|

Thursday, 27 June 2024 |

Te Hui o Te Kaunihera ā-Rohe o Heretaunga

Hastings District Council: Council Meeting

Ngā

Miniti

Minutes

|

Kua Tae ā-tinana: |

Chair - Tiamana: Mayor Sandra Hazlehurst Councillors - Ngā KaiKaunihera: Councillors Ana Apatu, Marcus Buddo, Alwyn Corban, Malcolm Dixon, Michael Fowler, Damon Harvey, Kellie Jessup, Tania Kerr (Deputy Mayor), Eileen Lawson, Hana Montaperto-Hendry, Simon Nixon, Wendy Schollum, Heather Te Au-Skipworth and Kevin Watkins |

|

Kua Tatū: |

Chief Executive – Nigel Bickle Deputy Chief Executive – Bruce Allan Group Manager: Asset Management – Craig Thew Group Manager: Planning and Regulatory Services – John O’Shaughnessy Group Manager: Strategy and Development – Craig Cameron General Counsel – Scott Smith Senior Environmental Planner Policy (Special Projects) – Anna Sanders Environmental Policy Manager – Rowan Wallis Public Spaces and Building Assets Manager – Colin Hosford Public Spaces Asset Planer – Jeff Clews Strategy Manager – Lex Verhoeven Management Accountant – Development Contributions – Richard Elgie Director – Growth and Development – Raoul Oosterkamp Manager: Democracy and Governance Services – Louise Stettner Democracy and Governance Advisor – Caitlyn Dine |

|

Kei Konei: |

Chair of Maungaharuru Tangitū Trust, Tania Hopmans (Item 6) Bevan Taylor, Maungaharuru Tangitū Trust – (Item 6) Chair of Ngāti Kahungunu Iwi Inc. Bayden Barber (Item 7) |

Apology for lateness from Mayor Hazlehurst

Deputy Mayor Kerr resumed the chair.

1. Opening prayer - Karakia

The opening prayer was given by Pou Ahurea Matua: Principal Advisor: Relationships, Responsiveness and Heritage, Petera Hakiwai. The Pou Ahurea also acknowledged the visitors in attendance including members of Maungaharuru Tangitū Trust and Chair of Ngāti Kahungunu Iwi Inc.

Mayor Hazlehurst joined the meeting at 1.12pm and resumed the chair.

With the agreement of the meeting Items 6 and 7 were taken out of order.

2. Apologies & Leave of Absence - Ngā Whakapāhatanga me te Wehenga ā-Hui

Leave of Absence had previously been granted to Councillor Heke.

|

|

Mayor Hazlehurst/Councillor Schollum That apologies from Councillor Buddo from 3pm – 3.30pm be accepted. That leave of absence be granted to Councillor Lawson for 14 August to 23 August 2024. |

3. Conflicts of Interest - He Ngākau Kōnatunatu

Councillor Montaperto-Hendry declared a conflict of interest in relation to Item 19 and left the room when this item was addressed.

Councillor Harvey declared a conflict of interest in relation to Items 21 and 25, and left the room when this item was addressed.

4. Confirmation of Minutes - Te Whakamana i Ngā Miniti

|

|

Councillor Watkins/Councillor Dixon That the minutes of the Council Meeting held Thursday 9 May 2024 be confirmed as an accurate record. |

The meeting adjourned at 2.35pm

And reconvened at 2.45pm.

|

9. |

|

|

|

(Document ref 24/244) Management Accountant – Development Contributions, Richard Elgie, spoke to the report and responded to questions from the meeting. |

|

|

Councillor Kerr/Councillor Schollum A) That Council receive the report titled Resolution to Set the Rates for the 2024/25 Financial Year dated 27 June 2024. B) That pursuant to Sections 23, 24 and 57 of the Local Government (Rating) Act 2002 the Hastings District Council sets the Rates on rating units in the District for the financial year commencing on 01 July 2024 and ending on 30 June 2025 and sets the due dates and penalty dates for the 2024/25 financial year, as follows:

INTRODUCTION

Hastings District Council has adopted its 2024/34 Long Term Plan. This has identified the Council’s budget requirement, and set out the rating policy and funding impact statement. The Council hereby sets the rates described below to collect its identified revenue needs for 2024/25 commencing 01 July 2024. All rates are inclusive of Goods and Services Tax.

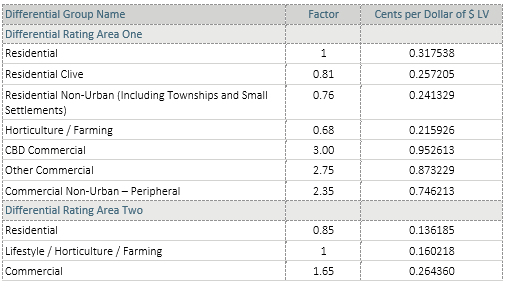

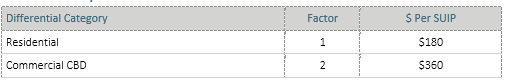

GENERAL RATES A general rate set and assessed in accordance with Section 13 of the Local Government (Rating) Act 2002, on the land value of all rateable land within the district on a differential basis as set out below:

UNIFORM ANNUAL GENERAL CHARGE A uniform annual general charge set and assessed in accordance with Section 15 of the Local Government (Rating) Act 2002, of $234 on each separately used or inhabited part of a rating unit within the district.

TARGETED RATES

All differential categories of targeted rates areas are as defined in the Funding Impact Statement for 2024/25. For the purposes of the Havelock North Promotion, Hastings City Marketing, Hastings CBD Targeted Rate, Havelock North Parking, Havelock North CBD Targeted Rate, and Security Patrols (Hastings and Havelock North), a commercial rating unit is one that fits the description as set out under DRA1 CBD Commercial and DRA1 Other Commercial in Part B of the Funding Impact Statement for 2024/25.

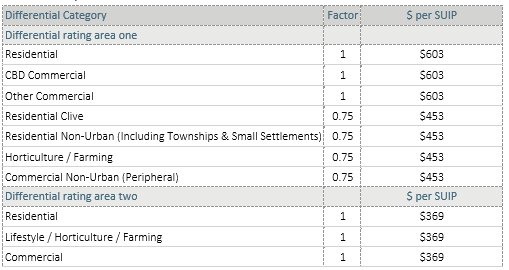

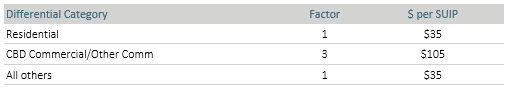

COMMUNITY SERVICES & RESOURCE MANAGEMENT RATE A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on a differential basis, on each separately used or inhabited part of a rating unit in the district as follows:

CYCLONE RECOVERY TARGETED RATES Two targeted rates set and assessed for the purposes of funding the costs of Cyclone Gabrielle recovery. The first as a rate in the dollar of land value and the second as a fixed amount.

All land in the Hastings District will be allocated to either Differential Rating Area One or Differential Rating Area Two. These areas are defined on Council map ‘Differential Rating Areas’ and are based on broad areas of benefit from the Council’s services and facilities. The costs of cyclone recovery have been allocated into the two rating groups with 67% of costs assigned to Differential Rating Area One and 33% of costs allocated to Differential Rating Area Two.

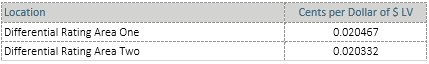

A differential targeted rate set and assessed in accordance with Section 16, Schedule 2 Clause 6, and Schedule 3 Clause 3 of the Local Government (Rating) Act 2002, on the land value of all rateable land within the district. The rate is set on a differential basis, based on the location of the land within the district. This is applied to the same two differential rating areas as defined and used for the general rate:

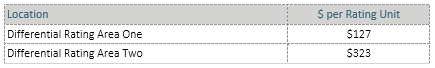

A differential targeted rate set and assessed in accordance with Section 16, Section 18 (2) and Schedule 2 Clause 6 of the Local Government (Rating) Act 2002, as a fixed amount per rating unit in the district. The rate is set on a differential basis, based on the location of the land within the district: This is applied to the same two differential rating areas as defined and used for the general rate:

HAVELOCK NORTH PROMOTION A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on the land value of any commercial rating unit located within Havelock North as defined on Council Map “Havelock North Promotion Rate”, of 0.092638 cents per dollar of land value. SWIMMING POOL SAFETY A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, as a fixed amount on every rating unit where a swimming pool (within the meaning of the Fencing of Swimming Pools Act 1987) is located, of $88 per rating unit.

HAVELOCK NORTH PARKING A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on a differential basis, on each separately used or inhabited rating unit located within Havelock North as defined on Council Map “Havelock North Parking Rate Map”, as follows:

HASTINGS CITY MARKETING A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on the land value of any commercial rating units located within Hastings as defined on Council Map “Hastings City Marketing Rate Map”, of 0.199507 cents per dollar of land value.

HASTINGS CBD TARGETED RATE A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on the land value of any commercial rating unit located within Hastings as defined on the Council Map “Hastings CBD Targeted Rate Map”, of 0.141267 cents per dollar of land value.

HAVELOCK NORTH CBD TARGETED RATE A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on the land value of any commercial rating unit located within Havelock North as defined on Council Map “Havelock North CBD Upgrades Map”, of 0.049832 cents per dollar of land value.

SECURITY PATROLS Targeted rates set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on the land value of any commercial rating unit located within each respective Council Map defined “Hastings Area - Security Patrol Map” and “Havelock North Security Patrol Area Map”, as follows:

Hastings Security Patrol Area - 0.090661 cents per dollar of land value.

Havelock North Security Patrol Area - 0.043539 cents per dollar of land value.

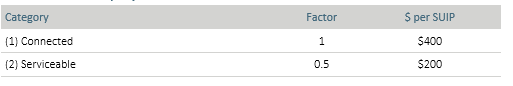

SEWAGE DISPOSAL A differential targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, based on the provision or availability to the land of the service. The rate is set as an amount per separately used or inhabited part of a rating unit.

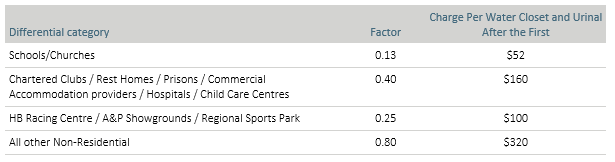

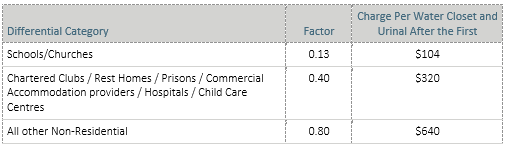

A differential targeted rate for all non-residential rating units classified as “connected”, based on the use to which the land is put. The rate is an amount for each water closet or urinal after the first.

The rates apply to connected or serviceable rating units in all areas excluding those in the Waipatiki scheme area.

The rates for the 2024/25 year are:

Where connected, in the case of non-residential use, the differential charge for each water closet or urinal after the first is as follows:

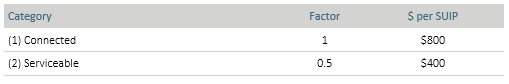

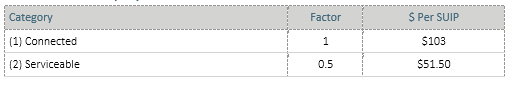

WAIPATIKI SEWAGE DISPOSAL A differential targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, based on the provision or availability to the land of the service. The rate is set as an amount per separately used or inhabited part of a rating unit.

A differential targeted rate for all non-residential rating units classified as “connected”, based on the use to which the land is put. The rate is an amount for each water closet or urinal after the first.

The rates apply only to connected or serviceable rating units in the Waipatiki scheme area.

The rates for the 2024/25 year are:

Where connected, in the case of non-residential use, the differential charge is set for each water closet or urinal after the first as follows:

WASTEWATER TREATMENT A differential targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, based on the provision or availability to the land of the service. The rate is set as an amount per separately used or inhabited part of a rating unit.

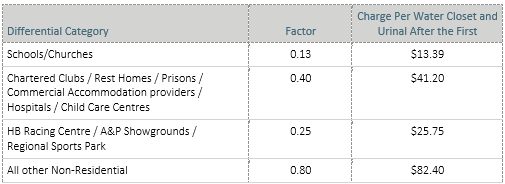

A differential targeted rate for non-residential rating units classified as “connected”, based on the use to which the land is put. The rate is an amount for each water closet or urinal after the first.

The rates apply to connected or serviceable rating units in all areas excluding those in the Waipatiki scheme area. The rates for the 2024/25 year are:

Where connected, in the case of non-residential use, the differential charge is set for each water closet or urinal after the first as follows:

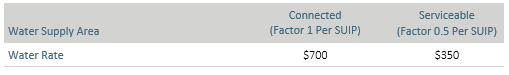

WATER SUPPLY Targeted rates set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on each separately used or inhabited part of a rating unit and based on the provision or availability to the land of the service, for each water supply service, on a differential basis as follows.

The rates for the 2024/25 year are:

The Council has water supply services for Hastings, Havelock North, Flaxmere, Waipatu, Haumoana/Te Awanga, Clive, Whakatu, Omahu, Paki Paki, Waimarama, Waipatiki, Whirinaki, Te Pohue.

WATER BY METER A targeted rate set and assessed in accordance with Section 19 of the Local Government (Rating) Act 2002, on the volume of water supplied as extraordinary water supply, as defined in Hastings District Council Water Services Policy Manual (this includes but is not limited to residential properties over 1,500m2 containing a single dwelling, lifestyle lots, trade premises, industrial and horticultural properties) of $1.17 per cubic metre of water supplied over and above the typical household consumption as defined in the Hastings District Council Water Services Policy Manual.

RECYCLING A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on each separately used or inhabited part of a rating unit and based on the provision or availability to the land of the service provided in the serviced area. The service areas are set out in council maps “Recycling Map incl Clive Whakatu”, “Recycling Map incl Hastings, Flaxmere, Havelock North”, “Recycling Map incl Haumoana Te Awanga” and “Recycling incl Whirinaki”.

Rating units which Council officers determine are unable to practically receive the Council service and have an approved alternative service will not be charged the rate.

The rate for 2024/25 is $110 per separately used or inhabited part of the rating unit.

REFUSE A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on each separately used or inhabited part of a rating unit in the serviced areas, differentiated based on the use to which the land is put and location.

Rating units which Council officers determine are unable to practically receive the Council service and have an approved alternative service will not be charged the rate. The Council maps “Refuse Map Incl Clive Whakatu”, “Refuse Map incl Hastings”, “Refuse Map Incl Haumoana Te Awanga” and “Refuse Map Incl Whirinaki” set out the serviced areas.

Residential rating units currently receive a weekly collection. Commercial rating units located within the Hastings area as defined on Council Map “Hastings CBD Targeted Rate Map”, and located within the Havelock North area as defined on Council Map “Havelock North CBD Upgrades Map” currently receive a twice weekly collection.

The rates for the 2024/25 year are:

WAIMARAMA REFUSE A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002, on each separately used or inhabited part of a rating unit located within Waimarama as defined on Council Map “Waimarama Refuse Collection”, and based on the provision or availability to the land of the service provided, of $170 per separately used or inhabited part of the rating unit.

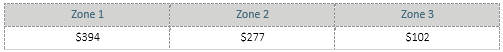

WAIMARAMA SEA WALL A targeted rate set and assessed in accordance with Section 16 of the Local Government (Rating) Act 2002 on a differential basis, on each separately used or inhabited part of a rating unit within each individual zone defined on Council Map “Waimarama Sea Wall Map Zones 1-3” of the following amounts per separately used or inhabited part of the rating unit:

Zone 1 shall pay 67% of the cost to be funded, whilst Zone 2 shall pay 23% of the cost and Zone 3 10% of the cost, based on the extent of the provision of service.

DUE DATES AND PENALTY DATES

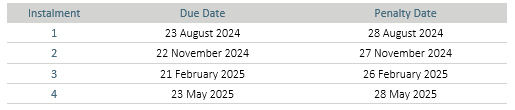

Due Dates for Payment and Penalty Dates (for Rates other than Water by Meter Rates):

The Council sets the following due dates for payment of rates (other than Water by Meter) and authorises the addition of penalties to rates not paid on or by the due date, as follows:

Rates will be assessed in quarterly instalments for an equal amount and are payable on the due dates below:

A penalty of 10% will be added to any portion of rates (except for Water by Meter) assessed in the current year which remains unpaid after the relevant instalment due date, on the respective penalty date above.

Arrears Penalties on Unpaid Rates from Previous Years

Any portion of rates assessed in previous years (including previously applied penalties) which are unpaid on 05 July 2024 will have a further 10% added, to be added on 8 July 2024, and if still unpaid, again on 08 January 2025.

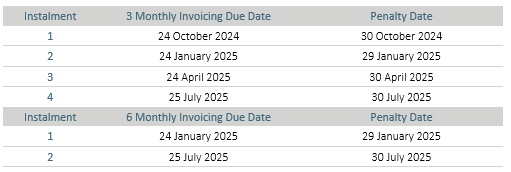

Due Dates for Payment and Penalty Dates (for Water by Meter Rates):

For those properties that have a metered water supply, invoices will be issued either three-monthly or six-monthly. The due dates for both options are set out in the following table:

A penalty of 10% will be added to any portion of rates for water supplied by meter, which remains unpaid after the relevant instalment due date, on the respective penalty date above.

With the reasons for this decision being: The Council is required to collect funds from rates on properties to undertake the functions outlined in the 2024/34 Long Term Plan. |

Councillor Buddo left the meeting at 3.00pm.

16. Minor Items - Ngā Take Iti

There were no additional business items.

17. Urgent Items - Ngā Take Whakahihiri

Item of Business not on the Agenda, which cannot be delayed. The discussion of this item could not be delayed until a subsequent meeting. The meeting had to resolve to deal with the item. (Standing Orders 9.12 refers).

|

|

|

|

|

Mayor Hazlehurst/Councillor Fowler That Council resolve to deal with the Item of Business not on the Agenda, which cannot be delayed. CARRIED |

|

Recommendation to Exclude the Public from Items 19, 20, 21, 22, 23, 24 and 25 |

||||||||||||||||||||||||||||

|

|

SECTION 48, LOCAL GOVERNMENT OFFICIAL INFORMATION AND MEETINGS ACT 1987 |

|||||||||||||||||||||||||||

|

|

Councillor Apatu/Councillor Schollum THAT the public now be excluded from the following parts of the meeting, namely; 19 Civic Honours Nominations 2024 20 Proposal to lease Property 21 305 Heretaunga Street East 22 Kererū Gorge Culvert Replacement - Procurement Methodology 23 Appointment of Independent Chair to Risk and Assurance Committee 24 Flaxmere Commercial Transaction 25 Appointments to

Cyclone Gabrielle Recovery Road Infrastructure Works Suppliers Panel &

The general subject of the matter to be considered while the public is excluded, the reason for passing this Resolution in relation to the matter and the specific grounds under Section 48 (1) of the Local Government Official Information and Meetings Act 1987 for the passing of this Resolution is as follows:

|

________________________

The meeting closed at 6.39pm

Confirmed:

Chairman:

Date: