Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Finance and Monitoring

Committee MEETING

|

Meeting Date:

|

Tuesday,

28 November 2017

|

|

Time:

|

1.00pm

|

|

Venue:

|

Council

Chamber

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Committee Members

|

Chair: Councillor

Kerr

Acting Mayor Hazlehurst

Councillors Barber, Dixon, Harvey, Heaps, Lyons, Nixon, O’Keefe,

Poulain, Redstone, Travers (Deputy Chair) and Watkins (Quorum = 8)

|

|

Officer

Responsible

|

Chief Financial Officer – Bruce

Allan

|

|

Committee

Secretary

|

Christine Hilton (Ext 5633)

|

Finance and Monitoring Committee

Fields of

Activity

Oversight of all

the Council’s financial management policy and operations (including

assets, cash, investment and debt management) including (but not limited to):

·

Monitoring compliance

with the Long Term Plan/Annual Plan and budget implementation.

·

Finance and Ownership

·

Audit and other

accountability requirements;

·

Business units/CCO/CCTO

ownership overview;

·

Rating matters

including rating sale proceedings;

·

Taxation.

·

Establishing the

strategic direction of Council’s business units (if any), Council

Controlled Organisations (CCOs) and Council Controlled Trading Organisations

·

Other matters

including:

- Performance Management

- Other matters not otherwise within the

scope of other Committees

Monitoring

compliance with the Long Term Plan/Annual Plan and budget implementation.

Membership

Chairman appointed

by Council

Deputy Chairman

appointed by Council

The Mayor

All Councillors

Quorum – 8 members

Delegated

Powers

General

Delegations

1. Authority to exercise all of

Council powers, functions and authorities (except where prohibited by law or

otherwise delegated to another committee in relation to all matters detailed in

the Fields of Activity.

2. Authority to re-allocate funding

already approved by the Council as part of the Long Term Plan/Annual Plan

process, for matters within the Fields of Activity provided that the

re-allocation of funds does not increase the overall amount of money committed

to the Fields of Activity in the Long Term Plan/Annual Plan.

3. Responsibility to develop policies,

and provide financial oversight, for matters within the Fields of Activity to

provide assurance that funds are managed efficiently, effectively and with due

regard to risk.

Fees and Charges

4. Except

where otherwise provided by law, or where delegated to another Committee, the

authority to fix fees and charges in respect of Council activities or services.

HASTINGS DISTRICT COUNCIL

Finance and Monitoring

Committee MEETING

Tuesday, 28 November 2017

|

VENUE:

|

Council Chamber

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

1.00pm

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the Chief Executive or Executive Advisor/Manager:

Office of the Chief Executive (preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Finance and Monitoring Committee Meeting held Tuesday 12 September 2017,

including minutes while the public were excluded.

(Previously circulated)

4. HB LASS Limited

Annual Report for the year ended 30 June 2017 7

5. Hawke's Bay

Regional Sports Park Trust Annual Report to 30 June 2017 11

6. Hawke's Bay

Museums Trust Annual Report for the year ended 30 June 2017 13

7. New Zealand Local

Government Funding Agency Limited - Annual Report for the year ended 30 June

2017 17

8. Financial

Quarterly Report for the three months ended 30 September 2017 21

9. Additional

Business Items

10. Extraordinary

Business Items

11. Recommendation

to Exclude the Public from Item 12 30

12. Hawke's Bay Museums Trust -

Chairperson Appointment

REPORT TO: Finance

and Monitoring Committee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: HB

LASS Limited Annual Report for the year ended 30 June 2017

1.0 SUMMARY

1.1 The

purpose of this report is to present to the Committee the HB LASS Limited

Annual Report for the year ended 30 June 2017.

1.2 This

request arises from a requirement under the Local Government Act 2002 for

Council Controlled Organisations (CCO) to submit an annual report to their

shareholders within 90 days of year end.

1.3 The

Chair Craig Waterhouse will be in attendance at the committee meeting.

1.4 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.5 The objective of this decision relevant to

the purpose of Local Government is to enable HB LASS to develop the most cost

effective delivery of joint services for the five shareholding Councils

1.6 This report concludes by recommending that

the HB LASS Limited Annual Report for the year ended 30 June 2017 be received.

2.0 BACKGROUND

2.1 HB

LASS Limited is a Local Authority Shared Services company established by four

Hawke’s Bay Territorial Local Authorities and the Hawke’s Bay

Regional Council.

2.2 As at

30 June 2017 the Directors of HB Lass Limited were:

· Craig Waterhouse (Independent Chair)

· Monique Davidson (Central Hawke’s Bay District Council)

· Wayne Jack (Napier City Council)

· James Palmer (Hawke’s Bay Regional Council)

· Vacant (Wairoa District Council)

· Ross McLeod (Hastings District Council)

John Freeman (Acting

CEO, Wairoa District Council) was appointed 31/07/2017

2.3 The

Directors of HB LASS Limited are required to deliver to their shareholders an

annual report within 90 days of the end of each financial year which will

consist of:

· A Chairman’s report, containing a review of the Company

operations with specific attention to the performance against the key

performance indicators established in the respective Statement of Intent.

· A comparison of actual performance with targeted performance

· Annual audited financial accounts to be completed in accordance with

generally accepted accounting standards and to include:

i. Statement of Financial

Position

ii. Statement of Financial

Performance

iii. Auditor’s

Report

3.0 CURRENT SITUATION

3.1 Attachment

1 is the 2017 Annual Report including the report from the Chair.

3.2 HB

LASS Limited was established to investigate, develop and deliver shared

services, where and when it can be done more effectively for any combination of

the Shareholding Councils. The annual report contains a comprehensive report

from the Board Chairman which details the activities currently being undertaken

by the participating Councils.

3.3 The

annual result is a break even result which is consistent with the Statement of

Intent and last year’s result. The intention of HB LASS Limited is to

recover its costs of operations from shareholder membership fees and project

evaluation fees.

3.4 Details

of performance against its Statement of Intent performance targets are detailed

in the annual report.

3.5 Officers

consider that HB LASS Limited has performed well and achieved the majority of

the performance targets set out in the Statement of Intent.

3.6 The

two KPI’s that were not fully met include the decision to cease

publishing the quarterly newsletter, and missing some shareholder reporting

deadlines. Neither of these breaches are considered of serious concern by

Officers.

3.7 During

the year the board has shifted focus from achieving share services to

delivering greater value to the respective councils through greater

collaboration. Examples of this is Napier City Council (NCC) hosting web

services for Hastings District Council (HDC); joint S17a reviews by NCC and HDC

being undertaken for both roading and waste minimisation, and papers being developed

for both Parks and Animal Control departments on how they could work more

collaboratively across councils.

4.0 SIGNIFICANCE

AND CONSULTATION

4.1 The

issues for discussion are not significant in terms of the Council’s

policy on significance and engagement and no consultation is required.

|

5.0 RECOMMENDATIONS AND

REASONS

A) That

the report of the Manager Strategic Finance titled “HB

LASS Limited Annual Report for the year ended 30 June 2017”

dated 28/11/2017 be received.

B) That the HB LASS Limited Annual Report for the year ended 30 June

2017 be received.

|

Attachments:

|

1

|

HBLASS Annual Report ADOPTED

|

ADM-02-7-17-431

|

Separate Document

|

REPORT TO: Finance

and Monitoring Committee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Hawke's

Bay Regional Sports Park Trust Annual Report to 30 June 2017

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Council about the Hawke’s Bay

Regional Sports Park Trusts (the Trust) full year result to 30 June 2017.

1.2 This

update arises from a requirement detailed in the Funding Agreement between

Council and the Trust.

1.3 The

Trust’s Chief Executive (Jock Mackintosh) will be in attendance at the

meeting.

1.4 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good quality

means infrastructure, services and performance that are efficient and effective

and appropriate to present and anticipated future circumstances.

1.5 The

Trust is responsible for the efficient and cost effective management of

sporting facilities (good quality local infrastructure) located at the Hawkes

Bay Regional Sports Park.

1.6 This report concludes by recommending the Hawke’s Bay Regional

Sports Park Trust annual report to 30 June 2017 be received.

2.0 BACKGROUND

2.1 The

presentation of a annual report by the Trust is a requirement of the Funding

Agreement between Council and the Trust which was updated and executed in

December 2013. The revised Funding Agreement states that the Trust shall

provide to Council as part of its project reporting, annual and six monthly

financial accounts for the Trust. The half year report of the Trust has been

received in accordance with the requirements set down in the Funding Agreement.

2.2 Officers

are working with the Trust to transition from the current funding agreement to

a management agreement.

3.0 CURRENT

SITUATION

3.1 The

presentation of the Trust’s half year report is in accordance with the

funding agreement. Attachment 1 includes the Hawke’s Bay Regional

Sports Park Trusts annual report to 30 June 2017. These accounts show an

operating deficit of $3,169 before depreciation for the year compared to a

budgeted loss of $55,785 and a $146,101 surplus for the same period last year.

3.2 The

Trust’s financial performance was impacted by additional maintenance incurred

when compared to both the budget and the previous year. This was partly related

to the increased use the park enjoyed this year, and partly due to one-off

items such as burst water mains.

3.3 During

the period the Trust received $403,355 in capital grants. These were mainly

applied to the extension of the PAK’nSAVE Hastings Netball Centre (total

cost $497,594).

4.0 OPTIONS

4.1 The Council can receive the Trust’s annual report to 30 June

2017.

5.0 SIGNIFICANCE

AND ENGAGEMENT

5.1 No consultation is required and there is nothing in this report that

triggers any threshold in the significance and engagement policy.

6.0 PREFERRED

OPTION/S AND REASONS

6.1 That Council receive the Trust’s annual report to 30 June 2017.

|

7.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “Hawke's

Bay Regional Sports Park Trust Annual Report to 30 June 2017”

dated 28/11/2017 be received.

B) That the Hawke’s Bay Regional Sports Park Trust Annual

Report to 30 June 2017 be received.

|

Attachments:

|

1

|

Signed Independent Auditors Report Hawkes Bay

Regional Sports Park Trust Financial Statements Year Ended 30 June 2017

|

EXT-10-38-17-204

|

Separate Document

|

1.

REPORT TO: Finance

and Monitoring Committee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Hawke's

Bay Museums Trust Annual Report for the year ended 30 June 2017

1.0 SUMMARY

1.1 The

purpose of this report is to update the Committee on the performance of the

Hawke’s Bay Museums Trust for the year ended 30 June 2017.

1.2 This

request arises from the receipt of the Hawke’s Bay Museums Trust Annual

Report for the year ended 30 June 2017.

1.3 Unfortunately

Dr Grant (Chair of the Hawke’s Bay Museums Trust) is unable to attend

this meeting.

1.4 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances

1.5 The

objective of this decision relevant to the purpose of Local Government is to

meet the needs of current and future communities in providing good quality

public services.

1.6 This

report concludes by recommending that the Hawke’s Bay Museums Trust

Annual Report for the year ended 30 June 2017 be received.

2.0 BACKGROUND

2.1 The

Hawke’s Bay Museums Trust (HBMT) is a Council Controlled Organisation

with 3 of the 5 Trustees appointed by Napier City Council (NCC) and Hastings

District Council (HDC) and with the bulk of its funding provided jointly by

those Councils. The HBMT Board is responsible for a management agreement

between the HBMT and the NCC with the management agreement providing for the

operations of the Museum, Art Gallery and associated activities which are operated

by the NCC.

HBMT has 4 main goals:

1. To protect the regional collection

2. To maintain and enhance the quality of the

collection

3. To maximise access to the collection

4. To further develop the collection

2.2 The

HBMT (Incorporated) is registered as a charitable entity under the Charities

Act 2005.

2.3 The

Board is constituted to have five members appointed as follows:

§ One

appointed by Napier City Council

§ One

appointed by Hastings District Council

§ One

appointed by the Hawke’s Bay Museums Foundation Charitable Trust

§ One

appointed by Ngati Kahungunu Iwi (Incorporated)

§ The

Chairperson who shall be appointed by Napier City Council and Hastings District

Council jointly.

2.4 The

current Trustees are as follows:

|

Director

|

Effective From

|

|

Dr Richard Grant

|

December 2014

|

|

Deputy Mayor Faye White

(Napier)

|

September 2015

|

|

Councillor George Lyons

(Hastings)

|

December 2013

|

|

Johanna Mouat

|

December 2013

|

|

Mike Paku

|

December 2013

|

2.5 Dr Grant was appointed as the Independent Chairman by the joint

appointments committee in late 2014. Council’s Policy on Appointment and

Remuneration of Directors for Council Organisations states that the Independent

Chair be appointed jointly by NCC and HDC and that HDC’s member on this

Appointments Panel be the Mayor Yule or their delegate.

3.0 CURRENT SITUATION

3.1 Attachment

1 is a copy of the Hawke’s Bay Museum Trust’s Annual Report

including signed and audited accounts for the year ended 30 June 2017. Officers

consider this is a very well presented and comprehensive Annual Report.

3.2 Hastings

District Council’s representative on the Trust is Cr George Lyons.

3.3 The

HBMT received grants of $900,850 in aggregate from the NCC and HDC compared to

$897,260 received in the 2016 financial year. The grants cover the

contracted costs to NCC to provide administrative and management services for

the management of the collection. The costs of the regional collection

are met equally by the HDC and NCC with HDC contributing $442,925 in 2017

compared to $441,130 in 2016. HDC also contributes $15,000 as a training grant

to the Trust whereby the NCC training grant offsets expenditure incurred by NCC

on behalf of the Trust.

3.4 The

audited accounts show a net surplus from operating activities for the year

ended 30 June 2017 of $198,689 ($39,384 in 2016). $171,301 of this surplus is

due to the recognition of the value of assets gifted to the Trust, with the

remaining $27,388 surplus coming from normal operations.

3.5 The

Statement of Financial Position reports accumulated funds of $39,902,897 as at

30 June 2017 compared with $45,599,161 as at 30 June 2016. This large

decrease in accumulated funds relates predominately to $5.9m write down in the

carrying values of the collection due to a revaluation. Cash and cash

equivalents were $571,377 compared to $564,873 in 2016.

3.6 The

Annual Report also includes a comparison of the target performance measures

included in the Statement of Intent for the year ended 30 June 2017

against the actual results.

3.7 Generally

the targets set in the Statement of Intent have been met and officers believe

that the Annual Report presented by the Trust details a good financial result.

3.8 The

KPI’s that haven’t been met include the fading (damage) of 10

photo’s that have been on long term display, and the number of

stakeholder meetings held. Where targets have not been achieved

explanations have been provided and officers are satisfied with the response.

3.9 The

HBMT owns, protects, and makes available the collection of art, local history,

Maori and ethnographic objects. The primary place of display and storage of the

collection is at the MTG Hawkes Bay, while overflow storage is housed at the

Rothmans Building in Napier. This offsite storage has been a long standing

issue as it is expensive and not ideal for storing historical artefacts (lack

of climate control).

With NCC’s council and library

buildings being recently deemed an earthquake risk, it is proposed that the

library be relocated to part of the MTG building. This area of the MTG

currently displays the HBMT’s archives, and as a result the archives will

need to relocated to the Rothmans building.

HDC is awaiting a formal proposal from NCC

for a long term solution for the physical storage of the collection, and what

the cost of this solution might be.

4.0 SIGNIFICANCE AND

CONSULTATION

4.1 The

issues for discussion are not significant in terms of the Council's policy on

significance and engagement and no consultation is required.

|

5.0 Recommendations

and Reasons

A) That

the report of the Manager Strategic Finance

titled “Hawke's

Bay Museums Trust Annual Report for the year ended 30 June 2017” dated 28/11/2017 be received.

B) That the Hawke's Bay Museums Trust

Annual Report for the year ended 30 June 2017 be received.

|

Attachments:

|

1

|

HB Museums Trust Annual Report for the year ended 30

June 2017

|

EXT-10-11-3-17-155

|

Separate Document

|

REPORT TO: Finance

and Monitoring Committee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: New

Zealand Local Government Funding Agency Limited - Annual Report for the year

ended 30 June 2017

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Committee of the financial results of

New Zealand Local Government Funding Agency Limited (LGFA) for the year ended

30 June 2017.

1.2 This issue arises from the receipt of the annual report for the 12

months ended 30 June 2017 from the LGFA.

1.3 The Council is required to give effect to

the purpose of local government as prescribed by Section 10 of the Local

Government Act 2002. That purpose is to meet the current and future needs of

communities for good quality local infrastructure, local public services, and

performance of regulatory functions in a way that is most cost–effective

for households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.4 This

report concludes by recommending New Zealand Local Government Funding Agency

Limited Annual Report for the year ended 30 June 2017 be received.

2.0 BACKGROUND

2.1 The

LGFA was established on 1 December 2011 with 18 Local Government shareholders

and the Crown. Hastings District Council became a shareholder with a

shareholding investment of $400,000 (1.8%). The LGFA is a Council Controlled

Organisation.

2.2 During

2012 12 new shareholders joined the LGFA as part of the second opening with

Council selling down some shares to the 12 new shareholders. This reduced

HDC’s shareholding to $373,196 (1.77%).

3.0 CURRENT

SITUATION

3.1 Attachment

1 is a copy of the 2016/17 Annual Report for the 12 months ended 30 June

2017.

3.2 The

Annual Report is very comprehensive and the results reflect another strong year

for LGFA and operations from 1 July 2016 to 30 June 2017. The annual report

includes the following:

- Chairman’s Report

- Governance Structure

- Statement of Service Performance

- Financial Statements

- Directors’ Declaration

- Audit Report

- Other Disclosures

- Directory

3.3 The

LGFA has continued to build on the solid base that has been established. They

have highlighted the following developments over the past year:

· Strong financial and operational performance – 15.3% increase

in interest income ($320.7m : 2017) and 15.7% increase in net operating profit

($11.05m : 2017)

· Issued $1.285b of bonds over the year

· LGFA added 3 new member Councils during the year (53 Councils in

total)

3.4 During

2016/17 LGFA issued $1.285 billion with a weighted average on maturity of 8

years. As at 30 June 2017 the level of bonds on issue was $7.855 billion with

$265 million outstanding in their longest dated maturity (April 2033). The LGFA

continues to provide savings in borrowing costs for councils relative to other

sources of borrowing (Auckland and Dunedin Councils are paying between 12 and

22 basis points more when borrowing externally than the LGFA equivalent

offerings).

3.5 In

April 2017, LGFA commenced issuance of a 16 year bond (April 2033). The

previous longest dated bond was April 2027. This, along with the bespoke

lending introduced last year, now allows Councils to borrow for periods

anywhere from 30 days to 16 years in length.

3.6 LGFA

bonds continue to be popular with investors with an average of 2.96 bids per

bond being offered during 2016/17 (there were nine tenders during this

year).

3.7 The

Statement of Comprehensive Income reports a net operating profit of $11.05m

compared to a profit of $9.55m in 2015/16. The 2016/17 profit of $11.05m was

ahead of its 2016/17 Statement of Intent target primarily due to councils

taking advantage of the unusually low interest rates and refinancing their

December 2017 loan maturities early and investing the money on deposit until

the repayment date.

3.8 The

Statement of Service Performance sets out progress on the achievement of its

primary objectives, additional objectives and actual performance against its

performance targets. The commentary is very good and the majority of

performance targets were achieved. Officers are of the opinion that the

LGFA’s performance continues to be very successful; creating a more

efficient and diversified funding market for Councils to participate in.

3.9 LGFA

has achieved its key financial results for the year to 30 June 2017 and these

are set out in the table below:

|

In $ million

|

30 June 2017 Actual

|

Statement of Intent Forecast

|

|

Total Net Income (net of

borrower notes)

|

17.51

|

16.58

|

|

Issuance and operating

expenses

|

(6.46)

|

(6.58)

|

|

Net Profit

|

$11.05

|

$10.00

|

3.10 The

key performance targets are set out in the table below including an explanation

of any material variances:

|

Current performance targets

|

Target

|

Result

|

Outcome

|

|

Average cost of funds relative to NZ Govt Stock

|

<0.50%

|

0.709%

|

No (i)

|

|

Average base on-lending margin above LGFA’s

cost of funds

|

<0.10%

|

0.104%

|

No (i)

|

|

Annualised operating overheads (excluding AIL (ii))

|

<$4.80 million

|

$4.67 million

|

Yes

|

|

Lending to participating councils

|

>$7,341 million

|

$7,736 million

|

Yes

|

(i) The

average cost of borrowings and margins are determined by the length of the

borrowings the Councils choose to request. The longer dated debt comes at a

higher cost of borrowing and higher margin due to higher level of risk

(uncertainty) factored into the pricing by the investors on lending the money.

(ii) AIL

– Approved Issuer Levy

3.11 LGFA

have declared a $1.39 million dividend for the year ended 30 June 2017. This

equates to a dividend payment to Council of $20,750.

4.0 SIGNIFICANCE

AND CONSULTATION

4.1 The issues for discussion are not significant in terms of the

Council's policy on significance and engagement and no consultation is

required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “New

Zealand Local Government Funding Agency Limited - Annual Report for the year

ended 30 June 2017” dated 28/11/2017 be received.

B) That the New Zealand Local Government Funding

Agency Limited Annual Report for the 12 months ended 30 June 2017 be

received.

|

Attachments:

|

1

|

LGFA Annual Report for the year ended 30 June 2017

|

FIN-15-5-17-650

|

Separate Document

|

REPORT TO: Finance

and Monitoring Committee

MEETING DATE: Tuesday 28

November 2017

FROM: Financial Controller

Aaron

Wilson

SUBJECT: Financial

Quarterly Report for the three months ended 30 September 2017

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Committee of the financial result for

the three months ended 30 September 2017.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This report concludes by recommending that the report for the 3

Months ended 30 September 2017 be received.

2.0 BACKGROUND

2.1 The accounting operating financial result is reported on quarterly

during the year and at year end a report is prepared on the financial as well

as the rating result. The rating result differs from the accounting

result in respect of non-cash items such as depreciation, vested assets and

development contributions that are not included.

2.2 This financial report is governance focussed and

allows significant variances to be highlighted with explanations provided in a

way this is easy to read and understand through dashboard analytics and

commentary.

2.3 If Councillors require

clarification on any points, please contact the writer prior to the meeting to ensure complete

answers can be given at the meeting on the detail in these reports.

3.0 CURRENT

SITUATION

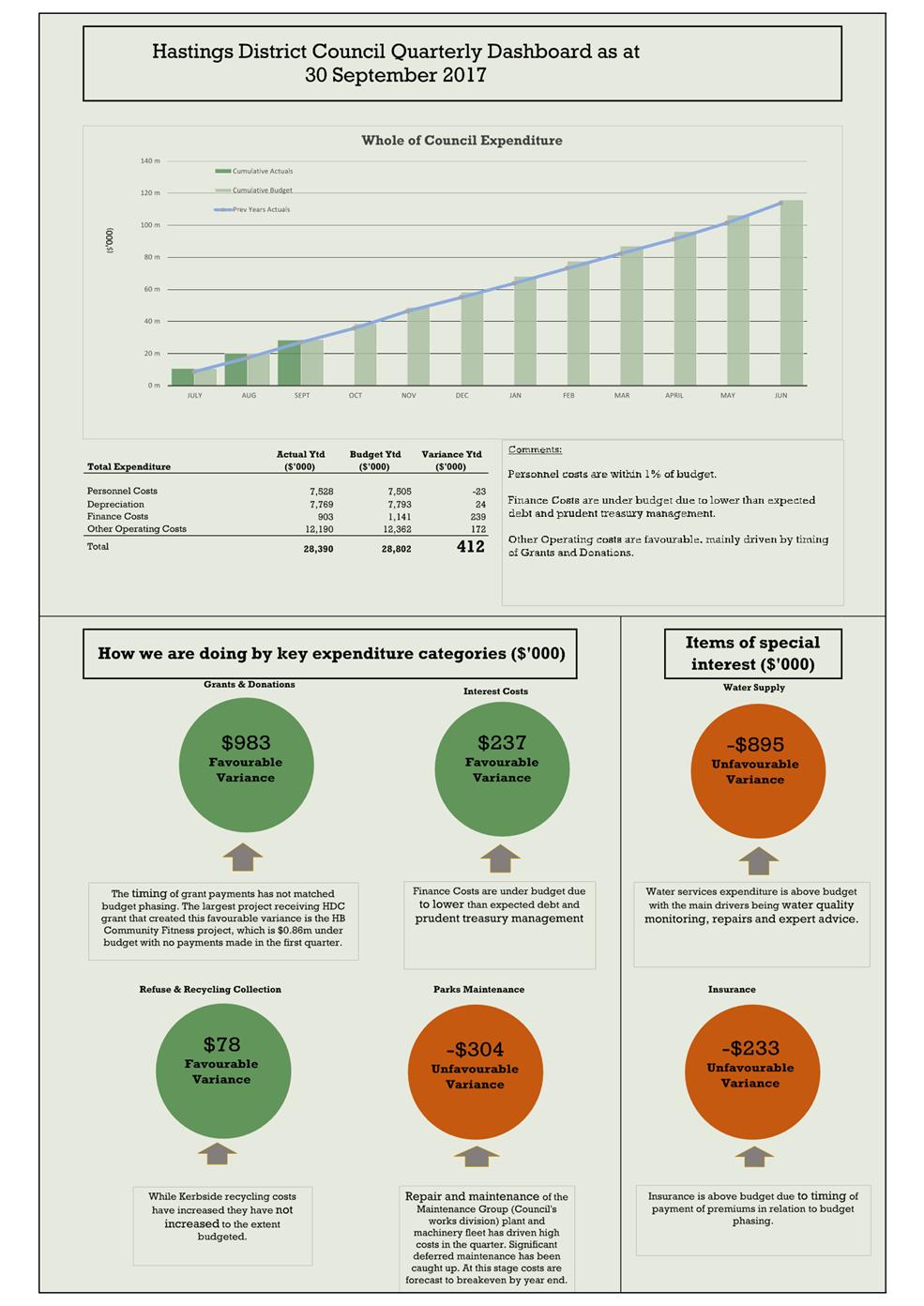

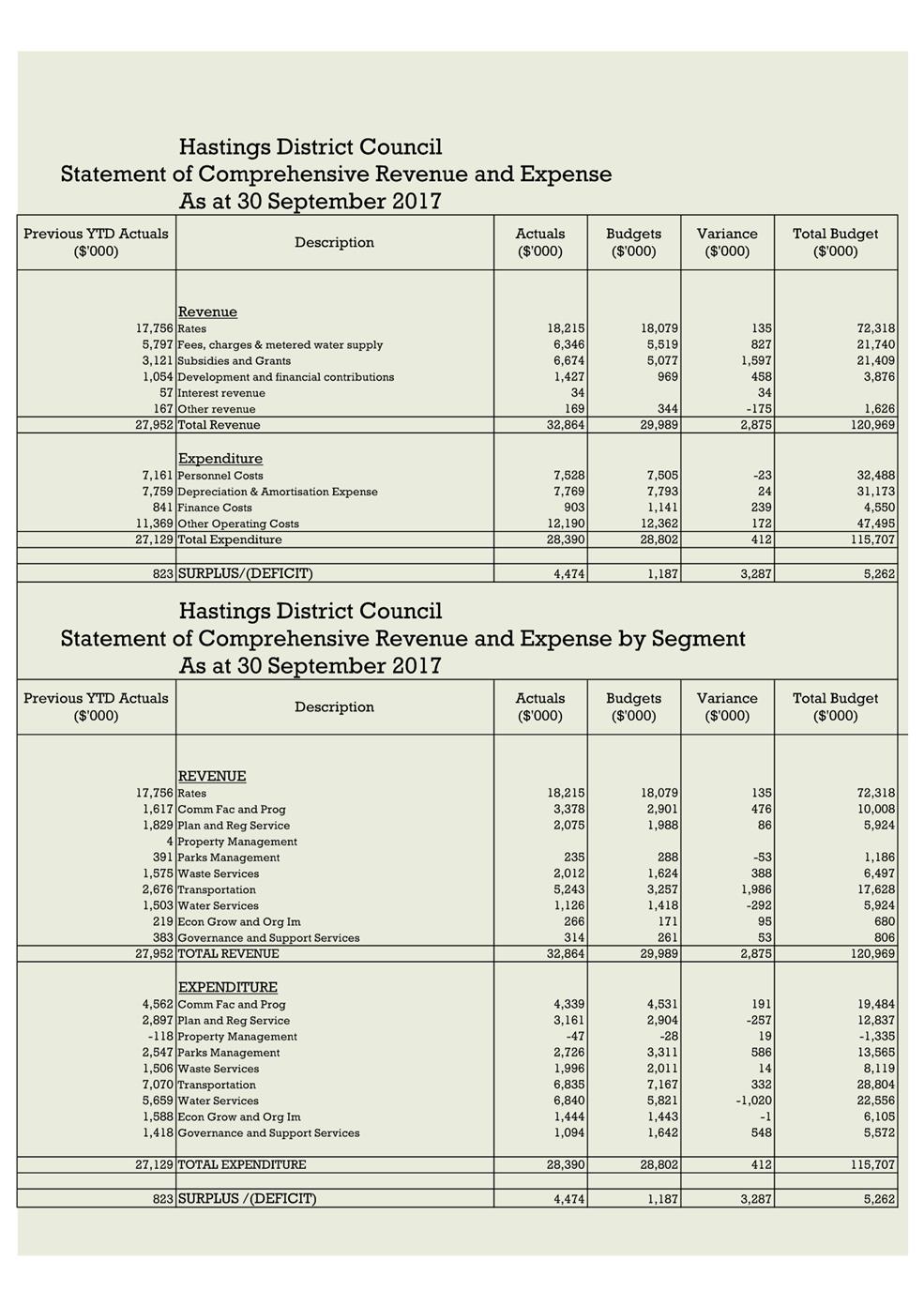

3.1 Set out below is a summary of the operating financial result year to

date. The financial results detailed below represent the accounting view

and does not reflect the potential rating result for 2017/18:

|

|

$’000

|

$’000

|

$’000

|

Full Year

Revised Budget*

|

|

2017/18

|

YTD Actual

|

YTD Revised Budget

|

YTD Variance

|

|

Operating

Revenue

|

32,864

|

29,989

|

2,875

|

120,969

|

|

Operating

Expenditure

|

28,390

|

28,802

|

412

|

115,707

|

|

Net

Surplus/(Deficit)

|

4,474

|

1,187

|

3,287

|

5,262

|

* Revised budget

includes the Annual budget, Brought Forwards and surplus allocations from 16/17

financial year

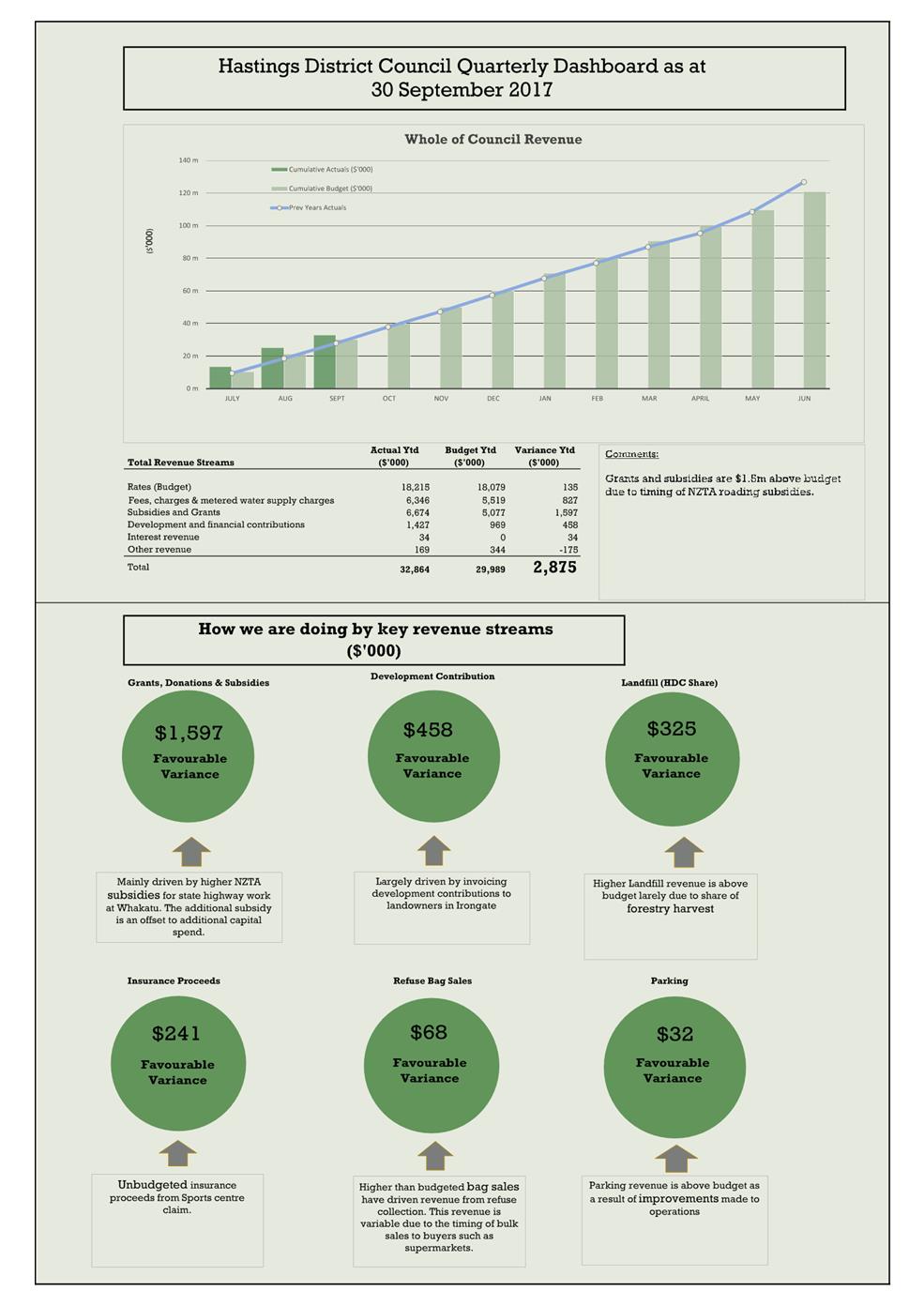

3.2 The result above is presented against the revised budget. The revised

budget includes changes and decisions made during the year on Council budgets

which for the first quarter relates to the inclusion of carry forwards and

allocations of the 2016/17 rating surplus.

3.3 Council’s overall financial

performance is $3.28m ahead of YTD budget for the quarter

ended 30 September 2017. Financial performance for the quarter is

positive. Revenue is above budget and expenditure is under budget. As it is

early in the financial year and it is difficult to identify definitive trends.

3.4 Overall revenue is $2.87m

ahead of YTD budget and expenditure is $412,000 under YTD budget.

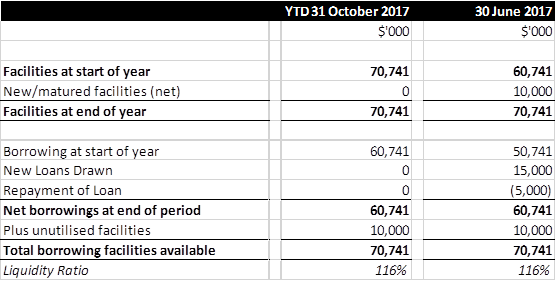

Revenue

3.5 Subsidies, grants and donations

are above YTD budget by $1.59m with the main driver being the 100% subsidies received for the Whakatu

Arterial roundabout. This additional revenue is offsetting the capital

cost for this part of the project.

3.6 Fees and charges revenue across

Council are favourable by $827,000 with the main drivers being:

· Community Facilities & Programme fees and charges are $299,045 favourable and is mainly driven by an

insurance payout to the Hastings Sports Centre of $228,249. In addition

Crematorium & Cemetery revenue is up by $34,085, along with higher than

budgeted swimming pool revenue of $33,825.

· Asset management fees and charges are favourable by $300,223.

This is driven by higher than budgeted revenues at the Landfill and relates

primarily to the final payment being received of $280,000 for the harvesting of

the forestry block.

3.7 Development contributions are

favourable to YTD budget by $458,000, largely driven by landowners in Irongate

being invoiced.

3.8 Overall revenue has performed well

in the first quarter with many of the revenue lines reflective of the increased activity within the region. There

are no areas of concern across Council’s business activities.

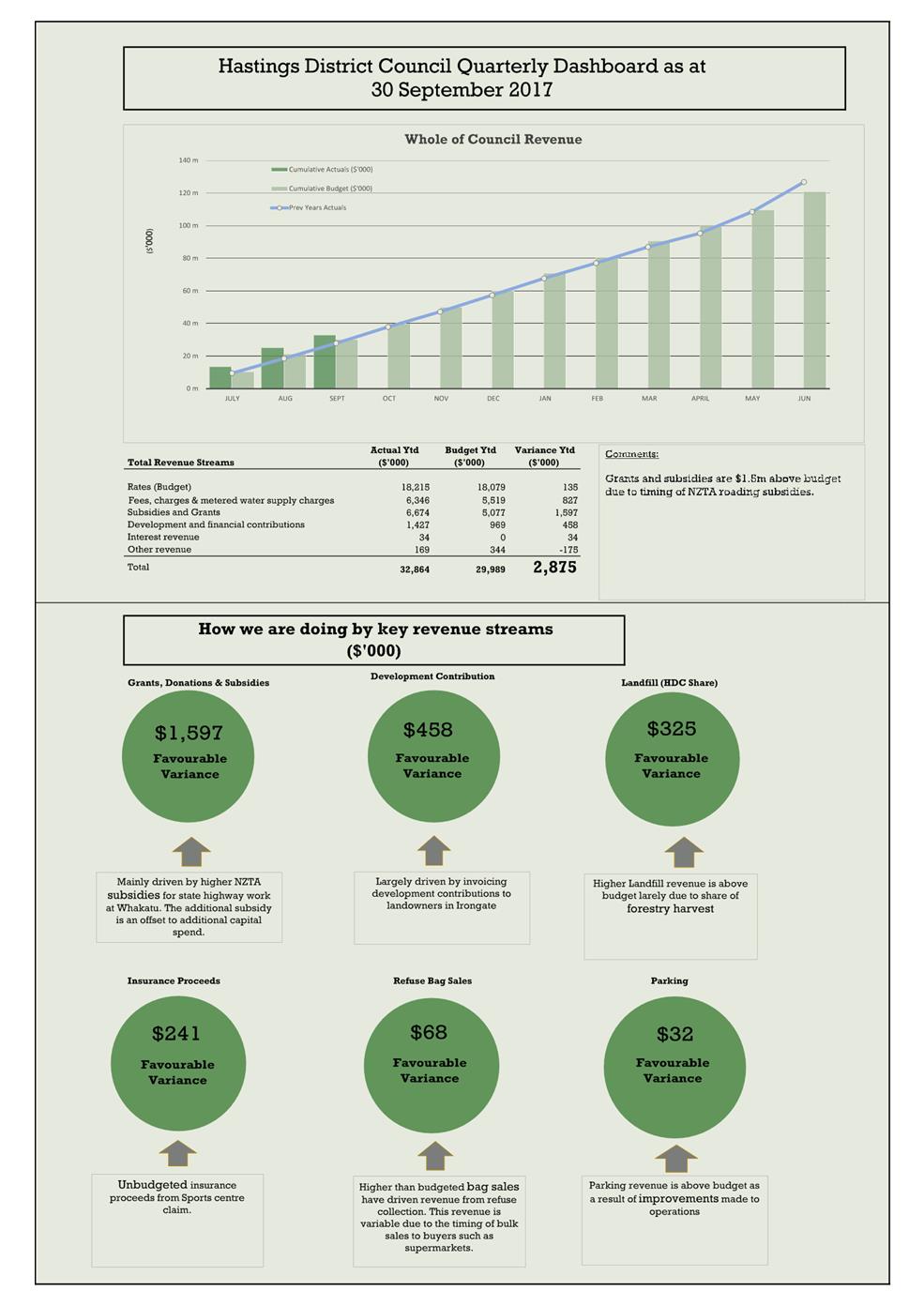

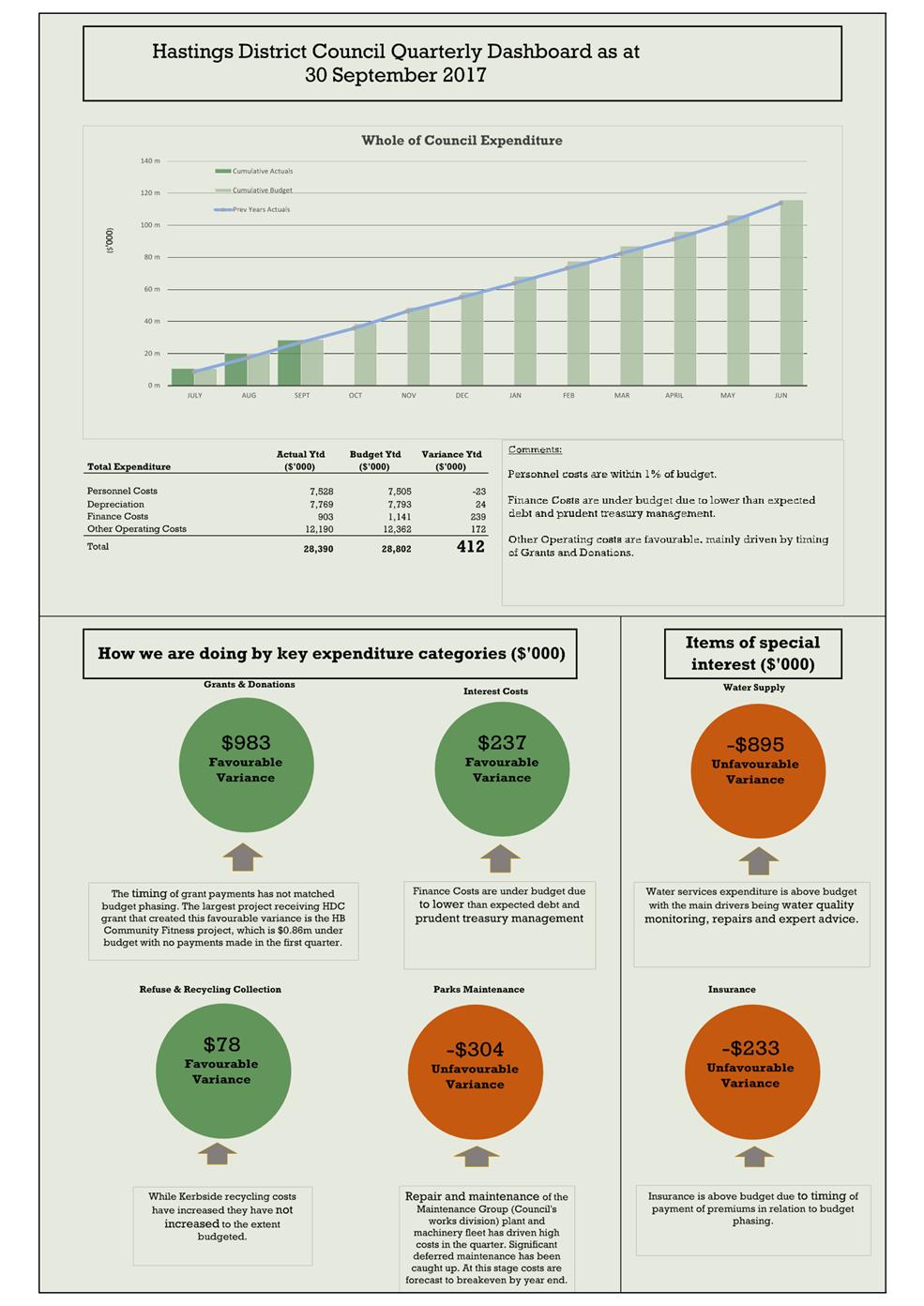

Expenditure

3.9 Overall expenditure is

tracking below budget to 30 September 2017 by $412,000 or 1.4% of total

budgeted expenditure year to date.

3.10 Council continues to

spend significant sums of money on water supply activity including both Capital

and Operational expenditure. This activity is funded by

way of a separate water account which is designed to either accumulate reserves

or run in deficit depending on expenditure needs and Council decision making.

This allows Council to spread the impact of “lumpy” expenditure in

this activity.

3.11 Given the planned large scale expenditure on

water supply, Council in the 2017/18 Annual Plan, provided for the water

account to run in deficit for a number of years to come. This approach

will be continued in the 2018 – 2028 Long Term Plan.

3.12 The current year’s budget was based on

expenditure and activity levels forecast in February 2017. Operational requirements

and the overall capital investment forecast have increased since that time as

operational and project requirements have been planned in detail and become

better understood. Greater public awareness of water leaks has led to

increased demand on maintenance services, while water quality testing,

monitoring and chlorination requirements have also been higher than initially

forecast. This is leading to budgeted variances. It is not possible

to defer most of the work driving these costs.

3.13 These variances will affect the yearend

balance of the water account. However, work is being done through the

Long Term Plan to ensure that the account comes back into a surplus position in

an appropriate time frame.

3.14 Areas in Council that are favourable due to

timing, include, capital grants not yet paid out, ($807,000, HB Community

Fitness Centre Trust) along with lower spends in Transport due to lower expert

advice and depreciation ($331,000).

3.15 Management are continuing to tightly manage

all areas of expenditure within Council. There is a strong efficiency culture

throughout Council.

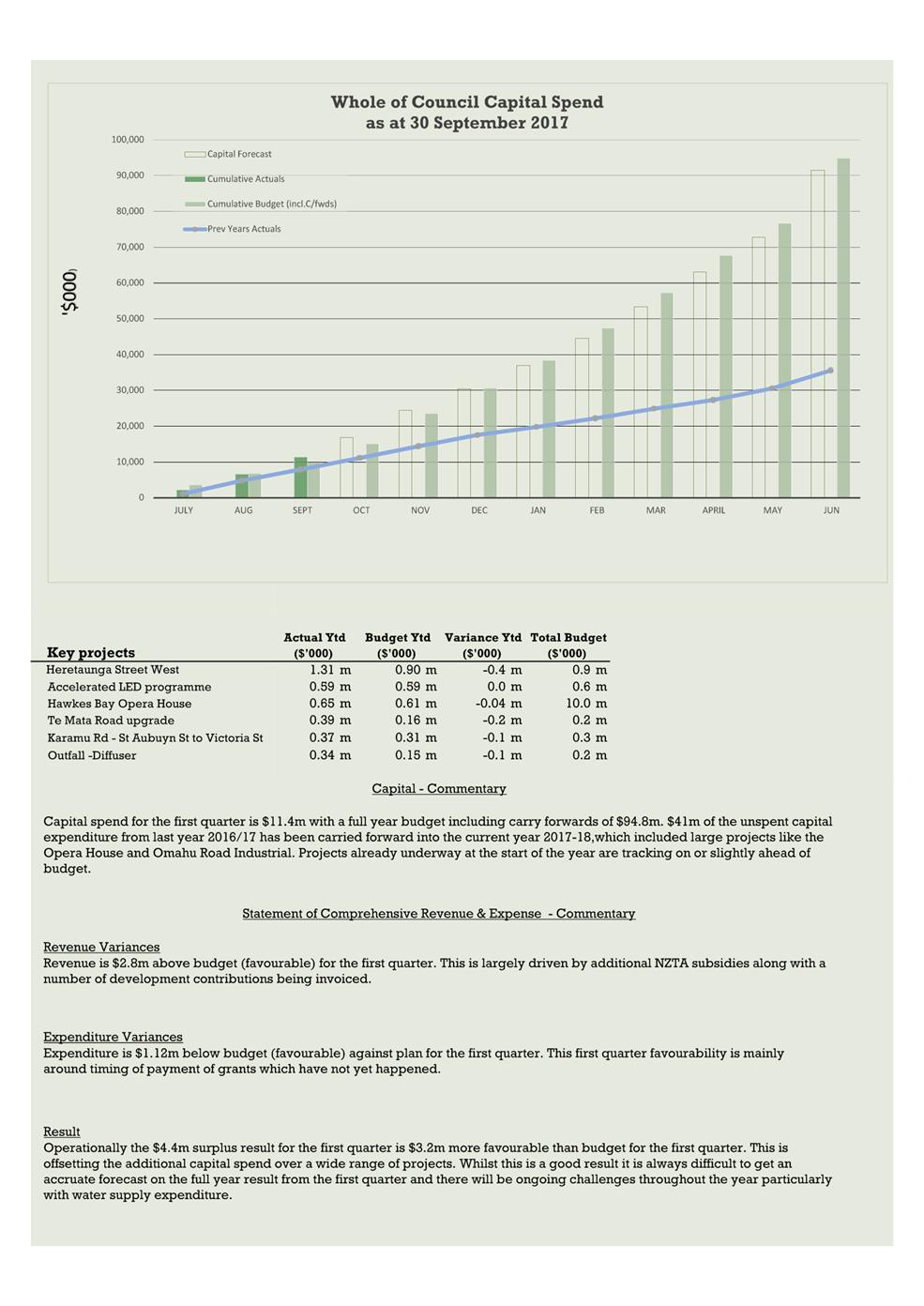

Capital Spend

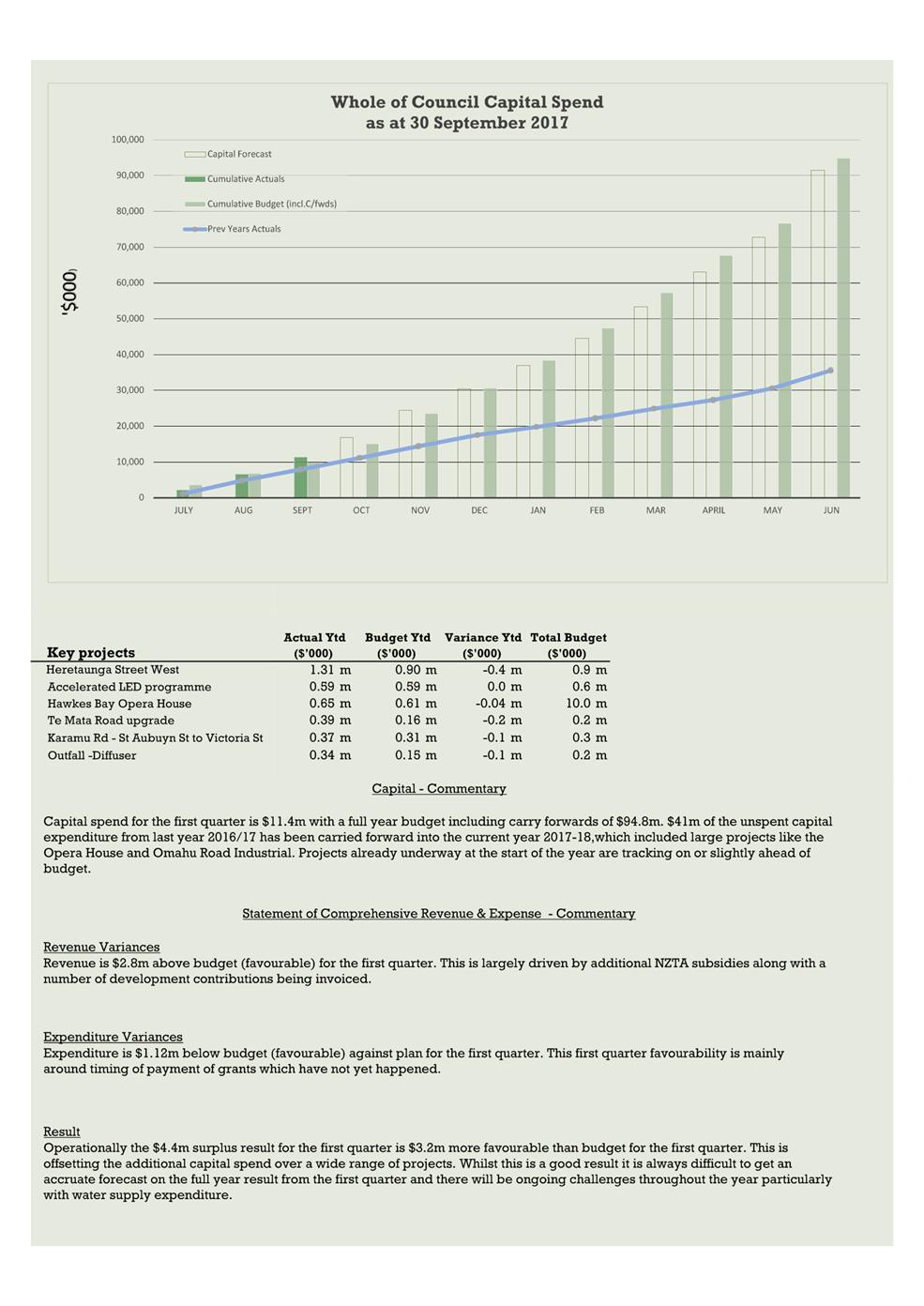

3.16 Council’s

total capital budget (including carry forwards, renewals, new works, and growth

projects) for 2017/18 is $94.8m. Capital spend year to date is ahead of

budget at this early stage of the year, due to projects being already underway

at the beginning of the year.

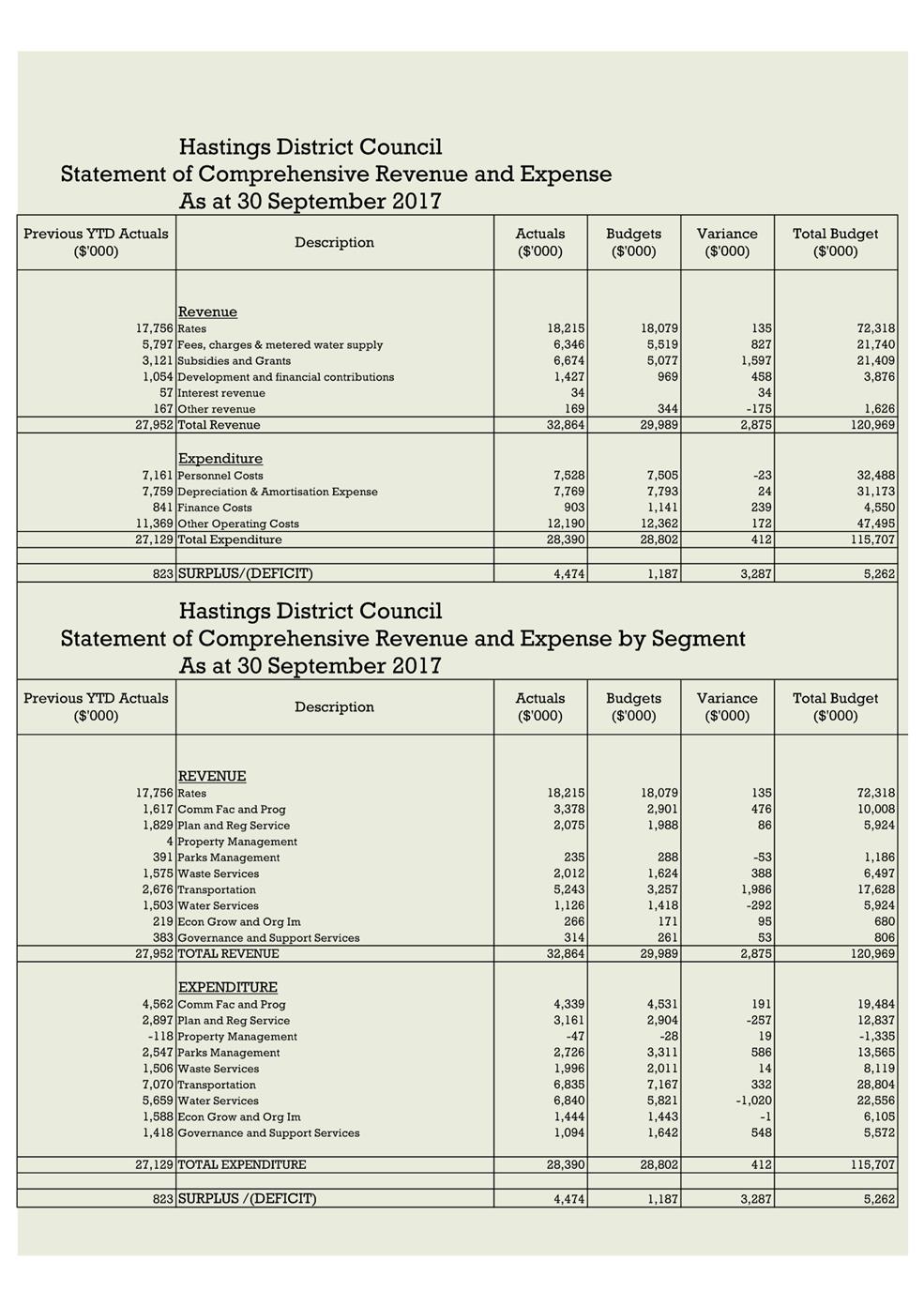

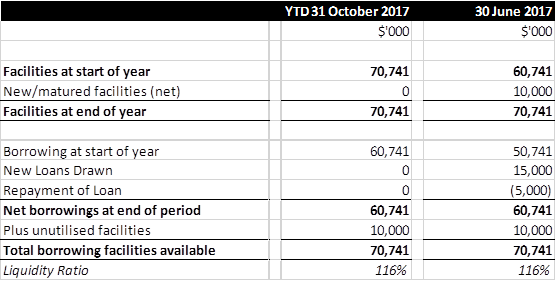

Treasury

3.17 Total net borrowing as at the end of

September 2017 is $60.7m with committed borrowing facilities of $70.7m,

providing headroom of $10m. The liquidity ratio is at 116% compared to the

policy minimum of 110%.

3.18 The following table sets out Council’s

overall compliance with the Treasury Management Policy as at 30 September 2017:

|

Measure

|

Compliance

|

Actual

|

Minimum

|

Maximum

|

|

Liquidity

|

ü

|

116%

|

110%

|

170%

|

|

Fixed debt

|

ü

|

95%

|

55%

|

95%

|

|

Funding profile:

0 – 3 years

3 – 5 years

5 years +

|

ü

ü

ü

|

42%

28%

29%

|

10%

20%

10%

|

50%

60%

60%

|

3.19 Council is currently compliant with Treasury

Management Policy. The Risk and Audit subcommittee is responsible for

setting the Council’s policy in conjunction with Price Waterhouse Coopers

(PWC). Officers manage Council’s treasury policy and report to the

subcommittee bi-monthly.

3.20 Current debt forecasts predict debt at 30

June 2018 to be between $80m and $85m with major capital projects well

underway.

4.0 SIGNIFICANCE AND CONSULTATION

4.1 This

report does not raise any issues that are significant in terms of the Councils

Significance Policy that would require consultation.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Financial Controller titled “Financial

Quarterly Report for the three months ended 30 September 2017”

dated 28/11/2017 be received.

|

Attachments:

|

1

|

Quarterly Report to 30 September 2017

|

CG-14-27-00029

|

|

|

Quarterly Report to 30 September 2017

|

Attachment 1

|

|

Trim File No.: CG-14-2-00053

|

Agenda Item: 11

|

HASTINGS DISTRICT COUNCIL

Finance and Monitoring

Committee MEETING

Tuesday, 28 November 2017

RECOMMENDATION TO EXCLUDE THE PUBLIC

SECTION 48, LOCAL GOVERNMENT OFFICIAL INFORMATION AND

MEETINGS ACT 1987

THAT the public now be excluded from the

following part of the meeting, namely:

12. Hawke's

Bay Museums Trust - Chairperson Appointment

The general

subject of the matter to be considered while the public is excluded, the reason

for passing this Resolution in relation to the matter and the specific grounds

under Section 48 (1) of the Local Government Official Information and Meetings

Act 1987 for the passing of this Resolution is as follows:

|

GENERAL SUBJECT OF EACH MATTER TO BE CONSIDERED

|

REASON FOR PASSING THIS RESOLUTION IN RELATION TO

EACH MATTER, AND

PARTICULAR INTERESTS PROTECTED

|

GROUND(S) UNDER SECTION 48(1) FOR THE PASSING OF EACH

RESOLUTION

|

|

|

|

|

|

12. Hawke's

Bay Museums Trust - Chairperson Appointment

|

Section 7 (2)

(a)

The withholding

of the information is necessary to protect the privacy of natural persons,

including that of a deceased person.

For individual's

privacy protection.

|

Section

48(1)(a)(i)

Where the Local

Authority is named or specified in the First Schedule to this Act under

Section 6 or 7 (except Section 7(2)(f)(i)) of this Act.

|

Hastings District

Council

Hastings District

Council