Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Finance and Risk Committee MEETING

|

Meeting Date:

|

Tuesday,

13 November 2018

|

|

Time:

|

1.00pm

|

|

Venue:

|

Council

Chamber

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Committee Members

|

Chair: Councillor

Travers

Mayor Hazlehurst

Councillors Barber, Dixon, Harvey, Heaps, Kerr (Deputy Chair), Lawson, Lyons,

Nixon, O’Keefe, Poulain, Redstone, Schollum and Watkins (Quorum = 8)

|

|

Officer

Responsible

|

Chief Financial Officer – Bruce

Allan

|

|

Committee

Secretary

|

Christine Hilton (Ext 5633)

|

Finance and Risk Committee

Fields of

Activity

Oversight of all

the Council’s financial management policy and operations (including

assets, cash, investment and debt management) including (but not limited to):

·

Monitoring compliance

with the Long Term Plan/Annual Plan and budget implementation.

·

Finance and Ownership

·

Audit and other

accountability requirements;

·

Business units/CCO/CCTO

ownership overview;

·

Rating matters including

rating sale proceedings;

·

Taxation.

·

Establishing the

strategic direction of Council’s business units (if any), Council

Controlled Organisations (CCOs) and Council Controlled Trading Organisations

·

Other matters

including:

- Performance Management

- Other matters not otherwise within the

scope of other Committees

Monitoring

compliance with the Long Term Plan/Annual Plan and budget implementation.

Membership

(Mayor and 14 Councillors)

Chairman appointed

by Council

Deputy Chairman

appointed by Council

The Mayor

All Councillors

Quorum – 8 members

DELEGATED

POWERS

General

Delegations

1. Authority to

exercise all of Council powers, functions and authorities (except where

prohibited by law or otherwise delegated to another committee in relation to

all matters detailed in the Fields of Activity.

2. Authority to

re-allocate funding already approved by the Council as part of the Long Term

Plan/Annual Plan process, for matters within the Fields of Activity provided

that the re-allocation of funds does not increase the overall amount of money

committed to the Fields of Activity in the Long Term Plan/Annual Plan.

3. Responsibility to

develop policies, and provide financial oversight, for matters within the

Fields of Activity to provide assurance that funds are managed efficiently,

effectively and with due regard to risk.

Fees and Charges

4. Except

where otherwise provided by law, or where delegated to another Committee, the

authority to fix fees and charges in respect of Council activities or services.

HASTINGS DISTRICT COUNCIL

Finance and Risk Committee MEETING

Tuesday, 13 November 2018

|

VENUE:

|

Council Chamber

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

1.00pm

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

Leave of Absence had previously

been granted to Councillor O'Keefe.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the General Counsel or the Democratic Support Manager

(preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Finance and Risk Committee Meeting held Tuesday 11 September 2018.

(Previously circulated)

4. Update from the

Chair of the Risk and Audit Subcommittee 5

5. Horse of the Year

(Hawke's Bay) Limited Annual Report for the year ended 31 May 2018 7

6. Hawke's Bay

Regional Sports Park Trust Annual Report to 30 June 2018 23

7. Hawke's Bay

Airport Limited - Annual Report for the year ended 30 June 2018 25

8. Financial

Quarterly Report for the three months ended 30 September 2018 29

9. Economic Outlook

Update 39

10. Hastings District Holdings

Limited Equity 51

11. HB LASS Limited Annual Report

for the year ended 30 June 2018 55

12. Hawke's Bay Museums Trust

Annual Report for the year ended 30 June 2018 59

13. New Zealand Local Government

Funding Agency Limited - Annual Report for the year ended 30 June 2018 63

14. Local Government Funding

Agency - Annual General Meeting 2018 67

15. Additional

Business Items

16. Extraordinary

Business Items

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Chief Financial Officer

Bruce

Allan

SUBJECT: Update

from the Chair of the Risk and Audit Subcommittee

1.0 SUMMARY

1.1 The purpose of this report is to update Council

about the activities of the Risk and Audit Subcommittee.

1.2 The Council is required to give effect to

the purpose of local government as prescribed by Section 10 of the Local

Government Act 2002. That purpose is to meet the current and future needs of

communities for good quality local infrastructure, local public services, and

performance of regulatory functions in a way that is most cost–effective

for households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.3 This

report concludes by recommending that the update from the Chair of the Risk and

Audit Subcommittee be received.

2.0 BACKGROUND

2.1 The

Risk and Audit Subcommittee’s terms of Reference state that the

subcommittee is responsible for assisting Council in its general overview of

financial management, risk management and internal control systems that

provide:

· Effective management of potential risks, opportunities and adverse

effects; and

· Reasonable assurance as to the integrity and reliability of the

financial reporting of Council; and

· Monitoring of the Council’s requirements under the Treasury

Policy.

2.2 The

Chair of the Risk and Audit Subcommittee, Mr Jon Nichols, provided the first

verbal update to Council at the September 2017 Council meeting on the

Subcommittee’s activities.

2.3 Given

that just four Councillors are represented on the Subcommittee it is considered

good practice for the Chair of the Risk & Audit Subcommittee to provide

regular updates to Council. It is also envisaged that the Chair will report

more formally to Council on an annual basis.

3.0 SIGNIFICANCE

AND ENGAGEMENT

3.1 This

matter is not significant in relation to Council’s Significance and

Engagement Policy.

|

4.0 RECOMMENDATIONS AND

REASONS

A) That

the report of the Chief Financial Officer titled “Update

from the Chair of the Risk and Audit Subcommittee” dated 13/11/2018

be received.

|

Attachments:

There are no

attachments for this report.

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Horse

of the Year (Hawke's Bay) Limited Annual Report for the year ended 31 May 2018

1.0 SUMMARY

1.1 The

purpose of this report is present the Horse of the Year (Hawke’s Bay)

Limited (HOYHB) annual report for the year ended 31 May 2018 and provide

Council with an opportunity to provide feedback to Council on the Horse of the

Year’s Draft Statement of Intent (SOI).

1.2 This

issue arises from a requirement under the Shareholders Agreement that requires

HOYHB to submit an Annual Report within 3 months after the end of the financial

year and Statement of Intent (SOI) 3 months prior to the start of the financial

year. The HOYHB financial year commences 1 June.

1.3 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.4 The

objective of this decision relevant to the purpose of Local Government is to

support a major Hastings event that contributes to the provision of good local

services by increasing economic activity, contributing to a resilient job rich

district while also contributing to an appealing visitor destination.

1.5 This

report concludes by recommending that the 2017/18 Annual Report be received and

the Draft 2018/19 Statement of Intent be received with any feedback passed onto

the directors of HOYHB.

2.0 BACKGROUND

2.1 The

shareholding of HOYHB is made up of Hastings District Council, Equestrian Sport

New Zealand (ESNZ) and Show Jumping Hawke’s Bay (SJHB) with each entity

holding one third of the allotted shares. Each shareholder has advanced

$30,000 as shareholder loans.

2.2 Each

shareholder is allowed up to 2 shareholder appointed directors and until

recently each shareholder had been comfortable with just one representative

each on the Board. In June ESNZ advised that they would be taking up the option

of having a second appointed director and SJHB subsequently followed. Cynthia

Bowers resigned from the Board effective from the October AGM and

Council’s appointed Director Tim Aitken has been appointed by the Board

as the Chairperson.

2.3 The

current Board is as follows:

· Tim Aitken HDC

appointment

· William Moffett SHB

appointment

· Dirk Waldin SHB

appointment

· Vicki Glynn ESNZ

appointment

· Richard Sutherland ESNZ appointment

· Craig Foss Independent

2.4 While

there is a resolution of Council to appoint a second director to the Board,

Council was very mindful that any appointment needed to have the required

skills to complement the existing board and fill any gaps that may be evident. Council

has yet to make an appointment and with the resignation of Cynthia Bowers there

is also a vacancy for a second independent director.

2.5 The

executed Shareholders Agreement provides the following in regard to the Annual

Report:

“Annual

Report: Within 90 days after the end of the each financial year, the

Company will deliver to the shareholders an annual report which will consist

of:

· A Chairman’s report, containing a review of the Company

operations with specific attention to the performance against the key

performance indicators established in the respective Statement of Intent.

· A comparison of actual performance with targeted performance.

· Annual audited financial accounts to be completed in accordance with

general accepted accounting standards and to include:

- Statement of

Financial Position

- Statement of

Financial Performance

- Auditor’s

Report”

2.6 The

executed Shareholders Agreement provides the following in regard to the

Statement of Intent:

“A

draft Statement of Intent is to be provided to the shareholders for comment

three months prior to the start of each financial year. The Board will

review any comments received from shareholders and approve the Statement of

Intent prior to the start of each financial year. The Statement of Intent

will address such matters as:

· Nature and objectives of the Company

· Mission Statement

· Shareholding Role

· Principal Objectives

· The Board’s approach to Governance

· Strategic Direction

· Scope of Company

· Financial Forecasts including cashflow statement of financial

position

· Key Performance Measures and Targets

· Reporting Requirements

· Accounting Policies”

3.0 CURRENT

SITUATION

3.1 Annual

Report

3.2 The

2017/18 Annual Report including the Chairman’s report, report against

Statement of Intent KPI’s and the Financial Statements are attached as Attachment

1. The 2018 show was the third show managed by SMC Events and ran

smoothly and in fine weather (unlike the 2017 show). The show achieved a 90%

satisfaction rating from competitors and spectators, however there is some

concern that gate takes were down on the previous year.

3.3 The

event finished with a net operating surplus of $25,539 ($28,686: 2017). This

was on the back of higher revenues $2,412,974 ($2,288,267: 2017) with higher

corporate sales, offset by lower grants and gate revenues. Costs were also up

(but in line with revenues) and are being tightly managed.

3.4 The

table below shows how this compares to the budget contained in the 2017/18

statement of intent:

|

|

Actuals

|

Budget (SOI)

|

Variance

|

|

REVENUE

|

|

|

|

|

Event Income

|

1,084,197

|

1,044,000

|

40,197

|

|

Corporate Income

|

1,213,148

|

1,228,000

|

(14,852)

|

|

Charitable Income

|

124,629

|

200,000

|

(75,371)

|

|

Total Income

|

2,421,974

|

2,472,000

|

(50,026)

|

|

Expenses

|

2,396,435

|

2,422,000

|

25,565

|

|

Net Operating

Surplus

|

25,539

|

50,000

|

(24,461)

|

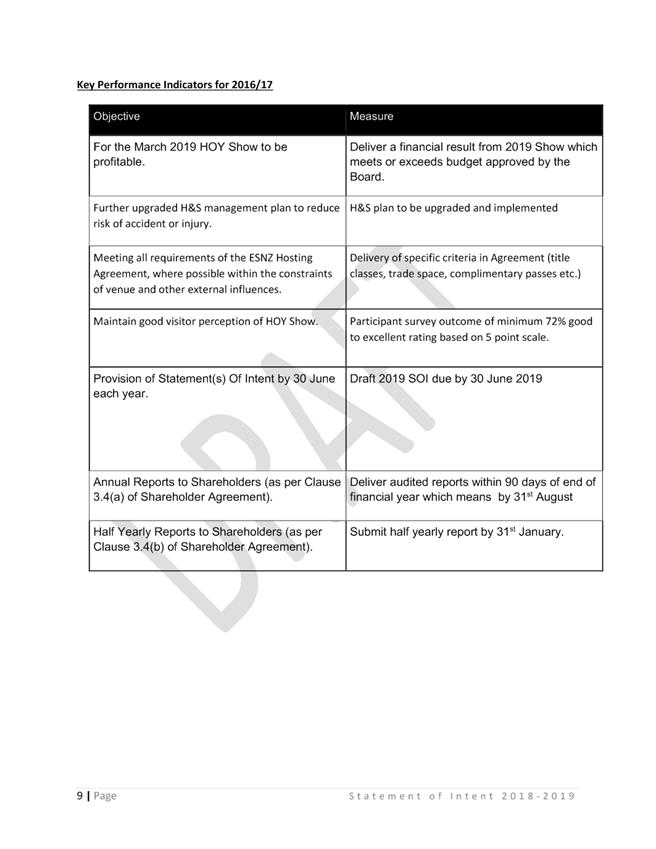

3.5 The

Statement of Intent non-financial measures have been reported against as this

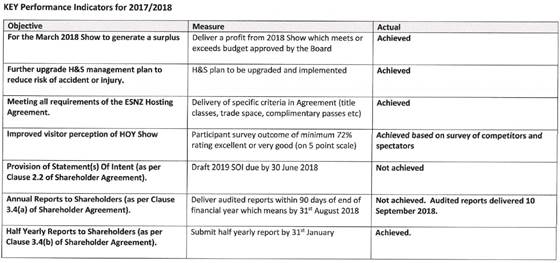

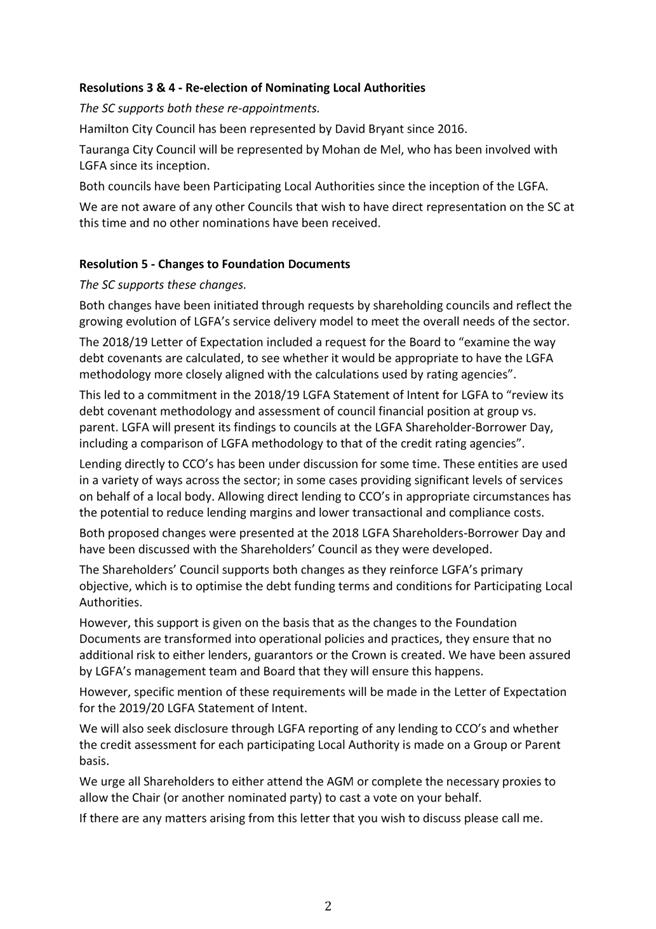

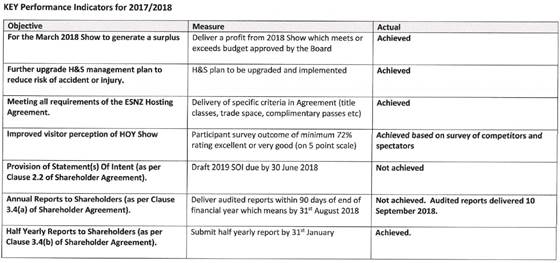

table from page 4 of the annual report illustrates:

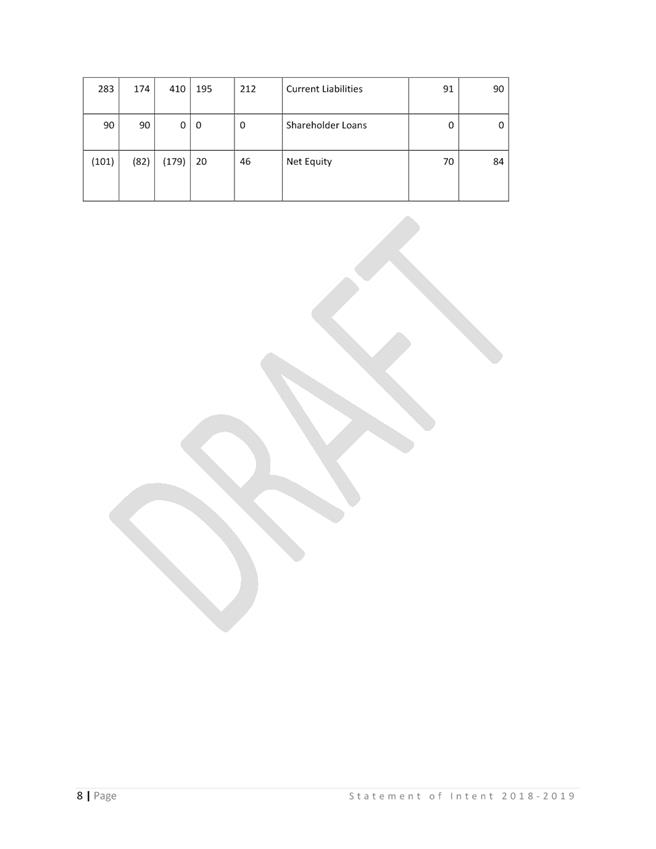

3.6 Statement

of Intent

3.7 The

Draft 2018/19 Statement of Intent was received by Council on 23rd October

2018.

3.8 The

Draft 2018/19 Statement of Intent (Attachment 2) satisfies the

requirements of the Shareholders Agreement, provides a budgeted financial

position for 2018/19 and includes a number of relevant performance objectives.

3.9 The

financial projections outlined in the Statement of Intent project a small

surplus in 2018/19 which continue into future years. The projected financial

result for 2018/19 when compared to the actual 2017/18 result is achieved

through increased revenue across the board. The 2018/19 forecast is showing an

11% increase in event expenses which is in line with the expected revenue

growth. The risk is committing to this increased expenditure if the additional

revenue doesn’t eventuate.

3.10 The Key Performance

Indicators contained in the Statement of Intent for 2018/19 are unchanged from

2017/18 and are very generic.

3.11 Other Key Performance

Indicators that might be considered as best practice include:

· Increase the Number of Competitors Participating

· Satisfaction survey of Competitors

· Increase the Number of Spectators Attending

· Satisfaction survey of Spectators

· Increase the Number of Trade Stalls exhibiting

· Satisfaction of Trade Stall Retailers

· Reduction of H&S Incidents compared to prior year

3.12 The 2018/19 Statement

of Intent has included a risk assessment. This identifies a number of risks to

the HOY, assesses the exposure that this creates and identified any mitigation

strategies that are available. The assessed risks and mitigation strategies are

in line with last year’s Statement of Intent.

3.13 The draft Statement of

Intent meets the requirements of the Shareholders Agreement.

4.0 OPTIONS

4.1 Council

can receive the HOYHB 2017/18 Annual Report.

4.2 Council

can receive the draft 2018/19 Statement of Intent. Council can also

request directors of HOYHB to consider changes to the Statement of Intent if it

wishes. The directors of HOYHB would then need to consider the request, with

consideration of the wishes of the other 2 shareholders, and decide if a change

is appropriate.

5.0 SIGNIFICANCE

AND CONSULTANT

5.1 The

issues for discussion are not significant in terms of the Council’s

policy on significance and engagement and no consultation is required.

6.0 PREFERRED

OPTIONS AND REASONS

6.1 The

preferred option is for the 2017/18 Annual Report and the draft Statement of

Intent for 2018/19 be received with any suggested changes to the Statement of

Intent passed onto the HOYHB Board.

6.2 The

Draft 2018/19 Statement of Intent presented by HOYHB satisfies all the

requirements as set out in the Shareholders Agreement and clearly sets out the

nature and scope of the HOYHB activities and its performance targets.

6.3 There

are no direct financial implications for Council in receiving the Draft 2018/19

Statement of Intent for HOYHB.

|

7.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “Horse

of the Year (Hawke's Bay) Limited Annual Report for the year ended 31 May

2018” dated 13/11/2018 be received.

B) That

Council receive the Horse of the Year (Hawke’s Bay) Limited 2017/18

Annual Report.

C) That

the Draft 2018/19 Statement of Intent for Horse of the Year (Hawke’s

Bay) Limited be received with any feedback passed on to the directors of

Horse of the Year (Hawke’s Bay) Limited for consideration.

With the reasons for this decision

being that the objective of the decision will contribute to meeting the

current and future needs of communities for good local public services in a

way that is most cost-effective for households and business by:

i) supporting and attracting business,

building a resilient job rich district while also contributing to an

appealing visitor destination.

|

Attachments:

|

1

|

Annual Report for the year ended 31 May 2018

|

EXT-10-20-18-86

|

Under Separate Cover

|

|

2

|

Draft Statement of Intent 2018-19

|

EXT-10-20-18-88

|

|

|

Draft Statement of Intent 2018-19

|

Attachment 2

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Hawke's

Bay Regional Sports Park Trust Annual Report to 30 June 2018

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Council about the Hawke’s Bay

Regional Sports Park Trusts (the Trust) full year result to 30 June 2018.

1.2 This

update arises from a requirement detailed in the Funding Agreement between

Council and the Trust.

1.3 The

Trust’s Chief Executive (Jock Mackintosh) will be in attendance at the

meeting.

1.4 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.5 The

Trust is responsible for the efficient and cost effective management of

sporting facilities (good quality local infrastructure) located at the Hawkes

Bay Regional Sports Park.

1.6 This report concludes by recommending the Hawke’s Bay Regional

Sports Park Trust annual report to 30 June 2018 be received.

2.0 BACKGROUND

2.1 The

presentation of an annual report by the Trust is a requirement of the

Management Agreement between Council and the Trust which was executed in March

2018.

3.0 CURRENT

SITUATION

3.1 The

presentation of the Trust’s annual report is in accordance with the

management agreement. Attachment 1 includes the Hawke’s Bay

Regional Sports Park Trusts annual report to 30 June 2018. These accounts show

an operating surplus of $109,310 before depreciation for the year compared to

budgeted surplus of $117,206 and a deficit of $3,169 for the same period last

year.

3.2 After

accounting for depreciation the Hawke’s Bay Regional Sports Park Trust

has recorded a deficit of $417,189 for the year compared to $525,042 last year.

What this shows is that while the Trust result is positive from an operational

sense, the surpluses generated will not be sufficient in themselves to fully fund

the eventual replacement of their infrastructure without further external

funding.

3.3 The

Trust was again well supported by community grants and corporate sponsorship.

This accounted for 40% of all revenue raised, with only 17% coming from the 286,000

users of the park.

3.4 During

the year the athletics track was repaired and re-marked courtesy of a $47,000

grant from the New Zealand Community Trust.

3.5 Event

revenues and costs were down on the previous year which contained the Te

Matatani Celebrations and an International Hockey Tournament, neither of which

repeated in 2018.

3.6 An

outdoor aquatic facility is the next major development being undertaken by the

Sports Park Trust. This is a 6,000 square metre facility which will be used by

a range outdoor aquatic sports including canoe polo, triathlons, waka ama and

kayak training. Two thirds of the funding for this facility has been raised and

development is expected to commence towards the end of 2018.

4.0 OPTIONS

4.1 The Council can receive the Trust’s annual report to 30 June

2018.

5.0 SIGNIFICANCE

AND ENGAGEMENT

5.1 No consultation is required and there is nothing in this report that

triggers any threshold in the significance and engagement policy.

6.0 PREFERRED

OPTION/S AND REASONS

6.1 That Council receive the Trust’s annual report to 30 June

2018.

|

7.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “Hawke's

Bay Regional Sports Park Trust Annual Report to 30 June 2018”

dated 13/11/2018 be received.

B) That the Hawke’s Bay Regional Sports Park Trust Annual

Report to 30 June 2018 be received.

|

Attachments:

|

1

|

Hawke's Bay Regional Sports Park Trust - HBRSP

Annual Report 2017/18

|

EXT-10-38-18-221

|

Under Separate Cover

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Hawke's

Bay Airport Limited - Annual Report for the year ended 30 June 2018

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Committee on the financial results of

Hawke’s Bay Airport Limited (HBAL) for the year ended 30 June 2018.

1.2 This

issue arises from the receipt of the 2018 Annual Report from HBAL.

1.3 Tony

Porter (Chairman) and Stuart Ainslie (Chief Executive) from HBAL will be in

attendance at the Council meeting.

1.4 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.5 The

objective of this decision relevant to the purpose of Local Government is to

provide good quality local infrastructure in a way that is most cost-effective

for households and business and the community.

1.6 This report

concludes by recommending that the HBAL Annual Report for the year ended 30

June 2018 be received.

2.0 BACKGROUND

2.1 The

2018 Annual Report represents the eight year of trading for the HBAL following

corporatisation in July 2009 and the acquisition of the assets of the

Hawke’s Bay Airport Authority. The company is owned 50% Crown, 26% Napier

City Council and 24% Hastings District Council.

2.2 The

Statement of Intent requires that an Annual Report including audited financial

statements be provided to shareholders. A six monthly report is also required

to be delivered to shareholders.

3.0 CURRENT

SITUATION

3.1 Attachment

1 is a copy of the 2018 Annual Report.

3.2 Net

Profit after income tax was $1,444.975 compared with $1,717,609 for the 2017

financial year and $1,254,896 budgeted. Income increased by 9% to

$6,649,167 with a 5% increase in passenger numbers to 700,000.

3.3 Operating

expenses of $3,041,665 increased from the previous year by 35% and 6% higher

than budget due to the increased costs in Task Protection Services (additional

staff due to Civil Aviation Authority requirements), appointment of key staff,

and legal and consultancy costs for terminal redevelopment.

3.4 The

Return on Equity of 4.9% which is 0.6% higher than the Statement of Intent and

the Company’s Gearing Ratio of 12% was well below the Statement of Intent

as a result the terminal development starting later.

3.5 In

September 2018 the Watchman Road Entrance was opened to traffic. In March 2018

Stage one of the Terminal Expansion commenced construction. Total capital

expenditure for the year ended 30 June 2018 was $5.4m with a further $16.1m

committed for future years. Loan funding at 30 June 2018 was $4m ($Nil: 2017).

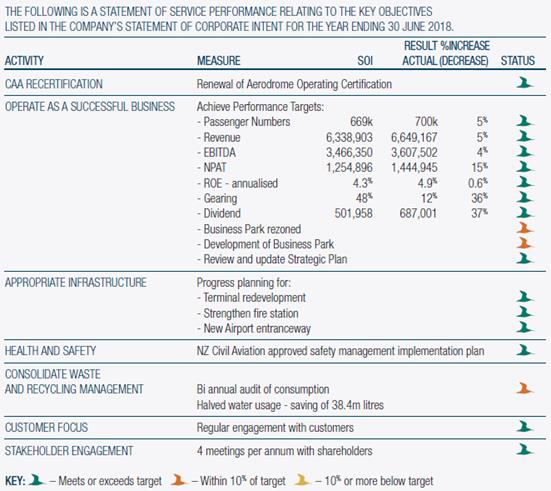

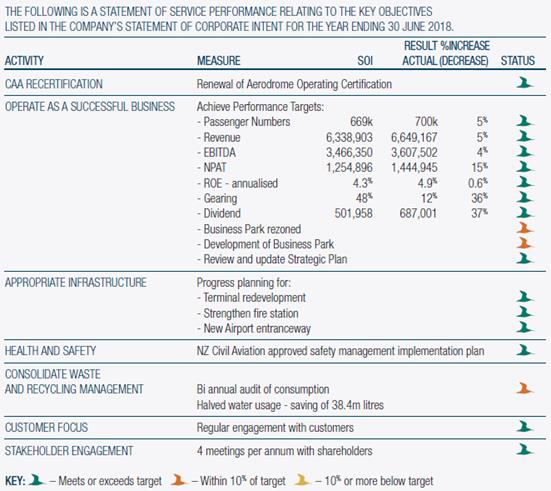

Performance

targets for HBAL for the year ended 30 June 2018.

3.6 The

key objectives, performance targets and performance results (as reflected in

the Company’s Annual Report for 2017/18) are:

3.7 Officers

are of the view that HBAL has performed well over 2017/18 and continues to show

growth in revenue and passenger numbers.

4.0 OPTIONS

4.1 Council

is only being asked to receive this report and an analysis of options is not

required.

5.0 SIGNIFICANCE

AND CONSULTATION

5.1 The issues for discussion are not significant in terms of the

Council’s Significance Policy and Engagement and no consultation is

required.

|

6.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance

titled “Hawke's

Bay Airport Limited - Annual Report for the year ended 30 June 2018” dated 13/11/2018 be received.

B) That

the Hawke’s Bay Airport Annual Report for the year ended 30 June 2018

be received.

|

Attachments:

|

1

|

Hawke's Bay Airport Limited Annual Report 2018

|

EXT-10-9-1-18-49

|

Under Separate Cover

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Financial Controller

Aaron

Wilson

SUBJECT: Financial

Quarterly Report for the three months ended 30 September 2018

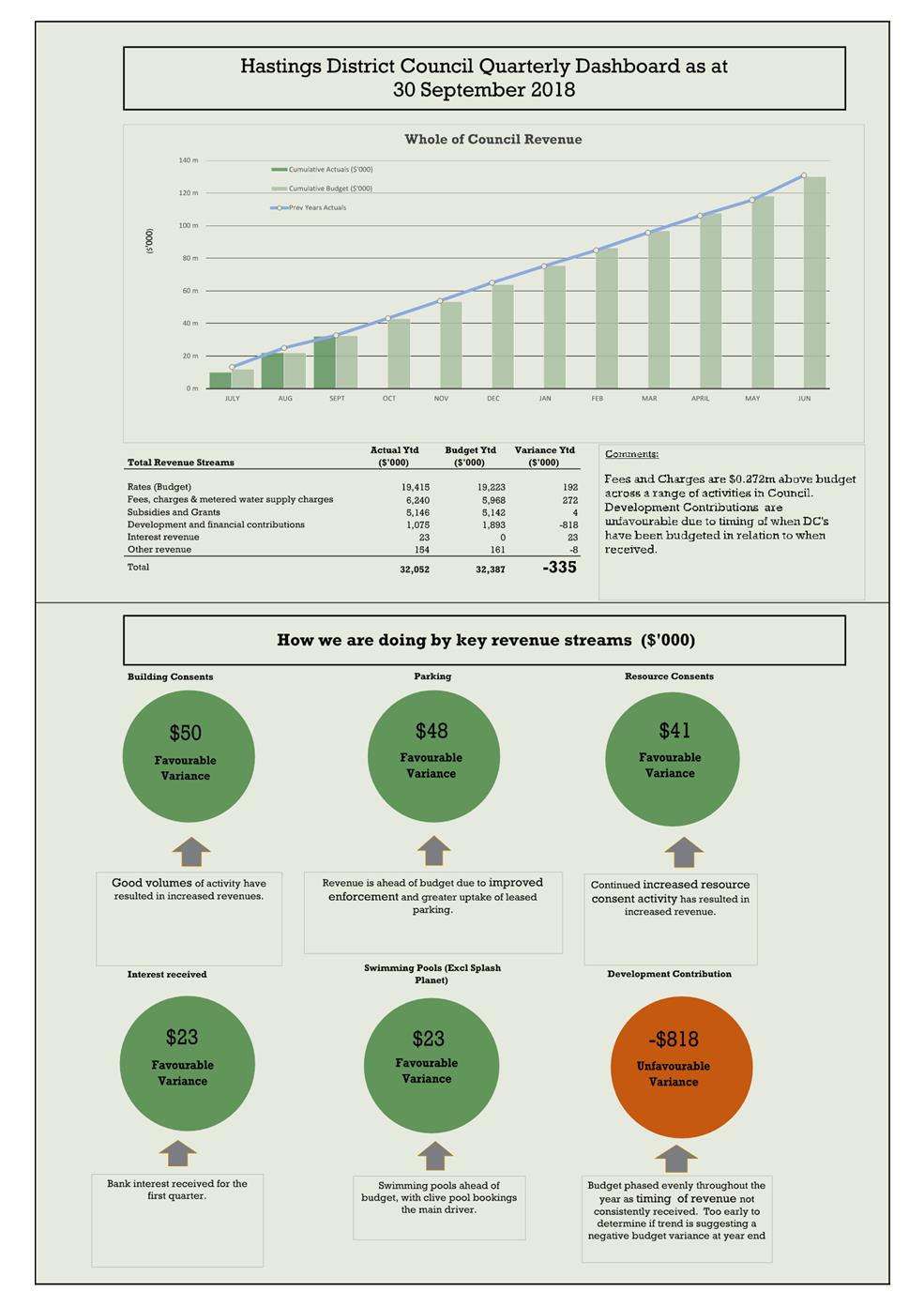

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Committee of the financial result for

the three months ended 30th September 2018.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This report concludes by recommending that the report for the three

months ended 30th September 2018 be received.

2.0 BACKGROUND

2.1 The accounting operating financial result is reported on quarterly

during the year and at year end a report is prepared on the financial as well

as the rating result. The rating result differs from the accounting

result in respect of non-cash items such as depreciation, vested assets and

development contributions that are not included.

2.2 This financial report is governance focussed and

allows significant variances to be highlighted with explanations provided.

3.0 CURRENT

SITUATION

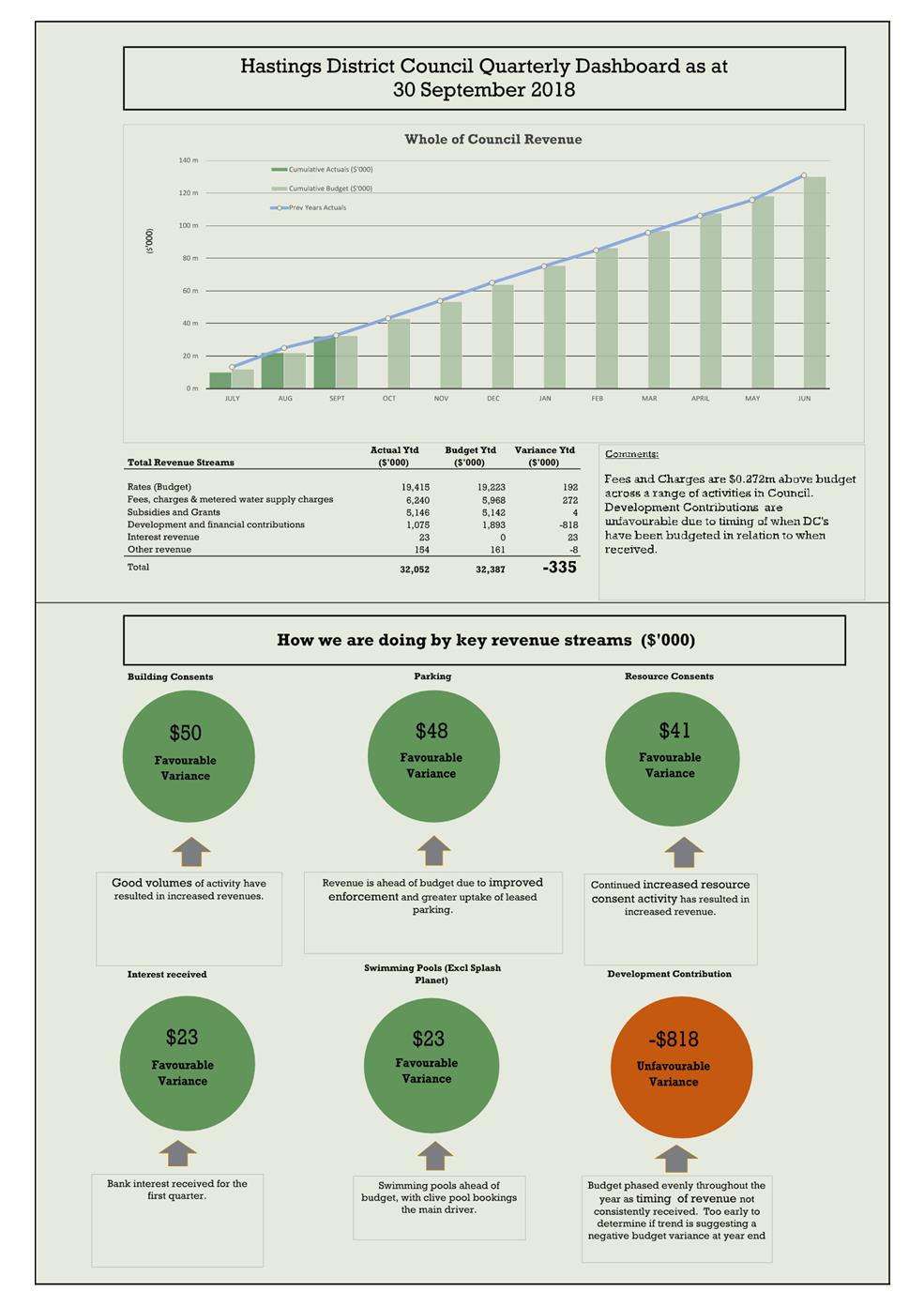

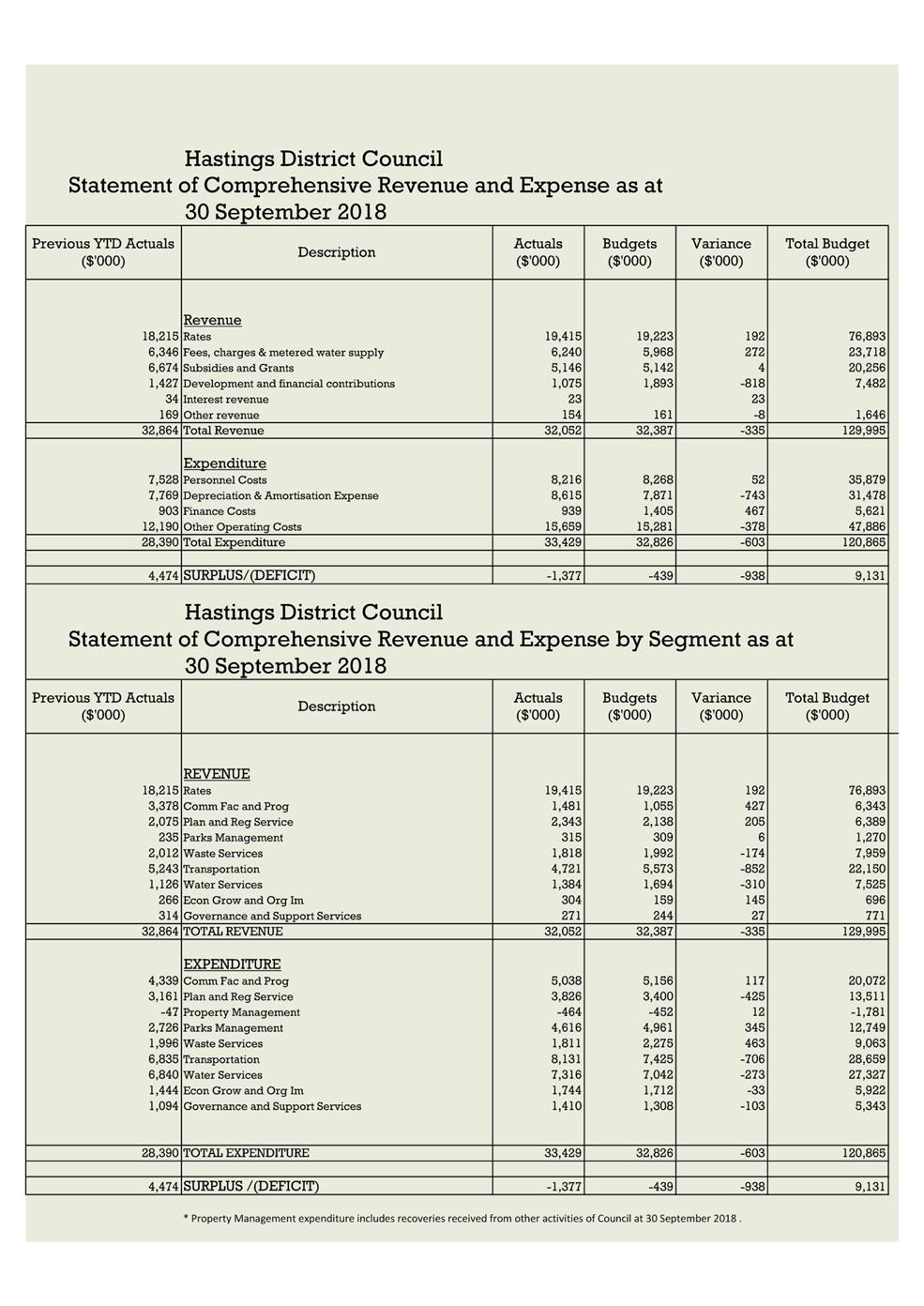

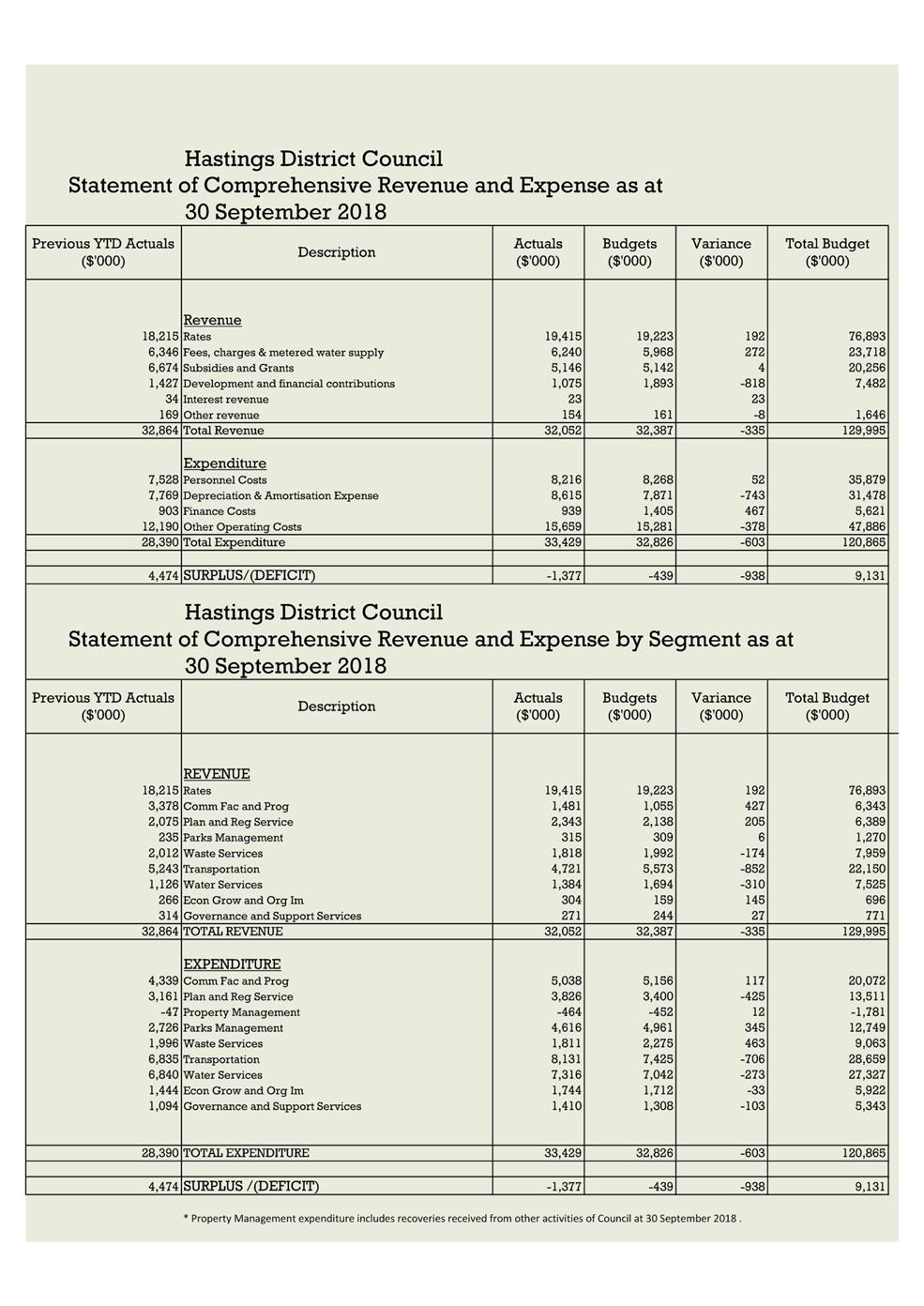

3.1 Set out below is a summary of the operating financial result year to

date. The financial results detailed below represent the accounting view

and do not reflect the potential rating result for 2018/19:

|

|

$’000

|

$’000

|

$’000

|

$’000

|

|

2018/19

|

YTD Actual

|

YTD Revised Budget

|

YTD Variance

|

Full Year Revised Budget *

|

|

Operating Revenue

|

32,052

|

32,387

|

(335)

|

129,995

|

|

Operating

Expenditure

|

33,429

|

32,826

|

(603)

|

120,865

|

|

Net

Surplus/(Deficit)

|

(1,377)

|

(439)

|

(938)

|

9,131

|

* Revised budget

includes the Annual budget, Brought Forwards and surplus allocations from 17/18

financial year

3.2 The result above is presented against the revised budget. The revised

budget includes changes and decisions made during the year on Council budgets

which includes carry forwards from 2017/18 and allocations from the 2017/18

rating surplus.

3.3 Council’s overall financial

performance is $0.938m behind YTD budget for the quarter

ended 30th September 2018. Revenue is unfavourable to budget

and expenditure is unfavourable to budget.

3.4 Overall revenue is $0.335m

unfavourable to YTD budget and expenditure is $0.603m, unfavourable to YTD

budget.

Revenue

3.5 Fees and charges revenue across

Council are favourable against budget by $0.272m with the main drivers being:

· Community Facilities & Programme fees and charges are $45k favourable spread across a wide range of

activities from pools to cemeteries.

· Transport are $75k favourable YTD due to having received

reimbursement for emergency Haumoana shingle replenishment.

· Economic and Social Development are $88k favourable to budget due to

grant revenue carried forward from the prior year in addition to some smaller

unbudgeted grants.

· Planning and Regulatory services are favourable to budget by $205k

driven by higher environmental ($41k), and building consents (50k) revenue

along with higher than budgeted parking revenues of $81k.

3.6 Subsidies,

grants and donations are tracking to budget for the first quarter.

3.7 Development contributions are

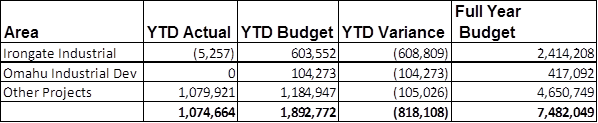

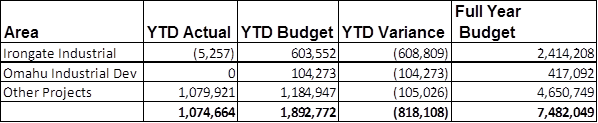

unfavourable to YTD budget by $0.818m. Phasing of budgets in relation to when

contributions occur is difficult, and creates timing differences as it is not

always known in advance in what month a payment will occur when the budget is

being set.

3.8 Key contributors to the negative

budget variance are the Irongate and Omahu Industrial developments which have

ring fenced development contribution policies. While there is still a lot of

pre-development activity at Irongate, it has yet to materialise into

development contributions paid this financial year. This does pose a risk for

Council in that assumptions that underlie the development contribution rates

assume a level of update which has been budgeted. If development does not occur

as assumed, Council will be required to review the Development Contribution

rate for the 2019/20 financial year through the Annual Plan process.

3.9 This is still the expectation by

officers, however, it is likely to be towards the end of the financial year

before developers pay the contributions expected.

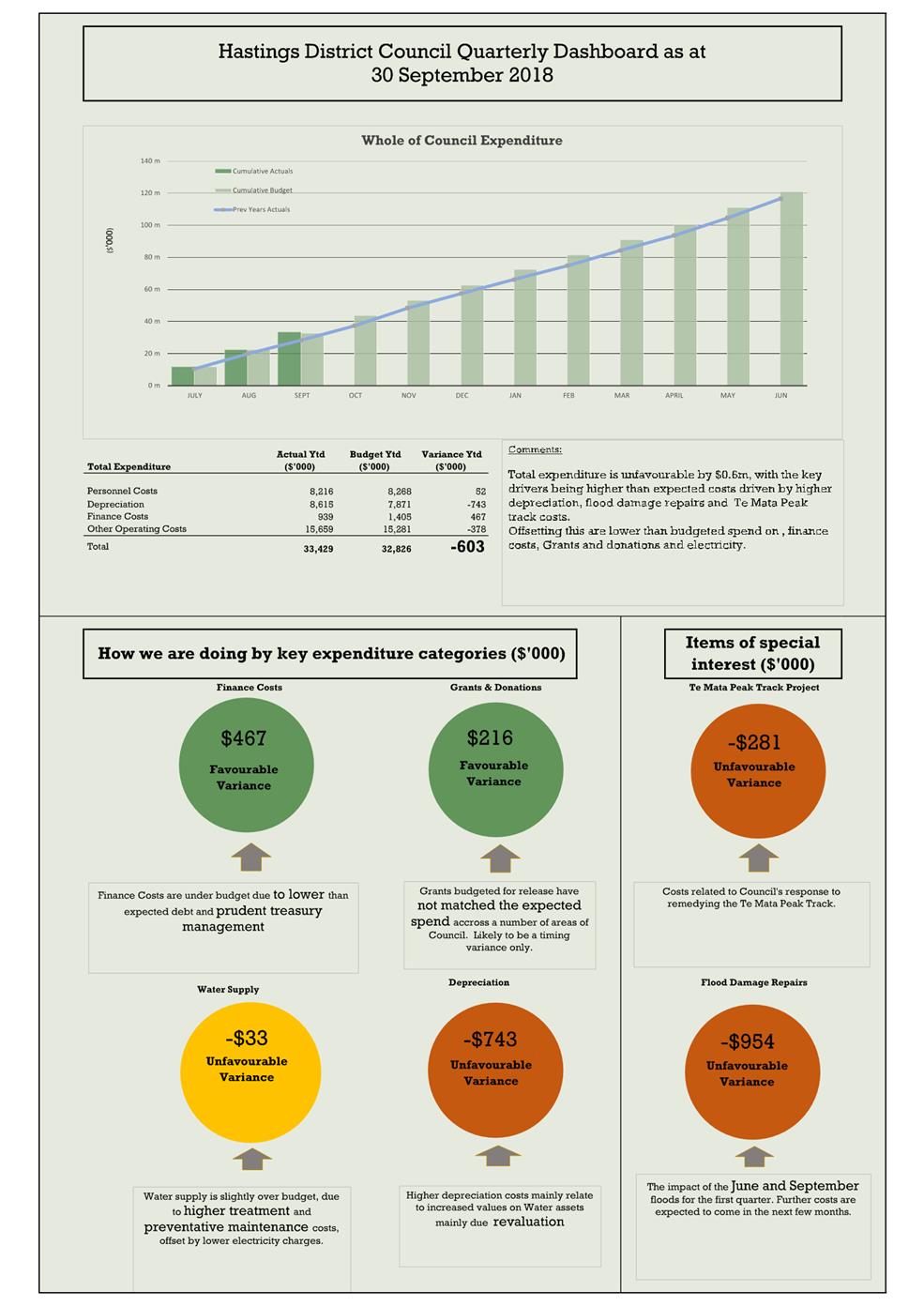

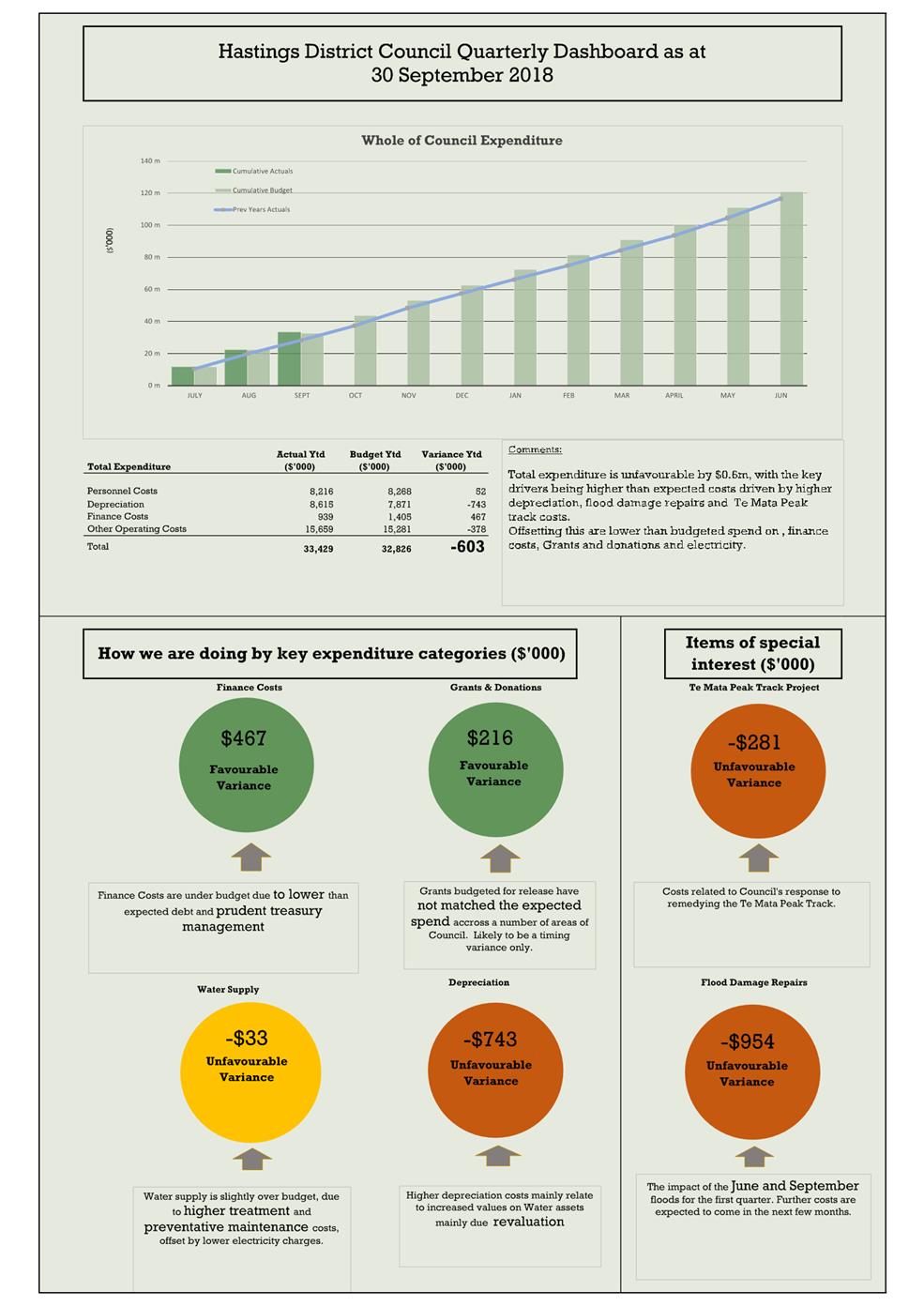

Expenditure

3.10 Overall expenditure is

tracking above budget to 30th September 2018 by $0.603m or 1.83% of total

budgeted expenditure year to date.

3.11 The Transport area is $0.706m unfavourable to

budget, driven by higher emergency reinstatement costs for the June flood and

costs coming through in September. This will be offset by a reserve

adjustment from the flood reserve and NZTA subsidies.

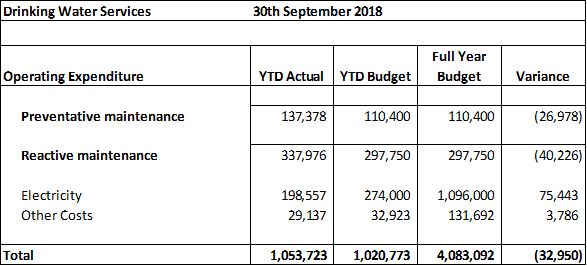

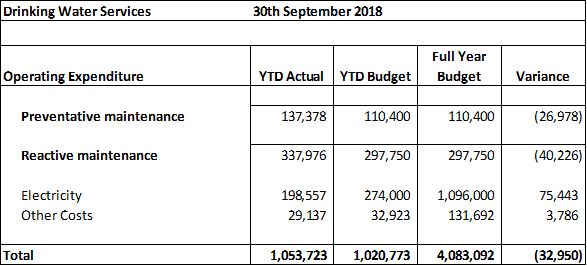

Water:

3.12 Council continues to

spend significant sums of money on water supply activity in Operational

expenditure. This activity is funded by way of a

separate water account which is designed to either accumulate reserves or run

in deficit depending on expenditure needs and Council decision making. This

allows Council to spread the impact of “lumpy” expenditure in this

activity.

3.13 There has been a considerable increase in the

operational budgets for water in recognition of the higher operational spend

now required in this area. Higher treatment costs along with reactive

maintenance have been offset by savings in electricity. Below shows a summary

table of spend to budget in this area:

3.14 Te Mata Peak Project:

Council has spent

$280k to-date on the Craggy Range Te Mata Peak Track with this spend focused

on:

- Cultural and landscape impact evaluations

- Development, evaluation and report of

suitable track options

1.0

It should be

noted that while this is unbudgeted, some of this expenditure would have been

required at some future date to inform the District Plan.

3.14.1 Flood Damage:

Costs associated

with the June 2018 flood have continued to impact on this financial year. Along

with the impact of the September flood the total overspend to budget for the

first quarter is $0.954m. With further costs still to come in for the

September flood the final costs are estimated to be in the vicinity of

$2m. The Rating area 2 flood reserve, will fund the majority of this in

addition to some subsidy by NZTA for work done. The net financial impact

for Council’s local share is expected to be $0.716m

2.0

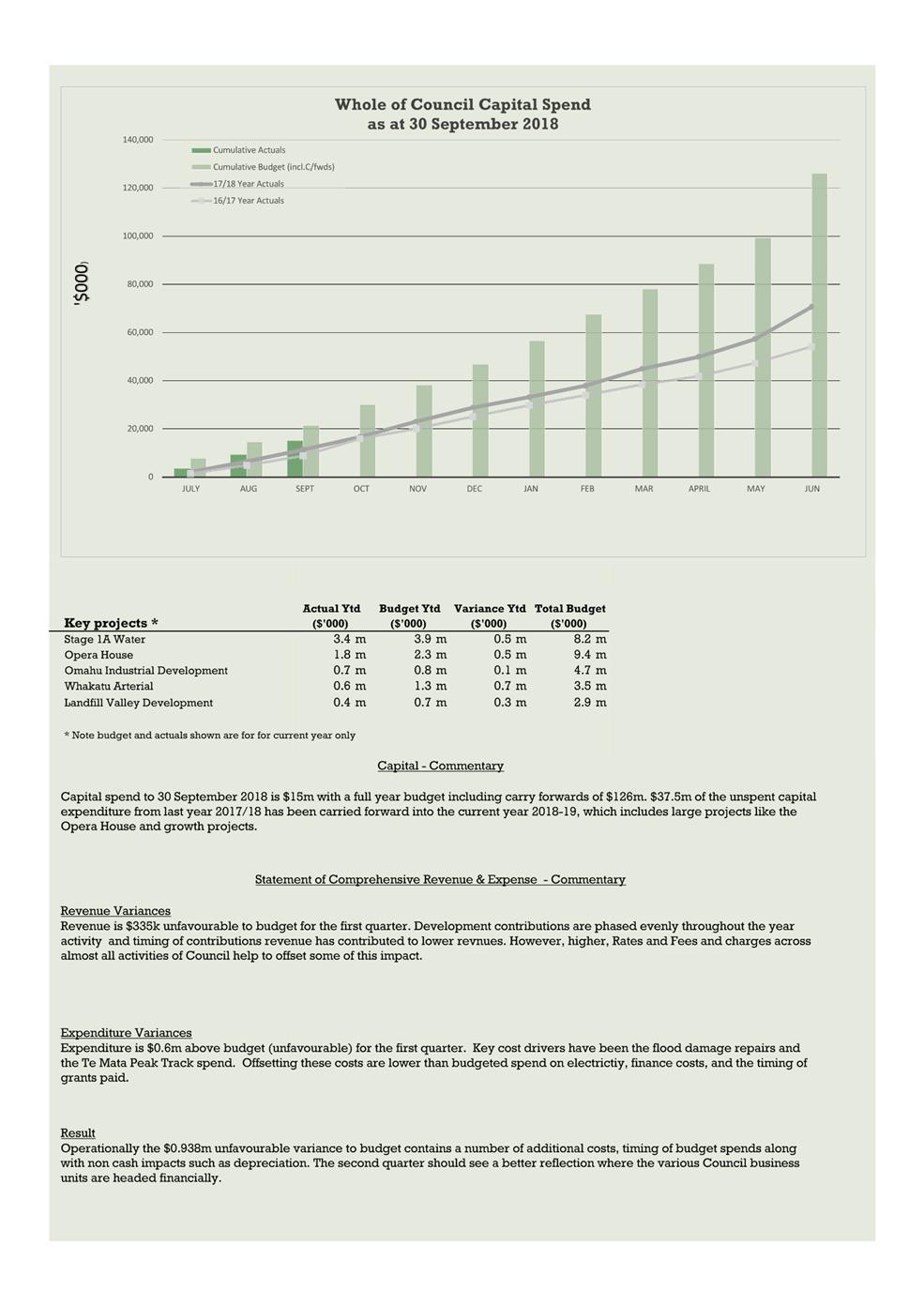

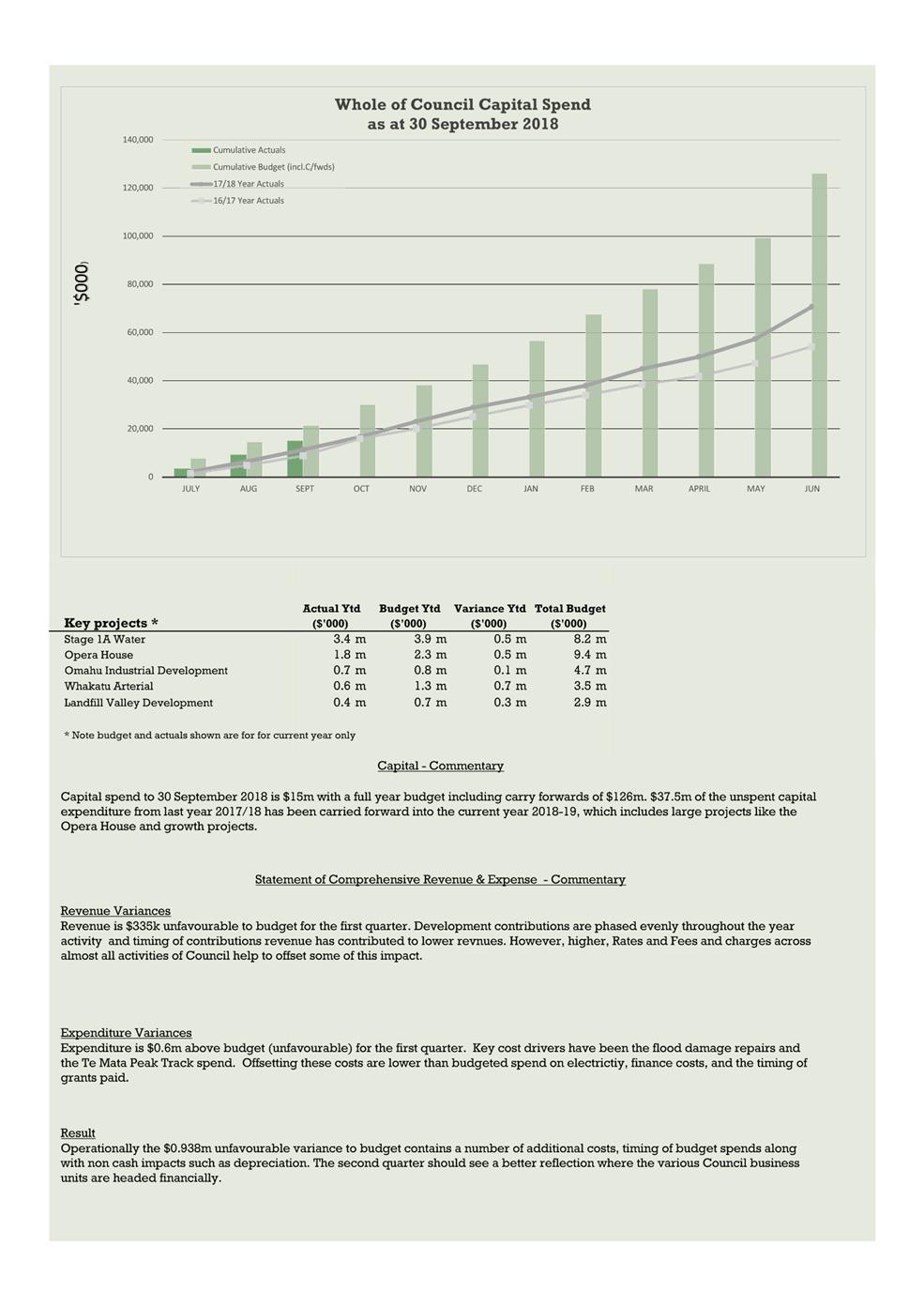

Capital Spend

3.15 Council’s

total capital budget (including carry forwards, renewals, new works, and growth

projects) for 2018/19 is $126m. This level of expenditure is a

significant increase on what has been delivered previously by Council and there

is a real risk associated with the ability of Council to deliver on this

programme. Capital spend year to date of $15.2m is ahead of actual

spend for the prior year ($11m), however it is behind current year to date

budget.

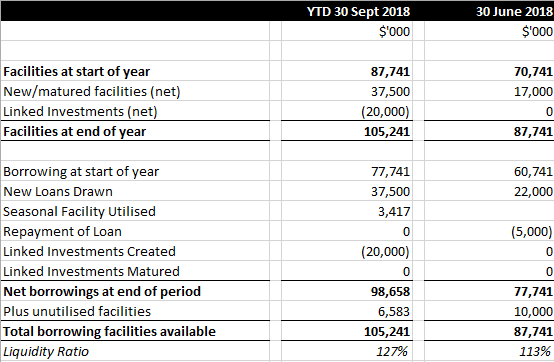

Treasury

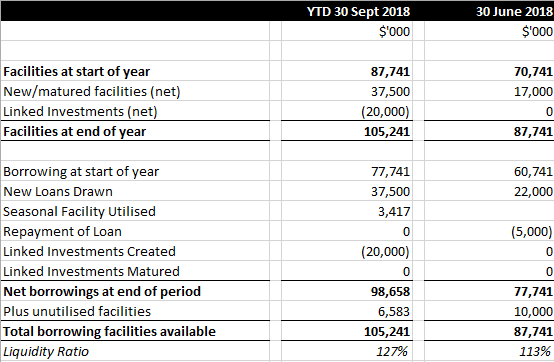

3.16 Total net external borrowing as at the end of

September 2018 is $98.7m with committed borrowing facilities of $105.2m,

providing headroom of $6.6m. The liquidity ratio is at 127% compared to the

policy minimum of 110%.

3.17 The following table sets out Council’s

overall compliance with the Treasury Management Policy as at 31 October 2018:

|

Measure

|

Compliance

|

Actual

|

Min

|

Max

|

|

Liquidity

|

ü

|

131%

|

110%

|

170%

|

|

Fixed debt

|

ü

|

59%

|

55%

|

95%

|

|

Funding

profile:

0 – 3

years

3 – 5

years

5 years +

|

ü

ü

ü

|

41%

26%

33%

|

10%

20%

10%

|

50%

60%

60%

|

|

Net Debt as %

Equity

Net Debt as %

Income

Net Interest

as % Income

Net Interest

as % Rates

|

ü

ü

ü

ü

|

5%

71%

3%

5%

|

0%

0%

0%

0%

|

20%

150%

15%

20%

|

3.18 Council is currently compliant with its

Treasury Management Policy. The Risk and Audit subcommittee is

responsible for reviewing Council’s treasury performance and policy with

advice from PricewaterhouseCoopers (PwC). Current debt forecasts indicate

a debt position at 30 June 2019 to be $127m with major capital projects well

underway.

4.0 SIGNIFICANCE AND CONSULTATION

4.1 This report does not raise any

issues that are significant in terms of the Councils Significance and

engagement Policy that would require consultation.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Financial Controller titled “Financial Quarterly Report for

the three months ended 30 September 2018”

dated 13/11/2018 be received.

|

Attachments:

|

1

|

Quarterly dashboard as at 30 September 2018

|

FIN-09-01-18-163

|

|

|

Quarterly dashboard as at 30 September

2018

|

Attachment 1

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Senior Advisor Economic Policy and

Evaluation

Bill

Murdoch

SUBJECT: Economic

Outlook Update

1.0 SUMMARY

1.1 The purpose of this report is to inform the Committee about the

current economic situation in the Hastings District as measured by selected key

indicators.

1.2 The Council is required to give effect to the purpose of local

government as prescribed by Section 10 of the Local Government Act 2002. That

purpose is to meet the current and future needs of communities for good quality

local infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 It is

recommended that this report is received.

2.0 BACKGROUND

2.1 The data presented is for indicators that are identified as being

relevant to the current Hastings District and Hawke’s Bay socio-economic

environment. Further data can be provided on request and included in future

reports.

2.2 The

information provided should assist Council in the conduct of Council business.

3.0 CURRENT

SITUATION

3.1 The

Hawke’s Bay and Hastings economies have performed strongly over the past

12 months. There is indication that growth will continue throughout the

remainder of 2018 with the recently released national GDP growth of 1.9% for

the September quarter being above expectations. The anomaly is the youth NEETS

rate which has deteriorated over the same period.

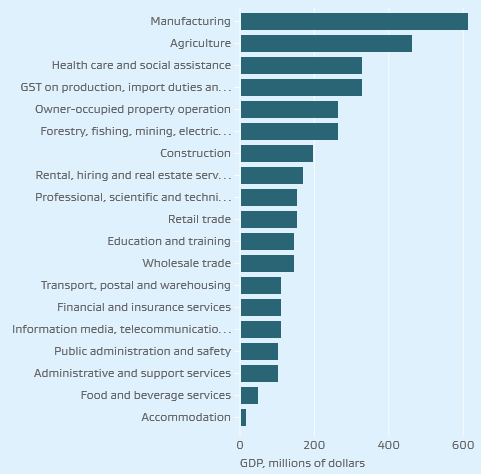

Gross Domestic

Product

3.2 Hastings

GDP increased to $3,721m as at 31 March 2017 (note the time lag in regional GDP

reporting), an increase of 6.1% over the previous 12 months. This was stronger

than the 4.5% increase in Hawke’s Bay GDP (to $7,095m) and 4.9% for total

New Zealand. Hastings percentage of national GDP is 1.5% and Hawke’s Bay

2.8%.

3.3 The

graph below shows the breakdown of Hastings GDP by sector.

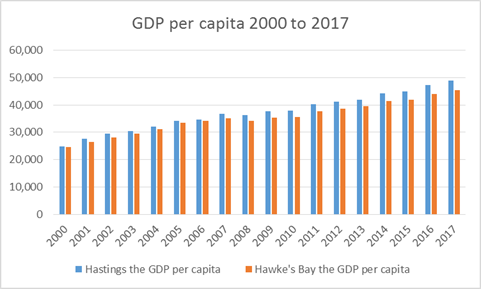

3.4 As at

March 2017 Hastings GDP per person increased by 3.4% to $48,970 which was lower

than the 4.8% increase in 2016. Overall the GDP per capita for Hawke’s

Bay increased by 4.8% compared to the 5.7% increase in 2016. New

Zealand’s GDP per capita is $56,441.

3.5 Hastings

District GDP per capita year-on-year is consistently slightly higher than for

overall Hawke’s Bay.

3.6 The

lower GDP per capita growth rate than the total GDP growth rate indicates that

productivity is not improving. The strong population increase over the 12 month

period would partly account for the lower year-on-year growth rate in GDP per

capita.

Unemployment and

Employment

3.7 Both

Hawke’s Bay and Hastings had improved unemployment and employment rates

year-on-year.

3.8 As at

30 June 2018 the unemployment rate for both Hawke’s Bay and Hastings was

5.8%, an improvement from the previous year of 7.1% for Hawke’s Bay and

6.1% for Hastings.

3.9 Notwithstanding

the improvement, Hawke’s Bay has the second highest regional unemployment

in the country behind Manawatu/Whanganui (6.1%). The unemployment rate for all

of New Zealand is 4.5%.

3.10 The national and

regional trend in unemployment since 2013 has been downward, however, of note

is the intra-year volatility within Hawke’s Bay and Hastings due to the

seasonal nature of the horticultural industry. The graph below shows Hastings

in turquoise, Hawke’s Bay in green and New Zealand in dark blue.

3.11 Statistics NZ has just

released the September quarter employment data for Hawkes Bay/Gisborne

combined. The unemployment rate has dropped to 4.1%. The lower rate is

consistent with the fall to 3.9% for total New Zealand.

3.12 The employment rate

for Hawke’s Bay improved from 62.4% to 64.1% and for Hastings from 66.4%

to 67.9%. The Hastings rate is similar to the employment rate for all of New

Zealand of 67.7%. Since 2016 Hastings has a higher employment rate than total

Hawke’s Bay, reversing the position of the previous two years.

NEET

3.13 The number of youth

(15 to 24 year old age group) not in education, employment or training (NEET)

in Hawke’s Bay and Hastings as at 30 June 2018 was 17.6% and 18.3%

respectively. In both cases this is a deterioration from 16.9% and 17.0% from a

year earlier.

3.14 The size of the 15 to

24 year old age group has remained the approximately the same year-on-year at

an estimate of 10,147. This means that for Hastings the number of NEET in 2017

was 1,725 and in 2018 is 1,856.

3.15 A point of

significance is that Hawke’s Bay NEET rate is now the highest of all New

Zealand’s regions. The second worse NEET region as at June 2018 is

Manawatu-Whanganui at 15.6%.

3.16 Of note is the

significant improvement in Northland, which previously has consistently had the

country’s highest NEET rate. Their rate is now 11.7%, a fall from 16.8%

in 2017.

3.17 The graph below shows

Hastings in green, Northland in turquoise and New Zealand in dark blue.

3.18 Statistics NZ has just

released the September quarter NEET data for Hawkes Bay/Gisborne combined. The

rate has dropped to 14.9% from 18.4% in the June quarter. This is still,

however, the highest NEET rate in the country as most regions showed

improvement. Hastings and Hawke’s Bay data is not yet available.

Guest nights

3.19 For Hawke’s Bay

guest nights rose strongly year-on-year from 1,413,000 to 1,535,000 (8.6%).

Domestic guest nights, 1,051,000, account for 74.4% of guests compared to

392,000 international guest nights.

3.20 Average annual

occupancy rate at as 31 March 2018 is also higher at 42.2% for Hastings, up

from 41.5% in 2017 and for Hawke’s Bay 44.5% compared to 42.9%.

3.21 The rise in guest

nights and occupancy rate continues an upward trend that commenced in 2013.

Retail sales

3.22 Hawke’s Bay and

Hastings continue to have strong year-on-year growth in retail sales with the

rate of increase climbing in most recent years.

3.23 As at 31 March 2018

the total retail sales for Hawke’s Bay was $2,821m and Hastings $1,353m,

an increase of 6.9% and 5.8% respectively over the preceding 12 months. This

follows strong growth between 2016 and 2017 of 5.8% for Hawke’s Bay and

7.3% for Hastings.

3.24 Hastings accounts for

48.3% of Hawke’s Bay retail sales, up from 46.8% five years ago.

|

Year

|

Hawke's

Bay the annual actual retail sales values

|

Hastings

the annual actual retail sales values

|

Hawke's

Bay annual percentage change in annual retail sales values

|

Hastings

annual percentage change in annual retail sales values

|

|

2012

|

2,223 M

|

1,024 M

|

-

|

-

|

|

2013

|

2,254 M

|

1,050 M

|

1.4

|

2.5

|

|

2014

|

2,310 M

|

1,072 M

|

2.5

|

2.1

|

|

2015

|

2,357 M

|

1,107 M

|

2

|

3.2

|

|

2016

|

2,479 M

|

1,191 M

|

5.2

|

7.7

|

|

2017

|

2,638 M

|

1,279 M

|

6.4

|

7.4

|

|

2018

|

2,821 M

|

1,353 M

|

6.9

|

5.8

|

Household income

(average annual)

3.25 As at 31 March 2018

the average household income for Hastings was $90,400 which is higher than the

$86,700 for all of Hawke’s Bay and lower than the $104,400 for total New

Zealand.

3.26 Hastings and

Hawke’s Bay average household income increased by 3.9% and 4.0%

respectively between 2017 and 2018.

3.27 After large percentage

increases in household income in 2015 and 2016 the level of income has stayed

flat for the past three years and is actually marginally lower in 2018

($90,400) compared to 2016 ($90,800).

Port of Napier

3.28 As at 31 March 2018

the Port handled record exports by volumes, 3,530,315 tonnes, which is up 11%

from 2017. The value was lower at $3,530,315,000 compared to $3,768,476,000

i.e. -4.8%. The higher volume, lower value, is due to an increase in log and other

forest product exports and a small rise in apple exports.

3.29 2018 import volumes

were marginally higher at 700,969 tonnes compared to 698,111 tonnes in 2017.

Value was lower in 2018 at $1,048,048,000 compared to $1,198,078,000.

3.30 Of note is the very

sharp rise in import values that occurred between 2016 and 2017, a rise from

$594,791,000 to $1,198,078,000 i.e. +101%.

3.31 The reason for the

increase in import values is the Kaikoura earthquake which crippled

Wellington’s Centrepoint container terminal for 10 months. All Wellington

region’s imports are now back to being handled by Wellington but Port of

Napier has retained some Manawatu cargo.

Exports

3.32 The chart below shows

the percentage share of the top 10 exports by industry for the Hastings

District in 2017 and the almost complete dominance of primary industry.

Population

3.33 As at 30 June 2018 the

population of Hastings District is estimated at 80,600, an increase of 700

(0.9%) from 2017.

3.34 The main cause of the

recent higher population growth than previous years is positive net migration.

Between 2017 and 2018 Hastings had net migration of +413. This follows on from

positive net migration numbers in 2015 and 2016. This is significant as since

the 1980s the region has had negative net annual migration numbers each year

with the exception of 1993. Early data indicates that the positive net

migration trend will continue in second half of 2018 albeit at a lower rate

than in 2017.

Building Consents

3.35 In the 12 months to June

2018 there were 289 new building consents for residential buildings in Hastings

District. This is an increase of 6.3% from 2017 and follows a 23% and 17.6%

increase in 2017 and 2016. These increases however are from a low base of 187

in 2015.

Housing

3.36 House prices have

risen strongly in the past three years. The percentage increase in the 12

months to June 2016 was 9.0%; June 2017 18.1%; and June 2018 13.9%. The current

average house price is $479,828.

3.37 In the past three

years the percentage increase in rents has been lower than the percentage

increase in house prices. In 2016, 2017 and 2018 the percentage increase in

average rent each year has been 4.9%, 8.6% and 8.0% respectively.

3.38 The average weekly

rent in Hastings as at June 2018 was $363.00 per week an increase from $266 ten

years ago in 2009.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report is not significant in relation to Council’s Significance and

Engagement Policy.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Senior Advisor Economic Policy and Evaluation titled

“Economic Outlook Update” dated 13/11/2018

be received.

|

Attachments:

There are no

attachments for this report.

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Hastings

District Holdings Limited Equity

1.0 SUMMARY

1.1 The

purpose of this report is to obtain a decision from the Council on recommendation

from the Director’s to Hastings District Holdings Limited to return

unneeded equity.

1.2 This

issue arises from the resolution of the Hastings District Holdings Limited

Director’s at the 9th October 2018 Board Meeting.

The Council is

required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the

current and future needs of communities for good quality local infrastructure,

local public services, and performance of regulatory functions in a way that is

most cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.3 The

objective of this decision relevant to the purpose of Local Government is to

make efficient use of spare funds.

1.4 This

report concludes by recommending Council agree to approve the return of equity

proposed by the Directors of Hastings District Holdings Limited.

2.0 BACKGROUND

2.1 In

September 2018, Hastings District Properties Limited agreed to close its bank

accounts, and remit the surplus funds contained in those bank accounts back to

its Parent (Hastings District Holdings Limited) as a return of equity as it was

no longer trading and in need of the funds. This amounted to funds to be

transferred of $118,436.

2.2 This

return of equity from Hastings District Properties Limited won’t create

any tax issues, and while this has left Hastings District Properties Limited with no assets, this doesn’t formally cease the

company’s existence. Hastings District Properties

Limited could be reactivated at any stage and reopen

new banks accounts and once again be provided seed funding from its Parent

Company.

3.0 CURRENT

SITUATION

3.1 With

the return of funds from Hastings District Properties Limited (once fully

implemented) will leave Hastings District Holdings Limited with $132,350 of

surplus funds.

3.2 While

Hastings District Holdings Limited is not trading it has no current need for

these funds and could return this unneeded equity back to its parent (the

Hastings District Council).

3.3 Like

Hastings District Properties Limited return of capital, such a transaction

won’t create any tax issues, and doesn’t formally dissolve the

company. The company could be reactivated again in the future should the need

arise.

3.4 At

the Board Meeting of Hastings District Holdings Limited on the 9th

October 2018, the Directors passed the following resolution:

“The

Directors of Hastings Holdings Limited recommend to Hastings District Council as

100% shareholder to close the bank accounts of Hastings District Holdings

Limited, and remit the surplus funds contained in those bank accounts back to

its Parent (Hastings District Council) as a return of equity.”

4.0 OPTIONS

4.1 Option

A – Hastings District Council could approve the recommendation of the

Hastings District Holdings Limited Director’s to return its equity.

4.2 Option B - Hastings District Council

could decline the recommendation of the Hastings

District Holdings Limited Director’s to return

its equity.

5.0 SIGNIFICANCE

AND ENGAGEMENT

5.1 The

issues for discussion are not significant in terms of the Council’s

policy on significance and engagement and no consultation is required.

6.0 PREFERRED

OPTION/S AND REASONS

6.1 The

preferred option is option A as Hastings District Council can make better use

of these funds since Hastings District Holdings Limited currently isn’t

trading and has no immediate need for these funds.

|

7.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “Hastings

District Holdings Limited Equity” dated 13/11/2018

be received.

B) That Hastings District Council approves the recommendation of the

Hastings District Holdings Limited Director’s to return its equity.

With the reasons for this decision

being that the objective of the decision will contribute to meeting the

current and future needs of communities in a way that is most cost-effective

for households and business by making efficient use of surplus funds.

|

Attachments:

There are no

attachments for this report.

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: HB

LASS Limited Annual Report for the year ended 30 June 2018

1.0 SUMMARY

1.1 The

purpose of this report is to present to the Committee the HB LASS Limited

Annual Report for the year ended 30 June 2018.

1.2 This

request arises from a requirement under the Local Government Act 2002 for

Council Controlled Organisations (CCO) to submit an annual report to their

shareholders within 90 days of year end.

1.3 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.4 The objective of this decision relevant to

the purpose of Local Government is to enable HB LASS to develop the most cost

effective delivery of joint services for the five shareholding Councils

1.5 This report concludes by recommending that

the HB LASS Limited Annual Report for the year ended 30 June 2018 be received.

2.0 BACKGROUND

2.1 HB

LASS Limited is a Local Authority Shared Services company established by four

Hawke’s Bay Territorial Local Authorities and the Hawke’s Bay

Regional Council.

2.2 As at

30 June 2018 the Directors of HB Lass Limited were:

· Craig Waterhouse (Independent Chair)

· Monique Davidson (Central Hawke’s Bay District Council)

· Wayne Jack (Napier City Council)

· James Palmer (Hawke’s Bay Regional Council)

· Steven May (Wairoa District Council)

· Ross McLeod (Hastings District Council)

2.3 The

Directors of HB LASS Limited are required to deliver to their shareholders an

annual report within 90 days of the end of each financial year which will

consist of:

· A Chairman’s report, containing a review of the Company

operations with specific attention to the performance against the key

performance indicators established in the respective Statement of Intent.

· A comparison of actual performance with targeted performance

· Annual audited financial accounts to be completed in accordance with

generally accepted accounting standards and to include:

i. Statement of Financial Position

ii. Statement of Financial Performance

iii. Auditor’s Report

3.0 CURRENT SITUATION

3.1 Attachment

1 is the 2018 Unaudited Annual Report (which only covers 10 months of

trading).

3.2 HB

LASS Limited was established to investigate, develop and deliver shared

services, where and when it can be done more effectively for any combination of

the Shareholding Councils.

3.3 The

annual result is a break even result which is consistent with the Statement of

Intent and last year’s result. The intention of HB LASS Limited is to

recover its costs of operations from shareholder membership fees and project

evaluation fees.

3.4 At

the Board meeting on the 8th December 2017 the five Chief Executives of the Hawke’s Bay Councils recommended that HBLASS be wound up to become a dormant company.

This was subsequently endorsed at the Hastings District Council’s Finance

and Monitoring Sub Committee meeting on the 20th March 2018.

3.5 HBLASS

will be replaced by “The Chief Executive (CE)

Forum” with the same five Council CEs and independent chair continuing

the function of HBLASS but without the legislative requirements of operating a

Company. The CE Forum group is fully committed to working together focusing on

improving Service and Value for the Hawke’s Bay region through

collaboration.

3.6 Since

this time the final bills of HBLASS have been settled, final tax liabilities

dealt with, and surplus funds have been transferred to Napier City Council

($71,783). These funds will be used to pay for the ongoing services of the Chairman and Collaborator roles.

3.7 These

unaudited accounts represent the trading of HBLASS up till the time it dissolved

all its assets and liabilities and passed its surplus funds over to Napier City

Council.

4.0 SIGNIFICANCE

AND CONSULTATION

4.1 The

issues for discussion are not significant in terms of the Council’s

policy on significance and engagement and no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “HB

LASS Limited Annual Report for the year ended 30 June 2018”

dated 13/11/2018 be received.

B) That the HB LASS Limited Annual Report for the year ended 30 June

2018 be received.

|

Attachments:

|

1

|

HB LASS Limited - Annual Report 2017/18

|

ADM-02-7-18-436

|

Under Separate Cover

|

1.

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Hawke's

Bay Museums Trust Annual Report for the year ended 30 June 2018

1.0 SUMMARY

1.1 The

purpose of this report is to update the Committee on the performance of the

Hawke’s Bay Museums Trust for the year ended 30 June 2018.

1.2 This

request arises from the receipt of the Hawke’s Bay Museums Trust Annual

Report for the year ended 30 June 2018.

1.3 Unfortunately

Dr Grant (Chair of the Hawke’s Bay Museums Trust) is unable to attend

this meeting.

1.4 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances

1.5 The

objective of this decision relevant to the purpose of Local Government is to

meet the needs of current and future communities in providing good quality

public services.

1.6 This

report concludes by recommending that the Hawke’s Bay Museums Trust

Annual Report for the year ended 30 June 2018 be received.

2.0 BACKGROUND

2.1 The

Hawke’s Bay Museums Trust (HBMT) is a Council Controlled Organisation

with 3 of the 5 Trustees appointed by Napier City Council (NCC) and Hastings

District Council (HDC) and with the bulk of its funding provided jointly by

those Councils. The HBMT Board is responsible for a management agreement

between the HBMT and the NCC with the management agreement providing for the

operations of the Museum, Art Gallery and associated activities which are

operated by the NCC.

HBMT has 4 main goals:

1. To protect the regional collection

2. To maintain and enhance the quality of the

collection

3. To maximise access to the collection

4. To further develop the collection

2.2 The

HBMT (Incorporated) is registered as a charitable entity under the Charities

Act 2005.

2.3 The

Board is constituted to have five members appointed as follows:

§ One

appointed by Napier City Council

§ One

appointed by Hastings District Council

§ One

appointed by the Hawke’s Bay Museums Foundation Charitable Trust

§ One

appointed by Ngati Kahungunu Iwi (Incorporated)

§ The

Chairperson who shall be appointed by Napier City Council and Hastings District

Council jointly.

2.4 The

current Trustees are as follows:

|

Director

|

Effective

From

|

|

Dr Richard Grant

|

December 2014

|

|

Deputy Mayor Faye White

(Napier)

|

September 2015

|

|

Councillor George Lyons (Hastings)

|

December 2013

|

|

Johanna Mouat

|

December 2013

|

|

Mike Paku

|

December 2013

|

2.5 Dr Grant was appointed as the Independent Chairman by the joint

appointments committee in late 2014. Council’s Policy on Appointment and

Remuneration of Directors for Council Organisations states that the Independent

Chair be appointed jointly by NCC and HDC and that HDC’s member on this

Appointments Panel be the Mayor Hazlehurst or their delegate.

3.0 CURRENT SITUATION

3.1 Attachment

1 is a copy of the Hawke’s Bay Museum Trust’s Annual Report

including signed and audited accounts for the year ended 30 June 2018.

3.2 Hastings

District Council’s representative on the Trust is Cr George Lyons.

3.3 The

HBMT received grants of $917,320 in aggregate from the NCC and HDC compared to

$900,850 received in the 2017 financial year. The grants cover the

contracted costs to NCC to provide administrative and management services for

the management of the collection. The costs of the regional collection

are met equally by the HDC and NCC with HDC contributing $466,160 in 2018

compared to $457,925 in 2017. The HDC contribution includes $15,000 as a

training grant to the Trust whereby the NCC training grant offsets expenditure

incurred by NCC on behalf of the Trust.

3.4 The

audited accounts show a net surplus from operating activities for the year

ended 30 June 2018 of $78,444 ($198,689 in 2017). $56,496 of this surplus is

due to the recognition of the value of assets gifted to the Trust, with the

remaining $21,948 surplus coming from normal operations.

3.5 The

Statement of Financial Position reports accumulated funds of $40,840,378 as at

30 June 2018 compared with $39,902,897 as at 30 June 2017. $800,266 of the

change in equity between 2017 and 2018 is due to the increased valuation of the

collection, with the balance coming from operating activities.

3.6 The

statement of Financial Position records the collection at $40,179,424 as at 30

June 2018 compared to $39,324,935 in 2017.

3.7 The

statement of Financial Position also records an operating bank balance of

$17,786 ($31,117: 2017) with a further $635,260 held in investments ($540,260:

2017). Of the investments of $635,260, $507,263 are held as special purpose

reserves (see note 7) with various restricted use applications.

3.8 The

Annual Report also includes a comparison of the non-financial performance

measures included in the Statement of Intent for the year ended 30 June

2018 against the actual results achieved, and these are as follows:

3.9 Generally

the targets set in the Statement of Intent have been met and officers believe

that this plus the financial result reported in the Annual Report presents a

good result for the Trust.

3.10 The

HBMT owns, protects, and makes available the collection of art, local history,

Maori and ethnographic objects. The primary place of display and storage of the

collection is at the MTG Hawke’s Bay, while overflow storage is housed at

the Rothmans Building in Napier. This offsite storage has been a long standing issue

as it is expensive and not ideal for storing historical artefacts (lack of

climate control).

With the NCC’s library moving

temporarily into the MTG building, storage has become an even more pressing

issue, which has been resolved in the short term with a 5 year lease being

signed on the Rothmans Building. However the Trustees continue to search for

the permanent solution.

A recent review of the management

arrangements held by the Trust was undertaken, and this along with storage and

identity issues are being considered by a joint working group between the two

Councils (refer to Council workshop held on the 4th September 2018

which presented the findings of the review undertaken by Rationale)..

4.0 SIGNIFICANCE AND

CONSULTATION

4.1 The

issues for discussion are not significant in terms of the Council's policy on

significance and engagement and no consultation is required.

|

5.0 Recommendations

and Reasons

A) That

the report of the Manager Strategic Finance

titled “Hawke's

Bay Museums Trust Annual Report for the year ended 30 June 2018” dated 13/11/2018 be received.

B) That the Hawke's Bay Museums Trust

Annual Report for the year ended 30 June 2018 be received.

|

Attachments:

|

1

|

HBMT Annual Report 30 June 2018

|

EXT-10-11-7-18-218

|

Under Separate Cover

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: New

Zealand Local Government Funding Agency Limited - Annual Report for the year

ended 30 June 2018

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Committee of the financial results of

New Zealand Local Government Funding Agency Limited (LGFA) for the year ended

30 June 2018.

1.2 This issue arises from the receipt of the annual report for the 12

months ended 30 June 2018 from the LGFA.

1.3 The Council is required to give effect to

the purpose of local government as prescribed by Section 10 of the Local

Government Act 2002. That purpose is to meet the current and future needs of

communities for good quality local infrastructure, local public services, and

performance of regulatory functions in a way that is most cost–effective

for households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.4 This

report concludes by recommending New Zealand Local Government Funding Agency

Limited Annual Report for the year ended 30 June 2018 be received.

2.0 BACKGROUND

2.1 The

LGFA was established on 1 December 2011 with 18 Local Government shareholders

and the Crown. Hastings District Council became a shareholder with a

shareholding investment of $400,000 (1.8%). The LGFA is a Council Controlled

Organisation.

2.2 During

2012 12 new shareholders joined the LGFA as part of the second opening with

Council selling down some shares to the 12 new shareholders. This reduced

HDC’s shareholding to $373,196 (1.77%).

3.0 CURRENT

SITUATION

3.1 Attachment

1 is a copy of the 2017/18 Annual Report for the 12 months ended 30 June

2018.

3.2 The

Annual Report covers a number of topics including financial performance, how

they manage their treasury risk, and how they performed against their Statement

of Intent.

3.3 The LGFA

has had another good financial year with interest income up 7% to $342.8m

($320.7m: 2017). This was matched with a 7% increase in Interest Costs and

Operating Costs of $331.0m ($309.7m: 2017). This saw the net operating profit

increase to $11.8m from $11.0m from the previous year.

3.4 Three

new Councils joined the LGFA (Westland District Council, Stratford District

Council, and Rangitikei District Council) during 2017/18.

3.5 As at

30 June 2018 56 Councils had borrowed a total of $7,976m ($7,784m: 2017). The

average term of new borrowings during the year was 6.9 years (8.1 years: 2017).

3.6 Page

61-62 of the annual report lists all the Councils that had borrowings through

the LGFA as at 30 June 2018. There were 54 of them, with 21 of them having higher

levels of debt than Hastings District Council. In fact Hastings District

Council’s debt of $77.2m only represents 1% of the total borrowings from

the LGFA.

3.7 The

LGFA continues to provide savings in borrowing costs for councils relative to

other sources of borrowing (Auckland and Dunedin Councils are paying between 10

and 21 basis points more when borrowing externally than the LGFA equivalent

offerings).

3.8 The

LGFA allows Councils to borrow for periods anywhere from 30 days to 15 years in

length.

3.9 LGFA

bonds continue to be popular with investors with an average of 2.8 bids per

bond being offered during 2017/8 (there were nine tenders during this

year).

3.10 The Statement of

Service Performance sets out progress on the achievement of its primary

objectives, additional objectives and financial performance against its

financial performance targets.

3.11 Officers are of the

opinion that the LGFA’s performance continues to be very successful;

creating a more efficient and diversified funding market for Councils to

participate in.

3.12 LGFA has achieved its

key financial results for the year to 30 June 2018 and these are set out in the

table below:

3.13 The key performance

targets are set out in the table below including an explanation of any material

variances:

3.14 LGFA have declared a

$1.285 million dividend for the year ended 30 June 2018. This equates to a

dividend payment to Council of $21,314.

4.0 SIGNIFICANCE

AND CONSULTATION

4.1 The issues for discussion are not significant in terms of the

Council's policy on significance and engagement and no consultation is

required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Manager Strategic Finance titled “New

Zealand Local Government Funding Agency Limited - Annual Report for the year

ended 30 June 2018” dated 13/11/2018 be received.

B) That the New Zealand Local Government Funding

Agency Limited Annual Report for the 12 months ended 30 June 2017 be received.

|

Attachments:

|

1

|

LGFA Annual Report 2018

|

FIN-15-5-18-706

|

Under Separate Cover

|

REPORT TO: Finance

and Risk Committee

MEETING DATE: Tuesday 13

November 2018

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Local

Government Funding Agency - Annual General Meeting 2018

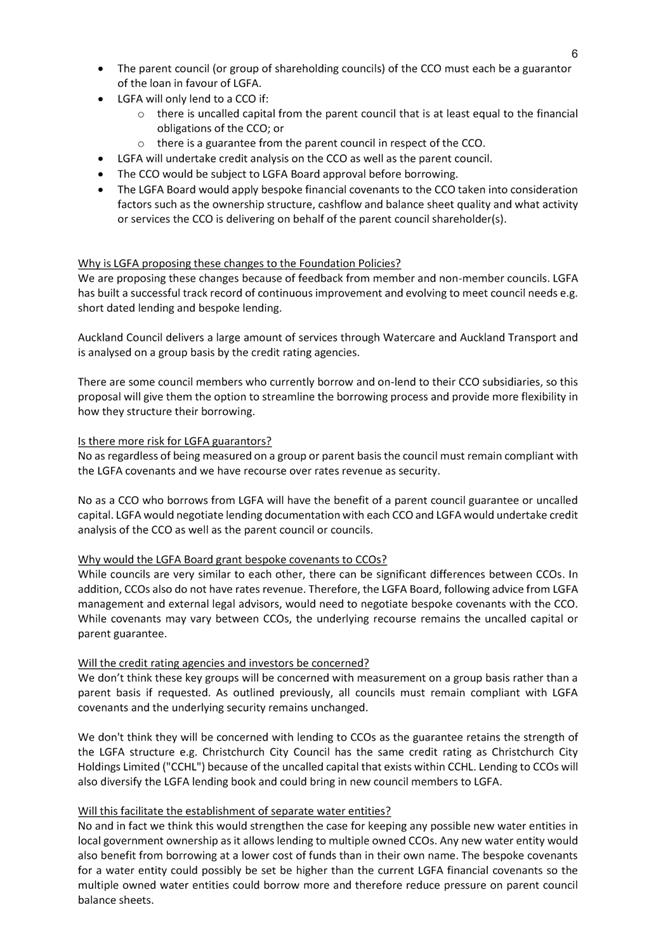

1.0 SUMMARY

1.1 The

purpose of this report is for the Finance and Risk

Committee to provide voting recommendations to the Council when in attendance

of the Local Government Funding Agency’s (LGFA’s) Annual General

Meeting (AGM) to be held on 21 November 2018.

1.2 This report is staff generated as a result of receiving the

LGFA’s Notice of AGM and information supporting agenda items.

This report concludes

by recommending that the Council votes in favour of the following proposals

which require ordinary shareholder resolutions:

a. John Avery is re-appointed to the Local

Government Funding Agency’s board as an independent director;

b. Mike Timmer is re-appointed to the Local

Government Funding Agency’s board as a non-independent director;

c. Hamilton

City Council is re-elected to the Shareholders’ Council;

d. Tauranga

City Council is re-elected to the Shareholders’ Council;

e. Changes

to the Local Government Funding Agency’s foundation policies

2.0 BACKGROUND

2.1 The

LGFA is a Council-controlled organisation (CCO), owned 11.1% by the Government

and 88.9% by 30 local authorities. The Council has an ownership stake of 1.77

%.

2.2 The

LGFA was established to provide councils with improved access to cost-effective

long term debt. It is a registered financial institution regulated by the

Reserve Bank. Total loans made to local government total around $7.976

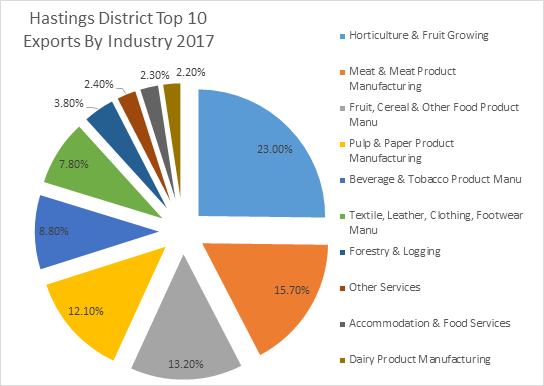

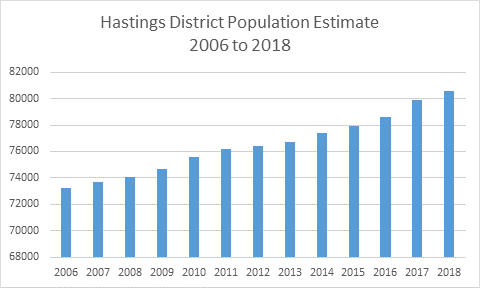

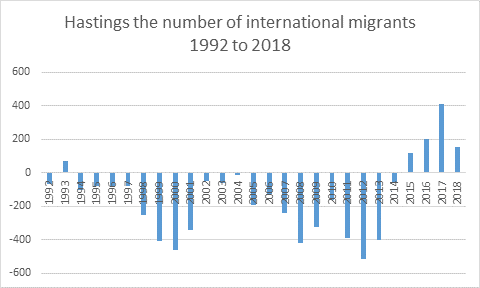

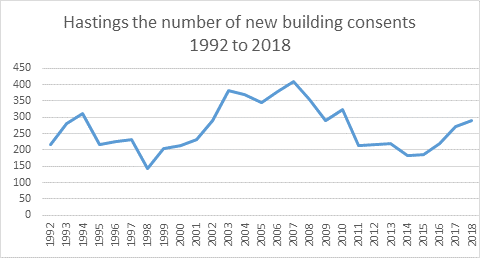

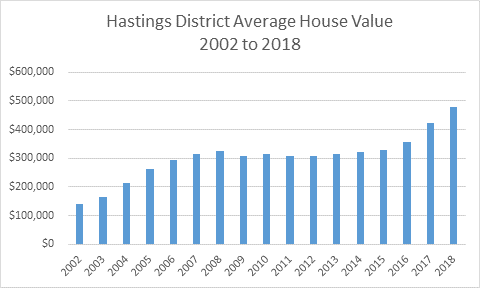

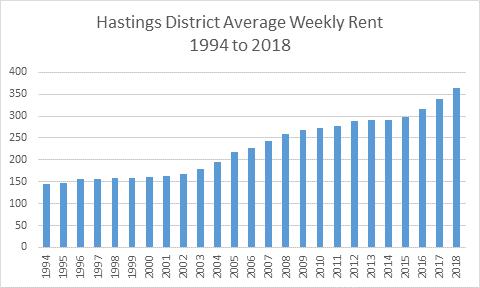

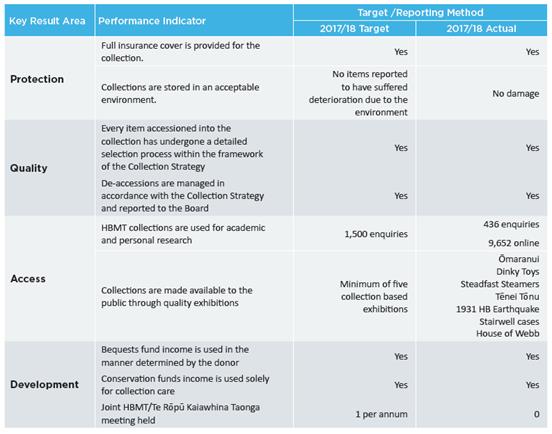

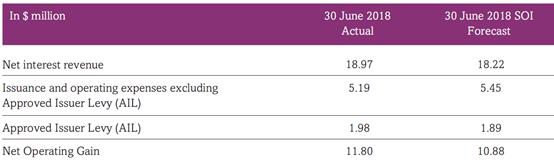

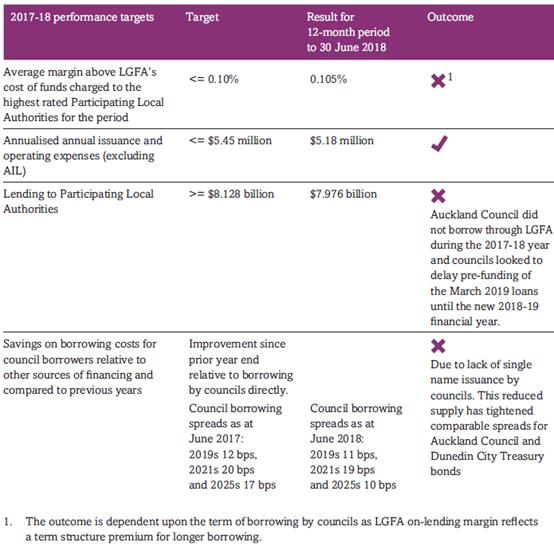

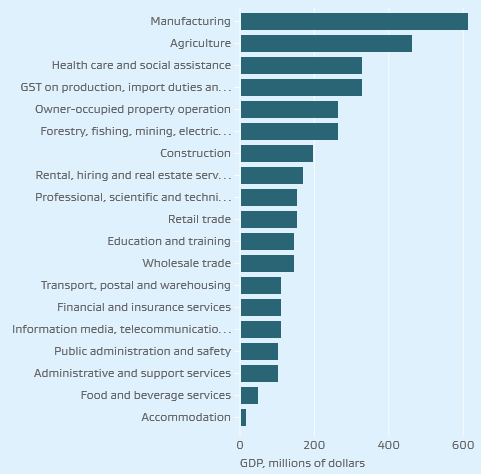

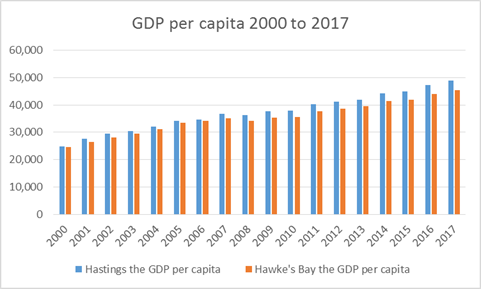

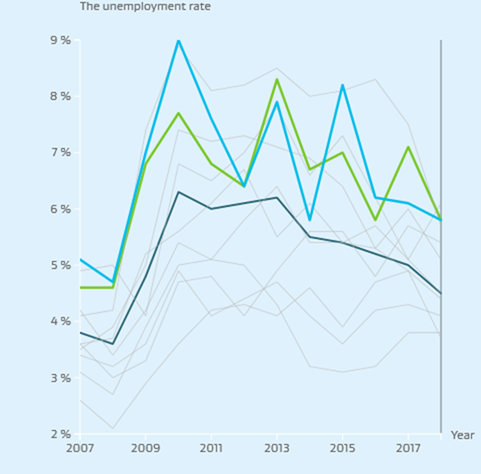

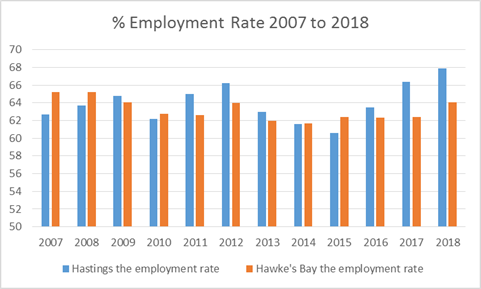

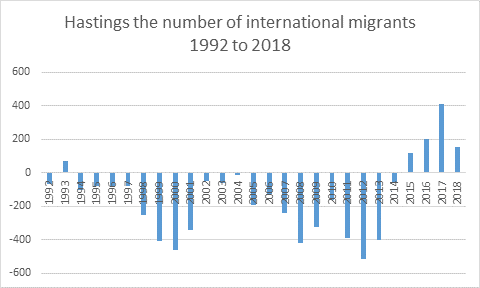

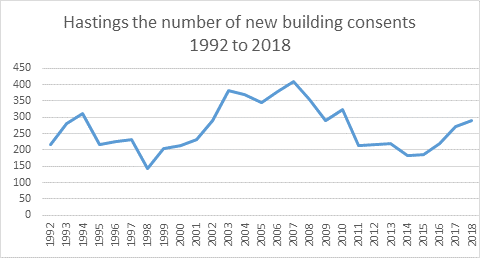

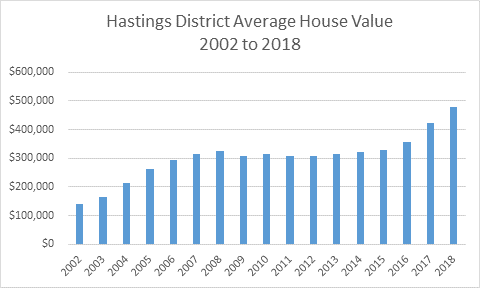

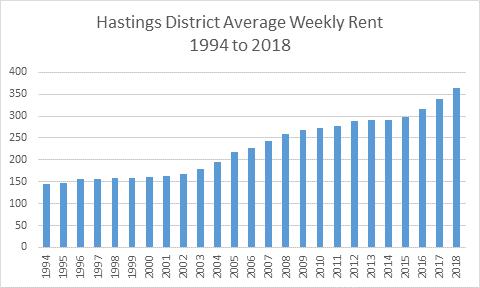

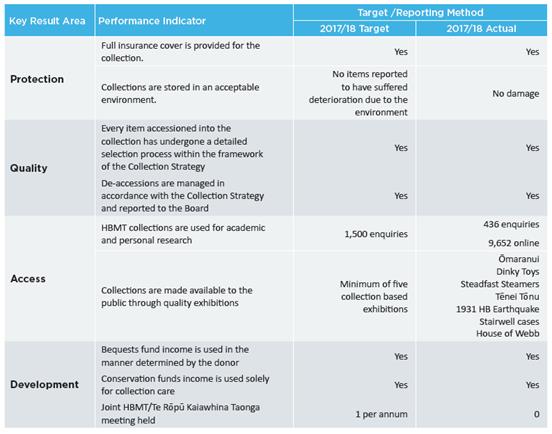

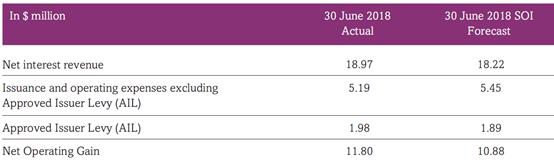

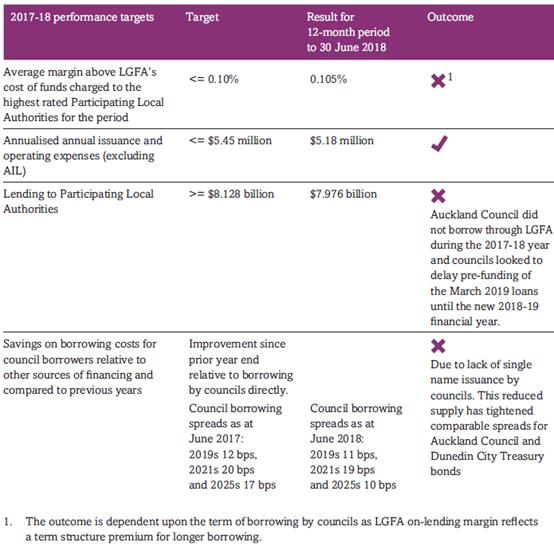

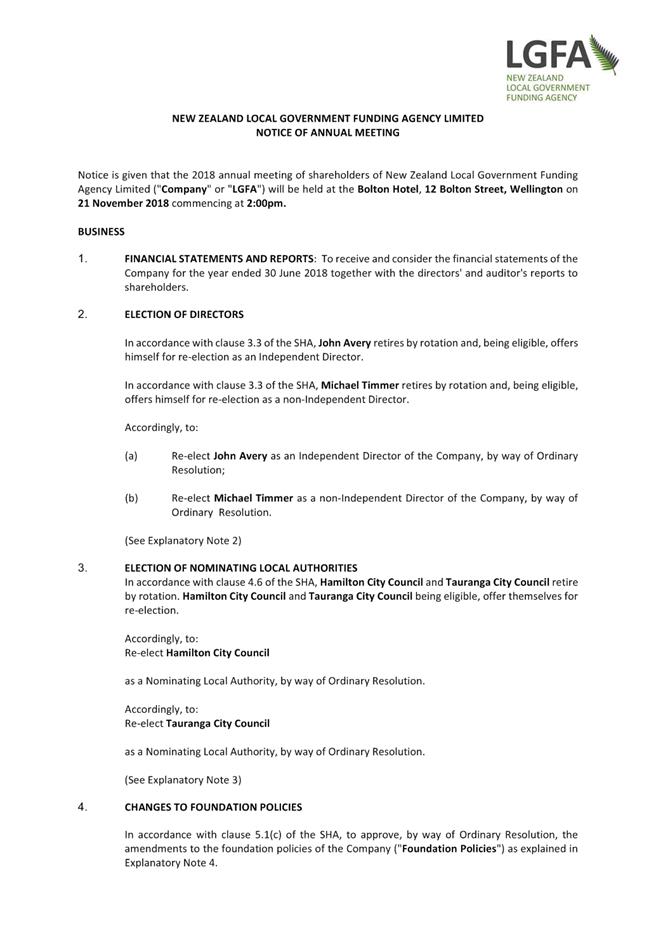

billion. Together, Auckland Council and Christchurch City Council have