Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Risk and Audit Subcommittee MEETING

|

Meeting Date:

|

Monday, 6

May 2019

|

|

Time:

|

10.00am

|

|

Venue:

|

Landmarks

Room

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Subcommittee Members

|

Chair: Mr J

Nichols

Ex Officio: Mayor Hazlehurst

Deputy Mayor Kerr (Deputy Chair)

Councillors

Nixon and Travers

(Quorum=3)

|

|

Officer

Responsible

|

Chief Financial Officer, Bruce Allan

|

|

Committee

Secretary

|

Christine Hilton (Ext 5633)

|

Risk and Audit Subcommittee – Terms of Reference

A subcommittee of

the Finance and Risk Committee

Fields of

Activity

The Risk and Audit Subcommittee is responsible for

assisting Council in its general overview of financial management, risk

management and internal control systems that provide:

· Effective management of potential risks,

opportunities and adverse effects; and

· Reasonable assurance as to the integrity and

reliability of the financial reporting of Council; and

· Monitoring of the Council’s requirements under

the Treasury Policy

Membership

(4 Members)

Chairman

appointed by the Council

The Mayor

Deputy Mayor

2

Councillors

An

independent member appointed by the Council.

Quorum – 3 members

DELEGATED

POWERS

Authority to consider and make recommendations on all matters detailed

in the Fields of Activity and such other matters referred to it by the Council

or the Finance and Risk Committee

The

subcommittee reports to the Finance and Risk Committee.

HASTINGS DISTRICT COUNCIL

Risk and Audit Subcommittee MEETING

Monday, 6 May 2019

|

VENUE:

|

Landmarks Room

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

10.00am

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the General Counsel or the Democratic Support Manager

(preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

Minutes of the

Risk and Audit Subcommittee Meeting held Monday 18 February 2019.

(Previously circulated)

4. Treasury Activity and

Funding 5

5. Health and Safety Risk

Management Update 15

6. Cape Kidnappers Interim

Operations Manual 19

7. General Update Report

and Status of Actions 23

8. MBIE Review of Tauranga

City Council - Bella Vista Development 59

9. Internal Audit Report 61

10. Additional

Business Items

11. Extraordinary

Business Items

1.

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 6 May 2019

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Treasury

Activity and Funding

1.0 SUMMARY

1.1 The

purpose of this report is to update the Subcommittee on treasury activity and

funding issues.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost effective to households and businesses. Good quality

infrastructure means infrastructure, services and performance that are

efficient and effective and appropriate to present and anticipated future

requirements.

1.3 This

report concludes by recommending that the report on treasury activity and

funding is received.

2.0 BACKGROUND

2.1 The

Hastings District Council has a Treasury Policy which forms part of the 2018-28

Long Term Plan and a Treasury Management Policy. Under these policy documents

responsibility for monitoring treasury activity is delegated to the Risk and

Audit Subcommittee.

2.2 Council

is provided with independent treasury advice by Stuart Henderson of

PricewaterhouseCoopers and receives weekly and monthly updates on market

conditions.

2.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in depth treasury reporting is provided for the Risk and Audit

Subcommittee.

3.0 CURRENT SITUATION

3.1 Council’s

debt portfolio is managed within the macro limits set out in the Treasury

Policy. It is recognised that from time to time Council may fall out of policy

due to timing issues as debt moves closer to maturity and shifts from one time

band to another. The treasury policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

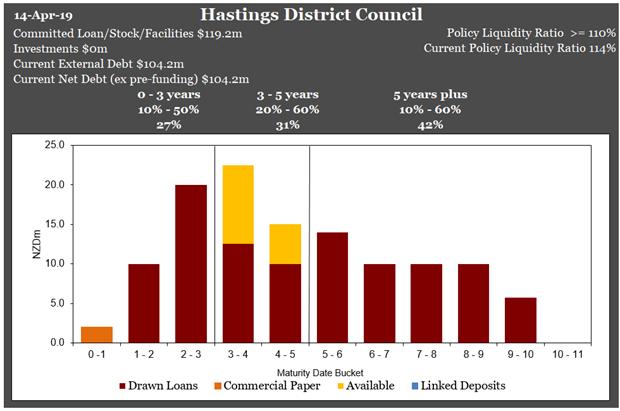

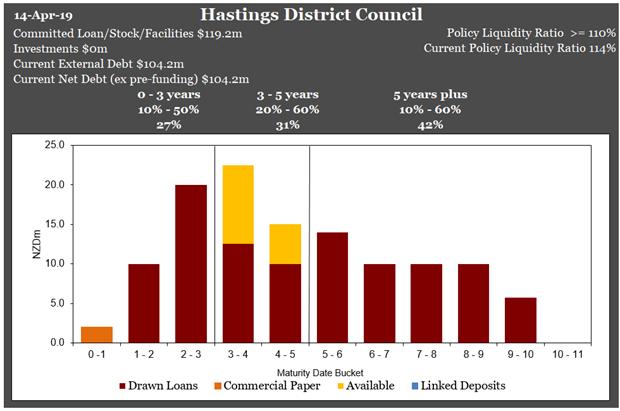

3.2 The

following table sets out Council’s overall compliance with Treasury

Management Policy as at 30 April 2019:

|

Measure

|

Compliance

|

Actual

|

Min

|

Max

|

|

Liquidity (1)

|

ü

|

115%

|

110%

|

170%

|

|

Fixed Interest Debt

|

ü

|

68%

|

55%

|

95%

|

|

Funding Maturity

profile:

0 – 3 years

3 – 5 years

5 years +

|

ü

ü

ü

|

27%

31%

42%

|

10%

20%

10%

|

50%

60%

60%

|

|

Net Debt as % Equity

Net Debt as % Income

Net Interest as % Income

Net Interest as % Rates

|

ü

ü

ü

ü

|

6%

93%

3%

5%

|

0%

0%

0%

0%

|

20%

150%

15%

20%

|

(1) Liquidity

Ratio = (Cash Reserves + Lines of Credit + Drawn Debt) / Drawn Debt

Council is currently compliant with

Treasury Management Policy.

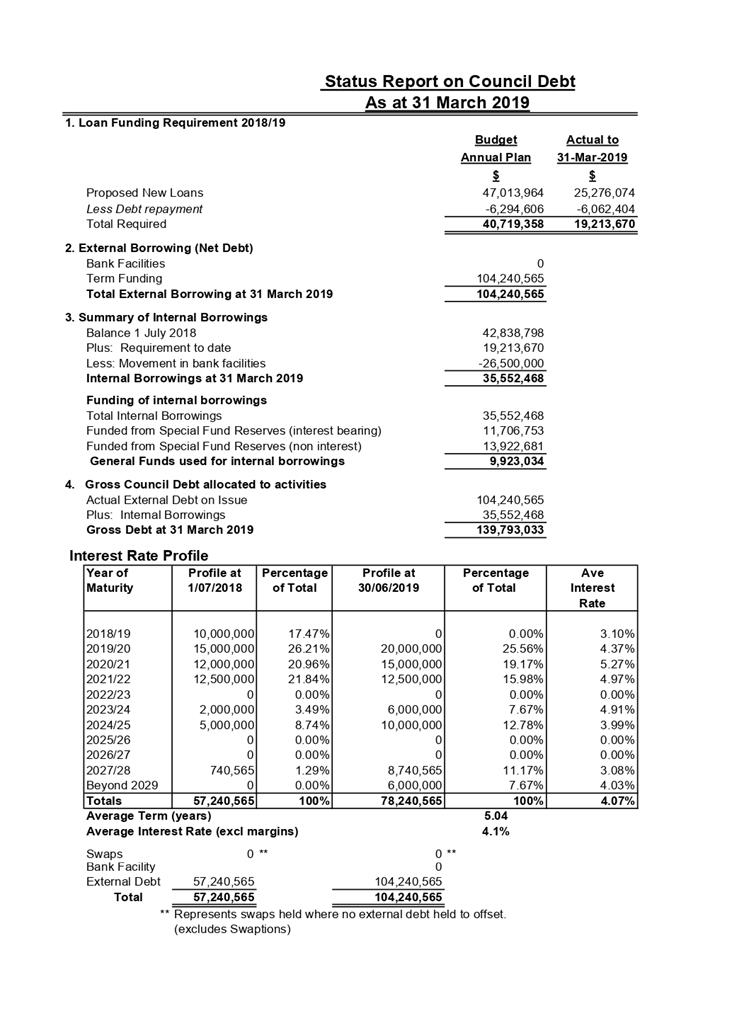

3.3 The

current total core net external debt is $104.2m as at 30 April 2019. This is

supported by the Debt Status Report as at 30 April 2019 (Attachment 1).

This report shows the debt at $104.2m.

3.4 On

the 15th March 2019 Council repaid, on maturity, $20m of Local

Government Funding Agency (LGFA) debt. This was funded by two new LGFA loans

taken out in August 2018, and the proceeds invested on term deposit until

needed in March 2019. Over this period the term deposit earned Council

$362,175, and cost Council $235,665 in loan holding costs, giving a net

positive return to Council of $126,510.

3.5 Council

has a further LGFA loan obligation of $2m due in June 2019, and a further $10m

due in April 2020. Officers are currently investigating the merits of

prefunding the second of these obligations in a similar manner, but this will

be dependent on interest rates and how much debt Council wishes to hold at

balance date. At the time of writing Council could borrow for a four year term

at 2.06% pa fixed, and invest for nine months at 3.15% pa earning net interest

income of $75,000 over this period of prefunding.

3.6 Note

it is not normal practice for Council to borrow money simply to invest it in

financial instruments, however where there is an known need for the funds at a

future point in time, Council Officers will consider borrowing early

(prefunding) if it is financially advantageous to do so.

3.7 Under

Council’s treasury policy Council must maintain a liquidity ratio of

greater than 110% (see 3.2 for an explanation of how this is calculated). This

liquidity is essentially maintained through an undrawn $10m line of credit with

Westpac Bank plus any surplus funds held in the Councils “Call

Account”. As Council’s debt has now surpassed $100m, the $10m line

of credit no longer, by itself, provided the 10% liquidity needed. As a result

Officers have arranged a second $5m line of credit with Westpac Bank, giving

Council a total of $15m of liquidity at any point in time. The cost of having

this second line of credit available to the Council is 0.27% pa, or $13,500 pa.

The cost using this line of credit is Westpac’s 90 day bank bill rate

plus a margin of 1.35% pa.

3.8 Standard

and Poors is currently consulting on proposed changes to its credit rating

methodology. The main impact to Hastings District Council if adopted has to do

with how they view liquidity. Essentially they would like to see that for the

forthcoming 12 month period, our cash ending position is positive after taking

into account the following formula:

Opening Bank Balance

Plus Forecast Cash Operating

Surplus/(Deficit)

Minus Forecast Capital Requirements

Minus Loans due for repayment in the next

12 months

Plus

Lines of Credit Available and/or Loan Prefunding Contractually Committed

3.9 We

are currently seeking clarification on whether the Capital Requirements will be

based on Councils full budgeted program, or whether they will give this number

a 20% haircut. In the past they have treated Council Capital programs as

aspirational rather than deliverable.

3.10 At

present (even with our increased $15m line of credit), due to our loan

maturities and large capital program, the combined expected cash outflows

exceed our available funding. That is we expect to have to increase our

external debt to fund this level of activity. To meet this new liquidity test

Council will have to prefund its loan maturities and possibly a proportion of

its expected capital program, or have even more lines of credit.

3.11 Officers

are keeping a watch on the outcome and implications of this consultation.

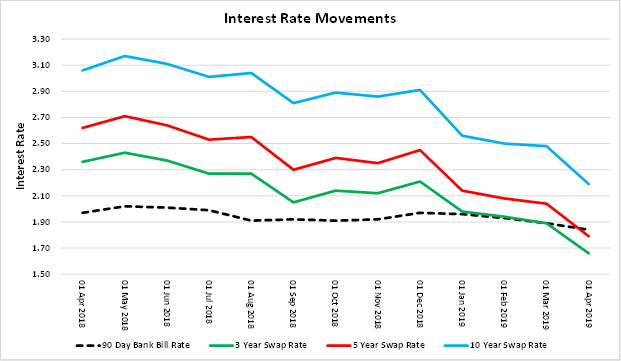

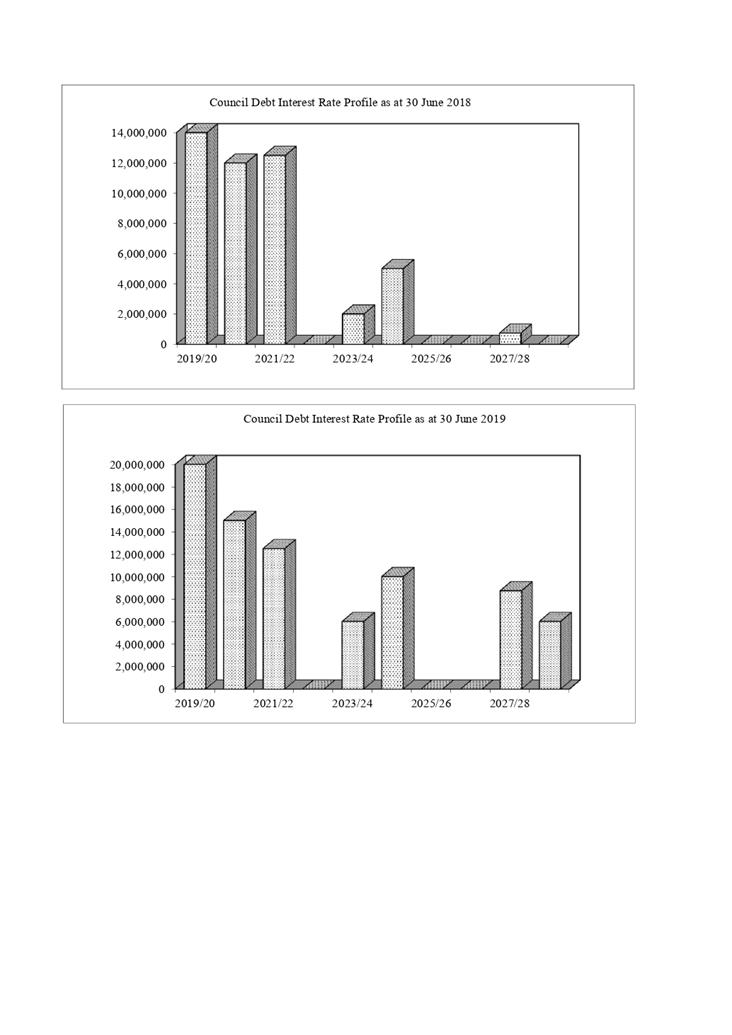

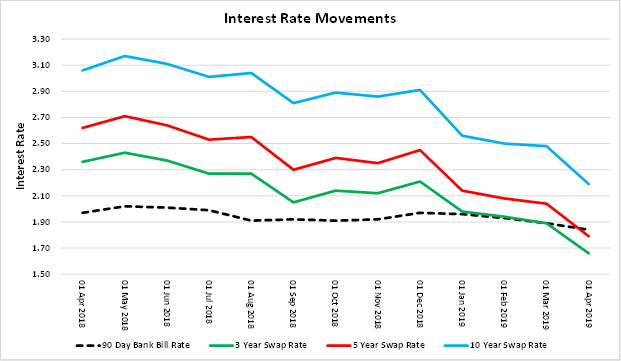

3.12 The graph below shows what has been happening in the wholesale

interest rate market over the past 12 months. Councils floating rate loans are

linked to the 90 day bill rate plus a bankers margin, so this is indicative of

Council floating rate cost of funds. The 3,5, and 10 year swaps rates are

indicative of what Council can buy interest rate swaps (a mechanism for buying

fixed interest rate cover) at, plus a bankers margin

3.13 You

will note that the longer term swap rates have been steadily declining over the

past 12 months. This is a reflection that the financial markets believe that

interest rates will stay lower for longer.

3.14 On

27 March 2019, the Reserve Bank of New Zealand released the following

statement:

“The Official Cash Rate (OCR)

remains at 1.75 percent. Given the weaker global economic outlook and reduced

momentum in domestic spending, the more likely direction of our next OCR move

is down.

The global economic outlook has

continued to weaken, in particular amongst some of our key trading partners

including Australia, Europe, and China. This weaker outlook has prompted

central banks to ease their expected monetary policy stances, placing upward

pressure on the New Zealand dollar.

Domestic growth slowed in 2018, with

softness in the housing market and weak business investment

contributing.”

3.15 This

was a significant change in stance by the Reserve Bank, and caused a further

fall in wholesale interest rates. In fact the fall has caused both the 3 year

and 5 year swap rates to fall below the 90 day bank bill rate (essentially the

floating rate). This inverting of the yield curve is very unusual and has some

business commenters pointing out that this is typically a precursor to a

recession, arguing that history says that recessions typically follow 12 to 18

months behind such a phenomenon occurring.

3.16 On

17 April 2019 the quarterly Consumer Price Index (CPI) figure was released for

the latest quarter. CPI only rose by 0.1% for the quarter (below expectations),

with the annual CPI easing to 1.5%. This is below the mid-point of the Reserve

Bank’s annual inflation bank of 1-3%. This has financial commentators

musing that with the publishing of such a low CPI number, the likelihood of a

cut to the official Cash Rate in May 2019 has increased.

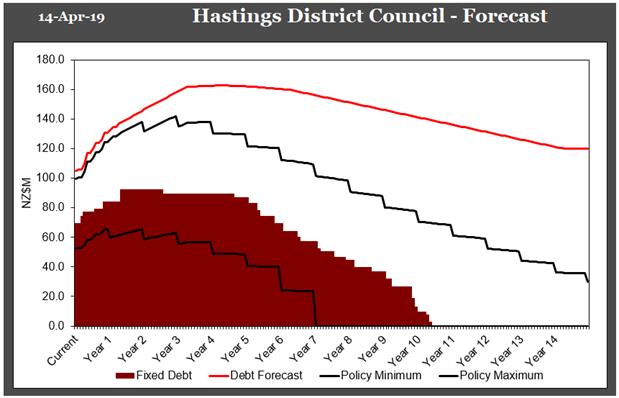

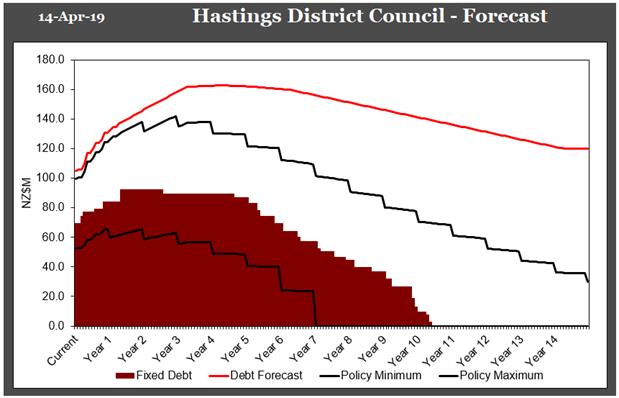

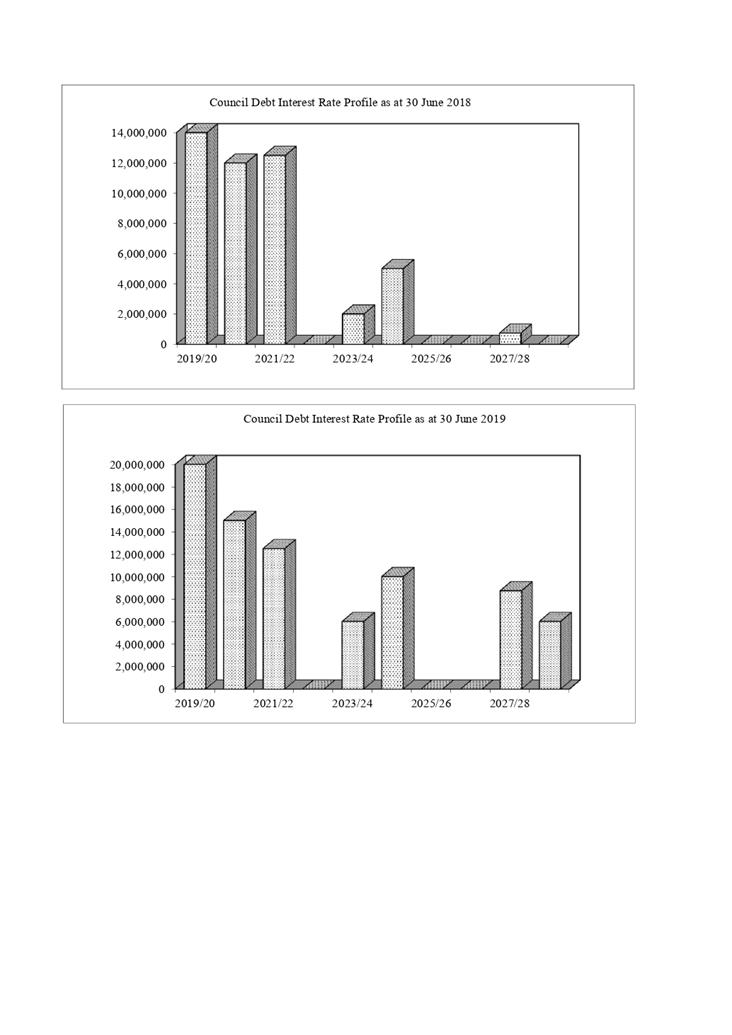

3.17 The following graph shows Council’s fixed debt is within the

policy minimum and policy maximum set out in Council’s Treasury

Management Policy. This graph also incorporates Council’s forecast debt

over the long term (based on the LTP adjusted to reflect the current level of

activity). The projected external debt requirement for the next 12 months is

forecast to increase, which coupled with the maturity of some existing LGFA

debt, gives the Council the opportunity to take advantage of new longer term

debt at historically low levels of interest.

3.18 Officers and PWC advisors are currently comfortable with the level

of interest rate cover in place. We will continue to pick off dips in the

wholesale interest rate markets, while benefiting from the low floating rates

available at the moment.

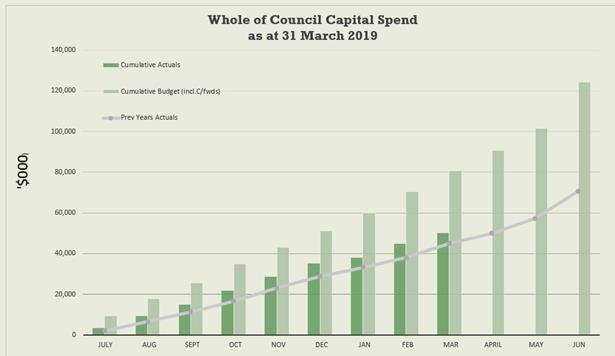

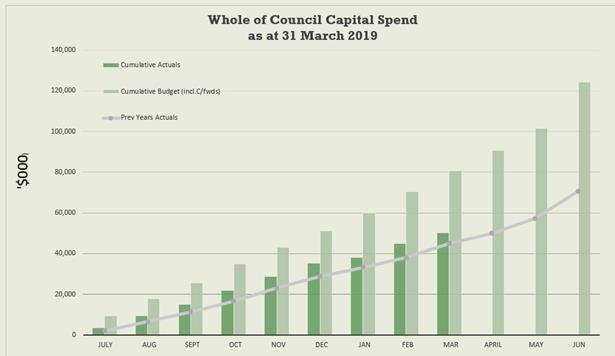

3.19 The graph below shows

the budgeted capital spend program for the 2018-19 year and what has been

delivered to date:

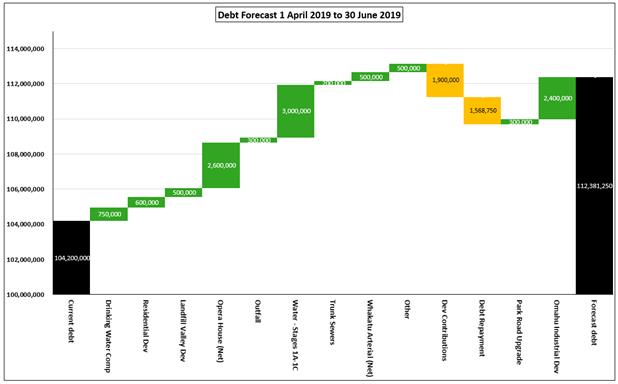

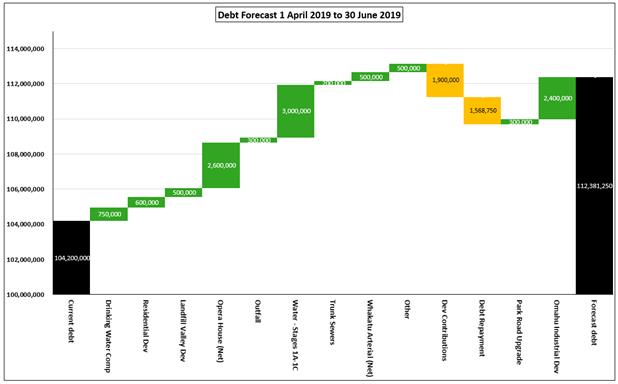

3.20 The chart below shows

the key drivers of the expected movement in borrowings over the next three

months. This is based on projects that have started already, or are highly

likely to commence before 30 June 2019 and indicates a forecast debt position

of $112m (the 2018-2028 Long Term Plan forecast a debt position of $125m as at

30 June 2019).

3.21 The chart identifies

the major projects underway, however the smaller debt funded renewal projects

have been aggregated into the “Other” heading.

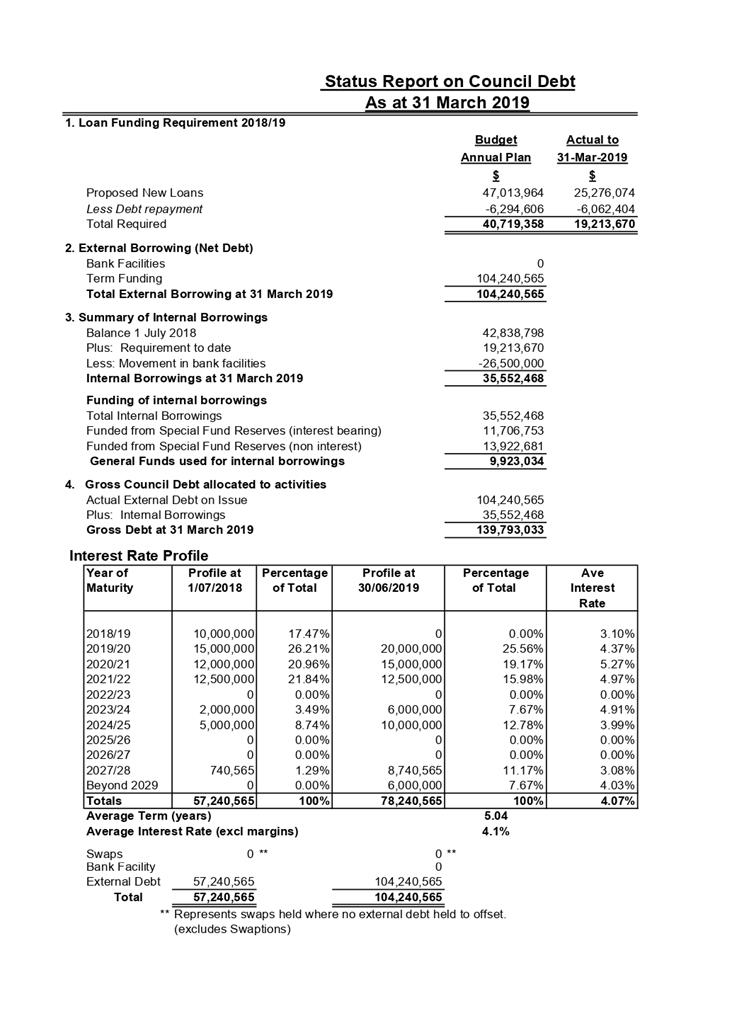

3.22 The Council debt maturity has the following profile:

3.23 Any

new debt will be considered along with Council’s working capital

requirements and liquidity ratios.

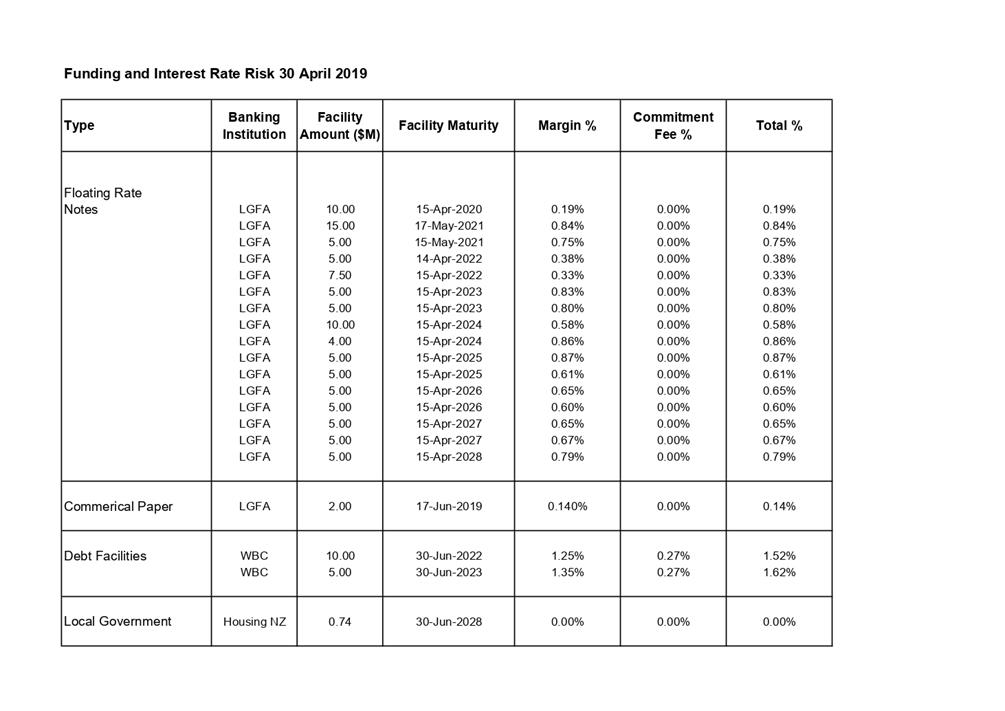

4.0 FUNDING FACILITIES

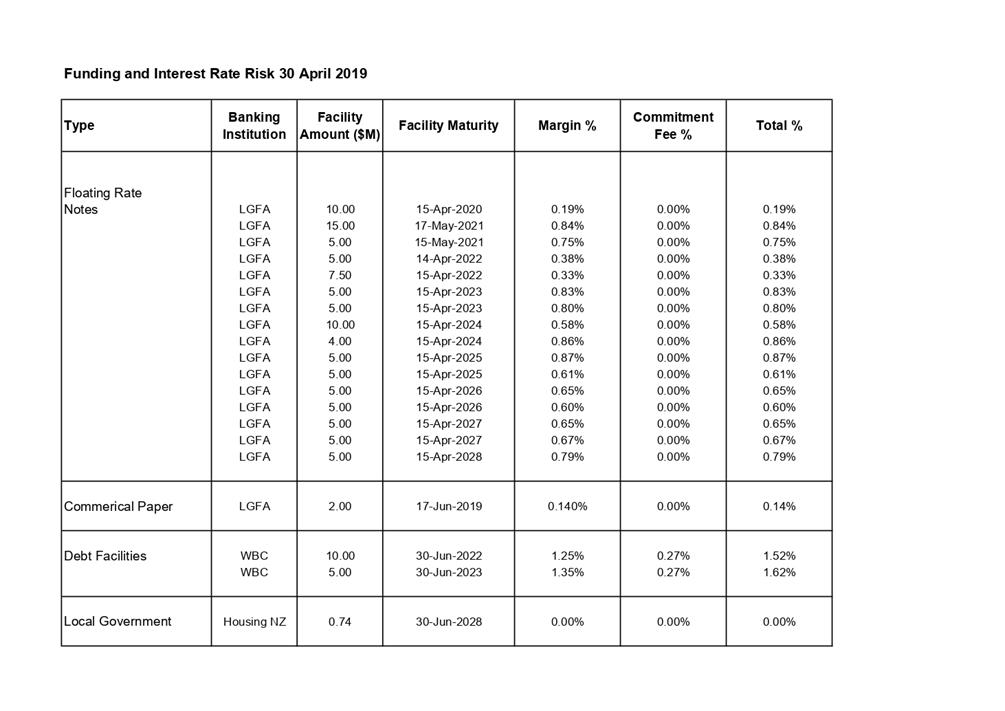

4.1 Attachment

2 shows details of Council’s current debt facilities together with

details of expiry dates and margins.

4.2 Council’s

liquidity ratio of 115% at 31 March 2019 is within policy (refer to 3.6 for

further commentary).

|

5.0 Recommendations

That the

report of the Manager Strategic Finance titled

Treasury Activity and Funding dated 6/05/2019 be received.

|

Attachments:

|

1

|

Public Debt Status 31 March 2019

|

FIN-15-03-19-190

|

|

|

2

|

Debt Facilities as at 30 April 2019

|

FIN-15-03-19-189

|

|

|

Public Debt Status 31 March 2019

|

Attachment 1

|

|

Debt Facilities as at 30 April 2019

|

Attachment 2

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 6 May 2019

FROM: Health and Safety Manager

Jennie

Kuzman

SUBJECT: Health

and Safety Risk Management Update

1.0 SUMMARY

1.1 The purpose

of this report is to provide an update to the subcommittee in regards to the

management of health and safety risks within Council.

1.2 This issue

arises due to the Health and Safety at Work Act 2015 and the requirement of

that legislation for Elected Members to exercise due diligence to ensure that

Council complies with its health and safety duties and obligations.

2.0 BACKGROUND

2.1 At its June

2016 meeting, Council accepted the recommendations from the Audit and Risk

Subcommittee in relation to health and safety reporting.

2.2 This report

serves as an update report to the Risk and Audit Subcommittee on health and safety

risk management.

3.0 CURRENT

SITUATION

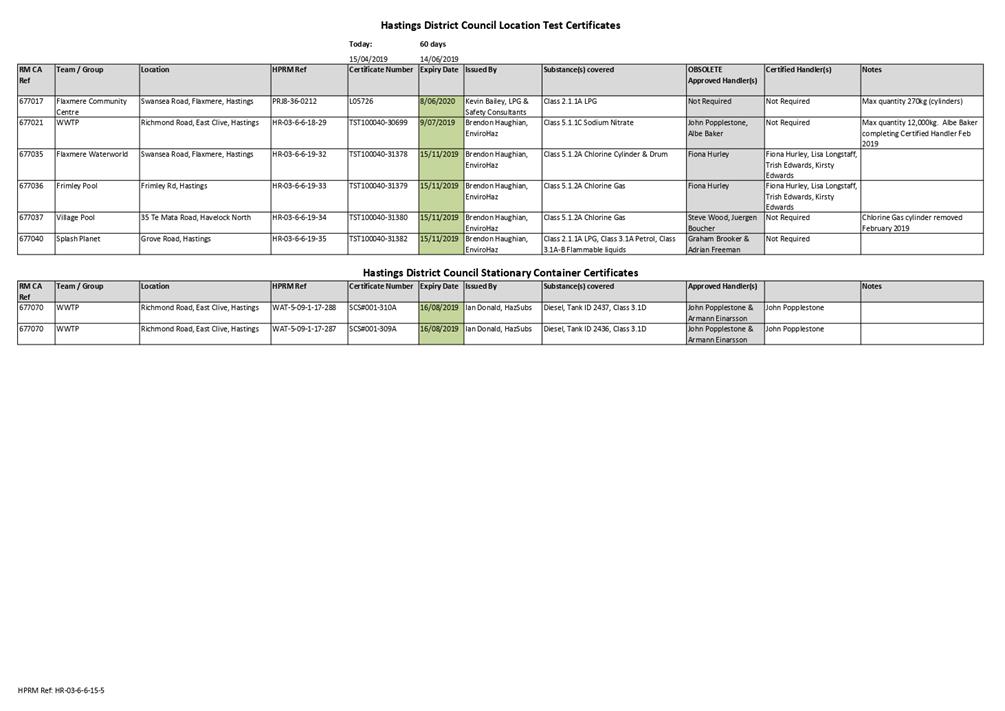

3.1 Hazardous

Substances

3.2 The

regulation of hazardous substances that affect human health and safety in the

workplace now sits under the Health and Safety at Work Act 2015 (previously

regulated under the Hazardous Substances and New Organisms Act 1996).

3.3 Location

compliance certificates and stationary tank certificates are required under the

Health and Safety at Work (Hazardous Substances) Regulations 2017, when an

organisation stores or uses explosive, flammable, oxidising, toxic or corrosive

substances and the quantity exceeds the thresholds specified in the

Regulations.

3.4 Location

compliance and stationary tank certification are issued annually by a licenced compliance

certifier on behalf of WorkSafe NZ.

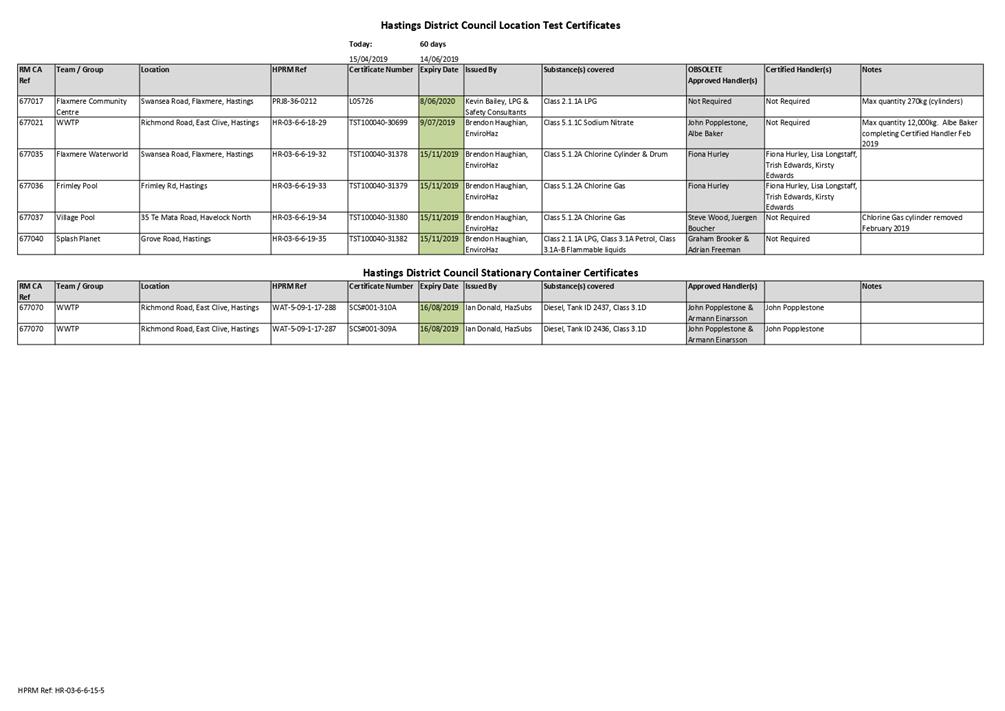

3.5 Council currently

has six locations and two stationary tanks requiring certification, of which

all have current certification (see attachment one).

3.6 In addition

to certification requirements, Council is required to ensure that all hazardous

substances are appropriately stored, as well as maintaining up- to-date

inventory registers of all hazardous substances and ensuring that staff have

appropriate equipment and training to competently use/handle these substances

safely.

3.7 Council is

also required to regularly undertake workplace exposure testing and to monitor

the health of workers who regularly use/handle hazardous substances to ensure

that health exposure risks are appropriately managed.

3.8 Regular

internal and external inspections and audits are undertaken to ensure

compliance with the Regulations.

3.9 Council is

also responsible for the regulation of non-work related hazardous substances

that can affect human health and safety under the Hazardous Substances and New

Organisms Act 1996 (HSNO). This regulatory work is currently undertaken

by Planning & Regulatory staff, guided by advice from Health & Safety

staff.

3.10 Organisation

Security Project

3.11 Under the Health and

Safety at Work Act 2015, Council is responsible for providing safe secure

facilities and environments for all staff to work in, and the public to frequent

(such as its libraries, pools, sports centres, and community centres).

3.12 In 2018, Council

engaged WSP Opus to undertake a review of security measures across all 23 Council

facilities. The scope of this review included the review of all Council

facilities electronic security services and staff requirements for:

Specification of systems, age of systems, quantity / alternatives, cost and

efficiencies, staff processes and procedures, perceptions and behaviour, site

design / CPTED (Crime Prevention Through Environmental Design), lighting

(Security), upgrade recommendations for both physical and electronic systems

3.13 The review was

completed in late 2018, providing Council with a report addressing each

facility and outlining recommendations in order to manage the security

requirements for each facility.

3.14 There are many

recommendations through this report, some are simple and require minimal

effort, and others require significant planning and expertise. Therefore an

experienced Project Manager has been engaged for 12 months in order to

implement the recommendations across the organisation.

3.15 Regular progress

updates on this project shall be provided to the Risk and Audit subcommittee over

the next 12 months.

3.16 Implementation of

ISO/NZS 45001:2018 Health and Safety Standard

3.17 As previously advised

to the Risk and Audit Subcommittee, Council’s external audit

certification (ACC Workplace Safety Management Practices (WSMP) accreditation)

lapsed in February 2019. This ACC scheme is now defunct, and therefore Council

should undertake an alternative external audit verification of its health and

safety system.

3.18 To achieve this

external verification, in December 2018 the then Acting Chief Executive

authorised implementation of the international health and safety standard ISO/NZS

45001:2018 which has been adopted by New Zealand (replacing all previous NZ

standards).

3.19 Officers are currently

working through a direct engagement process with Telarc to undertake a gap

analysis of what is required to meet the standard and an initial audit

assessment. It is anticipated that the gap analysis will be completed within

the next 3-6 months. The delay in undertaking the gap analysis is due to

a large number of other organisations undertaking similar gap analyses and a

skills shortage and availability of experienced accredited auditors.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This Report

does not trigger Council’s Significance and Engagement Policy and no

consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Health and Safety Manager titled “Health

and Safety Risk Management Update” dated 6/05/2019

be received.

|

Attachments:

|

1

|

Hazard Identification Assessment & Management -

Hazardous Substances Management - HDC Location Compliance Certificates and

Stationary Container Certificates April 2019 (For May 2019 Risk &

Audit Report)

|

HR-03-6-6-19-37

|

|

|

Hazard Identification Assessment &

Management - Hazardous Substances Management - HDC Location Compliance

Certificates and Stationary Container Certificates April 2019 (For May

2019 Risk & Audit Report)

|

Attachment 1

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 6 May 2019

FROM: Group Manager: Asset Management

Craig Thew

Group Manager: Human Resources

Bronwyn

Bayliss

SUBJECT: Cape

Kidnappers Interim Operations Manual

1.0 SUMMARY

1.1 The purpose

of this report is to inform and enable endorsement and further input from the

Subcommittee on the interim operations measures to manage the unquantified

risks along the beach from Clifton to Cape Kidnappers.

1.2 This request

arises from Council’s decision on 5 March to remove the road closure of

the beach from Clifton to Cape Kidnappers subject to the implementation of

reasonable control measures.

1.3 The Council

is required to give effect to the purpose of local government as prescribed by

Section 10 of the Local Government Act 2002. That purpose is to meet the current and future needs of communities

for good quality local infrastructure, local public services, and performance

of regulatory functions in a way that is most cost–effective for

households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.4 This report

concludes by recommending that the Committee endorses the interim operations

manual.

2.0 BACKGROUND

2.1 On the 23

January 2019 a significant landslide occurred on the beach between Clifton and

Cape Kidnappers. Immediately following this event the Department of

Conservation (DOC) closed their section of the walk to the gannet colony and

Hastings DC temporarily closed the beach.

2.2 Following

investigations a paper was taken to Council on the 5 March where Council adopted

to re-open the beach and commence the Quantitative Risk Analysis (QRA), working

with support from DOC on the QRA.

2.3 The

recommendations adopted also required officers to consider and implement

reasonable control measures prior to opening, along with a requirement to

continue to investigate known risks and minimise, where practical, and

regularly report back.

2.4 On the 28

March officers provided a summary to the full council meeting of the interim

control measures proposed and council adopted the recommendations, with the 29

April date set for the implementation of the measures and removal of the

temporary road closure.

3.0 CURRENT

SITUATION

3.1 The interim

operations manual (attached) has been produced and will be in operation when

this committee meets.

3.2 The manual

has been produced with input from Matt Shore of Stantec and council officers.

Officers have also meet with Worksafe to talk through the management approach.

3.3 Importantly

the interim operations manual includes a number of both proactive and reactive

trigger conditions that instigate further action, including temporary road

closures.

3.4 The

attached manual also describes the steps being taken on an ongoing operational

basis, such as signage and ongoing inspections, and the approach to

verification.

3.5 The interim

measures were activated on and before the 29 April, and the interims operations

manual will be in effect at the time of the meeting.

3.6 The interim

operations manual triggers were invoked by a further large landslide over the

Easter holiday period. Whilst detailed survey information is not yet available

to accurately state the size the photos provided clearly show a landslide well

over the lower 100 cubic metres of material. At the time of writing this report

this trigger event means that the beach access remains closed until the

assessment of the new landslide, and an updated risk assessment has been

completed.

3.7 DOC’s

position is unchanged with their section of the walk remaining closed until the

QRA is completed and assessed. Officers are following up with DOC to confirm

when their new signage will be erected.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This item

does not trigger significance or further engagement requirements. The manual is

an operational item that officers are providing to the risk and audit committee

for endorsement and further input if required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Group Manager: Asset Management titled “Cape

Kidnappers Interim Operations Manual” dated 6/05/2019

be received.

B) That the Risk and Audit subcommittee endorse the interim

operations manual for the management of the beach road from Clifton to Cape

Kidnappers.

|

Attachments:

|

1

|

Clifton Beach Operations Manual REV D HDC Version

FINAL

|

PRJ19-002-0205

|

Under Separate Cover

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 6 May 2019

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: General

Update Report and Status of Actions

1.0 CURRENT

SITUATION SUMMARY

1.1 The

purpose of this report is to update the Risk & Audit Subcommittee on

various matters including actions raised at previous meetings.

1.2 The

Council is required to give effect to the purpose of local government as

prescribed by Section 10 of the Local Government Act 2002. That purpose is to

meet the current and future needs of communities for good quality local

infrastructure, local public services, and performance of regulatory functions

in a way that is most cost–effective for households and businesses. Good

quality means infrastructure, services and performance that are efficient and

effective and appropriate to present and anticipated future circumstances.

1.3 This

report concludes by recommending that the report titled “General Update

Report and Status of Actions” from the Manager Strategic Finance be

received.

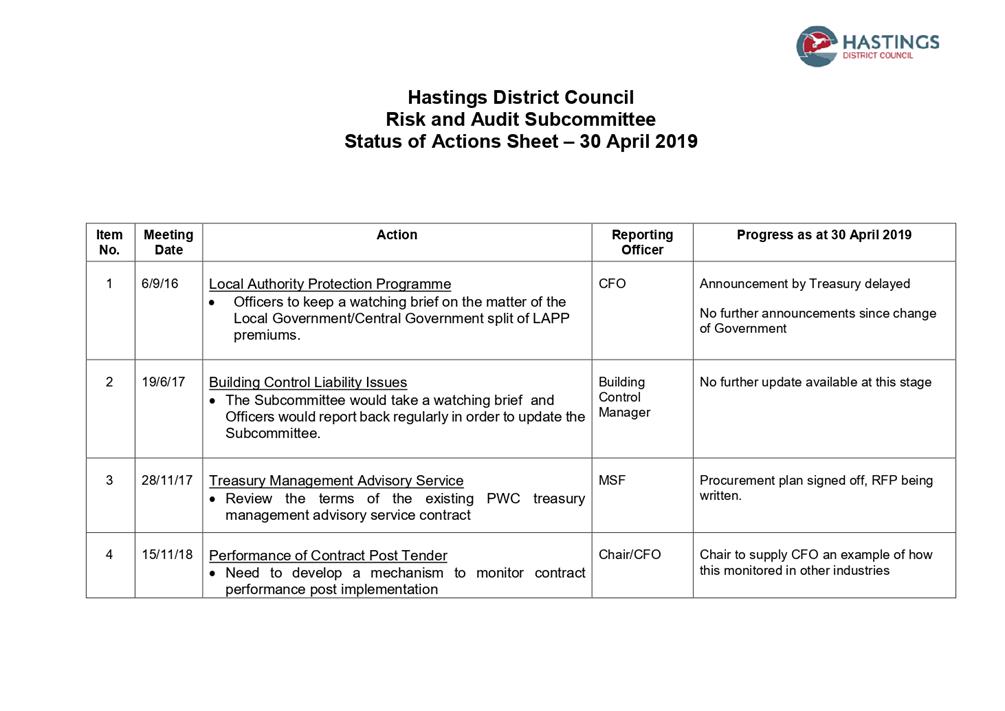

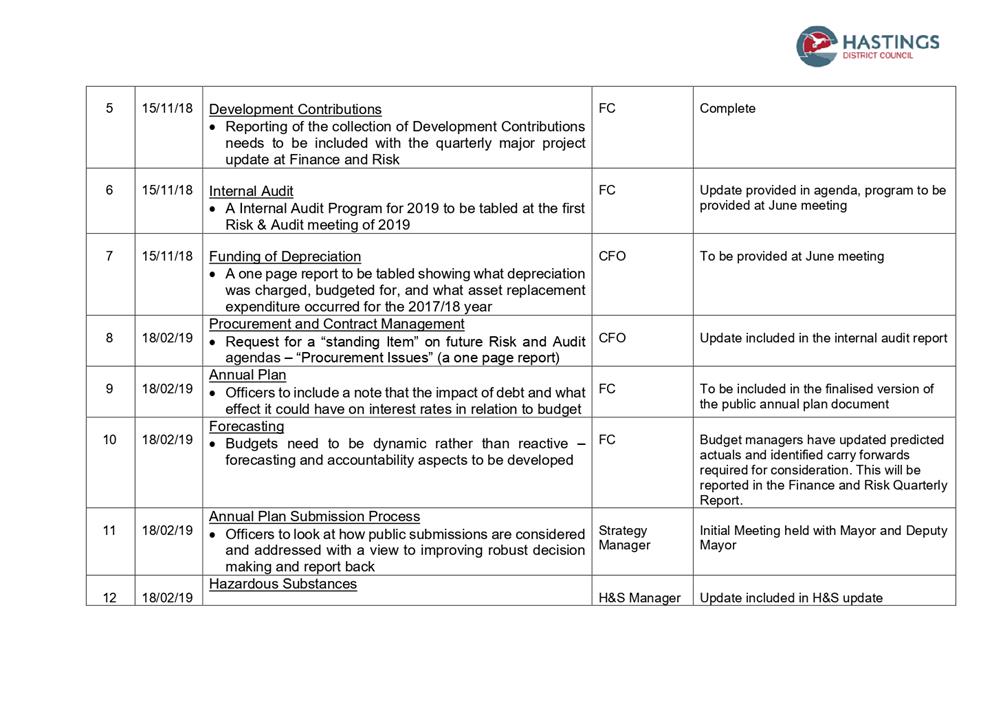

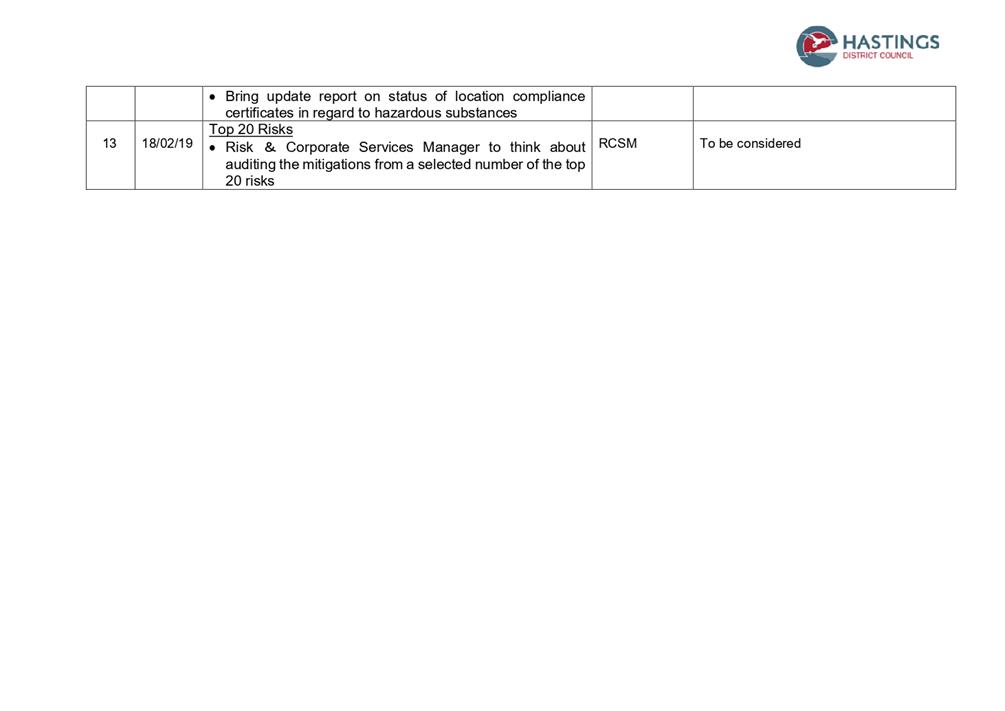

2.0 BACKGROUND

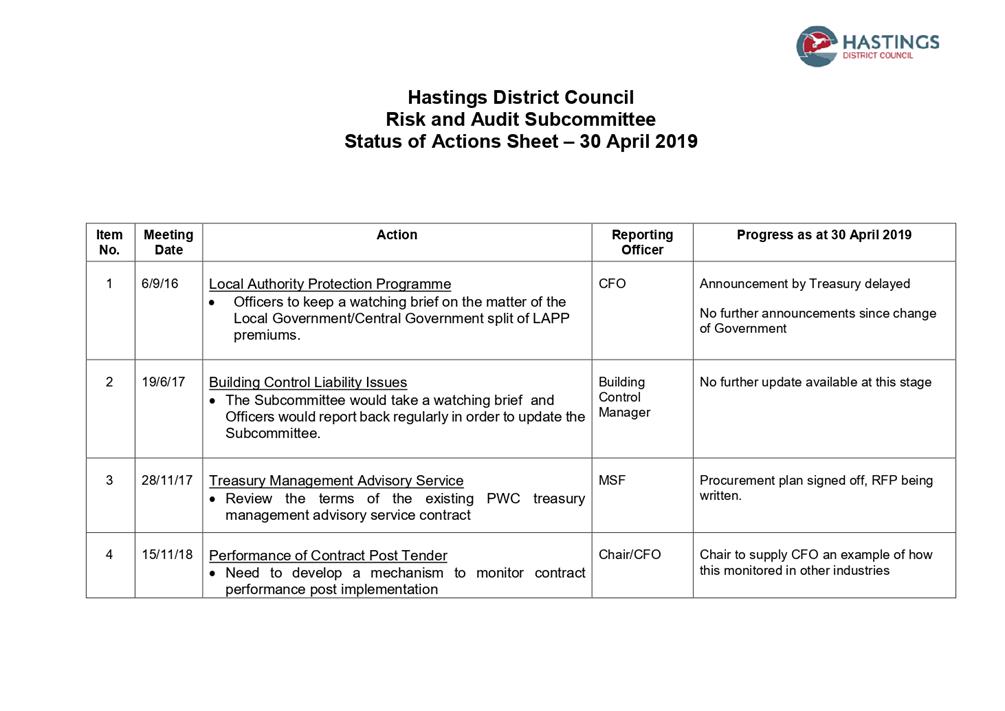

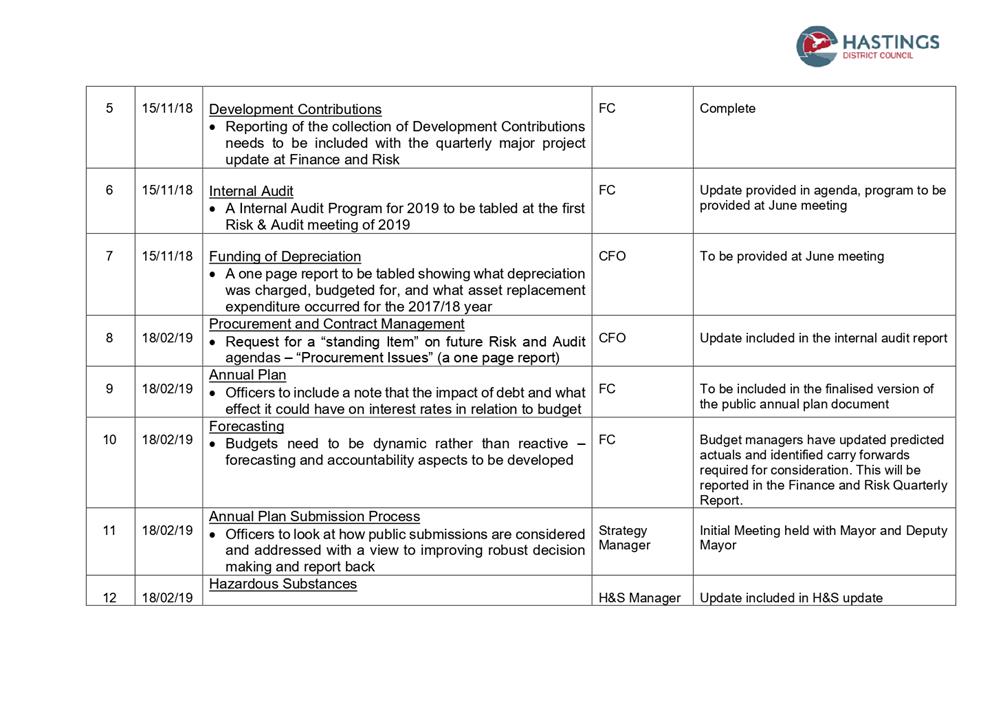

2.1 The

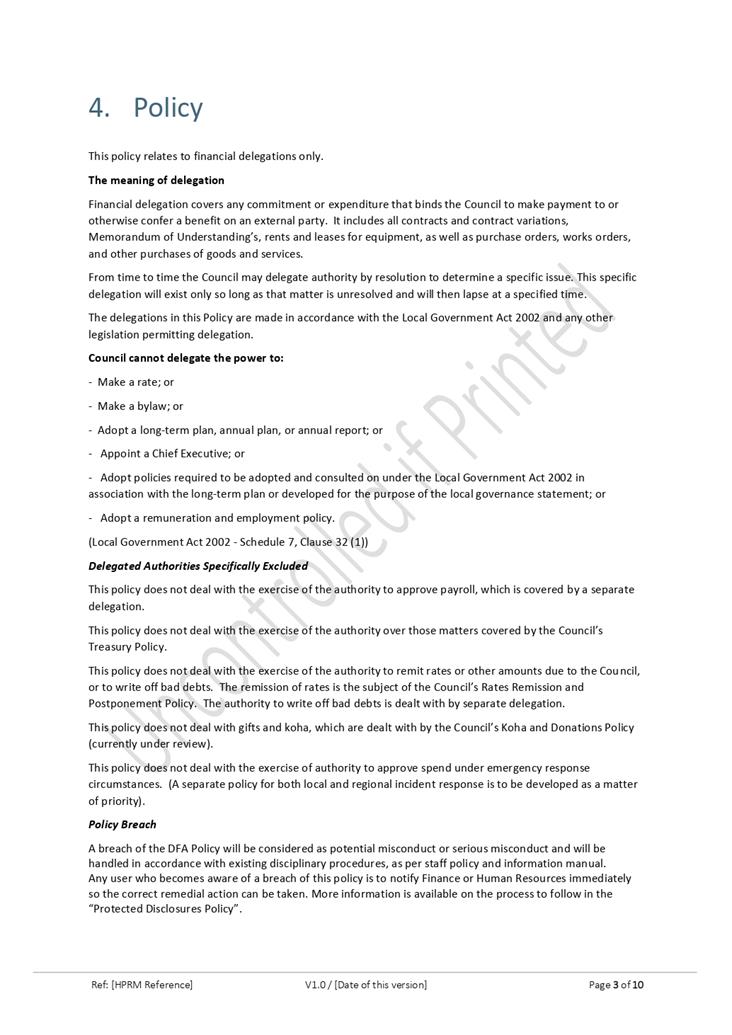

Risk & Audit Subcommittee members requested that officer’s report

back at each meeting with progress that has been made on actions that have

arisen from the Risk & Audit Subcommittee meetings. Attached as Attachment

1 is the Risk & Audit Subcommittee Action Schedule as at 30 April 2019.

3.0 CURRENT

SITUATION

3.1 Tech

one Upgrade:

There are three main

tranches of work underway in this area. The first is the upgrading of the

Finance module, in order to allow for the implementation of the Procure to Pay

(P2P) module. As the finance module was being upgraded it was decided to

bring forward the property and rating module upgrade in order to maintain

compatibility across the Council’s ERP system.

Both these upgrades

are well underway with a complete testing programme being undertaken across all

areas of Council to ensure there are no adverse effects from the upgrades once

they go “live”.

3.2 Electronic

Purchase Order Project (Procure to Pay (P2P))

The third tranche of

this work is the P2P implementation. Configuration for this has now

started in “test” with workstreams for this project underway.

It is expected that a pilot programme in “live” will be underway in

October, with a full rollout from November this year.

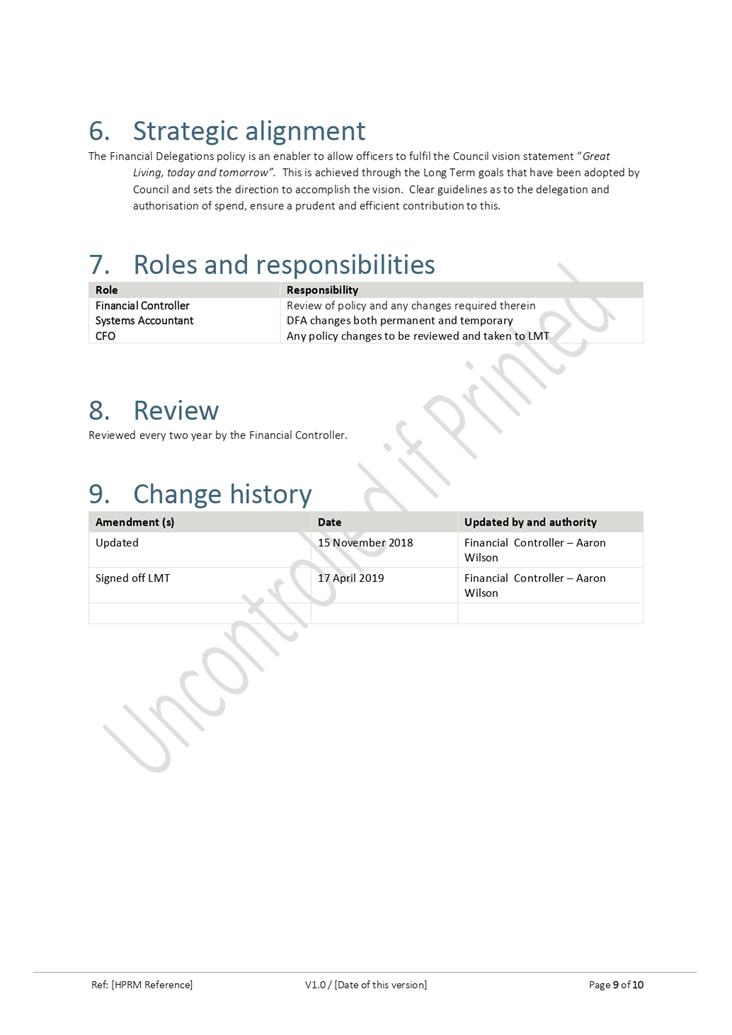

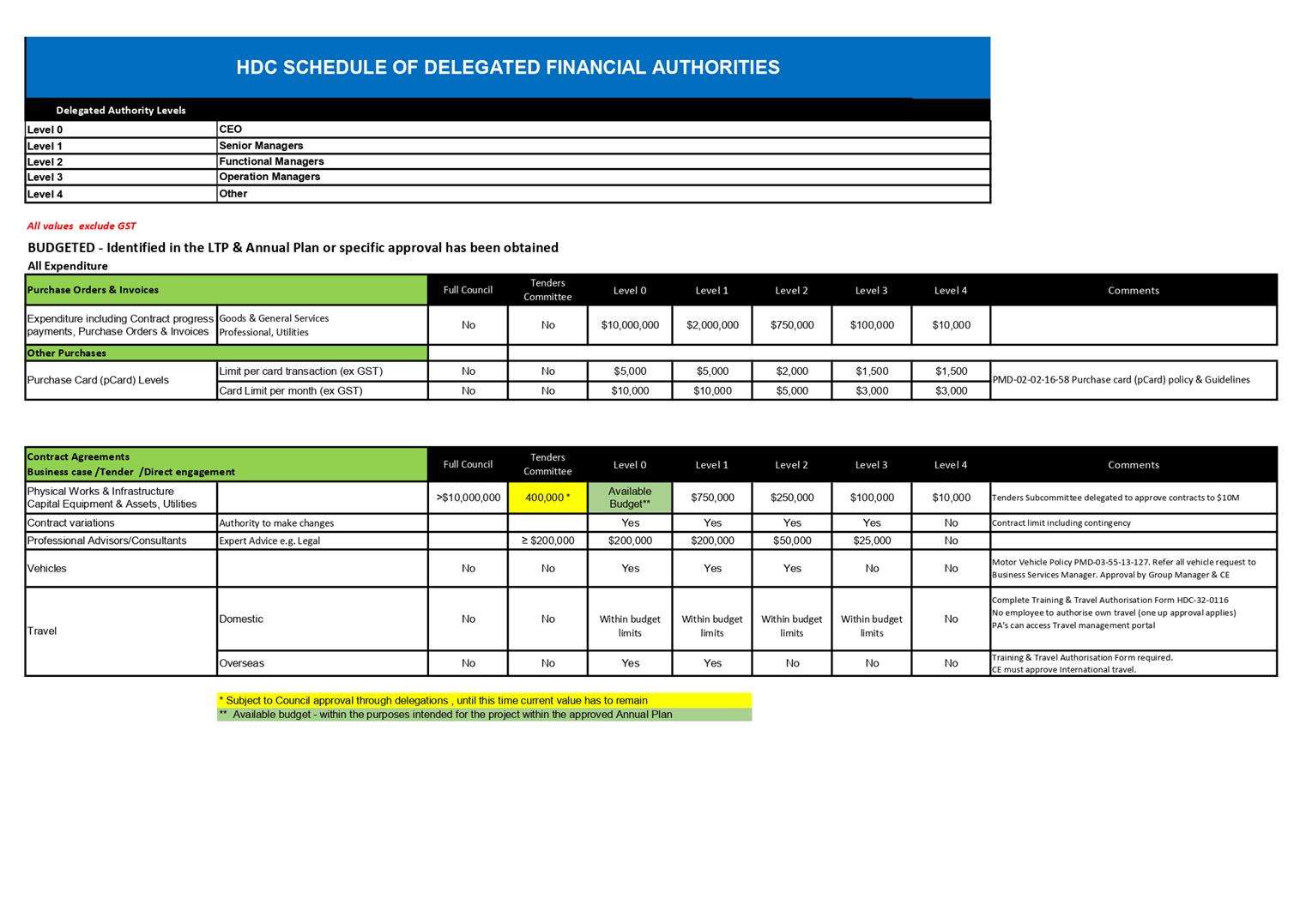

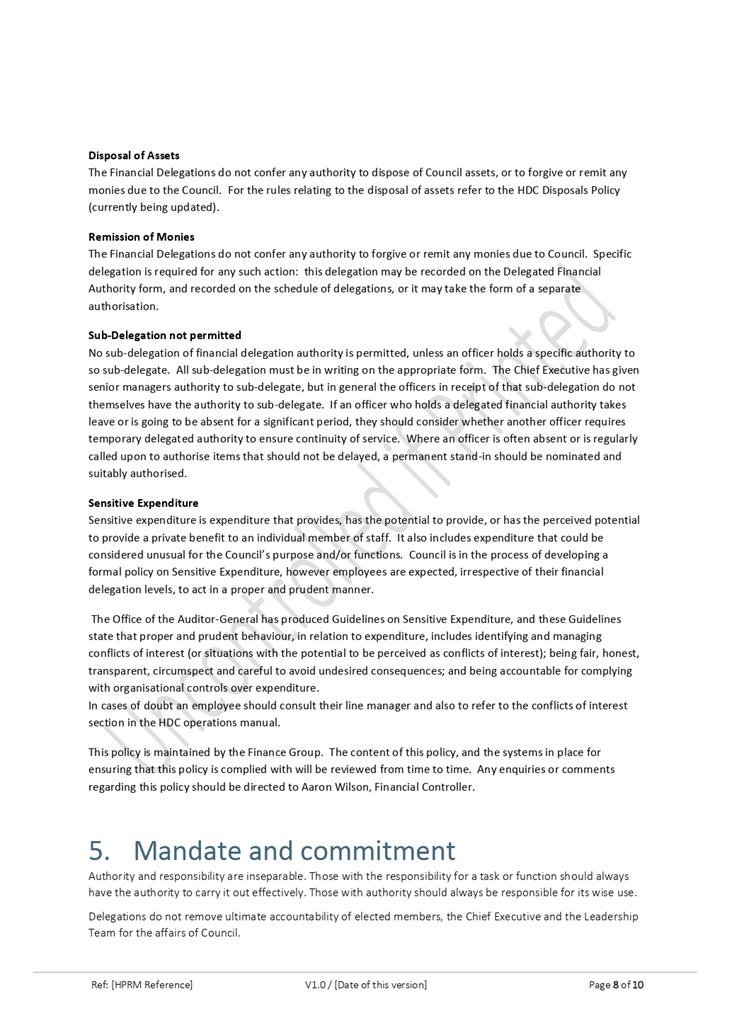

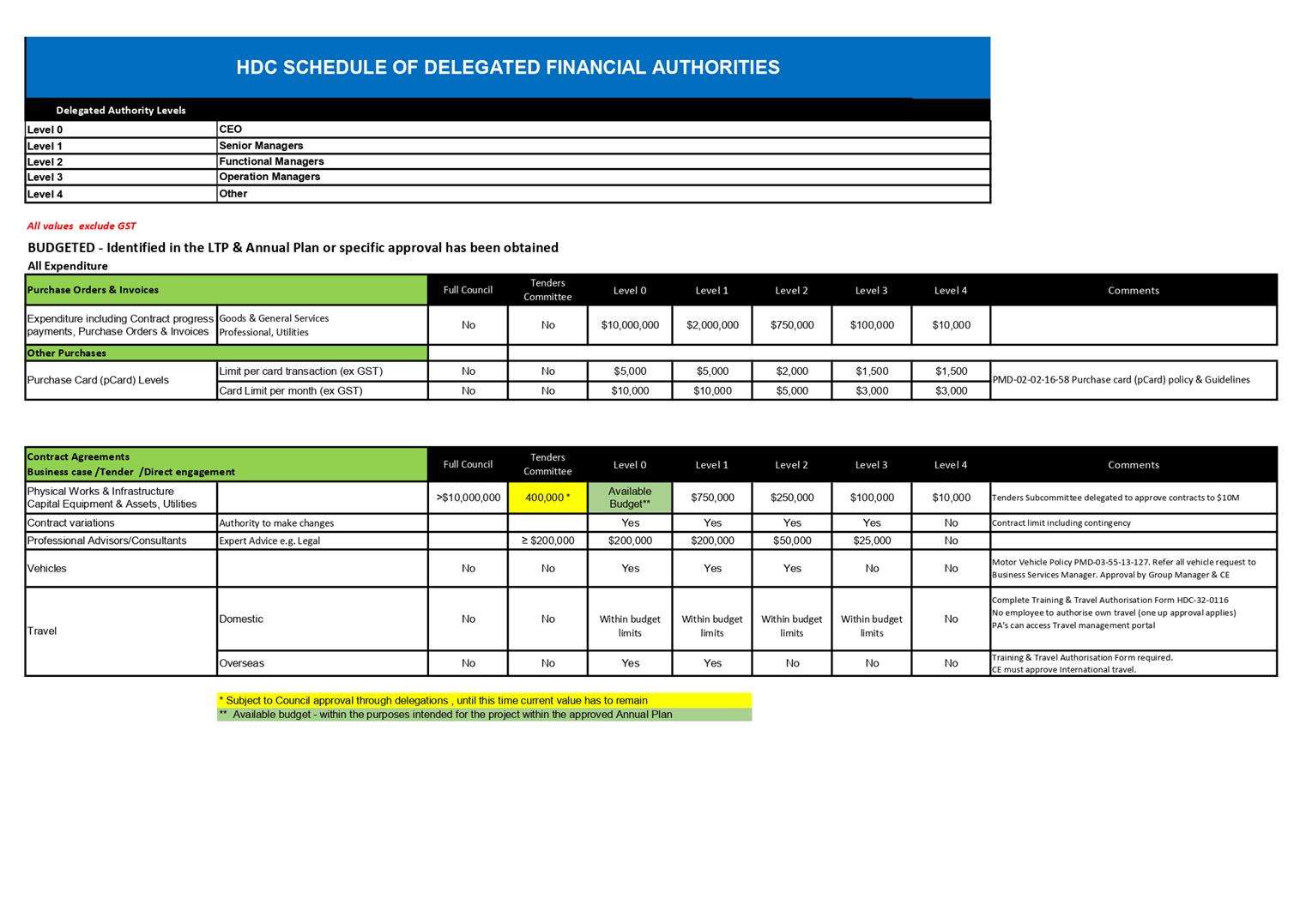

3.3 Delegated

Financial Authority (DFA):

A DFA policy has

been written and presented to LMT for feedback, review and signoff. The

current model and levels of authorisation have been adjusted in order to better

reflect the way Council does business along with enabling a model of

authorisation that can allow the new P2P system to control the levels of spend.

Attached as Attachments 2 and 3 is the DFA policy and the supporting

schedule of delegations.

The changes to the

DFA’s reflect a role based delegation approach with increased financial

delegations to allow staff to efficiently and effectively do their jobs.

The Policy has been

drafted with input from a number of areas of Council and has taken good

practice from other organisations in its development. It is important to

acknowledge that the need to update delegations was to ensure Council had

delegations that could be supported by the financial systems that provide the

necessary approval controls.

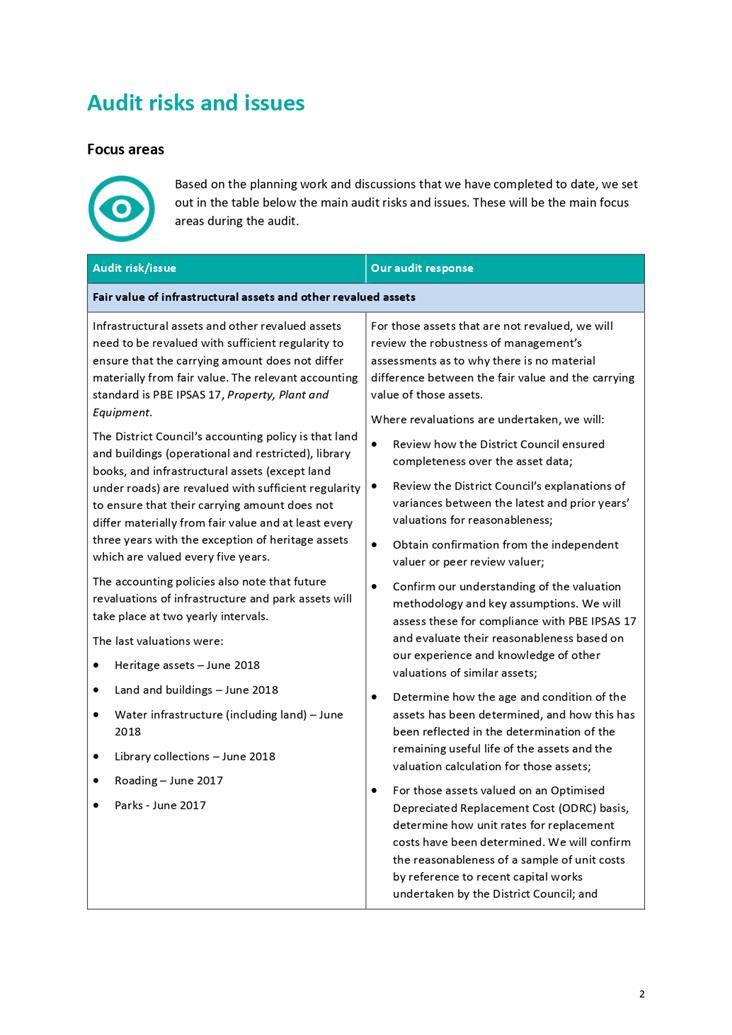

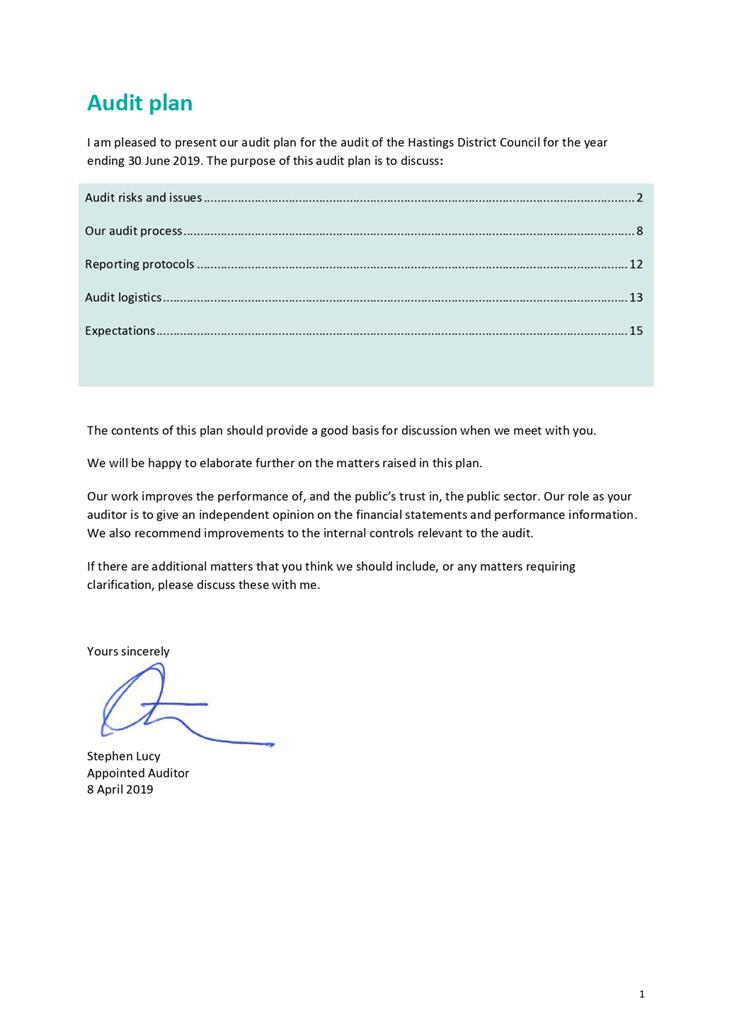

3.4 Audit

New Zealand 2019 Audit Plan

Attached as Attachment

4 is the Audit New Zealand 2019 Audit Plan. The Plan highlights the audit

risks and issues and has five key focus areas identified. A standard item on

all Audit Plans is fraud risk and this is covered in some detail.

4.0 SIGNIFICANCE

AND ENGAGEMENT

4.1 This

report does not trigger Council’s Significance and Engagement Policy and

no consultation is required.

|

5.0 RECOMMENDATIONS

AND REASONS

A) That the report of the Manager

Strategic Finance titled “General Update Report and Status of Actions” dated 6/05/2019 be received.

B) That the Subcommittee note that the Delegated Financial Policy and

the associated Delegated Financial Authorities have been updated and adopted

by the Chief Executive and the Lead Team.

|

Attachments:

|

1

|

Risk and Audit Status of Actions 30 April 2019

|

FIN-09-01-19-170

|

|

|

2

|

Delegated Financial Authority Policy

|

FIN-09-4-19-178

|

|

|

3

|

DFA Schedule 2019

|

CG-14-25-00081

|

|

|

4

|

Audit NZ 2019 Audit Plan

|

FIN-07-01-19-426

|

|

|

Risk and Audit Status of Actions 30

April 2019

|

Attachment 1

|

|

Delegated Financial Authority Policy

|

Attachment 2

|

|

DFA Schedule 2019

|

Attachment 3

|

|

Audit NZ 2019 Audit Plan

|

Attachment 4

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 6 May 2019

FROM: Group Manager: Planning &

Regulatory

John

O'Shaughnessy

SUBJECT: MBIE

Review of Tauranga City Council - Bella Vista Development

1.0 SUMMARY

1.1 The purpose of this report is to inform the

Committee of the outcomes of the review undertaken by the Ministry of Business,

Innovation & Employment’s Review of Tauranga City Council Performance

of statutory functions under the Building Act 2004 with respect to the Bella

Vista development.

1.2 This report

concludes by recommending that the report be received.

2.0 CURRENT

SITUATION

2.1 The review

of Tauranga City Council is attached as Attachment 1 and provides a good

summary of the findings of the review into the Bella Vista development.

Officers will talk to this report, highlighting key risk areas and activities

and actions that the Risk and Audit Subcommittee should be aware of.

|

3.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Group Manager: Planning & Regulatory titled “MBIE

Review of Tauranga City Council - Bella Vista Development” dated

6/05/2019 be received.

|

Attachments:

|

1

|

Review of Tauranga City Council - Bella Vista

development

|

Reg-2-3-19-1736

|

Under Separate Cover

|

REPORT TO: Risk

and Audit Subcommittee

MEETING DATE: Monday 6 May 2019

FROM: Financial Controller

Aaron Wilson

Chief Financial Officer

Bruce

Allan

SUBJECT: Internal

Audit Report

1.0 SUMMARY

1.1 The purpose of this report is to update the Subcommittee about

progress being made with the Internal Audit plan.

1.2 The Council is required to give effect to

the purpose of local government as prescribed by Section 10 of the Local

Government Act 2002. That purpose is to meet the current and future needs of

communities for good quality local infrastructure, local public services, and

performance of regulatory functions in a way that is most cost–effective

for households and businesses. Good quality means infrastructure, services and

performance that are efficient and effective and appropriate to present and

anticipated future circumstances.

1.3 This report

concludes by recommending that the Internal Audit update be received.

2.0 CURRENT

SITUATION

Data Analytics

2.1 This is the

second year that we have had Crowe Horwath undertake the data analytic

assessment across the Accounts Payable and Payroll masterfiles and the

year’s transactional data, this time from 1 July 2017 to 30 June 2018.

The objective of the data analytics was to perform a data analysis review that

involved an analysis of master file data and transaction data for payroll and

vendor (accounts payable) payments.

2.2 The

analysis provided 45 recommendations or comments on the outcomes of the

analysis on the tests for the payroll and vendor masterfile and transactional

data. Officers have reviewed the recommendations and have not found any

suspicious transactions. Officers will also review the outcomes of the

results from the tests undertaken and consider if there are opportunities for

making improvements to current practices.

Contract

Management Review

2.3 The Crowe

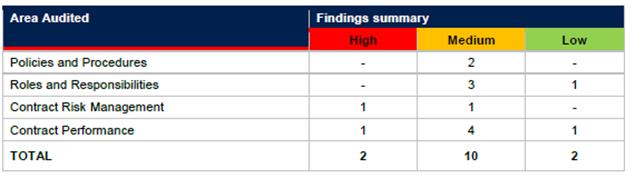

Horwath Contract Management Review undertaken in September/October 2018 separated

their findings into four sections:

· Policies and Procedures;

· Roles and Responsibilities;

· Contract Risk Management; and

· Contract Management Performance

2.4 A key part

of their recommendations they have identified that there is a lack of council

wide contract management policies, procedures, templates and manuals. While

these exist in places, they have been developed for particular areas of Council

or by specific staff to meet their own needs.

2.5 This review

has highlighted for Council that while work has been done to improve the

robustness of council’s contract management, it has often been done at a

group or team level and not with the wider organisations needs in

consideration. There is significant opportunity to improve these practices.

2.6 There are

14 recommendations made with the majority of those recommendations assessed as

having moderate risk to the organisation.

The two findings

rated “High” were the following:

1) Contracts not assessed for risk – while there are

some risk assessment practices, these are not consistently applied.

2) Lack of reporting requirements – this is particularly

relevant for reporting at a governance level and review of governance reporting

is being considered.

2.7 The work

being undertaken through the development Procurement and Contract Management

Framework is continuing to address the findings of this review.

Procurement and

Contract Management

2.8 In February

the Subcommittee was given an update on a review of the procurement activities

across Council. That review had highlighted opportunities to make improvements

to current documentation procedures and systems to meet current best practice.

The review also highlighted that there were pockets of procurement improvement

projects underway that would benefit from some centralised oversight to ensure

that the various initiatives remain aligned. To address both issues, a

programme of work was established to create a Council Procurement and Contract

Management Framework. The initial work streams for this programme of work

include:

· Procurement policy, strategy(s) & plans

· Templates Procedures & Guides

· Training - Procurement & Contract Management

· Communications (Staff & Supplier)

2.9 Despite the

departure of Council’s Procurement Manager in March, progress has been

made on a number of activities including:

· An introductory procurement and contract management training

exercise for staff has been developed – at the time of writing

approximately 40 staff had been identified to undertake this in-house training

during May.

· The Ministry of Business, Innovation and Employment (MBIE) are

rolling out contract management training this year with the first session held

in Napier in February. Further sessions will be available in the coming months

to the 5 Hawkes Bay Councils along with online resources.

· Significant progress has been made in developing tools and templates

that are required to support the business. Typically the approach being taken

is to modify the MBIE tools and templates where applicable as these are

recognised as being best practice in New Zealand. These tools and templates

will be much more accessible to staff.

· Work continues across the organisation to bring the contracts

register up to date.

· Work has progressed updating the Council website to aid in

communicating more effectively with suppliers, giving them more access to

information on how to do business with Council.

· The next significant phase of work will be a refresh of the

Procurement Policy and Manual, expected to be commenced by June.

· A wider programme of work is currently being scoped by the HB LASS

Programme Manager looking at the creation of a Hawkes Bay Council Centre of

Excellence for Procurement. While this will take some coordinated effort to

create, there is a strong willingness across the 5 Councils to progress this

and it is expected that such an approach will go along way to addressing the

shortcomings that were identified in the Crowe Horwath Contract Management

review and the shortcomings identified in our own Procurement review.

Future Audits

2.10 Crowe Horwath will be

on-site in early May to do their annual follow-up audit to assess actions taken

to address findings from previous audits. They will also be undertaking some

training with finance staff to enable internal staff to be more proactive in

providing internal audit support, particularly in relation to reviewing

practices at our remote sites of activities.

2.11 Officers will bring

back to the Subcommittee in June the proposed audit plan for 2019/20.

Audit Action Sheet

2.11.1 Attached as Attachment 1 is an

updated Audit Action sheet providing the Subcommittee with a view of the status

of recommendations made from previous internal and external audits. Good

progress has been made on addressing recommendations. Note that at this stage

the most recent contract management audit has yet to be added to this schedule

as there is some work required to understand how those recommendations can be

delivered, the resources required and the time needed to do so.

|

3.0 RECOMMENDATIONS

AND REASONS

A) That

the report of the Financial Controller titled “Internal

Audit Report” dated 6/05/2019 be received.

|

Attachments:

There are no

attachments for this report.

Hastings District

Council

Hastings District

Council