REPORT TO: Commissioner

Hearing

MEETING DATE: Tuesday 28

November 2017

FROM: Financial Policy Advisor

Ashley

Humphrey

SUBJECT: Irongate

Road East, Hastings Lot 2 DP 3067 (CFR) H4/1146)

1.0 INTRODUCTION

1.1 An objection to a Development

Contributions Assessment has been lodged with the Hastings District Council

(HDC or Council) by Jara Family Trust (Jara or the objector). The objection

relates to the development contributions assessment issued on 9 August 2017 in

relation to subdivision consent RMA20170079.

1.2 This report outlines the basis for the

assessment generated and addresses the points raised by the objector in its objection

and in the statement of evidence from John Alan Roil dated 7 November 2017. It

concludes with the view that:

A) the assessment issued has been generated in

accordance with HDC’s 2016/17 Development Contributions Policy (DCP), and

B) HDC rejects those points raised in the objection and

believes the contribution should be paid in accordance with the Local

Government Act 2002 (LGA 2002).

2.0 BACKGROUND

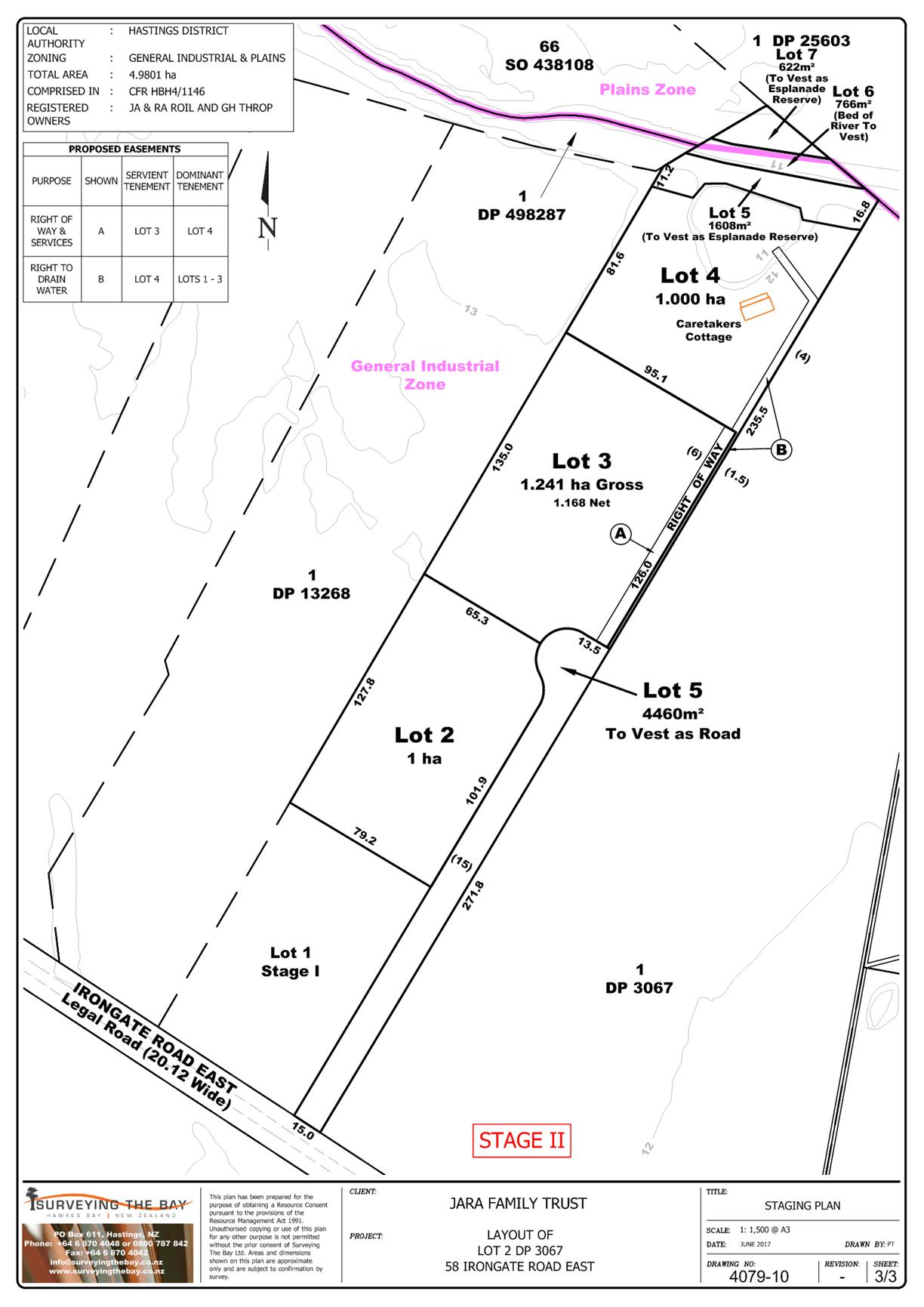

The Land

2.1 Jara Family Trust is the registered

owner of Irongate Road East, Hastings (Lot 2 DP 3067 / CFR H4/1146). The site

consists of 4.98ha of land and prior to development, was predominately used for

horticulture / farming purposes.

The

Development Contributions Policy and the Irongate Industrial Catchment

2.2 HDC first introduced its DCP in July

2007 in accordance with the relevant provisions of the LGA 2002. In

accordance with that Act, the purpose of the DCP is to recover from those

undertaking developments, a fair, equitable and proportionate share of the

costs of capital expenditure necessary to service growth. In general, the

policy was established using a mainly district wide approach, to set and

recover development contributions.

2.3 Following consultation, Council adopted

an amended DCP in 2010, which included the creation of specific local

catchments for the proposed industrial areas at Irongate and at Omahu. This has

enabled and will enable Council to recover the capital costs associated with

growth development in the Irongate Industrial Area, from those landowners /

developers benefitting from, and creating the need for, the infrastructure

assets required to accommodate that growth.

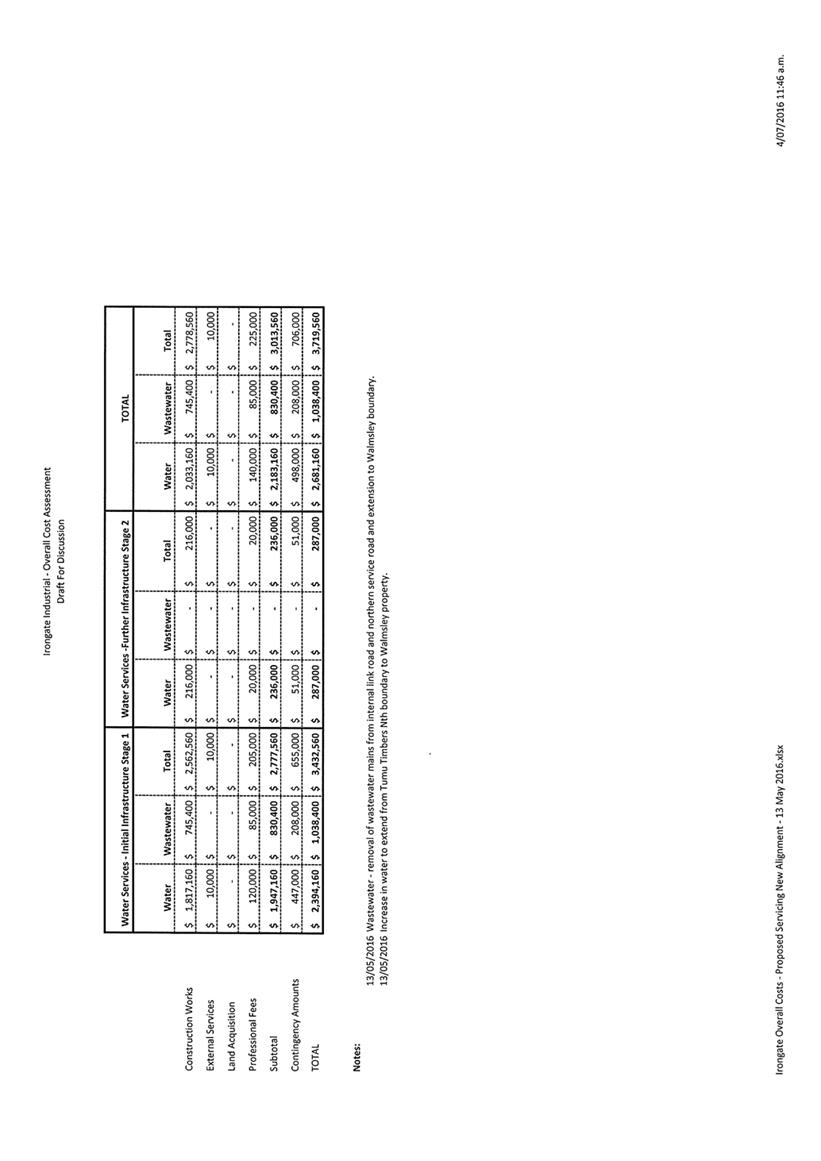

2.4 The capital expenditure costs being

recovered through the Irongate Industrial Area relate primarily to the physical

works proposed within the catchment area. A decision to exclude a share of the

wider network growth-related costs was made by Council at the outset in order

to allow for a lower DC rate for Irongate.

2.5 In May 2011, Irongate was formally

rezoned for industrial purposes under Plan Change 50. The objector’s land

forms part of the 71.5ha of land that was rezoned.

2.6 To minimise the exposure to Council, the

development was proposed over two stages, 35.3ha Stage 1 and 36.2ha Stage 2.

Each stage was anticipated to provide 10 years growth. Council’s DCP in

place at that time was to recover contributions on a Gross Floor Area basis

with a contribution of approximately $273,000 (excl. GST) per ha based on a

2500m2 GFA building.

2.7 Concerns were raised by land owners

around servicing options and the quantum of development contributions, and in

2015, Council commissioned a review of the services through BECA and PwC. The

BECA report concluded that the level of service for the provision of

reticulated infrastructure to service Irongate was appropriate and that the

costs associated with providing the services was also appropriate.

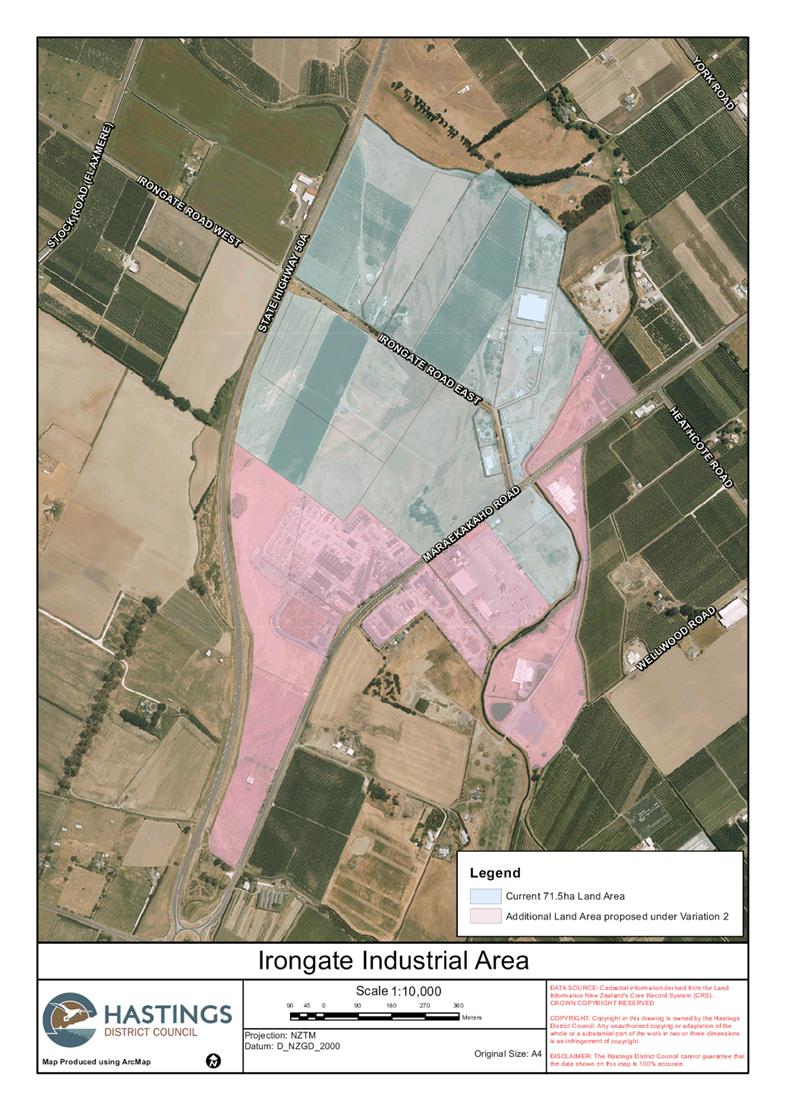

2.8 With land owners concerns still evident,

in March 2016, Council formally resolved to proceed with Variation 2 that would

a) remove the need to connect to a Council reticulated scheme for Stormwater,

b) remove staging and deferment and c) increase the area by an additional

46.9ha. A map showing the current area and proposed additional area is attached

under Attachment 1.

2.9 Workshops were held with land owners in

February and May 2016 who were supportive of Council’s approach and also

receptive to a proposed change in how the DC was recovered, moving from a per

m2 Gross Floor Area Basis to a per m2 of Land Area basis.

2.10 Following consultation, Council amended its

policy to reflect a) remove the need to connect to a Council reticulated scheme

for Stormwater, b) remove staging and deferment, c) update the budgets that

underpin the DC calculation, and d) change the basis for recovering the DC from

m2 GFA to a per m2 of land area. As concerns were raised

around DC’s and other stipulations under which development was allowed to

occur by land owners whose land formed the additional 46.9ha, no change was

made to land area at this point. The rates per m2 of land set under

council’s DCP Schedule of Fees & Charges is based on a capital

expenditure of $7.855m before interest and inflation, servicing the total Plan

Change 50 area of 71.5ha of industrially zoned land.

2.11 Council is currently working through

resolving a number of appeals to the variation which include requirements

around the maximum building height, setbacks, servicing, and the minimum site

size. Council has signalled its intention to revise its Schedule of Fees &

Charges and DCP (which would factor in the additional 46.9ha) once all matters

relating to the appeals are resolved.

2.12 Whilst additional infrastructure is

envisaged, the additional area now likely to be included in the zone is likely

to result in an overall reduction in the DC rate per m2. This is

noted in Council’s DCP under Section 4.6. Jara was advised of this

in the assessment letter issued on 9 August 2017 and in subsequent email

correspondence. If a revision results in a development contribution rate that

is lower than the development contribution paid, a refund of the difference

will be made to the person who has paid the development contribution.

2.13 Until any revision is formally adopted by

Council, the current Schedule of Fees and Charges and 2016/17 DCP applies to

any development.

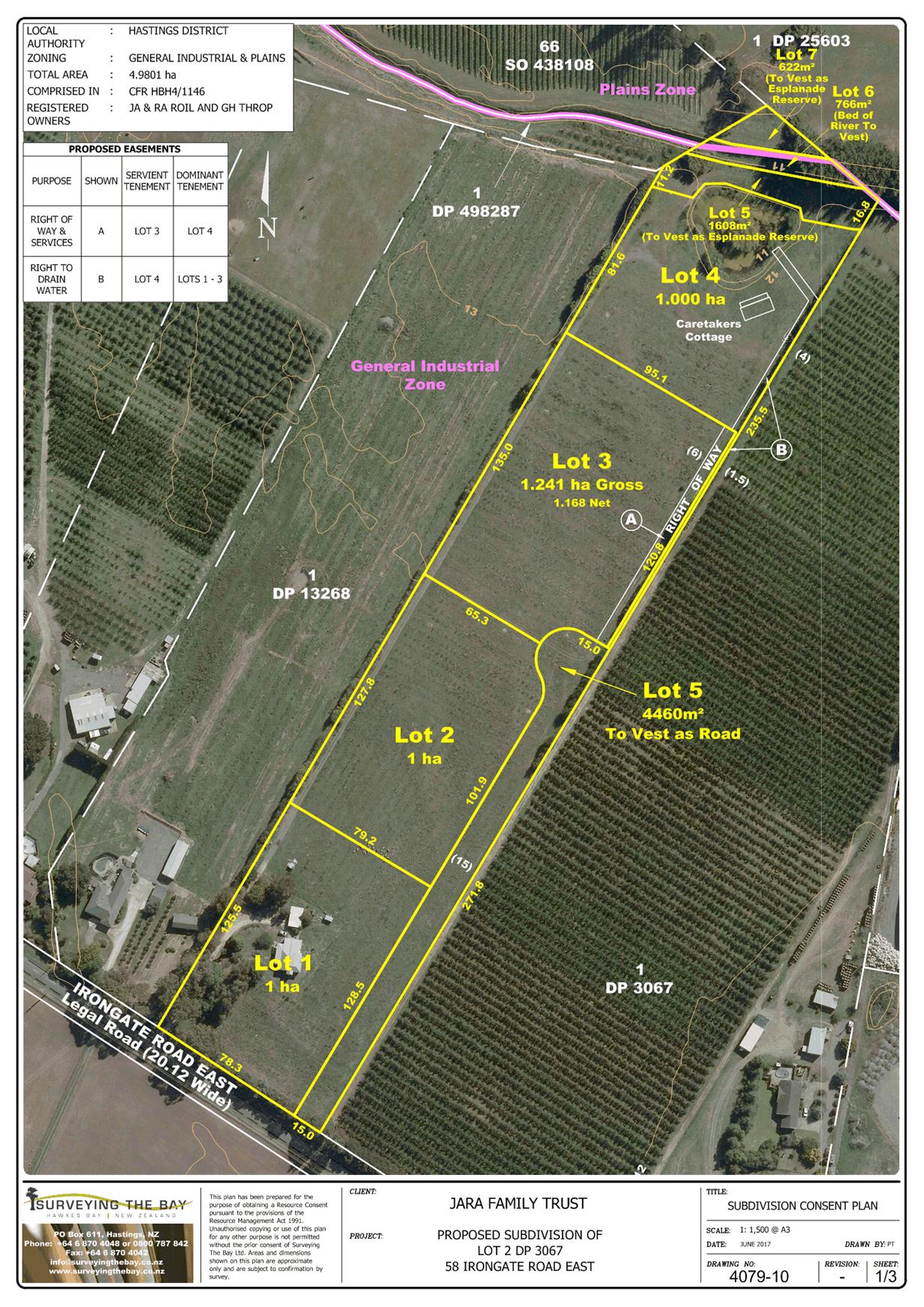

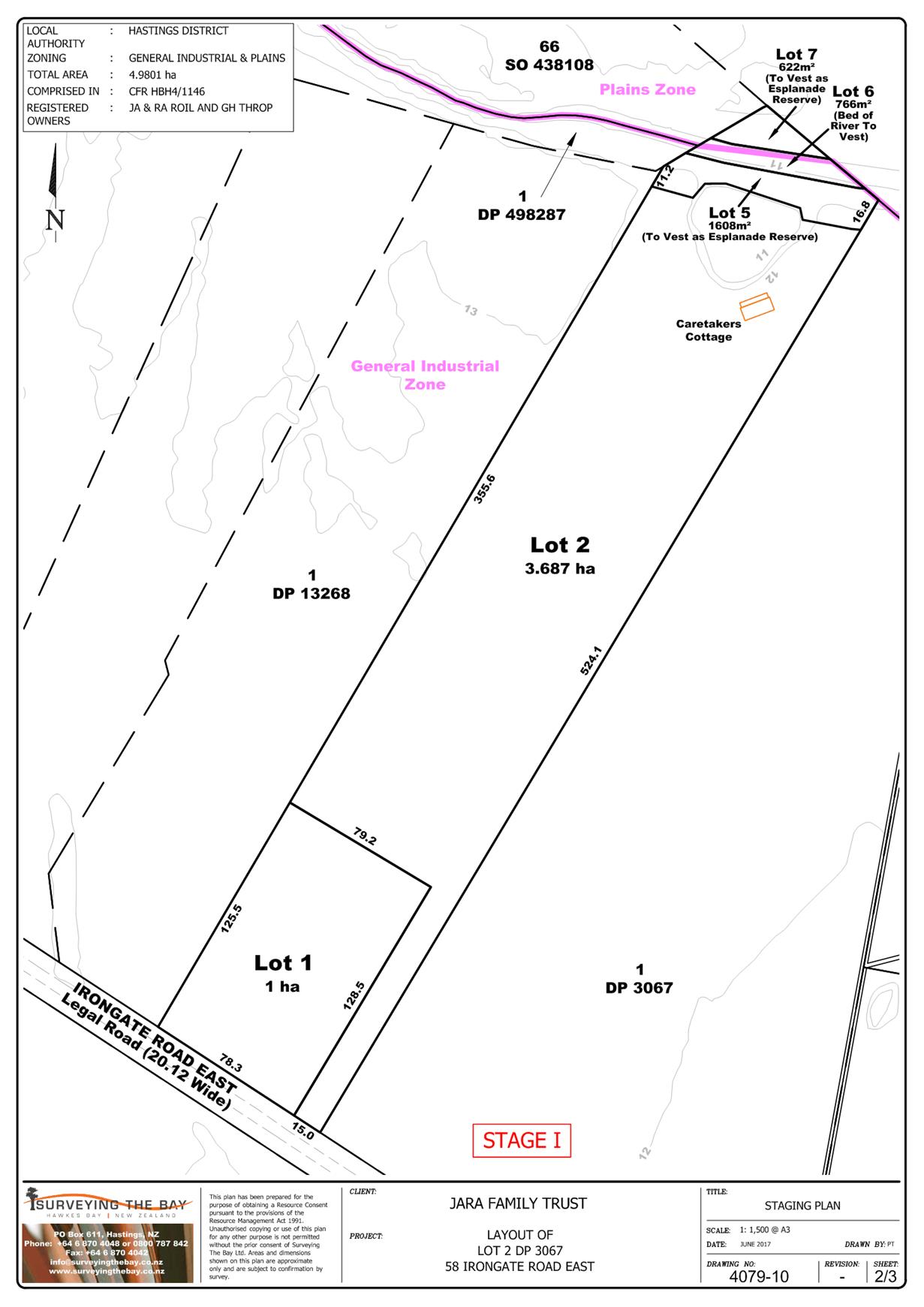

The

Application for Subdivision Consent

2.14 Subdivision consent was sought by Jara to

subdivide its land at Irongate Road East, over two stages, into four industrial

lots intended for development. The Scheme Plan is attached under Attachment 2.

· Stage 1

o Lot

1 of 1ha in size

o Lot

2 of 3.687ha (balance lot)

o Lot

5 of 1608m2 (to vest as Esplanade Reserve)

o Lot

6 of 766m2 (to vest as Bed of River)

o Lot

7 of 622m2 (to vest as Esplanade Reserve)

· Stage 2, being a subdivision of the balance lot (Lot 2, above)

o Lot

2 of 1ha

o Lot

3 of 1.241ha

o Lot

4 of 1ha

o Lot

5 of 4460m2 (to vest as Road)

The

subdivision consent was approved under the Resource Management Act 1991 by

Council.

Assessment of

Development Contributions

2.15 The resource consent approval triggered a

requirement for Council to undertake an assessment of development contributions

in accordance with 6.1 and 6.1.2 in the 2016/17 DCP.

6.1 Timing of Development Contributions

General

Under Section 202 of the LGA 2002, Council can apply a

development contribution upon the granting of:

A resource consent (subdivision or land use)

A building consent

An authorization for a service or infrastructure connection.

In the case

subdivisions, in the majority of applications, contributions will be collected

at subdivision consent stage. Council considers that the subdivision consent

stage is generally the most appropriate stage to take a development

contribution …

|

Table 6.1.2 Timing of

Development Contributions Milestones – Residential and non-Residential

Applications

|

|

Action

|

Timing

of Action

|

|

Assessment

of the Development Contribution

|

Upon

granting:

1. Subdivision

Consent

2. Land

Use Consent

3. Building

Consent (Including Certificate of Acceptances)

4. Authority

to make service or

infrastructure

connection

|

|

Payment

of the Development Contribution

|

1. Before

issue of 224 Certificate; or

2. On

issue of Code Certificate Of Compliance; or

3. On

issue of an authority to make service or infrastructure connection.

|

2.16 The land, situated at Irongate Road East, is

to the south of Hastings City and lies within Map 10 Irongate Industrial

Catchment as identified in the 2016/17 DCP. The costs of providing

infrastructure to support development in this area have been ring-fenced.

2.17 The consent conditions stipulate that the

development is required to connect to council reticulated services (water and

wastewater). The development will be required to address all stormwater matters

onsite.

2.18 There is a causal nexus link between this

development (and others cumulatively within the catchment area) and the

infrastructure being provided, for which the development contributions are

required.

2.19 An assessment of the contributions for

roading, wastewater and water infrastructure in respect of both Stage 1 and

Stage 2 of the development was generated in accordance with Section 4.6 of the

2016/17 DCP which states that:

“The

assessment will cover development contributions in respect of Roading,

Wastewater and Water Infrastructure services calculated on the land area of the

site being developed.”

2.19 Each

assessment was generated using the Schedule of Fees and Charges as outlined in

Table A-2 in Appendix A of the 2016/17 DCP:

|

Table A-2 IRONGATE INDUSTRIAL

DEVELOPMENT CHARGE PER M2 OF LAND

|

|

Activity

|

DC per m2 Of Land

(Excluding GST)

|

DC per m2 of Land

(Including GST)

|

|

Roading

|

$5.99

|

$6.89

|

|

Wastewater

|

$2.35

|

$2.70

|

|

Water Supply

|

$4.36

|

$5.01

|

2.20 For Stage 1, an assessment in respect of Lot

1 (1ha) only was generated. No assessment was generated in relation to the

balance lot (Lot 2), which was the subject of the Stage 2 assessment (see

below), nor Lot 5, Lot 6 and Lot 7 which are intended to be vested in Council

and not developed.

2.21 For Stage 2, a cumulative assessment in

respect of Lot 2 (1ha), Lot 3 (1.241ha) and Lot 4 (1ha) was generated. No

assessment was generated in relation to Lot 5 which is intended to be vested in

Council and not developed.

2.22 The assessments and invoice for Stage 1 were

formally issued to Jara on 9 August 2017.

2.23 Under section 199C of the LGA 2002, Jara

formally objected to the development contribution assessment issued on 23 August

2017, within the required timeframe.

3.0 GROUNDS

OF OBJECTION

3.1 The

permissible scope of a development contribution objection is set out in section

199D of the LGA 2002. An objection to a development contribution may be made

only on the grounds that the territorial authority has:

a) failed

to properly take into account features of the objector’s development

that, on their own or cumulatively with those of other developments, would

substantially reduce the impact of the development on requirements for

community facilities in the territorial authority’s district or parts of

that district; or

b) required

a development contribution for community facilities not required by, or related

to, the objector’s development, whether on its own or cumulatively with

other developments; or

c) required

a development contribution in breach of section 200; or

d) incorrectly

applied its development contributions policy to the objector’s

development.

3.2 Four main points are raised in the

objection. These are related to matters around:

· Interest costs

· Roading costs

· Water

· Fairness, equity and proportionality under ‘Closing

Comments’.

3.3 The statement of evidence of Mr Roil

dated 7 November 2017 expands on these grounds. Many of the matters raised

in the objection and in Mr Roil’s evidence are not available grounds of

objection. By responding to those matters the Council is not to be taken

as accepting that they are properly the subject of an objection under the LGA

2002.

4.0 CONSIDERATION

OF OBJECTION

4.1 The objector raised a number of

issues in their initial objection and clarified their concerns in their brief

of evidence, which could be claimed to relate to grounds 3.1a and 3.1b. The

following outlines Council’s response to those points raised.

Interest

Costs

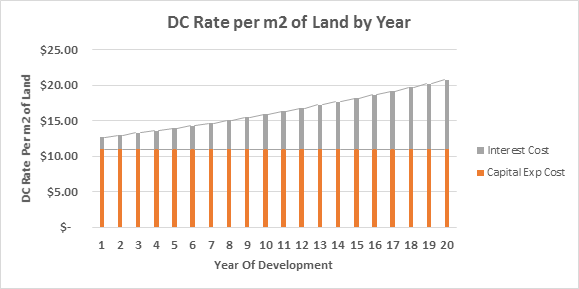

The

objector believes the interest cost component of the development contribution

is disproportionate and unfair, and should not be applied to those developing

in the early years of the lifetime of the project.

4.2 Council does not agree that the

interest component of the development contribution is disproportionate and

should not be applied to those developing in the early years of the lifetime of

the project.

4.3 First, the objector’s

calculations around the Year 1 interest component for all activities are

incorrect as it has started by incorrectly calculating the rate per m2

by dividing the $7.855m capital expenditure cost by an area of 100ha. The

2016/17 Policy and Schedule of Fees and Charges is based on servicing an area of

71.5ha over a 20 year period. The following is taken from 4.6 of the 2016/17

DCP which outlines the basis for the current calculation.

The basis

for the calculation under this schedule of charges is a developable area of

71.5ha of land which reflects the current District Plan.

4.4 Council has referenced 100ha in

the policy as the potential extent of the area to be zoned under Variation 2.

Upon resolution of the Variation 2 appeals, Council has signalled its intention

to revise and update its DC rate to encompass both any additional servicing

costs and the increased area. However, the current policy basis is presently

71.5ha.

4.5 By dividing the capital

expenditure by 100ha, the objector has significantly overstated the interest

component of the DC rate as being $4.84 per m2. The correct portion

of capital expenditure and interest for those developing in Year 1 for each

activity is listed below, on a per square metre basis (excl. GST):

|

Activity

|

Cost / Area = Rate per m2

|

Interest Component

|

DC Policy Rate

|

|

Roading

|

$4.199m / 71.5ha = $5.87

|

$0.12

|

$5.99

|

|

Wastewater

|

$1.282m / 71.5ha = $1.79

|

$0.56

|

$2.35

|

|

Water

|

$2.373m / 71.5ha = $3.32

|

$1.04

|

$4.36

|

|

|

$10.98m2

|

$1.72m2

|

$12.70m2

|

4.6 Council does not believe that the

interest component in Year 1 is disproportionate.

4.7 Secondly, the LGA 2002 makes

provision for councils to recover the total cost of capital expenditure which

may (and in most cases, will) include an interest component. When taking

into account the different timeframes of all developments, applying a portion

of the interest cost to those developing in Year 1 is not unfair nor an

unreasonable approach. Early development triggers the requirement for Council

to invest in the infrastructure to which the charge relates, and Council will

start to incur interest costs. If Council was to remove the interest

component from early developments, then all of the interest costs would need to

be passed on through a higher development contribution for land owners within

the catchment who do not develop until later. Those later developers

could well argue that they should not have to pay interest costs incurred

merely because some developers required the infrastructure earlier than they

did.

4.8 There is also the fact that the earlier

developers will have had the use and benefit of the infrastructure over a

longer period, and the later developers will have less use and benefit,

particularly as the infrastructure approaches the end of its design life.

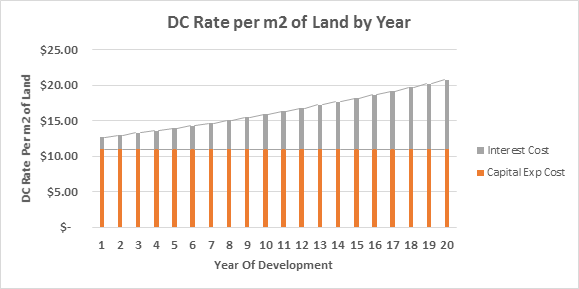

4.9 It should be noted that those developing

in Year 1 do receive a somewhat discounted rate in so far as they will pay a

lower rate per m2 of land than those developing in later years. The

Year 1 rate ($12.70m2) that is set in Council’s DCP, has been

modelled to allow for an ‘inflationary adjustment’ for future

years. Council intends to update its Schedule of Fees & Charges

annually with the new rate, or add a table upon its next revision outlining the

rates for the next three years. This ‘adjustment’ has been

communicated to landowners previously through various workshops.

4.10 The following table shows the level of

development contribution forecast to be required each year. Through the

adjustment, those developing in later years will indirectly be required to pay

a greater share of the interest cost.

4.11 Council intends to monitor all of its

assumptions including interest rates over the lifetime of the project, and

intends to revise its future development contribution calculation where

required, to ensure it does not under or over recover contributions over the

lifetime of the project.

4.12 Council considers it reasonable and

fair that all developments within the Irongate Industrial area pay a share of

the interest cost incurred over the lifetime of the project.

Roading

Costs

The objector believes that as

the intersection upgrades (roundabouts) for Irongate Rd and York / Maraekakaho

Rd are not required until 2030, and as they fall outside the Council’s

10-year LTP, they should be excluded from the calculation. The objector

believes that with a reduction in speed limit, some of the proposed works

(including Maraekakaho Road widening and proposed roundabouts) are not

required. The objector notes that LTNZ are only making a small contribution

towards the cul de sac costs ($50,000).

4.13 The current development

contribution calculation has been set based on a budget of $4.2m, to

specifically cover the following works:

· T-intersection at Irongate Rd (modelled to commence in 2018/19)

· Upgrades to Irongate Road including a cul de sac (modelled to

commence in 2018/19)

· Upgrade from a T-intersection to a roundabout at Irongate Rd,

(modelled to commence in 2030/31)

4.14 The objector makes reference to works that

are not part of the current policy calculation. The current policy calculation

does not include any costs relating to the York / Maraekakaho Road roundabout

nor the Maraekakaho Road widening. These works specifically relate to

additional infrastructure that would be required to support the wider variation

development area (100ha), once appeals are resolved. They are not within

the scope of infrastructure projected to service the 71.5ha. While

Council’s Program of Capital Works could have been more detailed, a

number of workshops have been held with land owners which have outlined the

scope of the infrastructure servicing requirements for both the current 71.5ha

area, and the proposed 100ha Variation 2 area should it be adopted.

4.15 During the design stage, Council engaged

Stantec (previously MWH) to independently undertake detailed traffic data

analysis to support the proposed programme of works. With regards to the above

programme of works, they were firmly of the view that a reduction in the speed

limit would not remove the need for a roundabout at Irongate Rd / Maraekakaho

Road, and they reiterated their view in a workshop held with Irongate land

owners in September 2017.

4.16 The capital expenditure associated with an

upgrade from a T-intersection to a roundabout at Irongate Rd is contained

within Council’s 2015-25 LTP being forecast to be undertaken in 2021/22

and 2022/23. However, since the 2015-25 LTP was adopted, more detailed design

estimates have been provided and these estimates ($4.2m) were used for setting the

DC rate in Council’s 2016/17 DCP.

4.17 The current calculation is modelled on the

upgrade from a T-intersection to a roundabout at Irongate Rd / Maraekakaho Road

commencing in 2030/31, although the actual timing of the work is somewhat

fluid, as the traffic modelling has identified that the upgrade will be

required once 36ha of development has occurred.

4.18 Deferring the upgrade to 2030/31 was very

optimistic considering likely uptake rates. There is every likelihood that the

work will be required much sooner, and well within the 10 year LTP. For the

purpose of modelling and setting its DC rate, given the fluidity of uptake

rates, Council made the decision to leave the timing of this particular work in

2030/31 and review its policy as actual uptake information becomes available.

Bringing forward the upgrade works would result in higher interest costs being

incurred which would be reflected in a higher DC rate.

Water

The objector argues that the

assessment does not align with Council’s development contribution policy.

4.19 The objector implies the water

component is incorrectly set, however the assessment issued ($43,600 per ha or

$4.36 per m2) aligns with council’s Schedule of Fees and

Charges as set out in its 2016/17 DCP.

4.20 The

objector uses an incorrect figure of $23,700 per ha or $2.37 per m2

of land area as a figure that should be assessed for water, however this has

been incorrectly calculated using the proposed Variation 2 area, refer to paras

4.3 to 4.5 above.

4.21 It should be noted that none of the wider

district water costs have been included in the Irongate Industrial rate. A

decision to exclude the wider network costs was made by Council at the outset

in order to set a lower DC rate for Irongate land owners.

Budgetary

Misalignment between Council’s LTP and DCP Policy

The

objector focuses on differences between the budget information contained within

Councils 2015-25 LTP and the 2016/17 DCP as additional capital expenditure

which is unexplained and doesn’t relate to their development.

4.22 The

budget information contained in the 2015-25 LTP was based on servicing 35.3ha

of land under Stage 1 only. Following consultation a number of changes

including changes to the budget were made to Council’s DCP from July

2016. The capital expenditure costs listed within the 2016/17 DCP Policy do

relate to those developments within Irongate.

Council

entering into unfair and inequitable development agreements not aligned to the

2016/17 DCP

The objector implies that Council

has entered into private agreements with developers and provided them with

different assessments that are less than the 2016/17 DCP.

4.23 Council

entered into one agreement with a land owner in the Irongate Industrial Area.

By securing their commitment to paying the DC, Council was able to update its

assumptions around early uptake which underpin the calculation, with this

change being reflected in the 2016/17 DCP. The payment had a positive impact on

the DC rate through reduced interest costs which benefitted all land owners.

The basis for their agreement was the 2016/17 DCP rate of $12.70 per m2

(excl. GST).

Actual

Budgets Vs Estimated Budgets

The

objector implies that Council is over recovering DC’s as actual capital

costs are less than budgeted costs in the DCP

4.24 The implementation of reticulated services has not yet been

completed. The objector submitted a LGOIMA request on 7 November regarding

costs to date which Council will respond to within the permitted timeframes.

Council has been transparent in its policy and communication that once the

Variation 2 appeals are resolved, it will go through the process of revising

its DC rate to reflect the wider extent of the area and any updated servicing

costs, and consult on those changes with affected land owners.

4.25 Where a DC has been paid that is greater than the rate set after

revision following the resolution of the appeals under Variation 2, a one off refund

will be made of the difference between the new rate and what was paid. Council

will continue to monitor its budgets and assumptions around interest rates and

uptake to ensure it does not over recover contributions from those developing

within the Irongate Industrial catchment, in accordance with its legislative

obligations.

Fairness,

Equity and Proportionality under Closing Comments

The objector does not believe

the development contribution assessed is fair, equitable or a proportionate

portion of the total cost of capital expenditure necessary to service Irongate.

4.26 Council acknowledges that

‘growth’ provides some benefits to the wider community in terms of

job creation and economic wellbeing, however, its current funding approach is

to recover growth-related capital costs from those causing the growth and benefiting

from the assets, and not to reduce its development contribution through some

form of explicit public subsidy.

4.27 Council believes that it has

recognised any benefit from the assets accrued to the wider community through

its cost allocation process (particularly for water) and that those costs being

recovered through the contribution are fair, equitable and proportionate.

4.28 The objector uses the proposed water

link via Maraekakaho Road as evidence of greater resilience for the community.

Council does not support this view and believes that the link actually provides

greater resilience to those developments within the Irongate Industrial area as

they are now to be serviced from two sources. This link was originally proposed

for Omahu Road so there is no additional benefit accrued to the wider community

over and above what they would have received had the work been undertaken in

its original intended location.

4.29 It should be noted that none of the

costs associated with this link are being recovered from the Irongate

development contribution. Council has simply replaced the link it was going to

undertake in Omahu Road with a link in Maraekakaho Road which is to be funded

by other sources (rates).

4.30 The costs as they are outlined in the Program

of Capital Expenditure within the 2016/17 DCP implies that 100% of the capital

expenditure cost is being recovered from those developing within the Irongate

Industrial Catchment area without any reduction for funds sourced from

elsewhere. However that is not in fact the case. Aside from the fact none

of the wider district costs have been included in the Irongate Industrial

development contribution rate, which was a decision taken by Council at the

outset in order to set a lower rate, the figures shown in the 2016/17 DCP are

in actually net capital expenditure after factoring in a $50,000 subsidy from

LTNZ, and water cost allocations attributing a share of the Trunk Main Wilson

Road, and Wilson Road Bore Upgrade costs to non-growth (rates). Council

intends to update the policy wording at its next reiteration to correct this

mistaken impression.

5.0 RESPONSE

TO PARTICULAR SECTIONS IN THE EVIDENCE OF MR ROIL DATED 7 NOVEMBER 2017

5.1 As noted earlier in this report, Mr Roil

is wrong to treat the area covered by the DCP as 100ha. The 2016/17 DCP

was prepared on the basis of the Irongate Industrial Zoning as then proposed,

being 71.5ha. Variation 2 should extend this to 100ha (undeveloped) but

that has not been completed and until it is the DCP figures must stand.

Mr Roil’s recalculation of the development contribution rates is

therefore incorrect.

5.2 At para 29 Mr Roil contends that the

development contribution includes financing costs over a 30-year period.

This is incorrect. A period of 20 years has been assumed for the 71.5ha

development area covered by the current DCP. Council’s position

around financing costs is covered under para 4.7.

5.3 Mr Roil’s calculation at para 30

of a “financing fee” of $4.84 (GST exclusive) is

wrong. Based on the correct area of 71.5ha as the basis for the DCP

amounts, the interest and inflation component of the development contributions

charged to Jara is $1.72 per m2 (excl. GST). Refer to para 4.5

above.

5.4 At para 32 Mr Roil complains about the

provision made for ‘contingencies’ in the assessment of the likely

cost of the infrastructure provision. It is common practice to include an

allowance for contingencies when estimating the likely future costs of

construction work. There can be any number of matters arising between

when cost estimates are provided and the final costs are established following

completing of the work. Council’s experience is that an allowance

for contingencies is both necessary and appropriate.

5.5 At para 36 Mr Roil refers to the

Council’s Long Term Plan (LTP) which showed roading projects

totalling $2.761m. These costs were for the originally intended Stage 1

works based on servicing an area of only 36ha. Stage 2 costs sat outside

the 10-year window at that time. As explained earlier in this report, the

anticipated uptake has meant that this has had to be brought forward and

provision made to service 71.5ha (and soon 100ha). Council is currently

in the process of its 3-yearly review of the LTP as the result of which these

figures will be updated.

5.6 At para 37 Mr Roil refers to the roading

expenditure of $4,199,800 which he then says should equate to $4.19 per m2,

and says he has instead been charged $4.99 psm. His calculation of $4.19

per m2 is based on the erroneous figure of 100ha, when the correct

figure (as per the DCP) is 71.5ha. The amount charged to Jara was, as per

the DCP (Tabe A-2) $5.99 per m2 or $6.89 GST inclusive.

5.7 At para 38 Mr Roil refers to unnamed

sources of information that the expenditure is for road widening [and] the

construction of roundabouts at York Road and at the Irongate Road / Maraekakaho

Road intersection. While the $4.199m includes the roundabout at Irongate Road /

Maraekakaho Road, it does not include any costs towards the York Road

roundabout nor the road widening at Maraekakaho Road. The Irongate Road /

Maraekakaho Road roundabout does relate to Jara’s development being

within the 71.5ha development area.

5.8 At para 39 Mr Roil asserts (again based

on unknown sources) that some of the works are unlikely to be constructed until

2030. A traffic impact analysis undertaken by Stantec (formerly MWH)

showed the need for the upgrade is being driven by development at Irongate.

The rate of uptake as now anticipated makes it very likely this will be brought

forward. Had this been carried through into the modelling it would have

increased the interest costs, resulting in a higher overall development

contribution rate.

5.9 Again, at paras 40 and 41 (this time in

relation to water supply) Mr Roil refers to the LTP projections. As noted

above, these were based on Stage 1 only, servicing 36ha. Stage 2

servicing costs sat outside the 10-year window of the LTP at that time.

The 10-year timeframe of the LTP does not dictate the longer term planning

which underpins the DCP.

5.10 In para 42 Mr Roil compounds the error by

spreading the water supply costs over the Variation 2 100ha area, instead of

the 71.5ha in the DCP. The development contribution charged to Jara was

at the rate of $4.36 per m2 (excl. GST) as set out in Table A-2 of

the DCP. This provides a ‘raw’ cost of $3.31 per m2 and

an additional $1.05 per m2 for finance and holding costs.

5.11 At para 43 Mr Roil refers to agreements with

individual landowners at Omahu. His speculation about these agreements is

incorrect. The LGA 2002 provides that Council may enter into such

agreements. They are not relevant to Jara’s land or to the grounds

of its objection.

5.12 At para 44 Mr Roil asserts that the

developers in Irongate are being charged 100% of the costs of roading and water

supply. This is incorrect (although it is acknowledged that the wording of the

DCP gives this impression). In fact, the amounts set out in the DCP are

for the net growth portion only. Funds received (or to be received) from other

sources are not clearly stated, but the amounts shown are net of these

contributions. The wording of the DCP will be updated at its next

iteration to reflect funding from other sources such as LTNZ and rates (for

non-growth related share of the assets).

5.13 It should also be noted that none of the

district-wide growth-related water supply or roading costs have been included

in the Irongate development contribution figures. This is a significant

concession to the Irongate landowners and was done so as to allow a lower

overall DC rate for Irongate.

5.14 At para 45 Mr Roil asserts that properties to

the east of the Irongate Industrial area will obtain a benefit from the water

main constructed from the Flaxmere Pump Station, being looped back along

Maraekakaho Road. This overlooks that the looped service now provides

greater resilience for developments at Irongate which are serviced from two

sources. The ‘loop’ was always intended to be provided via

Omahu Road, so there is no additional benefit to the wider community from the

loop now running up Maraekakaho Road. The cost of the loop itself is not

included in the calculation of the Irongate development contribution.

5.15 Mr Roil is therefore mistaken at para 47

where he claims that 100% of the costs attributable to the reticulation from

Flaxmere has been included. The cost have been apportioned, as part of

the formulation of the DCP, based on the potential demand from Irongate to the

upgrades that have resulted from this new development.

5.16 Mr Roil’s para 49 refers to the roading

improvements which have been addressed above. The need for, and benefit

from, the Irongate Road / Maraekakaho Road roundabout is directly driven by

development within the Irongate catchment.

5.17 At para 52 Mr Roil complains that the money

he pays now represents money the Council will not have to borrow and so incur

interest on. The contribution rate in the DCP has applied assumptions around

those paying early as well as those paying later. It is reasonable that

those paying earlier should pay a share of the interest costs incurred over the

lifetime of a project.

5.18 At para 53 Mr Roil complaints that there is

no “explanation or justification” in Appendix D of the DCP

as to the amount of the capital costs. The 2016/2017 DCP was consulted on

prior to it being adopted by the Council in June 2016. Changes to the

costs in Appendix D were made mainly because of the removal of the Stage 1 and

Stage 2 staging, and reflecting the costs associated with servicing 71.5ha and

not just Stage 1 (35.3ha) as was in the LTP.

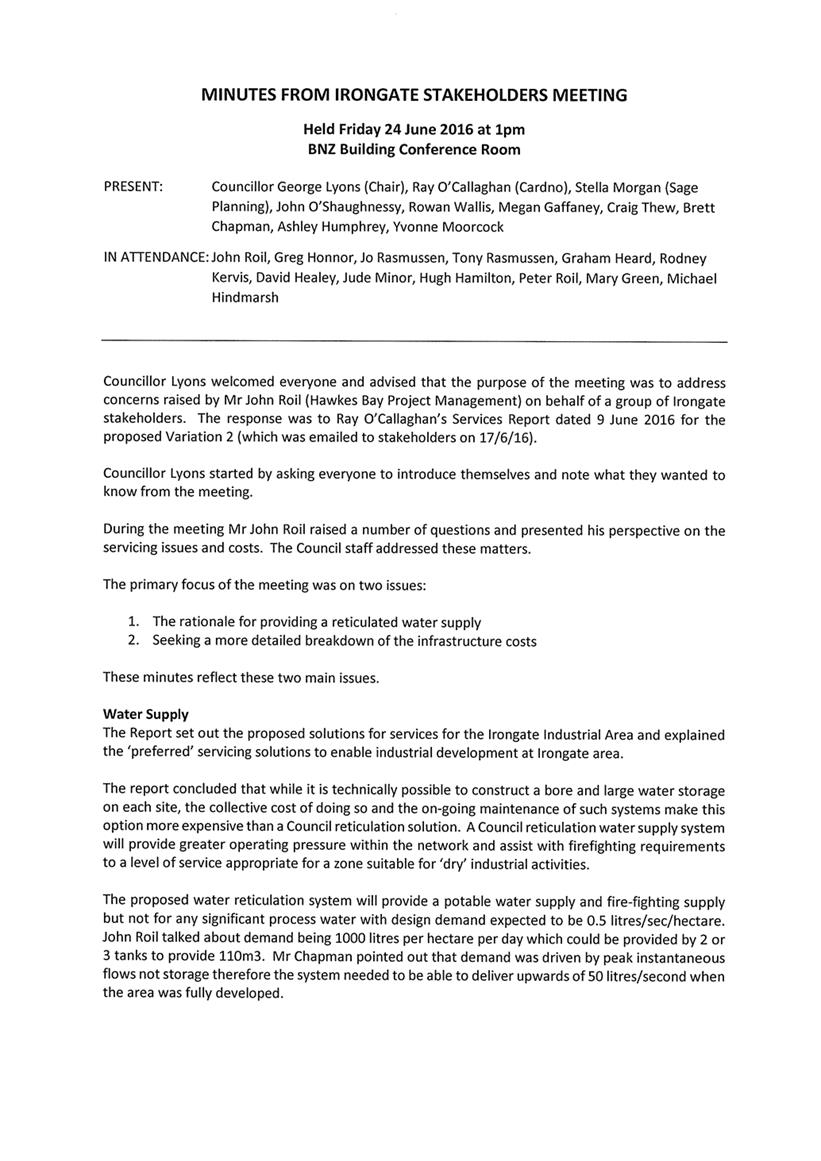

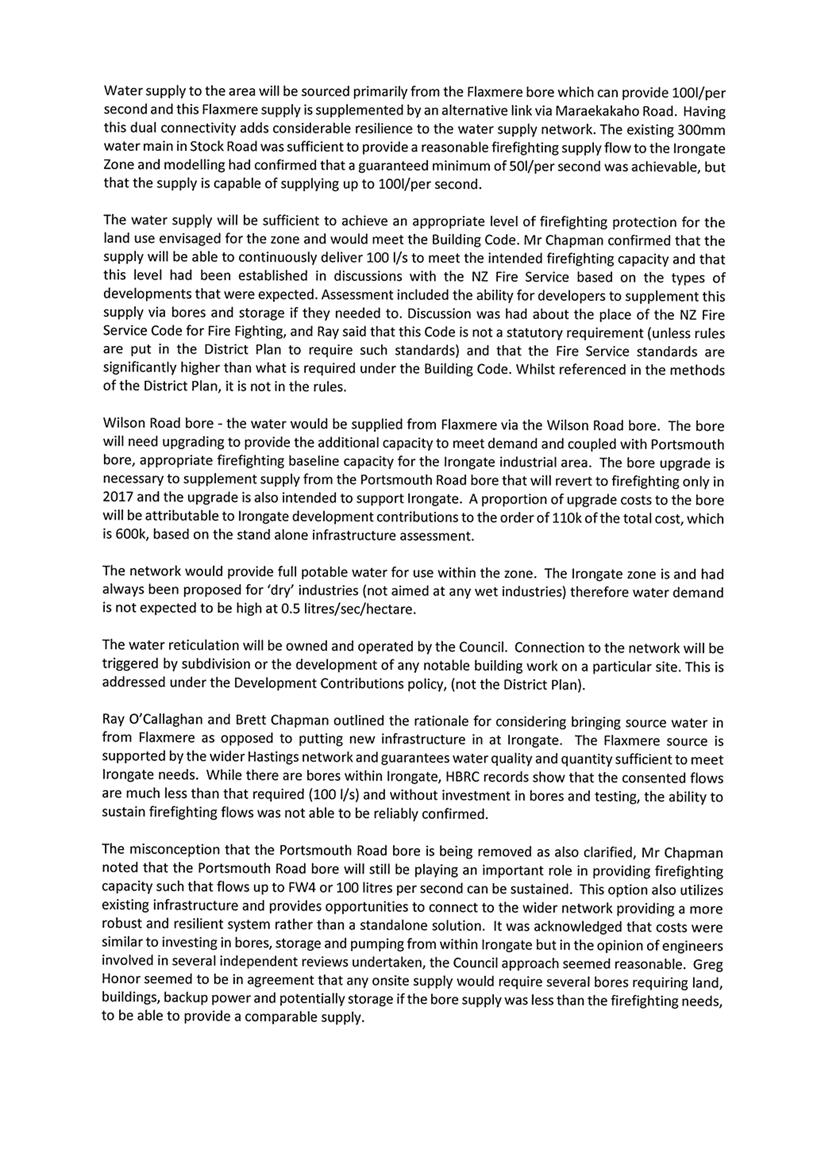

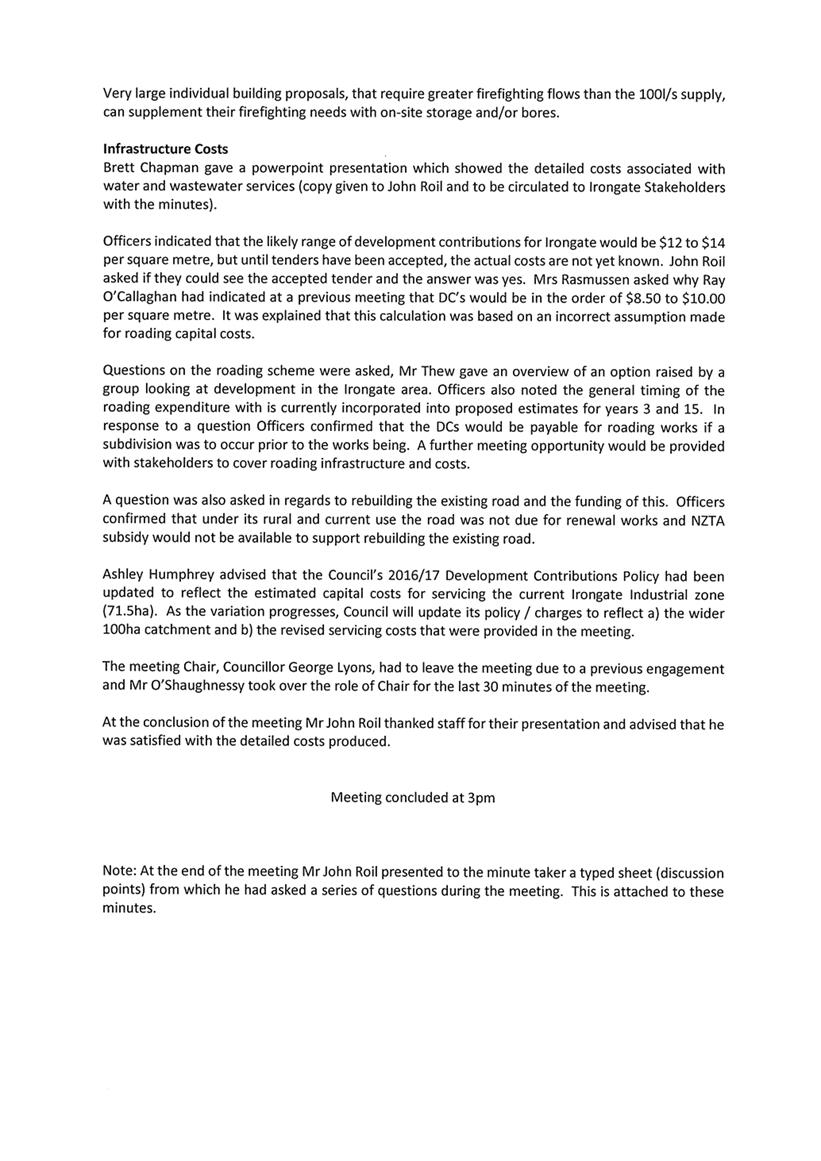

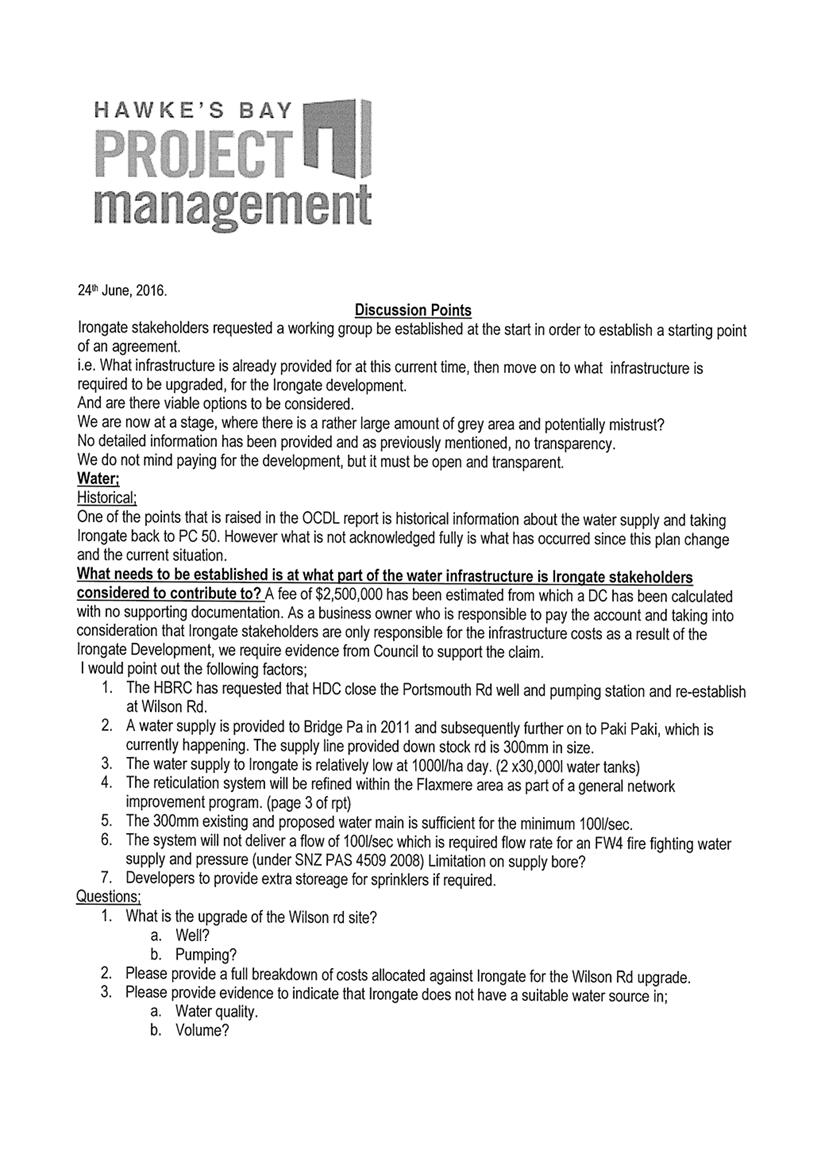

5.19 It should also be noted that a number of

workshops and meetings have been held with the objector and other land owners

where details around capital costs. As an example, a meeting was held on 24

June 2016 where the objector and other land owners were provided with a

detailed breakdown of the water capital costs. Attachment 3 records the

minutes of that meeting.

5.20 In summary, Mr Roil has sought to recalculate

the development contribution rate set out in the DCP on the basis of an

incorrect land area and using LTP figures which applied to an earlier (and no

longer applicable) staging scenario. This has resulted in an under-calculation

of the rates as set out in the DCP, and a considerable over-calculation of the

interest component of the rates.

6.0 CONCLUSION

6.1 The assessment

has been generated in accordance with the 2016/17 HDC DCP.

6.2 While there are

some areas for improvement in terms of how the information contained in the DCP

is expressed, specifically the Program of Capital Works, these will be

corrected at the next policy reiteration. However, Council rejects the

points raised in the objection, and believes the development contribution

assessed should be paid in accordance with the LGA 2002.

Attachments:

|

1

|

Irongate Industrial Map

|

25105#0145

|

|

|

2

|

Scheme Plan

|

25105#0146

|

|

|

3

|

Minutes of Landowners Meeting held 24 June 2016

|

25105#0147

|

|

Hastings District

Council

Hastings District

Council