1.

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 11

September 2018

FROM: Financial Controller

Aaron Wilson

Chief Financial Officer

Bruce

Allan

SUBJECT: Draft

Financial Year End Result - 30 June 2018

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Council of the unaudited accounting and

rating result for the year ended 30 June 2018 and for the Council to allocate

the reported surplus. It also seeks the approval from Council to carry

forward project budgets. This report has been prepared on the basis that the

Hastings District Rural Community Board has approved the recommendations

submitted to it on 10 September 2018 relating to the year-end rating result for

Rating Area 2.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 The

rating result is favourable to budget.

This is a consequence of the adoption of sound financial management including

active treasury management, continued pursuit of efficiencies and delays in

some projects.

1.4 The

unaudited rating result for the 2017/18 year is a positive result and is as

follows:

|

Rating Area 1

|

$518,439

|

Surplus

|

|

Rating Area 2

|

$424,274

|

Surplus

|

|

Total for the District

|

$942,713

|

Surplus

|

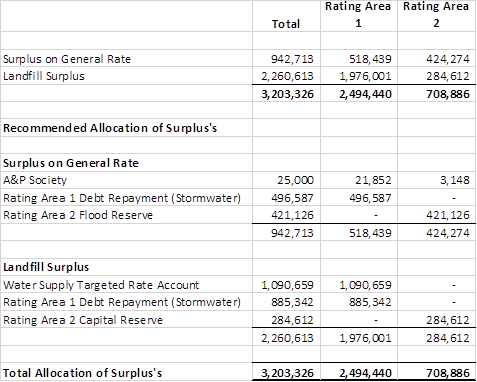

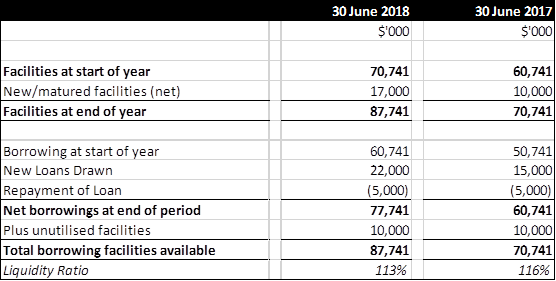

1.5 In

addition to the Rating Result, Council also generated a surplus from the

Landfill operation, the report recommends that these surpluses be allocated as

follows:

1.6 The report also recommends that budget

allocations proposed to be carried forward from the 2017/18 year to 2018/19 to

enable project completion be approved.

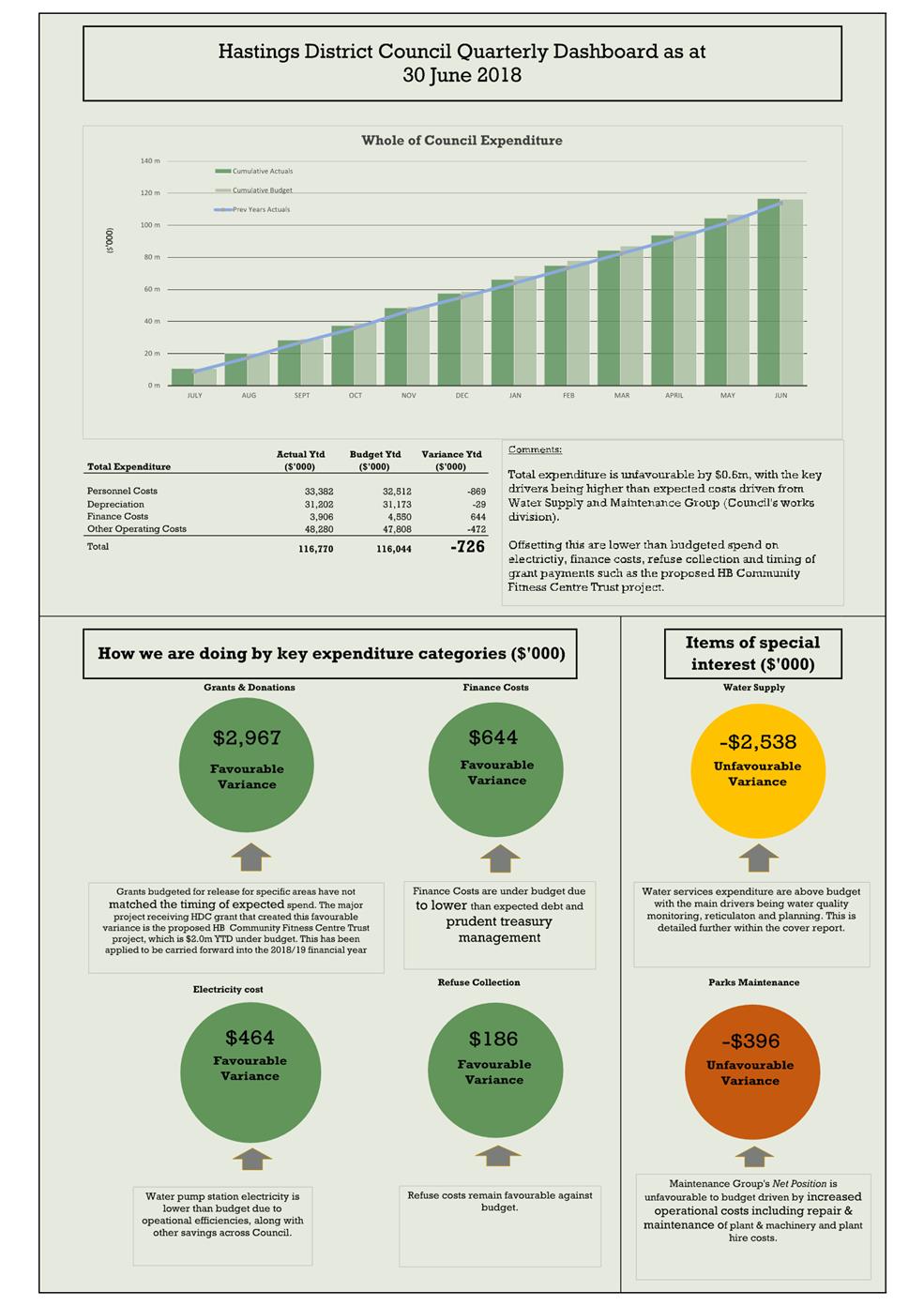

2.0 BACKGROUND

2.1 Council

is provided with quarterly financial reports during the year with the unaudited

year end result presented annually at the September Finance and Risk Committee

meeting.

2.2 Officers’

report on the operating financial result (Operating surplus/deficit) as well as

the rating result. The operating (accounting) financial result is

reported on quarterly during the year and at year end a report is prepared on

the rating result in addition to the accounting result.

2.3 The

rating result differs from the accounting result in respect of non-cash items

such as depreciation, gains or losses on interest rate swaps, vested assets,

impairment of assets and investments and development contributions income which

have no impact on setting rates and are therefore excluded from the rates

calculations. The rating result reports on the variance of rates collected and

net total expenditure (including capital and reserve transfers) for Council.

2.4 The

Financial Reports attached to supplement this report include:

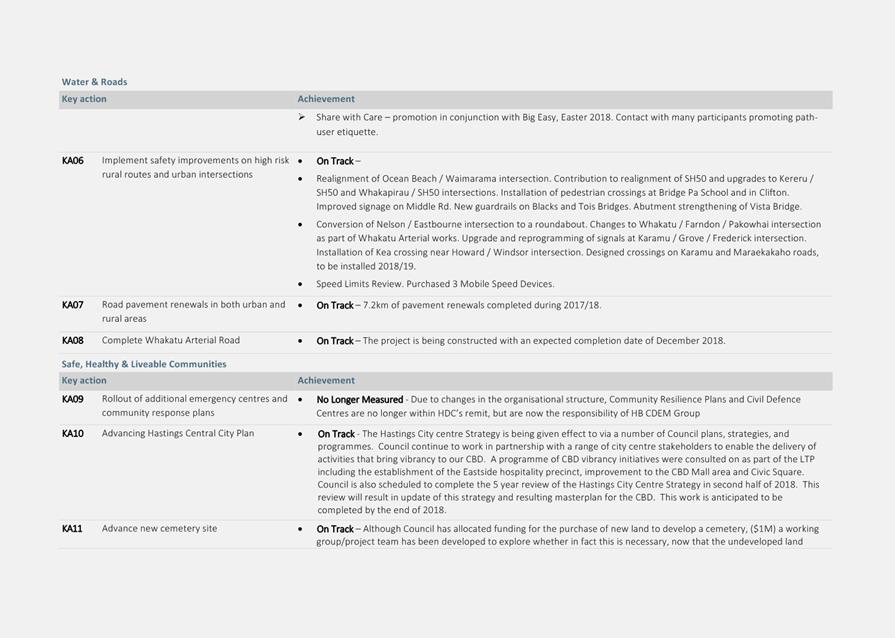

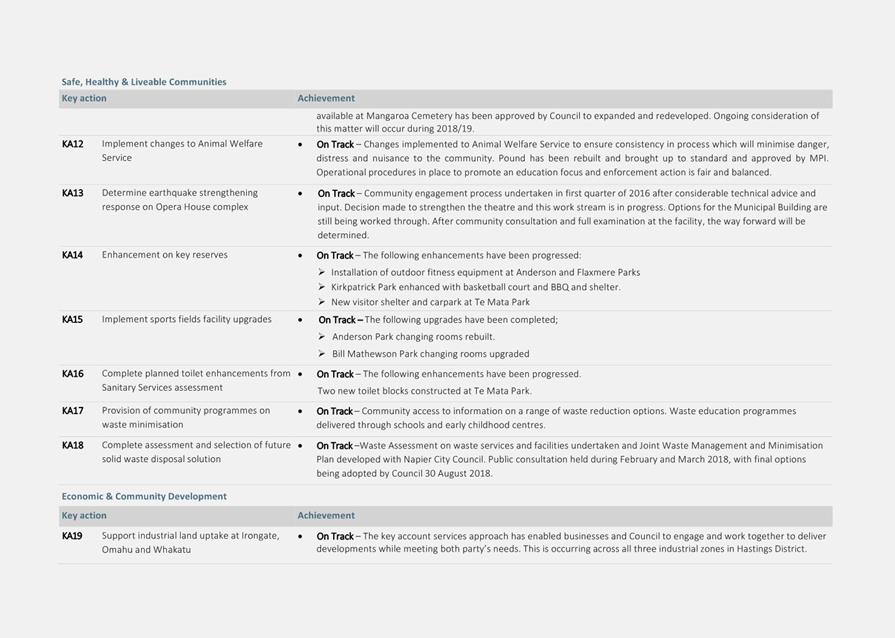

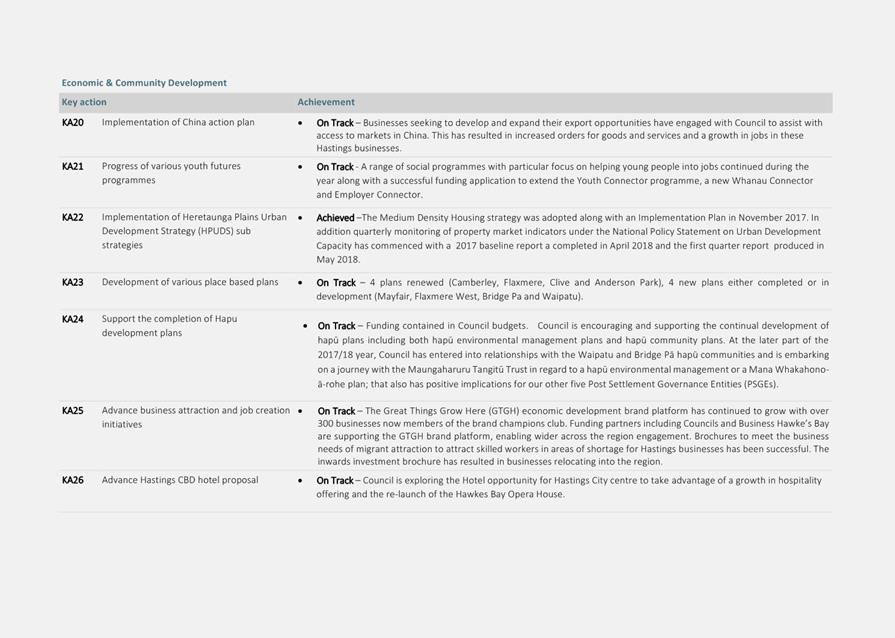

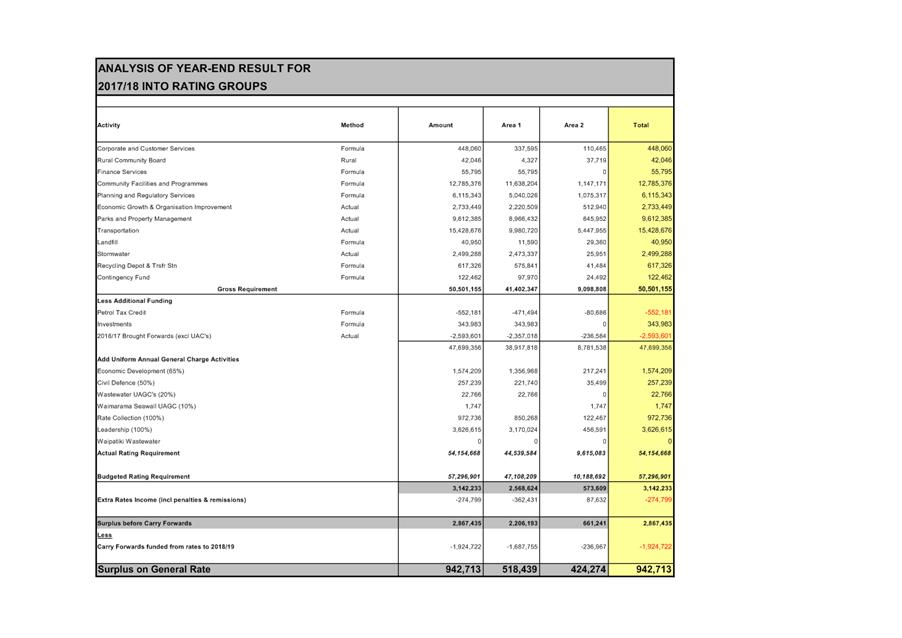

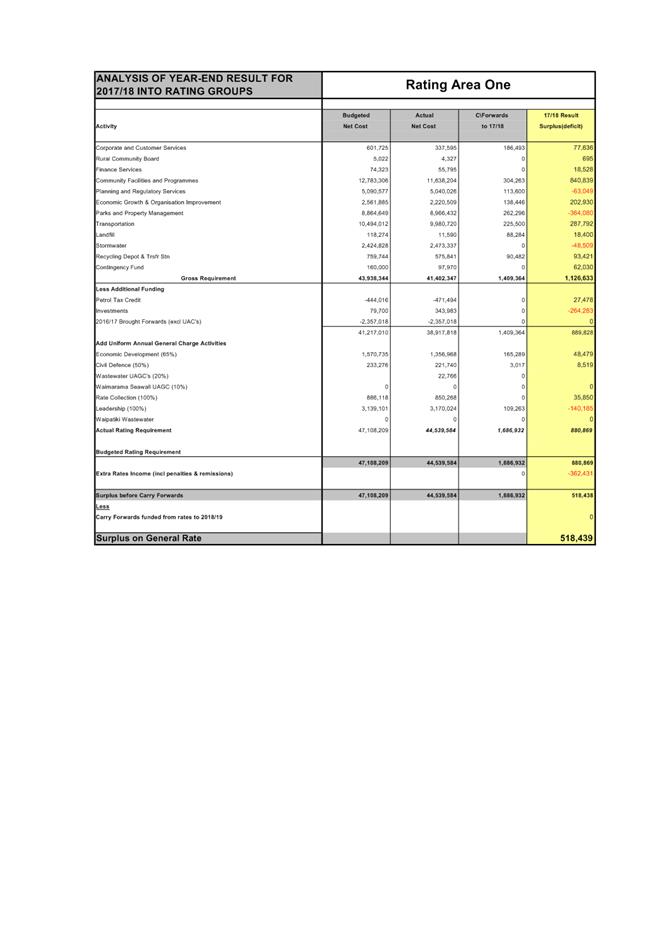

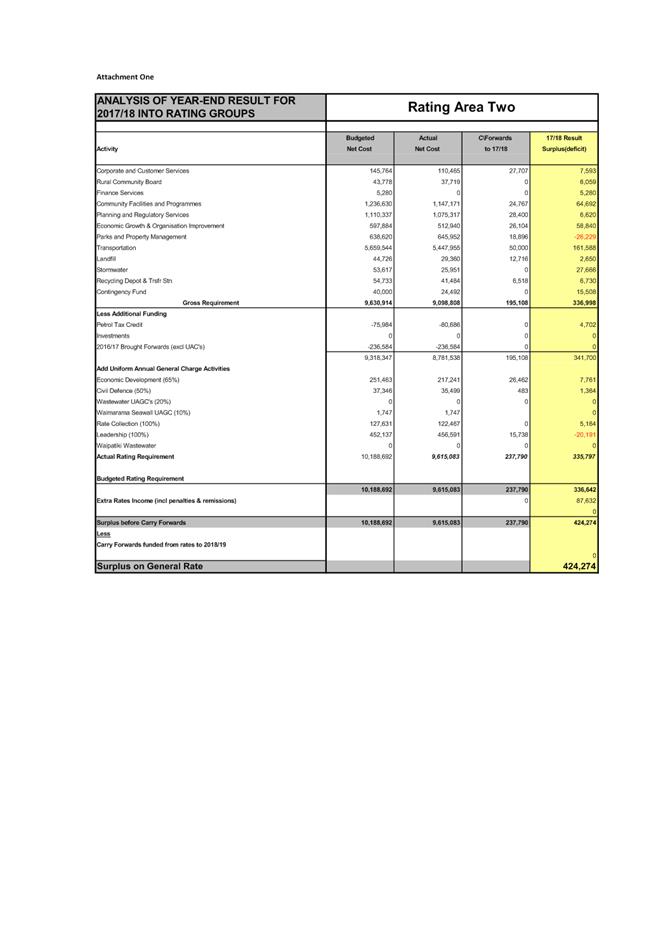

Attachment 1 – Interim Rating Result for the year ended 30 June 2018

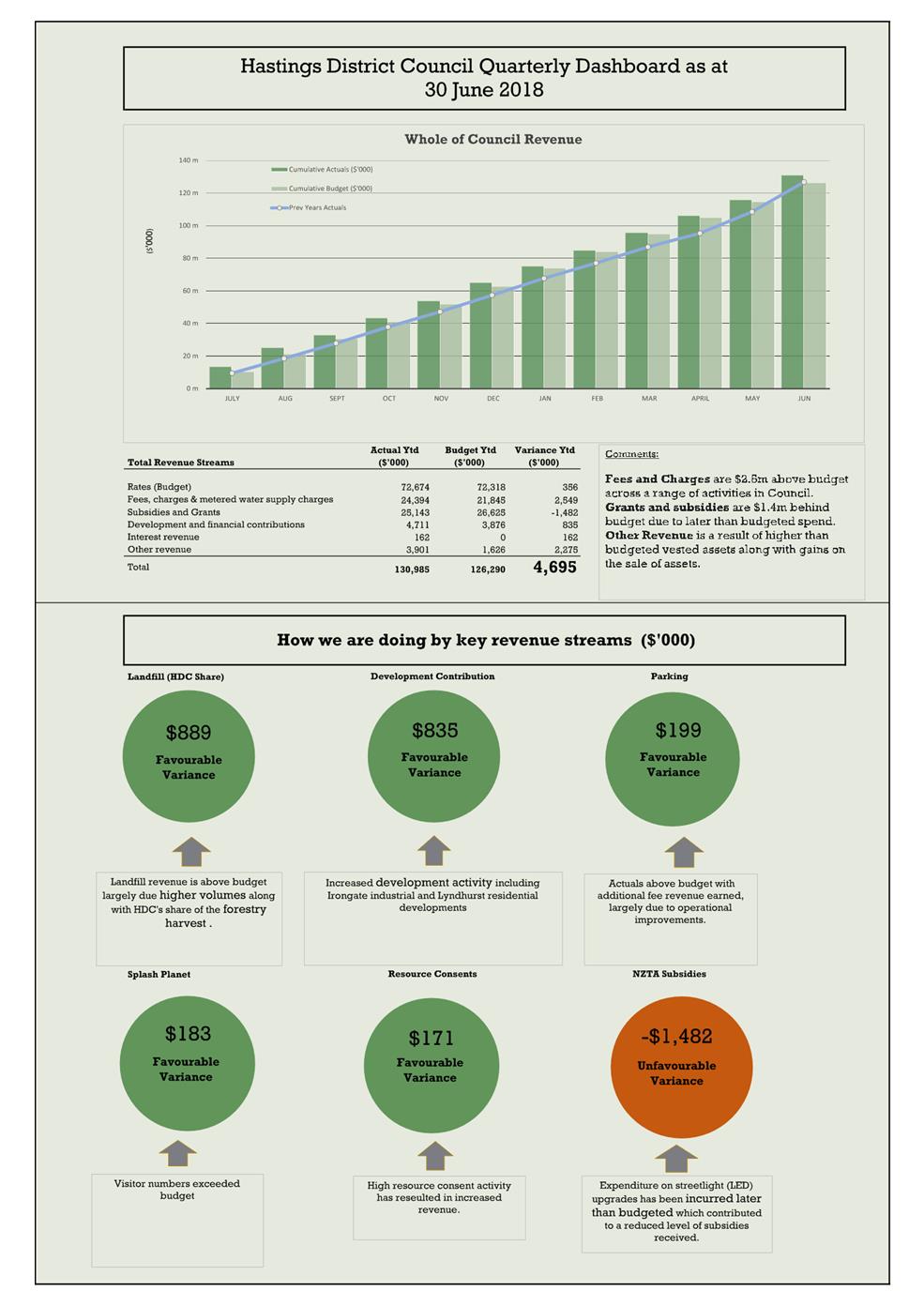

Attachment 2 – Dash Board Summary of Financial performance

Attachment 3 – Draft Unaudited

Financial Statements

Attachment 4 – Detailed Carry Forward Schedule.

2.5 The

financial reports contain summarised information. Please feel free to

contact the report writer or the Chief Financial Officer directly on any

specific questions from the reports before the meeting. This will

ensure that complete answers can be given at the meeting on the detail that

forms the basis for these reports.

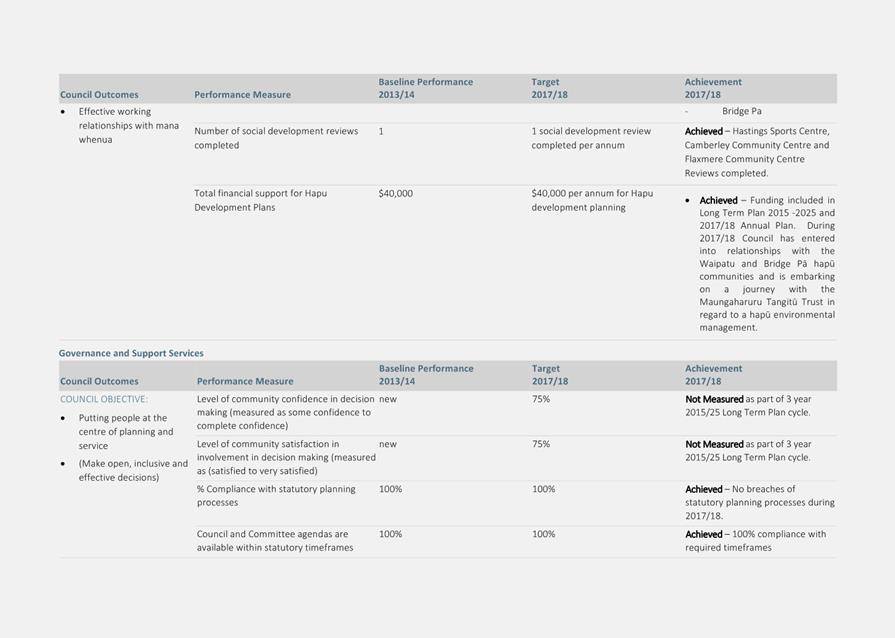

3.0 CURRENT SITUATION

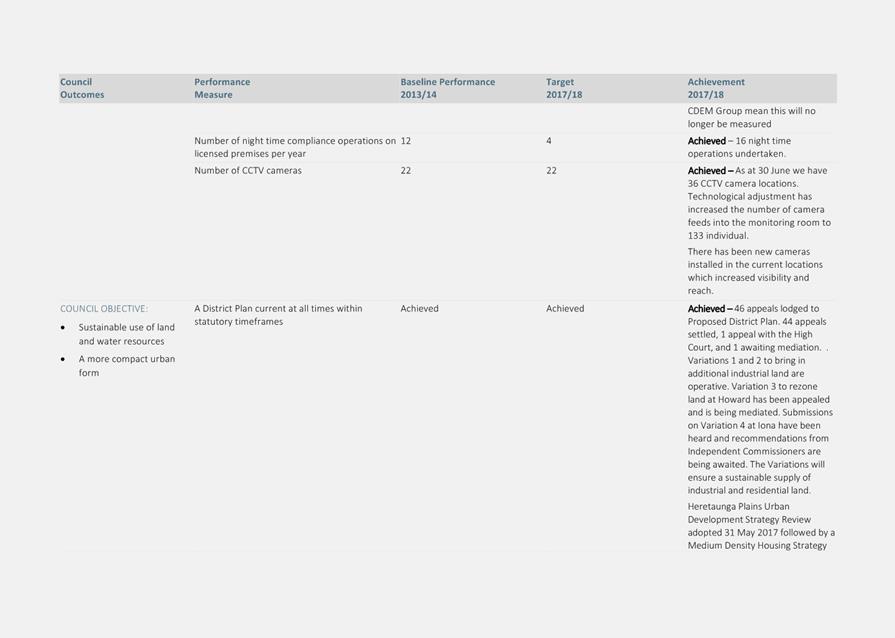

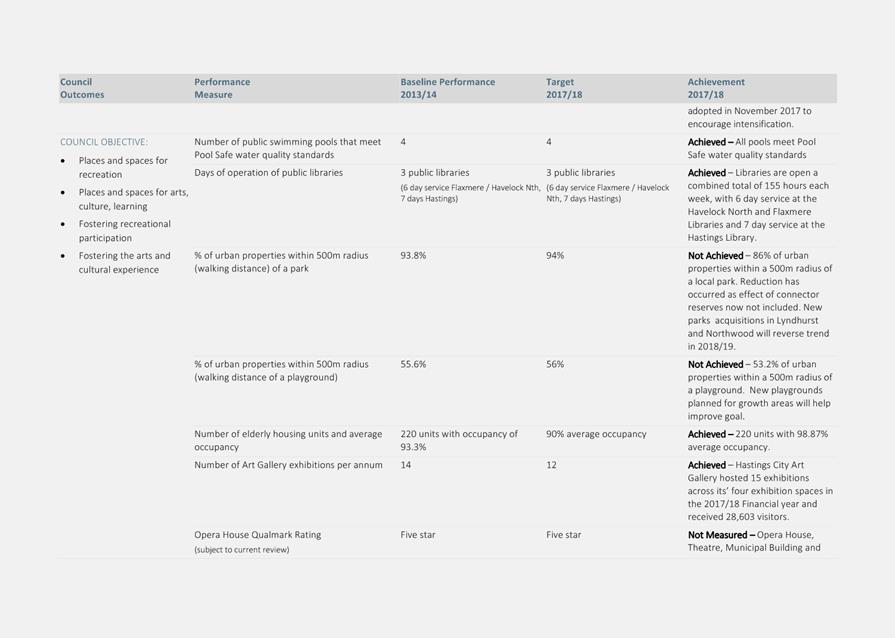

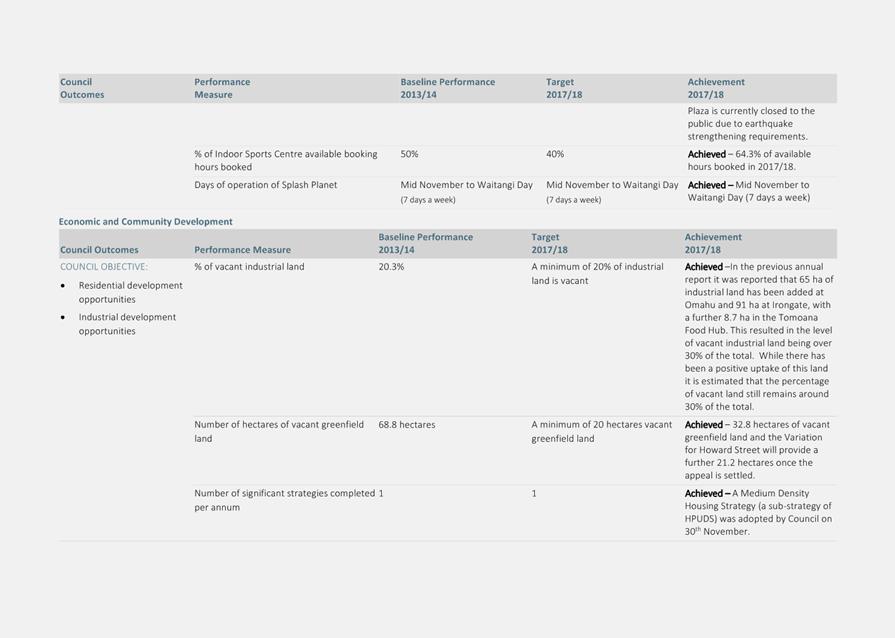

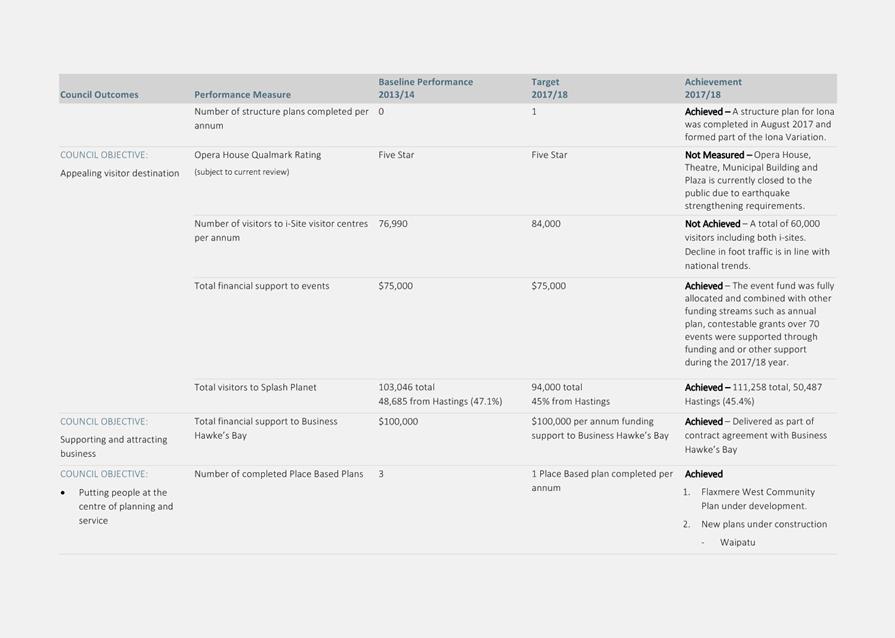

3.1 The

2017/18 financial year has seen a continuation of a strong Hawke’s Bay

economy. In terms of Council performance, almost all areas of Council have met

their respective revenue targets. At the same time a close watch was kept on

expenditure to ensure Council maintained a prudent approach to cost pressures.

3.2 Since

the financial quarterly report for the year to March 31 was presented in May,

most of the issues and trends identified have remained on the same track to the

end of the financial year. This report sets out the financial performance

(accounting result) and the rating result for the year ended 30 June 2018.

These results are unaudited and may be subject to minor adjustments.

4.0 THE RATING RESULT

4.1 Council adopts strong financial

management practices. Council prepares a balanced budget to deliver

Council’s desired programme, including high levels of fiscal tensioning

and stretch targets. In addition projects are only proceeded with after a

thorough review and analysis. This also ensures that projects are not

undertaken until they are required thereby deferring expenditure and reducing

debt and interest costs to Council.

4.2 Interest savings of $927,257

have contributed significantly to the surplus, with savings and overspends across

Council matching off.

4.3 Interest savings are mainly

due to:

· effective treasury management

· favourable market conditions with interest rates being at 30 year

historical lows

· projects being deferred until the later part of the year or carried

forward

4.4 Council

has managed its interest rate risk in the short and medium term through its

interest rate risk position (swaps) and Council has a strong debt maturity

portfolio which is cost effective. Council’s weighted average cost of

funds was 5.31% at 30 June 2018 (4.97% at 30 June 2017). The lower

average cost of capital last year is reflective of higher levels of cash on

hand and interest received income impacting on the net interest expense.

4.5 Overall the net interest

savings were $997,729 of which $927,257 directly impacted on the overall rating

result and includes interest income which is not budgeted for. The

remainder of the savings were to offset the loan funding required on growth

projects which are repaid through development contributions.

|

INTEREST

|

Budget

$

|

Actual

$

|

Variance

$

|

|

Interest –

HDC Loans*

|

3,835,255

|

3,042,386

|

792,869

|

|

Interest –

Growth Loans

|

787,561

|

717,089

|

70,472

|

|

Interest Income*

|

-

|

(134,388)

|

134,388

|

|

TOTAL NET

INTEREST

|

4,622,816

|

3,625,087

|

997,729

|

* Contribute to Rating Surplus

4.6 The rating result for the

2017/18 financial year is a positive result and compares with a $1,158,370

surplus reported in 2016/17.

|

Rating Area 1

|

$518,439

|

Surplus

|

|

Rating Area 2

|

$424,274

|

Surplus

|

|

Total for the

District

|

$942,713

|

Surplus

|

4.7 The rating surplus is 0.7%

of the total reported revenue in the 2017/18 Statement of Comprehensive Revenue

and Expense. Achieving this positive result where there are continued pressures

on Council funds is reflective of the prudent financial strategies adopted by

Council.

4.8 In addition to the rating

surplus, the Council’s share of the surplus from the Landfill operations

is $2.2m. Prior to last year the Landfill surpluses were used to replay

Landfill debt. The remaining debt was extinguished by application of the

surplus from the 2015/16 financial year. Council resolved last year to apply

the 2016/17 landfill surplus of $1.615m to the water supply targeted rate

account for RA1 ($1.4m), and to the capital reserve for RA 2 ($0.203m). This

now leaves the Council with a decision on how to allocate the 2017/18 Landfill

surplus.

4.9 In addition to the above,

which is after all necessary reserve transfers have been made, there are a

number of significant activities where surpluses or deficits are ring fenced

and/or transferred to reserves and include:

|

|

2018 Surplus / (Deficit)

$

|

Reserve Balance as at 30 June 2018

$

|

|

Opera House Operations

|

232,293

|

1,244,569

|

|

Targeted Rate Accounts

|

|

|

|

Water Supply

– RA1

|

(1,209,245)

|

(2,905,153)

|

|

Water Supply – RA2

|

(127,258)

|

(370,561)

|

|

Waste Water

|

(188,434)

|

859,594

|

|

Refuse &

Recycling

|

196,305

|

1,545,735

|

4.10 In allocating surpluses and reserves,

Council’s prudent financial policy approach has traditionally focused on

debt repayment or borrowing reduction. In Rating Area 2, priority has

been given to replenishing the Rural Flood and Emergency Event Reserve.

4.11 In determining priorities for surplus and

revenue allocation, staff advise that the following priority order would be in

line with Council’s prudent financial management approach:

1. Repay Rating Area 1 Debt

2. Reduce Water Supply Targeted Rate Account Deficits

3. Contribute to the Rating Area 2 Flood and Emergency

Event Reserve and the Rating Area 2 Capital Reserve

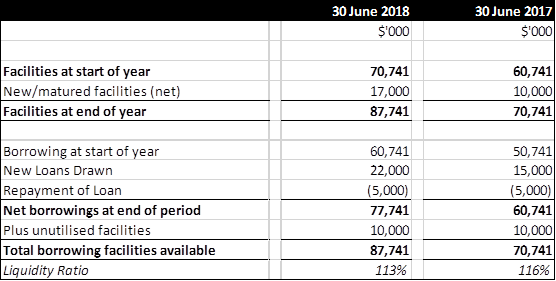

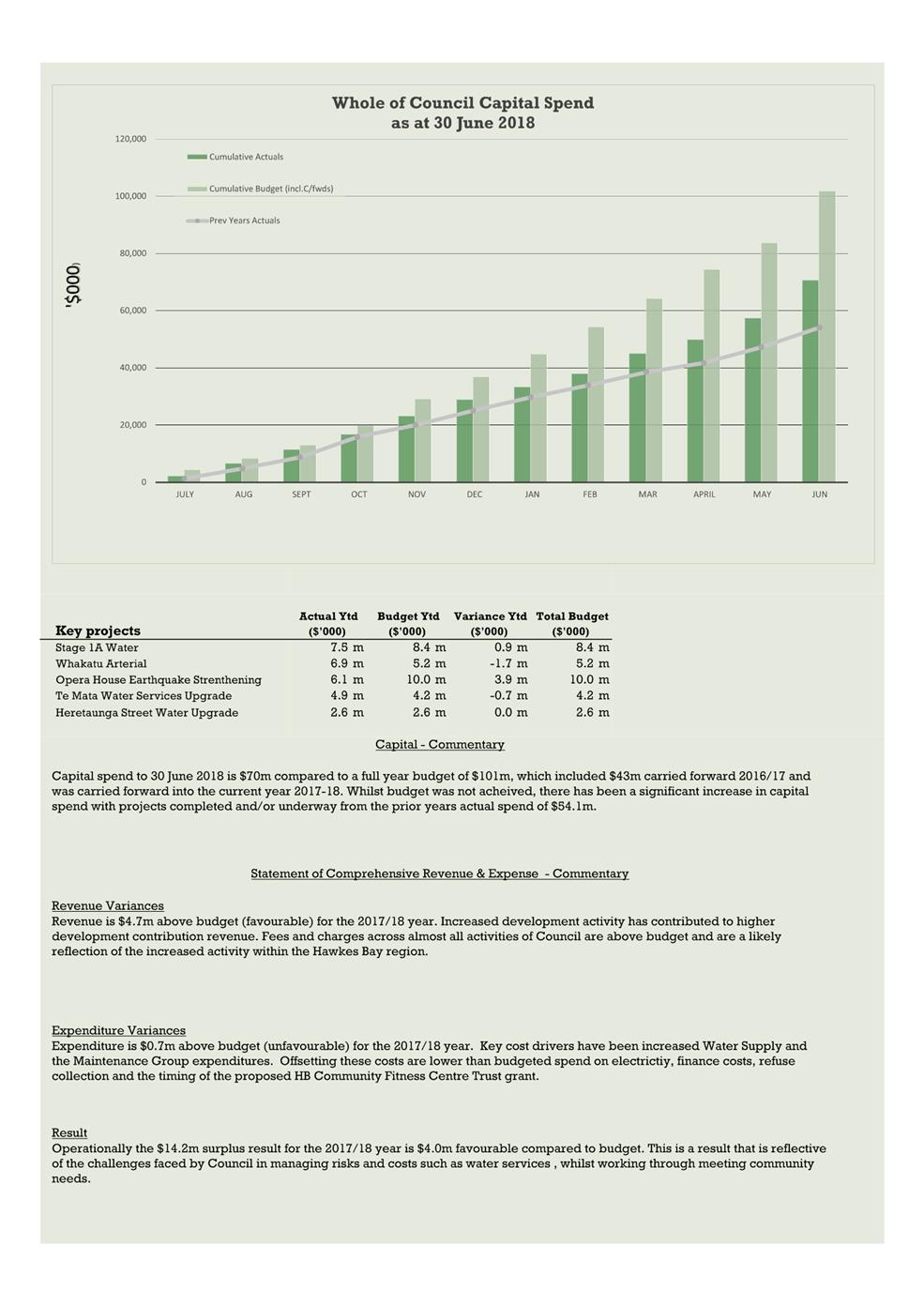

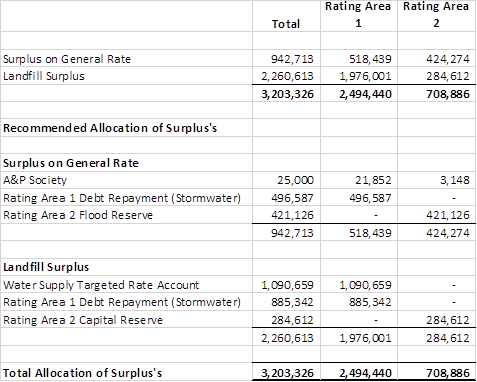

5.0 EXTERNAL DEBT

5.1 Total

net borrowing as at the end of June is $77.7m, an increase from last year

($60.7m), although is still lower that what was projected in the 2015-25 Long

Term Plan (LTP) which had forecast debt levels of $98.9m at this time.

Committed borrowing facilities in place are $87.7m, providing headroom of $10m.

The liquidity ratio is at 113% compared to the policy minimum of 110% and is

therefore above the minimum requirements set by Council.

5.2 While

there are lower debt levels when compared to the LTP, it needs to be noted the

significant increase in debt levels when compared to the previous year’s

actuals. This is reflective of the large number of projects well underway,

including the Opera House and Whakatu Arterial and the new Havelock North water

main. Prudent management of Council’s financial affairs has created

capacity for future borrowing requirements.

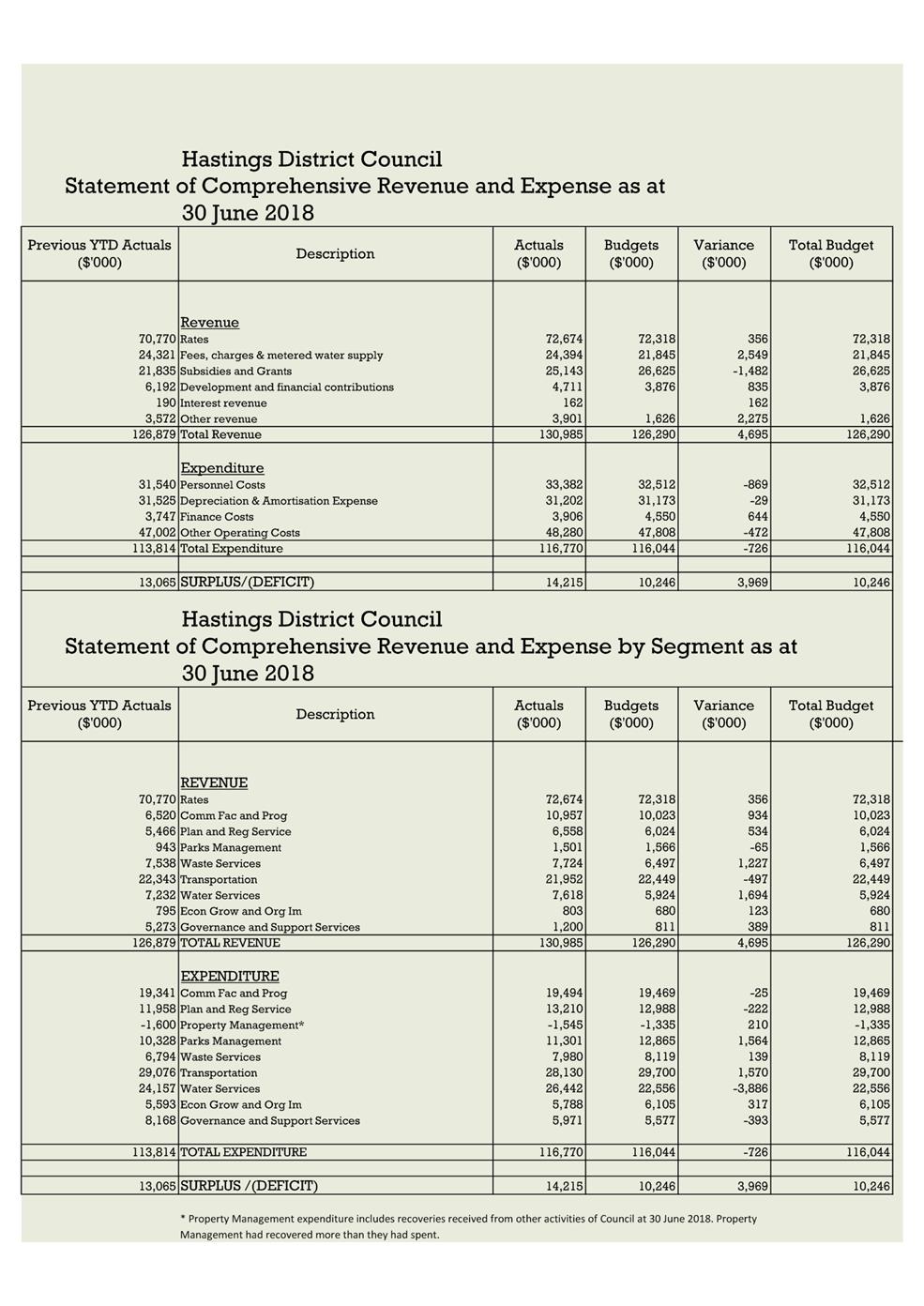

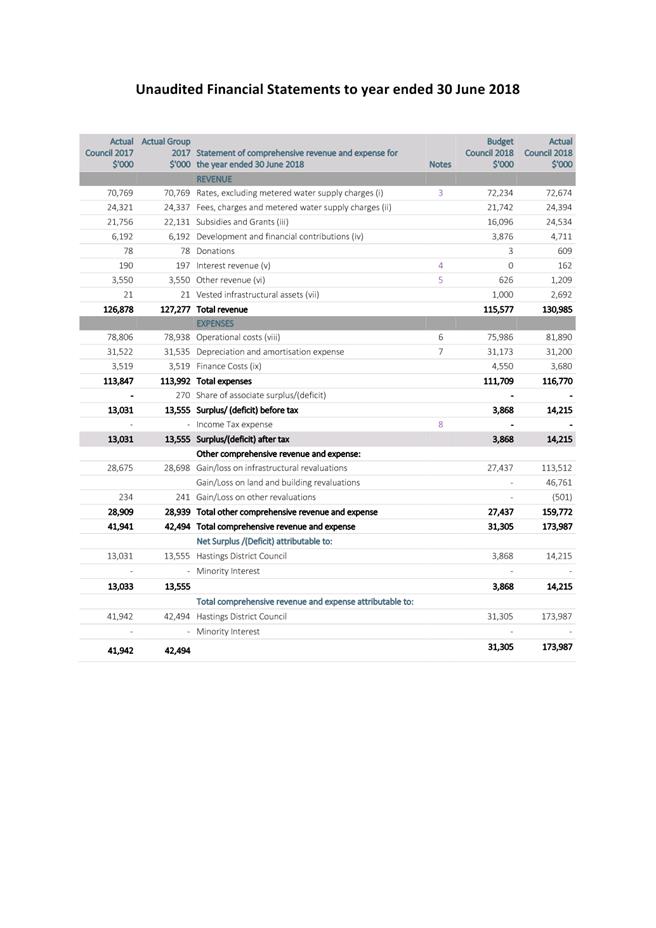

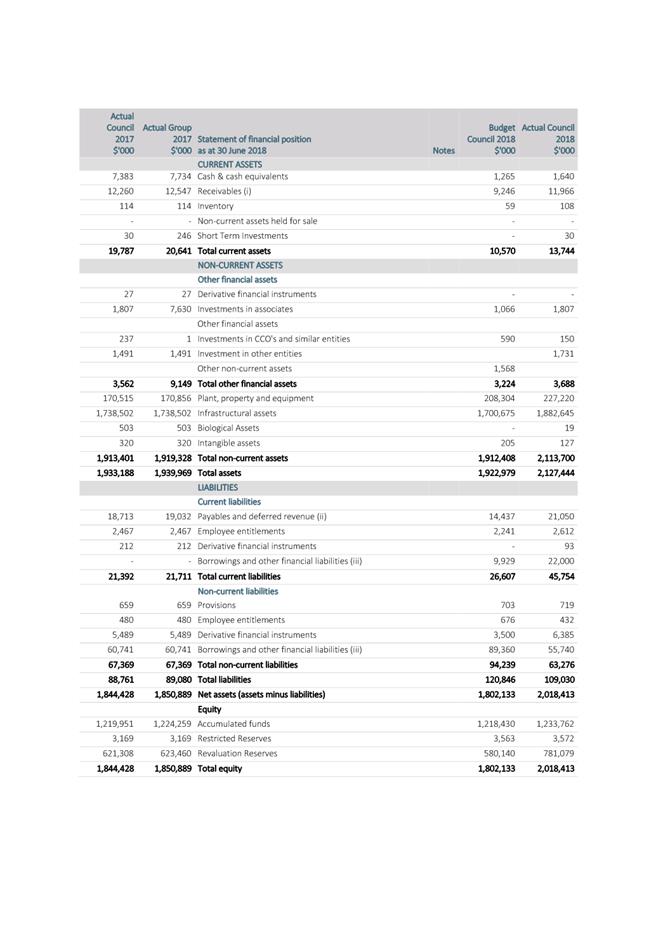

6.0 THE unaudited ACCOUNTING

RESULT

6.1 Draft

Unaudited Operating Accounting Result

Set out below is a summary of the for the

2017/18 financial year. Please note that this is not the same as the rating

result.

|

Unaudited Operating Accounting

Result

|

Budget Council

$’000

|

Actual Council

$’000

|

Variance

$’000

|

|

Operating Revenue

|

115,577

|

130,985

|

15,408

|

|

Less Operating Expenditure

|

111,709

|

116,770

|

(5,061)

|

|

Net Surplus/(Deficit)

|

3,868

|

14,215

|

10,347

|

|

Gain / (Loss) Revaluations

|

27,437

|

159,772

|

132,335

|

|

Net Surplus after accounting gains / losses

|

31,305

|

173,987

|

142,682

|

6.1.1 The

draft unaudited financial result for the year ended 30 June 2018 before gains

or losses on revaluations is a surplus of $14.2m with favourable variance to

the budget of $10.3m. This includes an unrealised loss on interest rate swaps

of $0.803m, and is before the impact of the revaluation of assets.

6.1.2 The unrealised loss on interest rate swaps is an

accounting entry and reflects the potential cost to Council of replacing all of

its interest rate swaps at the prevailing swap interest rates on 30 June

2018. Council is however extremely unlikely to be put in that situation

and the loss is therefore recognised as an ‘unrealised loss’.

6.1.3 It is important to note that when we refer to

budget variances in the table above, we are referring to variances against the

Annual Plan excluding carry forwards or any other budget adjustments as this is

what we are required to report against in the Annual Report.

6.1.4 Revenue

has a favourable variance of $15.4m. The increase in revenue compared to budget

is made up of the following activities:

· Subsidies and grants make up a significant amount of the increase in

revenue at $8.4m. Most of this is made up of NZTA subsidies that are

reimbursements for capital work done, along with $3.75m granted to the Opera

house project.

· Development Contributions of $4.7m are $0.8m above budget with large

contributions received from the Irongate and Lyndhurst residential development

areas driving this increase. Additional Development Contribution revenue

represents a higher than expected level of development which drives further

investment in growth related expenditure and growth related debt which

DC’s are designed to repay. Total growth related debt as at 30 June 2018

was $10.2m

· Fees and Charges are above budget by $2.5m. This increased revenue

has been achieved across a wide range of Council activities Landfill through

increased tonnages ($0.889m) and Splash Planet attendance and insurance

proceeds ($0.183m) along with Parking ($0.199m) and Environmental Consents

($0.171m).

· Water vested assets are above budget by $1.7m.

6.2 Expenditure is higher than budgeted by $5m and higher than last year

by $2.9m. Highlights in expenditure are:

· Contracted services which are $4.6m above budget, this is primarily

in the areas of infrastructure where there have been and are large capital

projects underway. Brought forwards from the prior 2016/17 year however, are an

offset to a large portion of the higher expenditure at $4m.

· The unrealised loss on swaps of $0.803m. As mentioned in paragraph

6.3, this is an accounting entry that has no effect on cash.

· Personnel costs were higher than budget and last year, with the

addition of personnel in the water area a key driver.

6.3 All

asset classes are on a revolving revaluation cycle, transportation and parks

and reserves were revalued last year, this year the revaluation of the land and

buildings, water services and heritage and culture assets have been the major

revaluation activity.

6.4 This year the valuation for Land and Buildings has seen the fair

value assessed at $208.6m which is an increase of $46.8m in value. The main

drivers for this increase are due to strong market and economic conditions,

along with the increase in costs of rebuilding or constructing an asset of a

comparable nature.

6.5 This year the valuation of the 3 waters assets have shown a $113.5m

increase in the depreciated replacement cost. The increase in replacement

costs were driven primarily by an adjustment to unit rates on the

recommendation of a specific review undertaken by Opus International of unit

rates used.

6.6 The

Heritage and Cultural assets are revalued every five years. This class of

asset involves the collection of Mayoral portraits. The valuation was completed

by Webbs and had an adjustment downward adjustment of $24,000. It must be noted

that this reduced value of the overall collection is not a reflection on the

additional painting recently added to the collection.

6.7 Summary

by Areas of Activity of Council:

Economic Growth and

Organisational Improvement

6.8 Economic

Growth and Organisational Improvement (EGOI) Group had an overall group result

of $0.439m favourable to budget. The key drivers were in the Economic

Development budget with underspends in expert advice ($0.202m), and contracted

services ($0.186m) across a number of operational projects. Where

required, some of this underspend has been requested to be carried forward to

2018/19.

Governance

and Support Services

6.9 Included

in this group of activities are the support services of Finance, HR, Democratic

Support, Leadership and the Chief Executive’s Office. Overall, these

activities have been managed either in line with budget.

Community

Facilities & Programmes

6.10 This

group of activities has a favourable variance against budget of $0.910m

primarily driven by favourable revenue lines in fees and charges such as Splash

Planet ($0.183m), swimming pools ($0.101m) and housing for the elderly

($0.120m). In addition libraries received a $0.501m donation from the estate of

a benefactor.

Planning

& Regulatory Services

6.11 Planning

and Regulatory had an overall group result of $0.312m favourable to budget.

Revenue was $0.534m favourable to budget. Fees and charges across the

group have been the main driver, parking ($0.199m), along with environmental

consents ($0.171m), Offsetting this was higher expenditure of $0.222m driven by

higher personnel and contracting costs required to deliver the increased

revenue.

Asset

Management

6.12 Landfill

revenue was favourable to budget by $0.889m,with higher volumes contributing to

the favourable revenue variance with the forestry harvest contributing $0.282m

to that surplus. This increased revenue has translated into a HDC share of the

surplus of $2.2m.

6.13 The

surpluses generated from the Landfill are released to the shareholding

Council’s and it is up to the two Councils as to what they decide to do

with those funds. In previous years HDC has decided to repay landfill debt with

those surpluses, however with all landfill debt now repaid Council can decide

how it wishes to allocated those funds. Last year Council allocated $1.6m to

the RA1 water services targeted reserve ($1.4m) and the RA2 Capital reserve

($0.20m).

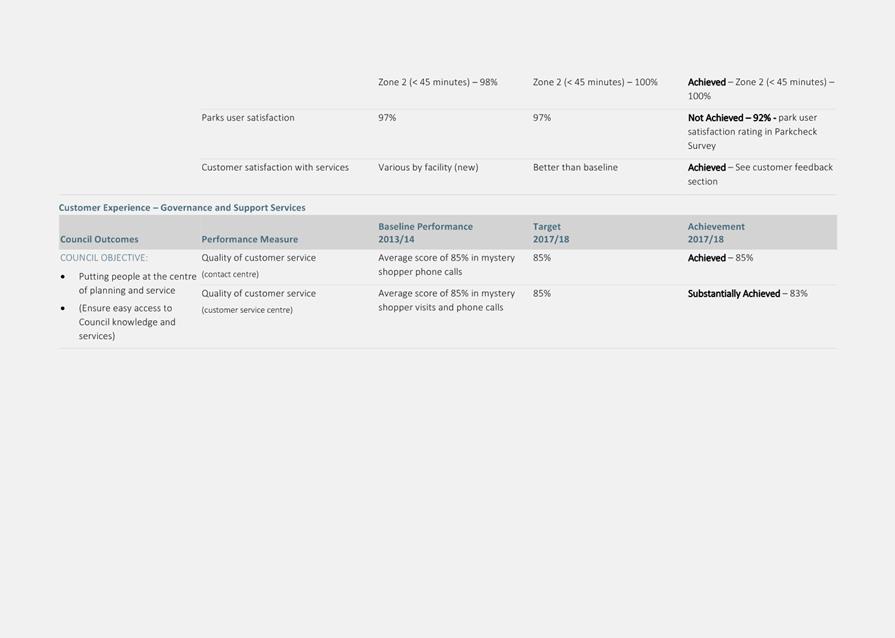

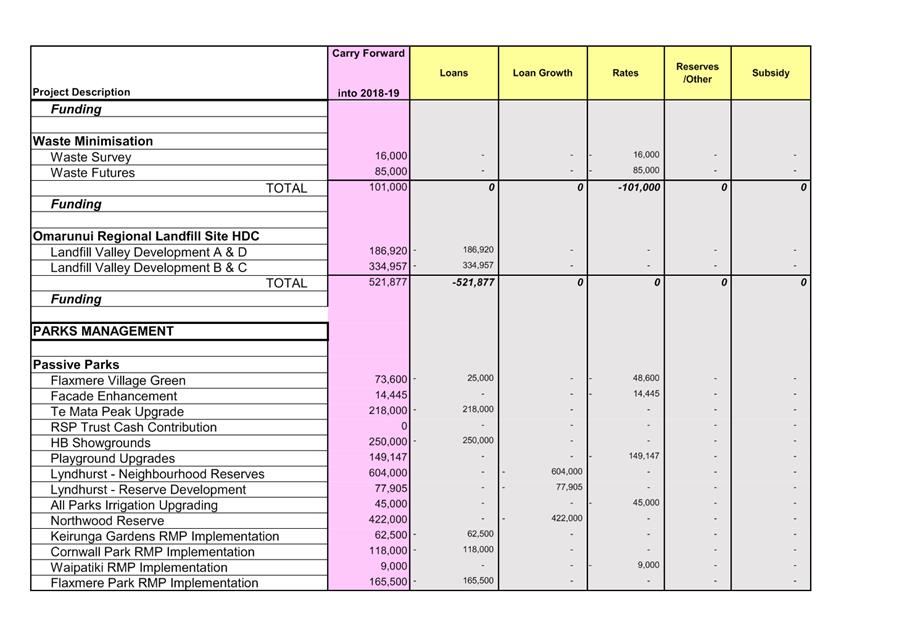

6.13.1 Parks

operational expenditure was $1.5m favourable due to a proposed grant to the

Hawke’s Bay Community Fitness Centre Trust not being fully drawn down.

This is one of the recommended carried forwards into 2018/19 year and those

funds are expected to be fully drawn down by the end of the second quarter of

2018/19.

6.13.2 The

Maintenance Group (Council’s service delivery unit) had an overall loss

reported of $0.395m. The deficit is largely due to the timing of maintenance

expenditure.

6.13.3 Building Service costs were $0.210m

favourable due to lower than planned maintenance and services costs, these

funds have been retained in the building reserve.

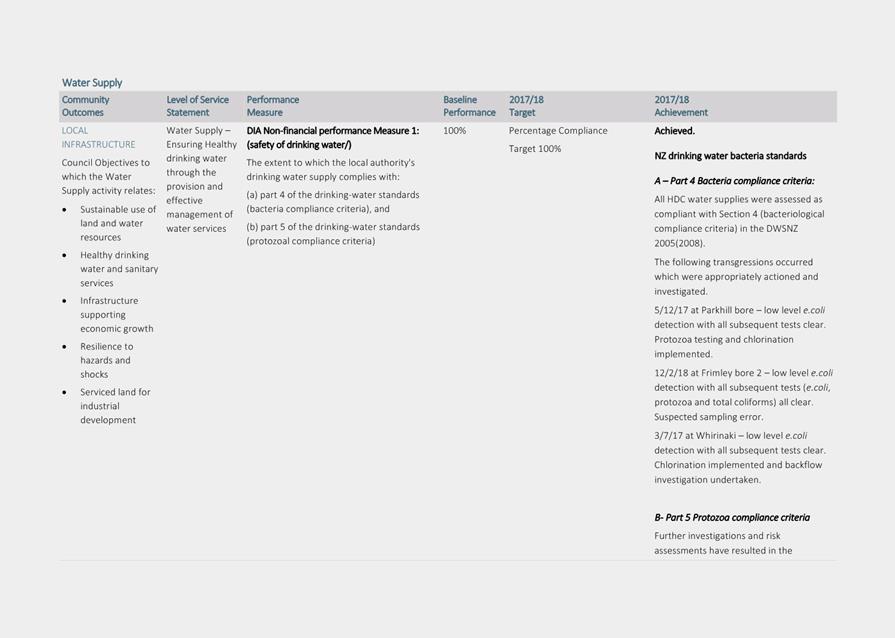

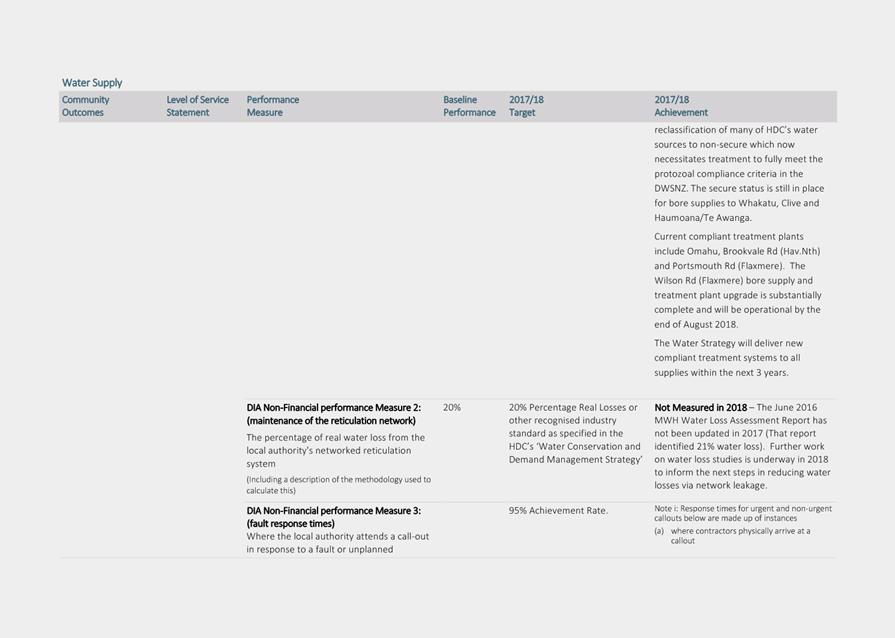

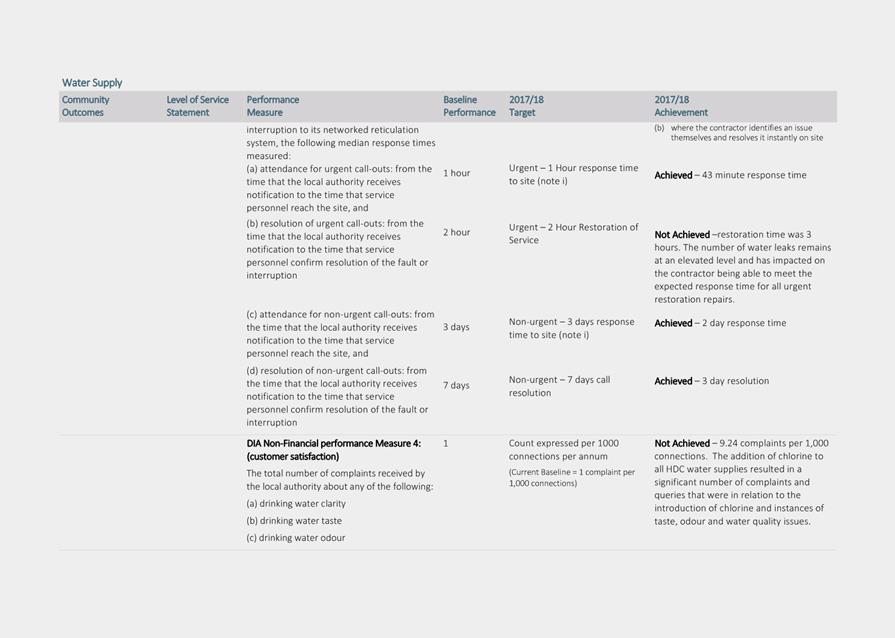

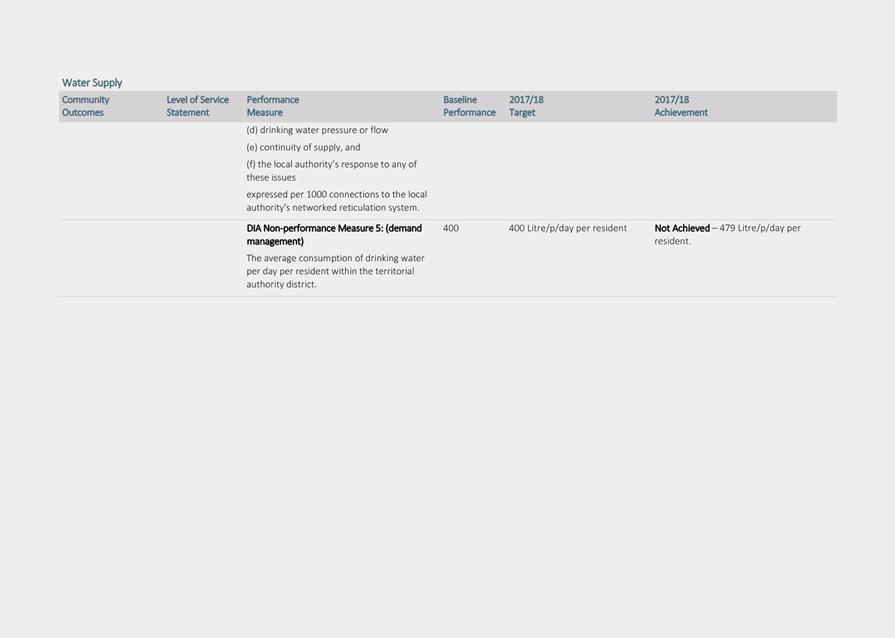

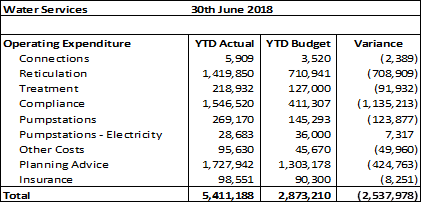

6.14 Water Services

Council continued to spend

significant sums of money on water supply activity through 2017/18 including

both Capital and Operational expenditure. This activity

is funded by way of a targeted rate and accounted for in a separate water

account which is designed to either accumulate reserves or run in deficit

depending on expenditure needs and Council decision making. This allows Council

to spread the impact of “lumpy” expenditure in this activity.

6.14.1 Below is a summary of operating water

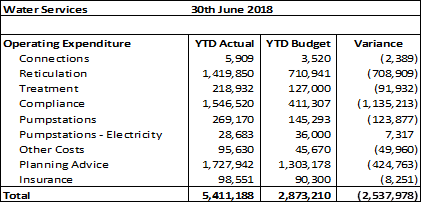

services costs as at 30 June 2018.

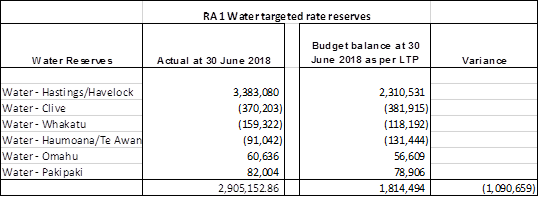

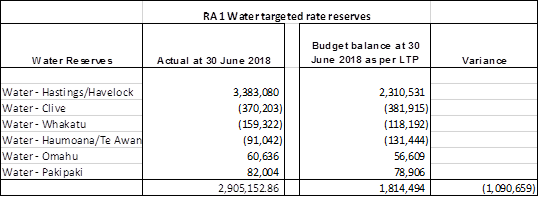

6.14.2 The 2018-28 Long Term Plan anticipated that the Water Supply Targeted

rate account would be in a deficit position of $1.8m due to increased

operational expenditure, with increased water quality monitoring, maintenance

and expert advice required post the water contamination incident of August

2016. The high level of operational expenditure has continued at a rate higher

than anticipated through 2017/18 and the Water Supply Targeted Rate account has

ended the year with a deficit of $2.9m, $1.1m higher than expected.

6.14.3 The increases forecast to the Water Supply Targeted Rate

signaled in the 2018-28 Long Term Plan of an additional $100 for years 1 and 2

and then an additional $50 in year three assumed that with an opening deficit

position in the Targeted Rate Account of $1.8m along with elevated levels of

operational expenditure, the Targeted Rate Account would achieve a breakeven

position within the life of the long term plan.

6.14.4 In light of the higher than expected deficit position at year

end, to achieve that breakeven position forecast during the life of the long

term plan an additional increase to the Water Supply Targeted Rate of $44 per

ratepayer would be required, unless there could be some allocation of Council

surplus’s to this account or significant savings in budgeted expenditure

in this activity.

6.14.5 It is proposed by officers, in order to maintain the expected

timeline of when the reserves will come back into surplus as per the 2018-28

Long Term Plan and to avoid additional increases to the Water Supply Targeted

Rate that the difference noted below of $1.09m be allocated out of the HDC

share of the Landfill surplus to the Water Supply Targeted Rate Account.

6.14.6 Below is a summary of the RA1 water

supply targeted rates reserves:

7.0 TRANSFER

TO RESERVES

7.1 Splash Planet

Reinvestment

The annual

Splash Planet budget contains a provision of $100,000 towards new or upgraded

attractions at Splash Planet. Due to the nature and cost of the attractions,

this budget is not spent every year and a Splash Planet Reinvestment Reserve

has been created. The Splash Planet Reinvestment Reserve has a balance of

$834,260. In addition to this annual budget, there is a standing process

whereby Council considers at this time each year a transfer up to a further

$100,000 to the Splash Planet Reinvestment Reserve should Splash Planet achieve

a result better than budget and if the overall Council surplus is sufficient

enough to allow such a transfer. While the Splash Planet financial result

is $78k better than budget, it is recommended that given Council’s other

financial priorities and the smaller than normal rating surplus, that the

transfer is not recommended in this year.

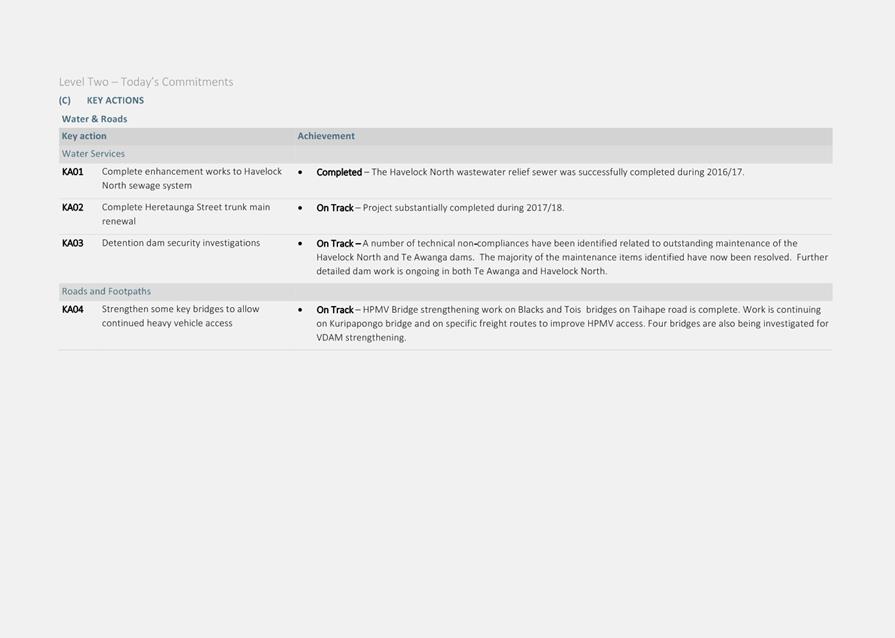

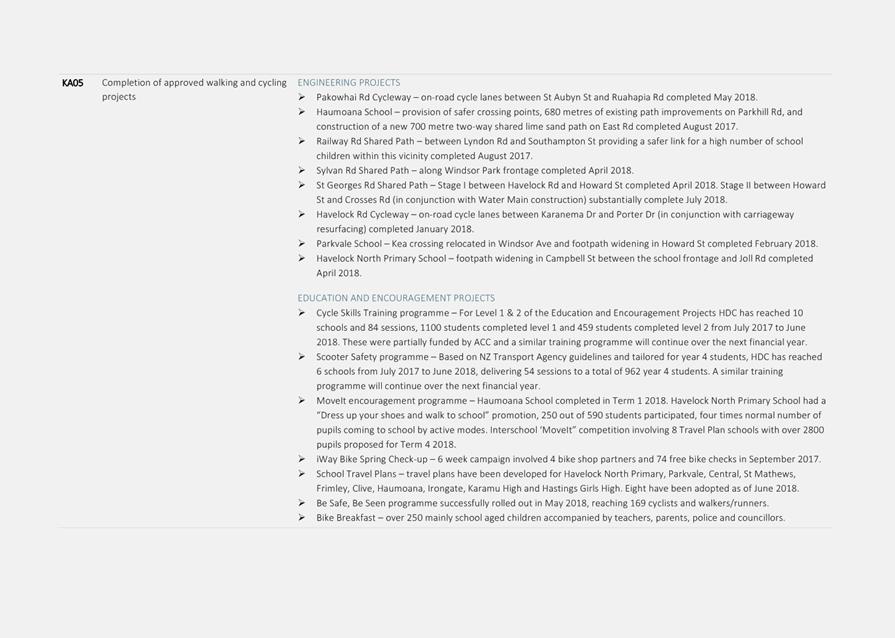

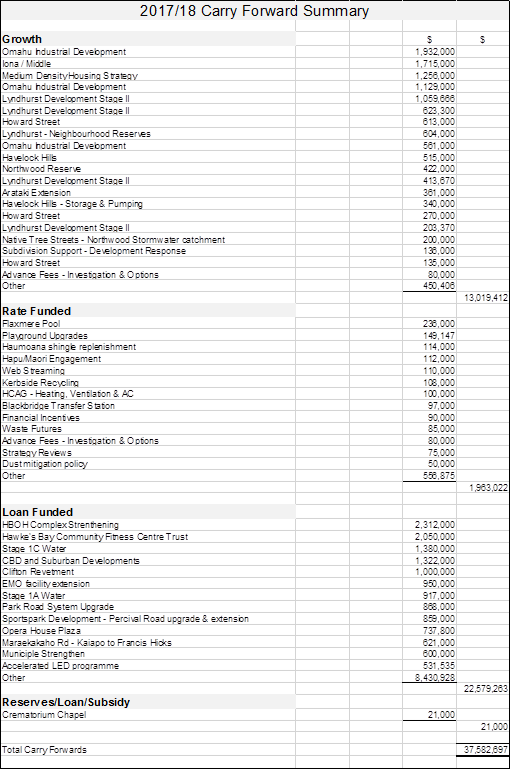

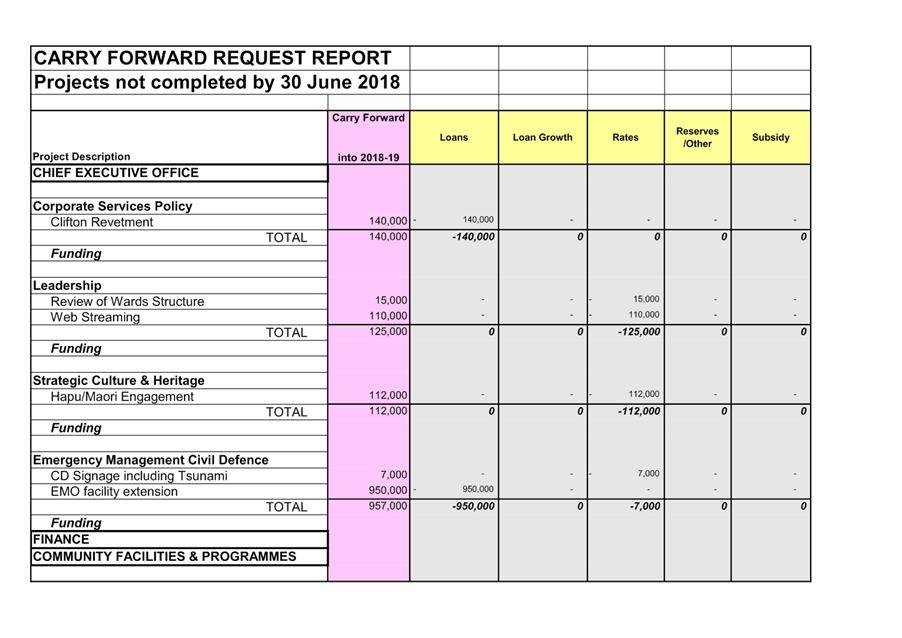

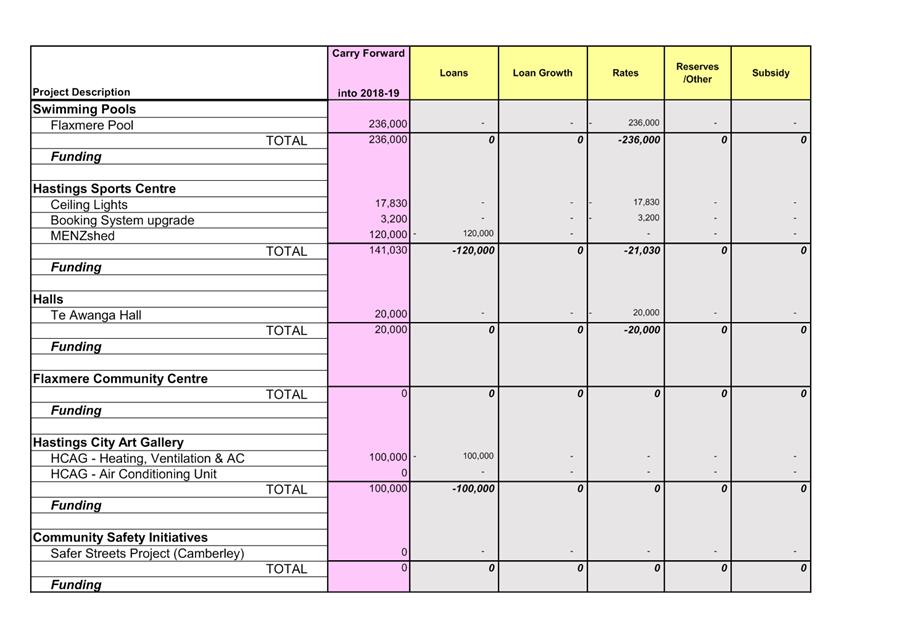

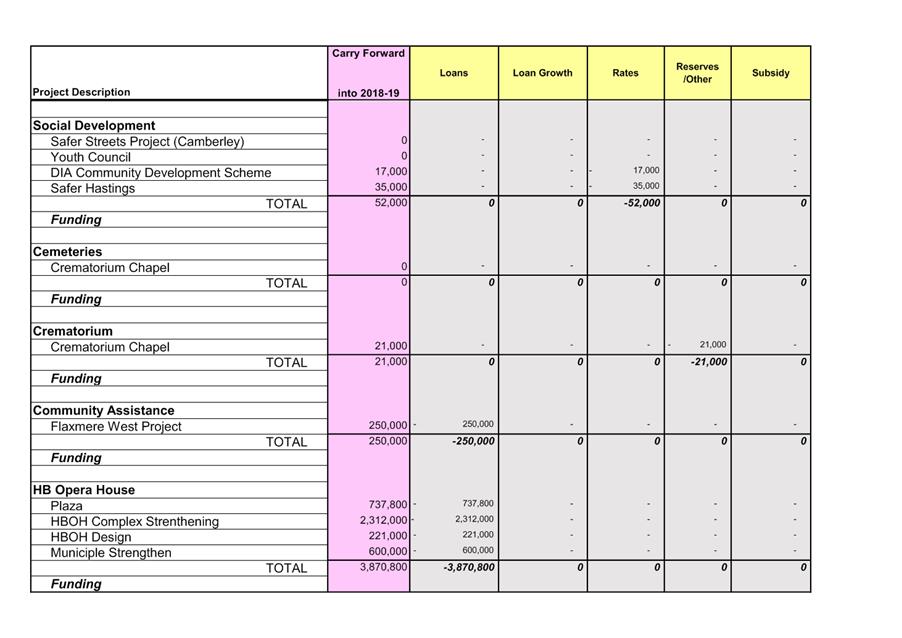

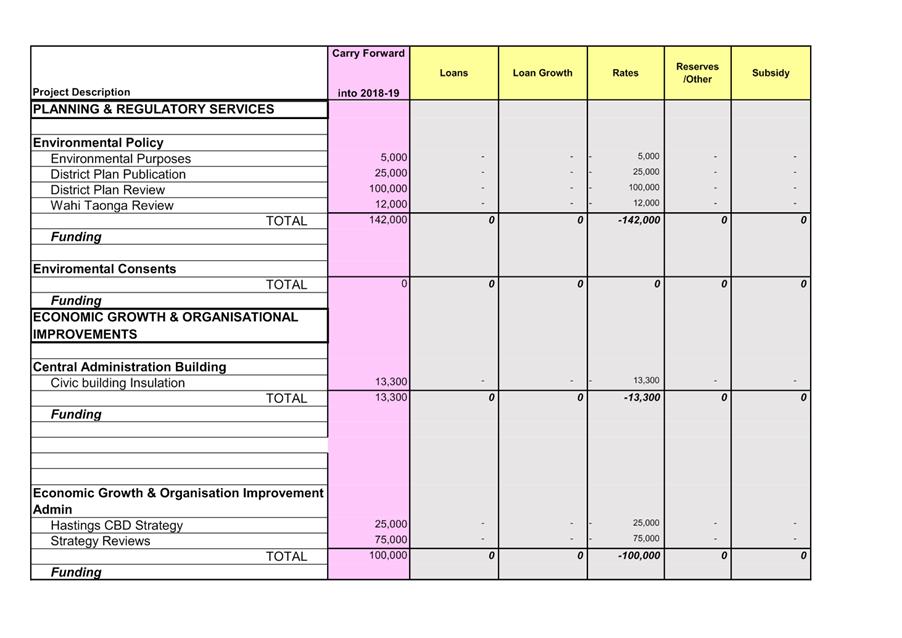

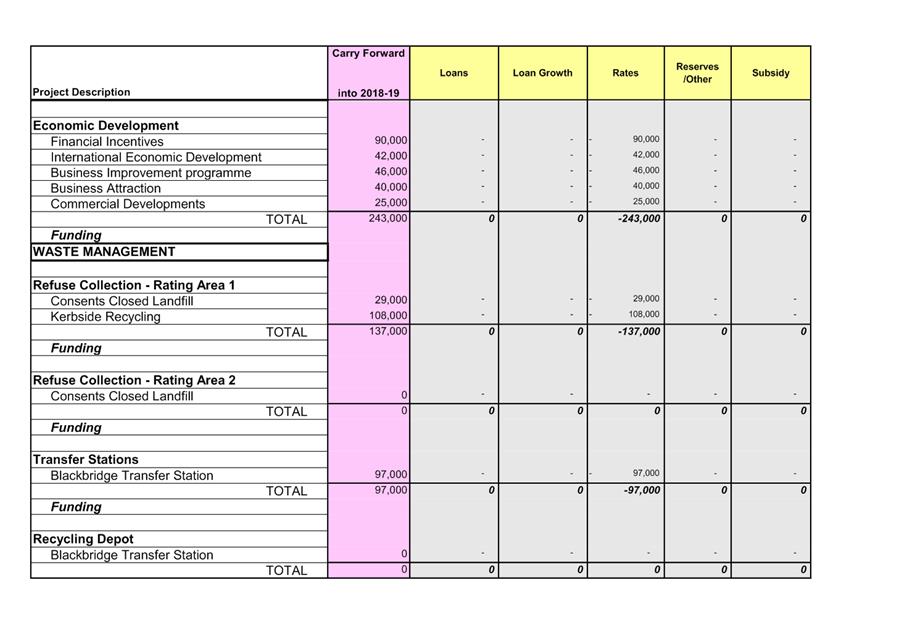

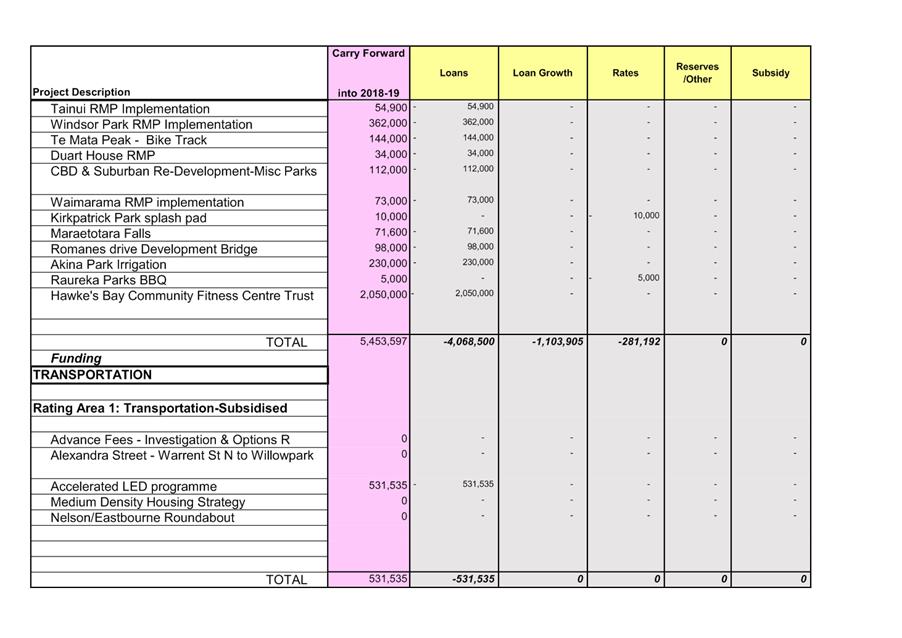

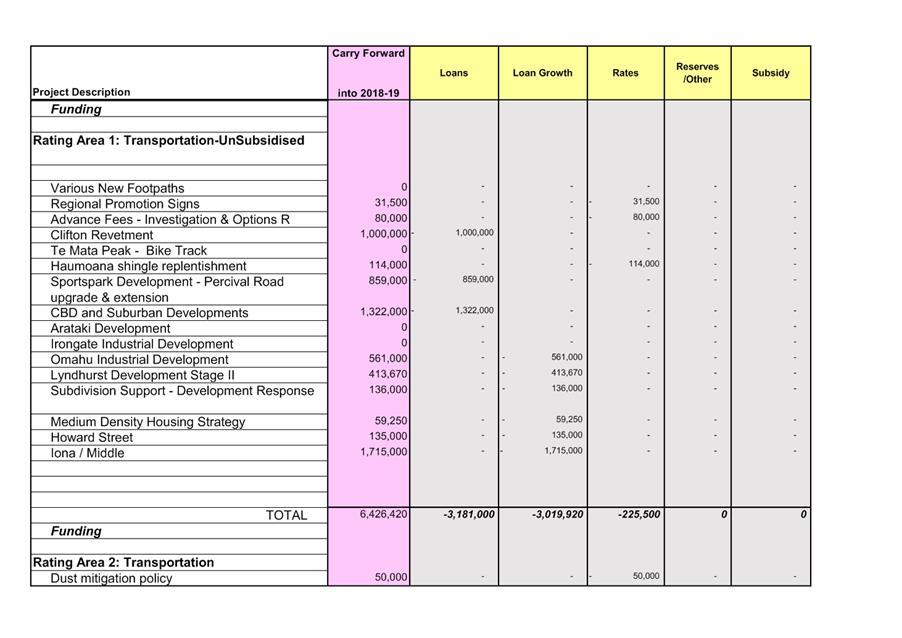

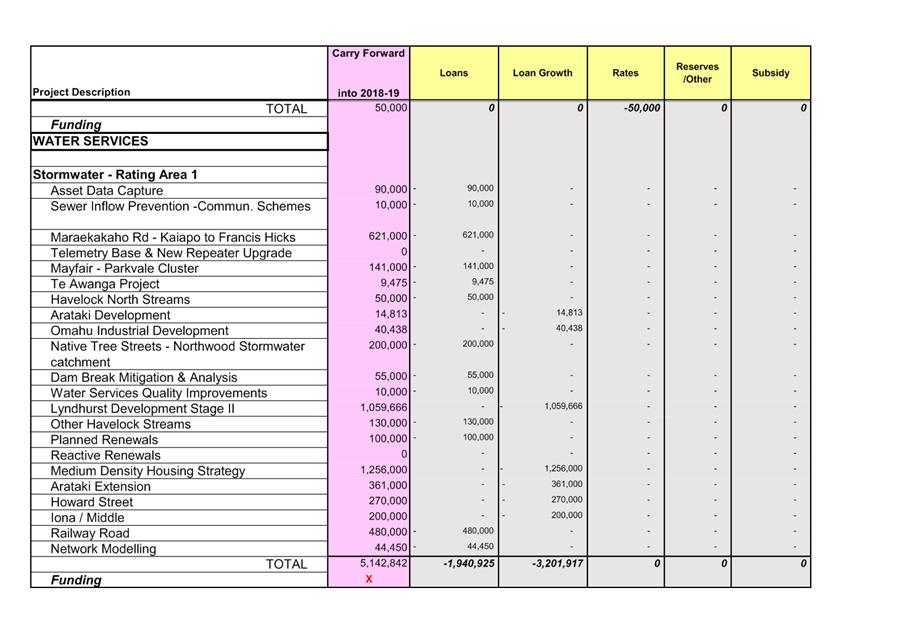

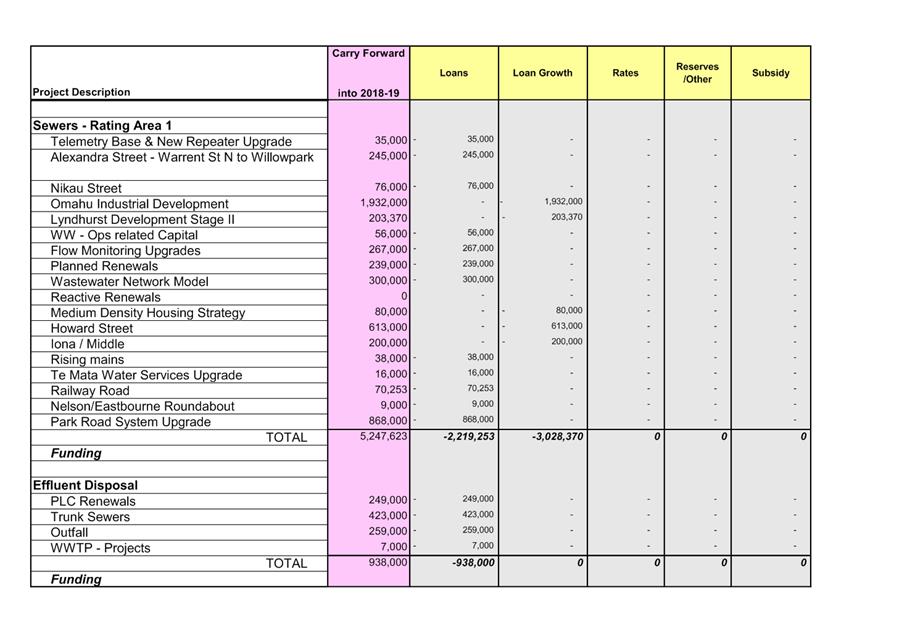

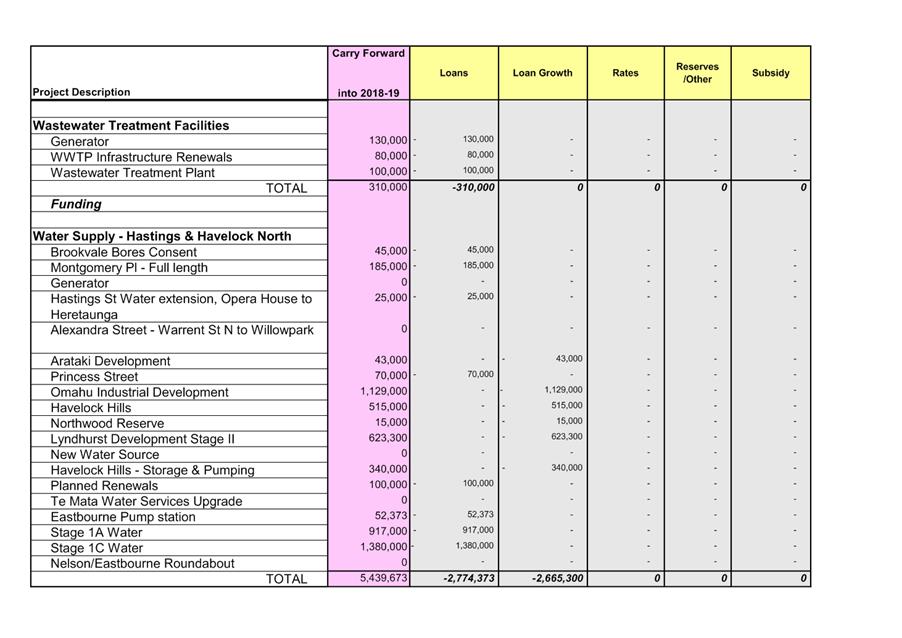

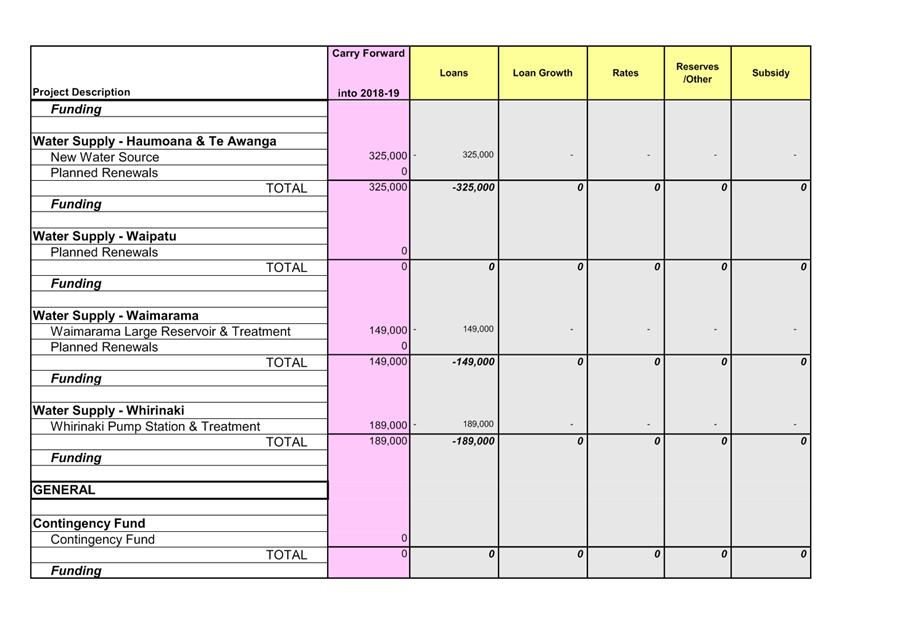

8.0 CARRY FORWARD SCHEDULE

8.1 Included

in Attachment 4 is a Schedule of Projects and budget amounts that

officers have requested to be carried forward to the 2018/19 year.

Management have reviewed these requests and also compared them to project

budgets in the 2017/18 year to ensure that the appropriate amount is being

carried forward.

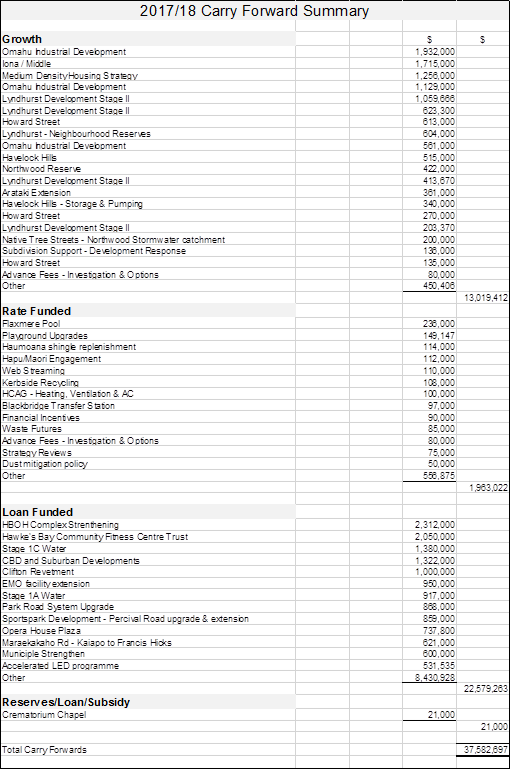

8.2 The

level of carry forwards requested at $37.6m is a reduction from last

year’s carry forwards of $43.5m.

8.3 The

level of carry forwards from rates funding has reduced from last year to $1.96m

($2.6m last year). While the table provides a summary of the major carry

forward items, the $0.556m of rates carry forwards classified as other is made

up of over 25 different carry forward projects. Details of all these

projects are included in Attachment 4.

8.4 Included

in the Loan Funded carry forwards is $3.8m for the Opera House, Plaza and

Municipal strengthening and upgrades for 2018/19. In addition, there are a

range of carry forwards across a number of Council activities, from the Clifton

revetment ($1m) through to the HB Community Fitness Centre Trust.

8.5 The

following table is a summary of 2017/18 Carry Forwards recommended for approval

and detailed in Attachment 4.

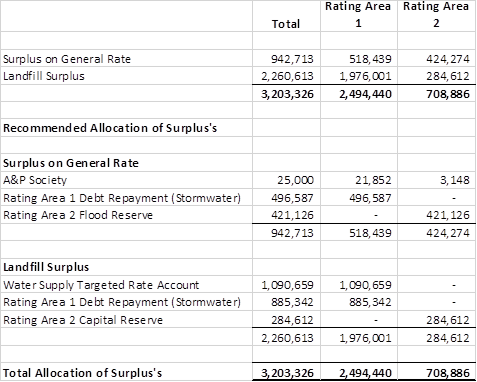

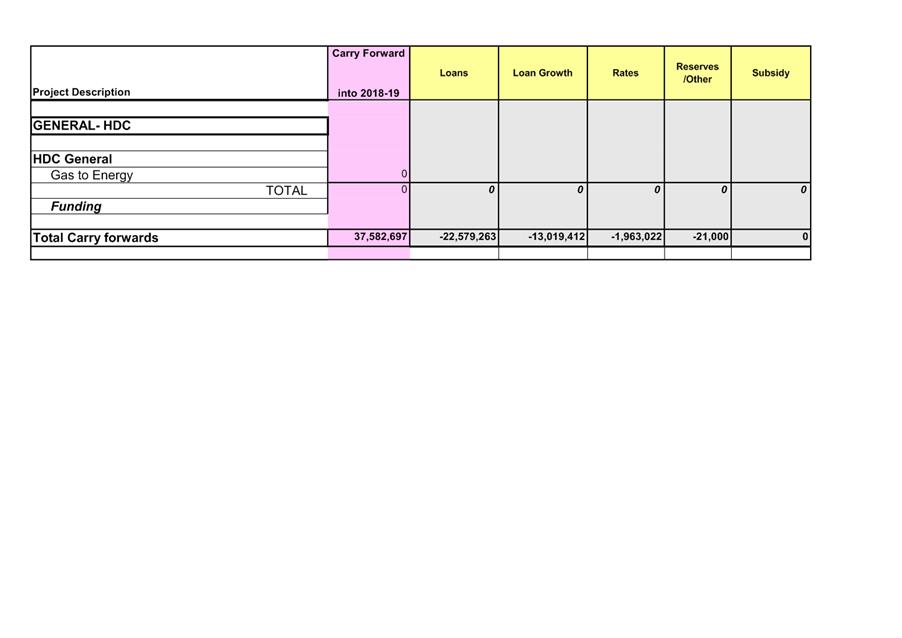

9.0 ALLOCATION

OF RATING SURPLUS

9.1 Council’s Treasury

Policy states the following on the allocation of surpluses:

“The funds from all asset sales

and operating surpluses will be applied to the reduction of debt and/or a

reduction in borrowing requirements, unless the Council specifically directs

that the funds will be put to another use.”

9.2 The

practice for Rating Area 2 has been that the surplus is transferred into the

Rural Flood and Emergency Event Reserve and used to repay RA2 debt.

Currently Rating Area 2 has no debt and the Hastings Rural Community Board has

previously recommended that the target for the Rural Flood and Emergency Event

reserve be increased to $2.0m.

9.3 Two

significant rain events in the second half of 2017/18 have reduced the balance

of the Rating Area 2 Rural Flood and Emergency Event Reserve by $0.605m to

$1.17m and it has been recommended to the Hastings Rural Community Board that

the Rating Area 2 surplus be used to contribute to the Rural Flood and

Emergency Event Reserve.

9.4 The

Rural Community Board has also previously recommended that surpluses be used to

contribute to the Rating Area 2 Capital Reserve, recognising that there is an

increasing capital programme included in the 2018-28 Long Term Plan and 30 year

Infrastructure Strategy.

9.5 The

Rating Area 1 surplus has been used to repay debt although some additional

projects have been funded from the surplus in the past as a way of offsetting

the need for additional debt or rates funding. However the events of 2016/17

have put ongoing financial pressure on the 2017/18 result and in particular on

the Rating Area 1 Water Supply Targeted Rate account.

9.6 The

following priorities for surplus allocations are detailed below:

9.6.1 Rating Surplus

Given the size of the rating

surplus from 2017/18, it is recommended that the two priority areas of Rating

area one debt repayment and the Rating area two rural flood and emergency

reserve replenishment are addressed.

It is also recommended that Council

contribute $25,000 to the A&P Society for the 2018 Royal Show. With the

changeover of General Managers this year the Society overlooked their annual

application to the discretionary grant fund and has subsequently asked if

Council would be prepared to fund this application from other budget sources.

As there are no other budgets for this application it is recommended that Council

fund this from the surplus. Council has made contributions to the A&P

Society over the past two years of $20,000 and $22,000.

9.6.2 Landfill additional surplus allocation

Council has previously used any

surpluses generated from the Landfill operations to repay Landfill debt. Debt

associated with the Landfill was repaid in 2015/16, providing Council with a

decision as to how future surpluses are to be utilised. Last year for the first

time the Landfill surplus was allocated based on the approved rating splits to

the Rating Area One Water Supply account and to the Rating Area Two Capital

Reserve.

9.7 Given

the financial pressures the Water Supply activity is under and the difference

between the actual deficit position of the Water Supply Targeted Rate Account

compared to the assumed opening position of the 2018-28 Long Term Plan, it is

recommended that in the first instance the Landfill surplus be allocated to the

Water Supply Targeted Rate Account to bring it in line with the LTP assumed

starting position. This will ensure the proposed increases in the Water Supply

Targeted Rate will be sufficient to meet the needs of that activity assuming

all other variables being met.

9.8 The

balance of Rating Area One’s share of the Landfill surplus is recommended

to be used to repay debt and the Rating Area Two share allocated to the Rating

Area Two Capital reserve.

9.9 It

is therefore recommended that revenues from the Landfill surplus be allocated

as follows:

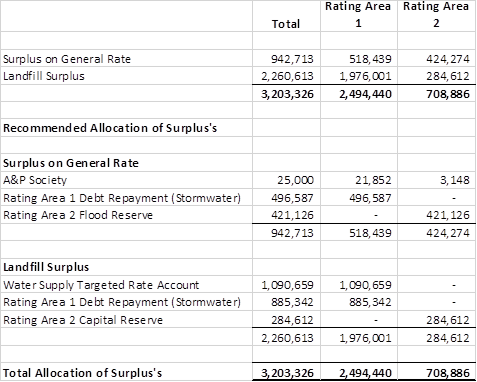

Total Landfill

Surplus to allocate $2,260,613

Rating Area 1

Allocation to

Water Targeted Rate Account $1,090,659

Repayment of RA 1

Debt $885,342

Rating Area 2

Allocation to RA

2 Capital Reserve $284,612

Total

Allocated $2,260,613

9.10 The

funds set out for the allocation to the Water Supply targeted rate account of

$1.09m above brings the opening balance of the water account in line with the

2018-28 Long Term plan assumptions and will reduce the potential need for

increases to the Water Supply Targeted Rate beyond that already forecast in the

Long Term Plan.

9.11 Given

the extraordinary events of 2016/17 and the projected increases in the Water

Supply Targeted Rate in future years it is recommended that the Rating Area 1

share of the 2017/18 Landfill surplus be allocated to the Rating Area 1 Water

Supply targeted rate account. It is not in keeping with sound financial

management to always “jam jar” account for future development

opportunities and create reserves for potential future expenditure. It would be

considered prudent for Council to allocate this additional surplus to the

Rating Area 1 water account to reduce the impact of future rate increases by

bringing the current deficit into line with the assumed LTP starting

position. It is also considered prudent for the Rating Area 2 share of

this surplus to be allocated to the Rating Area 2 Capital Reserve.

9.12 In

2008 the Rural Community Board recommended to Council that the Landfill rating

formula be changed to designated population which is the basis for the

allocation above. This recommendation was approved by Council and is

consistent with the allocations made last year for the Landfill surplus.

Hawea Park

9.13 It

has also been contemplated to use the 2017/18 surpluses to fund HDC’s

share of the land purchase for Hawea Park, a regional park to be owned and managed

by the Hawke’s Bay Regional Council. Through the land purchase

negotiations for the Whakatu Arterial an opportunity arose with HBRC to create

a new park adjacent to the existing Pakowhai Country Park and it was agreed

that HDC would contribute half of the land cost in order for this to be

achieved.

9.14 Council’s

share of this land purchase was $300,000 and is currently unbudgeted.

While there is an opportunity to use the 2017/18 surpluses to fund this land

purchase, the other priorities of RA1&2 are significant, particularly in

RA2 where the need to replenish the RA2 Flood Reserve is the main

priority. If surpluses were used to fund this land purchase, the impact

on the RA2 reserve contributions would be appropriately $40,000.

9.15 It

is recommended that the land purchase for HDC’s share of Hawea Park be

treated as unbudgeted expenditure and be loan funded.

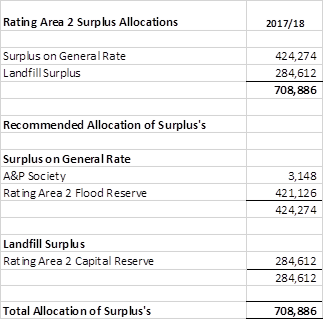

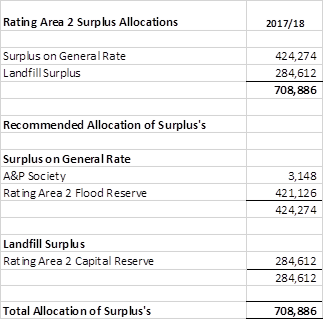

9.16 The Hastings District Rural Community Board

will meet on 10 September 2018 and the recommendation to the Board are as

follows:

A) That the report of the

Financial Controller titled “Draft Financial Year End Result - 30 June

2018” dated 11/09/2018 be received.

B) That the Hastings Rural

Community Board recommend to Council that the Rating Area 2 Rating

Surplus of $424,274 be allocated to the Rural Flood & Emergency Event

Reserve. Noting that the value of the surplus available will change if Council

makes decisions to allocate the overall Council surplus to other projects that

require a rating area allocation to be made.

C) That the Hastings Rural

Community Board recommend to Council that the RA2 allocation of the Landfill

surplus of $284,612 contribute to the RA2 Capital Reserve in accordance

with the approved rating allocation for the

Landfill.

Note: that the exact numbers recommended

to the Hastings District Rural Community Board have changed slightly with the

development of recommendations for this report. The decision of the

Hastings District Rural Community Board will be reported verbally to the

Committee.

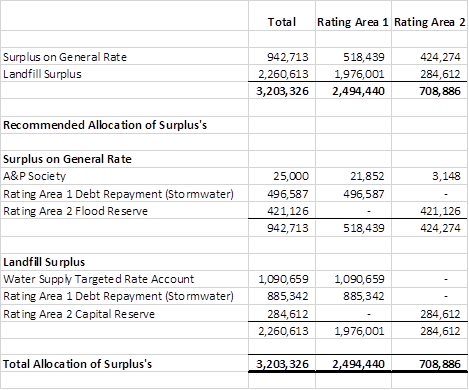

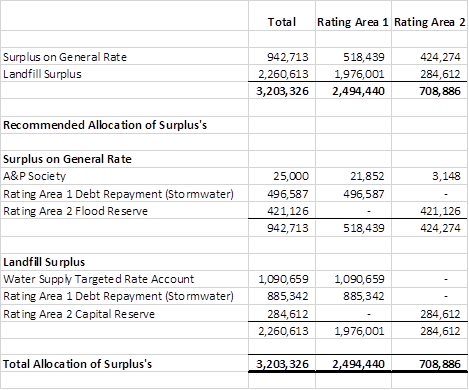

9.17 The

recommendation of this report taking into consideration the recommendations to

the Hastings District Rural Community Board is to allocate the rating surplus

as per the table below:

10.0 SIGNIFICANCE

AND CONSULTATION

10.1 This

report does not raise any issues that are significant in terms of the

Council’s Significance and Engagement Policy that would require

consultation.

11.0 SUMMARY/

PREFERRED OPTION

11.1 It

is the view of officers that this is a good financial result. Council’s

financial strategy is to budget for all known expenditure and when a surplus is

achieved to repay debt along with meeting other particular needs. Following the

extraordinary events of 2016/17 and the impact that has had on Council’s

finances in 2017/18, it is recommended that Council prioritise allocation of

the surpluses to repaying debt and repaying the Rating Area 1 Water Supply

deficit. In Rating Area 2, allocations are recommended to the Capital

Reserve and to the Rural Flood Emergency Event Reserve as per policy.

11.2 The

recommendations have been prepared on the basis of the recommendations to the

Hastings District Rural Community Board.

|

12.0 Recommendations

A) That the report of

the Financial Controller titled “Draft Financial Year End Result

- 30 June 2018” dated 11/09/2018, be received.

B) That the funds

arising from the Rating Area 2 surplus for the 2017/18 financial year as

recommended by the Hastings Rural Community Board be re-allocated as follows:

C) That the rating surplus be

allocated as per the following table:

D) That the budgets

as per the schedule of Carry Forwards funded by rates and loans be approved

to be carried forward to the 2017/18 financial year.

E) That $300,000 of

unbudgeted loan funding be provided for in 2018/19 for Council’s share

of land purchased for the creation of Hawea Park.

|

Attachments:

|

1

|

Draft Rating Result for the year ended 30 June 2018

|

FIN-09-3-18-290

|

|

|

2

|

Dashboard Summary of Financial Performance

|

FIN-09-3-18-289

|

|

|

3

|

Draft Unaudited Financial Statements

|

FIN-09-3-18-291

|

|

|

4

|

Detailed Carry Forward Schedule

|

FIN-09-3-18-292

|

|

Hastings District

Council

Hastings District

Council