Kaupapataka

Agenda

|

Te Rā Hui:

Meeting date:

|

Thursday, 8 August 2024

|

|

Te Wā:

Time:

|

1.00pm

|

|

Te Wāhi:

Venue:

|

Council Chamber

Ground Floor

Civic Administration

Building

Lyndon Road East

Hastings

|

|

Te Hoapā:

Contact:

|

Democracy

and Governance Services

P: 06 871 5000

| E: democracy@hdc.govt.nz

|

|

Te Āpiha Matua:

Responsible Officer:

|

Chief Executive - Nigel Bickle

|

Kaupapataka

Agenda

|

Mematanga:

Membership:

|

Tiamana

Chair: Mayor Sandra Hazlehurst

Ngā KaiKaunihera

Councillors: Ana Apatu,

Marcus Buddo, Alwyn Corban, Malcolm Dixon, Michael Fowler, Damon Harvey, Henry

Heke, Kellie Jessup, Tania Kerr (Deputy Mayor), Eileen Lawson, Hana

Montaperto-Hendry, Simon Nixon, Wendy Schollum, Heather Te Au-Skipworth and Kevin

Watkins

|

|

Tokamatua:

Quorum:

|

8 members

|

|

Apiha Matua

Officer Responsible:

|

Chief Executive – Nigel

Bickle

|

|

Te Rōpū Manapori me te Kāwanatanga

Democracy and Governance Services:

|

Louise Stettner (Extn 5543)

|

Te Rārangi Take

Order of Business

|

1.0

|

Opening

Prayer – Karakia

Whakatūwheratanga

|

|

|

2.0

|

Apologies

& Leave of Absence – Ngā Whakapāhatanga me te Wehenga ā-Hui

At the

close of the agenda no apologies had been received.

Leave of Absences

had previously been granted to Councillor Te Au-Skipworth and Councillor

Jessup

|

|

|

3.0

|

Conflict

of Interest –

He Ngākau Kōnatunatu

Members need to be vigilant to stand aside from

decision-making when a conflict arises between their role as a Member of the

Council and any private or other external interest they might have.

This note is provided as a reminder to Members to scan the agenda and assess

their own private interests and identify where they may have a pecuniary or

other conflict of interest, or where there may be perceptions of conflict of

interest.

If a Member feels they do have a conflict of

interest, they should publicly declare that at the start of the relevant item

of business and withdraw from participating in the meeting. If a Member

thinks they may have a conflict of interest, they can seek advice from

the General Counsel or the Manager: Democracy and Governance (preferably

before the meeting).

It is noted that while Members can seek advice and

discuss these matters, the final decision as to whether a conflict exists

rests with the member.

|

|

|

4.0

|

Confirmation

of Minutes –

Te Whakamana i Ngā Miniti

Minutes of the

Council Meeting held Thursday 23 May 2024.

(Previously circulated)

Minutes of the

Council Meeting held Tuesday 28 May 2024.

(Previously circulated)

Minutes of the

Council Meeting held Thursday 27 June 2024.

(Previously circulated)

|

|

|

5.0

|

Mayor's

Verbal Update

|

9

|

|

6.0

|

Petition

- To review rent increases of Senior Housing complexes at Tui Vale and

Kererū Heights

|

11

|

|

7.0

|

Petition

- To Install Speed Bumps on Cornwall Road, Hastings

|

13

|

|

8.0

|

Arts Inc.

Heretaunga Business Plan - Hawke's Bay Arts Festival

Attachment 2 to this report is

confidential in accordance with the Local Government Official Information and

Meetings Act 1987 Section 7 (2) (h) - The withholding of the information is necessary

to enable the local authority to carry out, without prejudice or

disadvantage, commercial activities.

Attachment 3 to this report is confidential in accordance with

the Local Government Official Information and Meetings Act 1987 Section 7 (2)

(h) - The withholding of the information is necessary to enable the local

authority to carry out, without prejudice or disadvantage, commercial

activities.

|

15

|

|

9.0

|

Parking

Controls

|

23

|

|

10.0

|

Alcohol

Licensing Fees Bylaw 2024

|

27

|

|

11.0

|

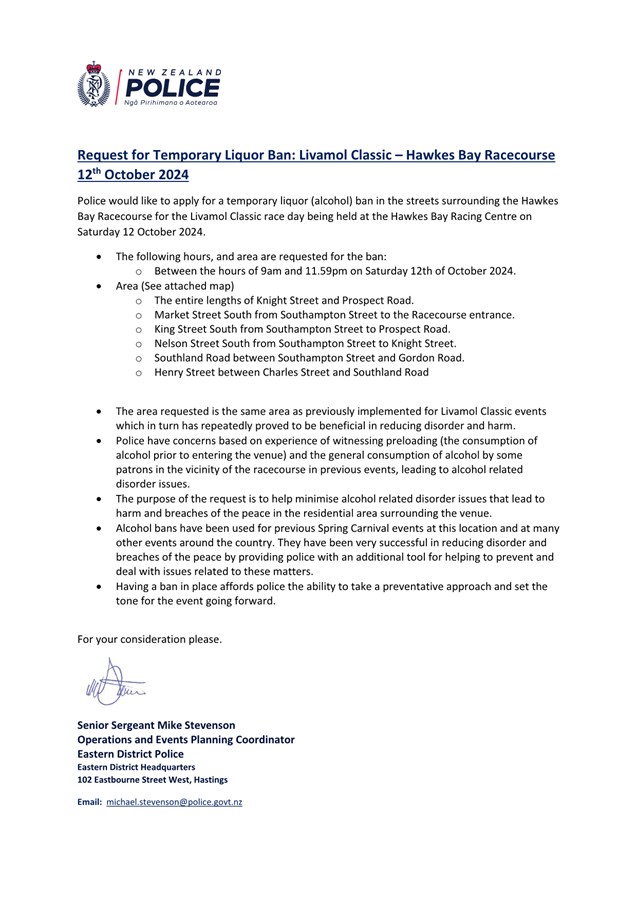

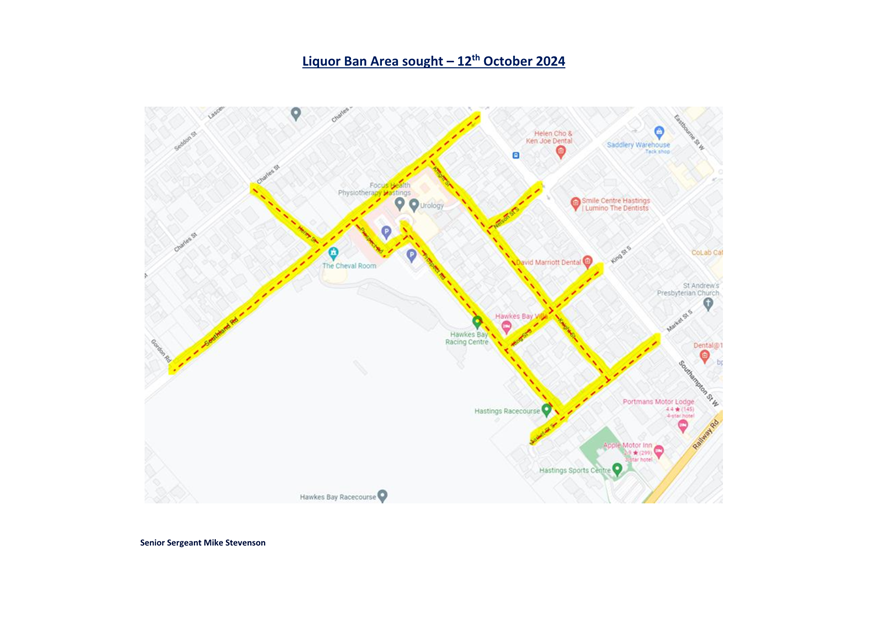

Application

for a Temporary Alcohol Ban

|

39

|

|

12.0

|

Adoption

of the Class 4 Venue Policy and TAB Venue Policy

|

45

|

|

13.0

|

Clifton

to Tangoio Coastal Hazards Joint Committee Meeting Summary

|

53

|

|

14.0

|

Amendments

to Schedule of Appointments to Committees, Subcommittees, Joint Committees

and External Organisations

|

55

|

|

15.0

|

Changes

to the Terms of Reference for the Risk and Assurance Committee and the

Schedule of Appointments to Committees, Subcommittees (2022-2025)

|

57

|

|

16.0

|

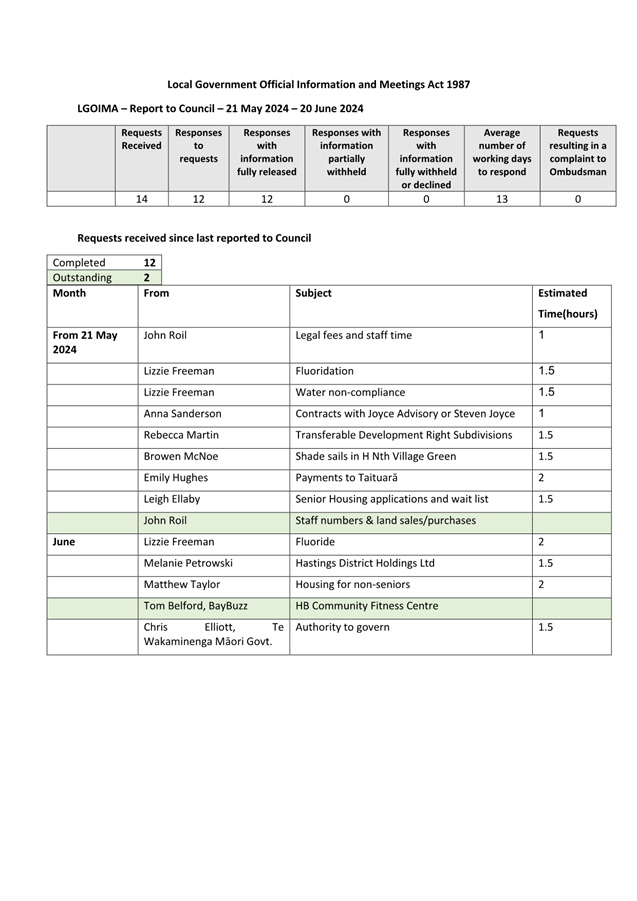

Requests

Received Under The Local Government Official Information and Meetings Act

1987 (LGOIMA) Update

|

61

|

|

17.0

|

Proposed

Amendments To Schedule Of Meetings

|

65

|

|

18.0

|

Minor Items

– Ngā Take

Iti

|

|

|

19.0

|

Urgent

Items –

Ngā Take Whakahihiri

|

|

|

20.0

|

Recommendation

to Exclude the Public from Items 21, 22, 23 and 24

|

67

|

|

21.0

|

Tender

Report for sale, development and partial leaseback of 300 Lyndon Road

|

|

|

22.0

|

Matapiro

Bridge Replacement - Stage 2 Award

|

|

|

23.0

|

Property

Agreements – Cyclone recovery works

|

|

|

24.0

|

CE

Performance Review and Planning

(Supplementary

agenda to be circulated separately)

|

|

Hastings

District Council: Council Meeting

Te Rārangi Take

Report to Council

|

Nā:

From:

|

Sandra Hazlehurst, Mayor

|

|

Te Take:

Subject:

|

Mayor's Verbal Update

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The

purpose of this Report is to provide the opportunity for a verbal update

from the Hastings District Council Mayor regarding current activities and

events.

|

2.0 Recommendations -

Ngā Tūtohunga

That Council receive the Report titled Mayor's Verbal

Update dated 8 August 2024.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Council Meeting

Te Rārangi Take

Report to Council

|

Nā:

From:

|

Louise Stettner,

Manager, Democracy & Governance Services

|

|

Te Take:

Subject:

|

Petition - To review

rent increases of Senior Housing complexes at Tui Vale and Kererū

Heights

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The

purpose of this Report is to inform the Council about a petition received from

lead petitioner Ms Sally Maoate on 17 April 2024. The petition will be

tabled at the meeting.

1.2 The

delay of this petition being presented to the Council has come about due to

some delays in being able to communicate with the lead petitioner.

1.3 The petitioner’s

prayer reads as follows:

1.4 “We the

residents of Kererū Height – petition the assistance of the HDC to

review the recent January 2024 rent increases.”

1.5 There are 23

signatories to the petition.

1.6 The lead petitioner

has advised that Mr Bruce Kellet; a tenant of Tui Vale will present the

Petition to the Council.

2.0 Background

2.1 Council has been

providing affordable and safe housing for eligible senior citizens for

over 60 years.

2.2 Council

owns and operates nine senior housing complexes comprised of 220

individual units located in Hastings, Flaxmere and Havelock North. The senior

housing portfolio consists of exclusively one-bedroom units, 175 of which are

single units and 45 of which are double units.

2.3 On

26 October 2023, Council adopted the Senior Housing Operational Management

Policy (Policy). The purpose of this Policy is to ensure the senior housing

portfolio is allocated according to need, remains affordable for tenants, and

is managed in a financially sustainable manner to support positive outcomes for

tenants, communities, and Council.

2.4 The Policy is due to

be reviewed in October 2024. The Review will include a market valuation

of the portfolio and subsequent rent setting proposal for Council to consider.

2.5 Officers

from Councils, Community Development Team have attended two meetings with

tenants of Kererū Heights and Tui Vale to try and address their

concerns. Officers continue to work with these tenants.

|

3.0 Recommendations -

Ngā Tūtohunga

A) That

Council receive the report titled Petition - To review rent increases of

Senior Housing complexes at Tui Vale and Kererū Heights dated 8 August

2024.

B) That

the tabled Petition be received.

C) That

the Council notes the Senior Housing Operational Management Policy is due to

be reviewed in October 2024.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Council Meeting

Te Rārangi Take

Report to Council

|

Nā:

From:

|

Louise Stettner,

Manager, Democracy & Governance Services

Bruce Conaghan,

Transportation Policy and Planning Manager

|

|

Te Take:

Subject:

|

Petition - To Install

Speed Bumps on Cornwall Road, Hastings

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this report

is to inform the Council about a petition received on the 12th of

February 2024 from lead petitioner Mr David Mardon. The petition will be

tabled at the meeting.

1.2 The petitioner’s

prayer reads as follows:

‘For

years now, drivers, especially the boy racer type, have been speeding down

Cornwall Road, Hastings.

This road is classified as a residential road, with restricted entrances and

exits to limit its use. However, this has not reduced the number of

drivers using the road or the speeds they travel, instead

it has become a bypass to avoid the Tōmoana-Frederick streetlights

intersection.

Cornwall

Park is a popular and well utilised park by many groups of people including

families, the elderly, dog

walkers and sports players etc. Due to this there is a high amount of

foot traffic that crosses

and is around Cornwall Road. Many elderly residents also live on Cornwall

Road and walk around the area. Therefore, when cars travel at high

speeds down this busy road, they are putting many

lives in danger.

We

the below residents and users of the park believe that the best way to keep

people safe and reduce

cars being able to drive at dangerous, high-speeds is to install speed bumps

down Cornwall Road, thus reducing

the risk of someone being killed or severely injured.’

1.3 There are 39

signatories to the petition.

1.4 Mr Mardon has

indicated that he wishes to present his petition to the Council.

1.5 Since

the petition was lodged, officers have undertaken initial investigation

into the matters raised in this petition. This investigation

included undertaking a traffic and speed survey count over the period of 2 June

to 9 June 2024, and a review of the crash history for the 2019 to 2023

period.

1.6 The

traffic and speed survey count noted that the 85%ile speed is

approximately 53 km/h which is in the range of speeds on a road

classed as a secondary collector classification in the Hastings District

Roading Hierarchy.

1.7 From

the review of the crash history, there had been three reported non-injury

crashes all during nighttime hours along Cornwall Road , and two reported

crashes (one serious and one minor) at the Nelson Street North and Cornwall

Road intersection. None of these five reported crashes involved speed as

a causal factor.

1.8 Considering

the urban environment and function of Cornwall Road in the road network,

officers recommend further work is undertaken to identify appropriate solutions

to manage consistent vehicle speed compliance and general driver behaviour.

1.9 The

report concludes by recommending that the petition be received, and that

further investigation be undertaken to identify appropriate solutions to manage

speeds on Cornwall Road.

|

2.0 Recommendations -

Ngā Tūtohunga

A) That

Council receive the Report titled Petition - To Install Speed Bumps on

Cornwall Road, Hastings dated 8 August 2024.

B) That

the tabled Petition “To Install Speed Bumps on Cornwall Road,

Hastings” be received.

C) Council

notes that Council officers have investigated the concerns raised in the

petition and found average vehicle speeds to be compliant for the class

of road within the Hastings District Roading Hierarchy.

D) Considering

the urban environment and function of Cornwall Road in the road network,

officers recommend further work is undertaken to identify appropriate

solutions to manage consistent vehicle speed compliance and general driver

behaviour.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Council Meeting

Te Rārangi Take

Report to Council

|

Nā:

From:

|

Naomi Fergusson, Group

Manager: Marketing & Communications

|

|

Te Take:

Subject:

|

Arts Inc. Heretaunga

Business Plan - Hawke's Bay Arts Festival

|

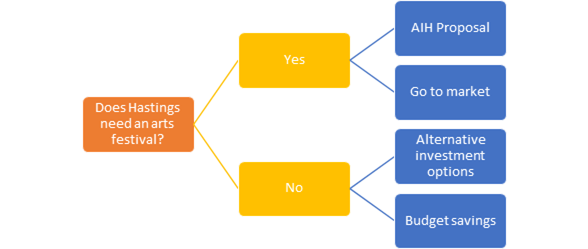

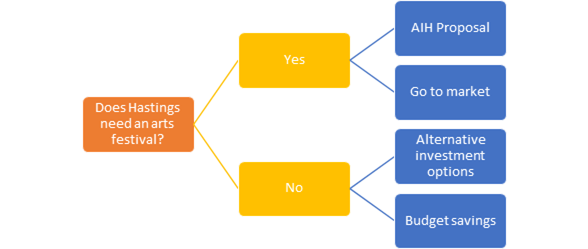

1.0 Executive Summary – Te Kaupapa Me

Te Whakarāpopototanga

1.1 The

purpose of this report is to consider a decision relating to a funding

application by Arts Inc. Heretaunga (AIH) for the Hawke’s Bay Arts

Festival (Festival).

1.2 In

making the recommendation, the Report steps through consideration of three

high-level decisions for Council, being:

· Should Council

fund an art festival?

· AIH's proposal for

a biennial Hawke’s Bay Arts Festival – does it positively support

the potential benefits through its event offering?

· If Council does

not support the proposal, what are the alternative investment options for the

$120,000 provided for in the Events Budget 2024-2027?

1.3 Based on the

discussion relating to 1.2, this Report addresses Council Resolution E in

respect of Agenda Item 7 ‘Funding - Arts Inc. Heretaunga’ (AIH)

which requires the provision of a Business Plan from AIH detailing

the events programme and expected outcomes of the Hawke’s Bay Arts

Festival . (Council Meeting on 23 May 2025).

Agenda Item 7: Funding – Arts Inc. Heretaunga

E) Council notes that the

$120,000 primarily allocated to support delivery of the Arts Festival (annual

allocation for 3 years with a whole of contract commitment of $360,000) in

Recommendation B for delivery of events, is subject to Council approval of a

Business Plan which details the events programme and expected outcomes. A

future Council decision may amend the $120,000 funding allocation. This Council

approval will inform the Chief Executives delegation in Recommendation C).

1.4 The

Council Report from 23 May 2024 (referred to in 1.3) is attached as (Attachment

1) to provide background and context for this Report.

1.5 AIH

have provided business plan documentation that is attached as (Attachment 2)

and the Hawke’s Bay Arts Festival business case (Attachment 3).

1.6 Councillor

agenda discussion on 23 May 2024 reflected concerns about the 3-year funding

quantum commitment of $360,000, the associated risks of fiscal sustainability

of AIH and the quantity/quality of Festival events to be delivered given the

main event would reduce from annual to biannual delivery.

1.7 The

report concludes by recommending that the Council approve the business plan for

the Hawke’s Bay Arts Festival and fund the festival with $60,000 per

annum for two years from the events budget (total contract value of $120,000).

|

2.0 Recommendations -

Ngā Tūtohunga

A) That Council

receive the report titled Arts Inc. Heretaunga Business Plan - Hawke's Bay

Arts Festival dated 8 August 2024.

B) That

Council notes it’s resolution from the Council Meeting held on 23 May

2024, in respect of Agenda Item 7 ‘Funding - Arts Inc.

Heretaunga’ (AIH) namely - Council notes that the $120,000 primarily

allocated to support delivery of the Arts Festival (annual allocation for 3

years with a whole of contract commitment of $360,000) in Recommendation B

for delivery of events, is subject to Council approval of a Business Plan

which details the events programme and expected outcomes. A future Council

decision may amend the $120,000 funding allocation. This Council approval

will inform the Chief Executives delegation in Recommendation C).

C) That Council approve the AIH Business Plan

detailing the events programme and expected outcomes of the Hawke’s Bay

Arts Festival. (Attached as Attachment 3).

D) That

Council approves a grant of $60,000 annually for two financial years (2024/25

to 2025/2026 from the Events budget) to support the delivery of the biennial

Hawke’s Bay Arts Festival.

E) That

Council delegate and direct the Chief Executive to execute a Contract for

Service between Council and AIH, which addresses Section 17A (5) of the Local

Government Act 2002 relating to Council funding. This Contract will have

clear milestones and performance measures for the Festival with associated

phased disbursement of funds. Subject to adherence to Contract Dispute

Resolution processes, Council will be able to cancel the Contract for

non-achievement of milestones, thus mitigating any future funding risks.

F) That

Council notes the Chief Executive will ensure Council Officers actively

manage the Contract for Service in Recommendation E to protect Council

interests and help ensure AIH sustainability and delivery of sought after

Festival outcomes.

|

3.0 Background

3.1 Refer Sections 3 and 4

of Attachment 1.

4.0 Discussion

4.1 The

purpose of local government is set out under the Local Government Act 2002, S10

(1) (b) as ‘to promote the social, economic, environmental, and cultural

well-being of communities in the present and for the future’.

4.2 To

contribute to social and cultural well-being, the Council supports creative

arts through rates-funded contributions to the operation of arts-focused

council facilities (Toitoi, Hastings City Art Gallery) and via the Community

Grants, City Centre Vibrancy Fund, Events Fund and through administration

of the Creative NZ Creative Communities Scheme.

4.3 This section of the

Report addresses the three key questions relating to the funding of the

Festival.

· Should

Council fund an arts festival, based on the potential benefits to the

community?

· If

the Council believes in supporting an arts festival and associated benefits,

does AIH's proposal satisfy the Council that the desired benefits can be

achieved through its event offering?

· If

Council does not believe an arts festival provides additional benefits to

Hastings District, what alternative options are there for the $120,000 that

would be unallocated from the Events Budget 2024-2027?

4.4 Benefits of arts

festivals

4.4.1 The proposal for

the establishment of the Hawke’s Bay Arts Festival was put forward by

Creative Hastings (now Arts Inc. Heretaunga) in 2015 following the closure of

the Hawke’s Bay Opera House due to its assessment as an earthquake-prone

building.

4.4.2 Council supported

the 2015 Festival with $85,000 grant funding from the Hawke’s Bay Opera

House operational budget, a $50,000 underwrite and in-kind support from other Council

operational budgets, in particular the marketing and events budgets. In

recent years, the funding has been $120,000 per year for an annual festival

event, which was initially driven by the cost of hiring the Spiegel Tent and

other costs to create an event venue when the Opera House closed.

4.4.3 The Hawke’s

Bay Opera House was re-opened in 2020 as Toitoi – Hawke’s Bay Arts

and Events Centre. The festival has continued to run, at the same funding

level, utilising Toitoi and other venues within the region. The last festival

generated approx. $40,000 in venue hire revenue for Toitoi.

4.4.4 Festivals have

become an integral part of cultural, social, and economic landscapes in many

cities in New Zealand and around the world. For Hastings, the Hawke’s Bay

Arts Festival provides numerous benefits as below:

4.4.5 In terms of

strategic alignment, The Hawke’s Bay Arts Festival aligns with:

· The

programming strategy and objectives of Toitoi Hawke’s Bay Arts &

Events Centre,

· The

Toi-Tū, the regional strategic framework for supporting creatives and

creativity in Hawke’s Bay, and

· The

Council Event Strategy objectives of celebrating culture & heritage,

enhancing civic pride and fostering health and wellbeing. It also

meets the favourable consideration factors or being in the shoulder season and

taking place in a Council owned venue.

4.5 Cultural

and social benefits are a ‘public good’ and intrinsic, relying on

qualitative data. For that reason, benefits are not easily measurable in terms

of a return on investment. A review of journal articles shows a consistent

theme of arts festivals providing a positive impact on cultural and social

wellbeing, particularly perceptions of quality of life, with the impact varying

based on the nature of the festival (tourism or community-centric, programming,

etc).

4.6 Depending

on programming, some examples of benefits may include:

- Showcasing

local talent: providing a platform for local artists, musicians, and

performers, enriching cultural capability, supporting representation,

supporting employment pathways in creative arts, and fostering community pride

in Hastings' unique cultural heritage.

- Community

engagement: Festivals create opportunities for social interaction,

fostering a sense of belonging and community cohesion. They also encourage

volunteerism and civic engagement.

- Cultural

identity: The festival enhances the city's cultural identity, positioning

Hastings as a vibrant and culturally rich destination to live, work and visit.

4.7 Festivals

can contribute economic benefits when promoted as a visitor experience to

markets outside of the host region. To date, the Hawke’s Bay Arts

Festival has focused promotion to Hawke’s Bay audiences, including

accessible programming for schools.

- Local

economy stimulation: Festivals can boost local spending on services, goods,

and hospitality, supporting employment in the creative arts and events

industries. The Event Economics report from Hawke’s Bay Arts Festival

2022 showed a negative real change in GDP of—$24,624. It should be noted

the event made a loss of -$120,000 while also delivering many free and low-cost

events in a ‘post-COVID’ environment.

- Tourism:

Attracting visitors from outside the region increases occupancy rates in local

accommodations, boosts restaurant business, and increases retail sales. This

has not previously been a focus for the Festival, but events with a significant

offering and effective promotion to target domestic visitor markets can lift

occupancy rates.

- Reputation

and visibility: A successful festival can be leveraged to achieve positive

media attention, enhancing Hastings' reputation and visibility as a cultural

hub. This aligns with Councils positioning of Hastings.

4.7.1 Many regions with

a performing arts venue also host arts festivals. While venues provide access

to the arts year-round, there are synergies between venues and festivals that

align with Toitoi:

- Complementary

roles: The festival provides variety and excitement at specific times,

while Toitoi ensures continuous access to the arts. This combination broadens

the overall audience for the arts. Toitoi also has extensive knowledge of local

preferences to support development of a programme that will appeal to audience

preferences while providing for exposure for, and testing of, new offerings.

- Enhanced

offerings: There are synergies between festival programming and Toitoi

programming that enhance the city's cultural offerings. Toitoi has a

programming strategy that is supported through hosting festival events. Toitoi

has a very limited budget for booking events of festival quality and uses a

profit-share model. Without a festival, Toitoi programming would reduce and/or

require a higher risk tolerance for booking more shows directly. Arts

festivals also enable Toitoi to use spaces in different ways, supporting a

dynamic audience experience within the premises.

- Collective

impact: A shared vision and collective impact approach can increase

credibility, leverage funding, and demonstrate the impact of both the festival

and Toitoi.

4.7.2 Aligning the

Hawke’s Bay Arts Festival with Toitoi can also enhance the venue's

benefits for the community, making Hastings a dynamic and culturally vibrant

destination. The Festival further enriches our local community and can enhance

the perceived quality of life. A new focus on visitor attraction could

also support sustained growth and event development.

4.7.3 A review of the

Festival recommended a range of changes, the most significant being the move to

a Biennial Festival, with the key benefits being:

- High-quality

programs: More time for planning allows for better curation, attracting

notable artists and ensuring a well-thought-out theme or concept.

- Resource

allocation: Biennial scheduling allows better allocation of financial,

human, and logistical resources, leading to a more sustainable event.

- Economic

impact: A biennial festival can create a more significant economic boost

during the festival period, benefiting local businesses more intensely.

- Inclusivity

and Sustainability: Greater involvement of local community groups and

sustainable practices can be planned and implemented.

4.7.4 As a regional example

the Dunedin Arts Festival, a biennial event, showcases the potential of such

festivals in small cities. It attracts national and international shows,

benefits from a diverse funding base, and supports local economic growth by

hiring local contractors and promoting local businesses. Dunedin City Council

has contributed around $60,000 per annum over the last four years (down to

$56,000 in 2023) under their Premier Events fund. This represents approx. 13

per cent of festival revenue.

4.8 Arts Inc.

Heretaunga Proposal – The Hawke’s Bay Arts Festival

4.8.1 AIH

provided its business case (Attachment 3) for the continued funding of

$120,000 per annum for a biennial Hawke’s Bay Arts Festival, as required

by Resolution E from Council Agenda Item 7, from the Council Meeting held on 23

May 2024.

4.8.2 Councillor agenda

discussion on 23 May 2024, reflected concerns about the 3-year funding quantum

commitment of $360,000, the associated risks of fiscal sustainability of AIH

and the quantity/quality of Festival events to be delivered. This was based on

a period of change which includes the move from annual to the biannual event,

compounding economic impacts (COVID-19, Cyclone Gabrielle, inflation), and a

change in management. AIH’s proposal includes information to address

these concerns and provide Council with confidence for continued investment.

4.8.3 While AIH has

requested the continuation of the current funding level of $120,000 per annum,

Resolution E states that a future Council decision may amend the $120,000

funding allocation.

4.8.4 Council’s

investment of $120,000 per annum in the festival represents less than 25 per

cent of the total cost of the event. The core funding from Council enables AIH

to leverage sponsorship and grants (along with ticket sales and concessions

revenue) to cover the full costs.

4.8.5 Council is a core

funder of AIH who relies on the total Council funding of $344,000 to provide a

range of activities benefiting community wellbeing. A reduction in the

total funding package may impact on other outcomes funded through Council

grants. AIH’s business plan (Attachment 2) provides an overview of its

full revenue model.

4.8.6 Due to Councils

three-year Long-Term Plan (LTP) cycle with the biennial festival cycle, the

multi-year grant will deliver one festival in this LTP (with smaller

activations in the two off-years), and, pending continued funding, two

festivals (with smaller activations in the one year between).

4.8.7 The funding

agreement term could be amended to align with the festival cycle (2-year or

4-year term). This would allow contract management to align with post-event

reviews. However, the negative outcome is that future funding decisions would

be out of step with the broader event funding allocation decisions, which feeds

into the LTP budget cycle.

4.8.8 Risks relating to

non-performance can be managed through the Contract milestones (subject to

adherence to Contract Dispute Resolution processes). Council could cancel the Contract

for non-achievement of milestones, thus mitigating any future funding risks.

4.8.9 Given the context

of Council’s fiscal position, the change to a biennial festival, an

initial 2-year term would enable the Festival to run one full cycle, at which

point both parties can review outcomes and learnings, refining any future

funding agreement to reflect any learnings. Subsequent terms can then align

with LTP cycles (e.g. a 4-year agreement starting 2026/2027 will realign with

LTP going forward).

4.9 Alternatives opportunities

for budget allocation

4.9.1 As an alternative to funding an arts

festival, the set-aside funds may be fully or partially reallocated across one

or more investment areas, aligned to the Events Strategy and/or other Council

outcomes set out in the LTP. Alternatively, they may be re-absorbed as budget

savings. Examples include but are not limited to:

· Funding

for significant events of strategic value (visitor attraction, economic

activity, community wellbeing).

- Regional

events fund, for general event attraction across a range of venues.

- Attracting

large-scale events to Tōmoana Showgrounds (e.g. music concerts, festivals,

expos).

- Go

to the market for event proposals (with the option to weight for desired

benefits, which may include social and cultural well-being and/or economic

outcomes).

· Resume

Contestable Community Events Fund

- Re-establishment

of Contestable Community Events Fund (closed in 2023 due to funding

restrictions)

· Increase

investment in urban centre vibrancy.

- Increase

city centre activations fund – events in Hastings, Havelock North and

Flaxmere to support vibrancy and economic activity throughout the year.

- Increase

vibrancy fund – increase funds for installation art and projection art.

- Activation

budget for Council-owned or affiliated venues within the city centre

(Angle’s Gym, Waiaroha as examples).

· Reinvest

in Toitoi programming and activation.

- Increase

programming budget.

- Fund

more free community arts activations.

· Asset

investment

- Permanent

stage for Tōmoana Showgrounds (supporting future event attraction, hireage

of the venue and associated benefits)

- Replacement

of temporary stage used for small events (at end of life – no funding to

replace)

· Budget

savings

- The

events budget is reduced by $120,000 as an operational saving. As the Council

is borrowing for operational costs, this reduction in spending would align with

the Financial Strategy.

5.0 Options –

Ngā Kōwhiringa

Option One - Recommended Option - Te Kōwhiringa

Tuatahi – Te Kōwhiringa Tūtohunga

5.1 That

Council approve the AIH Business Plan for the Hawke’s Bay Arts Festival

and releases Council-approved funding at the reduced amount of $60,000 per

annum for two years ($120,000 across 2024 to 2026). A Contract for Service will

be enacted to satisfy the requirements of Section 17A of the Local Government

Act 2002.

Advantages

· Provides

annual funding in support of the Hawke’s Bay Arts Festival.

· Enables

AIH to unlock other external funding critical to achieve revenue targets.

· Opportunity

to realign funding level following the re-opening of Toitoi.

· Provides

Council with options relating to the balance of funds as per 4.9.1, including

budget savings or driving alternative outcomes through reinvestment.

· Given

the scale and frequency of the AIH event proposal, $60,000 per annum is a more

appropriate level of funding, providing AIH with critical seed funding while

increasing accountability on AIH to secure more external funding or right-size

the event.

· Two-year

initial contract for first ‘cycle’ enables refinement of any future

funding agreement based on event/contract KPI review.

Disadvantages

· The

business plan presented by AIH may result in a diminished offering or not

be delivered at all due to the reduction in funding, resulting in a reduction

in benefit.

· The

reduction in funding may impact wider AIH activities beyond the festival (and

thus impact outcomes sought through the other funding agreements between

Council and AIH).

· Potential

reduction in community outcomes relating to social and cultural wellbeing,

either due to reduced Festival offering/AIH activities and/or reduced events

investment.

Option Two – Alternative -

Te Kōwhiringa Tuarua – Te Āhuatanga o nāianei

5.2 That

Council approve the AIH Business Plan for the Hawke’s Bay Arts Festival

and releases Council-approved funding of $120,000 per annum for three years

(2024 to 2027). A Contract for Service will be enacted to satisfy the

requirements of Section 17A of the Local Government Act 2002.

Advantages

· Provides

annual funding in support of the Hawke’s Bay Arts Festival.

· Aligns

funding with AIH budgets provided in the business plan.

Disadvantages

· Council

will not have funding for the alternative options set out under 4.9.1, including

budget savings.

Option Three

– Alternative - Te Kōwhiringa Tuarua – Te Āhuatanga o

nāianei

5.3 That

Council does not approve the AIH Business Plan detailing the events programme

and expected outcomes of the Hawke’s Bay Arts Festival, and declines the

request for funding.

Advantages

· Provides

Council with options relating to the balance of funds as per 4.9.1, including

budget savings or driving alternative outcomes through reinvestment.

Disadvantages

· No

Hawke’s Bay Arts Festival in 2025.

· Loss

of funding may have a detrimental impact on wider outcomes delivered by Arts

Inc. (including outcomes funded under separate agreements).

· Potential

reduction in community outcomes relating to social and cultural wellbeing.

Attachments:

|

1⇨

|

Funding - Arts Inc. Heretaunga 23 May 2024 Council Report

|

CG-17-1-01068

|

Under Separate Cover

|

|

2

|

Arts Inc. Heretaunga Business Plan(Attachment 2)

Confidential in accordance

with Section 7 (2) (h) of the Local Government Official Information and

Meetings Act 1987

|

CG-17-1-01069

|

Under Separate Cover

|

|

3

|

26724 HBAF Proposal (updated attachment 3)

Confidential in accordance

with Section 7 (2) (h) of the Local Government Official Information and

Meetings Act 1987

|

CG-17-1-01083

|

Under Separate Cover

|

|

4⇨

|

TAFT letter - HBAF

|

CG-17-1-01071

|

Under Separate Cover

|

|

5⇨

|

Letter of Support HBAF Cellar 495

|

CG-17-1-01072

|

Under Separate Cover

|

|

6⇨

|

DAF Letter Of support HBAF

|

CG-17-1-01073

|

Under Separate Cover

|

|

7⇨

|

Support of funding for HBAF(2)

|

CG-17-1-01084

|

Under Separate Cover

|

|

8⇨

|

Letter of support - Richard Brimer (AIH)

|

CG-17-1-01089

|

Under Separate Cover

|

Te

Hui o Te Kaunihera ā-Rohe o Heretaunga

Hastings

District Council: Council Meeting

Te

Rārangi Take

Report to Council

|

Nā:

From:

|

James Haronga, Parking

Transportation Officer

|

|

Te Take:

Subject:

|

Parking Controls

|

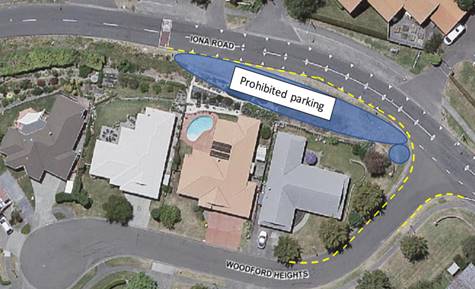

1.0 Executive Summary – Te Kaupapa Me Te

Whakarāpopototanga

1.1 The

purpose of this Report is to obtain a decision from Council regards changes to

parking controls on Karamu Road North and Iona Road.

1.2 This

proposal arises from several requests for changes to existing parking controls

in and around the Hastings District.

1.3 The Report recommends the following changes.

|

ROAD

|

EXISTING CONTROLS

TO BE REMOVED/CHANGED

|

PROPOSED CONTROLS

|

|

Karamu Road North

|

Revoke x2 P60 Carparks

|

x2 P5 Carparks

|

|

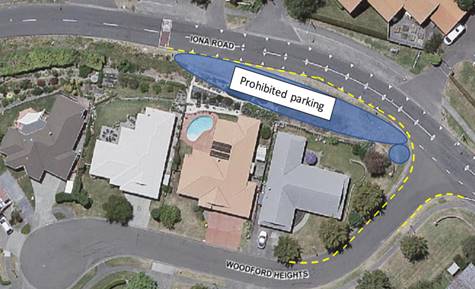

Iona Road

|

None

|

No Parking Zone

|

|

2.0 Recommendations - Ngā Tūtohunga

A) That

Council receive the Report titled Parking Controls dated 8 August 2024.

B) That Council resolve pursuant to Clause 5.3.1(a)(i) of Chapter 5 (Parking and

Traffic) of the Hastings District Council Consolidated Bylaw 2021, that the

two existing P60 parking spaces located 43.25 metres from the intersecting

point of Jervois Street and extending 12.60 metres north on the eastern side

of Karamu Road North be revoked and become P5 parking spaces.

C) That

Council resolve pursuant to Clause 5.3.1(a)(i) of Chapter 5 (Parking and

Traffic) of the Hastings District Council Consolidated Bylaw 2021, that the

grass berm on Iona Road located 2.5 metres from the intersecting point of

Woodford Heights and extending 62.15 metres west on the southern side of Iona

Road become a No Stopping Zone (Prohibited Parking).

|

3.0 Background – Te Horopaki

3.1 From time

to time, it is necessary to introduce parking controls and/or amend those that

are already in place.

3.2 In order

that the changes are legally established and enforceable, a formal resolution

by Council is required.

3.3 The

following information provides the background and current situation relevant to

the changes being proposed.

4.0 Discussion – Te Matapakitanga

4.1 Karamu

Road North – Revoke 2 P60 and change to P5 (Recommendation B)

Streetwise Coffee have relocated from 1004 to 905 Karamu Road North

and requested P5 time limit parking. Currently vehicles are parking in a

P60 zone, making business for Streetwise Coffee more difficult and leaving no

available spaces for potential customers. A P15 was considered but would not

suit the needs of the surrounding business. The change

will encourage traffic turnover allowing the public equal opportunity to gain

access to Streetwise Coffee and other businesses in the area.

4.2 Iona

Road – No Stopping Zone (Prohibited Parking) (Recommendation C)

Currently

residents in Woodford Heights are having issues with vehicles parking on the

grass berm. This is a safety concern for those trying to exit Woodford Heights

safely. There have been several near miss incidents, where vehicles that park

along the grass berm are obstructing the driver’s view of approaching

vehicle’s moving up Iona Road from the left. Another safety concern on

this stretch of road is that it is also located on a bend, creating a blind

corner for motorists.

Officers

recommend that this area becomes a No Stopping Zone (Prohibited Parking).

Yellow No Parking lines have already been established to help traffic move

safely through the area.

5.0 Options – Ngā Kōwhiringa

Option One - Recommended Option - Te Kōwhiringa Tuatahi – Te

Kōwhiringa Tūtohunga

5.1 To

change the Parking Controls to allow the parking arrangements as outlined at

the sites in section 4.

5.2 The

advantages of implementing the changes as recommended include enhanced public

and private sector services provision and better utilisation

of carpark assets.

Option Two – Status Quo - Te Kōwhiringa Tuarua – Te

Āhuatanga o nāianei

5.3 No advantages

are noted.

6.0 Next steps – Te Anga Whakamua

6.1 If

the recommendations are approved, appropriate paint and signage provisions will

be completed or removed.

Attachments:

There are no attachments for this report.

|

Summary of

Considerations - He Whakarāpopoto Whakaarohanga

|

|

Fit

with purpose of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-Rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural wellbeing of communities in the present and for

the future.

Link to the

Council’s Community Outcomes –

Ngā Hononga ki Ngā Putanga ā-Hapori

Moving people and goods around safely and efficiently thereby

enabling economic and social wellbeing.

|

|

Māori

Impact Statement -

Te Tauākī Kaupapa Māori

N/A

|

|

Sustainability

- Te

Toitūtanga

N/A

|

|

Financial

considerations -

Ngā Whakaarohanga Ahumoni

N/A

|

|

Significance

and Engagement -

Te Hiranga me te Tūhonotanga

This decision does not trigger the threshold

of the Significance and Engagement Policy.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto / ā-waho

Karamu Road North – Revoke two P60 and change to

P5

Consultation

was carried out with businesses in the area. Most of

the business in the area were in favour of the time limit change.

Iona Road

– No Stopping Zone (Prohibited Parking)

Consultation

was carried out with two residents of Woodford Heights, acting on behalf of

the other residents. All were in favour of the proposed changes.

|

|

Risks

N/A

|

|

Rural

Community Board –

Te Poari Tuawhenua-ā-Hapori

N/A

|

Te

Hui o Te Kaunihera ā-Rohe o Heretaunga

Hastings

District Council: Council Meeting

Te

Rārangi Take

Report to Council

|

Nā:

From:

|

Janine Green, Licensing

Inspector

|

|

Te Take:

Subject:

|

Alcohol Licensing Fees

Bylaw 2024

|

1.0 Executive Summary – Te Kaupapa Me

Te Whakarāpopototanga

1.1 The

purpose of this report is to seek approval of and adoption of an Alcohol

Licensing Fees Bylaw that allows Council to address a shortfall of forty

percent in revenue ($179,000) in relation to administering alcohol licensing

functions.

1.2 Alcohol

Licensing fees are set in the Sale and Supply of Alcohol (Fees) Regulations

2013 (The Regulations). Currently, The Regulations provide a risk-based fees

framework. Applicants pay an application and annual licensing fee to

legally sell or supply alcohol based on the risk profile of their business.

1.3 The

intent of the regulations is to provide for the total cost recovery of all

alcohol licensing functions of territorial authorities (TA’s). However,

the fees specified in the Regulations are now eleven years old and are not

providing total cost recovery.

1.4 The

Sale and Supply of Alcohol (Fee-setting Bylaws) Order 2013 (Fees Setting

Order), made under Section 405 of the Sale and Supply of Alcohol Act 2012 (SSAA

2012), provides for councils to make a fees bylaw. Fee bylaws offer a

mechanism for councils to have one hundred percent cost recovery for alcohol

licensing functions.

1.5 On

29 May 2024 a report went to the Planning and Bylaws Subcommittee seeking

approval to develop a bylaw increasing the licensing fees to remedy the

$179,000 deficit. The committee considered three options and resolved to

increase the fees by 85% which would result in a 100% cost recovery in year one

(no rate payer contribution) as recommended by Officers. The

Committee report and resolution are attached as Attachment 1.

1.6 The draft bylaw

was consulted on with interested parties as required under the Sale and Supply

of Alcohol Act 2013. The stakeholder feedback was analysed and subsequently

influenced a modified recommendation by officers for the schedule of fees

contained in this report. It is now recommended spreading recovery of the

shortfall over a three-year period (rather than all year one) with 100% cost

recovery by year three (i.e. 35%, 35% and 23% annual fee increases).

|

2.0 Recommendations - Ngā

Tūtohunga

A) That Council receive the

report titled Alcohol Licensing Fees Bylaw 2024 dated 8 August 2024.

B) That

Council notes Officers have satisfied the requirements for consultation as

required under the Sale and Supply of Alcohol Act 2012.

C) That Council approve and

enact The Alcohol Licensing Fees Bylaw 2024 pursuant to the Sale and Supply

of Alcohol (Fee-setting Bylaws) Order 2013, made under Section 405 of the

Sale and Supply of Alcohol Act 2012.

D) That Council approve and

adopt the Alcohol Licencing Fee Schedule. The proposed fee increases seek to

ensure by 2026 Council has full cost recovery for administering alcohol

licensing functions.

|

Application fee / Annual fee for

premises (new and renewal)

|

Current fee under the Act and

Regulations

|

Proposed fee 2024 (35% increase)

|

Proposed fee 2025 (35% increase)

|

Proposed fee 2026

(Approximately 23% increase)

|

|

Application Fee

- Very low risk

|

$368.00

|

$496.80

|

$670.70

|

$823.70

|

|

Application Fee

– Low Risk

|

$609.50

|

$822.80

|

$1110.80

|

$1364.40

|

|

Application Fee

– Medium Risk

|

$816.50

|

$1102.30

|

$1488.10

|

$1827.65

|

|

Application Fee

– High Risk

|

$1023.50

|

$1381.70

|

$1865.30

|

$2291.13

|

|

Application Fee

– Very High Risk

|

$1207.50

|

$1630.10

|

$2200.65

|

$2703.00

|

|

Annual Fee

– Very Low risk

|

$161.00

|

$217.35

|

$293.40

|

$360.30

|

|

Annual Fee

– Low Risk

|

$391.00

|

$527.85

|

$712.60

|

$875.30

|

|

Annual Fee

– Medium Risk

|

$632.50

|

$853.90

|

$1152.65

|

$1415.80

|

|

Annual Fee

– High Risk

|

$1035.00

|

$1397.25

|

$1886.30

|

$2316.80

|

|

Annual Fee

– Very High Risk

|

$1437.50

|

$1940.60

|

$2619.80

|

$3217.88

|

|

Special Licence

Fees

|

|

|

|

|

|

Class One

|

$575.00

|

$776.25

|

$1047.95

|

$1287.12

|

|

Class Two

|

$207.00

|

$279.45

|

$377.25

|

$463.40

|

|

Class Three

|

$63.25

|

$85.40

|

$115.30

|

$141.60

|

|

Temporary

licence types

|

|

|

|

|

|

Temporary

Authority

|

$296.70

|

$400.55

|

$540.75

|

$664.20

|

|

Temporary

Licence

|

$296.70

|

$400.55

|

$540.75

|

$664.20

|

|

Variation of

licence

|

$368.00

|

$496.80

|

$670.70

|

$823.60

|

|

Other Fee

|

|

|

|

|

|

Public

Notification via council website (instead of public newspaper)

|

$160 per

ad – newspaper

|

$50.00

|

$50.00

|

$50.00

|

E) That the Alcohol

Fees Bylaw be enacted by Council on 9 September 2024.

|

3.0 Background

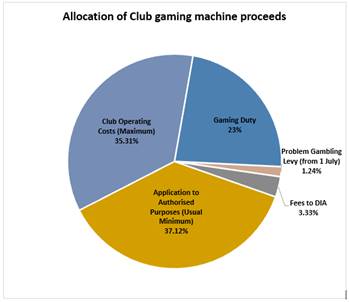

3.1 Regulations

and Risk Based Fee Structure

3.2 Currently,

The Sale and Supply of Alcohol (Fees) Regulations 2013 (the Regulations)

provides a risk-based fees framework. The risk categories and structure within

The Regulations cannot be altered by the bylaw.

3.3 A

risk-based weighting is attributed to each licence based on the type of

premises, the licensed hours and the number of enforcement holdings that have

been issued to the licence holder. The risk categories vary from very low

through to very high reflecting the potential harm to the community. The lower

the weighting/risk rating, the lower the fee category. For example, a bottle

store with limited hours would be a medium risk premises, a restaurant would be

medium risk, a late-night bar would be a high-risk premises and a small cellar

door would be very low risk.

3.4 Applicants

pay an application and annual licensing fee based on their risk category to

legally sell or supply alcohol. A portion of that fee is then paid to the

Alcohol Licensing and Regulatory Authority.

3.5 The

intent of the Fees Regulations is to provide for the total cost recovery of all

alcohol licensing functions of territorial authorities (TA’s). The fees

specified in the Regulations are now 11 years old and do not provide total cost

recovery.

3.6 Current

Expenditure and Cost recovery

3.7 The

Ministry of Justice developed a document to help guide TA’s in

calculating costs and revenue associated with alcohol licensing functions

called “Calculating the Costs and Revenue of the Alcohol Licensing System

Guidance Document 2018.” (The Guidance Document 2018). This document is

utilised by officers to analyse revenue and expenditure.

3.8 Analysis

has been undertaken of income and expenditure of the alcohol licensing cost

centre. Revenue is expected to be around $275,000 based on the average of

2021-2022 and 2022 - 2023 application activity. There are a base number of

premises applications that generate revenue and other applications which may

fluctuate over time, for example those relating to special licence applications

and managers certificates.

3.9 Council

expenditure is estimated at approximately $454,000 per year (2022-2023)

including overheads.

3.10 Officers

have analysed processing times by risk type. There was a large shortfall in

revenue from application fees for all special licence types (Class 1, 2 and 3).

There is a large shortfall in processing very low and low risk premises types

and generally a smaller shortfall for all other premises licence types.

3.11 The

reason very low and low risk type applications have such a shortfall is that it

doesn’t take a significantly longer amount of inspector time to process

the very low / low vs medium, high and very high licence application types. The

forms and process for applying or renewing a licence are prescriptive across

all risk types. The increase in cost to Council for a higher risk premises is

from additional monitoring, inspecting and enforcement.

3.12 Although

there is a 40% shortfall in costs overall, this equates to the need for an 85%

increase in fees for all premises licence types, due to the distribution of

licences that are in the Hastings District. (Currently 176 low and very low

premises vs only 89 medium and high premises types and no very high premises

types).

3.13 Analysis

of income versus expenditure and of officer time and costs by premises

risk type, has identified there is a 40% shortfall in revenue ($179,000). This

shortfall is currently covered by rates.

4.0 Discussion – Te Matapakitanga

4.1 Bylaw Proposal to District

Planning and Bylaws Sub Committee

4.2 On

29 May 2024 a report went to the Planning and Bylaws Committee seeking a

recommendation to develop a bylaw to increase fees to remedy the $179,000

shortfall and move to a one hundred percent cost recovery model (with no rate

payer contribution). The report to the committee provides the background for

this bylaw proposal and is attached as Attachment 1.

4.3 The

Subcommittee considered three options:

● Option One: Spread the shortfall across all licence types

evenly with a 100 percent cost recovery model in year one (no rate payer contribution).

● Option Two: Increase the fees by a percentage retaining a

rate payer contribution and complete stakeholder engagement.

● Option Three: Keep the current regime and fee structure

with no increase, i.e., await an increase through the Justice Department

review.

4.4 The

Subcommittee considered the following factors presented by officers:

● the preference to keep the intent of the original regime

under the regulations whereby alcohol licensing is a hundred percent cost

recovery model with no rate payer contribution.

● that the proposed increase sits in the middle to lower end

when compared to other councils with a fee bylaw and those considering bylaws

around New Zealand. Fees from other councils ranged from a 10 percent

increase to a 400% increase to recover costs. Some TA’s chose

a 100% cost recovery model and others subsidised a percentage via

rates.

● that New Zealand has one of the lowest cost alcohol

licensing regimes in the world.

● that the proposed fees are realistic considering how many

years Council has been running with a shortfall with a large and rising rate

payer contribution (eleven years).

● that

the alcohol industry is a private sector industry,

and this aligns with the “user pays” system.

● that a fees bylaw was considered

in the past, however, with the COVID epidemic and subsequent lockdown and then

Cyclone Gabrielle, businesses were already under financial pressure and

therefore it was postponed. The Ministry started reviewing the regulations two

years ago, but no outcome has been publicly presented yet. A bylaw now seemed

appropriate to recover these costs and remedy the deficit moving forward.

● Further

rationale for the fee increases can be seen in the Bylaws Committee Report in Attachment

1.

4.5 The

Subcommittee resolved to recommend spreading the shortfall across all licence

types evenly with a 100% cost recovery model in year 1.

4.6 Stakeholder engagement

4.7 On

7 June 2024 a consultation document and survey form were sent to all 265

licensees and ten regular special licence holders, seeking feedback on the

proposal (as required under the SSAA 2012). These documents are attached

as Attachment 2.

4.8 The

consultation period ran from 7 June 2024 to 5 July 2024.

4.9 In

addition, all licensees were invited to attend a consultation meeting held at

Council on 24 June 2024. Thirty-seven licensees accepted the invitation

and fourteen attended.

4.10 The

consultation meeting provided an opportunity for staff to further explain the

proposal. The meeting also allowed licensees to discuss the proposed

increases with staff.

Feedback from the consultation and survey

4.11 Council

officers were commended for the consultation and transparency by several

submitters.

4.12 There

were 24 responses to the consultation survey sent out to the licensees.

251 did not respond. Analysis of Stakeholder feedback is attached as

Attachment 3.

4.13 In

summary, three licensees agreed with the bylaw proposal, 12 partially agreed

and nine didn’t agree.

4.14 The

general comments made by licensees and special licence holders were that the

increase was very large in year one especially with the current economic

climate and historic events in the Hawke’s Bay and New Zealand (Covid-19/

Cyclone Gabrielle). Most understood the need for an increase, and some

suggested the increase be spread over three years.

4.15 Many

commented on the other significant increases in costs that the industry has

already had, namely rates, insurance, and general business costs.

4.16 Five

licensees did not think ratepayers should contribute to the licensing process

and 16 thought they should. Three did not answer this question.

4.17 Those

who specified that rate payers should contribute, stated licensees bring in

tourists and that ratepayers enjoy their services and venues. Licensees

said Hawke’s Bay is known for its wineries, restaurants and events, and

that ratepayers contributing to the fees enable this to continue.

Other feedback

4.18 Whilst

outside the scope of the stakeholder engagement process, two submissions were

received in the Long-Term Plan submission process calling for Council to

introduce an Alcohol Licensing Fees Bylaw increasing the fees back to a hundred

percent cost recovery model.

Officers’ response to issues raised in the licensees

submissions

4.19 Officers

recognise through their knowledge of licensees and from speaking to licensees

during monitoring and inspections over time, that several licensees are still

recovering from the effects of Covid-19 and Cyclone Gabrielle. Officers

support licensees in their concerns regarding such a large increase in year

one.

4.20 In

relation to the rate payer contribution, Council contributes financially and

via service provisions to tourism and the general vibrancy and night-time

economy of Hastings. Examples include The Local Alcohol Policy, Alcohol Harm

Reduction Strategy, and Events Strategy which are funded by rates.

4.21 The

Guidance Document 2018 states the above types of activities and other

programs of work should not be included or considered in the costs of the

regime.

4.22 Other matters - Public notification costs

4.23 To help alleviate the increasing

costs to the licensees, officers propose the Council provides an option to

undertake the notification process. Currently licensees are required to

place one or two advertisements, depending on their risk rating, in the local

paper, notifying the licence application to the public. One advertisement in

the newspaper costs $160.00. Council could offer this service for a

reduced flat fee of $50. This would equate to a $110 to $220 savings for

licensees per application cycle.

4.24 This

process is still in line with the legal requirement to notify the licence.

Currently several councils offer this service for a fee. Additionally,

this process will reduce staff monitoring time and minimise the risk of public

notices being posted incorrectly, which occurs frequently.

4.25 The

notification fee can be added to the bylaw at the discretion of the

Council. A proposed notification fee has been included in all options.

5.0 Options – Ngā Kōwhiringa

OPTION 1. Fee increase with a 100% cost recovery of the

shortfall in year one (85%, 10% and 10% annual increases).

● 85% increase for all licence types to cover full deficit in

year one.

● Then a 10% increase in year Two and Three to cover

inflation and other rising costs associated with increased officer time. The

10% increase is based on the financial information of the last 11 years of

shortfall data.

● No rate payer contribution. Full cost recovery year One.

● GST inclusive

|

Application fee / Annual fee for

premises (new and renewal)

|

Current fee under the Act and

Regulations

|

Proposed fee 2024

(85% increase)

|

Proposed fee 2025

(10% increase)

|

Proposed fee 2026

(10% increase)

|

|

Application Fee - Very low risk

|

$368.00

|

$680.80

|

$748.80

|

$823.70

|

|

Application Fee – Low Risk

|

$609.50

|

$1127.60

|

$1240.40

|

$1364.40

|

|

Application Fee – Medium Risk

|

$816.50

|

$1510.50

|

$1661.55

|

$1827.65

|

|

Application Fee – High Risk

|

$1023.50

|

$1893.50

|

$2082.85

|

$2291.13

|

|

Application Fee – Very High Risk

|

$1207.50

|

$2233.90

|

$2457.30

|

$2703.00

|

|

Annual Fee – Very Low risk

|

$161.00

|

$297.85

|

$327.60

|

$360.30

|

|

Annual Fee – Low Risk

|

$391.00

|

$723.35

|

$795.70

|

$875.30

|

|

Annual Fee – Medium Risk

|

$632.50

|

$1170.10

|

$1287.10

|

$1415.80

|

|

Annual Fee – High Risk

|

$1035.00

|

$1914.75

|

$2106.20

|

$2316.80

|

|

Annual Fee – Very High Risk

|

$1437.50

|

$2659.40

|

$2925.35

|

$3217.88

|

|

Special Licence Fees

|

|

|

|

|

|

Class One

|

$575.00

|

$1063.75

|

$1170.10

|

$1287.12

|

|

Class Two

|

$207.00

|

$382.95

|

$421.25

|

$463.40

|

|

Class Three

|

$63.25

|

$117.00

|

$128.70

|

$141.60

|

|

Temporary licence types

|

|

|

|

|

|

Temporary Authority

|

$296.70

|

$548.90

|

$603.80

|

$664.20

|

|

Temporary Licence

|

$296.70

|

$548.90

|

$603.80

|

$664.20

|

|

Variation of licence

|

$368.00

|

$680.80

|

$748.80

|

$823.60

|

|

Other Fee

|

|

|

|

|

|

Public Notification via council website

(instead of public newspaper)

|

$160 per ad – newspaper

|

$50.00

|

$50.00

|

$50.00

|

OPTION 2. A fee increase

spreading the shortfall over a three-year period with 100% cost recovery by

year three (i.e. 35%, 35% and 23% annual increases).

● Spread the increase over three years - 35% increase in year

one and two and remaining increase in year three.

● 100% cost recovery model by year three.

● No rate payer contribution by year three.

● This option includes an “inflation and other

costs” percentage rolled into year two and three.

● GST inclusive

|

Application fee / Annual fee for

premises (new and renewal)

|

Current fee under the Act and

Regulations

|

Proposed fee 2024 (35% increase)

|

Proposed fee 2025 (35% increase)

|

Proposed fee 2026

(Approximately 23% increase)

|

|

Application Fee - Very low risk

|

$368.00

|

$496.80

|

$670.70

|

$823.70

|

|

Application Fee – Low Risk

|

$609.50

|

$822.80

|

$1110.80

|

$1364.40

|

|

Application Fee – Medium Risk

|

$816.50

|

$1102.30

|

$1488.10

|

$1827.65

|

|

Application Fee – High Risk

|

$1023.50

|

$1381.70

|

$1865.30

|

$2291.13

|

|

Application Fee – Very High Risk

|

$1207.50

|

$1630.10

|

$2200.65

|

$2703.00

|

|

Annual Fee – Very Low risk

|

$161.00

|

$217.35

|

$293.40

|

$360.30

|

|

Annual Fee – Low Risk

|

$391.00

|

$527.85

|

$712.60

|

$875.30

|

|

Annual Fee – Medium Risk

|

$632.50

|

$853.90

|

$1152.65

|

$1415.80

|

|

Annual Fee – High Risk

|

$1035.00

|

$1397.25

|

$1886.30

|

$2316.80

|

|

Annual Fee – Very High Risk

|

$1437.50

|

$1940.60

|

$2619.80

|

$3217.88

|

|

Special Licence Fees

|

|

|

|

|

|

Class One

|

$575.00

|

$776.25

|

$1047.95

|

$1287.12

|

|

Class Two

|

$207.00

|

$279.45

|

$377.25

|

$463.40

|

|

Class Three

|

$63.25

|

$85.40

|

$115.30

|

$141.60

|

|

Temporary licence types

|

|

|

|

|

|

Temporary Authority

|

$296.70

|

$400.55

|

$540.75

|

$664.20

|

|

Temporary Licence

|

$296.70

|

$400.55

|

$540.75

|

$664.20

|

|

Variation of licence

|

$368.00

|

$496.80

|

$670.70

|

$823.60

|

|

Other Fee

|

|

|

|

|

|

Public Notification via council website (instead

of public newspaper)

|

$160 per

ad – newspaper

|

$50.00

|

$50.00

|

$50.00

|

OPTION 3. Increase fees aligned with an ongoing rate

payer contribution to fees.

● Increase of fees with an ongoing rate payer

contribution. Some examples are shown below.

● Rate payer Contribution examples: (Currently: $179,000 =

40% rate payer contribution)

o 45% increase fee equates to a $82,000 rate payer

contribution

o 65 % increase fee equates to a $41,000 rate payer

contribution

o 75% increase fee equates to a $20,000 rate payer

contribution

● This option includes an “inflation and other

costs” percentage of 10% rolled into year 2 and 3.

● This option means ratepayers

will continue to contribute a set percentage year on year.

● GST inclusive

|

Application fee / Annual fee for

premises (new and renewal)

|

Current fee under the Act and

Regulations

|

Proposed fee 2024 - 45% increase

|

Proposed fee 2024 - 65% increase

|

Proposed fee 2024 - 75% increase

|

|

Application Fee - Very low risk

|

$368.00

|

$533.60

|

$607.20

|

$644.00

|

|

Application Fee – Low Risk

|

$609.50

|

$883.80

|

$1005.70

|

$1066.60

|

|

Application Fee – Medium Risk

|

$816.50

|

$1183.95

|

$1347.25

|

$1428.90

|

|

Application Fee – High Risk

|

$1023.50

|

$1484.10

|

$1688.80

|

$1791.15

|

|

Application Fee – Very High Risk

|

$1207.50

|

$1750.90

|

$1992.40

|

$2113.10

|

|

|

|

|

|

|

|

Annual Fee – Very Low risk

|

$161.00

|

$233.45

|

$265.00

|

$281.75

|

|

Annual Fee – Low Risk

|

$391.00

|

$566.95

|

$645.15

|

$684.25

|

|

Annual Fee – Medium Risk

|

$632.50

|

$917.10

|

$1043.60

|

$1106.90

|

|

Annual Fee – High Risk

|

$1035.00

|

$1500.75

|

$1707.75

|

$1811.25

|

|

Annual Fee – Very High Risk

|

$1437.50

|

$2084.40

|

$2371.90

|

$2515.60

|

|

|

|

|

|

|

|

Special Licence Fees

|

|

|

|

|

|

Class One

|

$575.00

|

$833.75

|

$948.75

|

$1006.25

|

|

Class Two

|

$207.00

|

$300.15

|

$341.55

|

$362.25

|

|

Class Three

|

$63.25

|

$91.70

|

$104.40

|

$110.70

|

|

|

|

|

|

|

|

Temporary Licence Types

|

|

|

|

|

|

Temporary Authority

|

$296.70

|

$430.20

|

$489.55

|

$519.25

|

|

Temporary Licence

|

$296.70

|

$430.20

|

$489.55

|

$519.25

|

|

Variation of licence

|

$368.00

|

$533.60

|

$607.20

|

|

|

Other Fee

|

|

|

|

|

|

Public Notification via council website

(instead of public newspaper)

|

$160 per ad newspaper

|

$50.00

|

$50.00

|

$50.00

|

OPTION 4: Status Quo – No bylaw

● Continue with the existing fees as set in the Sale and

Supply of Alcohol (Fees) Regulations 2013.

5.1 Option

Analysis

5.2 Options

1-3 include a relatively large increase in fees as there has been no increase

in fees through the regulations since its inception in 2013. The costs

associated with the heavy workload of the Alcohol Licensing team have increased

significantly in response to meeting increased reporting and monitoring

requirements under the Act. This has meant that over the last eleven

years there is a cost recovery shortfall, and a larger proportion of costs are

covered by rates.

5.3 Options

1-3 include an “inflation and additional cost” increase included in

years two and three. Due to fees not being increased over several years this

has meant that revenue from fees is not covering inflation and additional

costs.

|

Option

|

Advantages

|

Disadvantages

|

|

Option

1:

Fee increase with a 100% recovery of the shortfall in year

one (85%, 10% and 10% annual increases).

|

· Council recovers costs in year one.

· The intent of the original regime under

the regulations is met, with the higher risk premises paying more than lower

risk premises.

· Increase sits in the middle when

compared to other councils with fee bylaws and those considering bylaws

around NZ (as detailed in the Bylaws Sub-committee report – Attachment

One of this report).

|

· Some premises or licensees may struggle

with an increase this large in year one.

· Small clubs may close or not renew their

licence and/ or trade illegally.

|

|

Option

2:

A

fee increase spreading the shortfall over a three-year period with 100% cost

recovery by year three (i.e. 35%, 35% and 23% annual increases).

|

· Council will recover some costs and ratepayers continue to

contribute for the first two years.

· Council at year three has full cost

recovery as intended by the original regime under the regulations.

· There is less financial burden on

premises in year one.

· The intent of the original regime under

the regulations is continued, with the higher risk premises paying more than

lower risk premises and moving towards a 100% cost recovery model.

· This option allows licensees to budget

and prepare for the increase over the three years and takes into

consideration some of the feedback received through consultation.

|

· Some premises or licensees may struggle

with the fee increase.

· Possible community perception/concern

regards subsidization.

|

|

Option

3:

A percentage fee increase in year one of either 45%, 65% or 75%

as specified by Council and an ongoing rate payer contribution. A further 10%

increase in year two and three.

|

· A rate payer contribution may reflect

the recognition of the health and safety benefits and public benefits

accruing to the wider community.

· A rate payer contribution may show