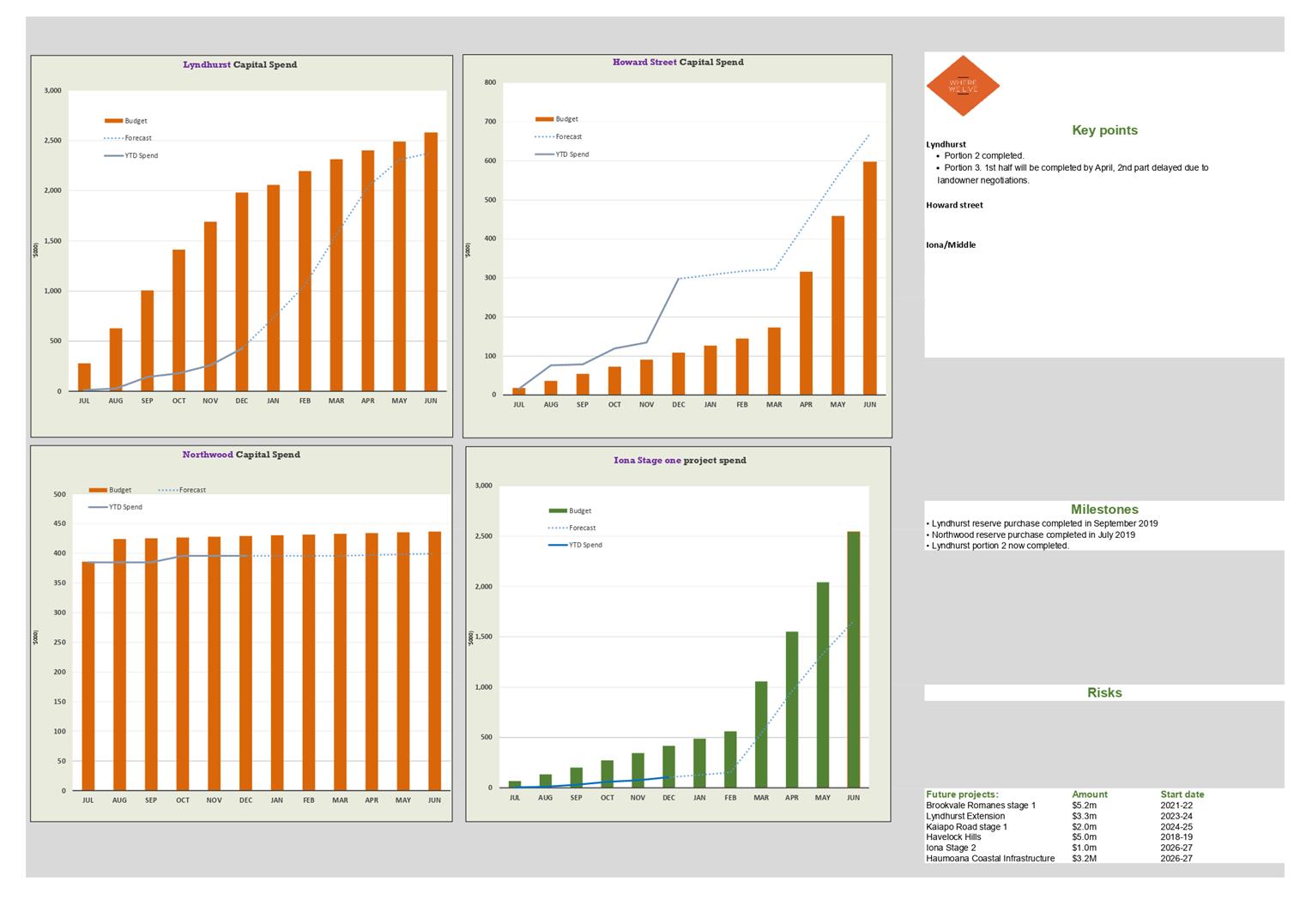

6.4 Where

we Live

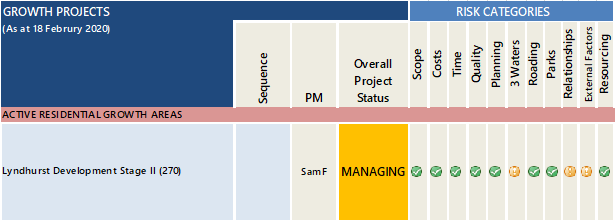

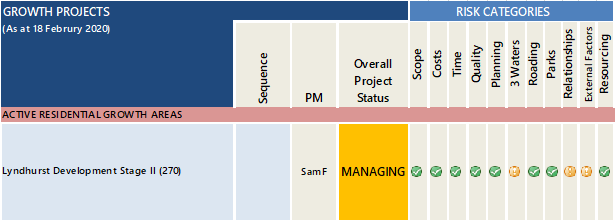

6.4.1 Lyndhurst Stage 2

Residential Growth: There are numerous dwellings being built within the stage

2 development area. ~167 lots have been consented. An additional ~50 lot

subdivision application has been granted. All the landowners within stage 2

have indicated their interest to develop. Portion 2 construction of bulk water

services from Lyndhurst Road through to Arbuckle Road is complete. Portion 3

construction of bulk water services from Arbuckle Road through to the 3Tuahine

land is under construction scheduled to be completed in the first quarter of

2020.

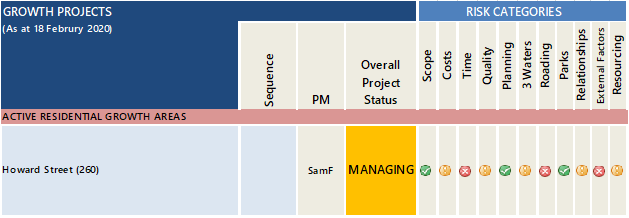

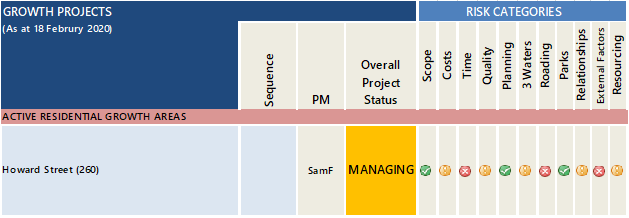

6.4.2 Howard Street

Residential Growth: Officers have completed developed design of the

internal water infrastructure and roading network (with the exclusion of

landowner vehicle crossings and manholes details). The Internal Servicing

Development Contribution (ISDC) is scheduled to be adopted in May 2020. Council

have met with the Tremains team to discuss the developed design estimate. Land

negotiations are ongoing with one conditional agreement for land purchase

signed.

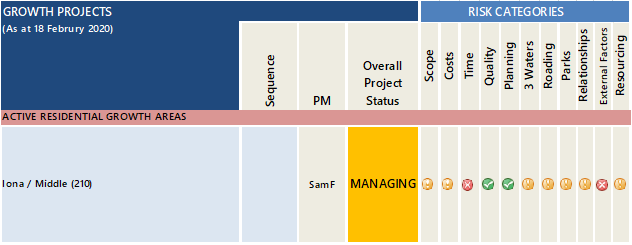

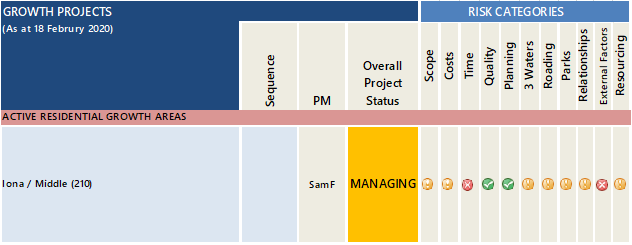

6.4.3 Iona Residential Growth:

There is currently a request from a landowner for Council to enter into an

agreement (regarding adjacent landowners contributing towards internal

infrastructure installation). Officers are working through this request. A

Working Group has been established to progress the request to enter into a

Development Agreement. The main landowner has inquired into any available 3

water capacity to allow for a small development ahead of HDC services upgrades.

Officers have confirmed 20 houses can occur ahead of HDC services upgrades.

Breadalbane Avenue is being designed with construction commencement of roading

and associated infrastructure for March 2020. Investigations into the

realignment and closure of Iona Road have commenced.

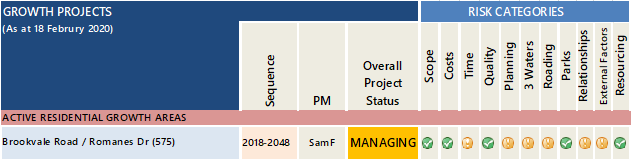

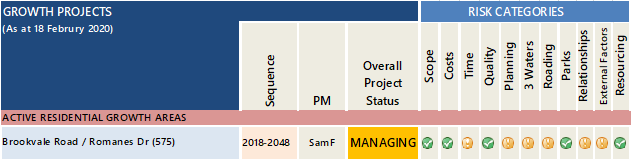

6.4.4 Brookvale Residential

Growth: The Environment Court has approved the Brookvale Structure Plan. A

main developer is close to submitting a consent to begin earthworks in Area A

(Stage1). The Stormwater Modelling Report is to be confirmed by HDC as a

priority.

6.5 Things

To Do

6.6 ToiToi:

The construction work at the theatre and the new Functions on Hastings

buildings is practically complete in readiness for the opening on the 29

February. Implementation of the strengthening work on the Municipal building

continues, this includes the structural propping installed to provide safe

egress from the Theatre. The design and pricing of the next stage is currently

underway, when completed this will come back to Council, along with an update

on funding.

6.7 Parks

RMPs: various parks improvements have been completed to date, with the most

significant project being the works and public opening of the Cornwall Park

premier playground.

7.0 Risk

Assurance summary

7.1 Potential

Regulatory and Policy changes that could affect Council:

7.1.1 National :

Solid

Waste: Changes to waste levy and Emissions trading scheme (ETS) have been

signalled, these if implemented will have direct effects on council and

community costs. It may also provide additional waste minimisation funding to

Council, but to what, if any, extent is unclear in current documents

Drinking

Water:

Consultation

on Drinking Water Regulator is out for submissions, the HB Drinking Water

Governance group is compiling a joint submission on this from the member

agencies. This regulator will have oversight over all drinking water suppliers,

it will also have a role in oversight of wastewater and stormwater performance

across the country.

The

Water Services Bill is expected later this year, this is the Bill that will

provide more detail as to the new operating environment, including

responsibilities and liabilities that organisations will have. Officers expect

that the detail development below this will be left for the new regulator to

finalise, likely building on work completed to date by MoH and DIA.

Transportation:

The Ministry of Transport has been working on a new Government position statement

(GPS) for transport, and will be providing workshops across the country to

discuss this proposed direction. Currently officers are not expecting a

significant shift from the core focus of the current government, but will

review and report on implications once this is available.

7.1.2 Regional:

The

TANK plan change is expected to be released by the Hawkes Bay Regional Council

for consultation within the next few months. Council will need to consider the

position(s) it takes over a range of issues once this is released for comment.

8.0 Programme

Delivery Overview

8.1 Significant

Projects in addition to base approved plan

Clifton

beach / Landslide – Report received but further work to increase

confidence has been commissioned. GNS progressing this work with draft report

due on 3 April, and final report within 2 weeks following receipt of comments

from Department of Conservation and Council.

Cape

view corner, concept design has been completed in regards to providing an

increased level protection from coastal erosion to public assets and public

access. Based on the concept works a budget provision to progress works in

20/21 has been included for consideration in the annual plan. This project will

need agreement from a number of landowners and also will need to work through

consenting processes. Officers are also assisting local property owners (H21)

as they consider their collective options.

Waipatu

community plan initiatives – Concept designs for sections of SH51

(Karamu Road) have been completed, survey and the detail design is underway.

Key risks to delivery relate to existing power poles, potential complications

in finding workable stormwater solutions, and securing funding. Discussions to

date with NZTA are positive both on the proposed concept and in regards to

State Highway funds being available to support the works. Further design work

will confirm costs, and assist funding conversations. Unison are also

progressing with design options in regards to the existing poles. On a related

traffic matter officers are investigating potential initiatives to

reduce/remove the current issues with burnouts and racing in the Waipatu area,

in particular the Otene and Ruahapia roads area.

Attachments:

There are no

attachments for this report.

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Parks and Property Services Manager

Colin

Hosford

SUBJECT: Track

Upgrades of Tainui, Tanner Street, Hikanui and Tauroa Road Reserves –

Request for Additional Funds

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to advise the Committee on the increased costs for

upgrading walking tracks in the Tainui, Tauroa, Tanner and Hikanui reserves and

to request additional funding to complete the adopted

track improvements be considered as part of the 2021/31 Long Term Plan.

1.2 This

decision contributes to the purpose of local government by promoting environmental and social wellbeing and more

specifically through the Council’s strategic objective of providing safe, fit for purpose services both now and into the

future and good quality local infrastructure.

1.3 The reports recommends that the Committee adopts Option 1 and the

allocation of an additional $120,000 be considered alongside other priorities

in the draft 2021/31 Long Term Plan.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Track Upgrades of

Tainui, Tanner Street, Hikanui and Tauroa Road Reserves – Request for

Additional Funds.

B) That the

Committee endorses an increase of $120,000 to undertake the upgrade the

walking tracks in Tainui, Tauroa and Tanner reserves to the NZ Short Walk

standard, and that the additional funding be included in Years 1 and 2 of the

Draft 2021/31 Long Term Plan, for consideration alongside other competing

priorities.

|

3.0 BACKGROUND – TE HOROPAKI

3.1 The

four Havelock North natural reserves, comprised of Tainui, Tauroa, Tanner and

Hikanui reserves are increasingly popular with local residents in offering a

natural park experience especially involving a challenging topography for

walking. They are used by walkers, bikers and joggers as well as an

off-lead area for those exercising their dogs.

3.2 During the reserve management planning process undertaken in 2015,

the community expressed a general desire to improve the walking tracks for year

round use and to improve safety.

3.3 The Reserve Management Plan (RMP) for Tainui, Tanner, Tauroa and

Hikanui Reserves in 2015 had estimated a modest budget of $92,000 for basic

walking track upgrades and for new mountain bike tracks.

3.4 The Council resolved on 28th of June 2018 to upgrade of

all walking tracks to meet the New Zealand Track Standards. The

independent Frame Group consultancy was commissioned to review the

tracks’ condition and estimate the cost to upgrade them. They

estimated that a total of $152,000 was required to upgrade the tracks to the NZ Short Walk standard.

3.5 Council, utilising the existing Long Term Plan (LTP) funding streams

has now completed approximately 650 metres of track upgrades in Tainui and

Tauroa Reserves.

3.6 With the track building expertise now within Recreational Services

Limited, Council’s parks maintenance providers, the actual cost to

upgrade the paths to the adopted standard are known.

3.7 This report seeks the Committee to consider making provision for the

additional $120,000 needed to complete the planned walking track upgrades in

the 2021/31 LTP, and also consider the time frame to undertake the work.

4.0 DISCUSSION

- TE MATAPAKITANGA

4.1 The

initial estimate for track upgrades considered in the RMP back in 2017 was a

modest $94,000 and this included $42,000 for mountain bike tracks. With

the subsequent calls from the community for higher levels of service, Council

made additional allocations in the 2018-2028 LTP up to a total of $120,000.

4.2 The

Frame Group (2018) estimates for the more recently adopted and higher specified

tracks for Tainui Reserve were estimated at an

average of $50.00/lineal metre. The most recent costs charged by

Recreational Services are $70.00/metre. The lineal metre rate for tracks

is at an average width of 1.5 metres.

4.3 Thus

at the current up to date cost, the funds required to complete the upgrade of

walking tracks in all four reserves, is $220,000. This

leaves a funding shortfall of $120,000 to complete the track work.

4.4 Councillors

also now needs to consider the timeframe for making the additional funding

available. This decision necessitates the allocation of the additional

$120,000 and to decide either to extend the time taken to complete the track

upgrades, or if Council is of the mind, undertake the task more quickly and

accelerate the project to achieve an earlier completion.

4.5 Officers

note that this report does specifically include any additional costs to build

mountain bike tracks. Due to the sensitive nature of mountain bike

activities it would seem prudent to defer any decision making until the

independent RMP review for Tainui is complete next year. In addition some

alternative locations may become available and further discussions with the

Bennelong Mountain Bike Club may again reveal alternative funding

streams. If Council of the mind it could also signal making a sum of

$25,000 available in the LTP as a placeholder to undertake work following the

completion of the Tainui Reserve RMP review.

4.6 As

mentioned earlier, Council has resolved to undertake a review of the Tainui

Reserve Section of the Havelock North Reserves RMP. As this planning work

will commence in the 20/21 financial year, it would seem prudent to not

undertake any track improvements in Tainui Reserve until the reviewed plan is

adopted by Council. On this basis it is noted that while the funding

stream for 20/21 is modest, it could still be used for track work in the other

three reserves.

4.8 There

are numerous possible timelines options that can be considered that either

accelerate or extend the timeline for undertaking the track work. The

following table suggests three scenarios for that would achieve track upgrades

with in the Council adopted timeframe of June 2018.

|

Options

|

20/21

|

21/22

|

22/23

|

23/24

|

24/25

|

25/26

|

26/27

|

|

Existing

LTP track allocations

|

$20,000

|

$20,000

|

$20,000

|

$20,000

|

$20,000

|

|

|

|

3

year project

|

$20,000

|

$100,000

(+$80,000)

|

$100,000

(+80000)

|

(-$20,000)

|

(-$20,000)

|

|

|

|

5

year project

|

$20,000

|

$67000

(+$47,000)

|

$67,000

(+47000)

|

$67,000

(+$47,000)

|

(-20000)

|

|

|

|

7

year project

|

$20,000

|

$35,000

(+15000)

|

$35,000

(+$15000)

|

$35,000

(+$15,000)

|

35000

(+15000)

|

(+35000)

|

(+25000)

|

Note;

$50,000 is in the draft 2021/22 Annual Plan for consultancy to carry out the

independent RMP review.

5.0 OPTIONS - NGĀ

KŌWHIRINGA

Option One -

Recommended Option – Upgrade the walking tracks over three years - Te

Kōwhiringa Tuatahi – Te Kōwhiringa Tūtohunga

5.1 Option

1, being the option recommended by officers, is to adopt a three year programme

for upgrading all the walking tracks in the four Havelock North natural

reserves.

5.2 The

funding stream recommended is to retain the existing $20,000 LTP budget in

2020/21. This is due to Council’s adopted position to undertake the

review of the Tainui Reserve’s section of the RMP and that it would seem

prudent to defer any work until full consultation is complete and the wider

community’s aspirations are known and adopted.

5.3 This

option is however the quickest option to complete the work with years 2 and 3

being targeted to complete all of the tasks.

Advantages

· no additional funding needed for tracks in the 2020/21 Annual Plan

· by advancing work after the completion of the Tainui RMP review,

full consultation will likely help Council obtain stronger community buy in and

support

· Within three years all track work will be completed and Council can

turn its attention to other reserves and their pressing needs

· Track safety issues will be advanced more quickly leading to

improved community wellbeing

Disadvantages

· As additional budget allocations are required, Council will need to

balance advancing this track work ahead of other pressing LTP priorities.

Option Two

– Status Quo - Te Kōwhiringa Tuarua – Te Āhuatanga o

nāianei

5.4 Council

has already adopted a position to upgrade the tracks to NZ Short Walk

standards. The status quo does not have sufficient funds available to honour

Council’s commitment.

Advantages

· By adopting the status quo, no additional funding would be needed

for track upgrades

Disadvantages

· Council would be seen as reversing its earlier decision on

committing to track upgrades and could risk losing the trust of the community.

· Only half of the planned track upgrades could be achieved due to

lack of funding.

· Ongoing concerns over the safety of portions of the track networks

could lead to closures of walks, especially in winter.

· Much of the good faith and community buy in achieved in recent years

would be at risk.

Option Three -

Upgrade the walking tracks over five years - Te Kōwhiringa Tuatahi

– Te Kōwhiringa Tūtohunga

5.5 Option

3 offers a slightly more modest funding requirement than option 1, as it would

fund the upgrades over five years rather than three.

5.6 Again,

this funding stream recommends to retain the modest $20,000 budget for 2020/21,

to await any changes brought about by the review of the Tainui Reserve’s

RMP.

Advantages

· no additional funding needed for tracks in 20/21 Annual Plan

· The track work will be advanced quicker than the current LTP funding

streams allow.

· With the completion of the Tainui RMP review, full consultation will

likely help Council obtain stronger community buy in and support for track

upgrades

· Within five years all track work will be completed and Council can

turn its attention to other reserves and their pressing needs

· Track safety issues will be advanced at a moderate pace leading to

improved community wellbeing

· The funding streams required are more affordable as they can be

smoothed out over a longer timeframe.

· The work would still be carried out within the original adopted

seven year timeframe.

Disadvantages

· As additional budget allocations are required, Council will need to

balance advancing this track work ahead of other pressing priorities.

Option Four -

Upgrade the walking tracks over seven years - Te Kōwhiringa Tuatahi

– Te Kōwhiringa Tūtohunga

5.7 Option

4 offers an even more modest funding requirement than all of the other options

as it proposes carrying out the upgrades over a longer timeframe of seven

years.

5.8 As

with all the other options, this funding stream recommends to retain the

modest $20,000 budget for 2020/21 to await any changes brought about by the

review of the Tainui Reserve’s RMP.

Advantages

· no additional funding needed for tracks in 20/21 Annual Plan

· The track work will be advanced to honour Council’s commitment

to undertaking work with seven years

· This timeline allocates a modest increase in funds in the LTP in

order to upgrade all the tracks. The funding streams required are more

affordable as they can be smoothed out over a longer timeframe.

· This option has the least impact on rates due to its extended

timeline to completion.

· With the completion of the Tainui RMP review, full consultation will

likely help Council obtain stronger community buy in and support for track

upgrades

· Track safety issues will be advanced but at a slower pace

· The work would still be carried out within the original adopted

seven year timeframe.

Disadvantages

· Council runs the risk of losing much of the current community buy in

on reserve improvements if it lest lets the work drag on over seven

years. The positive feedback garnered over the recent track

upgrades may well falter if we take an extended time to complete the works.

· There will be greater concerns over the safety of portions of the

track networks could lead to closures of walks, especially in winter.

6.0 NEXT STEPS - TE ANGA WHAKAMUA

6.1 By

allocating the required additional $120,000, Council can fulfil its commitment

to the community of upgrading all the walking tracks in Tainui, Hikanui, Tauroa

and Tanner Street Reserves to the NZ Short Walk standard.

6.2 While

there is a desire to complete the track upgrades, Council’s other

commitment to carry out a review of the Tainui Reserve section of the adopted

Reserve Management Plan will negate the need for additional funds in 2020/21.

6.3 All

the funding options align to this position as it would seem prudent to await

the outcome of the review prior to committing to track work that might change

due to community feedback.

6.4 If

the review endorses the existing or some realigned track layout, Council will

be able to include the required funding streams in the Draft 2021/31 LTP so

they can be considered alongside the community’s other priorities.

6.5 Officers

recommend that the Committee endorse the allocation of an additional $120,000

funding to enable the track work to be completed to meet NZ Walking Track

Standard, and that the timeframe for undertaking the work be considered

in Years 1 and 2 of the Draft 2021/31.

6.6 Officers

also note that an extended timeframe is also considered acceptable, but it will

lead to a protracted work programme in these sensitive areas. By

finishing the work quickly Council can turn its collective attention to other

priority areas.

Attachments:

There are no

attachments for this report.

|

SUMMARY OF CONSIDERATIONS - HE

WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose of Local

Government - E noho hāngai pū ai ki te

Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future.

This report contributes to the purpose of local government

by primarily promoting social wellbeing

|

|

Link to the Council’s

Community Outcomes - E noho hāngai pū ai ki te rautaki matua

This proposal promotes the provision of safe, healthy and liveable communities through

Council’s network of open spaces which provide accessible places and

spaces where recreation participation is fostered and also promotes

the physical well-being of communities in the present and

for the future.

|

|

Māori Impact Statement - Te

Tauākī Kaupapa Māori

The upgraded

tracks will provide recreation opportunities for Tangata Whenua to enjoy

better physical exercise and better access to increasingly restored native

bush areas and waterways in public reserves.

|

|

Sustainability - Te

Toitūtanga

The upgrade of

the four natural reserves in Havelock North combines track improvements

alongside ecological enhancements. The track improvement work will

ensure to local environment is protected from erosion and user damage, while

offering an enhanced local environment.

|

|

Financial considerations - Ngā

Whaiwhakaaro Ahumoni

The proposed Walking Track

Programme in Havelock Hill’s reserves will require an additional

$120,000. This requested additional allocation will need to be

included in the 2021/31 LTP for consideration alongside Council’s other

competing priorities.

Funds for RMP elements are

typically loan funded which has a lower rate impact. Conversely by

borrowing funds, Council’s needs to be cognisant of the long term

effect on ongoing borrowing in terms of Council’s debt profile.

|

|

Significance and Engagement - Te

Hiranga me te Tūhonotanga

This decision/report has been

assessed under the Council's Significance and Engagement Policy as being of

low significance.

The extent

of work recommended and funded requested does not trigger any of

Council’s financial significance thresholds. Land engagement

policy.

|

|

Consultation – internal

and/or external - Whakawhiti Whakaaro-ā-roto, ā-waho

Community interest in these track

networks has been strong and Council’s decision to upgrade tracks to

the national standard reflects how it has taken the pleas of local

petitioners very seriously. Community consultation and engagement has

been central to the desire to upgrade the tracks. This has occurred

through a number of forums, including the 2015 reserve management plan,

Council workshops, two public meetings on site with interested parties

including the Tainui Care Group and petitioners.

|

|

Risks: Legal/ Health and

Safety - Ngā Tūraru: Ngā Ture / Hauora me te Haumaru

There have been

safety concerns over the track network and hence the desire to improve them

to a national standard. There is a strong desire to bring the

unfinished tracks up to the safer standard to improve the health and safety

of park users.

|

|

Rural Community Board - Ngā

Poari-ā-hapori

This matter has

no specific implications for the rural community board.

|

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Group Manager: Planning &

Regulatory

John

O'Shaughnessy

SUBJECT: Building

Consent Authority Accreditation Update

1.0 PURPOSE AND

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The purpose

of this report is to update the Council on the results of the biennial

accreditation assessment of Council’s Building Consent Authority (BCA)

completed in November 2019.

1.2 The

assessment was carried out by International Accreditation New Zealand (IANZ).

Accreditation is required to maintain Council’s status as a registered

Building Consent Authority and to enable the Council to continue issuing and

certifying building consents.

1.3 The Council is required to give effect to the purpose of local

government as prescribed by Section 10 of the Local Government Act 2002. That

purpose is to meet the current and future needs of communities for good quality

local infrastructure, local public services, and performance of regulatory

functions in a way that is most cost–effective for households and

businesses. Good quality means infrastructure, services and performance that

are efficient and effective and appropriate to present and anticipated future

circumstances.

1.4 This report

addresses Council’s obligation to provide good quality regulatory

activities.

1.5 This report

concludes by recommending that the report be received.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Council/Committee receives the report titled Building Consent Authority Accreditation

Update

|

3.0 BACKGROUND TE

HOROPAKI

3.1 Hastings

District Council is deemed a Building Consent Authority (BCA) pursuant to the

Building Act 2004, and is registered as a BCA with the Ministry of Business,

Innovation and Employment.

3.2 The Council

is required to comply with the relevant statutory controls affecting

BCA’s. In particular, Council is required to achieve and maintain

Accreditation as a BCA, and comply with the Building (Accreditation of Building

Consent Authorities) Regulations 2006 in order to issue and certify building

consents.

3.3 BCA’s

are assessed by International Accreditation New Zealand (IANZ) every two years,

and sometimes more frequently as each situation demands, to ensure all relevant

statutory, systems and performance requirements are being complied with.

3.4 Hastings

District Council has been registered as a BCA since 2006 and six assessments

have been carried out since then.

3.5 The Council’s BCA has maintained its accreditation as a

Building Consent Authority during this time. The Council’s BCA has never

had its accreditation suspended or removed.

4.0 DISCUSSION

– TE MATAPAKITANGA

4.1 An

accreditation assessment was completed in November 2019. An intensive

assessment of the BCA’s systems, policies and procedures took place over four

days. At the end of the assessment the BCA was left with 14 general

non-compliance items to resolve.

4.2 The next

accreditation assessment is scheduled for November 2021.

IANZ Review

4.3 Listed

below is a brief summary of the results of the biennial accreditation

assessment completed in November 2019. The assessment was carried out by

International Accreditation New Zealand (IANZ). Accreditation is required

to maintain Council’s status as a registered Building Consent Authority

and to enable the Council to continue issuing building consents and code

compliance certificates (CCC’s). The total number of general

non-compliances issued was 21. During the assessment 7 of these were

cleared. At the end of the assessment the BCA was left with 14 non-compliances

to clear.

4.4 5.3 The

clearance plan has been provided to IANZ and MBIE and accepted 5/12/2019.

Progress on Clearance

Plan

4.5 One general

non-compliance (GNC) has been cleared since the plan was accepted. A

further 11 GNC’s are anticipated to be cleared on time (27/3/2020), the

remaining two GNC’s may require an extension of time.

4.6 Two

GNC’s in relation to compliance schedules documentation may require

further time to resolve because of additional requirements being raised by IANZ

advisors as at 14 February 2020.

4.7 This may

require a formal extension request from Council’s Chief Executive.

In parallel with these processes the Chief Executive intends to lobby the

appropriate people in central government on these GNC’s.

Attachments:

|

1⇨

|

IANZ Report 2019

|

REG-2-14-20-511

|

Under Separate Cover

|

REPORT TO: Operations

and Monitoring Committee

MEETING DATE: Thursday 27

February 2020

FROM: Waste Planning Manager

Angela

Atkins

SUBJECT: Waste

Levy Consultation Submission

1.0 PURPOSE AND

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The purpose

of the report is to obtain endorsement from the Committee for the submission to

the Ministry for the Environment by officers regarding the “Reducing

Waste: a more effective landfill levy”.

1.2 This

proposal contributes to the purpose of local government by primarily promoting

the environmental wellbeing and more specifically through the Council’s

strategic objective of a community which wastes less

1.3 The consultation period closed on Monday 3 February and did not allow for

prior endorsement by council before the deadline.

1.4 The submission was draft and submitted by officers, in consultation

with elected members who had been involved with waste management, and

based on feedback from the Joint Waste Management and Minimisation Plan

consultation and national discussion with other Councils and members of the

waste industry.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Waste Levy Consultation Submission

B) That the

Committee endorse the Reducing waste: a more effective landfill levy

submissions officers made on behalf of Council.

|

Attachments:

|

1⇩

|

Hastings District Council Submission on waste

disposal levy expansion

|

SW-25-20-4586

|

|

|

2⇩

|

WasteMINZ TAO Forum Reducing waste - a more effective

landfill levy submission

|

SW-25-20-4589

|

|

|

Hastings District Council Submission

on waste disposal levy expansion

|

Attachment 1

|

If calling ask for Angela Atkins

File Ref: SW-25-20-4586

27 February 2020

Waste disposal

levy expansion consultation

Ministry for the

Environment

PO Box 10362,

Wellington 6143 LandfillLevyConsultation@mfe.govt.nz

Hastings

District Council Submission on Waste Disposal Levy Expansion - Reducing waste:

a more effective landfill levy

Updated following the

Hastings District Council Operations and Monitoring Committee on 27 February

2020

Company name: Hastings

District Council

Contact person: Angela

Atkins, Waste Planning Manager

Address: Private

Bay 9001, Hastings 4156

Region: Hawke's

Bay/Te Matau-a-Māui

Country: New

Zealand

Phone: 06

871 5000

Email: angelama@hdc.govt.nz

Submitter type: Local

Government

Overall position:

Supportive, and support the

submissions presented by Local Government NZ and Waste MINZ Territorial

Authority (TA) Officers Forum.

Introductory

Comments:

This submission has been prepared by Council Officers and

Councillors who are involved in the Joint Waste Futures Project Steering

Committee based on their knowledge and experience, and also incorporates the

views of the community from the 2018 Waste Management and Minimisation Plan

consultation. This submission is yet to be endorsed by Council as

meeting schedules did not fit within the consultation period. Once

Council has viewed the submission, further communication will be sent to the

Ministry for the Environment.

It should be noted that the Local Government Waste

Management Manifesto was compiled prior to the China National Sword Policy

introduction and Emission Trading Scheme increases which have impacted the

industry in recent times.

Key Points

The reviews currently being undertaken

on waste disposal levy and Emission Trading Scheme can’t be treated in

isolation as both will have impacts on landfill disposal fees and whilst in the

long term both are trying to drive changes in behaviour for slightly different

outcomes, they will have a financial impact on the low income sector of our

community who can probably least afford additional costs.

Our preference is to expand the levy to different types

of landfills and then increase the levy for municipal landfills to mitigate

avoidance activities and allow time for the increase in costs to be

incorporated into Council budgets. More consideration would need to be given to

farm dumps and whether increasing the levy rates drive more waste to farm dumps

if they are exempt?

Although not directly related to the landfill levy, we

believe historic landfills should be considered for levy funding. A nationwide

historic landfill risk assessment will require a significant amount of

investment in order to identify and mitigate the level of risk each authority

holds – irrespective of whether the historic landfill sites are being

monitored or not.

Question 1: Do you think the current

situation of increasing waste to landfill and poor availability of waste data

needs to change?

Yes, as documented in the Local Government Waste

Management Manifesto (January 2018) and supported by Hastings District Council.

Since 2016, Omarunui Landfill (the only landfill for

Hastings and Napier) has experienced increasing tonnages, a 25% increase in 4

years, when the previous 10 years were decreasing and/or static.

Within the manifesto, the second priority identified was

“better waste data”. The current limitations that are holding

New Zealand back, impacting on the development of innovative opportunities to

decrease waste and improve resource recovery.

Question 2: Do you have any comments

on the preliminary review of the effectiveness of the waste disposal levy

outlined in appendix A? If so, please specify

No

Question 3: Do you think the

landfill levy needs to be progressively increased to higher rates in the future

(beyond 2023)?

In principle we are supportive of the landfill levy being

increased to higher rates in the future, however we recommend that more

in-depth research be undertaken into the effectiveness and opportunities for

the funds raised to be used for in the waste minimisation and resource recovery

sector.

Question 4: Do you support expanding

the landfill levy to the following landfills?

Officers are supportive of the levy expanding to all

types of landfills to mitigate avoidance activities and encourage greater

resource recovery.

i. waste disposed of at industrial monofills (class 1) -

Yes

ii. non-hazardous construction and demolition waste (e.g.

rubble/concrete/plasterboard/timber) (class 2) -

Yes

iii. contaminated soils and inert materials (class 3 and

4) (whether requiring restrictions on future use of site or not) -

Yes

Question 5: Do you think that some

activities, sites, or types of waste should be excluded from the landfill levy?

Hastings District Council supports the comments presented

in the Waste MINZ TA Officers Forum submission regarding this question.

i. cleanfills (class 5) – no further

comment

ii. farm dumps

With regards to “farm dumps” this is a

difficult situation as there should be an incentive to reduce the use of this

form of disposal and if the levy was to increase significantly and farm dumps

weren’t included, they could become the “local” option for a

community without robust management.

iii. any others (e.g. any exceptional circumstances)? If

so please specify

We recommend that an exemption be made for waste removed

from closed landfills (consented, monitored and unknown) that are subject to

remedial work (be that due sea level rise, flooding, erosion or

otherwise), be exempt from the landfill levy at a new disposal site. We also

recommend that the levy be permitted to be used for the physical cost of these

works.

Question 6: Do you have any views on

how sites that are not intended to be subject to a levy should be defined (e.g.

remediation sites, subdivision works)?

We support the views of the Waste MINZ TA Officers Forum

submission for this question.

The categories of landfill in the consultation document

and that are proposed to be included or excluded from the levy are based on the

descriptions in the Technical Guidelines for Disposal to Land. For the waste

levy to be effectively extended it is recommended that these guidelines are

formally adopted by the Ministry for the Environment prior to the expansion of

coverage of the levy.

Question 7: Which of the following

proposed rates for municipal (class 1) landfills do you prefer?

i. $50 per tonne – we support the lower

rate for the benefit of our residents who this year are incurring increased

costs for waste disposal and recycling due to the introduction of new kerbside

services. We are also aware of possible increases in the Emission Trading

Scheme which will also impact on disposal rates for all users as mentioned in

the introduction key points.

ii. $60 per tonne

iii. Other (please specify e.g. higher/lower)

We support the continued increase in landfill levy in

gradual increments over a longer time period that is confirmed and notified

well in advance and evidenced that the levy is effective. We also support

the view of many other Councils for the alignment of the levy reviews with

Council Long Term plans and Waste Management and Minimisation plans.

Question 8: Do you think that the

levy rate should be the same for all waste types?:

From an operational perspective as a landfill operator it

would increase administration processes if the levy rate was different for

different waste types and could create avoidance activities. We support

the levy rate being set for the type of landfill, not waste type/material.

Question 8i: Should the levy be

highest for municipal landfills (class 1)?

In principle, we are also supportive of the proposed levy

rates suggested in the consultation document where municipal landfills have the

highest levy.

Question 8ii: Should the levy be lower

for industrial monofills (class 1) than municipal landfills (class 1)?

Question 8iii: Should the levy be lower

for construction and demolition sites (class 2) than municipal landfills (class

1)?

Question 8iv: Should the levy be

lowest for contaminated soils and other inert materials (class 3 and 4)?

Question 8v: Should a lower levy

apply for specified by-products of recycling operations?

We have no comments on questions 8ii – 8v.

Question 9: Do you support phasing

in of changes to the levy?

Yes, see below

Question 9 (continued): if you

support phasing in of changes to the levy, which option do you prefer?

expand and increase (option B)

expand then increase (option C) –

support this phasing as it mitigates the current avoidance activities and

provides sufficient time to incorporate into Council’s fixed costs which

are set during Annual and Long Term Plan processes. Based on the proposed

timeline for implementation, TA municipal landfills would not be able to

implement an increase in levy fees until 1 July 2021 as gate rates are set via

the Annual Plan and Long Term Plan consultations. This also gives time to educate

and introduce programs to assist people with options and alternatives.

expand then higher increase (option D)

increase then expand (option A)

Question 10: Do you think any changes

are required to the existing ways of measuring waste quantities in the Waste

Minimisation (Calculation and Payment of Waste Disposal Levy) Regulations 2009?

If so, please specify:

As per advice provided by WasteMINZ Disposal to Land

Sector Group, Hastings District Council agree that some more specific

conversion factors need to be developed, as the application of the levy across

classes 1,2,3 and 4 will require more specific identification and

quantification of different waste streams meaning more accurate conversion

factors will be required.

We also support flexibility in application of the levy to

allow for practical assessment of tonnage where weighbridges would be

uneconomic, as the two cleanfills in the region do not currently have

weighbridges installed.

Question 11: Do you think any changes

are required to the definitions in the Waste Minimisation (Calculation and

Payment of Waste Disposal Levy) Regulations 2009?

Yes, these need to be aligned with the definitions in the

Technical Guidelines for Disposal to Land developed by Waste MINZ.

Question 12: What do you think about

the levy investment plan?

We support the views of the Waste MINZ TA Officers Forum

regarding this question, in particular to illegal dumping, discreet vs ongoing

funding for education programmes and the 50% funding split.

Hastings District Council also supports the continued

hypothecation of all levy funds to be spent on waste minimisation activities

and not accessible for other general/non-related activities.

Question 13: If the Waste

Minimisation Act 2008 were to be reviewed in the future, what are the changes

you would like a review to consider?

1) Consideration needs to be given to

legacy landfills. A nationwide historic landfill risk assessment will require a

significant amount of investment in order to identify and mitigate the level of

risk each authority holds – irrespective of whether the historic landfill

sites are being monitored or not.

The

work we have currently undertaken on legacy landfills is currently unbudgeted

and it is not known at this stage how much investment is required to gain site

assurance and possible ongoing monitoring of the sites once they are

identified.

The

categories will also need to be expanded to capture legacy landfills. i.e

we suspect that the legacy landfills (and ones currently being monitored) would

be a combination of classes 1 – 5 therefore would need their own category

and risk profile.

Allocation

of funding and establishing a national best practice standard on how we should

manage these sites going forward, not only from a legal compliance perspective

but also providing assurance to our community.

2) With regards to Illegal dumping, we

recommend that the TAs portion of the levy funds be accessible for costs

associated with illegal dumping clean up, enforcement along with education.

3) Affordability for residents.

Recommend allowance for the TA’s portion of the levy funds be able to be

used to buffer/lessen the effect/impact on householders as the value of the

funds increases. For example: Could it be directly used to subsidise

recycling activities, therefore not increasing the overall financial burden on

residents. Hawke’s Bay is introducing new kerbside collection services in

2020 and this is going to have an increased financial impact on residents and

we are mindful that some members of the community will struggle to afford the

change, which may significantly be impacted by an increase in the waste levy

value.

4) A significant roadblock for the

establishment of community recycling and resource recovery services is the

often the cost of land. We recommend that the act be amended to allow for

the purchase of land to establish or extend services to the community.

5) Regular Solid Waste Analysis

Protocol surveys are an expense that could be funded from levy funds under

compliance and monitoring. This would ensure that all TA’s have

access to undertake the surveys regularly to inform waste assessments and waste

management and minimisation plans.

6) As stated in Question

5 - We recommend that an exemption be made for waste removed from closed

landfills (consented, monitored and unknown) that are subject to remedial work

(be that due sea level rise, flooding, erosion or otherwise), be exempt

from the landfill levy at a new disposal site. We also recommend that the levy

be permitted to be used for the physical cost of these works.

Question 14: Do you agree that waste

data needs to be improved?

Yes, as documented in the Local Government Waste

Management Manifesto (January 2018) and supported by Hastings District Council.

Within the manifesto, the third priority identified was

that waste data needs improvement. We also support the views of the Waste

MINZ TA Officers Forum.

Question 15: If the waste data

proposals outlined are likely to apply to you or your organisation, can you

estimate any costs you would expect to incur to collect, store and report such

information? What challenges might you face in complying with the proposed

reporting requirements for waste data?

The main challenges we would face are:

Timeframes

We

would require a minimum of 12 months to set up reporting requirements at

landfills and transfer stations once the exact details are known. A National