Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Risk and Audit Subcommittee MEETING

|

Meeting Date:

|

Tuesday,

28 November 2017

|

|

Time:

|

9.00am

|

|

Venue:

|

Council

Chamber

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Subcommittee Members

|

Chair: Mr J

Nichols

Acting Mayor Hazlehurst

Acting Deputy Mayor Nixon

Councillors

Kerr and Travers

(Quorum=3)

|

|

Officer

Responsible

|

Chief Financial Officer, Bruce Allan

|

|

Committee

Secretary

|

Christine Hilton (Ext 5633)

|

Risk and Audit Subcommittee – Terms of Reference

A subcommittee of

the Finance and Monitoring Committee

Fields of

Activity

The Risk and Audit Subcommittee is responsible for

assisting Council in its general overview of financial management, risk

management and internal control systems that provide:

·

Effective management of

potential risks, opportunities and adverse effects; and

·

Reasonable assurance as to

the integrity and reliability of the financial reporting of Council; and

·

Monitoring of the Council’s

requirements under the Treasury Policy

Membership

Chairman

appointed by the Council

The Mayor

Deputy Mayor

2

Councillors

An

independent member appointed by the Council.

Quorum – 3 members

DELEGATED

POWERS

Authority to consider and make recommendations on all matters detailed

in the Fields of Activity and such other matters referred to it by the Council

or the Finance and Monitoring Committee

The

subcommittee reports to the Finance and Monitoring Committee.

HASTINGS DISTRICT COUNCIL

Risk and Audit Subcommittee MEETING

Tuesday, 28 November 2017

|

VENUE:

|

Council Chamber

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

9.00am

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the Chief Executive or Executive Advisor/Manager:

Office of the Chief Executive (preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Risk and Audit Subcommittee Meeting held Monday 4 September 2017.

(Previously circulated)

4. Health and Safety

Risk Management Update 5

5. Treasury Activity

and Funding 9

6. Annual Review of

Treasury Management Policy and Treasury Performance 19

7. Strategic Risk

Management Update 23

8. Audit Report for

the Financial Year ended 30 June 2017 45

9. General Update

Report and Status of Actions 55

10. Internal Audit Update 59

11. Water Services 63

12. Additional

Business Items

13. Extraordinary

Business Items

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Health and Safety Advisor

Jennie

Kuzman

SUBJECT: Health

and Safety Risk Management Update

1.0 SUMMARY

1.1 The

purpose of this report is to provide an update to the subcommittee in regards

to the management of Health and Safety risks within Council.

1.2 This

issue arises due to the Health and Safety at Work Act 2015 and the requirement

of that legislation for Elected Members to exercise due diligence to ensure

that Council complies with its Health and Safety duties and obligations.

2.0 BACKGROUND

2.1 At

its June 2016 meeting, Council accepted the recommendations from the Audit and

Risk Subcommittee in relation to Health and Safety reporting. The

recommendations were:

2.2

Monthly reporting in the form of a ‘high level dashboard report’ to

Council

2.3

Quarterly reporting at a more detailed level to Council and

2.4

Quarterly reporting on Health and Safety risk management to the Audit and Risk

Subcommittee.

2.5 This

report serves as a quarterly report to the Risk and Audit Subcommittee on

Health and Safety risk management.

3.0 CURRENT

SITUATION

3.1 Health

and Safety Risk Management

3.2 As

previously reported to the Audit and Risk subcommittee during the September

2017 meeting, the 12 critical Health and Safety Risks are currently being

analysed by officers using “Bow Tie” risk evaluation methodology.

3.3 “Bow

Tie” is a risk evaluation method which allows development of a diagram to

effectively communicate how critical risks should be managed. A Bow Tie diagram

is able to give an overview of multiple plausible scenarios and how they can be

prevented and mitigated in a single diagram.

3.4 Officers

are currently working through a procurement process to acquire software for

specific use in Bow Tie analysis, it is expected that this process will be

completed within the next month.

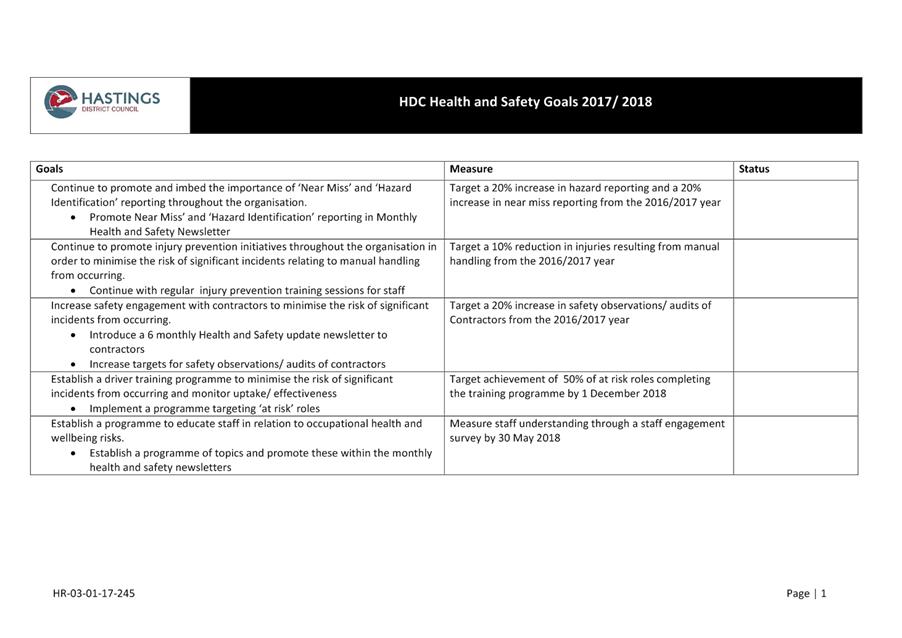

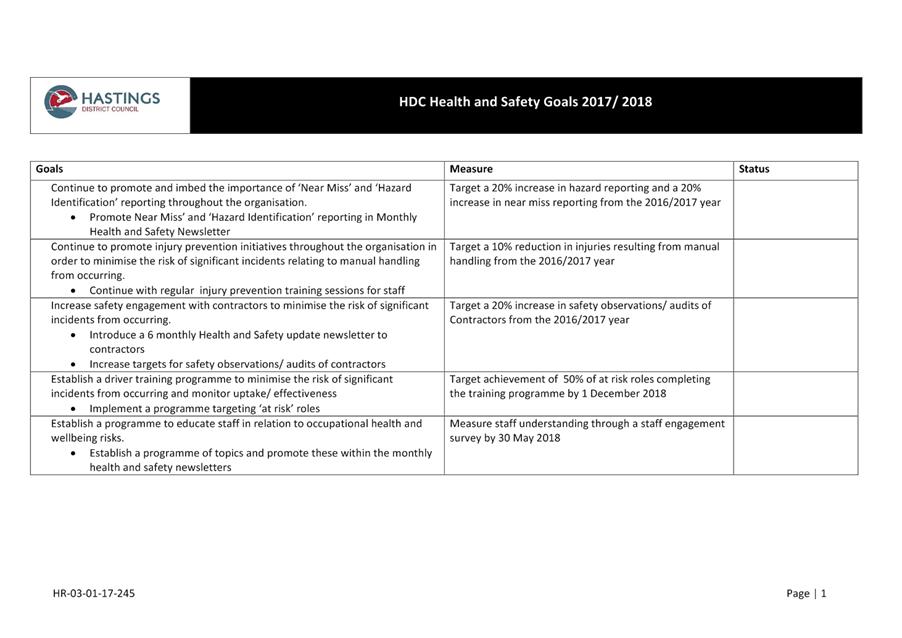

3.5 2017/18

Organisational Health and Safety Goals and Objectives

3.6 Health

and Safety goals and objectives for the 2017/18 year have been developed and

approved by the Leadership Management Team for implementation across Council.

3.7 These

objectives are listed below and set out in more detail in attachment 1.

· Continue to promote and imbed the importance of ‘Near

Miss’ and ‘Hazard Identification’ reporting throughout the

organisation.

· Continue to promote injury prevention initiatives throughout the

organisation in order to minimise the risk of significant incidents relating to

manual handling from occurring.

· Increase safety engagement with contractors to minimise the risk of

significant incidents from occurring.

· Establish a driver training programme to minimise the risk of

significant incidents from occurring and monitor uptake/ effectiveness

· Establish a programme to educate staff in relation to occupational

health and wellbeing risks.

3.8 Progress

towards completion of these goals and objectives will be provided to Council as

a part of the Quarterly Health and Safety Report

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report does not trigger Council’s Significance and Engagement Policy and

no consultation is required.

|

5.0 RECOMMENDATIONS AND

REASONS

A) That

the report of the Health and Safety Advisor titled “Health

and Safety Risk Management Update” dated 28/11/2017

be received.

|

Attachments:

|

1

|

Organisation Health and Safety Goals and Objectives

2017- 2018

|

HR-03-01-17-245

|

|

|

Human Resources (NO PERSONAL

INFORMATION) - Health and Safety - General - Organisation Health and Safety

Goals and Objectives 2017- 2018

|

Attachment 1

|

1.

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Treasury

Activity and Funding

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on treasury activity and

funding issues.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost effective to households and businesses. Good quality

infrastructure means infrastructure, services and performance that are

efficient and effective and appropriate to present and anticipated future

requirements.

1.3 This

report concludes by recommending that the report on treasury activity and

funding is received.

2.0 BACKGROUND

2.1 The

Hastings District Council has a Treasury Policy which forms part of the 2015-25

Long Term Plan and a Treasury Management Policy. Under these policy documents

responsibility for monitoring treasury activity is delegated to the Risk and

Audit Subcommittee.

2.2 Council

is provided with independent treasury advice by Stuart Henderson of

PricewaterhouseCoopers and receives weekly and monthly updates on market

conditions.

2.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in depth treasury reporting is provided for the Risk and Audit

Subcommittee.

3.0 CURRENT SITUATION

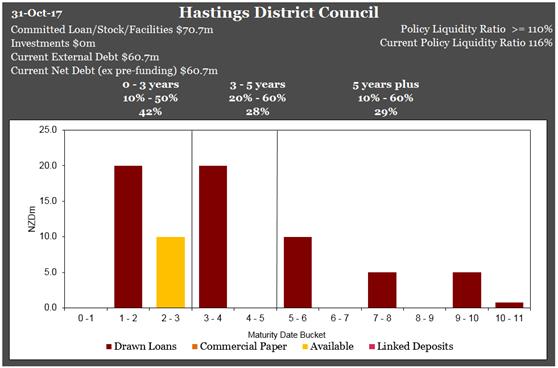

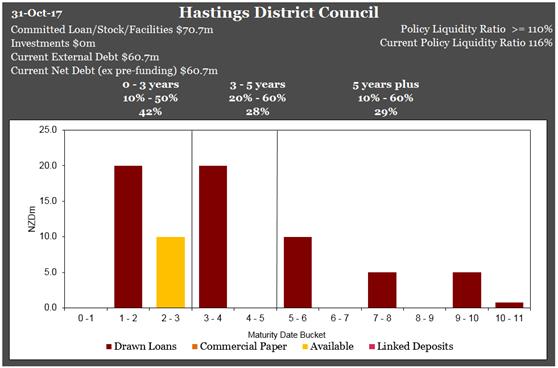

3.1 Council’s

debt portfolio is managed within the macro limits set out in the Treasury

Policy. It is recognised that from time to time Council may fall out of policy

due to timing issues as debt moves closer to maturity and shifts from one time

band to another. The treasury policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

3.2 The

following table sets out Council’s overall compliance with Treasury

Management Policy as at 31 October 2017:

|

Measure

|

Compliance

|

Actual

|

Minimum

|

Maximum

|

|

Liquidity

|

ü

|

116%

|

110%

|

170%

|

|

Fixed debt

|

ü

|

95%

|

55%

|

95%

|

|

Funding profile:

0 – 3 years

3 – 5 years

5 years +

|

ü

ü

ü

|

42%

28%

29%

|

10%

20%

10%

|

50%

60%

60%

|

Council is currently compliant with

Treasury Management Policy.

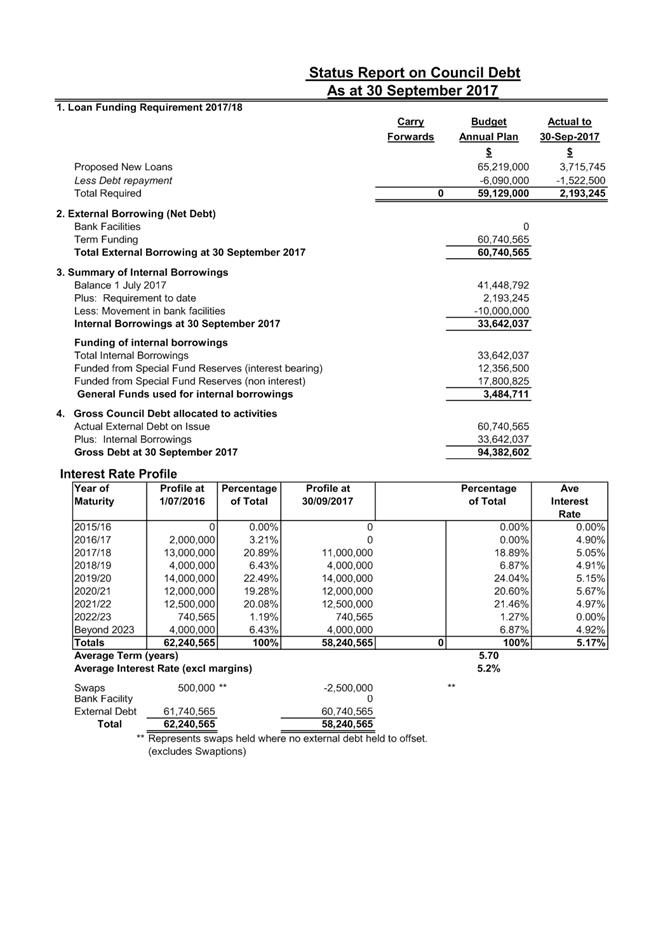

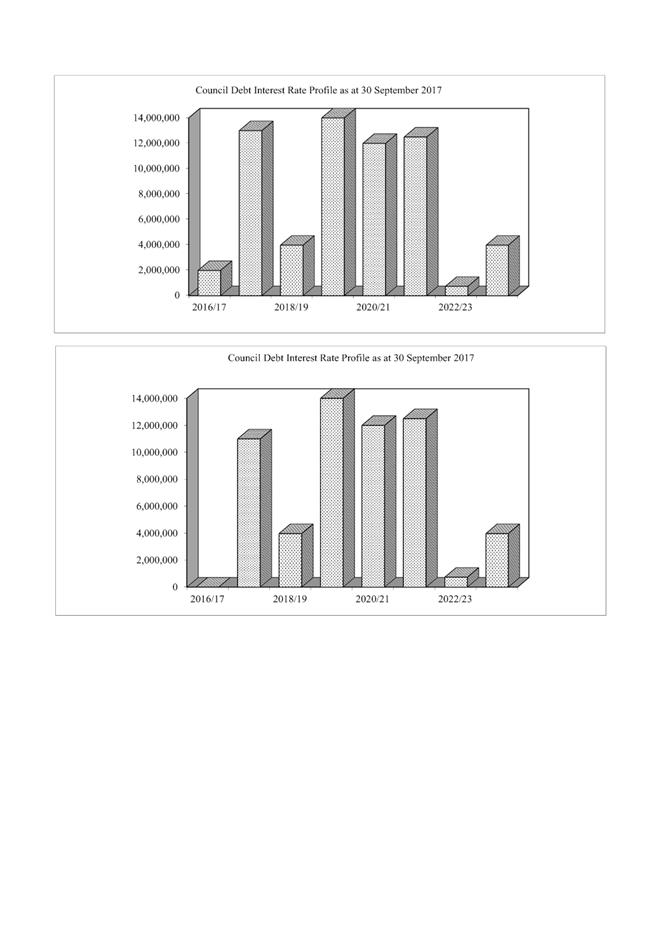

3.3 The

current total core net external debt is $60.7m as at 31 October 2017. This is

supported by the Debt Status Report as at 31 October 2017 (Attachment 1).

Core external debt remains unchanged from the August report.

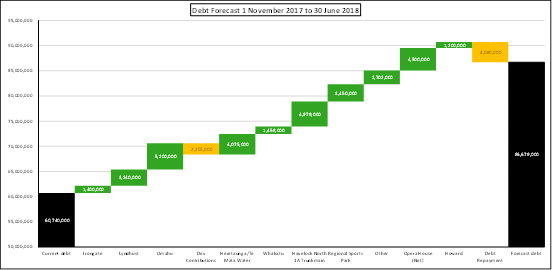

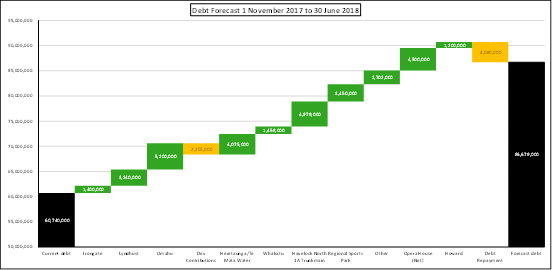

3.4 The

chart below shows the key drivers of the expected movement in borrowings over

the next year. This is based on projects that have started already, or are highly

likely to commence before 30 June 2018 and indicates a forecast debt position

of $86.7m.

The chart identifies the major projects

underway, however the smaller renewal projects have been aggregated into the

“Other” heading.

3.5 The

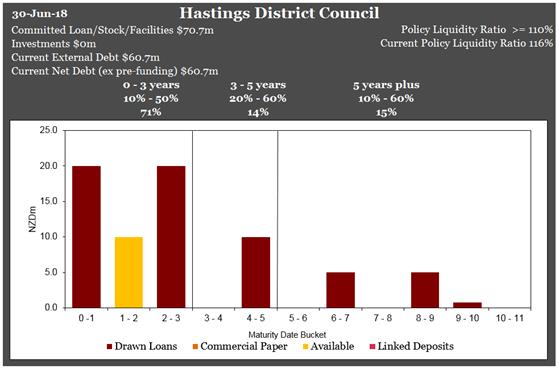

graph below shows the Council’s position for funding risk with $60.7

million of financing facilities as at 31 October 2017. Officers are working

towards getting an external credit rating from S&P Global Ratings by March

2018. There may be a need for additional facilities before then and the Local

Government Funding Agency (LGFA) short term lending facilities are an efficient

and cost effective option until the credit rating is in place. This will allow

the Officers to convert this short term debt to longer term debt at a later

date making use of the discounted interest a credit rating attracts. The

current liquidity ratio of 116% within the policy band of 110% - 170%.

Council’s current debt profile is within policy, with good treasury

management practices in place.

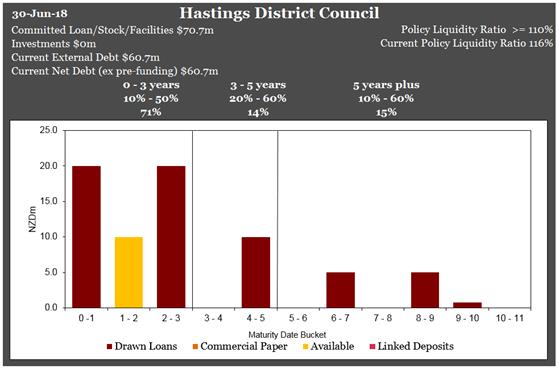

3.6 While

the Council is currently in policy, if it doesn’t borrow any further

funds before the 30th June 2018, the two existing LGFA loans with

LGFA of $20m each with end dates of March 2019 and May 2021 will both fall into

the 0-3 year profile pushing Council out of policy. Officers are

currently working with PWC to develop a plan to stay within policy which will

include any new debt being longer dated, and extending the maturity of the

Westpac seasonal loan facility beyond year three.

3.7 Officers

are currently working with PWC on reviewing its interest rate strategy. Since

the September meeting the Council has entered into two new forward start swaps

with ASB Bank:

|

Notional

(NZ$m)

|

Start

Date

|

Maturity

Date

|

Interest

Rate

|

|

3.00

|

21-Jan-20

|

21-Jan-25

|

3.365%

|

|

3.00

|

26-Oct-20

|

26-Oct-25

|

3.205%

|

3.8 This

is below the PWC recommended target level of 3.75% for retail swaps in the 5 to

10 year length.

3.9 The

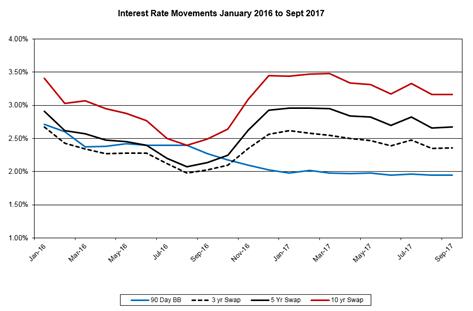

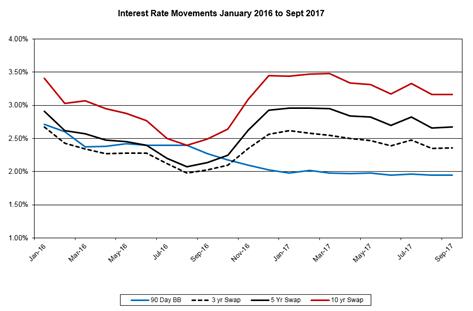

graph above shows what wholesale 10 year swap rates over the past 18 months.

While the Reserve Bank has indicated that it doesn’t plan to increase the

OCR rate until 2019 at the earliest, recent upwards movements in the swap rates

have been driven by the markets expectation that the US Federal Reserve will

start hiking their US Treasury Bond rates from December 2017 and from the

coalition uncertainties in NZ. The NZ elections (October 2017) have caused less

of a reaction in the market place than the protracted US elections that were

held a year earlier.

3.10 PWC

has also recommended further forward swaps with a 12 year maturity at levels

below the current market rate. Officers have placed leave orders in the market

that will only be actioned if the market takes another dip in rates and these

rates are struck.

|

Notional

(NZ$m)

|

Start

Date

|

Maturity

Date

|

Proposed

Leave Order Rate

|

|

2.00

|

20-Jun-24

|

20-Jun-29

|

3.70%

|

|

3.00

|

25-Aug-24

|

25-Aug-29

|

3.70%

|

|

5.00

|

19-Oct-24

|

19-Jul-29

|

3.70%

|

|

3.00

|

15-Sep-20

|

15-Mar-29

|

3.40%

|

3.11 Officers

are actively managing the interest rate and funding risk and currently there is

adequate interest rate cover in place based on the projected funding

requirements.

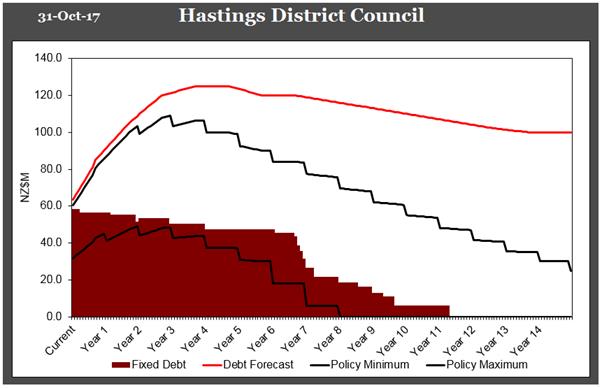

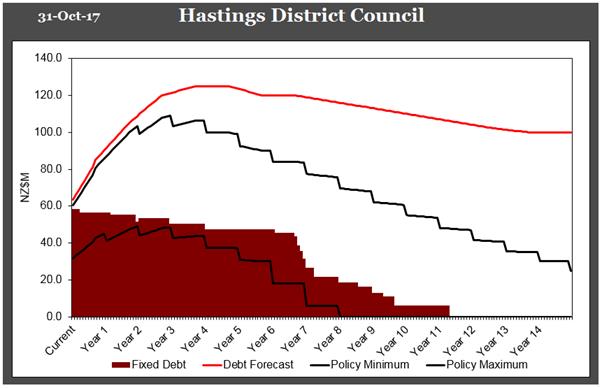

3.12 The following graph shows Council’s fixed debt is within the

policy minimum and policy maximum set out in Council’s Treasury

Management Policy. This graph also incorporates Council’s current

forecast debt over the long term. The projected external debt requirement for

the next 12 months is forecast to increase which will provide Council with the

opportunity to take advantage of funding longer term debt at historically low

levels of interest.

Fig:

Interest Swap Profile

Officers are currently working on the

draft LTP for 2018-28 which will give a better forward view of the expected

debt profile over the next 10 years. The first cut of this (which included the

full capex wish list from Council Officers) had debt breaching the forecast

shown above. This wish list is currently being refined and prioritised and the

final list should be firmed up by early 2018, which will give a more accurate

debt profile.

3.13 Any

new debt will be considered along with Council’s working capital

requirements and liquidity ratios.

4.0 MARKET COMMENTARY

4.1 The Reserve Bank of New Zealand (RBNZ) has held the Official Cash

Rate at 1.75% on 9 November 2017. The RBNZ stated;

Global economic growth continues to

improve, although inflation and wage outcomes remain subdued. Commodity prices

are relatively stable. Bond yields and credit spreads remain low and equity

prices are near record levels. Monetary policy remains easy in the advanced

economies but is gradually becoming less stimulatory.

The exchange rate has eased since the

August Statement and, if sustained, will increase tradables inflation and

promote more balanced growth.

GDP in the June quarter grew broadly in

line with expectations, following relative weakness in the previous two

quarters. Employment growth has been strong and GDP growth is projected to

strengthen, with a weaker outlook for housing and construction offset by

accommodative monetary policy, the continued high terms of trade, and increased

fiscal stimulus.

The Bank has incorporated preliminary

estimates of the impact of new government policies in four areas: new

government spending; the KiwiBuild programme; tighter visa requirements; and

increases in the minimum wage. The impact of these policies remains very

uncertain.

House price inflation has moderated due

to loan-to-value ratio restrictions, affordability constraints, reduced foreign

demand, and a tightening in credit conditions. Low house price inflation is

expected to continue, reinforced by new government policies on housing.

Annual CPI inflation was 1.9 percent in

September although underlying inflation remains subdued. Non-tradables

inflation is moderate but expected to increase gradually as capacity pressures

increase. Tradables inflation has increased due to the lower New Zealand dollar

and higher oil prices, but is expected to soften in line with projected low

global inflation. Overall, CPI inflation is projected to remain near the

midpoint of the target range and longer-term inflation expectations are well

anchored at 2 percent.

Monetary policy will remain

accommodative for a considerable period. Numerous uncertainties remain and

policy may need to adjust accordingly.

4.2 The

graph below shows how the NZ interest rate curve has moved over the past 21

months.

The PWC Treasury Advisory Team believe

that both short-term (although not till after mid 2018) and long-term interest

rates could move higher due to additional inflation caused by increased

government election spending promises, lower NZ dollar exchange rates causing

more expensive imports, and a lower immigration policy combined with higher

minimum wage rates leading to higher wages expectations. This may cause the Reserve

Bank to raise the OCR earlier than originally thought.

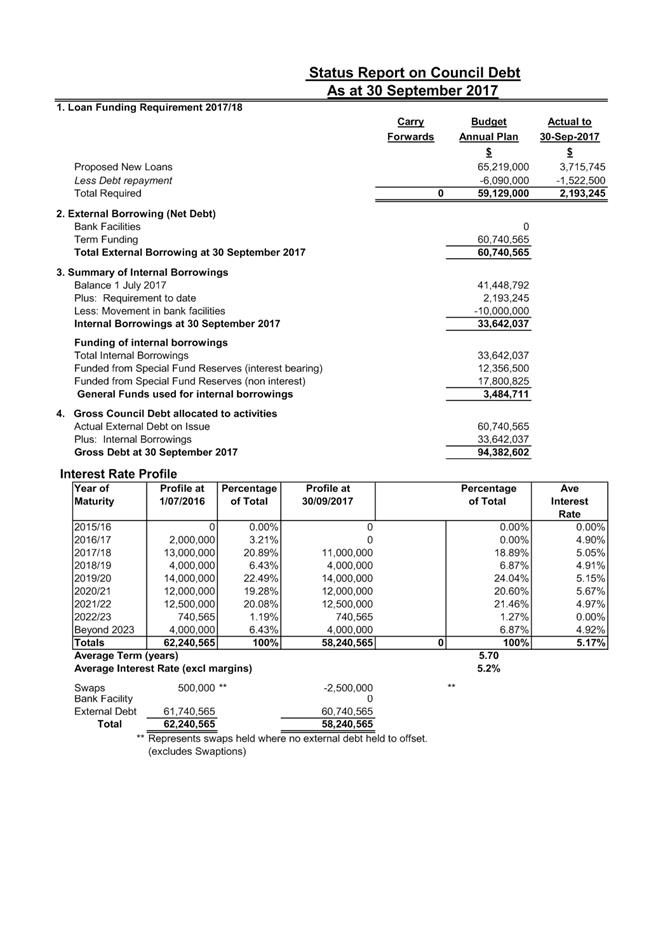

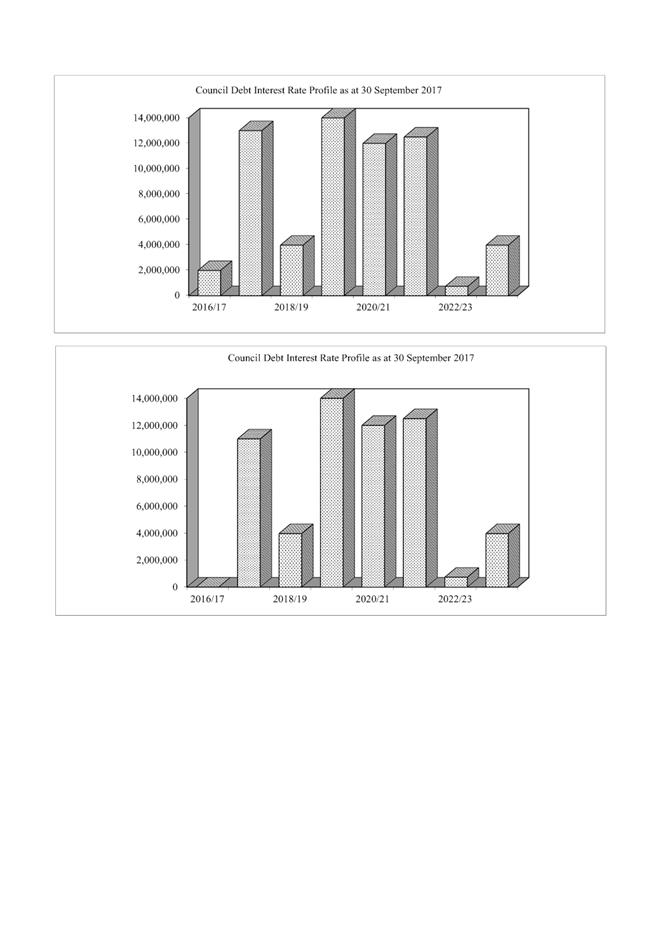

5.0 FUNDING FACILITIES

5.1 Attachment

1 shows details of Council’s current debt facilities together with

details of expiry dates and margins.

5.2 Council’s

liquidity ratio of 116% at 31 October 2017 (based on net external debt of

$60.7m and total debt facilities of $70.7m) is within policy (policy 110% -

170%). Officers are comfortable with this ratio because of continued

uncertainty on debt forecasts and the ability to increase debt from the LGFA at

relatively short notice.

|

6.0 Recommendations

That the

report of the Manager Strategic Finance titled

Treasury Activity and Funding dated 28/11/2017 be received.

|

Attachments:

|

1

|

Public Debt Status 30 September 2017

|

CG-14-25-00022

|

|

|

Public Debt Status 30 September 2017

|

Attachment 1

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent Chamberlain

Business Analyst

Cambell

Thorsen

SUBJECT: Annual

Review of Treasury Management Policy and Treasury Performance

1.0 SUMMARY

1.1 The purpose of this report is to update the Subcommittee on the

outcome of the annual review of the Treasury Management Policy and Treasury

Performance.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This report concludes by recommending the Annual Review of Treasury

Management Policy and Treasury Performance be received and that the

Subcommittee recommend to the Finance and Monitoring Committee changes to the

Treasury Management Policy.

2.0 BACKGROUND

2.1 The Treasury Management Policy requires that an annual review be

conducted which includes a review of Treasury Performance as set in Section 6

of the Treasury Management Policy.

3.0 CURRENT

SITUATION

3.1 In

accordance with Council’s Treasury Management Policy, an annual review of

the Treasury Policy has been conducted in conjunction with Stuart Henderson of

PricewaterhouseCoopers New Zealand (PwC), Council’s Independent Treasury

Advisor. The proposed amendments are marked up as Attachment 2.

3.2 Stuart

Henderson has provided a covering letter setting out the key observations and

recommendations made as part of the Treasury Review assignment. A copy of this

covering letter has been included as Attachment 1.

3.3 One

of the considerations that the Subcommittee had asked Officers to consider when

reviewing the existing policy was the fact that historically debt forecasts

have never been hit due to delays in capital work being undertaken. Officers

took advice from PwC on this matter and suggested to them that the interest

rate cover be calculated on 80% of future debt forecasts, rather than the

historical 100%.

3.4 PwC’s

recommendation was that this should be corrected through more robust forecasts

rather than interest rate risk policies. It was their recommendation that short

term debt forecasts should have a higher degree of accuracy, and that the

longer term interest rate cover thresholds already have reducing percentages of

cover reflecting the increasing uncertainly of debt forecasts the further out

you go.

3.5 Review of Treasury Management Performance

3.6 Council

takes a prudent approach to financial management including the management of

its interest rate risk. Council enters into long term swaps to manage its

interest risk over a long period. As a consequence of the current low interest

rate environment swap rates have reduced but these are not expected to remain.

Council’s interest rate risk management policy takes a long term view

protecting Council from interest rate volatility and providing Council with a

high degree of certainty in interest rates.

3.7 Interest

Costs versus Budget.

3.8 Interest

costs continue to track significantly below budget as a consequence of debt

levels being below budget, active treasury management and continuing historic

interest rate lows.

3.9 Bank

and Lender Service Provision.

3.10 Attached as Attachment

3 are details of bank and lender service provisions including the

share of interest rate cover held and debt facilities.

3.11 As at 30 June 2017

Council had $70.741m of funding facilities in place. Council has funded $60m of

its debt through the Local Government Funding Agency (LGFA). Bank facilities of

$10m are undrawn. The LGFA continues to provide Council with longer term

borrowing options at very competitive rates.

3.12 Council has $57.5m of

interest rate swap cover in place as at 31 October 2017, and a further $64.5m

of interest rate swaps with forward starts.

3.13 Overall Treasury

performance continues to be dominated by the continued historical lows in base

interest rates and swap rates.

3.14 The Council’s

External Auditors have not made any comments or recommendations on the treasury

function including internal controls, accounting treatment and reporting.

3.15 Clause 6.2 Management of Debt and Interest Rate Risk - Composite

Benchmark Indicator Rate - Micro Benchmark –

3.16 This measures the

actual weighted average interest rate for the financial year against the micro

benchmark inclusive of bank margins. The Micro benchmark is based on a

risk neutral position within existing policy. In essence it is measuring

management’s performance in managing within the existing policy.

The Composite Benchmark is calculated as follows:

|

Composite Benchmark Indicator Rate

|

|

Weighting

|

Rate

|

|

20%

|

Average 90-day bank bill bid-rate for the reporting

month

|

|

16%

|

5 year interest rate swap bid-rate, 1 year ago

|

|

16%

|

5 year interest rate swap bid-rate, 2 years ago

|

|

16%

|

5 year interest rate swap bid-rate, 3 years ago

|

|

16%

|

5 year interest rate swap bid-rate, 4 years ago

|

|

16%

|

5 year interest rate swap bid-rate, 5 years ago

|

3.17 The weighted average

interest rate for the year ended 30 June 2017 was 5.0% compared to the micro

benchmark indicator of 3.15%. The reason for the difference of 1.85%

between the actual position and the micro benchmark position is that long term

swap rates are at historical lows and that the majority of the swaps were

entered into in a period when swap rates were significantly higher. In

addition the weighted average interest expense also includes the fixed costs of

unused financing facilities which are a cost of maintaining liquidity. Attached

as Attachment 4 is a graph showing the micro benchmark indicator

compared Council’s cost of funds from 2012 to 2017. We would expect

that the micro benchmark would move closer to the weighted average cost of debt

as the 5 year swap rate increases and as the Reserve Bank lift the Official

Cash Rate (OCR).

3.18 Officers continue to

take opportunities as appropriate to take forward start swaps to take advantage

of the current favourable market conditions.

|

4.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “Annual

Review of Treasury Management Policy and Treasury Performance”

dated 28/11/2017 be received.

B) That

the Risk and Audit Subcommittee recommend that Council approve changes

to the Treasury Management Policy included in Attachment 2.

|

Attachments:

|

1

|

Hastings District Council Policy review cover letter

November 2017

|

PMD-02-06-03-17-34

|

Separate Doc

|

|

2

|

Treasury Management Policy November 2017 - marked up

version

|

PMD-02-06-03-17-33

|

Separate Doc

|

|

3

|

Bank Lender Service Provision as at 31 October 2017

|

FIN-15-5-17-656

|

Separate Doc

|

|

4

|

Micro Benchmark Indicator from 2012-2017

|

FIN-15-5-17-657

|

Separate Doc

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Quality Assurance and Business Services

Manager

Regan Smith

District Customer Services Manager

Greg

Brittin

SUBJECT: Strategic

Risk Management Update

1.0 SUMMARY

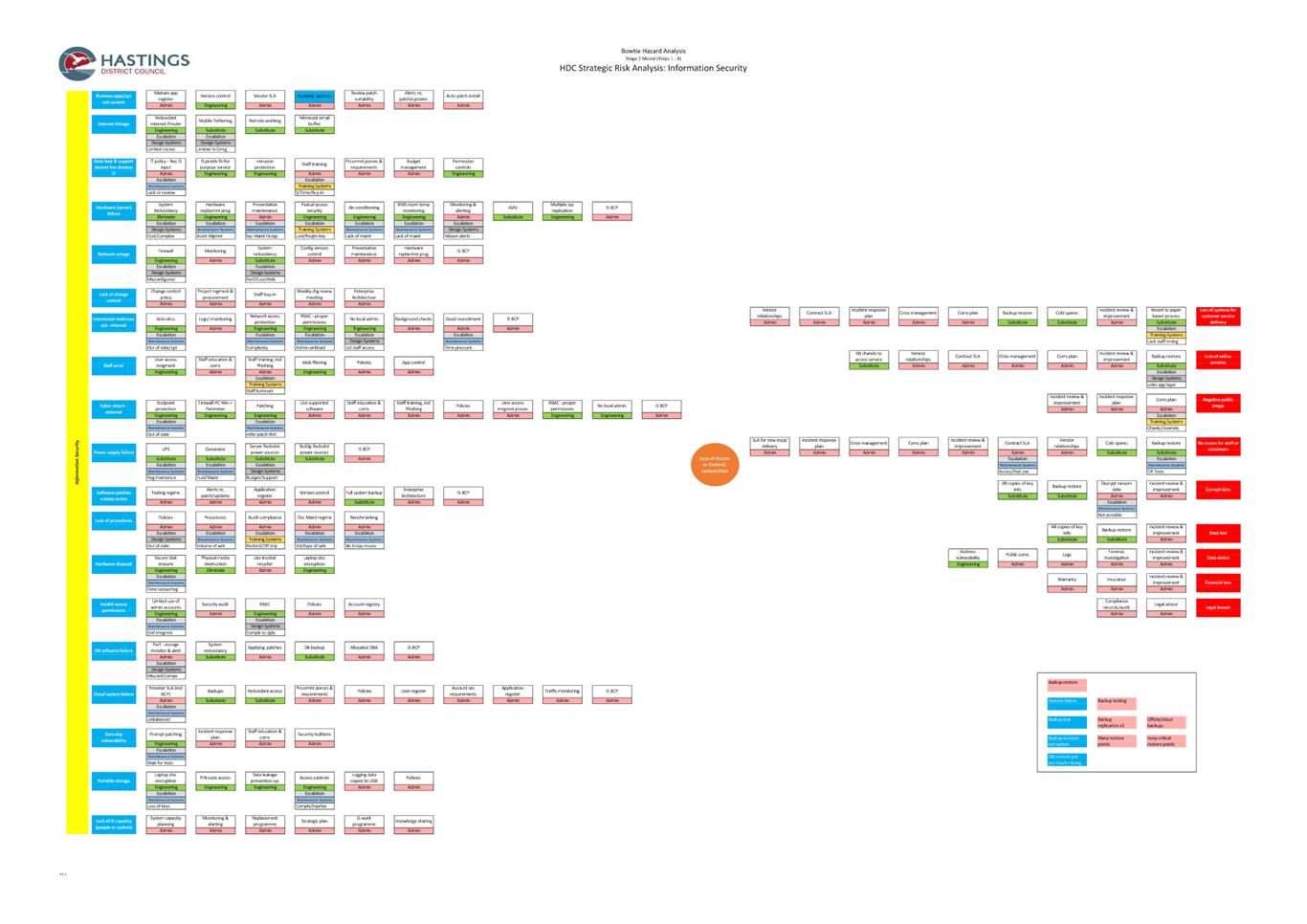

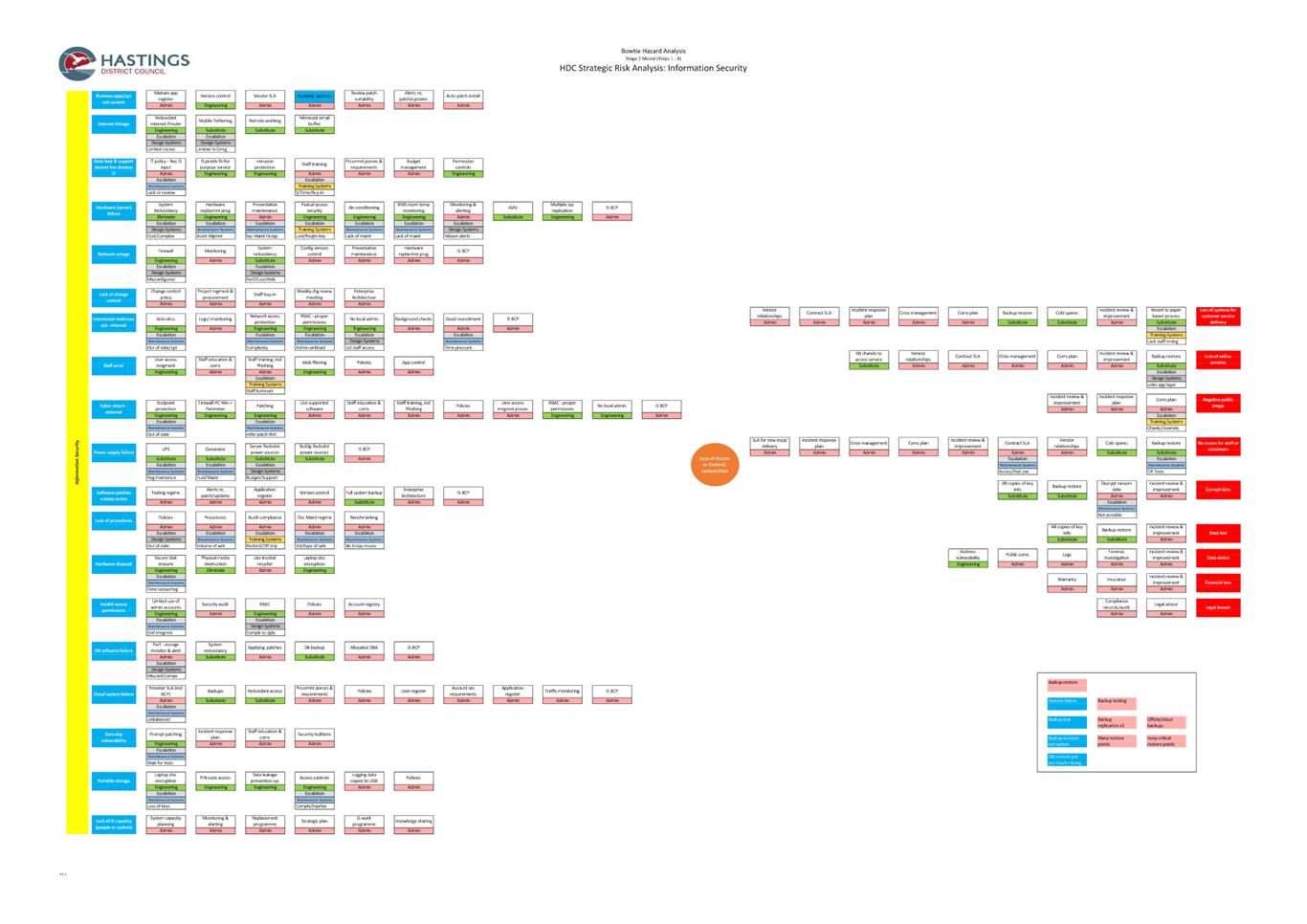

1.1 The purpose of this report is to update the Subcommittee on progress

made on analysis of the strategic risks adopted by Council and to present stage

1 Bow Tie analysis for; Infrastructure Service Failure

(Risk #4), Ineffective Regulatory Oversight (Risk #5), Demographic change (Risk

#7) and Information Security Failure (Risk #8).

1.2 This

issue arises from adoption of the Strategic Risk Register by Council.

The Council is

required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the

current and future needs of communities for good quality local infrastructure,

local public services, and performance of regulatory functions in a way that is

most cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.3 This

report concludes by recommending that the report be received and further

analysis of the critical controls be undertaken.

2.0 BACKGROUND

2.1 The

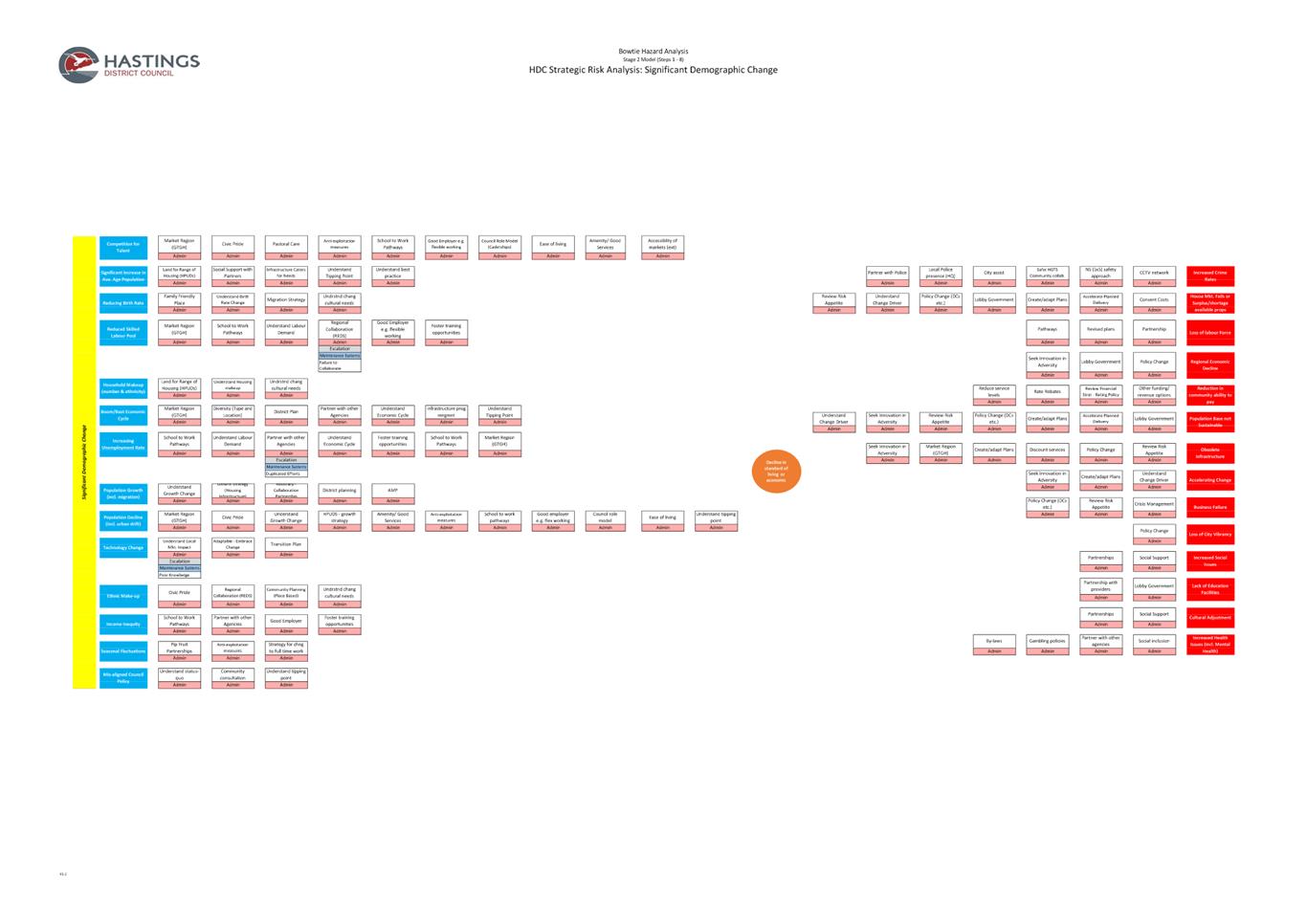

Bow Tie risk assessment method has been selected by Council as the means for

analysing the 20 strategic risks listed on the Strategic Risk Register adopted

by Council on 31 July 2017.

2.2 The Bow Tie risk assessment method was selected by Council as it is

an effective tool to demonstrate causal relationships

in complex systems. A Bowtie diagram does two things. First of all, it gives a

visual summary of all plausible accident scenarios that could exist around a

certain Hazard. Second, by identifying control measures the Bowtie displays

what the organisation does to control those scenarios.

2.3 The

Bow Tie analysis covering the key risk event and associated threats,

consequences and control barriers have already been provided to the

Subcommittee for the following risks:

· Civil Defence Emergency (Risk #2).

· Health & Safety Incident (Risk #3).

3.0 CURRENT

SITUATION

3.1 Through

a series of workshops held with the relevant subject matter experts, including

external representatives where this was appropriate, information has been

gathered to build the first stage of the Bow Tie diagrams for following

strategic risks (Note: copies of the 1-page summary, which is based on the

Bow Tie information, and the full Bow Tie diagrams for these risks are attached

for review):

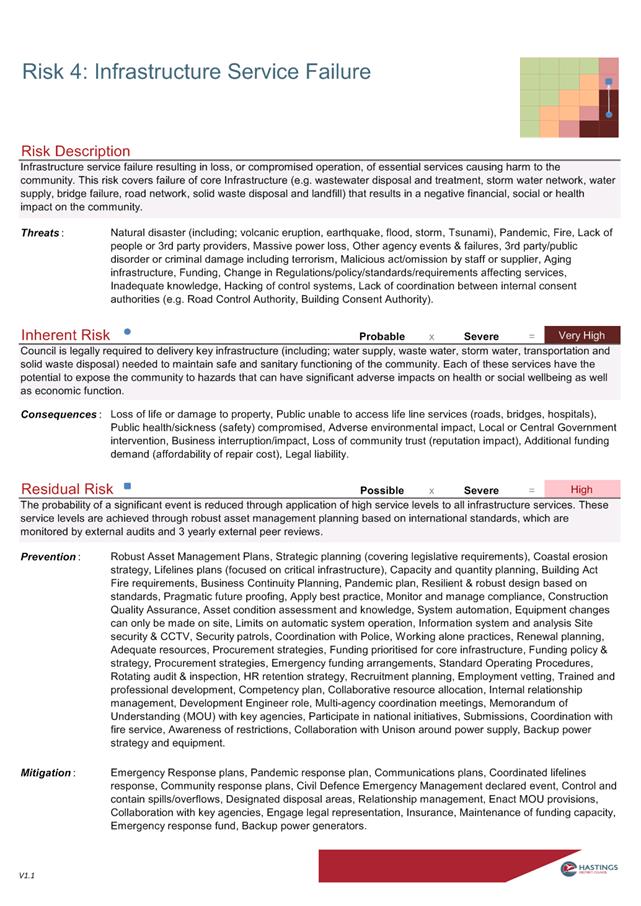

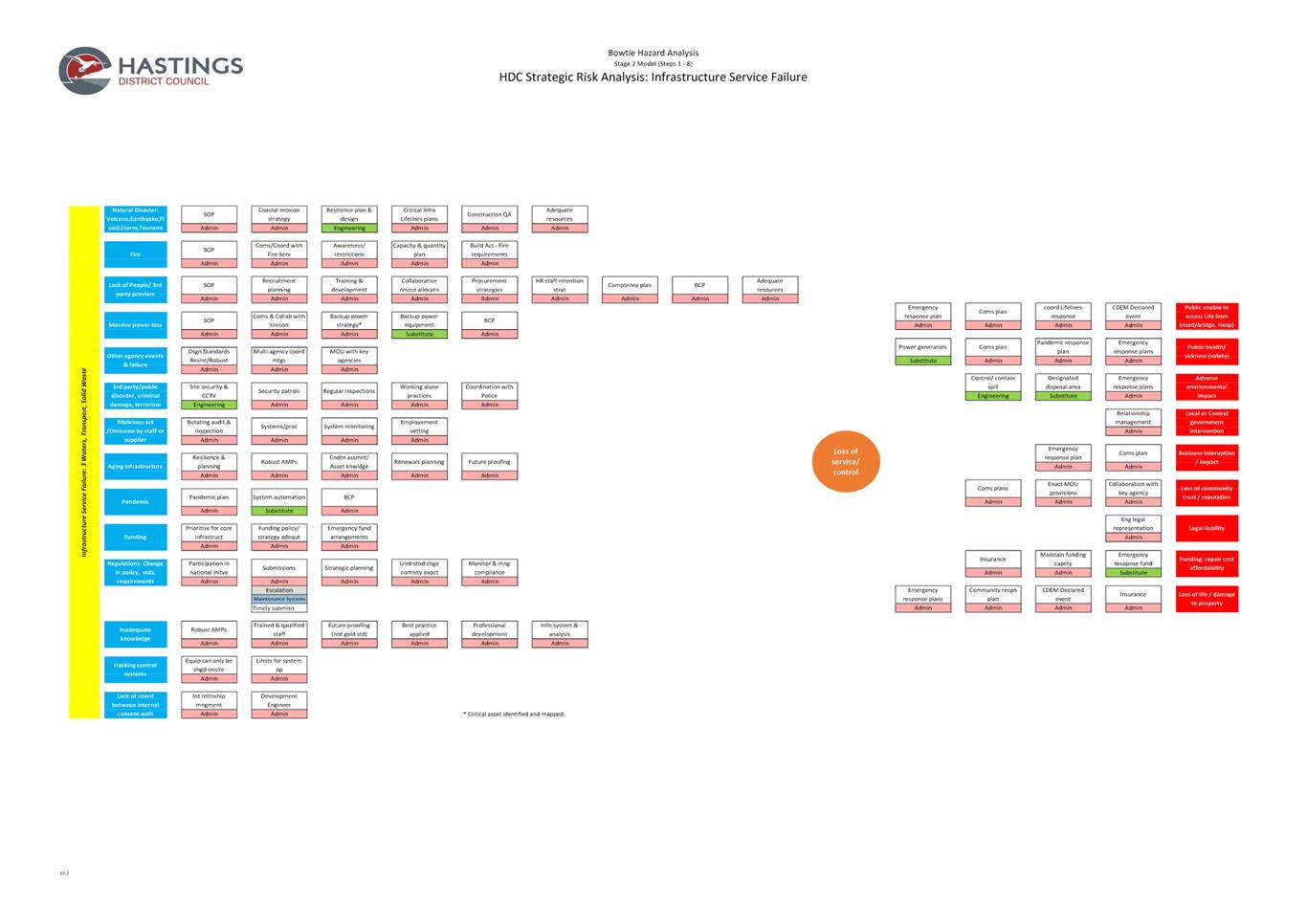

3.1.1 Infrastructure Service

Failure (Risk #4): The probability of a significant

event is reduced through application of high service levels to all

infrastructure services. These service levels are achieved through robust asset

management planning based on international standards, which are monitored by

external audits and 3 yearly external peer reviews.

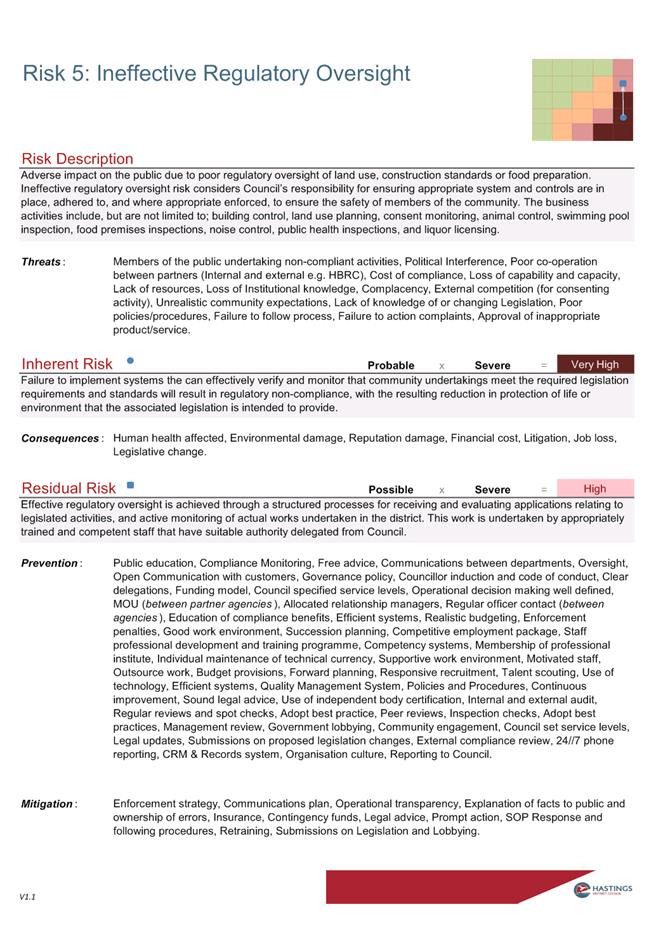

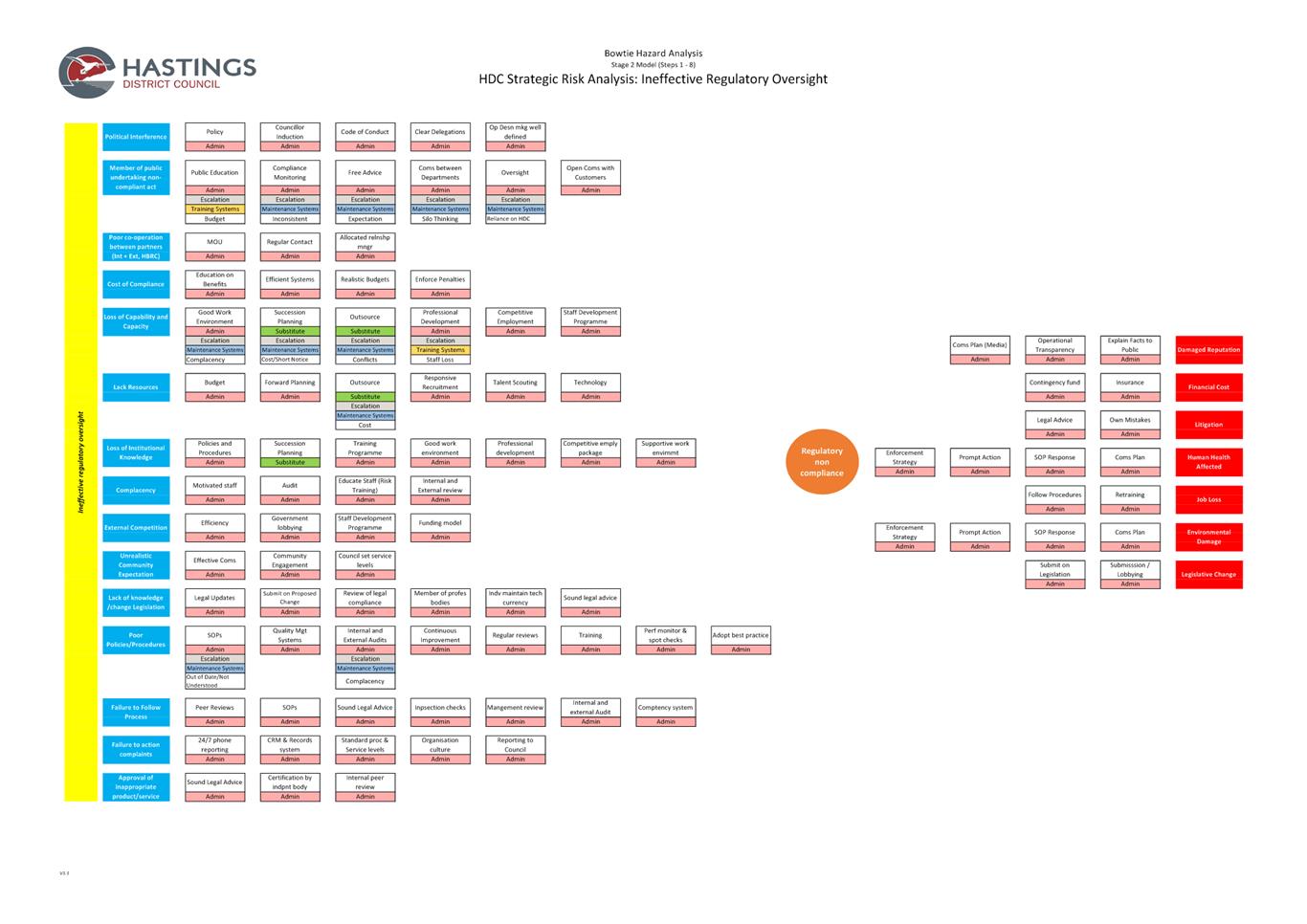

3.1.2 Ineffective Regulatory

Oversight (Risk #5): Effective regulatory oversight

is achieved through a structured processes for receiving and evaluating

applications relating to legislated activities, and active monitoring of actual

works undertaken in the district. This work is undertaken by appropriately

trained and competent staff that have suitable authority delegated from

Council.

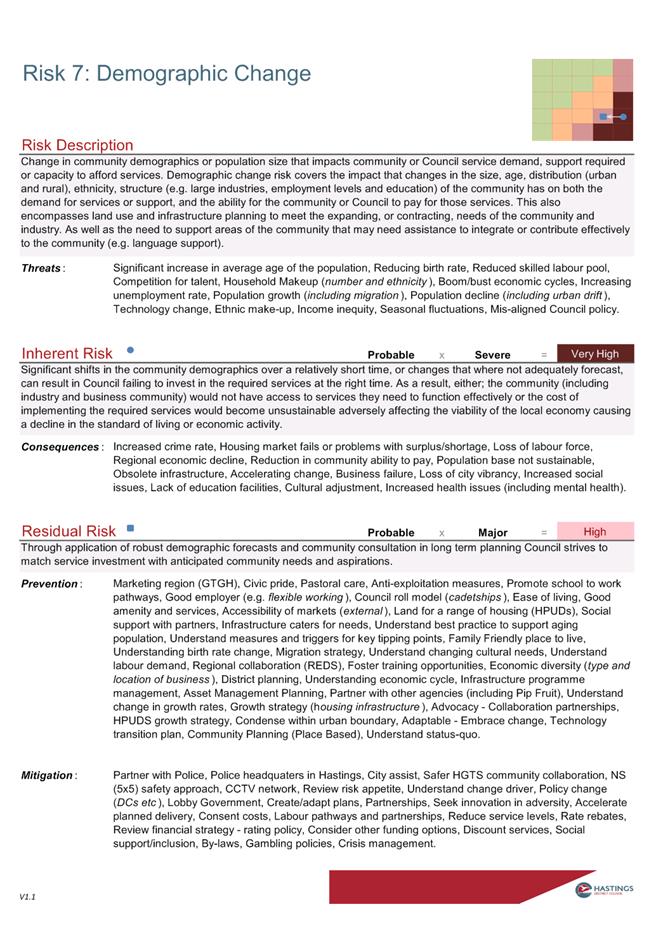

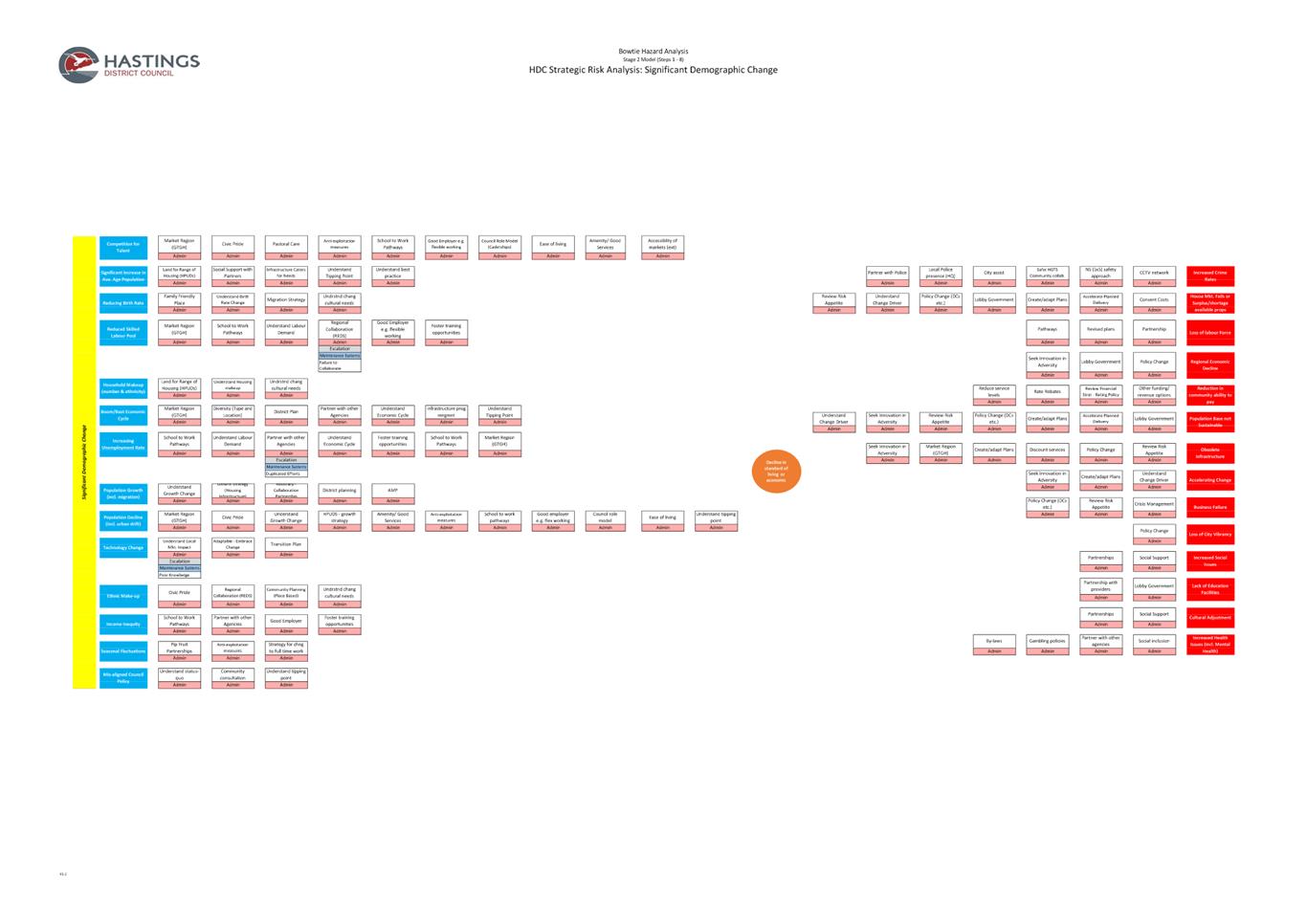

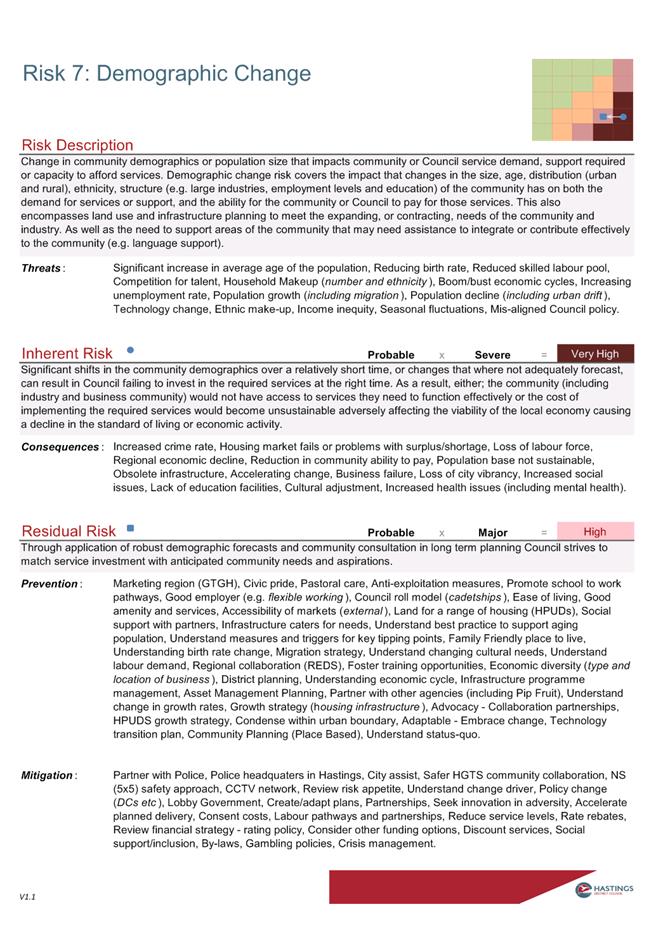

3.1.3 Demographic change (Risk #7): Through application of robust demographic forecasts and

community consultation in long term planning Council strives to match service

investment with anticipated community needs and aspirations.

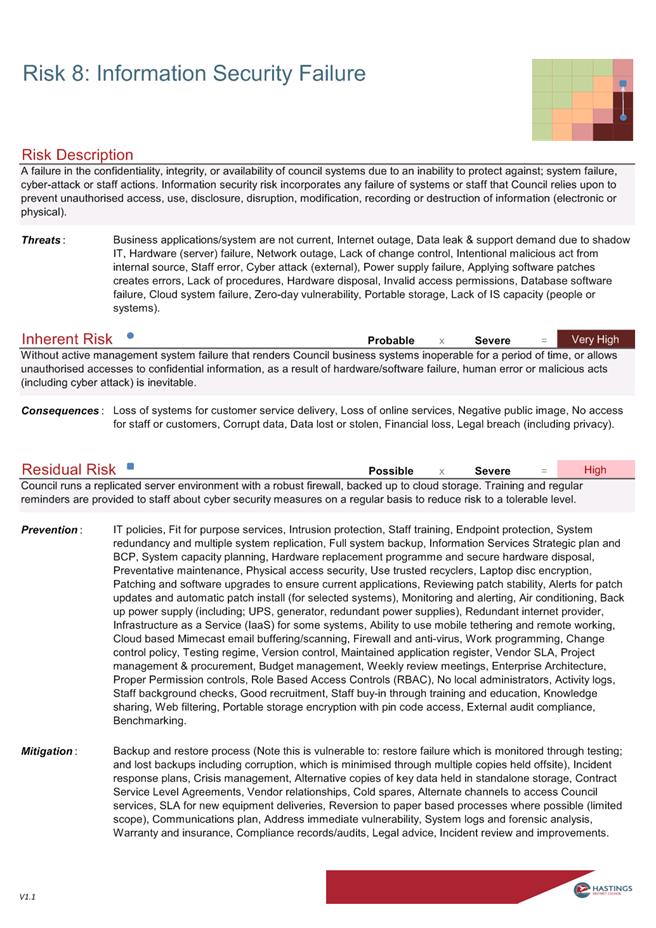

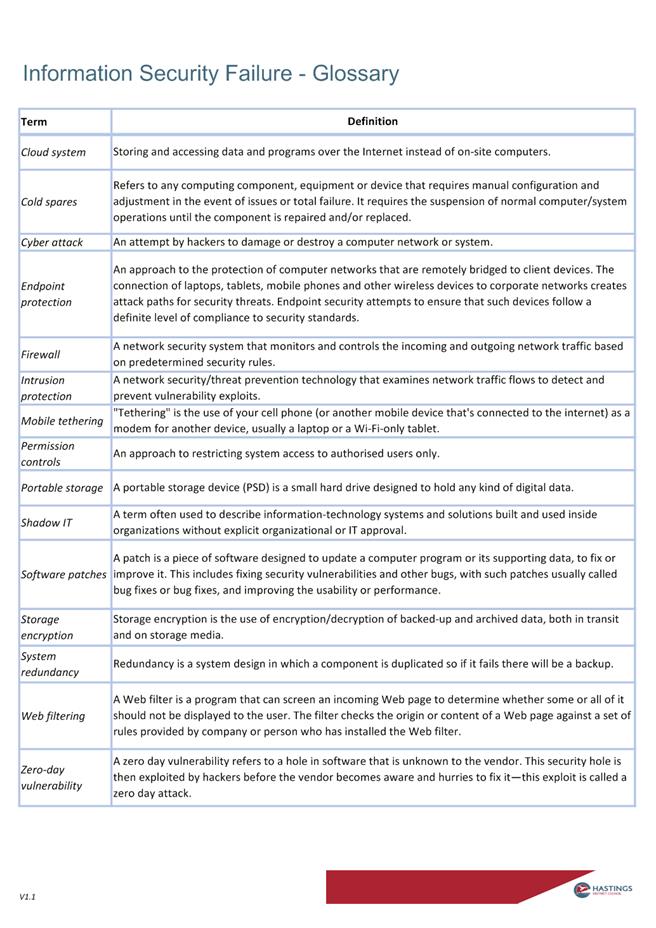

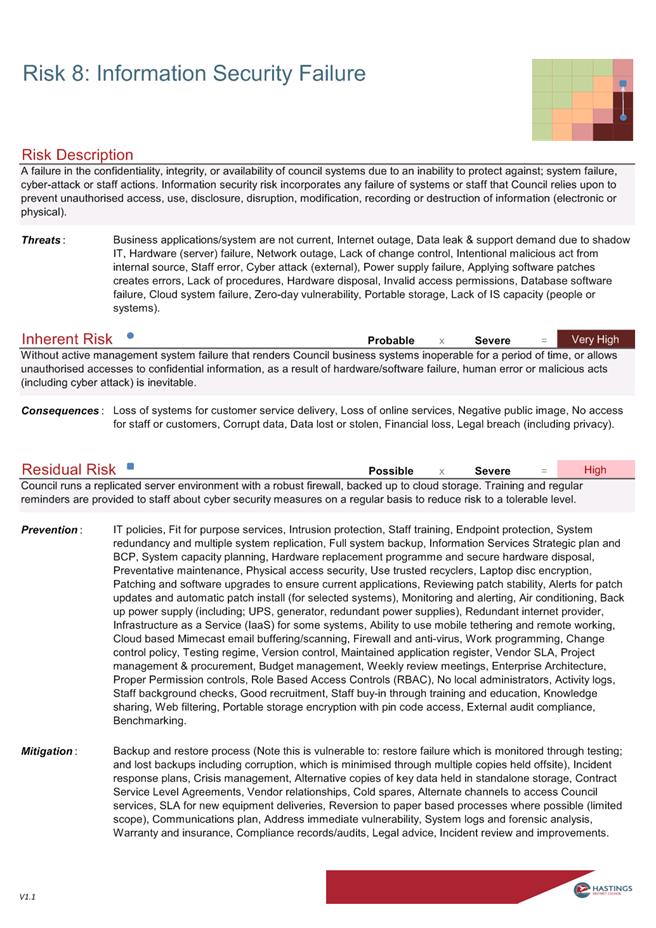

3.1.4 Information Security

Failure (Risk #8): Council

runs a replicated server environment with a robust firewall, backed up to cloud

storage. Training and regular reminders are provided to staff about cyber

security measures on a regular basis to reduce risk to a tolerable level.

3.2 Bow

Tie diagrams have not yet been completed for Water Supply Contamination (Risk

#1) and Adverse Environmental Change (Risk #6) for the following reasons:

3.2.1 Water Supply Contamination: Work on the water

service change project, as previously reported, has continued. This work is a

key element in addressing the water supply contamination strategic risk. As a

result it has been necessary to coordinate the timing for assembling the Bow

Tie summary with the review project.

3.2.2 Adverse Environmental Change: During initial

discussion on Demographic Change risk significant overlap with Adverse

Environmental Change was identified. As a result, the focus was put on

completing the Demographic Change risk as it was felt a large portion of the

threat, consequences and controls would be similar.

3.3 In

addition to the risk analysis work completed, a project Steering Group has been

established to oversee implementation of risk management processes throughout

Council. The Steering Group is made up of the Chief Financial Officer, Group

Manager: Economic Growth and Organisation Improvement, Group Manager: Human

Resources, Health and Safety Advisor, District Customer Services Manager and

Risk and Corporate Services Manager.

4.0 NEXT

STEPS

4.1 Analysis

will be completed to compile stage 1 Bow Tie diagrams for the following

strategic risks for presentation at the next Risk & Audit Subcommittee

meeting:

4.1.1 Water

supply contamination.

4.1.2 Adverse

Environmental Change.

4.1.3 Investment

Failure

4.1.4 Procurement

Failure

4.2 In addition, the second phase of the Bow Tie analysis will be

completed to confirm the effectiveness of the controls listed in the Civil

Defence and Health & Safety Bow Tie diagrams for presentation

to Risk & Audit Subcommittee.

4.3 A

6 month update report for Council is also due early in the New Year. As a

result, it is recommended that a report be made to Council that presents the

1-page risk summaries for those risks reported to this Subcommittee.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That the

report of the Quality Assurance and Business Services Manager titled “Strategic

Risk Management Update” dated 28/11/2017 be

received.

B) That an update report be provided to Council that includes 1-page

strategic risk summaries for; Civil Defence Emergency (Risk #2), Health &

Safety Incident (Risk #3), Infrastructure Service Failure (Risk #4),

Ineffective Regulatory Oversight (Risk #5), Demographic change (Risk #7) and

Information Security Failure (Risk #8).

With the reasons for this decision

being that the objective of the decision will contribute to meeting the

current and future needs of communities for good quality local infrastructure

and local public services in a way that is most cost-effective for households

and business by:

i) Ensuring strategic risks to the Council are effectively managed.

|

Attachments:

|

1

|

Governance Strategic Risk Summary

Infrastructure Services Failure for Risk and Audit Subcommittee 14 November

2017

|

PMD-03-81-17-104

|

|

2

|

Governance Strategic Risk Bow Tie Analysis

Infrastructure Services Failure for Risk and Audit Subcommittee 14 November 2017

|

PMD-03-81-17-105

|

|

3

|

Governance Strategic Risk Summary Ineffective

Regulatory Oversight for Risk and Audit Subcommittee 14 November 2017

|

PMD-03-81-17-106

|

|

4

|

Governance Strategic Risk Bow Tie Analysis

Ineffective Regulatory Oversight for Risk and Audit Subcommittee 14 November

2017

|

PMD-03-81-17-107

|

|

5

|

Policies, Procedures, Delgtns, Warrants &

Manuals - Manuals - Risk Management - Governance Strategic Risk Summary

Demographic Change for Risk and Audit Subcommittee 14 November 2017

|

PMD-03-81-17-108

|

|

6

|

Policies, Procedures, Delgtns, Warrants &

Manuals - Manuals - Risk Management - Governance Strategic Risk Bow Tie

Analysis Demographic Change for Risk and Audit Subcommittee 14 November 2017

|

PMD-03-81-17-109

|

|

7

|

Governance Strategic Risk Summary Information

Security Failure for Risk and Audit Subcommittee 14 November 2017

|

PMD-03-81-17-110

|

|

8

|

Governance Strategic Risk Bow Tie Analysis

Information Security Failure Overview for Risk and Audit Subcommittee 14

November 2017

|

PMD-03-81-17-111

|

|

9

|

Governance Strategic Risk Bow Tie Analysis

Information Security Failure Page 1 for Risk and Audit Subcommittee 14

November 2017

|

PMD-03-81-17-112

|

|

10

|

Governance Strategic Risk Bow Tie Analysis

Information Security Failure Page 2 for Risk and Audit Subcommittee 14 November

2017

|

PMD-03-81-17-113

|

|

Policies, Procedures, Delgtns,

Warrants & Manuals - Manuals - Risk Management - Governance Strategic

Risk Summary Infrastructure Services Failure for Risk and Audit Subcommittee

14 November 2017

|

Attachment 1

|

|

Policies, Procedures, Delgtns,

Warrants & Manuals - Manuals - Risk Management - Governance Strategic

Risk Bow Tie Analysis Infrastructure Services Failure for Risk and Audit

Subcommittee 14 November 2017

|

Attachment 2

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Summary Ineffective

Regulatory Oversight for Risk and Audit Subcommittee 14 November 2017

|

Attachment 3

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Bow Tie Analysis

Ineffective Regulatory Oversight for Risk and Audit Subcommittee 14 November

2017

|

Attachment 4

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Summary Demographic

Change for Risk and Audit Subcommittee 14 November 2017

|

Attachment 5

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Bow Tie Analysis

Demographic Change for Risk and Audit Subcommittee 14 November 2017

|

Attachment 6

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Summary Information

Security Failure for Risk and Audit Subcommittee 14 November 2017

|

Attachment 7

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Bow Tie Analysis

Information Security Failure Overview for Risk and Audit Subcommittee 14

November 2017

|

Attachment 8

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Bow Tie Analysis

Information Security Failure Page 1 for Risk and Audit Subcommittee 14

November 2017

|

Attachment 9

|

|

Policies, Procedures, Delgtns, Warrants & Manuals -

Manuals - Risk Management - Governance Strategic Risk Bow Tie Analysis

Information Security Failure Page 2 for Risk and Audit Subcommittee 14

November 2017

|

Attachment 10

|

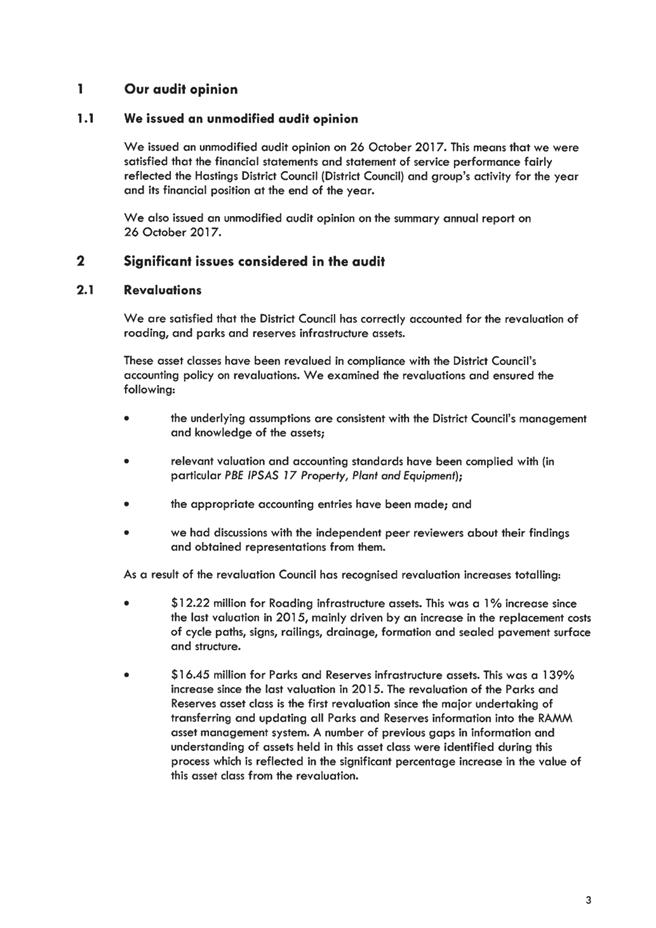

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Financial Controller

Aaron

Wilson

SUBJECT: Audit

Report for the Financial Year ended 30 June 2017

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Subcommittee about the Audit Management

Letter for the year ended 30 June 2017.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This report concludes by recommending that

the Audit Report for the year ended 30 June 2017 be received.

2.0 BACKGROUND

2.1 An

audit of the financial statements of the Council was completed for the year

ended 30 June 2017 by Audit New Zealand. An audit is undertaken every

year on the financial statements and working papers of the Council.

2.2 On

completion of the audit, an audit report is produced to highlight any issues

identified during the audit and suggested improvements.

2.3 Megan

Wassilieff and Jessica Noiseux will be in attendance at the Subcommittee.

3.0 CURRENT

SITUATION

3.1 The

report to Council from Audit New Zealand on the audit of Hastings District

Council and the group for the year ended 30 June 2017 has been received and is

attached as Attachment 1.

3.2 There

was significant improvements made to the end of the financial year and audit

processes this year. However there is still room for improvement and

officers will be working on an improvement plan and having further discussions

with Audit to ensure further efficiencies can be gained.

4.0 The

report from Audit New Zealand is broken into 5 sections which are covered off

below:

4.1 Audit

Opinion

4.2 Audit

issued an unmodified audit opinion on October 26th which ultimately

means they were satisfied that the financial statements and statement of

service performance fairly reflected the activity for the year and the

financial position at the end of the year.

4.3 Significant

Issues considered

4.4 This

year end it was the turn of the transport and parks assets to be revalued and

the report from audit noted that Council has correctly accounted for the

revaluation of those infrastructure assets.

4.5 Compliance

with significant legislation

4.6 The

Audit process reviews the systems and procedures that Council employs to

identify and comply with legislative requirements that could have a significant

effect on the financial statements.

4.7 Other

Audit findings

4.8 The

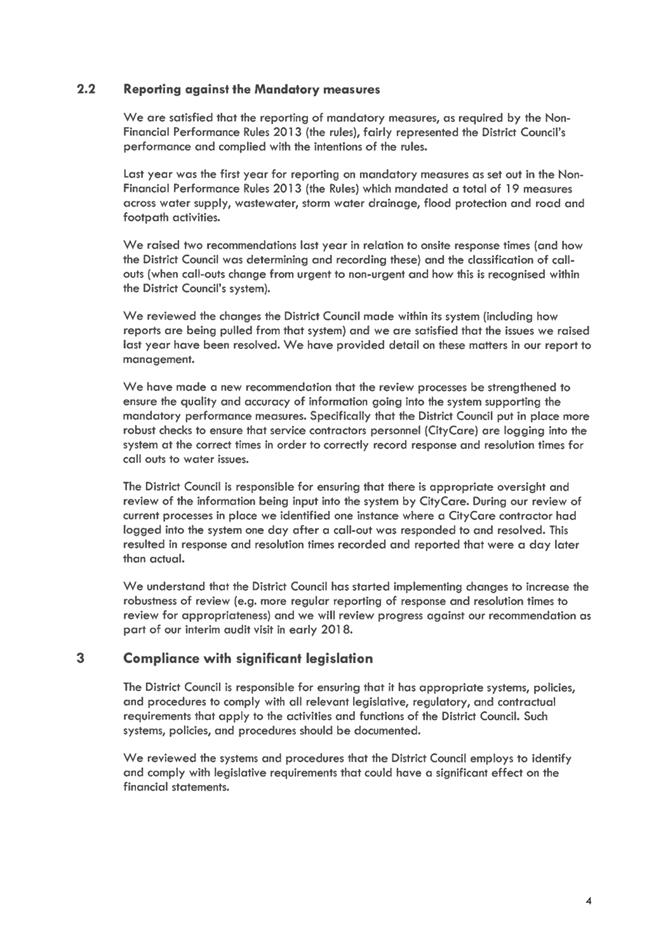

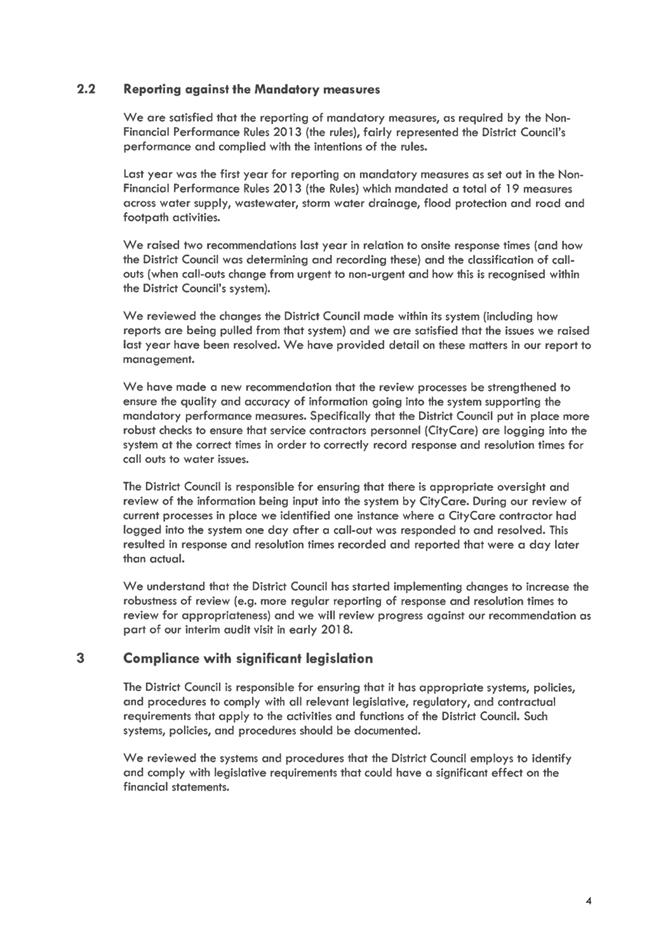

report notes one misstatement identified during the audit that was not

corrected. That misstatement relates to $187,000 the recognition of revenue relating

to the Fitzroy Avenue development. Officers believe that recognising this

revenue at 30 June 2017 would be premature as the development is very close to

completion and will be reported in the 2017/18 financial year when it is

complete.

4.9 Mandatory

Disclosures

4.10 The report also covers

off a number of Mandatory Disclosures that audit are required to make and it is

noted that there are no matters arising from those disclosures.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Financial Controller titled “Audit

Report for the Financial Year ended 30 June 2017” dated 28/11/2017

be received.

|

Attachments:

|

1

|

Report to Council on the audit of Hastings District

Council and group for the year ended 30 June 2017

|

FIN-07-01-17-393

|

|

|

Report to Council on the audit of

Hastings District Council and group for the year ended 30 June 2017

|

Attachment 1

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Manager Strategic Finance

Brent

Chamberlain

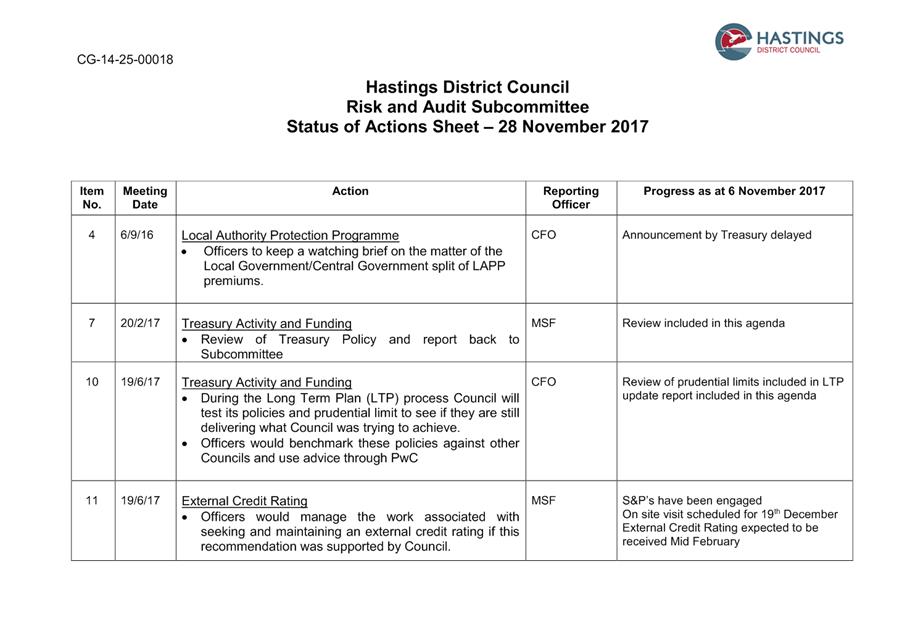

SUBJECT: General

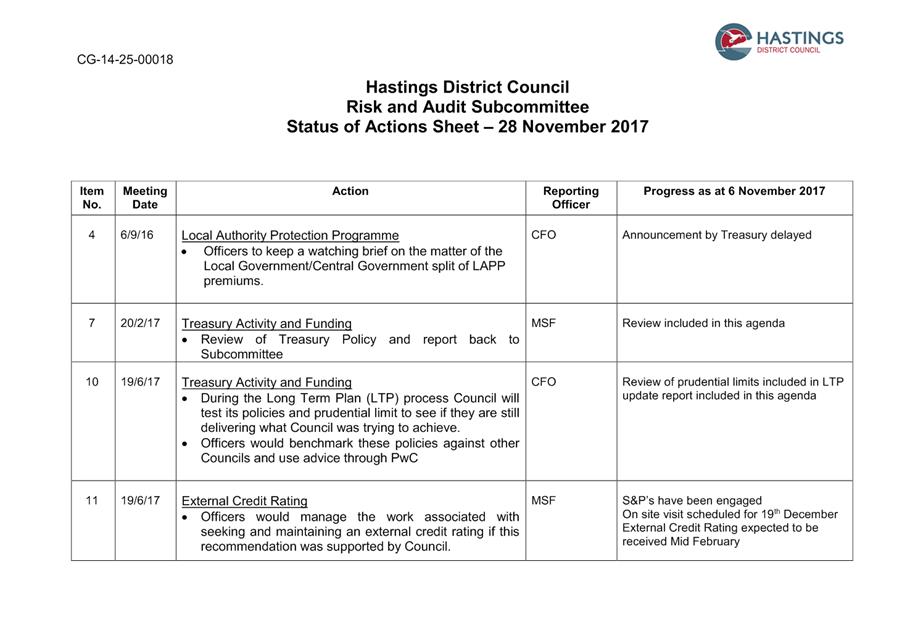

Update Report and Status of Actions

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on various matters

including actions raised at previous meetings.

1.2 The Council is required to give effect to the

purpose of local government as prescribed by Section 10 of the Local Government

Act 2002. That purpose is to meet the current and future needs of communities

for good quality local infrastructure, local public services, and performance

of regulatory functions in a way that is most cost–effective for

households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.3 This

report concludes by recommending that the report titled “General Update

Report and Status of Actions” from the Manager Strategic Finance be

received.

2.0 BACKGROUND

2.1 The

Audit & Risk Subcommittee members requested that officer’s report

back at each meeting with progress that has been made on actions that have

arisen from the Audit & Risk Subcommittee meetings. Attached as Attachment

1 is the Audit & Risk Subcommittee Action Schedule as at 28 November 2017.

3.0 CURRENT

SITUATION

3.1 2018-28

Long Term Plan

3.1.1 The 2018-28 Long Term Plan

is providing Council with many challenges as it responds to meeting the new

requirements for water supply, aging infrastructure and a desire from the

community to improve the level of service provided in our parks and open

spaces. A strong desire to improve the vitality of our CBD and town

centres is also putting pressure on forecast debt levels.

3.1.2 The Subcommittee will at

its February 2018 meeting receive the draft Financial Strategy, Infrastructure

Strategy and relevant Asset Management summaries for consideration prior to

Council adoption.

3.2 Tech

One Upgrade

3.2.1 Work is continuing on the

scope and nature of the upgrade to the Technology One Finance Module in order

to minimise risk and cost and maximise benefit. It is now not expected

that a complete install of the Finance Module will be required which may mean

that future improvements which would include the Procure to Pay function and

Electronic Purchase Orders could be achieved sooner than previously expected.

3.3 Credit

Rating

3.3.1 Standard &

Poor’s(S&P) have been engaged to provide Council with a credit rating

as previously approved by Council. S&P are expected to be onsite the

week commencing 18 December and will be interviewing the Mayor, Chief

Executive, Chief Financial Officer, Group Manager Asset Management and Group

Manager Economic Growth and Organisational Improvement. They will also be

looking to get an update on the Hawke’s Bay economy to help inform their

process. We have requested that the credit rating be available for public

release by early March 2018 to enable Council to have this as part of the Long

Term Plan conversation with the community.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report does not trigger Council’s Significance and Engagement Policy and

no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

That the report of the Manager Strategic Finance titled “General

Update Report and Status of Actions” dated 28/11/2017

be received.

|

Attachments:

|

1

|

Risk & Audit Subcommittee Action Sheet

|

CG-14-25-00018

|

|

|

Risk & Audit Subcommittee Action

Sheet

|

Attachment 1

|

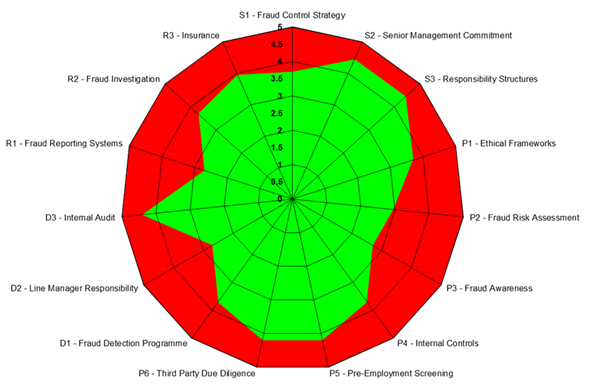

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Chief Financial Officer

Bruce

Allan

SUBJECT: Internal

Audit Update

1.0 SUMMARY

1.1 The purpose of this report is to update the Subcommittee about

progress being made with the Internal Audit plan.

1.2 The Council is required to give effect to

the purpose of local government as prescribed by Section 10 of the Local

Government Act 2002. That purpose is to meet the current and future needs of

communities for good quality local infrastructure, local public services, and

performance of regulatory functions in a way that is most cost–effective

for households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.3 This

report concludes by recommending that the Internal Audit update be received.

2.0 BACKGROUND

2.1 In

September 2017 the Risk and Audit Subcommittee received the draft Internal

Audit Plan for 2017/18. In that plan it was noted that the first focus for the

plan will be to understand more fully the fraud risks that council faces and in

order to do that Crowe Horwath would be undertaking some fraud risk gap

analysis to help us understand where practical actions can be taken to move toward

better practice. Complementing this will be some suspicious transaction

analysis using Crowe Horwath’s data analytic tools.

3.0 CURRENT

SITUATION

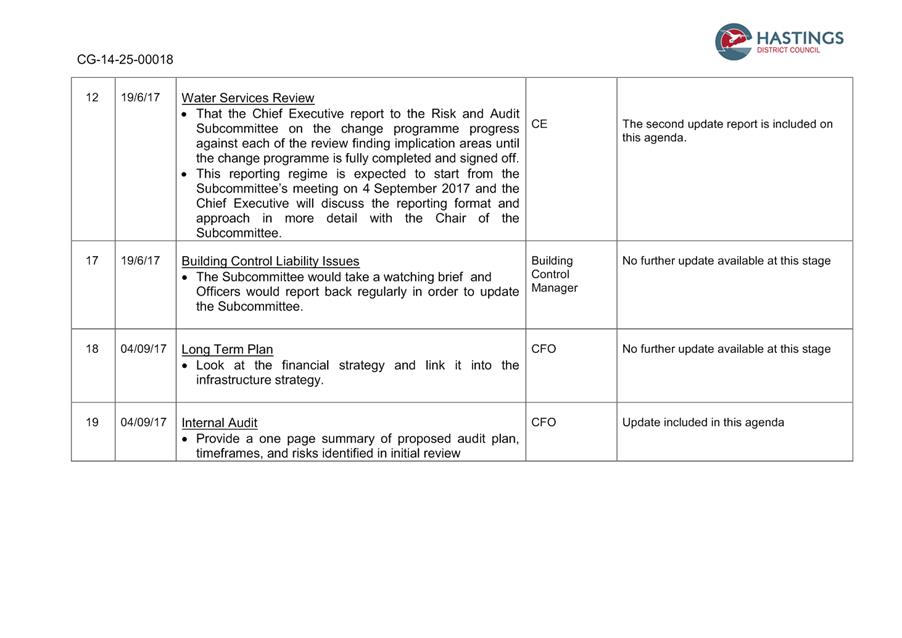

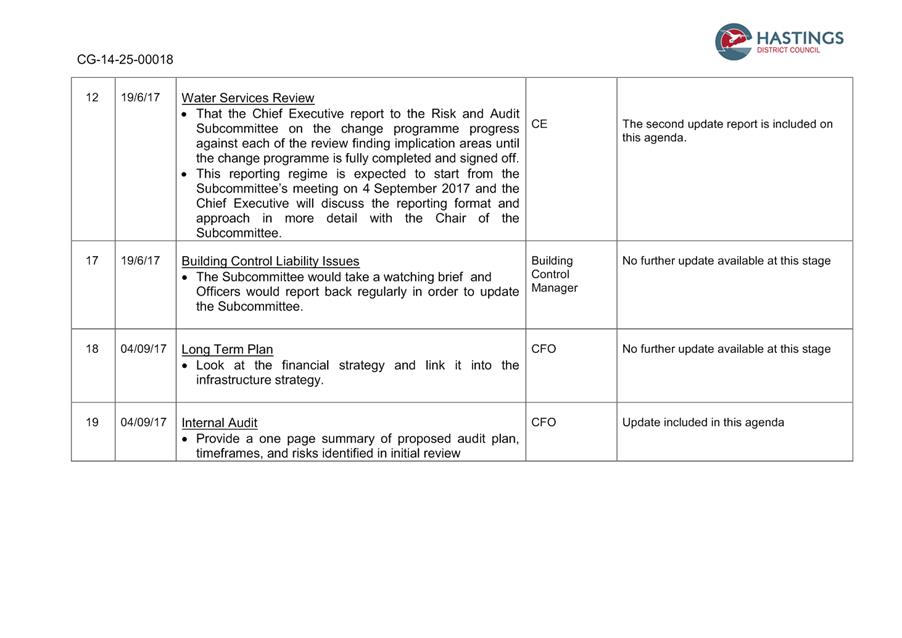

3.1 Fraud Risk Assessment

3.2 The

Audit Conclusion states the following:

“Our

review leads us to the overall conclusion that, whilst specific fraud control

plans and strategies specifically designed to prevent, detect and respond to

fraud exist, further development of these plans and strategies is required.

There is also only limited awareness of these plans and strategies amongst

Council staff.

Additionally the need for managers and

staff across the Council to understand and apply their responsibilities in

monitoring, identifying and reporting suspicious activity has not been fully

implemented and communicated.

Whilst we did not undertake any detailed

control testing as part of this review, a number of observations relating to

potential improvements in internal control were identified and have been

included in this report for management consideration.

The diagram below summarises against each

attribute inherent within the better practice model for fraud control

strategies (S), fraud prevention (P), fraud detection (D) and fraud response

(R) to fraud.

The diagram should be read in accordance

with the following colour coding:

Green Area - current performance against the better practice model.

Red Area - the difference between current performance and the better practice

model.”

3.3 The

report makes a number of recommendations particularly in relation to improving

the assessment tools Council has as its disposal and the awareness of fraud

policies and procedures for reporting fraud.

3.4 The

assessment tools have been strengthened with the addition of this fraud risk

management review and the data analytics recently undertaken.

3.5 Officers

accept that we can do better with staff training and development of policies

and procedures and will be reviewing how they are regularly communicated to

staff and their accessibility through Council’s intranet. The policy

review and communication will also address some of the weaknesses around fraud

reporting systems with staff being made more aware of Councils Protected

Disclosures Policy.

3.6 Data

Analytics

3.6.1 The objective of the data

analytics was to perform a data analysis review that involved an analysis of

master file data and transaction data for payroll and vendor (accounts payable)

payments. The transactional data testing covered the period 1 July 2016 to 30

June 2017 with the master data testing as at the date of extraction which was 7

September July 2017. The data analysis work did not include assessment of the

respective internal controls within the business processing areas and was

limited to factual reporting of identified data anomalies as per the specified

tests undertaken.

3.7 The

testing outcomes were achieved by the extraction, validation and analysis of

the relevant data files from the payroll and finance application systems. This

data was then imported into data analysis software where the specified tests

are performed upon the logical structure and reasonableness of the data, to

identify any anomalies.

3.8 Crowe

Horwath have provided workbooks of the high level summary findings of the

testing, associated risks and where appropriate recommendations for further

investigation of transactions or masterfile data identified as suspicious as

well as the detailed supporting results spreadsheets highlighting individual

transactions and anomalies in masterfile data that we consider require further

investigation.

3.9 The

analysis provided recommendations or comments on the outcomes of the analysis

on 56 separate tests for the payroll and vendor masterfile and transactional

data. Officers have reviewed the recommendations and have not found any

suspicious transactions.

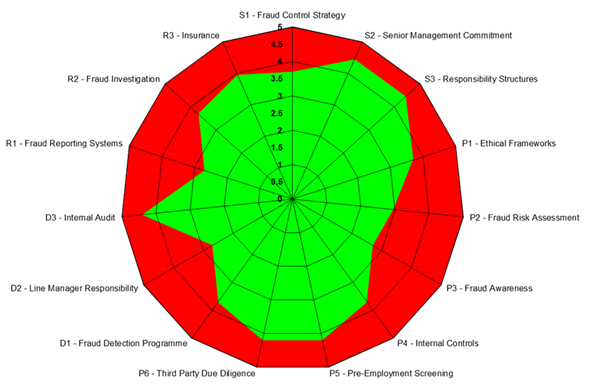

3.10 Audit Action Plan

3.10.1 Attached as Attachment 1 is an

updated Audit Action sheet providing the Subcommittee with a view of the status

of recommendations made from previous internal and external audits. Good

progress has been made on addressing recommendations and the new

recommendations from the recent audit work have now been included.

|

4.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Chief Financial Officer titled “Internal

Audit Update” dated 28/11/2017 be received.

|

Attachments:

|

1

|

Audit Action Sheet

|

CG-14-25-00021

|

|

|

Audit Action Sheet

|

Attachment 1

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Tuesday 28

November 2017

FROM: Chief Executive

Ross

McLeod

SUBJECT: Water

Services

1.0 SUMMARY

1.1 The

purpose of this report is to enable staff to update the Subcommittee on

progress with the Water Services Change Programme.

1.2 The

Water Services Change Programme was commissioned by the Chief Executive in June

2017, following receipt of the capability and capacity review into the water

services area that recommended that change work be undertaken. This

followed on from the Havelock North water contamination event, and issues

identified in some of Council’s water supply arrangements.

1.3 In

terms of governance oversight of the programme, Council asked that the Chief

Executive report progress on the change programme to the Risk and Audit

Subcommittee on a regular basis. Council is also receiving updates.

1.4 The Council is required to give effect to the purpose of local

government as prescribed by Section 10 of the Local Government Act 2002. That

purpose is to meet the current and future needs of communities for good quality

local infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.5 The

objective of this decision relevant to the purpose of local government is to

provide governance oversight to the water services change programme in order to

help Council ensure safe drinking water and fit for purpose, effective and

efficient water services across the three waters.

1.6 This

report concludes by recommending that the information be received.

2.0 BACKGROUND

2.1 The

Havelock North water contamination event led to the identification of some

areas of Council’s organisational arrangements and performance that were

not at the required standard. While the Inquiry found that Council did not

cause the contamination event and outbreak (surface water from a pond in the

Mangateretere Stream contaminated the aquifer and was drawn into the water

supply), the Chief Executive moved to address the issues identified and

undertake a significant review and improvement programme across the three

waters activities.

2.2 The

Chief Executive commissioned a capability and capacity review of the water

services area. This was part of wider array of initiatives to ensure water

safety and improve systems and performance that included additional resourcing

and support, modified processes and the use of new systems. The review was

carried out by a review team comprising Bruce Robertson, Ross Waugh and Neil

Taylor. A copy of the review report was circulated to members separately at the

time of the first report to the Subcommittee.

2.3 The

review identified a number of findings and implications of those findings. It

made a number of recommendations which the Chief Executive adopted without

modification.

2.4 In

order to deliver on the review recommendations and enable improvement more

broadly, a change management programme was initiated. This is led by a change

management team (CMT) that makes recommendations to the Chief Executive. The

CMT is led by an independent Chairman, Mr Garth Cowie, and comprises a number

of senior staff and an independent technical advisor, Mr Jim Graham, a water

industry expert now with Water New Zealand.

2.5 The

CMT is supported by a programme/change manager, and work is carried out through

a series of workstreams that involve a combination of internal staff and

external expertise.

2.6 The

aim of the work being undertaken is to deliver a water supply that is among the

safest in the country and, more broadly, the most cost-effective three waters

arrangements. “Operationalised” risk management is one of the key

areas of focus for the CMT to ensure that risks are actively being managed at

an operational level.

3.0 CURRENT

SITUATION

3.1 Work

on the change programme is well underway. Good progress is being made in

addressing the recommendations of the review team, with changes being made

across the various workstreams.

3.2 The

Chief Executive and members of the CMT will brief the Risk and Audit

Subcommittee on aspects of the work programme and be available to answer

questions. A six-monthly report to Council will be made on 14 December

2017.

|

4.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Chief Executive titled “Water Services”

dated 28/11/2017 be received.

With the reasons for this decision

being that the objective of the decision will contribute to meeting the

current and future needs of communities for good quality local infrastructure

in a way that is most cost-effective for households and business by:

i) Providing for effective Governance oversight of the water services

change programme.

|

Attachments:

There are no

attachments for this report.

Hastings District

Council

Hastings District

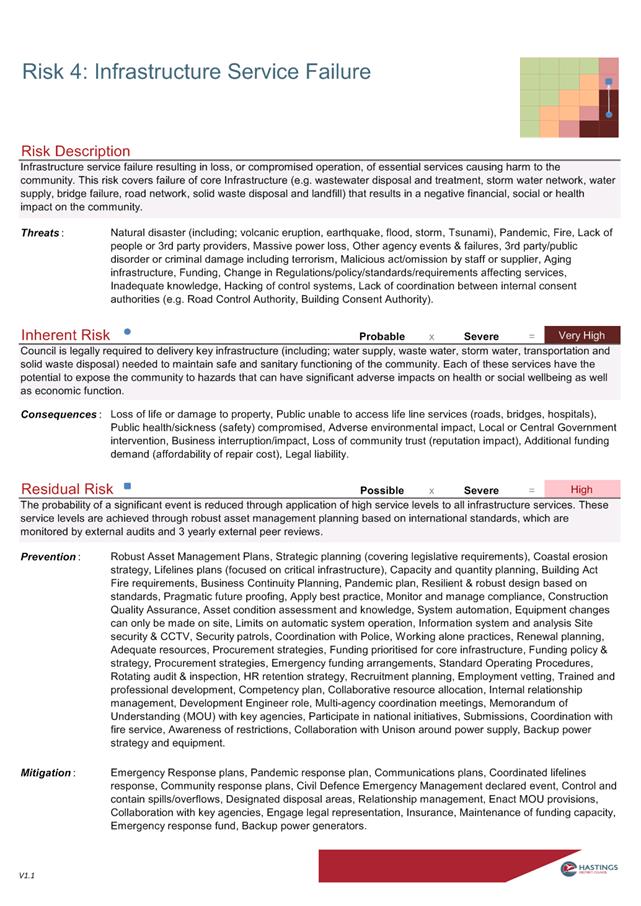

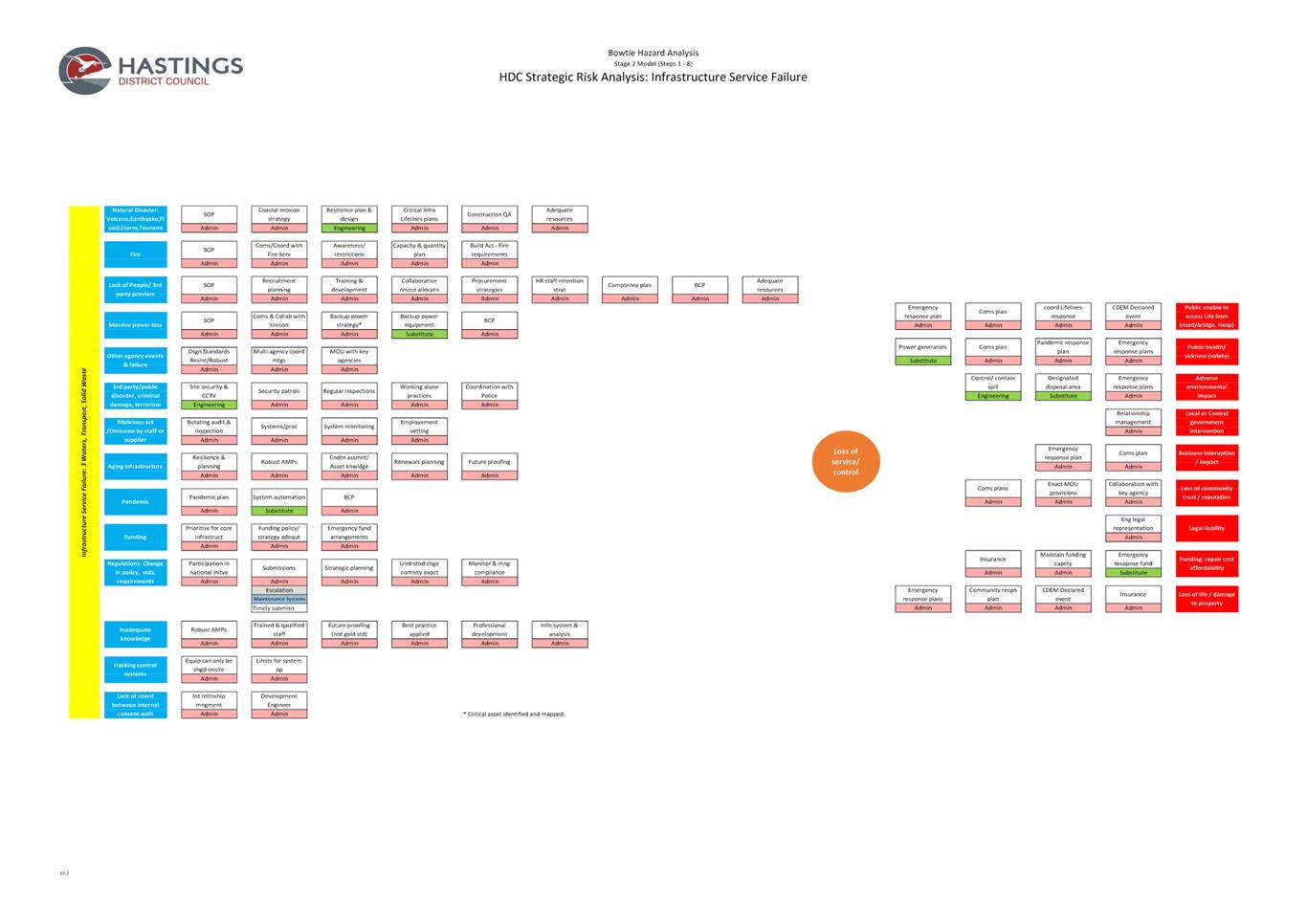

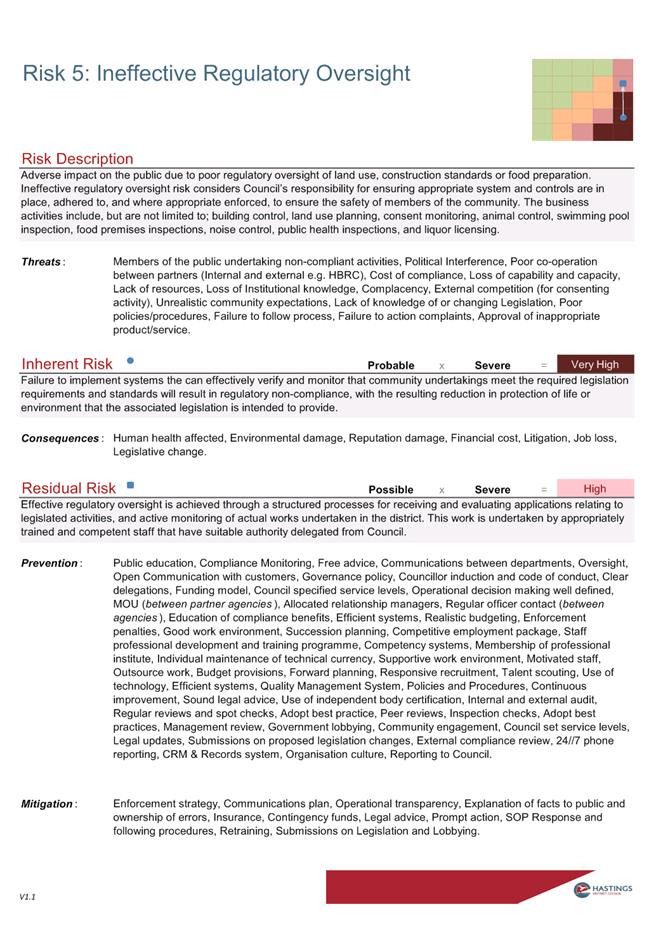

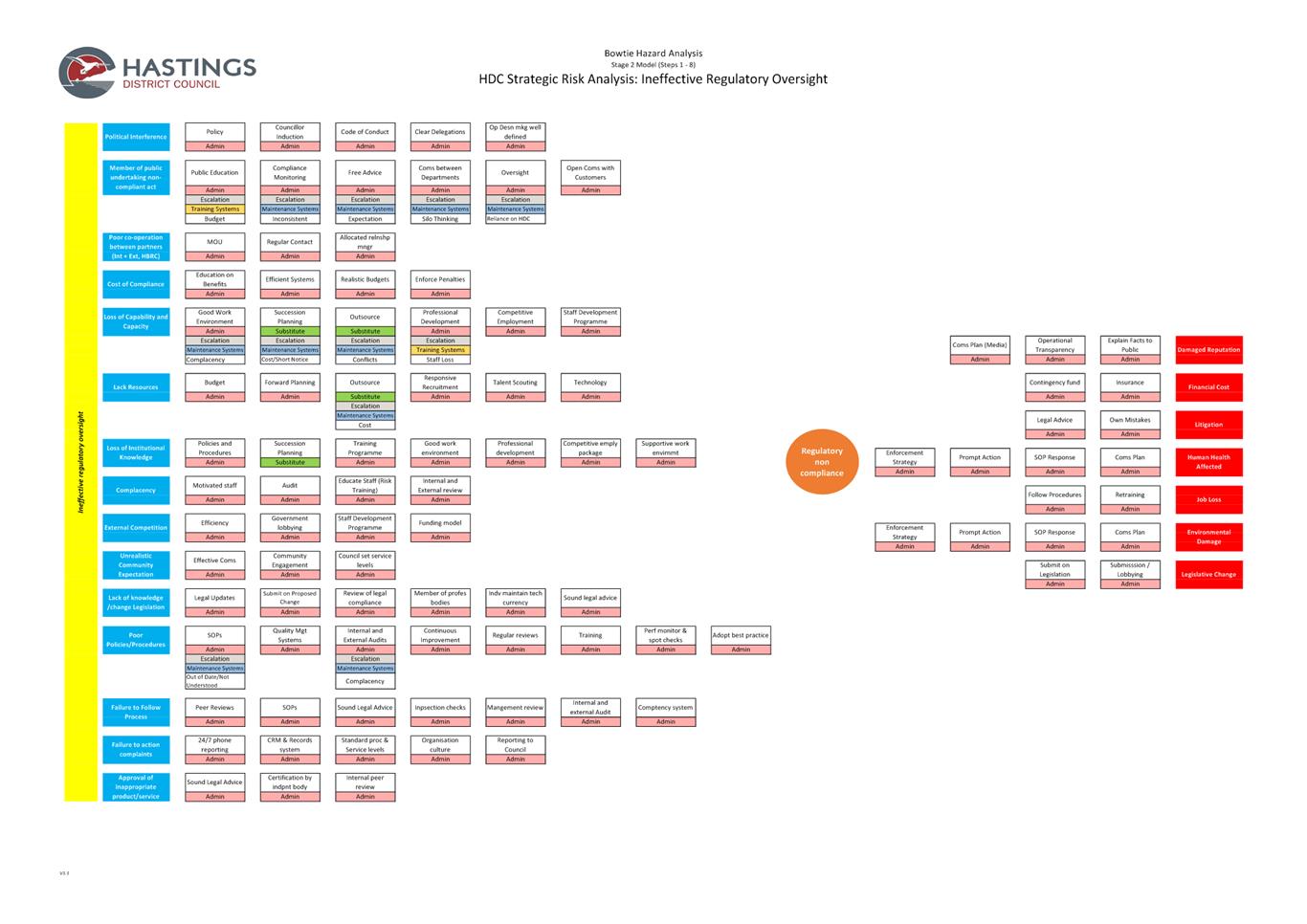

Council