Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Risk and Audit Subcommittee MEETING

|

Meeting Date:

|

Monday,

18 February 2019

|

|

Time:

|

10.00am

|

|

Venue:

|

Landmarks

Room

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Subcommittee Members

|

Chair: Mr J

Nichols

Ex Officio: Mayor Hazlehurst

Deputy Mayor Kerr (Deputy Chair)

Councillors

Nixon and Travers

(Quorum=3)

|

|

Officer

Responsible

|

Chief Financial Officer, Bruce Allan

|

|

Committee

Secretary

|

Christine Hilton (Ext 5633)

|

Risk and Audit Subcommittee – Terms of Reference

A subcommittee of

the Finance and Risk Committee

Fields of

Activity

The Risk and Audit Subcommittee is responsible for

assisting Council in its general overview of financial management, risk

management and internal control systems that provide:

·

Effective management of

potential risks, opportunities and adverse effects; and

·

Reasonable assurance as to

the integrity and reliability of the financial reporting of Council; and

·

Monitoring of the Council’s

requirements under the Treasury Policy

Membership

(4 Members)

Chairman

appointed by the Council

The Mayor

Deputy Mayor

2

Councillors

An

independent member appointed by the Council.

Quorum – 3 members

DELEGATED

POWERS

Authority to consider and make recommendations on all matters detailed

in the Fields of Activity and such other matters referred to it by the Council

or the Finance and Risk Committee

The

subcommittee reports to the Finance and Risk Committee.

HASTINGS DISTRICT COUNCIL

Risk and Audit Subcommittee MEETING

Monday, 18 February 2019

|

VENUE:

|

Landmarks Room

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

10.00am

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

Leave of Absence had previously

been granted to Councillor Kerr.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the General Counsel or the Democratic Support Manager

(preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Risk and Audit Subcommittee Meeting held Monday 5 November 2018.

(Previously circulated)

4. 2019/20 Budget

update 5

5. Procurement and

Contract Management Project update 9

6. Treasury Activity

and Funding 15

7. 10 Strategic

Resource Consents for Council 25

8. General Update

Report and Status of Actions 29

9. Additional

Business Items

10. Extraordinary

Business Items

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 18

February 2019

FROM: Chief Financial Officer

Bruce Allan

Strategy Manager

Lex

Verhoeven

SUBJECT: 2019/20

Budget update

1.0 SUMMARY

1.1 The purpose of this report is to inform the

Subcommittee about the budget process undertaken for the 2019/20 Annual Plan,

the challenges that this budget poses and the risks that the organisation faces

through the key decisions that it has to make.

1.2 The

Council is required to give

effect to the purpose of local government as prescribed by Section 10 of the

Local Government Act 2002. That purpose is to meet the current and future needs

of communities for good quality local infrastructure, local public services,

and performance of regulatory functions in a way that is most

cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.3 The

objective of this decision relates to numerous service delivery, decision

making, financial management and consultative provisions within the Local

Government Act 2002.

1.4 This

report concludes by recommending that the report be received.

2.0 BACKGROUND

2.1 The

2019/20 Annual Plan budget is fundamentally year 2 of the 2018-28 Long Term

Plan which was adopted in June 2018 with adjustments made based on changing

circumstances and priorities.

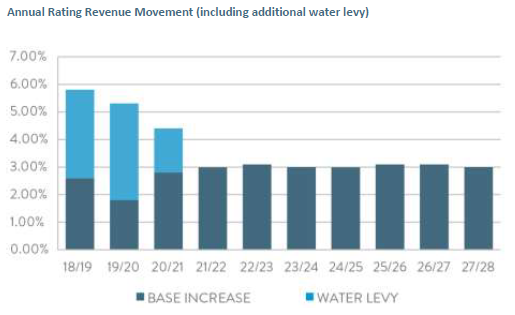

3.0 CURRENT

SITUATION

3.1 The

2019/20 Annual Plan has been prepared on the backdrop of the implementation of

the water change programme and the $47m investment in water supply enhancements

and water treatment facilities. The 2018-28 Long Term Plan signalled larger

rate increases in the first three years of the plan, largely driven by the

infrastructure investment, and enhanced operating environment to deliver safe

drinking water.

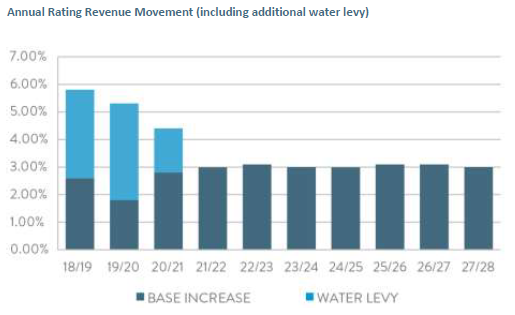

3.2 The

graph below depicts the forecast rate increases over the life of the plan, with

the additional water levy in the first three years.

Budget

Process

3.3 Given

the constrained fiscal environment detailed above, budget managers were given

instructions for the preparation of the 2019/20 Annual Plan to deliver services

within the Year Two funding envelope and to highlight any changes in context

for consideration by the Budget Review Board (made up by the Chief Financial

Officer and other senior managers). These instructions included:

· The

removal of any inflation adjustment (the LTP contains mandatory inflation indices

on budgets from Year 2) for expenses except for where contractual arrangements

stipulated CPI type escalation requirements.

· Inflation

adjustments were retained for all income budgets

· Year

2 of the 2018-28 LTP was to be the baseline for their 2019/20 budgets with

changes only included where Chief Executive approval had been attained for new

positions or a Council direction given for increased expenditure.

· Budget

Managers were required to enter a budget bid for any new expenditure that had

not been previously signalled in the Long Term Plan.

Outcome

of Budget Process

3.4 The

Budget Review Board met with all Group managers and senior staff to work

through issues raised, with no significant new risks identified. Some

minor reworking of the capital programme was required in the infrastructure

area to advance some projects where further investigation had confirmed the

need to commence these.

3.5 Some

changes in context within operational budgets have had to be responded to and

these can be summarised as follows:

§ Personnel - Council’s staffing compliment has been adjusted

in recent years to reflect various Council decisions relating to service

delivery. This year sees some additional capacity to drive initiatives

within the adopted Waste Minimisation and Management Plan, succession planning

in the building inspection function, an elevated focus on risk management,

capacity to drive development projects, a parks contract position identified

through the parks review and provision to address strategic water

considerations coming from the TANK process.

§ Water Supply

Management – The Committee will be aware that

the approach to water supply management has changed dramatically, and Council

has received regular updates on this programme of work. This

comprehensive programme is fundamentally in line with that contained in the LTP

with some further refinements to some operating costs.

§ Kerbside

Recycling – some escalation in costs is

having to be managed in the solid waste area, with the impact of changes in how

plastics are managed globally being the key driver.

§ Insurance – escalations in material damage insurance, over that forecast

in the LTP, have been provided for within the budget.

§ Information

Technology – Further to a review undertaken

(in conjunction with the development of Council’s Information Technology

Strategy) which recommended a small step up in investment in some areas, some

additional licensing and software/hardware maintenance items have been budgeted

reflecting Council’s focus on service delivery to our community and the

IT solutions assisting to deliver this.

3.6 The

additional cost pressures outlined above have been largely accommodated through

finding efficiencies, through rating base growth and by resetting some of the

targeted rates which fund these activities. At the time of preparing this

report the overall Annual Plan rate increase has been set at 5.6% compared to

5.3% forecast in the LTP.

3.7 Debt

Profile - The forecast debt position as at 30 June 2019 is circa $122

million depending on the timing of some projects, compared with the LTP

forecast of $125m. This shows that the substantive LTP capital

development programme is on track, however this has allowed little headroom in

terms of borrowing savings being able to be applied within the Council’s

budget. Note that the LTP assumed that there would be a reasonably consistent

level of carry forwards for capital projects.

Compliance with Council’s Financial Strategy

3.8 A

key requirement of an Annual Plan is to report on compliance against

Council’s Financial Strategy contained within the Long Term Plan.

The draft Annual Plan will outline Council compliance against the key fiscal

parameters, all of which are well within policy limits.

3.9 A

key parameter is the annual rates increase which is defined within the

Financial Strategy as (LGCI + 4.0%), which translates to 6.3% for the 2019/20

financial year. The proposed Annual Plan rates increase is within this

level, and provides some modest headroom for Council deliberation if required.

3.10 A

further key parameter is the Balanced Budget Benchmark, which is a measure that

annual operating revenue is set at a level to fund annual operating

expenses. The Council budget complies with this fiscal measure in

2019/20.

|

4.0 RECOMMENDATIONS AND

REASONS

A) That

the report of the Chief Financial Officer titled “2019/20

Budget update” dated 18/02/2019 be received.

|

Attachments:

There are no

attachments for this report.

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 18

February 2019

FROM: Chief Financial Officer

Bruce Allan

Procurement Manager

Sharon

O'Toole

SUBJECT: Procurement

and Contract Management Project update

1.0 SUMMARY

1.1 The purpose of this report is to inform the Subcommittee

about the procurement and contract management project currently underway aimed

at improving the consistency with which procurement is delivered across the

organisation, including how contracts are managed.

1.2 This

issue arises from a need identified by management that procurement including

contract management can be delivered more consistently and strategically across

the organisation. This has been reinforced by the recent Internal Audit

undertaken by Crowe Howarth on Contract Management.

1.3 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.4 This

report concludes by recommending that the report be received.

2.0 BACKGROUND

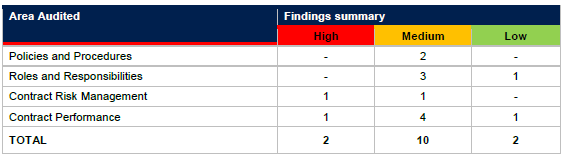

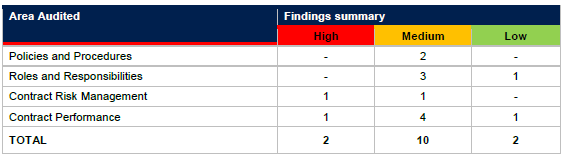

2.1 Crowe

Howarth Contract Management Audit

In October 2018

Council engaged Crowe Horwath to undertake an internal audit of Council’s

contract management activities. The Crowe Horwath report separated findings

into four sections:

· Policies and Procedures;

· Roles and Responsibilities;

· Contract Risk Management; and

· Contract Management Performance

2.2 A key

part of the recommendations identified were a lack of council wide contract

management policies, procedures, templates and manuals. While these exist in

places, they had been developed for particular areas of Council or by specific

staff to meet their own needs.

2.3 This

review highlighted for Council that while work has been done to improve the

robustness of council’s contract management, it has often been done at a

group or team level and not with the wider organisations needs in

consideration. There is significant opportunity to improve these practices.

2.4 There

were 14 recommendations made with the majority of those recommendations

assessed as having moderate risk to the organisation. The full report was

presented to the November 5 2018 Risk & Audit Subcommittee meeting,

The two findings

rated “High” were the following:

1) Contracts not assess for risk – while there are

some risk assessment practices, these are not consistently applied.

2) Lack of reporting requirements – this is

particularly relevant for reporting at a governance level and review of

governance reporting is being considered.

Officers made a

commitment to the Subcommittee in November 2018 that a plan to address the

recommendations made in the Crowe Horwath report would be reported to the

Subcommittee in February 2019.

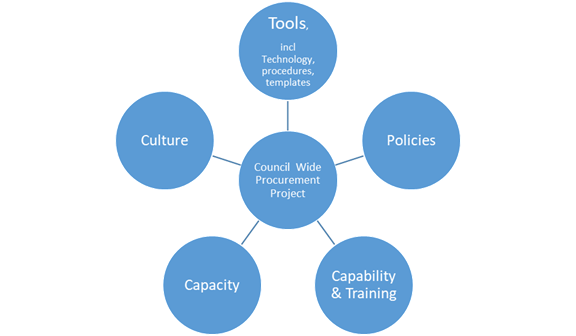

3.0 CURRENT

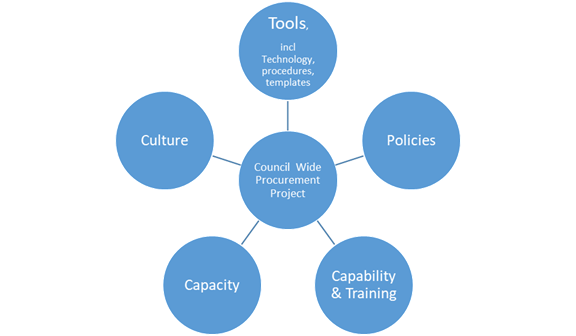

SITUATION

3.1 A

review of the procurement activity highlighted an opportunity to make

improvements to current documentation procedures and systems to meet current

best practice. The review also highlighted that there were pockets of

procurement improvement projects underway that would benefit from some

centralised oversight to ensure that the various initiatives remain aligned. To

address both issues, a programme of work has been established to create a

Council Procurement and Contract Management Framework. The initial work streams

for this programme of work include:

· Procurement policy, strategy(s) & plans

· Templates Procedures & Guides

· Training - Procurement & Contract Management

· Communications (Staff & Supplier)

3.2 This

programme will encompass the recommendations of the internal audit conducted on

Contract Management. Furthermore there is a Procure-to-Pay (P2P) project in

progress which will automate the financial controls and approval processes

related with the transactional payments for procurement and contract payments.

The new P2P solution was due to be implemented prior to July 2019 however has

been delayed as other related Technology One modules require updating to ensure

there is compatibility across Council’s ERP system.

3.3 The

project objective is:

“To produce a procurement framework that covers everything HDC

purchases and includes monitoring and delivery of benefits”

3.4 The

project has taken an initial six month planning horizon and is scoping out a

detailed plan for the short term (approx. six months) objectives and activities

for the four workstreams highlighted. An outline plan is being drafted for the

longer term activities. An example of the short term planning is the training

workstream which identified priority areas of training that can be addressed

quickly whilst at the same time creating a capability assessment of skills and

a training programme that can be tailored and deployed in the longer term.

3.5 The

overall goal of this project is to lift the awareness of staff across the

organisation of what is good procurement and contract management. In

doing so the capability of the organisation will be lifted and the culture of

the organisation will be improved.

3.6 Officers

are also very aware of the need to ensure that current procurement and contract

management is managed well and continues to achieve positive outcomes while

this work is being completed. The Communications workstream was been developed

to ensure staff are aware of their responsibilities and the tools and support

that is available to them as they undertake business as usual.

3.7 This

initial scoping work for the workstreams has been completed and the intent is

to work through this in more detail in February with senior management to

ensure that it represents Council’s current priorities in terms of risk

and opportunity.

3.8 The

initial scoping highlighted other initiatives which have a direct dependency on

this project. One of which is a HBLASS project to establish a Procurement

Centre of Excellence (CoE). The CoE will include:

· Commonality across policies

· Collaboration on procurement strategies

· Consistency in templates used

· Consistency in processes and procedures

· Centre of advice and possible support in tendering HBLASS

collaborative procurement initiatives (particularly corporate type

arrangements).

3.9 The

HBLASS Councils have advised that there is some HBLASS funding available for

this project and there may be additional funding available from the respective

Councils.

3.10 It was acknowledged

internally that there is some overlap in the scope of the HBLASS project and

the Procurement and Contract Management Framework. Therefore there has been

some discussion on how we could utilise the HDC Procurement and Contract

Management Framework project to help progress the HBLASS CoE project.

3.11 HBLASS are keen to

assist HDC with funding on the proviso that they have some input into the end

review of significant outputs and receive regular reports on project progress.

The detail of this arrangement will be teased out once the detailed planning

for the HDC project has been completed.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 While

Council’s procurement as a whole and the development of the Procurement

and Contract Management Framework is significant, when considered against

Council’s Significance and Engagement Policy the development of the

framework is not considered significant and community engagement is not

required. Engagement with the HBLASS Council’s will however be essential

if the HBLASS CoE project is to be successful.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Chief Financial Officer titled “Procurement

and Contract Management Project update” dated 18/02/2019

be received.

|

Attachments:

There are no

attachments for this report.

1.

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 18

February 2019

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Treasury

Activity and Funding

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on treasury activity and

funding issues.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost effective to households and businesses. Good quality

infrastructure means infrastructure, services and performance that are

efficient and effective and appropriate to present and anticipated future

requirements.

1.3 This

report concludes by recommending that the report on treasury activity and

funding is received.

2.0 BACKGROUND

2.1 The

Hastings District Council has a Treasury Policy which forms part of the 2018-28

Long Term Plan and a Treasury Management Policy. Under these policy documents

responsibility for monitoring treasury activity is delegated to the Risk and

Audit Subcommittee.

2.2 Council

is provided with independent treasury advice by Stuart Henderson of

PricewaterhouseCoopers and receives weekly and monthly updates on market conditions.

2.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in depth treasury reporting is provided for the Risk and Audit

Subcommittee.

3.0 CURRENT SITUATION

3.1 Council’s

debt portfolio is managed within the macro limits set out in the Treasury

Policy. It is recognised that from time to time Council may fall out of policy

due to timing issues as debt moves closer to maturity and shifts from one time

band to another. The treasury policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

3.2 The

following table sets out Council’s overall compliance with Treasury

Management Policy as at 31 January 2019:

|

Measure

|

Compliance

|

Actual

|

Min

|

Max

|

|

Liquidity (1)

|

ü

|

115%

|

110%

|

170%

|

|

Fixed Interest Debt

|

ü

|

56%

|

55%

|

95%

|

|

Funding Maturity

profile:

0 – 3 years

3 – 5 years

5 years +

|

ü

ü

ü

|

39%

24%

37%

|

10%

20%

10%

|

50%

60%

60%

|

|

Net Debt as % Equity

Net Debt as % Income

Net Interest as % Income

Net Interest as % Rates

|

ü

ü

ü

ü

|

6%

93%

3%

5%

|

0%

0%

0%

0%

|

20%

150%

15%

20%

|

(1) Liquidity

Ratio = (Cash Reserves + Lines of Credit + Drawn Debt) / Drawn Debt

Council is currently compliant with

Treasury Management Policy.

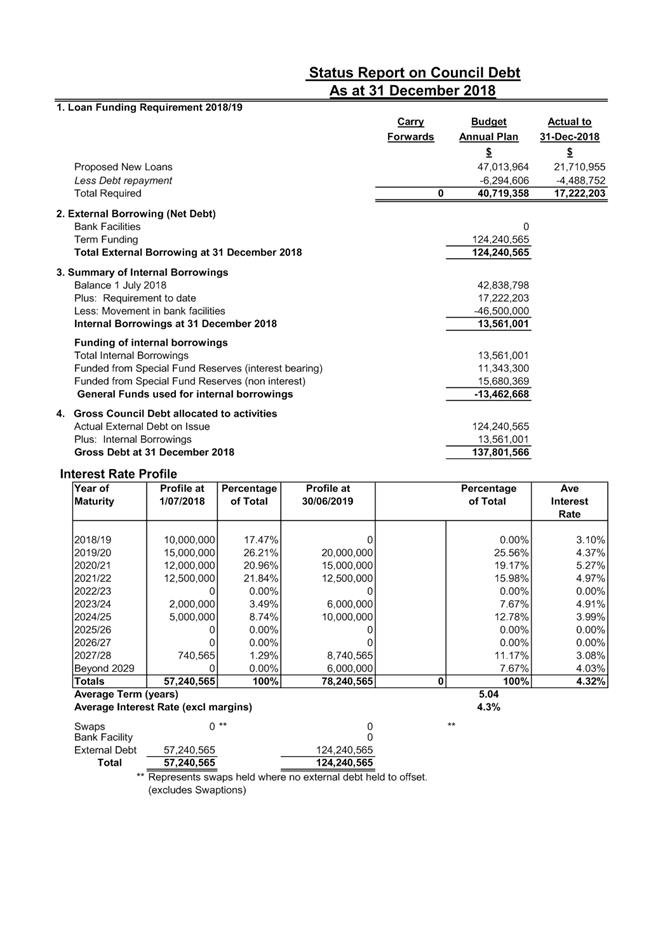

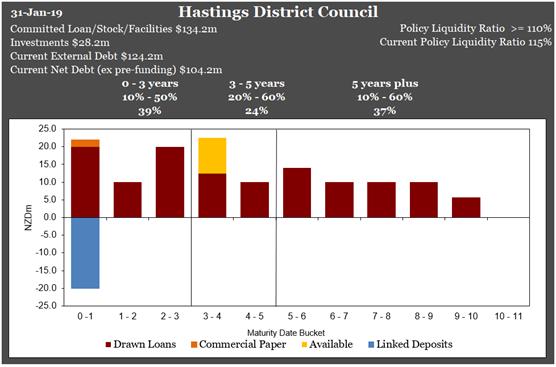

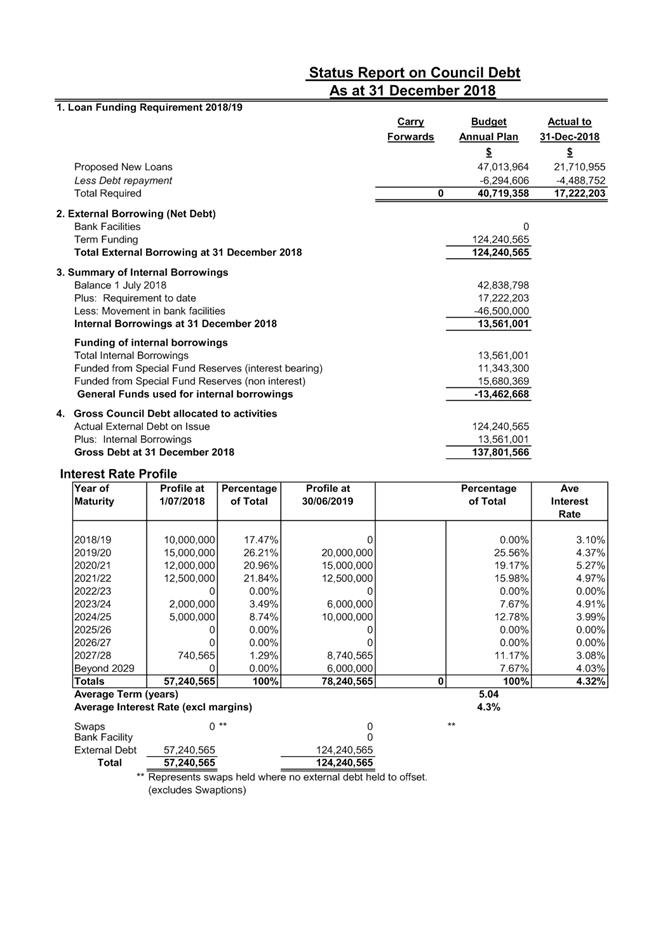

3.3 The

current total core net external debt is $104.2m as at 31 January 2019. This is

supported by the Debt Status Report as at 31 January 2019 (Attachment 1).

This report shows the gross debt at $124.2m which includes the $20m loan with a

March 2019 maturity and its associated term deposit.

3.4 The

additional $9m of borrowing in December 2018 was required to fund the current

capital spend program being undertaken. The terms of new debt were:

|

Bank

|

Amount

|

Start Date

|

Finish Date

|

Interest Rate

|

|

LGFA

|

$4m

|

12- Dec-2018

|

15-Apr-2024

|

2.86% Fixed

|

|

LGFA

|

$5m

|

12- Dec-2018

|

15-Apr-2028

|

BKBM + 0.7875%

|

The BKBM rate (or more commonly known as

the 90 day Bank Bill rate) at 31st January 2019 was 1.93% making the

current all in interest rate 2.7175% pa for the 2028 loan. This rate is reset

daily, effectively meaning that this loan is a floating loan.

With the advice of Council’s

Treasury Advisors, officers have opted to use a fixed loan for the second

tranche of borrowing. Historically Council has used interest rate swaps to

achieve its fixing. By borrowing fixed directly from the LGFA the fixed rate is

slightly cheaper than using interest rate swaps, but less flexible. Interest

rate swaps don’t have to match the value or term of the borrowing. That

is you might only choose to fix $3m of a $4m loan, or might only choose to fix

4 years out of a 5 year loan. Given this loan only represents 4% of

Council’s total borrowing the low interest rates available outweighed the

inflexibility.

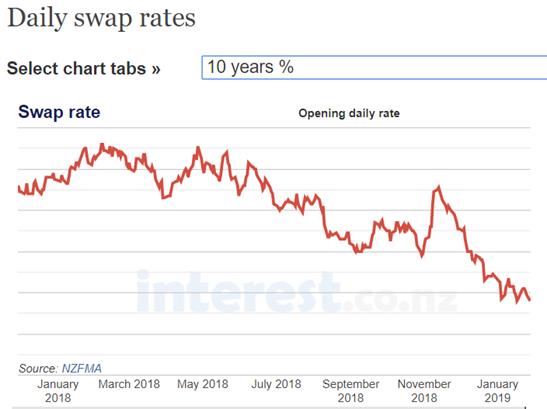

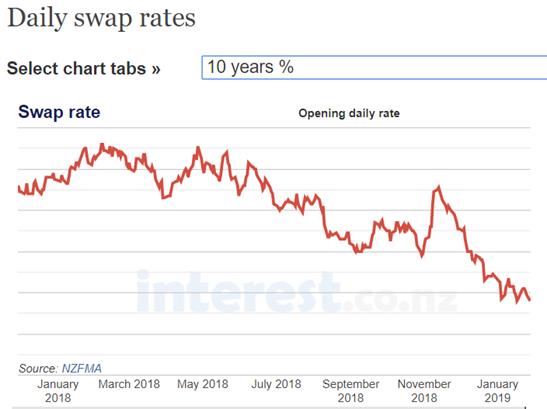

3.5 Over the Christmas/New Year period there has been a series of economic

bad news stories and heightened political uncertainty such as a slowdown in

economic growth in Europe, China and New Zealand, Brexit agreements not being

ratified, and US Government shutdowns. All this has the financial markets

concerned, which has led to a fall in anticipated interest rates. The wholesale

ten year swap rate has fallen to a 12 month low of 2.61% (see the graph below).

3.6 Officers

have responded to this situation and have taken a new forward starting interest

rate swap commencing July 2020:

|

Bank

|

Amount

|

Start Date

|

End Date

|

Interest Rate

|

|

Kiwibank

|

$8m

|

15/07/2020

|

15/01/2029

|

2.745%

|

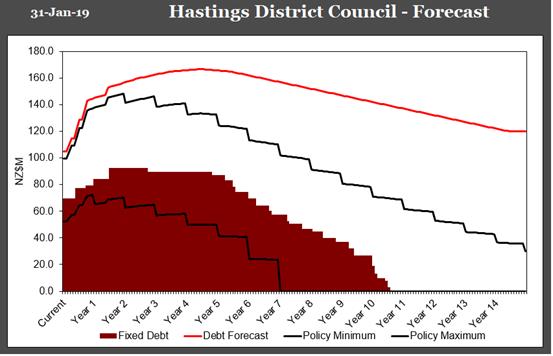

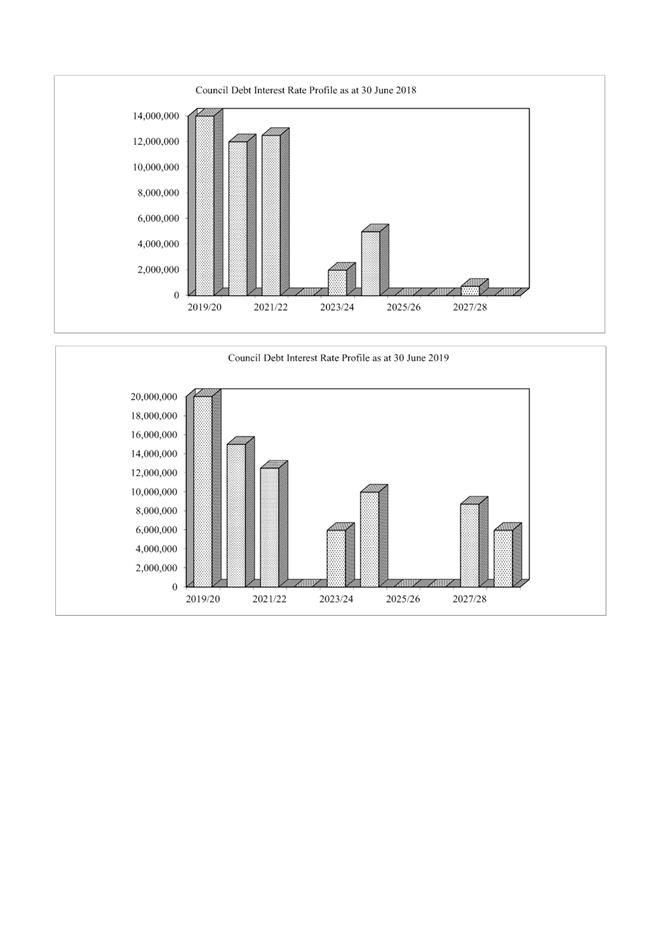

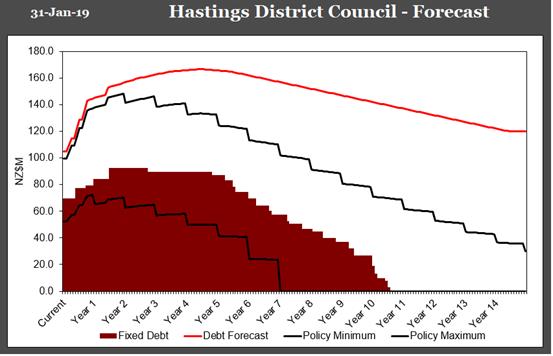

3.7 The following graph shows Council’s fixed debt is within the

policy minimum and policy maximum set out in Council’s Treasury

Management Policy. This graph also incorporates Council’s forecast debt

over the long term (based on the LTP adjusted to reflect the current level of

activity). The projected external debt requirement for the next 12 months is

forecast to increase, which coupled with the maturity of some existing LGFA

debt, gives the Council the opportunity to take advantage of new longer term

debt at historically low levels of interest. This is through replacing older

“non-rated” debt with newer “rated” debt, and replacing

older higher interest rate swaps with newer lower interest rate swaps.

3.8 The

interest rate swap cover is near the Council’s lower limit for the next

12 months (which aligns with the Reserves Bank’s policy of keeping the

OCR rate on hold till 2020), and then moves to policy midpoint as the levels of

uncertainty increases further out into the future.

3.9 In

fact ANZ is now forecasting interest rate cuts. On the 20th December

they released a research paper that stated:

“We are now forecasting a 25bp

cut in the Official Cash Rate in November 2019, with a further 50bps of cuts to

come over 2020, taking the OCR to 1.0%.

There are multiple drivers of this

changed call but in short they come down to a weaker outlook for medium-term

inflation, risks around global growth and liquidity, and the proposed capital

changes for banks. Our view of the New Zealand growth outlook has not materially

changed.”

3.10 PWC’s

view of the world isn’t as pessimistic, in their 29th January

opinion piece they are saying:

“The weaker Q3 NZ real GDP growth

data confirms neutral monetary policy outlook for 2019. We believe an RBNZ

interest rate increase in 2019 is unlikely, and maintain a neutral bias for

short term NZ swap rates over the first half of 2019.However, given the

stronger than expected CPI release view an interest rate cut during 2019 as

unlikely. Presently, financial markets are pricing roughly a 50% chance of an

interest rate cut in Q4 2019, presenting an opportunity for short term swap

rates to increase as the negativity is unwound. Domestic long term swap rates

appear to have re-converged with global, particularly US, long term interest

rate markets. We believe financial markets have underpriced the likelihood of

further US monetary policy tightening, and therefore forecast long term US

Treasury yields to gradually increase over the next six months. Accordingly, we

forecast NZ long term swap rates to gradually increase alongside US long term

Treasury yields.”

3.11 The

Council has a number of older historical interest rate swaps (many of which

expire in the next 2-3 years). The average rate of the interest rate swaps that

are currently live is 4.53% pa and is spread over $69.5m interest rate cover.

The Council also has a further $93.5m of forward starting swaps which have an

average interest rate of 3.71% pa.

3.12 Officers and PWC advisors are currently comfortable with the level

of interest rate cover in place. We will continue to pick off dips in the

wholesale interest rate markets, while benefiting from the low floating rates

available at the moment.

3.13 The graph below shows

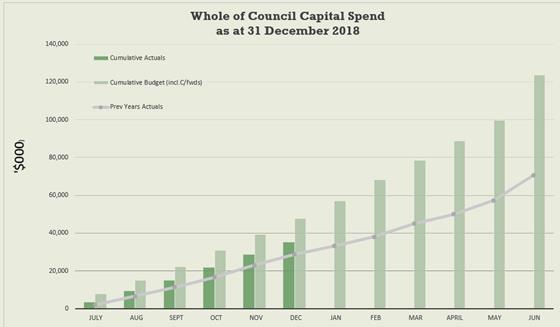

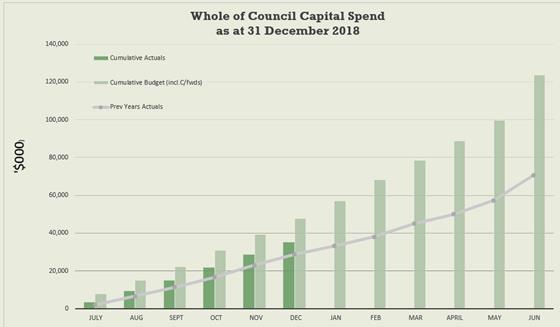

the budgeted capital spend program for the 2018-19 year and what has been

delivered to date:

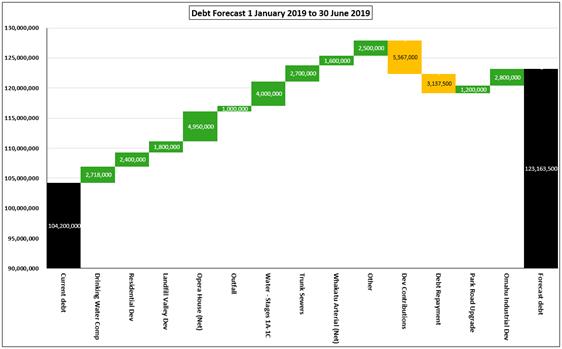

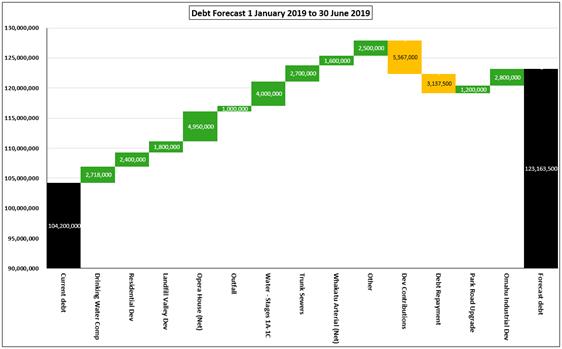

3.14 The chart below shows

the key drivers of the expected movement in borrowings over the six months.

This is based on projects that have started already, or are highly likely to

commence before 30 June 2019 and indicates a forecast debt position of $123m.

The chart identifies the major projects

underway, however the smaller debt funded renewal projects have been aggregated

into the “Other” heading.

3.15 Following the recent borrowing of $9m in December the Council debt maturity

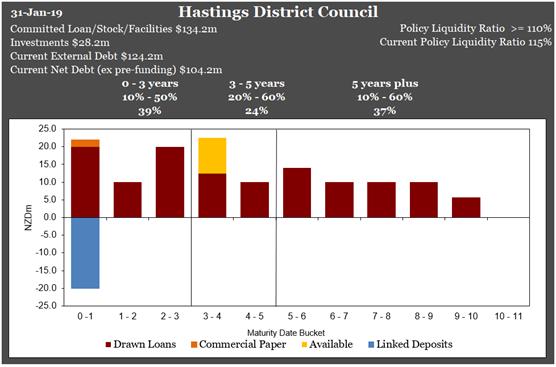

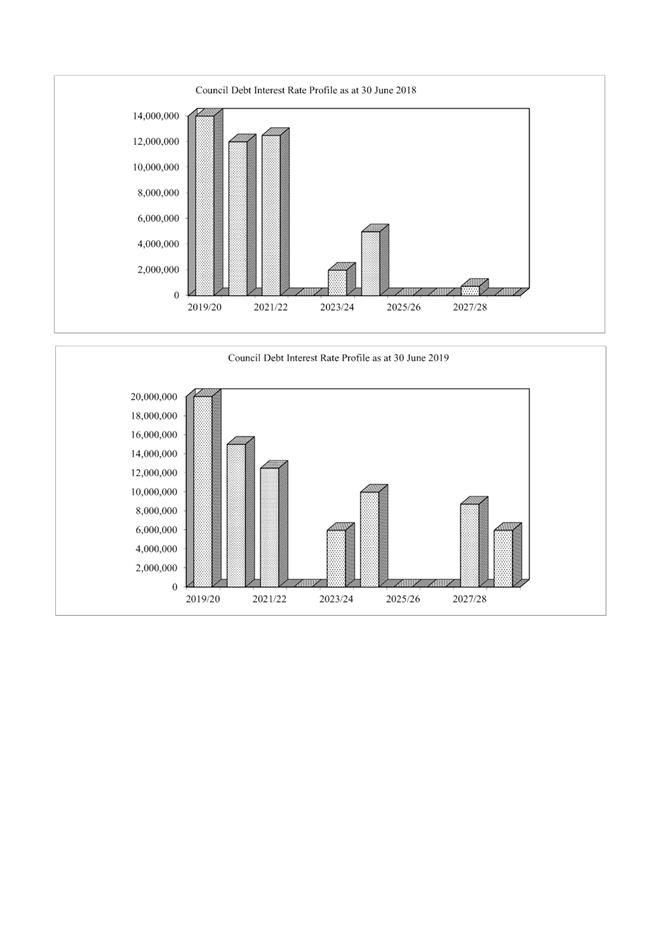

has the following profile:

3.16 This

shows a liquidity ratio of 115%. Now that Council’s net debt is in excess

of $100m, the $10m line of credit in itself is no longer sufficient to meet the

desired liquidity ratio of 110%. Funds held on call are currently supporting

the liquidity benchmark. Officers are looking to add further lines of credit to

bolster its liquidity position going forward. All debt maturity ratios are

maintained within policy.

3.17 Any

new debt will be considered along with Council’s working capital

requirements and liquidity ratios.

4.0 MARKET COMMENTARY

4.1 The Reserve Bank of New Zealand (RBNZ) has held the Official Cash

Rate at 1.75% on 8 November 2018. The RBNZ stated;

“The Official Cash Rate (OCR)

remains at 1.75 percent.

There are both upside and downside

risks to our growth and inflation projections. As always, the timing and

direction of any future OCR move remains data dependent.

We will keep the OCR at an expansionary

level for a considerable period to contribute to maximising sustainable

employment, and maintaining low and stable inflation.”

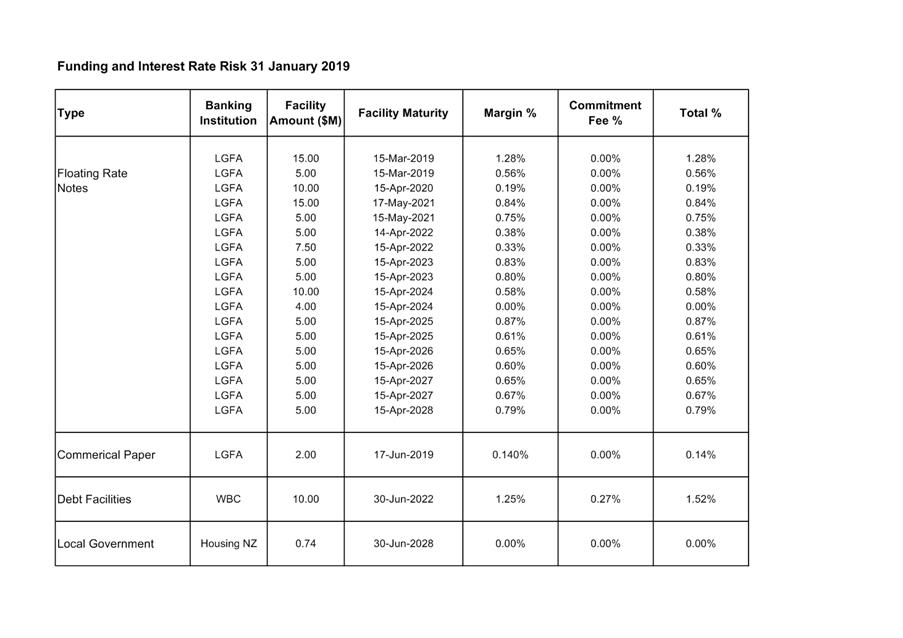

5.0 FUNDING FACILITIES

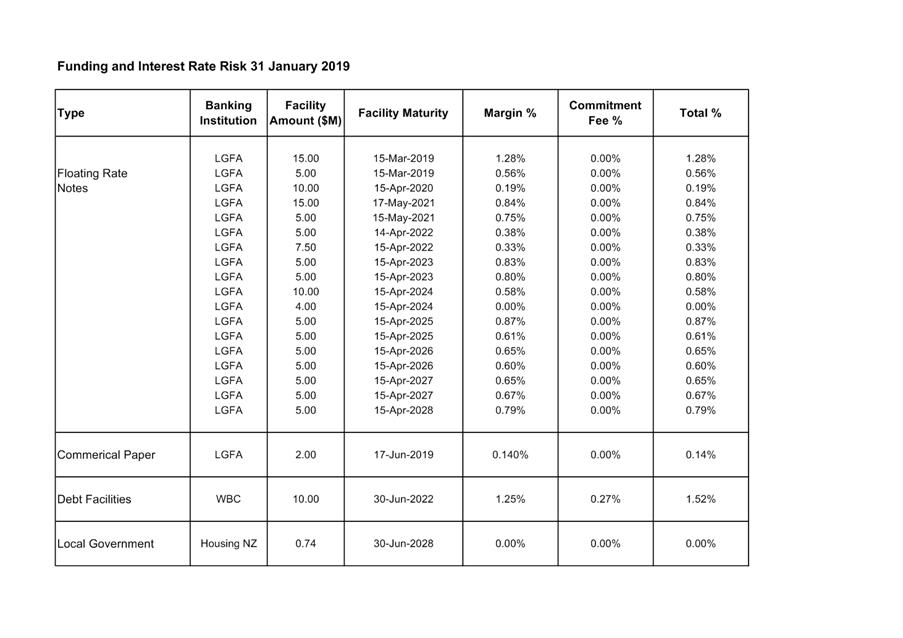

5.1 Attachment

2 shows details of Council’s current debt facilities together with

details of expiry dates and margins.

5.2 Council’s

liquidity ratio of 115% at 31 January 2019 is within policy (refer to 3.16 for

further commentary).

|

6.0 Recommendations

That the

report of the Manager Strategic Finance titled

Treasury Activity and Funding dated 18/02/2019 be received.

|

Attachments:

|

1

|

Public Debt Status as at 31 December 2018

|

FIN-15-03-19-184

|

|

|

2

|

Funding & Interest Risk January 2019

|

FIN-15-03-19-185

|

|

|

Public Debt Status as at 31 December

2018

|

Attachment 1

|

|

Funding & Interest Risk January 2019

|

Attachment 2

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 18

February 2019

FROM: Risk and Corporate Services Manager

Regan Smith

Risk Assurance Advisor

Dean Ferguson

District Customer Services Manager

Greg

Brittin

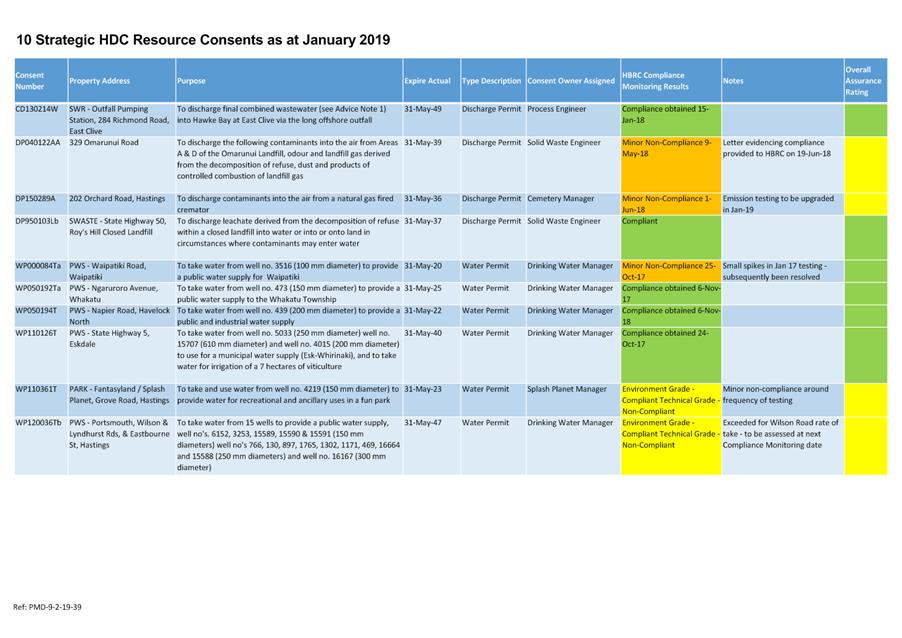

SUBJECT: 10

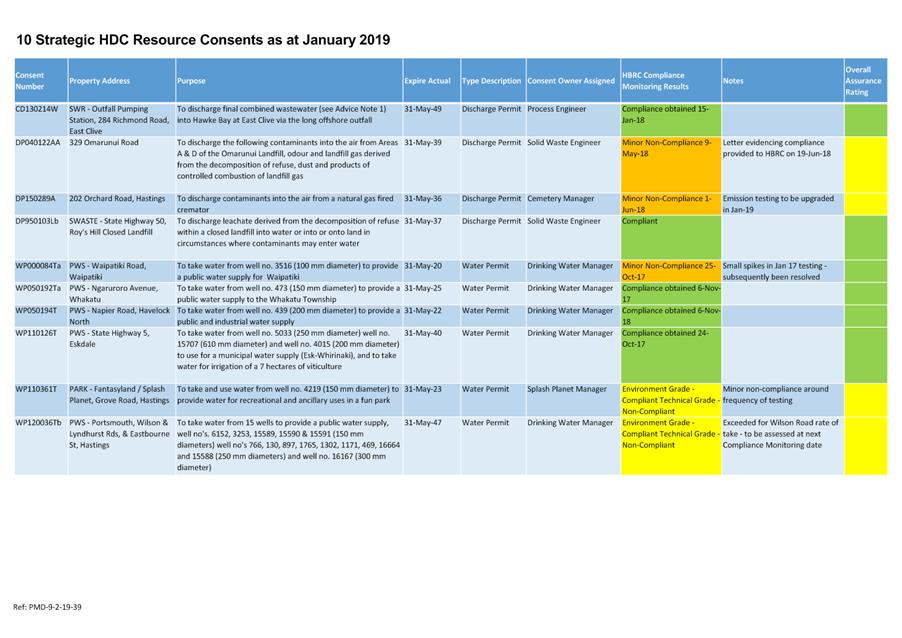

Strategic Resource Consents for Council

1.0 SUMMARY

1.1 The

purpose of this report is to inform the Subcommittee of 10 Resource Consents relating to key services

delivered by Council.

1.2 This

issue arises from a request made at the Risk and Audit Subcommittee meeting on

5 November 2018 to report on Council’s key resource consents.

The Council is

required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the

current and future needs of communities for good quality local infrastructure,

local public services, and performance of regulatory functions in a way that is

most cost–effective for households and businesses. Good quality means

infrastructure, services and performance that are efficient and effective and

appropriate to present and anticipated future circumstances.

1.3 This

report concludes by recommending the report be received.

2.0 BACKGROUND

2.1 A

Resource Consent (RC) is the authorisation given to certain activities or uses

that might affect the environment that are not allowed 'as of right' in a

district or regional plan. RC’s aim to ensure the environmental effects

of an activity or service meet acceptable environmental standards. Failure to

comply with the conditions imposed on a RC can result in fines or prosecution

under the Resource Management Act 1991

2.2 RC’s

can be issued for a one off activity or purpose, or to cover the on-going

operation of a service or facility. Consents that apply to an on-going service

usually have monitoring and reporting criteria that must be met to confirm

continued compliance is being achieved.

3.0 CURRENT

SITUATION

3.1 Council

currently has 93 active RC many of which require on-going monitoring. These

consents cover a range of council activities for example; water take and

supply, waste water discharge, storm water discharge, detention dams for flood

protection, bridge cleaning discharges and Cremator emissions.

3.2 95%

of RC issued to HDC related to services delivered by the Asset Management

Group, with the balance being split between Community facilities and Planning

and Regulatory Group.

3.3 A

summary of 10 RC that have strategic impact for Council are listed in Appendix

1. These consents have been chosen because they are essential to the

delivery of a key Council service.

3.4 As

can be seen from the attached list, while there have been some minor

non-conformances, overall Council has a good level of compliance with these RCs.

3.5 In

order to further increase confidence in RC compliance there is an internal

project underway to broaden the use of Lutra’s cloud hosted

Infrastructure Data (ID) Consent Management Module (CMM), which is already in

use by the Asset Management Water Services team. ID CMM provides tools to

register consents and their conditions, and log evidence to prove on-going

compliance. This enables near real time monitoring of RC status and simplifies

reporting to the relevant consent authority.

3.6 The

plan is to have all Council consents loaded in to ID CMM by the middle of 2019.

3.7 Once

implemented the responsibility for maintaining and overseeing the use of the

system will be allocated to a new position that has recently been established

within the 3 Waters Team. Allocation of these responsibilities to this new role

was considered appropriate considering that the majority of consents held by

HDC relate to water management.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 While

RC management is a significant administrative practice, it is essentially an

internal process and does not trigger Council’s Significance and Engagement

Policy, and therefore no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Risk and Corporate Services Manager titled “10

Strategic Resource Consents for Council” dated 18/02/2019

be received.

|

Attachments:

|

1

|

Policies, Procedures, Delgtns, Warrants &

Manuals - Manuals - Risk Management - 10 Strategic HDC Resource Consents

January 2019 for Risk and Audit18 February 2019

|

PMD-03-81-19-170

|

|

|

Policies, Procedures, Delgtns,

Warrants & Manuals - Manuals - Risk Management - 10 Strategic HDC

Resource Consents January 2019 for Risk and Audit18 February 2019

|

Attachment 1

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 18

February 2019

FROM: Manager Strategic Finance

BRENT

CHAMBERLAIN

SUBJECT: General

Update Report and Status of Actions

1.0 SUMMARY

1.1 The

purpose of this report is to update the Risk & Audit Subcommittee on

various matters including actions raised at previous meetings.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This

report concludes by recommending that the report titled “General Update

Report and Status of Actions” from the Manager Strategic Finance be

received.

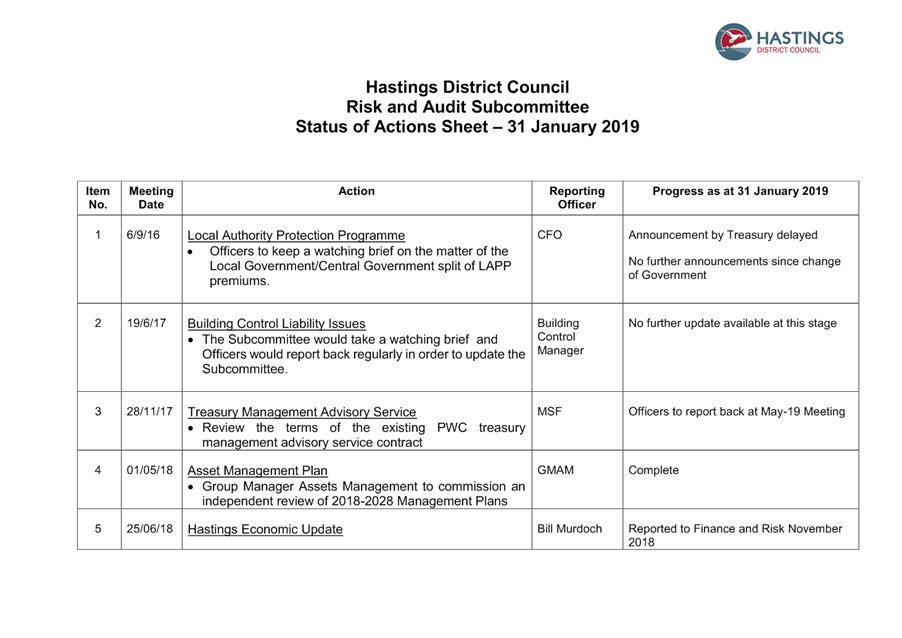

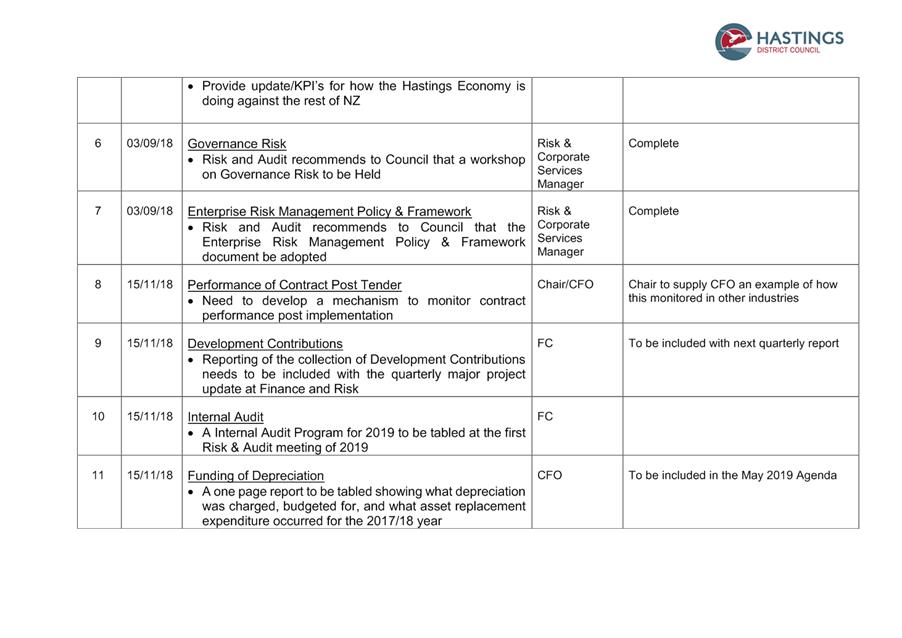

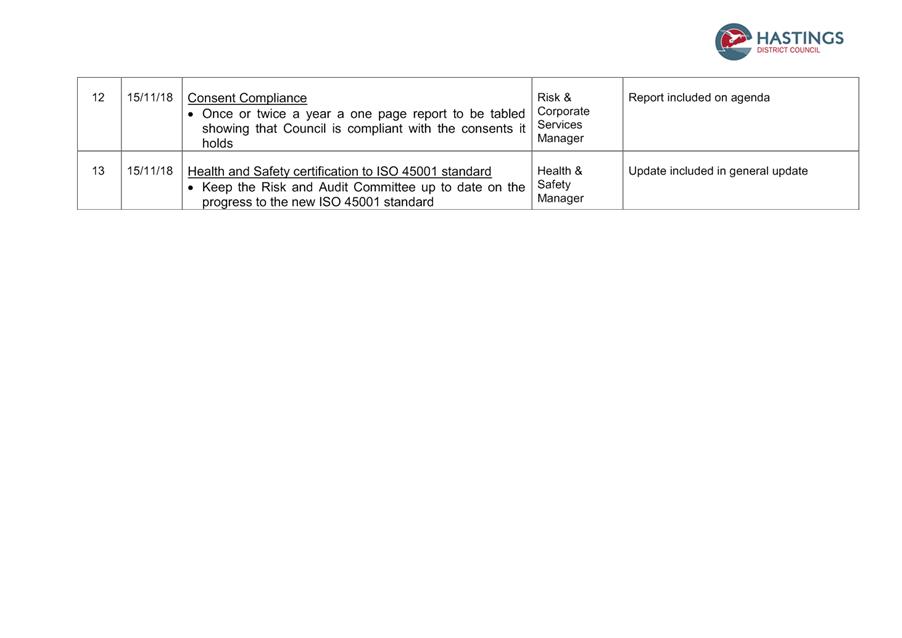

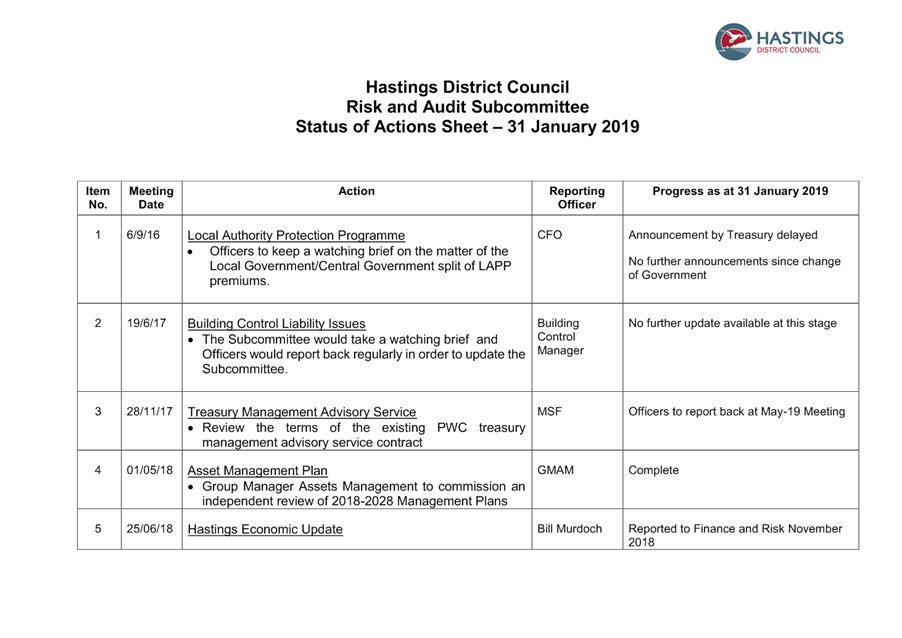

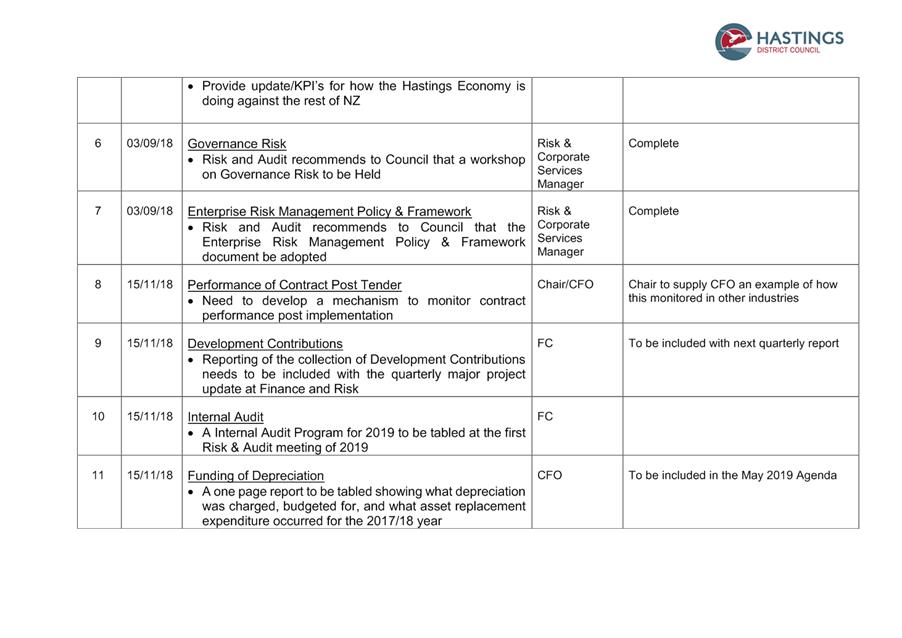

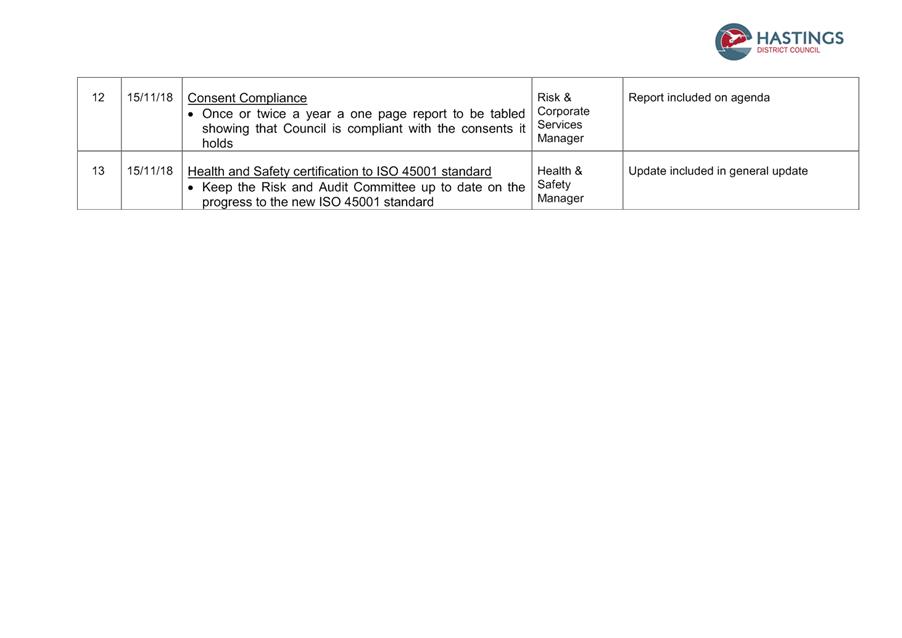

2.0 BACKGROUND

2.1 The

Risk & Audit Subcommittee members requested that officer’s report

back at each meeting with progress that has been made on actions that have

arisen from the Risk & Audit Subcommittee meetings. Attached as Attachment

1 is the Risk & Audit Subcommittee Action Schedule as at 31 January

2019.

3.0 CURRENT

SITUATION

Credit Rating

3.1 Standard

& Poor’s visited on the 13 November 2018 to undertake their annual

review of Council’s credit rating. The release of the formal credit

rating is due early February, but Standard & Poor’s analysts have

informally indicated they can’t see any reason for our existing rating

(AA) to be changed.

Electronic

Purchase Order Project (Procure to Pay (P2P))

3.2 The

new P2P solution was due to be implemented prior to July 2019 however has been

delayed as other related Technology One modules require updating to ensure

there is compatibility across Council’s ERP system.

Transition of the

Maintenance Group to Recreational Services Limited

3.3 The

transition from the Maintenance Group to Recreational Services has gone well

with Recreational Services commencing the contract delivery on 1 February

2019. Officers are continuing to actively monitor the transition process.

Health and Safety

certification to ISO 45001 standard

3.4 Officers

are progressing the procurement for professional services to identify the gap

between Council’s existing Health and Safety Standards and the newer ISO

45001 standard.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report does not trigger Council’s Significance and Engagement Policy and

no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

That the report of the Manager Strategic Finance titled “General Update Report and Status of Actions” dated 18/02/2019 be received.

|

Attachments:

|

1

|

Status of Actions 31 January 2019

|

FIN-09-01-19-167

|

|

|

Status of Actions 31 January 2019

|

Attachment 1

|

Hastings District

Council

Hastings District

Council