Hastings District

Council

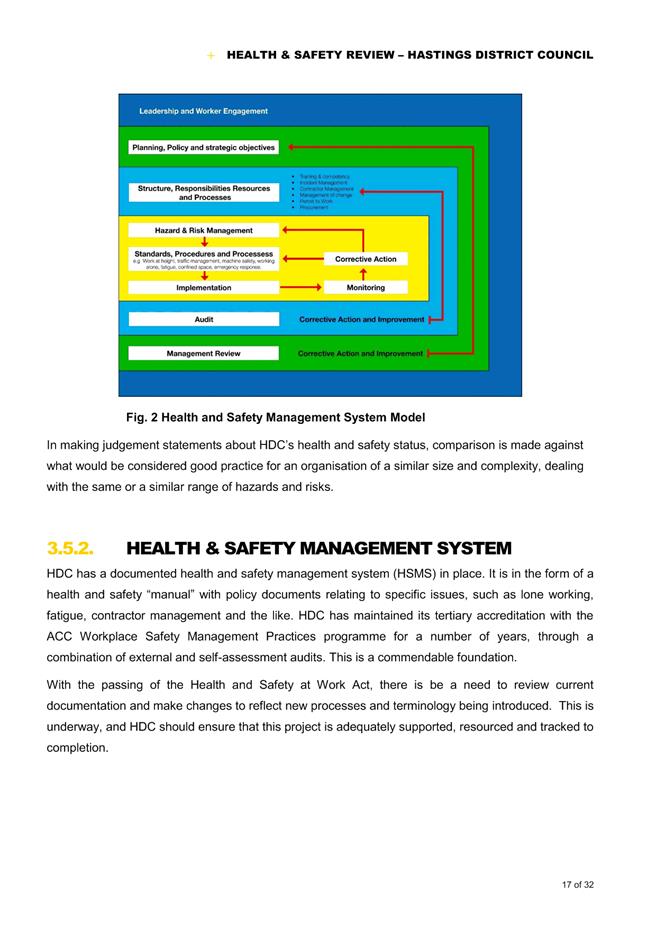

Hastings District

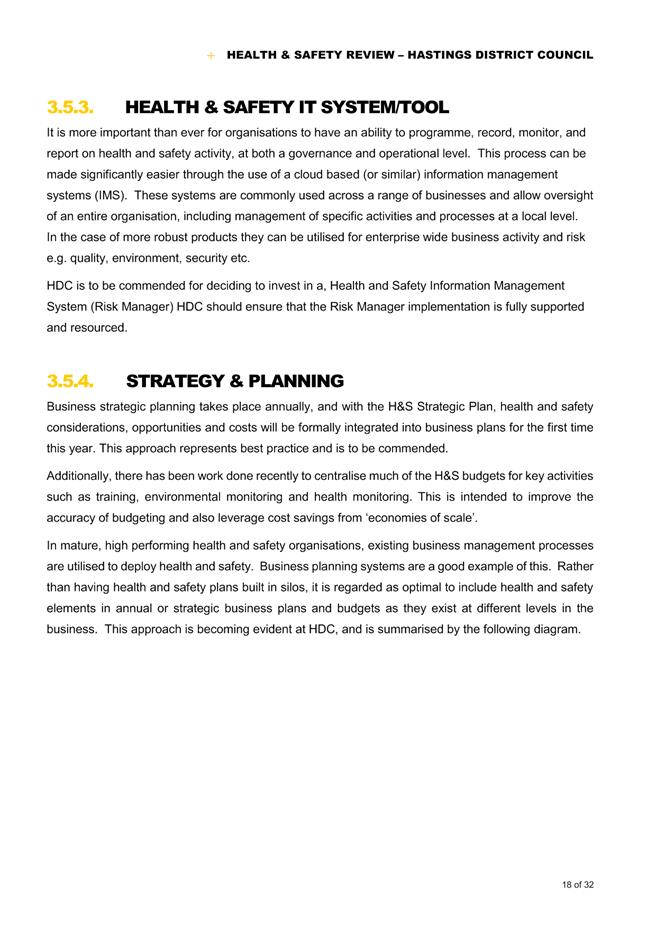

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Audit and Risk Subcommittee MEETING

|

Meeting Date:

|

Monday,

20 February 2017

|

|

Time:

|

10.00am

|

|

Venue:

|

Landmarks

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Subcommittee Members

|

Chair: Mr J

Nichols

Mayor Yule

Councillors

Hazlehurst, Kerr and Travers

(Quorum=3)

|

|

Officer

Responsible

|

Chief Financial Officer, Bruce Allan

|

|

Committee

Secretary

|

Carolyn Hunt (Ext 5634)

|

Audit and Risk Subcommittee – Terms of Reference

A subcommittee of

the Finance and Monitoring Committee

Fields of

Activity

The Audit and Risk Subcommittee is responsible for

assisting Council in its general overview of financial management, risk

management and internal control systems that provide:

·

Effective management of

potential risks, opportunities and adverse effects; and

·

Reasonable assurance as to

the integrity and reliability of the financial reporting of Council; and

·

Monitoring of the Council’s

requirements under the Treasury Policy

Membership

Chairman

appointed by the Council

The Mayor

Deputy Mayor

2

Councillors

An

independent member appointed by the Council.

Quorum – 3 members

DELEGATED

POWERS

Authority to consider and make recommendations on all matters detailed

in the Fields of Activity and such other matters referred to it by the Council

or the Finance and Monitoring Committee

The

subcommittee reports to the Finance and Monitoring Committee.

HASTINGS DISTRICT COUNCIL

Audit and Risk Subcommittee MEETING

Monday, 20 February 2017

|

VENUE:

|

Landmarks

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

10.00am

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the Chief Executive or Executive Advisor/Manager:

Office of the Chief Executive (preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Audit and Risk Subcommittee Meeting held Wednesday 7 December 2016.

(Previously circulated)

4. Health and Safety

Risk Report 5

5. Treasury Activity

and Funding 45

6. General Update

Report and Status of Actions 55

7. Strategic Risk

Management Update 59

8. Additional

Business Items

9. Extraordinary

Business Items

10. Recommendation

to Exclude the Public from Item 11 81

11. Cash Handling Internal Audit

REPORT TO: Audit

and Risk Subcommittee

MEETING DATE: Monday 20

February 2017

FROM: Health and Safety Advisor

Jennie

Kuzman

SUBJECT: Health

and Safety Risk Report

1.0 SUMMARY

1.1 The

purpose of this report is to provide an update to the subcommittee in regards

to the management of health and safety risks within Council.

1.2 This

issue arises due to the introduction of new legislation in relation to health

and safety, and the requirement of that legislation for elected members to

exercise due diligence to ensure that Council complies with its health and

safety duties and obligations.

2.0 BACKGROUND

2.1 At

its June 2016 meeting, Council accepted the recommendations from the Audit and

Risk Subcommittee in relation to health and safety reporting. The

recommendations were:

a) Monthly reporting in the form of a ‘high level dashboard

report’ to Council

b) Quarterly reporting at a more detailed level to Council and

c) Quarterly reporting on health and safety risk management

to the Audit and Risk Subcommittee.

2.2 This

report forms the first quarterly report on health and safety risk management.

3.0 CURRENT

SITUATION

3.1 Review

of Council’s Health and Safety Systems

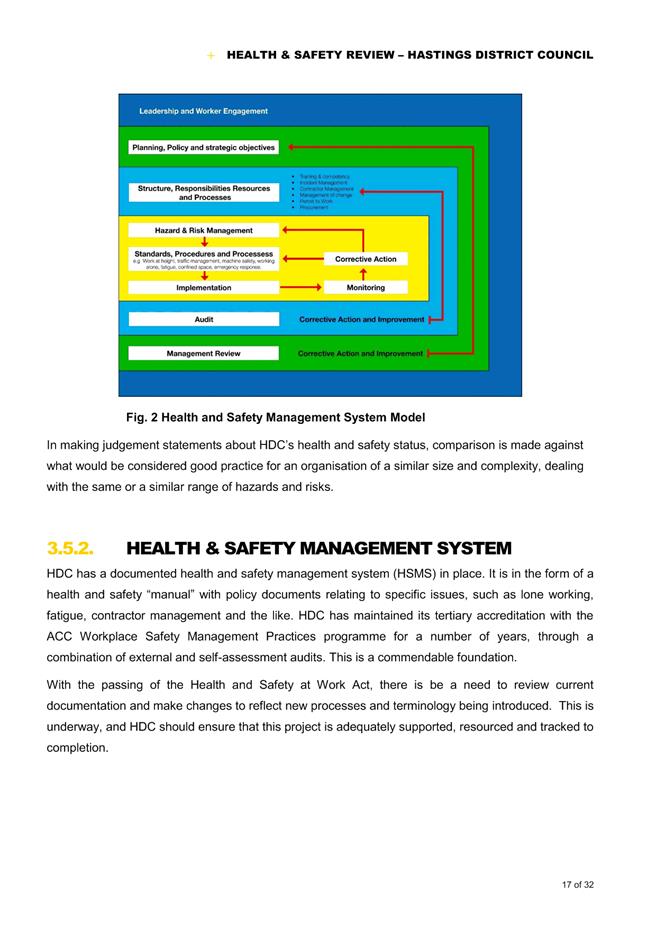

3.2 Council

engaged IMPAC services, a risk and safety management consultancy, to undertake

a strategic review of current health and safety management and performance,

with the aim of providing an independent view on the current state, positives

and areas for improvement along with a set of recommendations. A copy of the

full report is attached (attachment one).

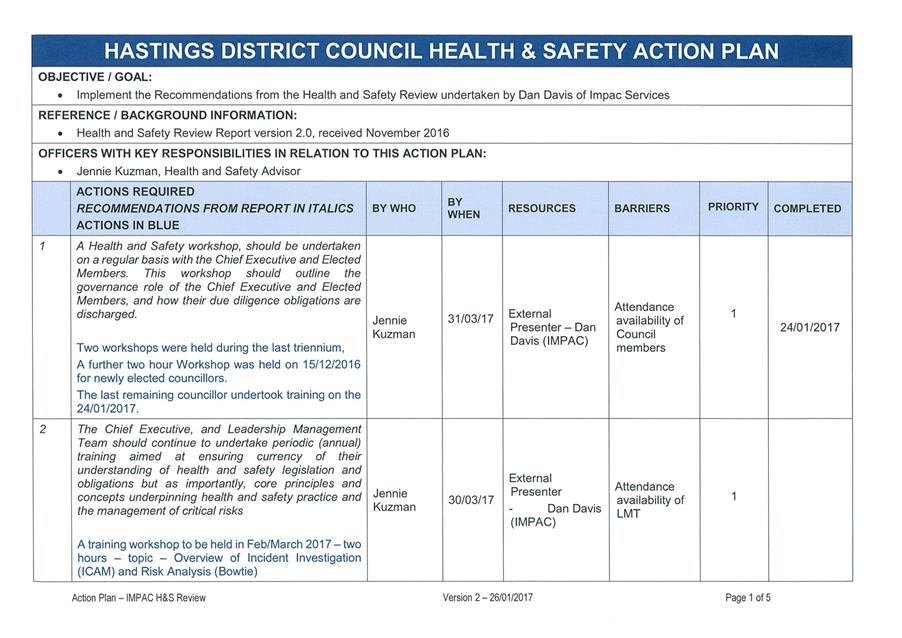

3.3 Following

receipt of the IMPAC report in November 2016, an action plan has been developed

to address the recommendations in the report. A copy of this action plan is

attached (attachment two).

3.4 Dan

Davis, the Health and Safety Specialist from IMPAC services who undertook the

strategic review, will provide a summary of the report findings to the

subcommittee at this meeting.

3.5 Identification

of Critical Health and Safety Risks

3.6 In

order to ensure that officers are focusing attention on critical health and

safety risks, a preliminary list of critical organisational health and safety

risks was identified by the Health and Safety Advisor in mid-2016.

3.7 These

risks were reviewed by Dan Davis during the IMPAC review and confirmed as

appropriate for the organisation.

3.8 The

list of these identified critical risks was reported to the Audit and Risk

Subcommittee in September 2016 and are detailed again in no particular order

below.

3.9 Organisational

Critical Health and Safety Risks:

· Risk of fatality from exposure to plant and machinery

· Risk of fatality from exposure to a moving vehicle

· Risk of fatality when working in confined spaces

· Risk of fatality when working in excavations

· Risk of fatality when working at height, resulting from a fall from

height or a falling object

· Risk of serious health and/or safety effects from manual handling of

loads or repetitive or forceful movements

· Risk of serious health effects from exposure to asbestos

· Risk of fatality from loss of containment and/or exposure to a

hazardous substance

· Risk of fatality or serious health effects from exposure to harmful

levels of noise, vibration, dust, or biological hazards

· Risk of serious health effects from exposure to factors causing

stress

· Risk of serious health and/or safety effects from fatigue and

working while fatigued

· Risk of adverse physical and mental health effects from exposure to

aggression, physical violence and verbal abuse from members of the public and

service users

3.10 These risks are

currently being analysed by officers using “Bow Tie” risk

evaluation methodology (explained below) and the outcome of this process will

provide a comprehensive overview of Council’s management of

organisational health and safety critical risks.

3.11 “Bow Tie”

is a risk evaluation method which allows development of a diagram to

effectively communicate how critical risks should be managed. A Bow Tie diagram

is able to give an overview of multiple plausible scenarios and how they can be

prevented and mitigated in a single diagram.

3.12 The picture on the

following page (Figure 1) provides a simple example of the structure view of a

Bow Tie diagram.

3.13 It is expected that

analysis of the risks identified and listed above in 3.9 will be completed by

May 2017.

Figure 1 -

Structure view of a Bow Tie diagram

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report does not trigger Council’s Significance and Engagement Policy and

no consultation is required.

|

5.0 RECOMMENDATIONS AND

REASONS

A) That

the report of the Health and Safety Advisor titled “Health

and Safety Risk Report” dated 20/02/2017 be

received.

|

Attachments:

|

1

|

Health and Safety Review of Hastings District

Council - 22 July 2016 - IMPAC Services

|

HR-03-01-17-191

|

|

|

2

|

Action Plan - IMPAC Health and Safety Review 2016

(signed)

|

HR-03-01-17-193

|

|

|

Health and Safety Review of Hastings

District Council - 22 July 2016 - IMPAC Services

|

Attachment 1

|

|

Action Plan - IMPAC Health and Safety Review 2016

(signed)

|

Attachment 2

|

1.

REPORT TO: Audit

and Risk Subcommittee

MEETING DATE: Monday 20

February 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Treasury

Activity and Funding

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on treasury activity and

funding issues.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost effective to households and businesses. Good quality

infrastructure means infrastructure, services and performance that are

efficient and effective and appropriate to present and anticipated future

requirements.

1.3 This

report concludes by recommending that the report on treasury activity and

funding is received.

2.0 BACKGROUND

2.1 The

Hastings District Council has a Treasury Policy which forms part of the 2015-25

Long Term Plan and a Treasury Management Policy. Under these policy documents

responsibility for monitoring treasury activity is delegated to the Audit and

Risk Subcommittee.

2.2 Council

is provided with independent treasury advice by Stuart Henderson of

PricewaterhouseCoopers and receives weekly and monthly updates on market

conditions.

2.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in depth treasury reporting is provided for the Audit and Risk

Subcommittee.

3.0 CURRENT SITUATION

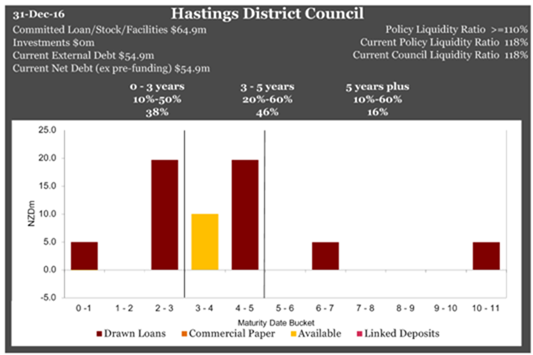

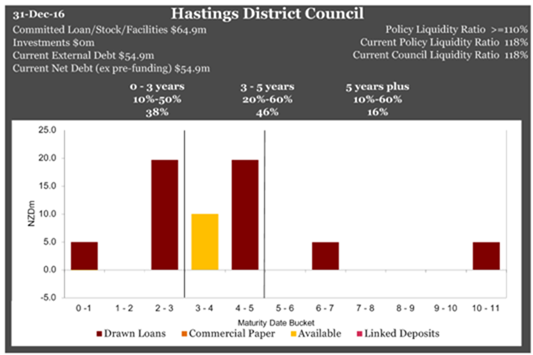

3.1 Council’s

debt portfolio is managed within the macro limits set out in the Treasury

Policy. It is recognised that from time to time Council may fall out of policy

due to timing issues as debt moves closer to maturity and shifts from one time

band to another. The treasury policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

3.2 The

following table sets out Council’s overall compliance with Treasury

Management Policy as at 31 December 2016:

|

Measure

|

Compliance

|

Actual

|

Minimum

|

Maximum

|

|

Liquidity

|

ü

|

118%

|

110%

|

170%

|

|

Fixed debt

|

ü

|

81%

|

55%

|

95%

|

|

Funding profile:

0 – 3 years

3 – 5 years

5 years +

|

ü

ü

ü

|

21%

23%

55%

|

10%

20%

10%

|

50%

60%

60%

|

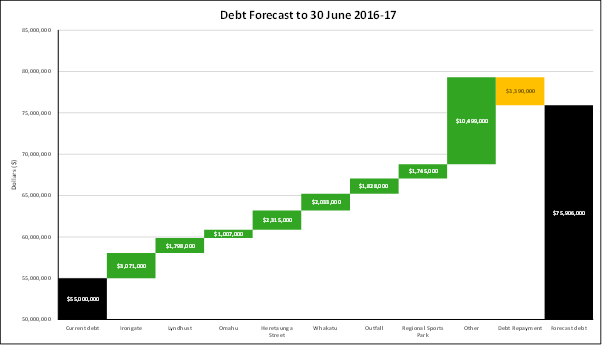

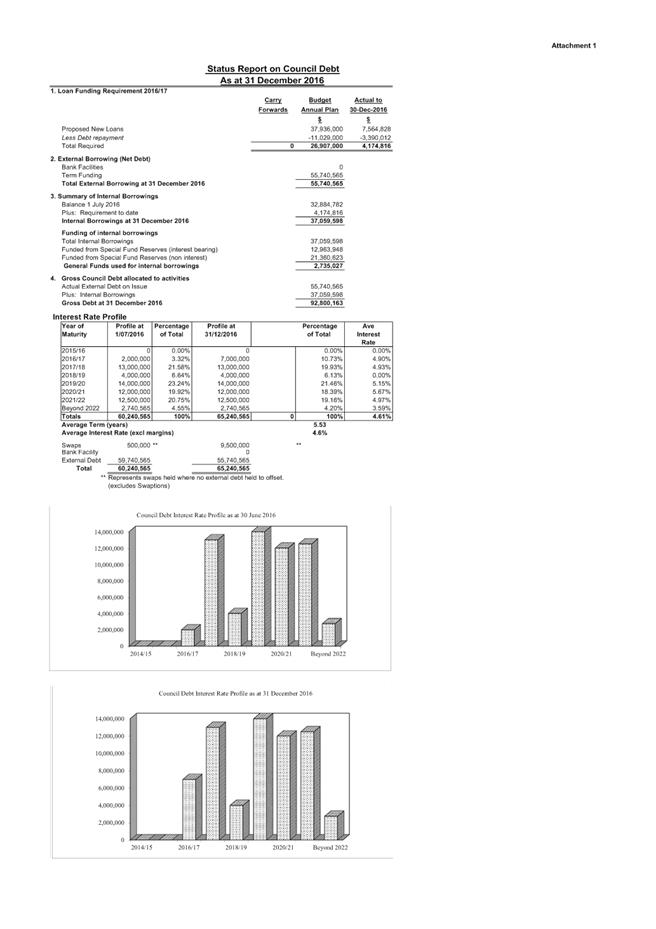

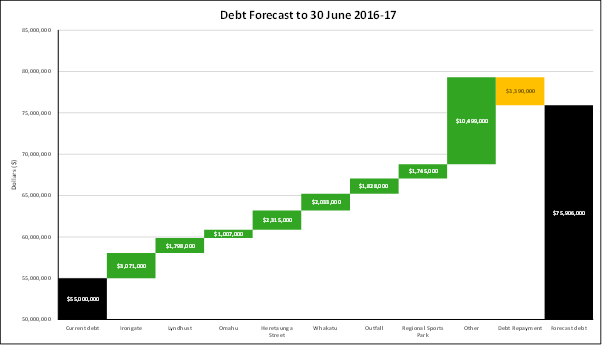

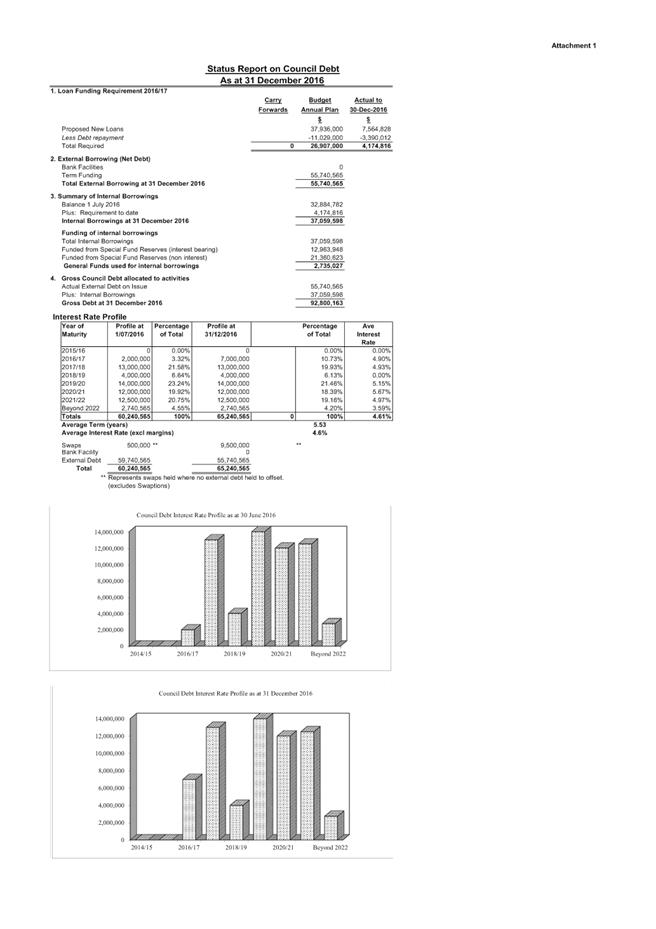

3.3 The

current total core net external debt remain is $55.7m as at 31 December 2016.

This is supported by the Debt Status Report as at 31 December 2016 (Attachment

1). Core external debt increased in December with $5m of short term

borrowing from LGFA for 90 days at 2.21%.

3.4 The

graph below shows the Council’s position for funding risk with $65

million of financing facilities as at 31 December 2016. The Council will need

additional facilities before the 30 June 2017 and is planning to use the next

Local Government Funding Agency (LGFA) bond tender (15 February 2017) to raise

additional debt to meet its current and future requirements. The current

liquidity ratio of 118% is well within the policy band of 110% - 170%.

Council’s current debt profile is within policy, with good treasury

management practices in place.

3.5 On

the advice of Council’s Treasury advisors, Officers have advised the LGFA

that HDC will participate in the February 15th tender with the

following:

$5m through to April 2023 (6 years)

$5m through to April 2025 (8 years)

Officers

are currently working on an interest rate strategy with PWC to take into

consideration the current over hedged position and also the expected growth in

forecasted debt. Details of this strategy will be discussed at the meeting.

3.6 The

chart below shows the key drivers of the expected movement in borrowings

between 31 December 2016 and 30 June 2017. This is based on projects that have

started already, or are highly likely to commence before 30 June 2017.

The chart identifies the major development

projects underway, however the renewal projects have been aggregated into the

“Other” heading. These include Parks and CBD renewals ($1.3m),

Stormwater ($0.8m design work and improvements to Davis and Chambers Streets),

Sewer ($1.6m renewals and Pump Station Flow monitoring work), Roading ($1.4m),

Water ($3.7m Brookvale Filter and UV treatment, Heretaunga Street, Te Mata,

Frimley Bore and Pump Station upgrades), and other sundry projects.

3.7 Any

new debt will be considered along with Council’s working capital

requirements and liquidity ratios.

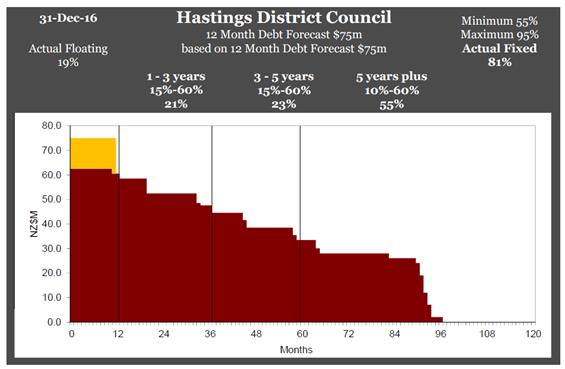

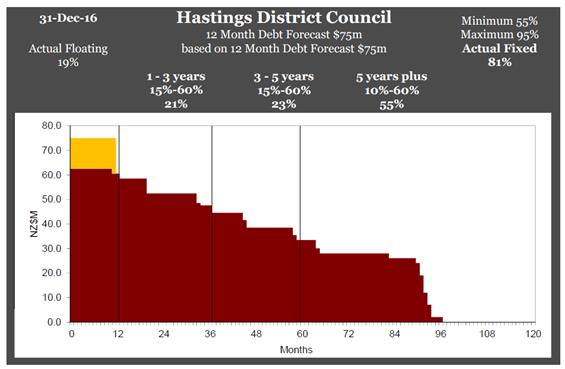

3.8 The

following graph shows the level of interest rate

cover in place based on the projected debt requirement for the next 12 months

is 81% with full policy compliance in the bands. The projected external debt

requirement for the next 12 months is forecast at $75m.

3.9 Officers

are actively managing the interest rate and funding risk and currently there is

adequate interest rate cover in place based on the projected funding

requirements.

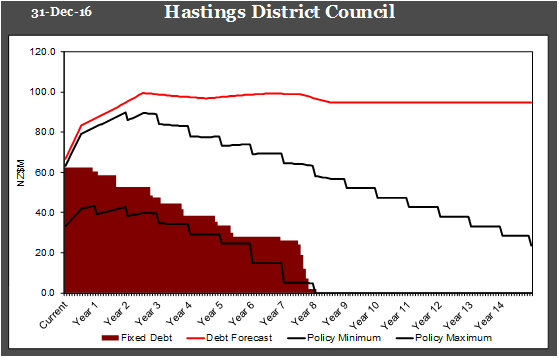

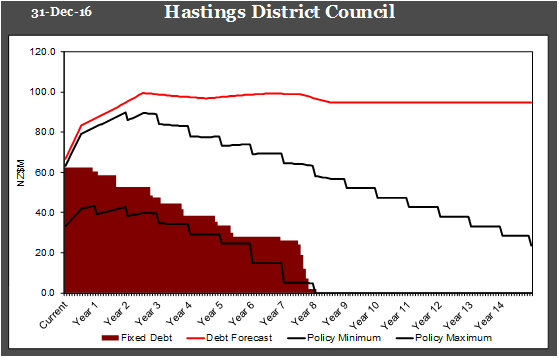

3.10 The following graph

shows Council’s fixed debt (including forward start swaps) is within the

policy minimum and policy maximum set out in Council’s Treasury

Management Policy. This graph also incorporates Council’s forecast debt

over the long term. The projected external debt requirement for the next 12

months is forecast to increase which will provide Council with the opportunity

to take advantage of funding longer term debt at historically low levels of

interest.

Fig:

Interest Swap Profile

3.11 Council’s

weighted average cost of debt is 5.14% as at 31 December 2016 (5.3% as at 30

September 2016). Officers continue to actively manage the swap portfolio.

4.0 MARKET COMMENTARY

4.1 The

Reserve Bank of New Zealand (RBNZ) has held the Official Cash Rate at 1.75% in

February 2017. The RBNZ stated;

“The

recovery in commodity prices and more positive business and consumer sentiment

in advanced economies have improved the global outlook. However, major

challenges remain with on-going surplus capacity in the global economy and

rising geo-political uncertainty.

Global headline inflation has

increased, partly due to rising commodity prices. Global long-term

interest rates have increased. Monetary policy is expected to remain

stimulatory, but less so going forward, particularly in the US.

New Zealand’s financial

conditions have firmed with long-term interest rates rising and continued

upward pressure on the New Zealand dollar exchange rate. The exchange

rate remains higher than is sustainable for balanced growth and, together with

low global inflation, continues to generate negative inflation in the tradables

sector. A decline in the exchange rate is needed.

Economic growth in New Zealand has

increased as expected and is steadily drawing on spare resources. The

outlook remains positive, supported by ongoing accommodative monetary policy,

strong population growth, increased household spending and rising construction

activity. Dairy prices have recovered in recent months but uncertainty remains

around future outcomes.

Recent moderation in house price

inflation is welcome, and in part reflects loan-to-value ratio restrictions and

higher mortgage rates. It is uncertain whether this moderation will be

sustained given the continued imbalance between supply and demand.

Headline inflation has returned to the

target band as past declines in oil prices dropped out of the annual

calculation. Inflation is expected to return to the midpoint of the

target band gradually, reflecting the strength of the domestic economy and

despite persistent negative tradables inflation. Longer-term inflation

expectations remain well-anchored at around 2 percent.

Monetary policy will remain

accommodative for a considerable period. Numerous uncertainties remain,

particularly in respect of the international outlook, and policy may need to

adjust accordingly.”

4.2 Following

the RBNZ OCR announcement the ASB chief economist Nick Tuffley said unless

there was a negative shock to the economy, it was unrealistic to expect

interest rates to stay at stimulatory levels indefinitely.

"We continue to view OCR increases

as a long way off, towards the end of 2018. In contrast, [financial]

market pricing favours [a] late 2017/early 2018 [increase]" Tuffley said.

4.3 PWC

Treasury Advisory Team state that “New Zealand long term swap rates

have also unwound with the 10 year swap rate down six basis points to 3.54%.

Global risk sentiment turned slightly negative over the past week with

heightened investor uncertainty driven by political risks in Europe and the

United States. The Federal Reserve meeting was somewhat of a non-event with

little impact on financial markets, while economic data in the US continues to

print strongly. We maintain a bias higher for the long end of the NZ interest

rate swap curve over the next 12 months, while acknowledging there are numerous

risks to this outlook, particularly around Trump’s policies.”

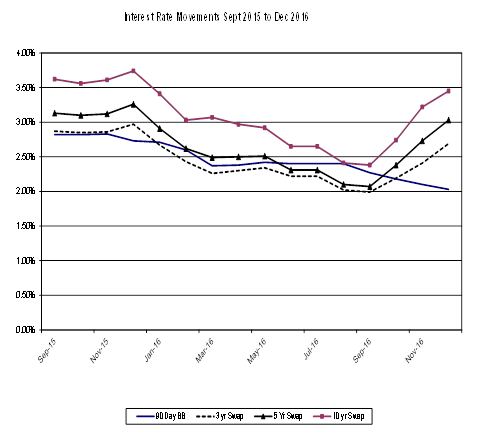

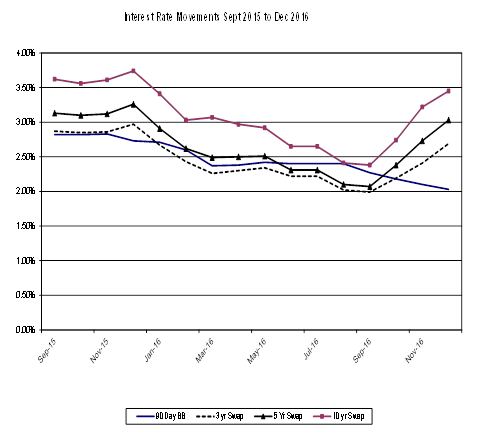

|

|

90 Day BB (%)

|

3 yr Swap (%)

|

5 yr Swap (%)

|

10 yr Swap (%)

|

|

Dec-15

|

2.73

|

2.97

|

3.26

|

3.74

|

|

Jan-16

|

2.71

|

2.67

|

2.91

|

3.41

|

|

Feb-16

|

2.6

|

2.43

|

2.62

|

3.03

|

|

Mar-16

|

2.37

|

2.26

|

2.49

|

3.07

|

|

Apr-16

|

2.38

|

2.3

|

2.5

|

2.97

|

|

May-16

|

2.42

|

2.34

|

2.51

|

2.92

|

|

Jun-16

|

2.4

|

2.22

|

2.31

|

2.65

|

|

Jul-16

|

2.4

|

2.22

|

2.31

|

2.65

|

|

Aug-16

|

2.4

|

2.02

|

2.1

|

2.41

|

|

Sep-16

|

2.27

|

1.99

|

2.07

|

2.38

|

|

Oct-16

|

2.18

|

2.19

|

2.38

|

2.74

|

|

Nov-16

|

2.1

|

2.41

|

2.73

|

3.22

|

|

Dec-16

|

2.03

|

2.69

|

3.03

|

3.45

|

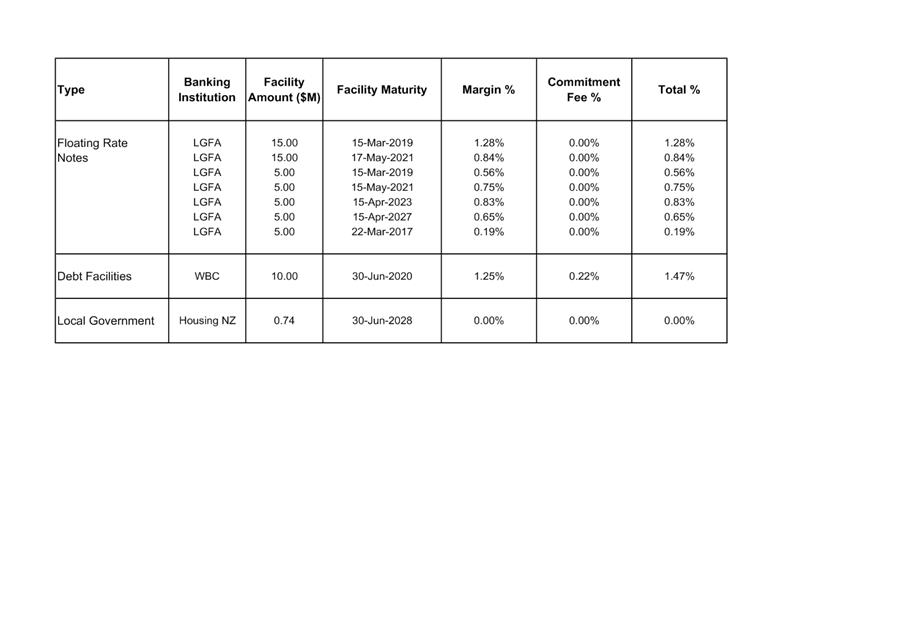

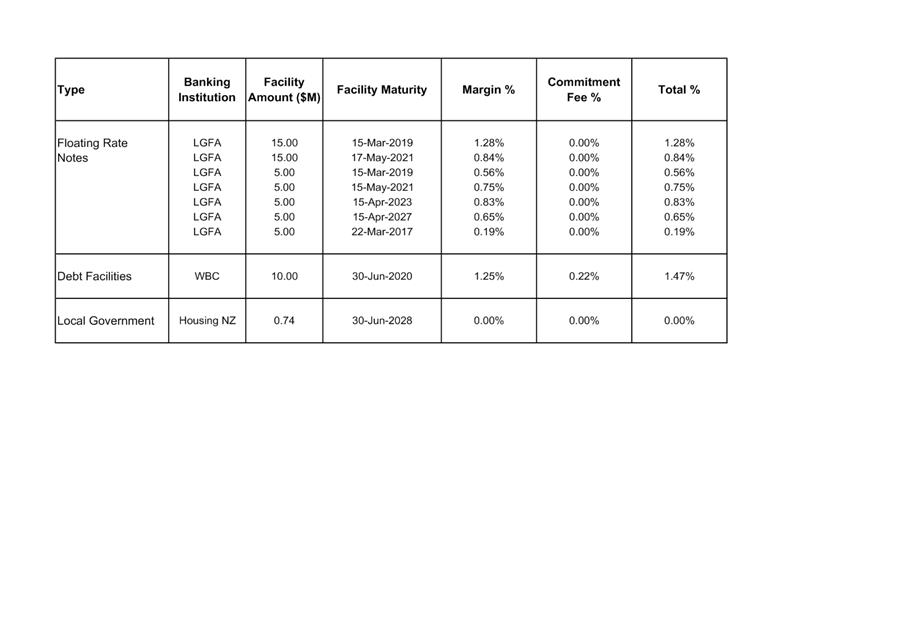

5.0 FUNDING FACILITIES

5.1 Attachment

2 shows details of Council’s current debt facilities together with

details of expiry dates and margins.

5.2 Council’s

liquidity ratio of 118% at 31 December 2016 (based on net external debt of $56m

and total debt facilities of $66m) is within policy (policy 110% - 170%).

Officers are comfortable with this ratio because of continued uncertainty on

debt forecasts and the ability to increase debt from the LGFA at relatively

short notice.

|

6.0 Recommendations

That the

report of the Manager Strategic Finance titled

Treasury Activity and Funding dated 20/02/2017 be received.

|

Attachments:

|

1

|

Debt Status Report as at 31 December 2016

|

CG-14-6-00007

|

|

|

2

|

Current Debt Facilities

|

CG-14-6-00010

|

|

|

Debt Status Report as at 31 December

2016

|

Attachment 1

|

|

Current Debt Facilities

|

Attachment 2

|

REPORT TO: Audit

and Risk Subcommittee

MEETING DATE: Monday 20

February 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: General

Update Report and Status of Actions

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on various matters

including actions raised at previous meetings.

1.2 The Council is required to give effect to the

purpose of local government as prescribed by Section 10 of the Local Government

Act 2002. That purpose is to meet the current and future needs of communities

for good quality local infrastructure, local public services, and performance

of regulatory functions in a way that is most cost–effective for

households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.3 This

report concludes by recommending that the report titled “General Update

Report and Status of Actions” from the Chief Financial Officer be

received.

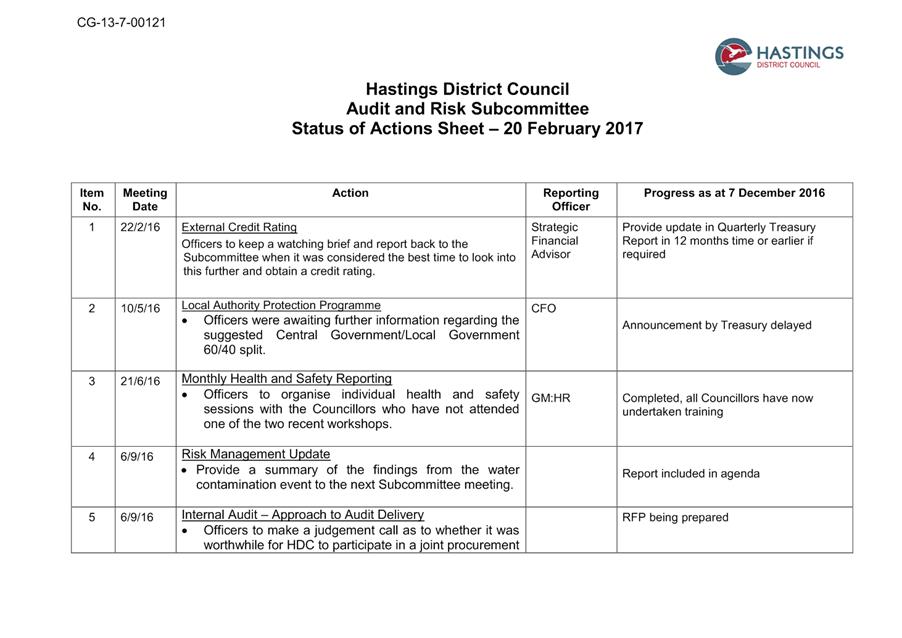

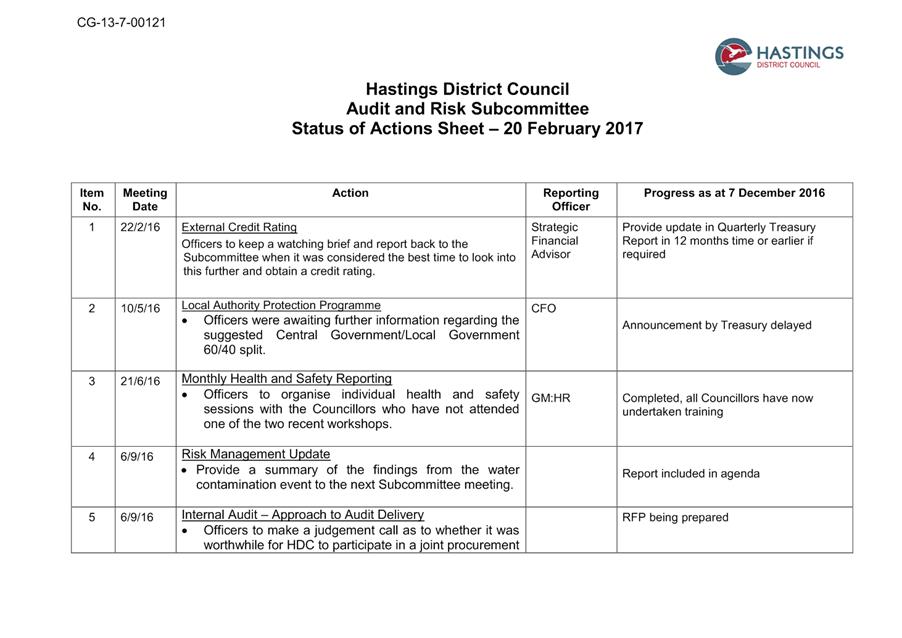

2.0 BACKGROUND

2.1 The

Audit & Risk Subcommittee members requested that officer’s report

back at each meeting with progress that has been made on actions that have

arisen from the Audit & Risk Subcommittee meetings. Attached as Attachment

1 is the Audit & Risk Subcommittee Action Schedule as at 20 February

2017.

3.0 CURRENT

SITUATION

3.1 Central

Government / Local Government 60:40 Split

It is expected that

cabinet will be discussing the discussion paper prepared by Treasury next week

with a potential release of the discussion document early in 2017. The

discussion paper reviews the current funding split between central and local

government in the event of a major catastrophe.

3.2 Review

of Financial Report Templates for Council Reporting

The Management

Accounting Team have been working on developing a new Financial Reporting

Template to be used for Council reports that ultilises dashboards and

KPI’s in addition to the traditional financial tables. This is in an

effort to make the Council’s financials easier to read for

non-accountants. A draft of the proposed quarterly

report to Council will be tabled at the meeting for consideration.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report does not trigger Council’s Significance and Engagement Policy and

no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

That the report of the Manager Strategic Finance titled “General

Update Report and Status of Actions” dated 20/02/2017

be received.

|

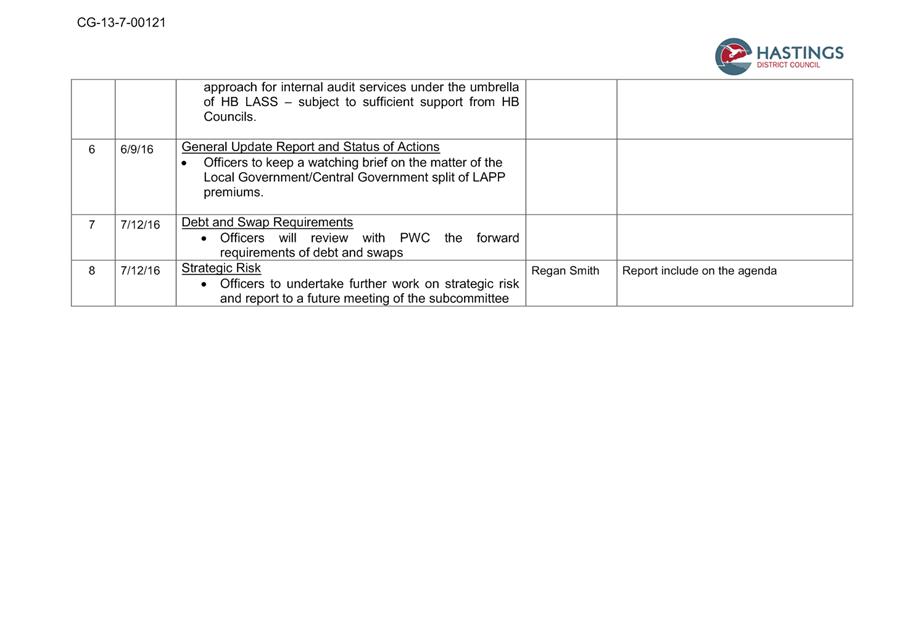

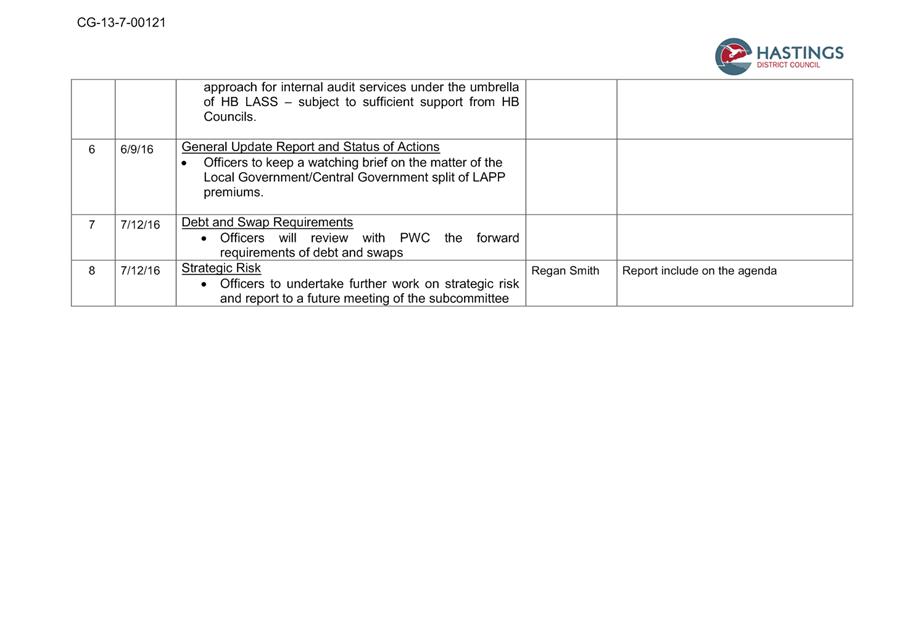

Attachments:

|

1

|

Status of Action Sheet

|

CG-13-7-00121

|

|

|

Status of Action Sheet

|

Attachment 1

|

REPORT TO: Audit

and Risk Subcommittee

MEETING DATE: Monday 20

February 2017

FROM: Business Services Manager

Regan

Smith

SUBJECT: Strategic

Risk Management Update

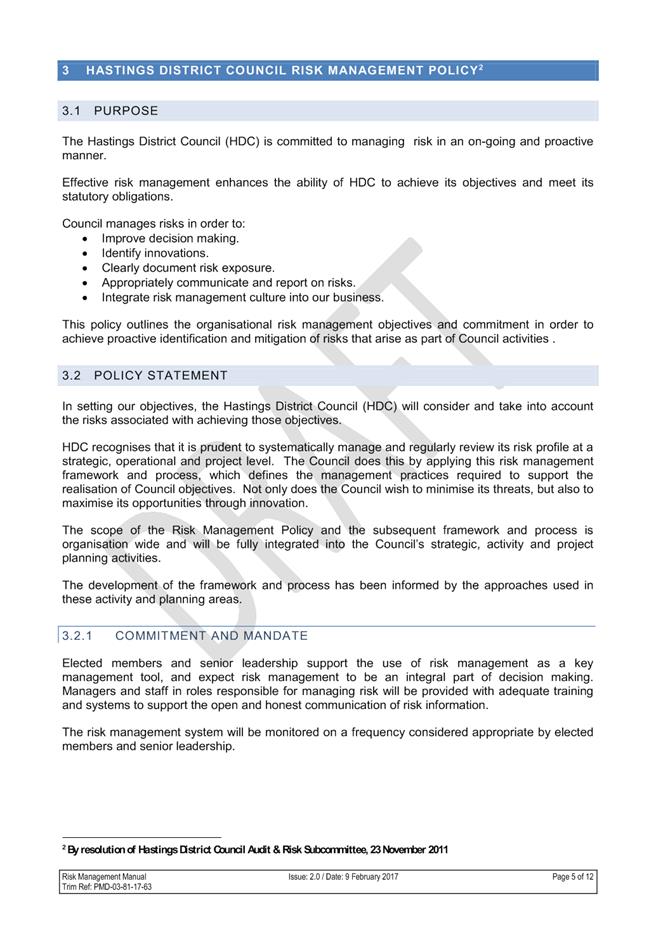

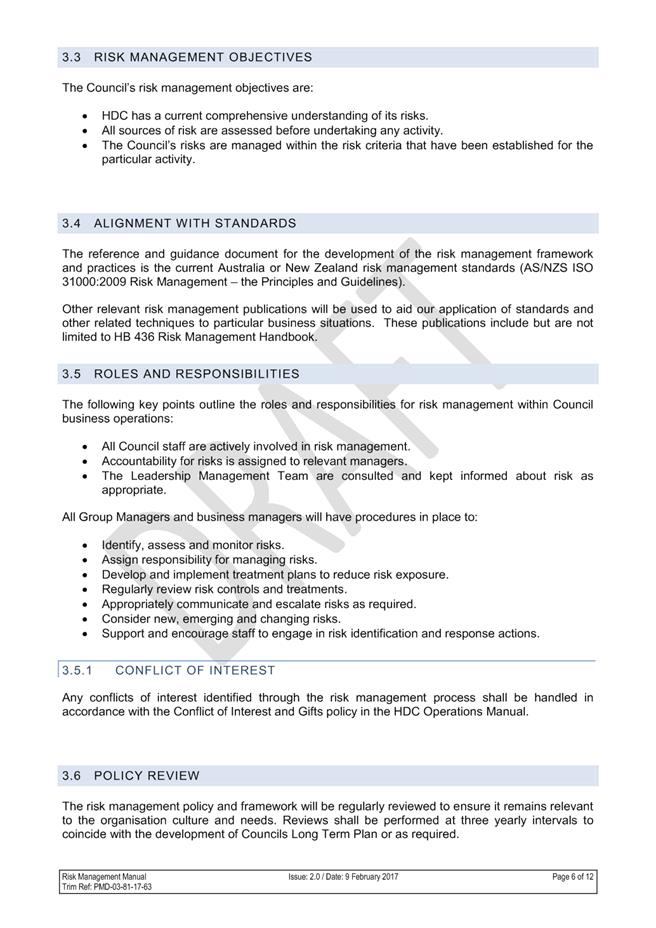

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee about the status of risk

management with Council and adopt the revised risk management policy.

1.2 This

issue arises from a regular review of the Council’s current risk

management policy and framework.

The Council is

required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the

current and future needs of communities for good quality local infrastructure,

local public services, and performance of regulatory functions in a way that is

most cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.3 This

report concludes by recommending that the Council adopt the revised Risk

Management Policy and Framework, and confirm the Council’s strategic risk

register is a fair representation of high level risks Council must manage.

2.0 BACKGROUND

2.1 The

Audit & Risk Subcommittee adopted the current Risk Management Policy and

Framework in November 2011. The policy included the need for regular review of

the policy.

2.2 The

Risk Management Policy and Framework provides guidance for implementation of

risk management at strategic and operationally levels. Risk management is then

put in place by each group through management level risk registers and

incorporation of risk assessments in projects plans and business cases.

3.0 CURRENT

SITUATION

3.1 A

workshop with the Chair of the Audit & Risk Committee, Mr J Nichols and the

Council Leadership Management Team was held to review current risk management

practices.

3.2 This

workshop identified opportunities for improvement to the risk management

approach and identified 16 key strategic risks facing the organisation.

3.3 As a

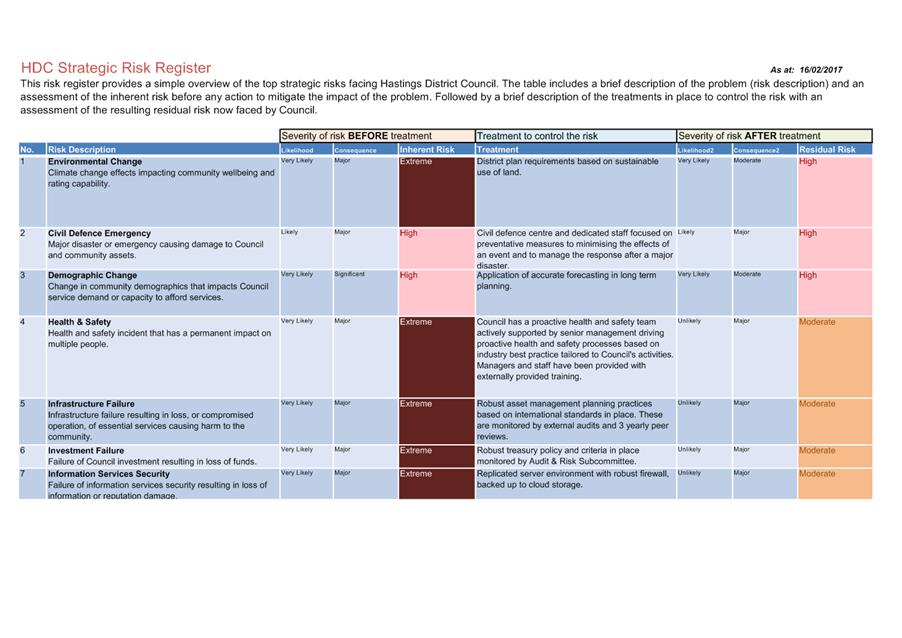

result the following documents are tabled for the Subcommittee’s

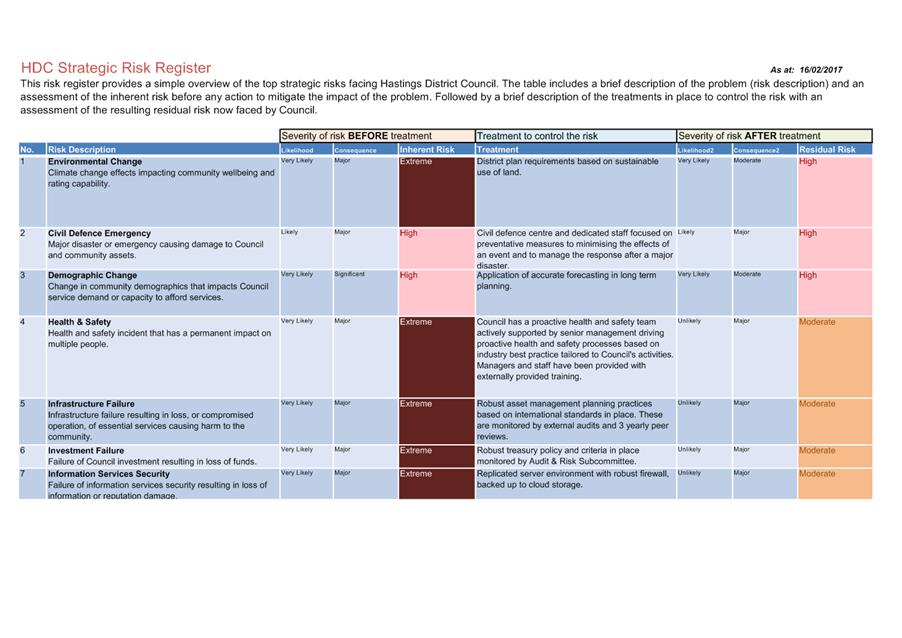

consideration:

· Two case studies illustrating how risk management has been applied by

Council. The purpose of these case studies is to present the terminology used

in the following risk register and risk management policy in real life

examples.

· A strategic risk register outlining the key issues facing the

organisation. These risks are presented as high level descriptions of the

threats that need to be managed, with an outline of the measures Council has in

place to minimise the risk. These items, listed below, are a combination of

issues identified by the executive team and additional detailed added after the

recent workshop.

|

Health

& Safety

Health and safety incident resulting in serious harm.

|

|

Environmental

Change

Climate change effects impacting community wellbeing and rating capability.

|

|

Fraud

Fraud incident resulting in loss of funds, loss

of assets or reputation damage.

|

|

Demographic

Change

Change in community demographics that impacts

Council service demand or capacity to afford services.

|

|

Civil

Defence Emergency

Major disaster or emergency causing damage to

Council and community assets.

|

|

Infrastructure

Failure

Infrastructure failure resulting in loss, or

compromised operation, of essential services causing harm to the community.

|

|

Investment

Failure

Failure of Council investment resulting in loss

of funds.

|

|

Information

Services Security

Failure of information services security resulting in loss of information or

reputation damage.

|

|

Business

Interruption

Business interruption caused by some unexpected event impacting service

delivery.

|

|

Retention

of Key Staff

Loss of key staff impacting service delivery

|

|

Ability

to Meet Regulatory Requirements

Failure to meet legislative/regulatory requirements resulting in suspension

of Council services.

|

|

Facility

Failure

Facility failure resulting in loss of community service.

|

|

Procurement

Poor procurement practices results in poor

expenditure decisions.

|

|

Legislative

Change

Legislation change that places additional demand

on Council resources.

|

|

Staff

Negligence

Staff negligence or poor competence resulting in litigation, reputation

damage or harm.

|

|

Business

as Usual Performance

Failure to deliver services to normal business levels.

|

· An updated version of the Council Risk Management Policy and

Framework. The main changes to the document include:

- Overview

of risk management updated to reflect ISO 31000 standard definition of risk.

- Roles

and responsibilities, and conflict of interested included in Policy section.

- Guiding

principles from the ISO 31000 standard included in risk framework.

- Need

for risk management to be integrated in to all business activities reinforced

throughout the policy.

3.4 Once

the strategic risks have been confirmed an internal and external audit

programme will be developed to confirm that the operational controls are in

place and working effectively.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 While

risk management is a significant administrative practice, the Risk Management

Policy and Framework does not trigger Council’s Significance and

Engagement Policy and no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Business Services Manager

titled “Strategic

Risk Management Update” dated 20/02/2017 be received.

B) That

the Audit and Risk Subcommittee endorse the updated Risk Management Policy

and Framework for adoption by Council.

C) That

the Audit and Risk Subcommittee confirm the strategic risk register as a fair

representation of strategic risks Officers need to manage, and that the

register be submitted to Council with the updated Risk Management Policy and

Framework.

With the reasons for this decision

being that the objective of the decision will contribute to meeting the

current and future needs of communities for good quality local infrastructure

and local public services in a way that is most cost-effective for households

and business by:

i) Ensuring strategic risks are effectively managed, and

ii) Assisting Council to successfully achieve its goals through

proactive management of risk.

|

Attachments:

|

1

|

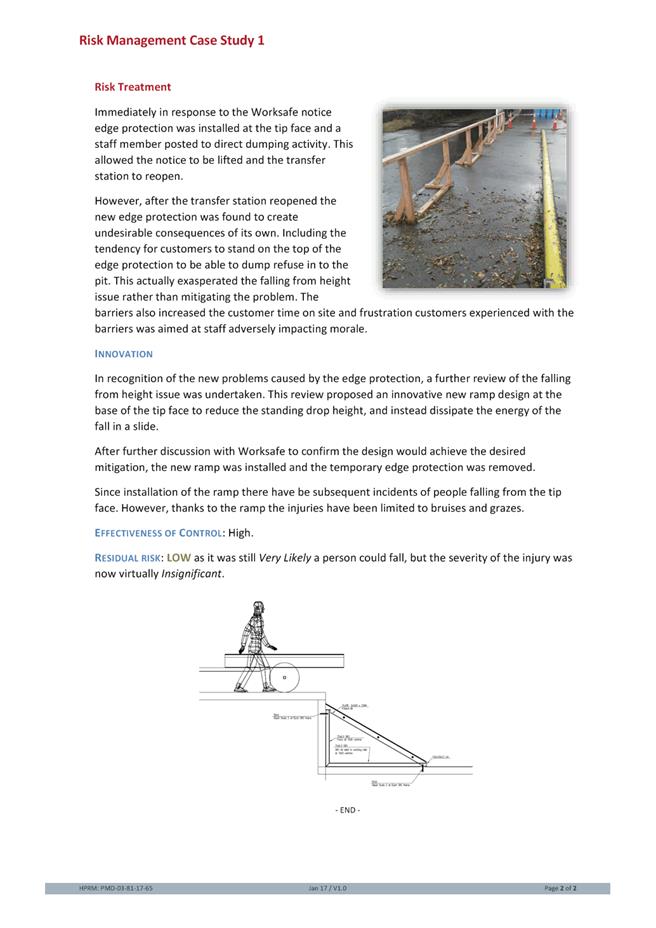

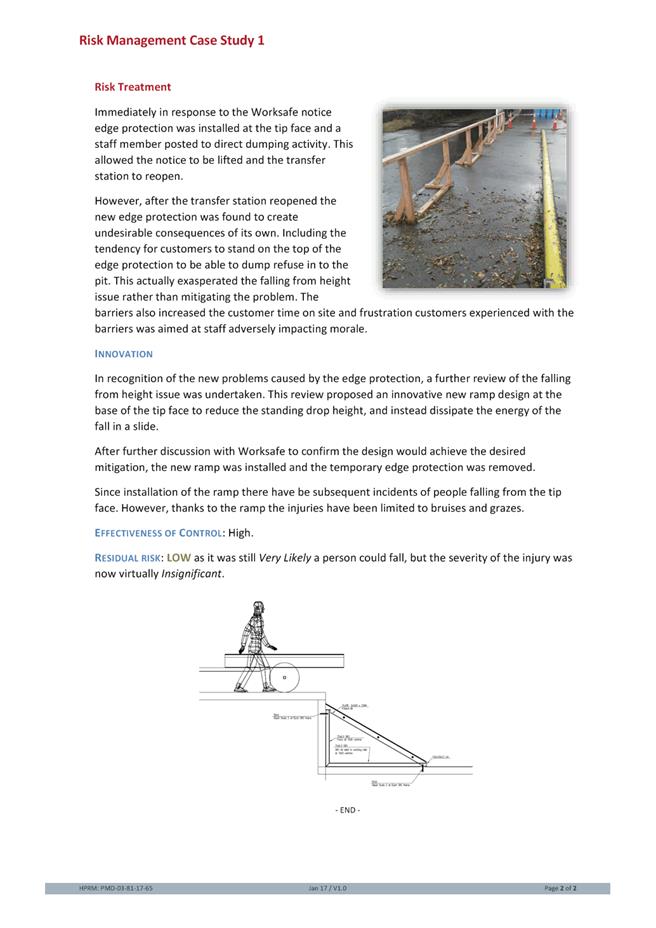

Risk Management Case Study 1 Transfer Station Refuse

Tip Face Pit Fall

|

PMD-03-81-17-67

|

|

|

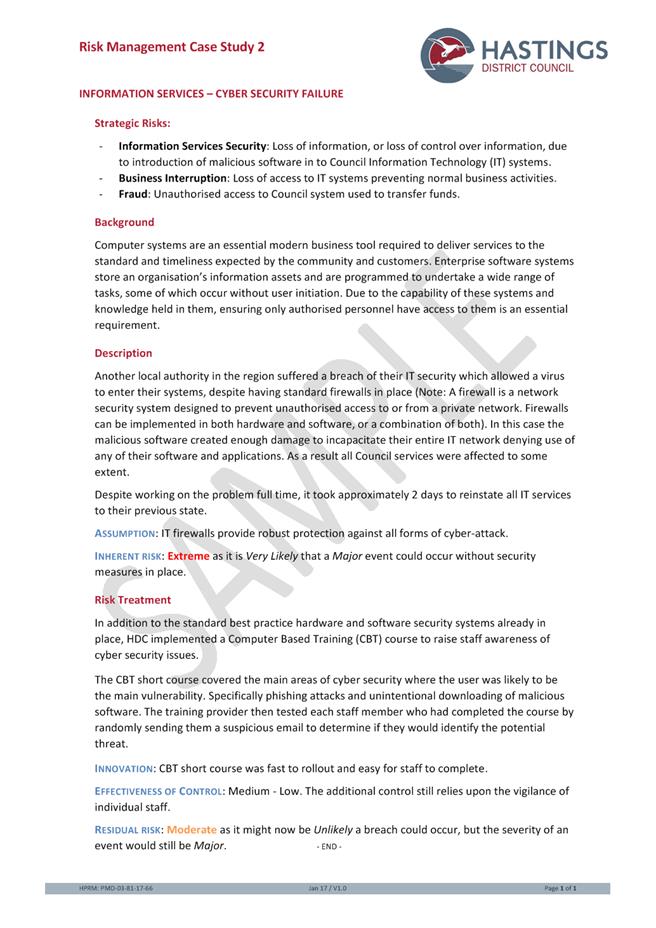

2

|

Risk Management Case Study 2 Information Technology

IT Security Breach

|

PMD-03-81-17-68

|

|

|

3

|

Strategic Risk Register

|

PMD-03-81-17-69

|

|

|

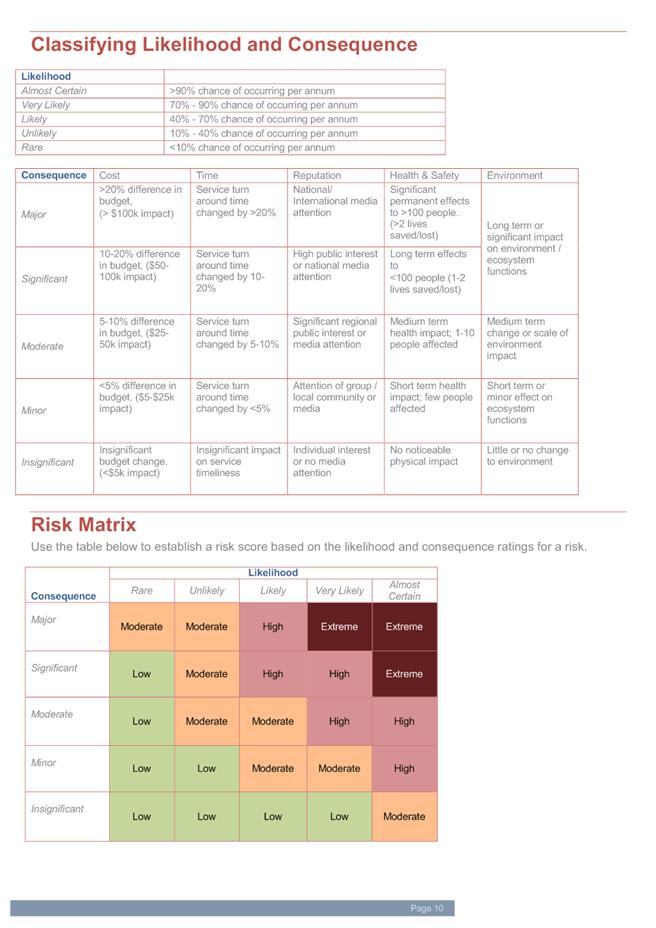

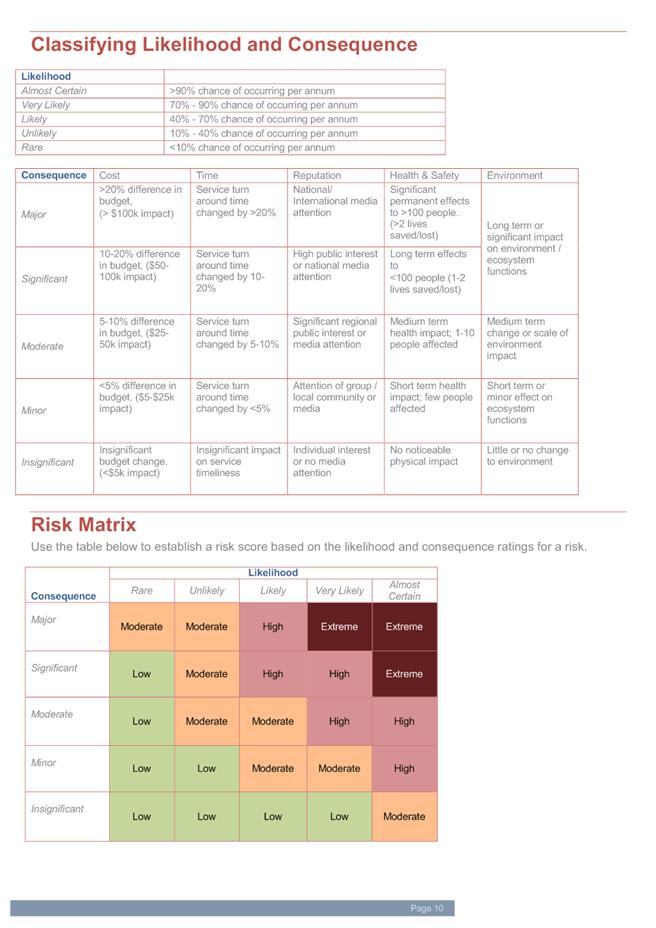

4

|

Hastings District Council Consequence Scale and Risk

Matrix

|

PMD-03-81-17-71

|

|

|

5

|

HDC Risk Management Policy and Framework V2.0

|

PMD-03-81-17-70

|

|

|

Risk Management Case Study 1 Transfer

Station Refuse Tip Face Pit Fall

|

Attachment 1

|

|

Risk Management Case Study 2 Information Technology IT

Security Breach

|

Attachment 2

|

|

Strategic Risk Register

|

Attachment 3

|

|

Hastings District Council Consequence Scale and Risk

Matrix

|

Attachment 4

|

|

HDC Risk Management Policy and Framework V2.0

|

Attachment 5

|

|

Trim File No.: Error! Unknown document property name.

|

Agenda Item: 10

|

HASTINGS DISTRICT COUNCIL

Audit and Risk Subcommittee MEETING

Monday, 20 February 2017

RECOMMENDATION TO EXCLUDE THE PUBLIC

SECTION 48, LOCAL GOVERNMENT OFFICIAL INFORMATION AND

MEETINGS ACT 1987

THAT the public now be excluded from the

following part of the meeting, namely:

11 Cash

Handling Internal Audit

The general

subject of the matter to be considered while the public is excluded, the reason

for passing this Resolution in relation to the matter and the specific grounds

under Section 48 (1) of the Local Government Official Information and Meetings

Act 1987 for the passing of this Resolution is as follows:

|

GENERAL SUBJECT OF EACH MATTER TO BE CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION IN RELATION TO

EACH MATTER, AND

PARTICULAR INTERESTS PROTECTED

|

GROUND(S) UNDER SECTION 48(1) FOR THE PASSING OF EACH

RESOLUTION

|

|

|

|

|

|

11 Cash

Handling Internal Audit

|

Section 7 (2)

(h)

The withholding

of the information is necessary to enable the local authority to carry out,

without prejudice or disadvantage, commercial activities.

The Internal

Audit includes the review of commercial arrangements as part of the audit process..

|

Section

48(1)(a)(i)

Where the Local

Authority is named or specified in the First Schedule to this Act under

Section 6 or 7 (except Section 7(2)(f)(i)) of this Act.

|

Hastings District

Council

Hastings District

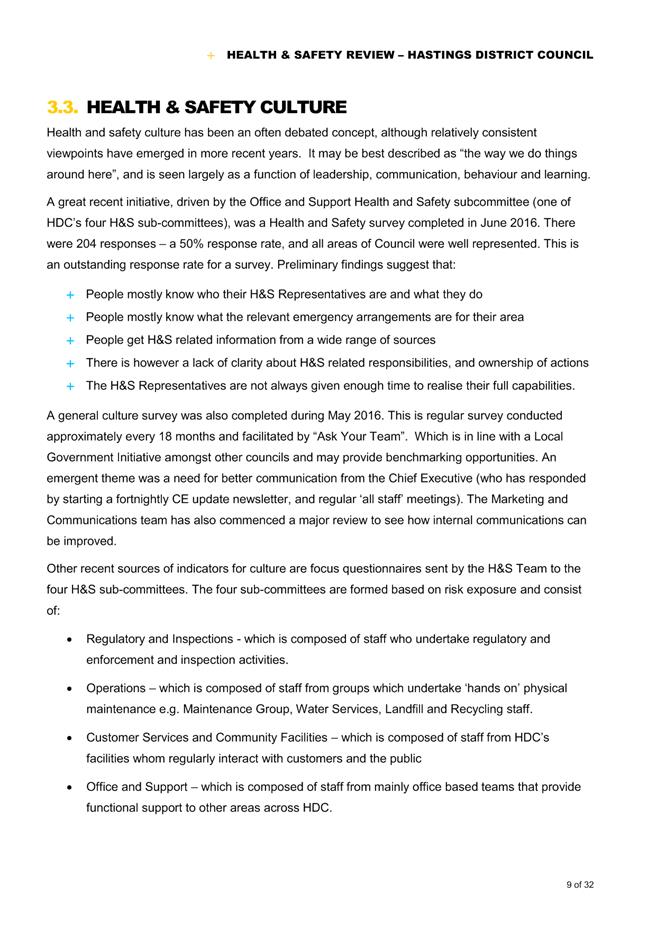

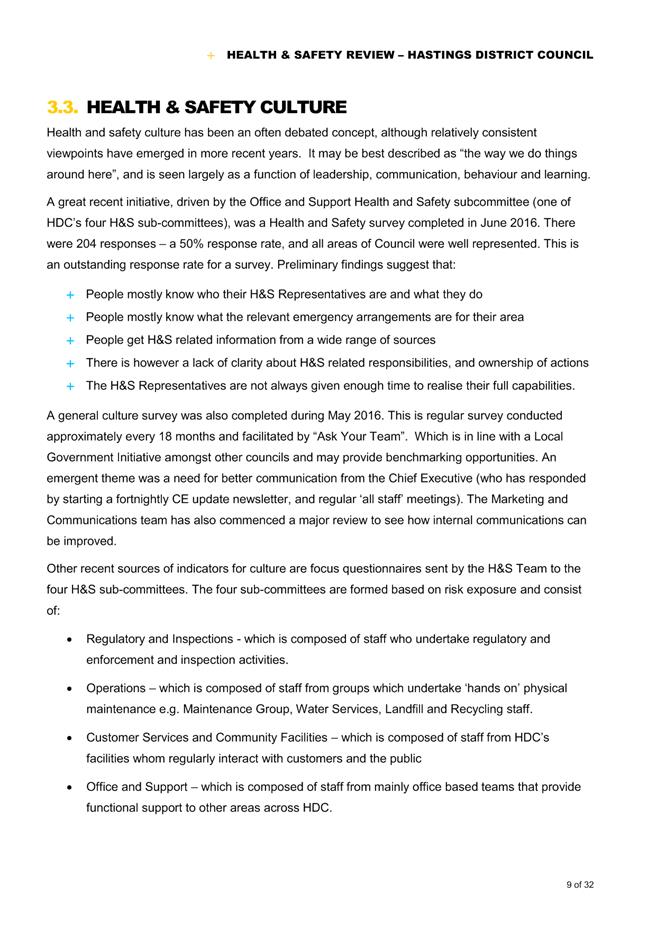

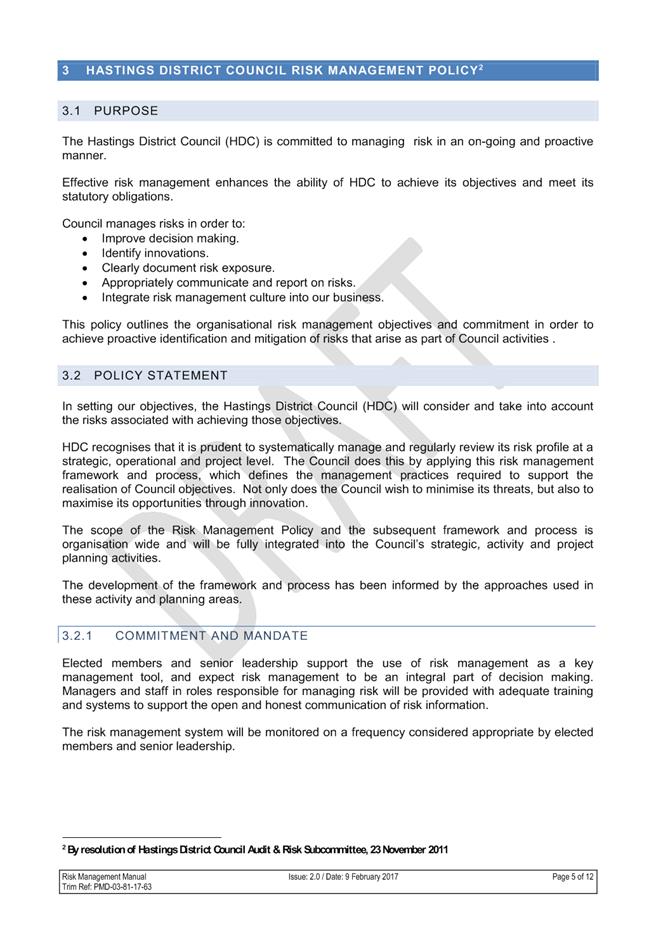

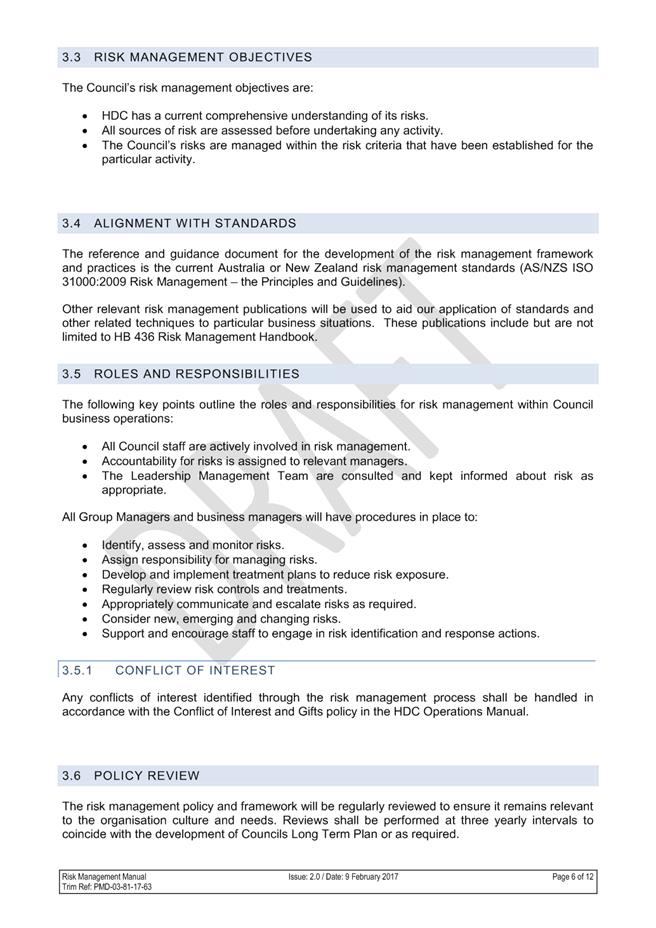

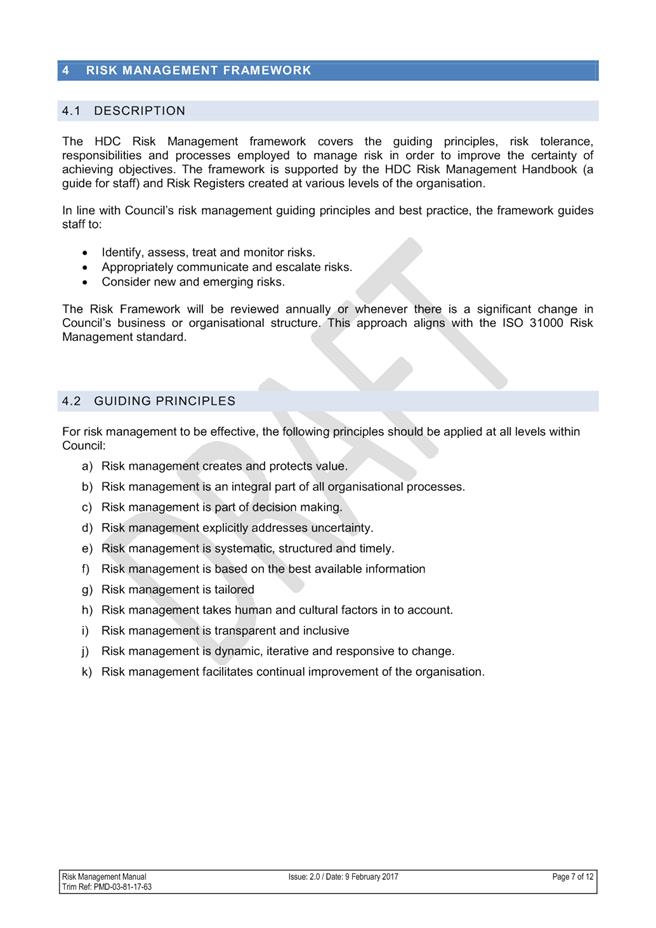

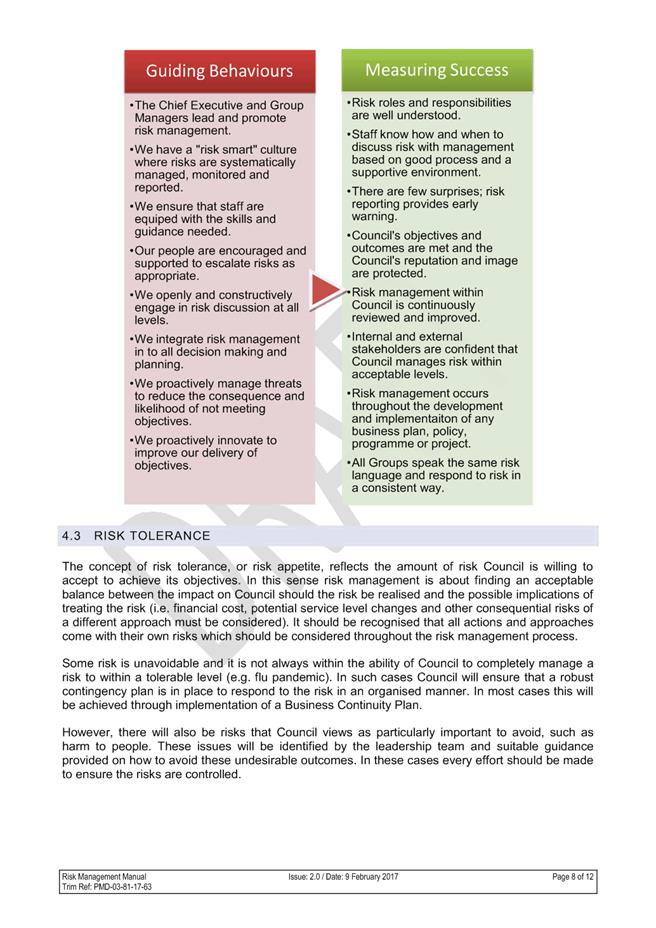

Council