|

6.0 RECOMMENDATIONS AND REASONS

A) That

the report of the Financial Policy Advisor titled “Resolution

to set the Rates for the 2018/19 Financial Year” dated 12/07/2018

be received.

B) That pursuant to the Local Government (Rating) Act 2002, the

Hastings District Council makes the rates on rating units in the District for

the financial year commencing on 1 July 2018 and ending on 30 June 2019 and

adopts the due dates and penalty dates for the 2018/19 financial year, as

follows:

INTRODUCTION

Hastings District

Council has adopted its 2018-28 Long Term Plan. This has identified the

Council’s budget requirement, and set out the rating policy and funding

impact statement. The Council hereby sets the rates described below to

collect its identified revenue needs for 2018/19 commencing 01 July

2018. All rates are inclusive of Goods and Services Tax.

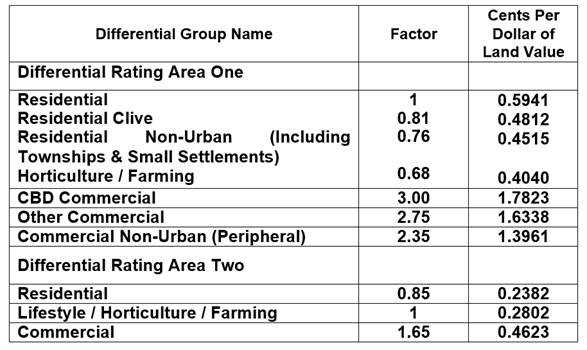

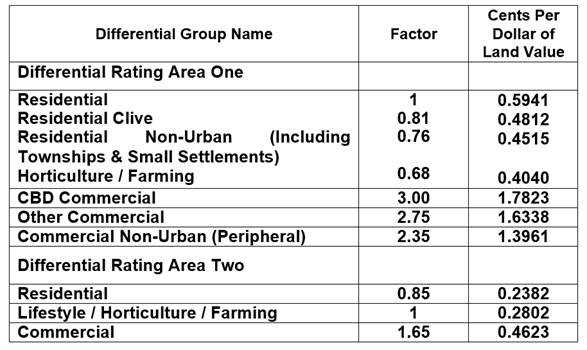

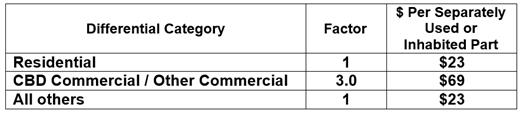

GENERAL RATES

A

general rate set and assessed in accordance with Section 13 of the Local

Government (Rating) Act 2002, on the land value of all rateable land within

the district on a differential basis as set out below:

UNIFORM ANNUAL GENERAL CHARGE

A

uniform annual general charge set and assessed in accordance with Section 15

of the Local Government (Rating) Act 2002, of $223 on each separately used or

inhabited part of a rating unit within the district.

TARGETED RATES

All differential categories of targeted rates areas

are as defined in the Funding Impact Statement for 2018/19. For the purposes

of the Havelock North Promotion, Hastings City Marketing, Hastings CBD

Targeted Rate, Havelock North CBD Targeted Rate, and Security

Patrols (Hastings and Havelock North), a commercial rating unit is one

that fits the description as set out under DRA1 CBD Commercial and DRA1 Other

Commercial in Part B of the Funding Impact Statement for 2018/19.

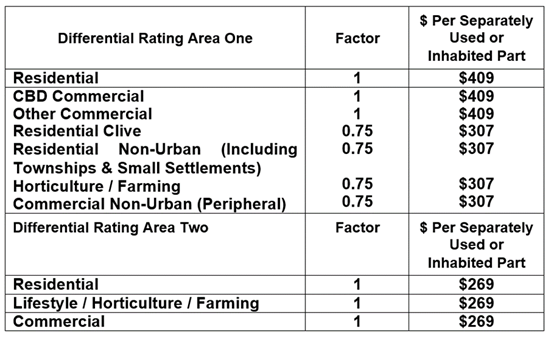

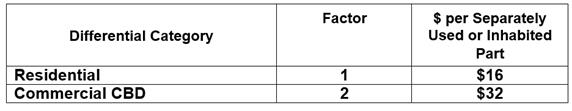

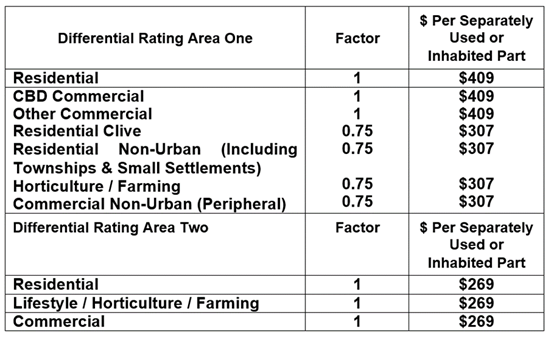

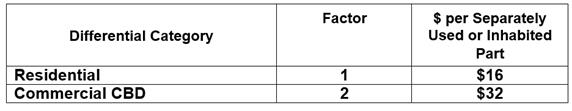

COMMUNITY SERVICES & RESOURCE MANAGEMENT RATE

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on a differential basis, on each separately

used or inhabited part of a rating unit as follows:

HAVELOCK NORTH

PROMOTION

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on the land value of any commercial rating unit

located within Havelock North as defined on Council Map “Havelock North

Promotion Rate”, of 0.1563 cents per dollar of land value.

SWIMMING POOL SAFETY

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, as a fixed amount on every rating unit where a

swimming pool (within the meaning of the Fencing of Swimming Pools Act 1987)

is located, of $58 per rating unit.

HAVELOCK NORTH PARKING

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on a differential basis, on each separately

used or inhabited rating unit located within Havelock North as defined on

Council Map “Havelock North Parking”, as follows:

HASTINGS CITY MARKETING

A targeted rate set and assessed in accordance with

Section 16 of the Local Government (Rating) Act 2002, on the land value of

any commercial rating units located within Hastings as defined on Council Map

“Hastings City Marketing Rate”, of 0.2599 cents per dollar of

land value.

HASTINGS CBD TARGETED RATE

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on the land value of any commercial rating unit

located within Hastings as defined on the Council Map “Hastings

CBD”, of 0.1448 cents per dollar of land value.

HAVELOCK NORTH CBD TARGETED RATE

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on the land value of any commercial rating unit

located within Havelock North as defined on Council Map “Havelock North

CBD”, of 0.0683 cents per dollar of land value.

SECURITY PATROLS

Targeted

rates set and assessed in accordance with Section 16 of the Local Government

(Rating) Act 2002, on the land value of any commercial rating unit located

within each respective Council Map defined “Hastings Security Patrol

Area” and “Havelock North Security Patrol Area”, as

follows:

Hastings

Security Patrol Area - 0.1049 cents per dollar of land value.

Havelock

North Security Patrol Area - 0.0635 cents per dollar of land value.

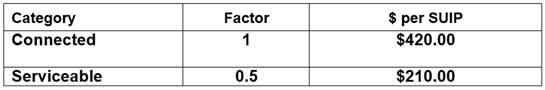

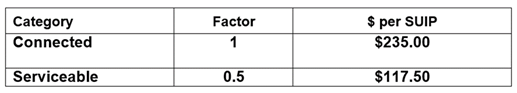

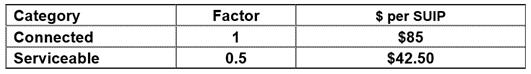

SEWAGE DISPOSAL

A

differential targeted rate set and assessed in accordance with Section 16 of

the Local Government (Rating) Act 2002, based on the provision or

availability to the land of the service. The rate is set as an amount per

separately used or inhabited part of a rating unit.

A

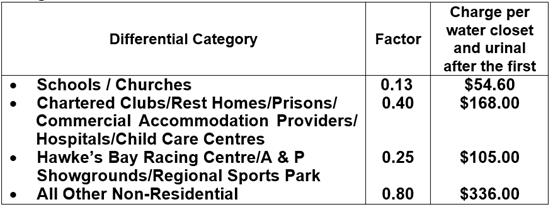

differential targeted rate for all non-residential rating units classified as

“connected”, based on the use to which the land is put. The rate

is an amount for each water closet or urinal after the first.

The rates apply to connected or serviceable rating

units in all areas excluding those in the Waipatiki scheme area.

The rates for the 2018/19 year are:

Where connected, in the case of non-residential use,

the differential charge for each water closet or urinal after the first is as

follows:

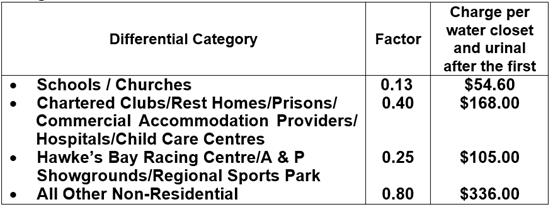

WAIPATIKI SEWAGE DISPOSAL

A

differential targeted rate set and assessed in accordance with Section 16 of

the Local Government (Rating) Act 2002, based on the provision or

availability to the land of the service. The rate is set as an amount per

separately used or inhabited part of a rating unit.

This

rate applies only to connected or serviceable rating units in the Waipatiki

scheme area.

The rates for the 2018/19 year are:

Where connected, in the case of non-residential use,

the differential charge is set for each water closet or urinal after the

first as follows:

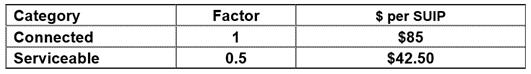

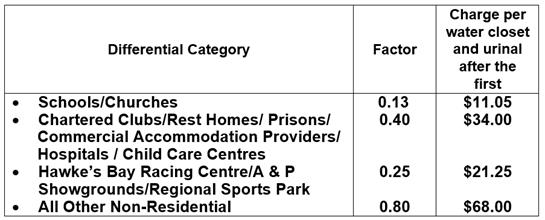

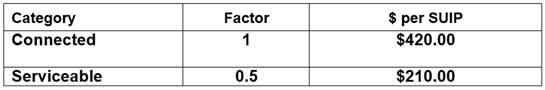

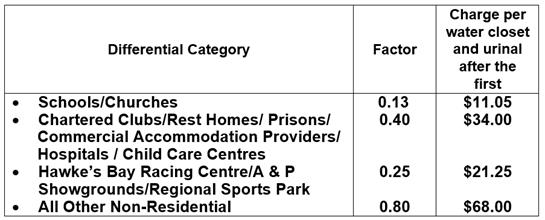

WASTEWATER TREATMENT

A

differential targeted rate set and assessed in accordance with Section 16 of

the Local Government (Rating) Act 2002, based on the provision or

availability to the land of the service. The rate is set as an amount per

separately used or inhabited part of a rating unit.

A

differential targeted rate for non-residential rating units classified as

“connected”, based on the use to which the land is put. The rate

is an amount for each water closet or urinal after the first.

The rates apply to connected or

serviceable rating units in all areas excluding those in the Waipatiki scheme

area.

The rates for the 2018/19 year are:

Where connected, in the case of non-residential use,

the differential charge is set for each water closet or urinal after the

first as follows:

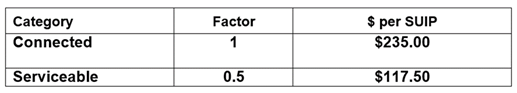

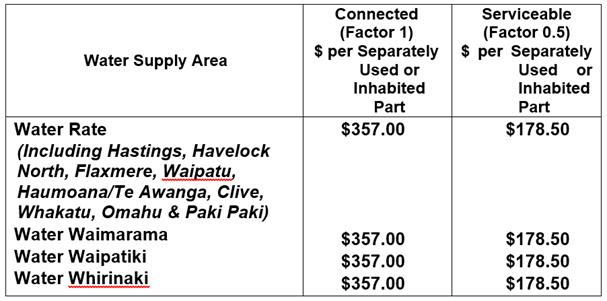

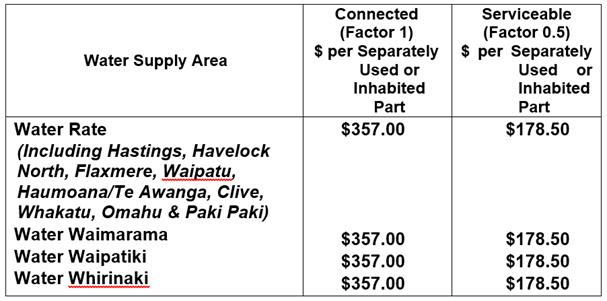

WATER SUPPLY

Targeted

rates set and assessed in accordance with Section 16 of the Local Government

(Rating) Act 2002, on each separately used or inhabited part of a rating unit

and based on the provision or availability to the land of the service, on a

differential basis as follows:

WATER BY METER

A

targeted rate set and assessed in accordance with Section 19 of the Local

Government (Rating) Act 2002, on the volume of water supplied as

extraordinary water supply, as defined in Hastings District Council Water

Services Policy Manual (this includes but is not limited to residential

properties over 1,500m2 containing a single dwelling, lifestyle lots, trade

premises, industrial and horticultural properties) of $0.62 per cubic metre

of water supplied over and above the typical household consumption as defined

in the Hastings District Council Water Services Policy Manual.

RECYCLING

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on each separately used or inhabited part of a

rating unit and based on the provision or availability to the land of the

service provided in the serviced area, of $43 per separately used or

inhabited part of the rating unit.

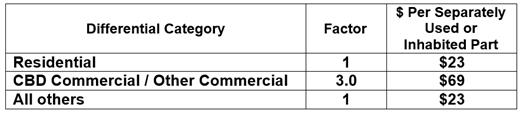

REFUSE

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on each separately used or inhabited part of a

rating unit, differentiated based on the use to which the land is put.

Residential

rating units currently receive a weekly collection. Commercial rating

units located within Hastings as defined on Council Map “Hastings CBD

Refuse”, and located within Havelock North as defined on Council Map

“Havelock North CBD Refuse” currently receive a twice weekly

collection.

The

rate for 2018/19 is:

WAIMARAMA REFUSE

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002, on each separately used or inhabited part of a

rating unit located within Waimarama as defined on Council Map

“Waimarama Refuse Collection”, and based on the provision or availability

to the land of the service provided, of $80 per separately used or inhabited

part of the rating unit.

CAPITAL COST OF SUPPLY EXTENSIONS

Targeted

rates set and assessed in accordance with Section 16 of the Local Government

(Rating) Act 2002, on each separately used or inhabited part of a rating

unit, and based on the provision or availability to the land of the service

provided, to fund the capital cost of the extension to the water supply and

sewerage networks in each of the following locations, as follows:

Whirinaki Water Supply:

$270

per separately used or inhabited part of a rating unit (over 4 instalments)

for those rating units where the ratepayer elected for a 25 year targeted

rate option and elected not to pay a lump sum option at the time of scheme

inception.

Waipatiki Sewage Disposal:

$1,312

per separately used or inhabited part of a rating unit (over 4 instalments)

for those rating units where the ratepayer elected for a 10 year targeted

rate option and elected not to pay a lump sum option at the time of scheme

inception.

Te Mata Sewer Extension Sewage Disposal

(Commercial Connections)

A targeted rate set and assessed in accordance with

Section 16 of the Local Government (Rating) Act 2002 on any commercial rating

unit located on Te Mata Road as defined on Council Map “Te Mata

Sewer”, and based on the extent of provision of any service, of the

following amounts per rating unit (over 4 instalments) (Inclusive of GST and

Interest):

Te Mata Estate $12,992

The Cheese Company $9,224

Black Barn $8,015

WAIMARAMA SEA WALL

A

targeted rate set and assessed in accordance with Section 16 of the Local

Government (Rating) Act 2002 on a differential basis, on each separately used

or inhabited part of a rating unit within each individual zone defined on

Council Map “Waimarama Sea Wall Zone” of the following amounts

per separately used or inhabited part of the rating unit:

Zone

1 shall pay 67% of the cost to be funded, whilst Zone 2 shall pay 23% of the

cost and Zone 3 10% of the cost, based on the extent of the provision of

service.

|

Zone 1

|

$270

|

Zone 2

|

$187

|

Zone 3

|

$70

|

DUE DATES AND PENALTY DATES

Due Dates for Payment and Penalty Dates (for Rates other than Water

by Meter Rates):

The

Council sets the following due dates for payment of rates (other than Water

by Meter) and authorises the addition of penalties to rates not paid on or by

the due date, as follows:

Rates

will be assessed by quarterly instalments over the whole of the district on

the due dates below:

|

Instalment

|

Due Date

|

Penalty Date

|

|

1

|

17 August 2018

|

22 August 2018

|

|

2

|

16 November 2018

|

21 November 2018

|

|

3

|

15 February 2019

|

20 February 2019

|

|

4

|

17 May 2019

|

22 May 2019

|

A penalty of 10% will be added to any portion of

rates (except for Water by Meter) assessed in the current year which remains

unpaid after the relevant instalment due date, on the respective penalty date

above.

Arrears Penalties on Unpaid Rates from Previous Years

Any portion of rates assessed in previous years (including previously

applied penalties) which remains unpaid on 19 July 2018 will have a further

10% added. The penalty will be added on 20 July 2018.

A further additional penalty of 10% will be added to any portion of rates

assessed in previous years which remains unpaid on 20 January 2019. The

penalty will be added on 21 January 2019.

Due Dates for Payment and Penalty Dates (for Water

by Meter Rates):

For

those properties that have a metered water supply, invoices will be issued

either three-monthly or six-monthly.

Three

Monthly Invoicing:

|

Instalment

|

Invoicing Due Date

|

Penalty Date

|

|

1

|

23 October 2018

|

24 October 2018

|

|

2

|

21 January 2019

|

22 January 2019

|

|

3

|

22 April 2019

|

23 April 2019

|

|

4

|

22 July 2019

|

23 July 2019

|

Six

Monthly Invoicing:

|

Instalment

|

Invoicing Due Date

|

Penalty Date

|

|

1

|

21 January 2019

|

23 January 2019

|

|

2

|

22 July 2019

|

23 July 2019

|

A penalty of 10% will be added to any portion of

water supplied by meter, assessed in the current year, which remains unpaid

after the relevant instalment due date, on the respective penalty date above.

Arrears Penalties on Unpaid Water by Meter Rates from

Previous Years

Any portion of Water by Meter rates assessed in previous years

(including previously applied penalties) which remains unpaid on 20 July 2018

will have a further 10% added. The penalty will be added on 23 July 2018.

A further additional penalty of 10% will be added to any portion of rates

assessed in previous years which remains unpaid on 23 January 2019. The

penalty will be added on 24 January 2019.

With the reasons for this

decision being:

The Council is required to

collect funds from rates on properties to undertake the functions outlined in

the 2018-28 Long Term Plan.

|

Hastings District

Council

Hastings District

Council