Hastings District

Council

Hastings District

Council

Civic Administration Building

Lyndon Road East, Hastings

Phone: (06) 871

5000

Fax:

(06) 871 5100

WWW.hastingsdc.govt.nz

Open

A G E N D A

Risk and Assurance Committee MEETING

|

Meeting Date:

|

Monday, 3

February 2020

|

|

Time:

|

1.00pm

|

|

Venue:

|

Landmarks

Room

Ground Floor

Civic

Administration Building

Lyndon Road

East

Hastings

|

|

Committee Members

|

Mr J Nichols

– External Independent Appointee (Chair)

Councillors Corban, Kerr, Nixon (Deputy

Chair) and Travers

Vacancy – External Independent

Appointee

Mayor Hazlehurst (ex-officio)

Quorum = 3

|

|

Officer

Responsible

|

Chief Financial Officer – Mr B

Allan

|

|

Democracy & Governance Advisor

|

Mrs C Hilton (Extn 5633)

|

Risk and Assurance Subcommittee – Terms of Reference

Fields of Activity

The Risk and Assurance Committee is

responsible for assisting Council in its general overview of financial

management, risk management and internal control systems that provide;

·

Effective management of potential risks,

opportunities and adverse effects.

·

Reasonable assurance as to the integrity and

reliability of the financial reporting of Council.

·

Monitoring of Council’s requirements under

the Treasury Policy.

·

Monitoring of Councils Strategic Risk Framework.

Membership

·

Membership (6 including 4 Councillors).

·

Independent Chair appointed by Council.

·

Deputy Chair appointed by Council.

·

2 external independent members appointed by

Council.

Quorum –

3 members

Delegated

Powers

Authority to

consider and make recommendations on all matters detailed in the Fields of

Activity and such other matters referred to it by Council.

HASTINGS DISTRICT COUNCIL

Risk and Assurance Committee MEETING

Monday, 3 February 2020

|

VENUE:

|

Landmarks Room

Ground Floor

Civic Administration Building

Lyndon Road East

Hastings

|

|

TIME:

|

1.00pm

|

|

A G E N D A

|

1. Apologies

At the close of the agenda no

apologies had been received.

At the close of the agenda no

requests for leave of absence had been received.

2. Conflict

of Interest

Members need to be vigilant to

stand aside from decision-making when a conflict arises between their role as a

Member of the Council and any private or other external interest they might

have. This note is provided as a reminder to Members to scan the agenda

and assess their own private interests and identify where they may have a

pecuniary or other conflict of interest, or where there may be perceptions of

conflict of interest.

If a Member feels they do

have a conflict of interest, they should publicly declare that at the start of

the relevant item of business and withdraw from participating in the

meeting. If a Member thinks they may have a conflict of interest,

they can seek advice from the General Counsel or the Democratic Support Manager

(preferably before the meeting).

It is noted that while Members can

seek advice and discuss these matters, the final decision as to whether a

conflict exists rests with the member.

3. Confirmation

of Minutes

4. Treasury Activity

and Funding Update 5

5. Annual Review of

Treasury Management Policy 15

6. Health &

Safety Risk Management Update 73

7. Council Risk

Appetite Statements 85

8. Risk Assurance

Insurance Review 99

9. Risk Assurance

Action Status 103

10. Chief Financial Officer Update 111

11. Additional

Business Items

12. Extraordinary

Business Items

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Treasury

Activity and Funding Update

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

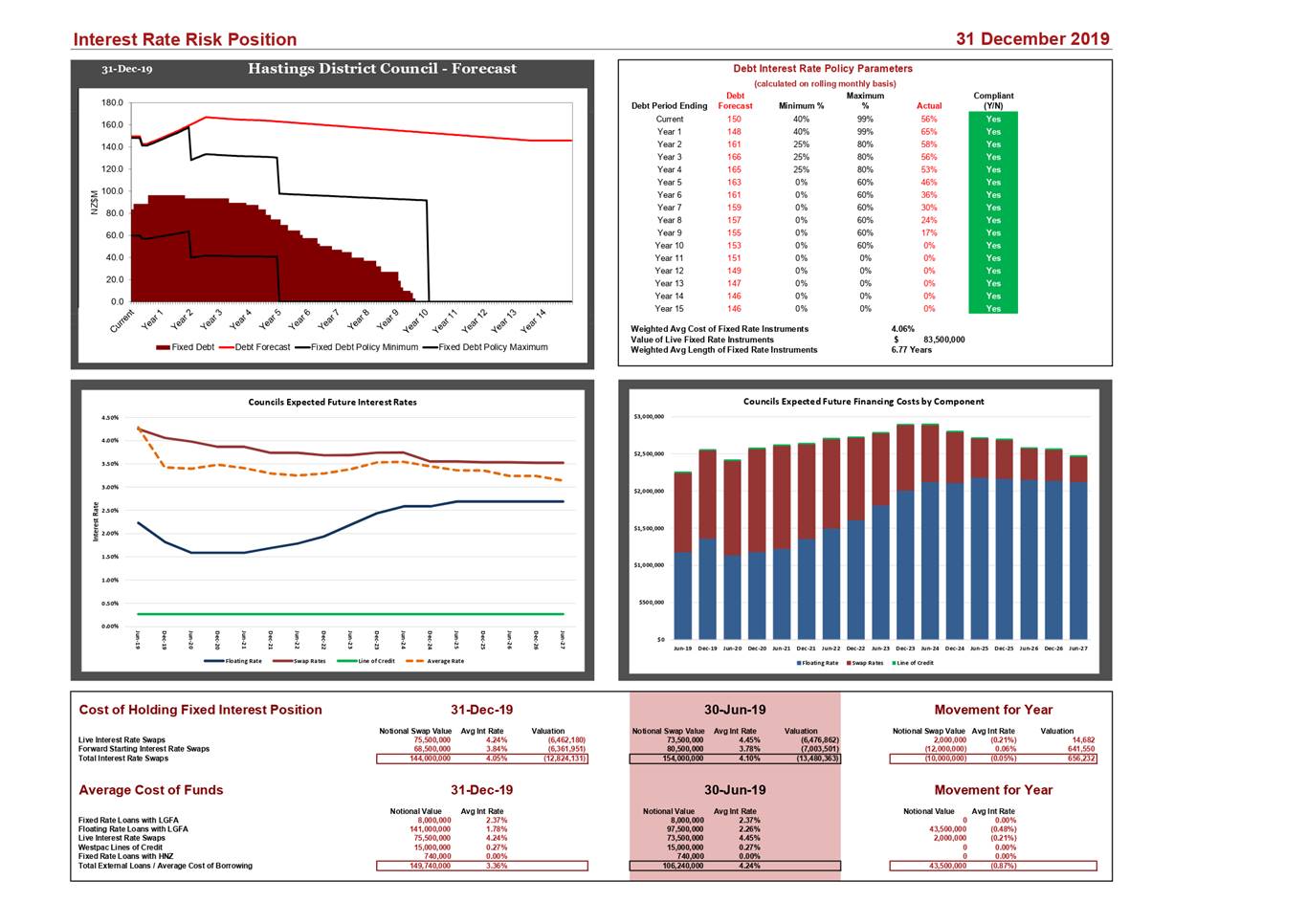

1.1 The purpose of this report is to update the Subcommittee on treasury

activity and funding issues.

1.2 This report

contributes to the purpose of local government by primarily promoting the economic and more specifically through

the Council’s strategic objective of sustainable use of resources and

providing resilience to hazards and shocks.

1.3 The Council’s current total external debt is $149.74m as at 31

December 2019. Offsetting this are $22m of term deposits, giving a net external

debt position of $127.74m.

1.4 Since the last update in September, Council has borrowed a further

$12m from the Local Government Funding Agency (LGFA). It has also had one term

deposit of $4m mature, and created has a further new term deposit of $4m.

1.5 Council is currently compliant with its Treasury Management Policy.

1.6 Officers have been working with Bancorp Treasury Services about

future funding requirements, and reviewing the Council’s Treasury Policy

(see separate report concerning this matter).

1.7 The Reserve Bank of New Zealand (RBNZ) left its Official Cash Rate

(OCR) at 1% at its 13th November 2019 review.

|

2.0 RECOMMENDATIONS - NGĀ

TŪTOHUNGA

A) That the Committee receives the report titled Treasury Activity and Funding

Update

|

3.0 BACKGROUND

– TE HOROPAKI

3.1 The

Hastings District Council has a Treasury Policy which forms part of the

2018-2028 Long Term Plan and a Treasury Management Policy. Under these policy

documents responsibility for monitoring treasury activity is delegated to the

Risk and Assurance Committee.

3.2 Council

is provided with independent treasury advice by Miles O’Connor of Bancorp

Treasury Services and receives daily and monthly updates on market conditions.

3.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in depth treasury reporting is provided for the Risk and Assurance

Committee.

4.0 DISCUSSION - TE MATAPAKITANGA

4.1 Council’s

debt portfolio is managed within macro limits set out in the Treasury Policy.

It is recognised that from time to time Council may fall out of policy due to

timing issues. The treasury policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

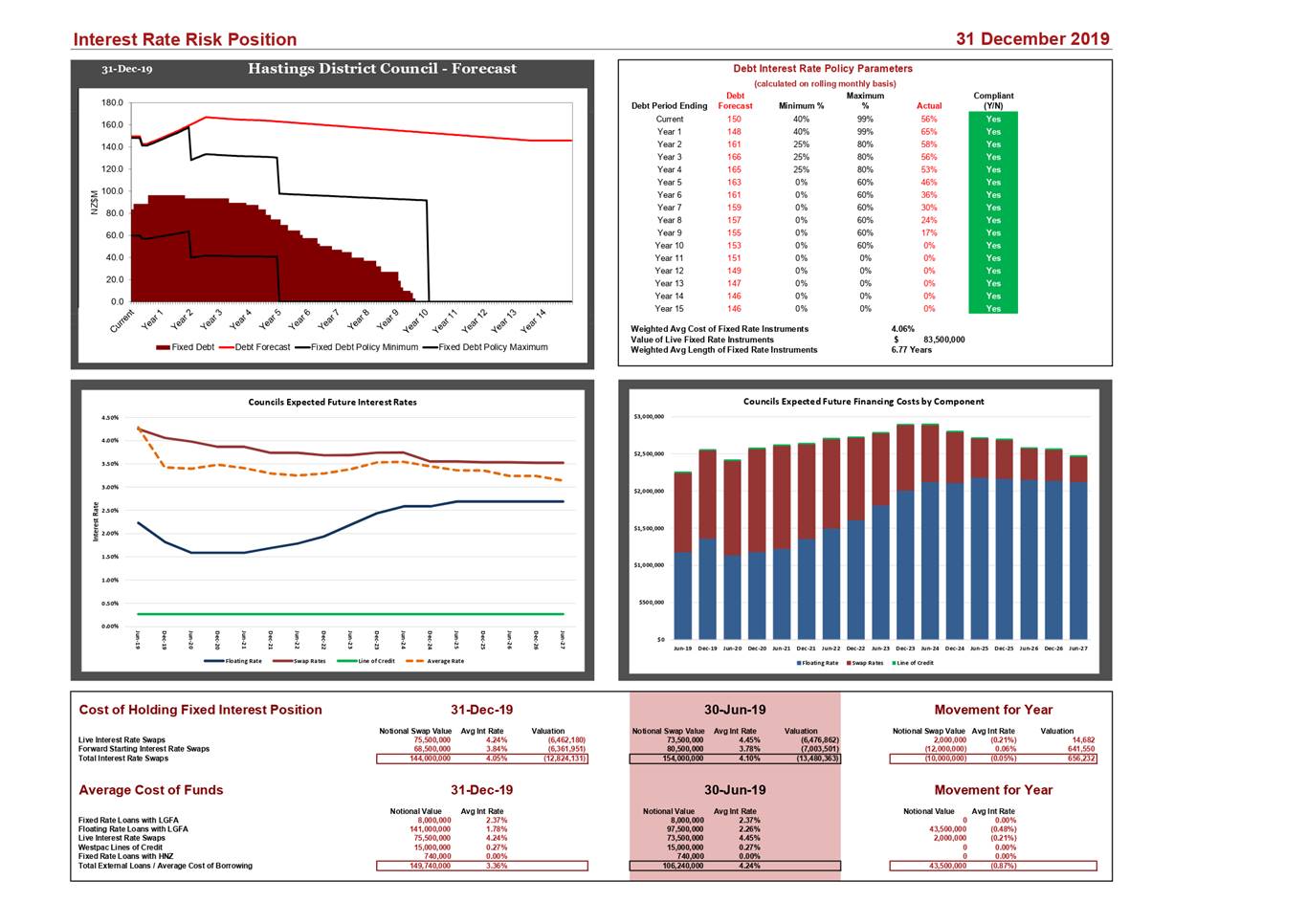

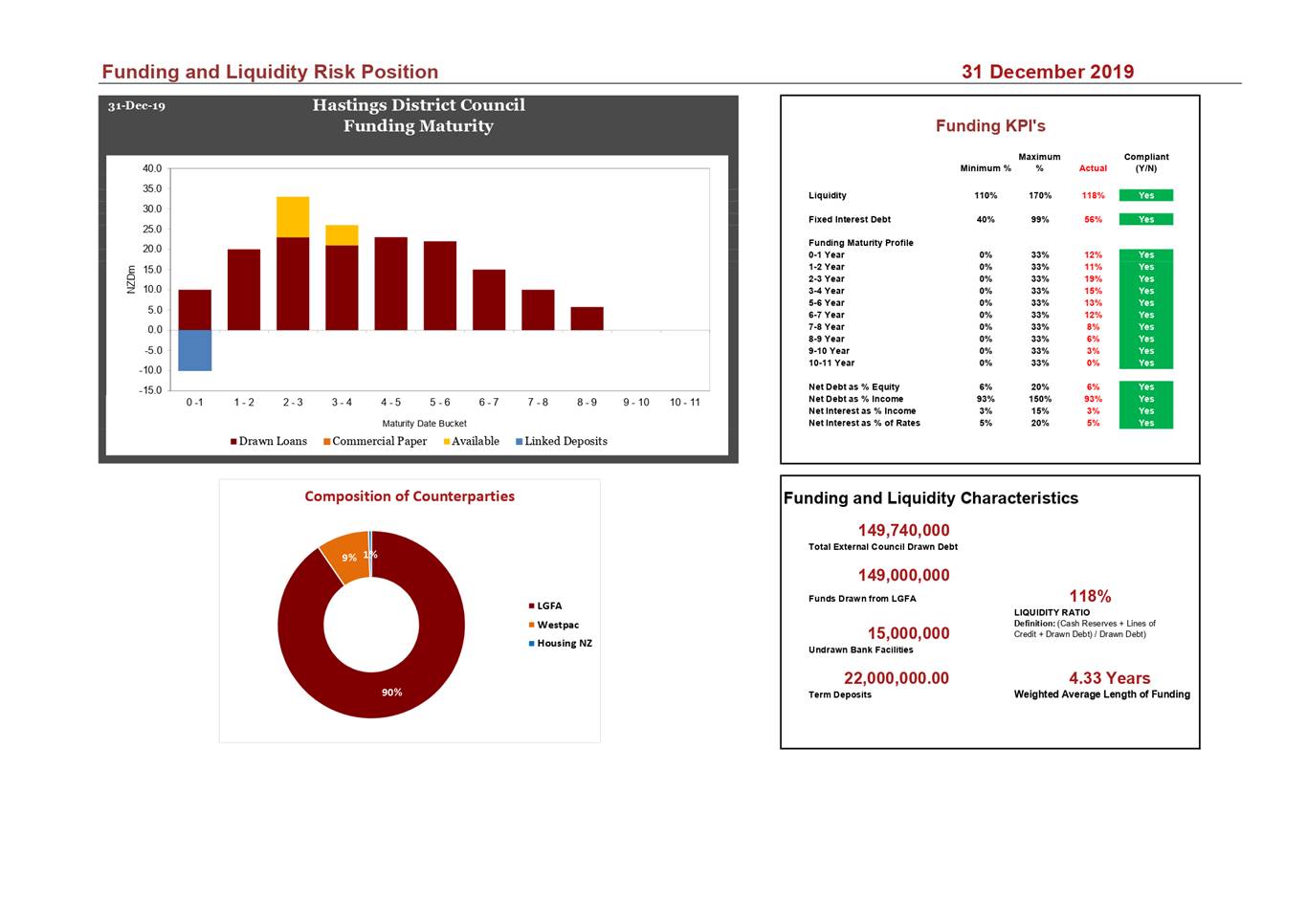

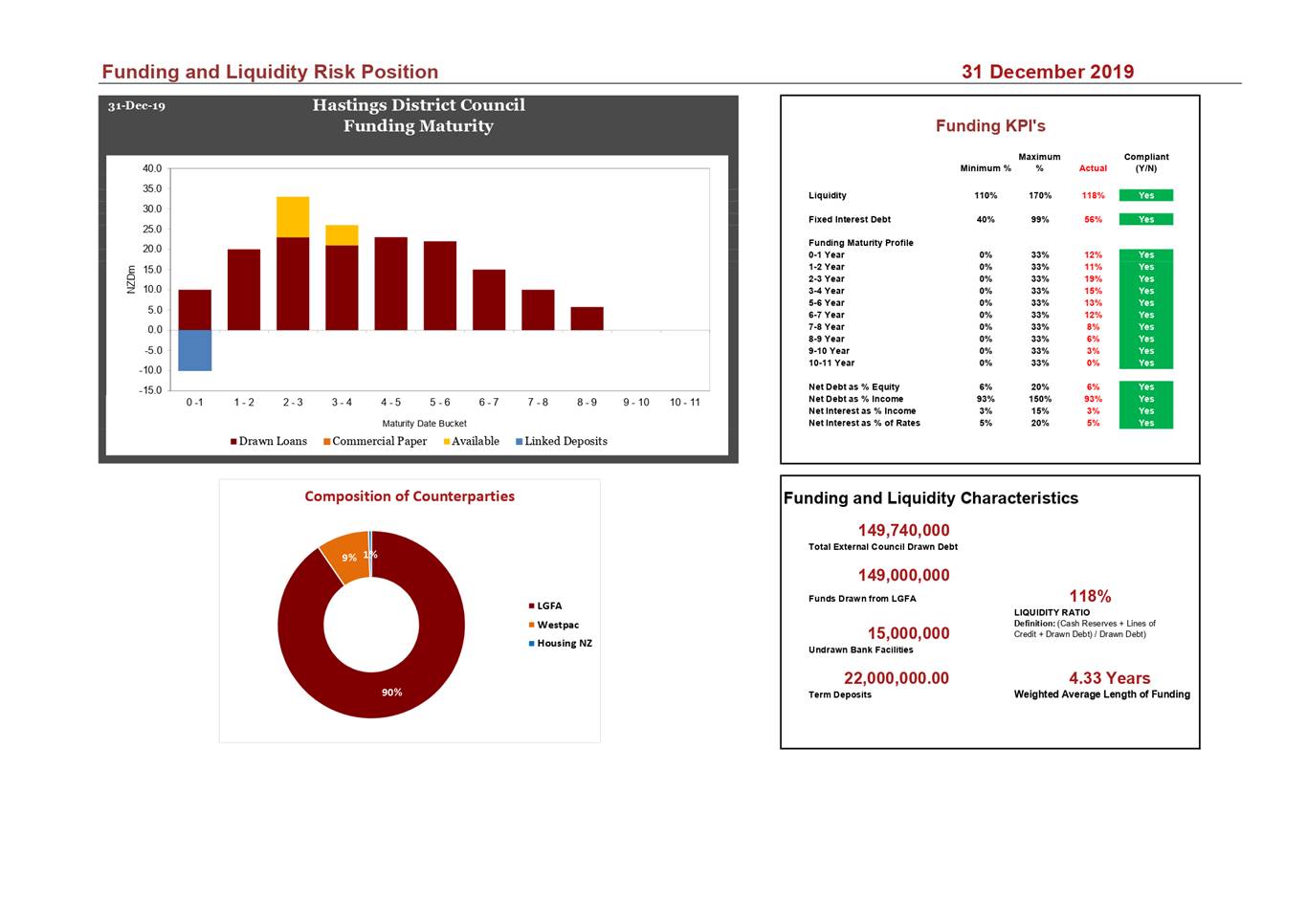

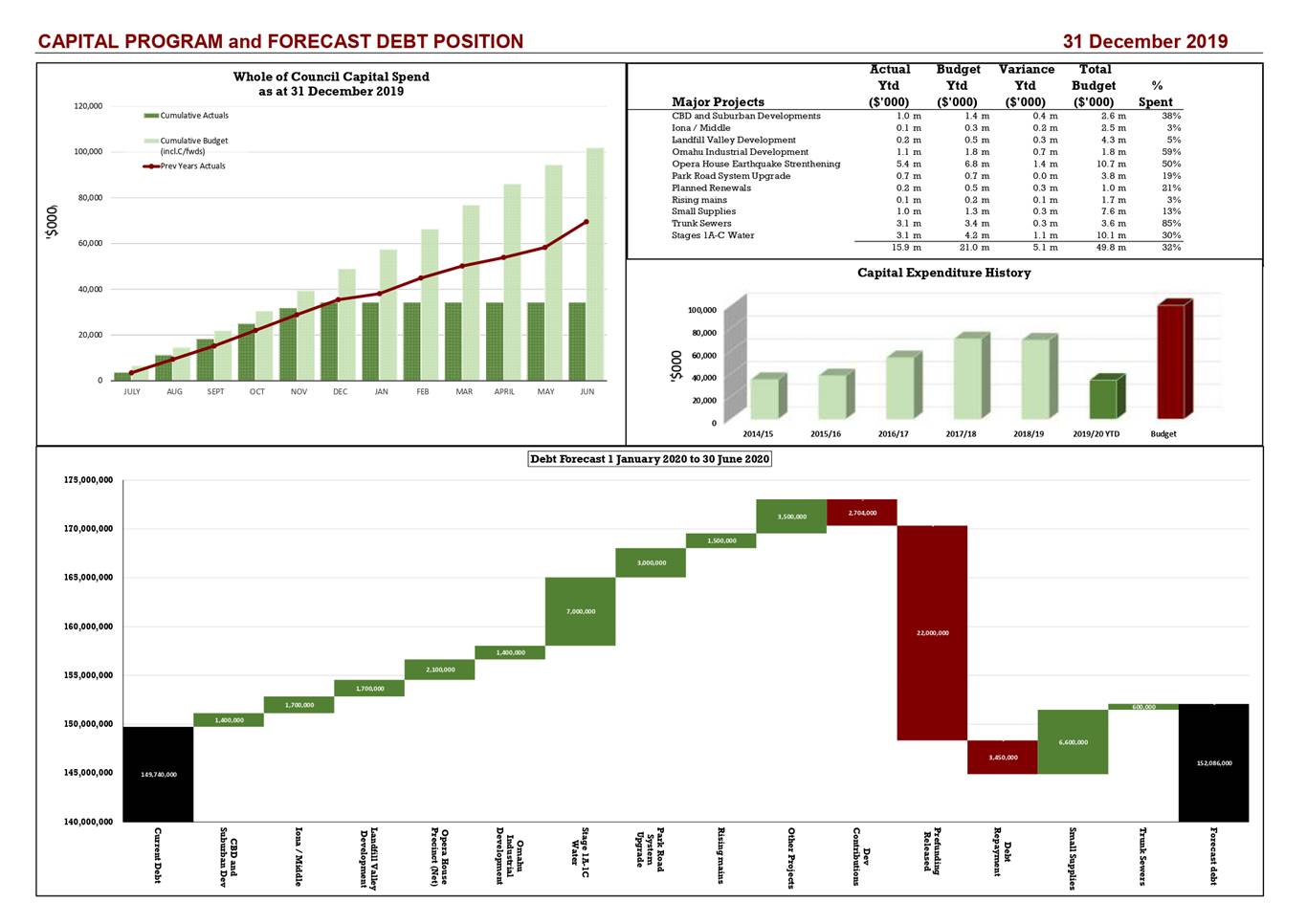

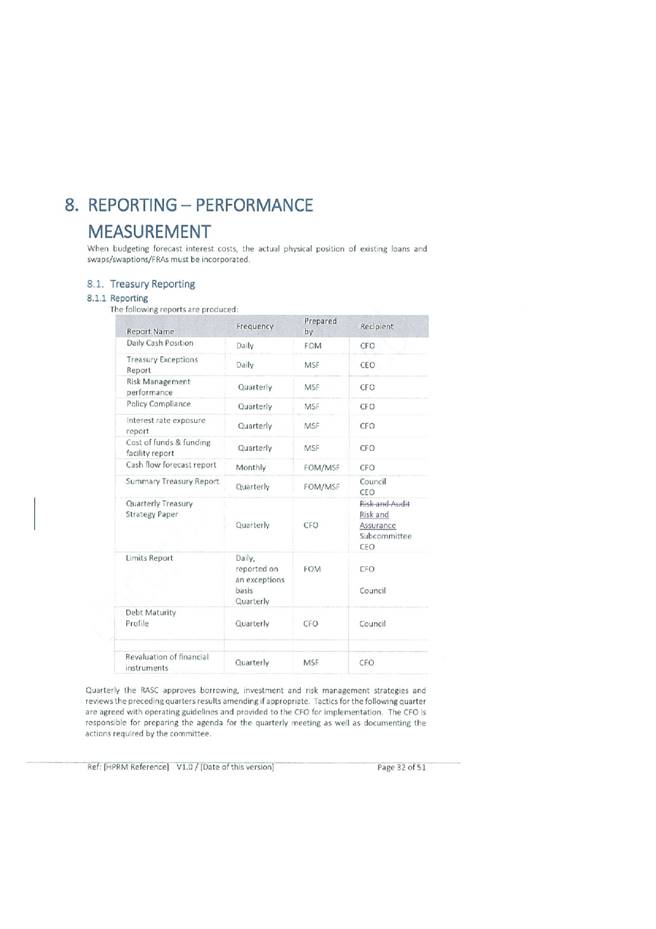

4.2 Attachment

1 sets out Council’s overall compliance with Treasury Management

Policy as at 31 December 2019.

4.3 The Council’s current total external debt is $149.74m as at 31

December 2019. Offsetting this are $22m of term deposits, giving a net external

debt position of $127.74m. This is supported by the Treasury Position 31

December 2019 Report in Attachment 1.

4.4 Recent

Borrowings: On the 7th October Council borrowed $5m, and on the

16th December Council borrowed a further $7m. Both these amounts

were borrowed from the Local Government Funding Agency (LGFA) at a floating

rate of Bank Bill 90 day Benchmark Rate (BKBM) (currently 1.22% pa) plus a

margin. The details are as follows:

|

Draw Date

|

Amount

|

Margin

|

Effective Interest Rate

|

Maturity Date

|

|

07/10/2019

|

$5m

|

0.6250%

|

1.8450%

|

15/04/2026

|

|

16/12/2019

|

$3m

|

0.3525%

|

1.5725%

|

14/04/2022

|

|

16/12/2019

|

$4m

|

0.5400%

|

1.7600%

|

15/04/2025

|

4.5 Recent

Movements in Investments: On the 4th October one of

Council’s Term deposits matured ($4m at 2.5%). These funds were used to

fund Council’s ongoing capital program.

Council has 3 active

term deposits totalling $18m with rates ranging from 3.1% pa to 3.13% pa. $10m

of these are linked to a loan maturity in April 2020, and the remaining $8m is

held as funding for future capital expenditure.

On the 16th

December Council entered into a two new deposits totalling $4m as follows:

|

Bank

|

Amount

|

Interest Rate

|

Maturity

|

|

BNZ

|

$2m

|

2.89%

|

17/07/2020

|

|

Westpac

|

$2m

|

2.62%

|

17/07/2020

|

The term deposit was

split across two banks as Council already had $18m of deposits with Westpac and

has an investment cap of $20m with any one bank as one time as per it’s

Treasury Policy.

4.6 Recent

RBNZ announcements: The

RBNZ left its Official Cash Rate (OCR) at 1% at its 13th November

2019 review.

4.7 In December 2019 the RBNZ also released the final outcome of its

banking capital review which will require the high street banks to hold more

funds to further protect from themselves from economic shocks. Economists

speculate that this change may have the impact of increasing retail interest

rates in the short term while the high street banks adjust their equity mix to

compile. The Council borrows on the wholesale market so this should have little

impact of their funding.

5.0 OPTIONS

- NGĀ KŌWHIRINGA

5.1 Not

applicable.

6.0 NEXT STEPS - TE ANGA

WHAKAMUA

6.1 Council Officers will continue to work with Bancorp Treasury

Services to keep Council’s financing costs to a minimum, maintaining

adequate liquidity, while maintaining compliance with Council’s Treasury

policy.

Attachments:

|

1⇩

|

Treasury Position Report 31 December 2019

|

FIN-15-03-20-197

|

|

|

2⇩

|

Capital Position Report 31 December 2019

|

FIN-15-03-20-198

|

|

|

SUMMARY

OF CONSIDERATIONS - HE WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose

of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future.

This report contributes to the purpose of local government

by primarily promoting economic wellbeing and more specifically through the Council’s

objective of sustainable use of resources and providing resilience to hazards

and shocks.

|

|

Link to the

Council’s Community Outcomes - E noho hāngai pū ai ki te

rautaki matua

This proposal promotes the economic

well-being of communities in the present and for the future.

|

|

Māori Impact

Statement - Te Tauākī Kaupapa Māori

There

are no known impacts for Tangata Whenua.

|

|

Sustainability - Te

Toitūtanga

This

proposal promotes sustainable financing costs ensuring the economic

well-being of communities in the present and for the future.

|

|

Financial

considerations - Ngā Whaiwhakaaro Ahumoni

This

proposal will ensure that financing costs are kept within Council’s

existing budgets.

|

|

Significance and

Engagement - Te Hiranga me te Tūhonotanga

This decision/report has been assessed

under the Council's Significance and Engagement Policy as being of minor significance.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto,

ā-waho

There

has been no external engagement.

|

|

Risks: Legal/

Health and Safety - Ngā Tūraru: Ngā Ture / Hauora me te

Haumaru

The

purpose of this report, and the Treasury Policies it refers to, assist

Officiers to manage Council’s treasury risk.

|

|

Rural Community

Board - Ngā Poari-ā-hapori

There

are no implications for the Rural Community Board.

|

|

Treasury Position Report 31 December

2019

|

Attachment 1

|

|

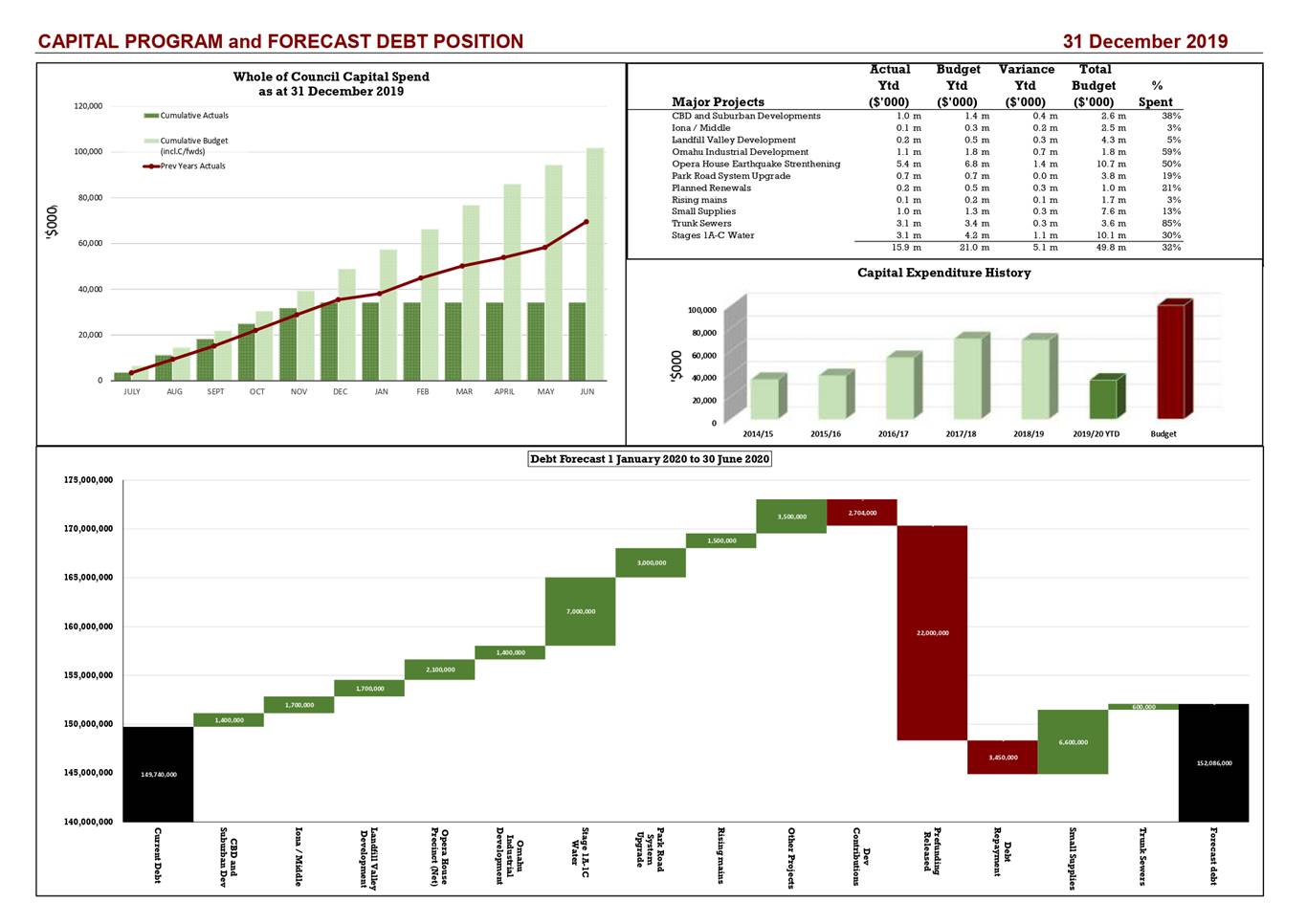

Capital Position Report 31 December 2019

|

Attachment 2

|

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Manager Strategic Finance

Brent

Chamberlain

SUBJECT: Annual

Review of Treasury Management Policy

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report to undertake a review of Council’s Treasury

Management Policy.

1.2 This

report contributes to the purpose of local government by primarily promoting economic wellbeing and more specifically

through the Council’s strategic objective of protecting

Council’s assets and efficient use of public funds.

1.3 This report reviews and proposes changes to Council’s Treasury

Management Policy.

1.4 The proposed change include changes to daily transaction limits,

definitions of liquid assets, the fixed and floating debts limits, the maturity

profile of external debt, and changes to interest cost benchmarks. In addition

there has been an attempt to shorten the policy by culling superfluous clauses.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Annual Review of Treasury Management Policy

B) That

the Committee approves the proposed changes to the Treasury Management

Policy, and sends it to Council for adoption

|

3.0 BACKGROUND – TE HOROPAKI

3.1 Hastings

District Council has a Treasury Management Policy which has the aim of

minimising the Council’s costs and risks in the management of its

external borrowings and maximise its return on investments.

3.2 It

is a requirement of the Local Government Act 2002 Section 102 [2] that all

Councils have a Liability Management Policy and an Investment Policy. Hastings

District Council has chosen to incorporate these policies into a single policy

entitled Treasury Management Policy.

3.3 Until

July 2019 Council’s treasury advisor was PriceWaterhouse Coopers. As a

result of a RFP process Council has changed its Treasury Advisors to Bancorp

Treasury.

3.4 This

is the first review of Council’s Treasury Management Policy undertaken by

Bancorp Treasury.

4.0 DISCUSSION - TE MATAPAKITANGA

4.1 Council’s

current Treasury Management Policy has been developed in conjunction with

PriceWaterhouse Coopers and was last reviewed in November 2018.

4.2 The

proposed replacement policy document is based on Council’s existing

policy, rather than a complete rewrite from scratch. Attached is

Council’s existing policy with the proposed changes marked up using track

changes.

4.3 The

current policy is quite wordy and repetitive, therefore a number of the changes

proposed are simply removing some of the unnecessary background information and

sharpening the document up without changing the underlying meaning.

4.4 The

major changes that alter absolute limits and KPI’s are as follows:

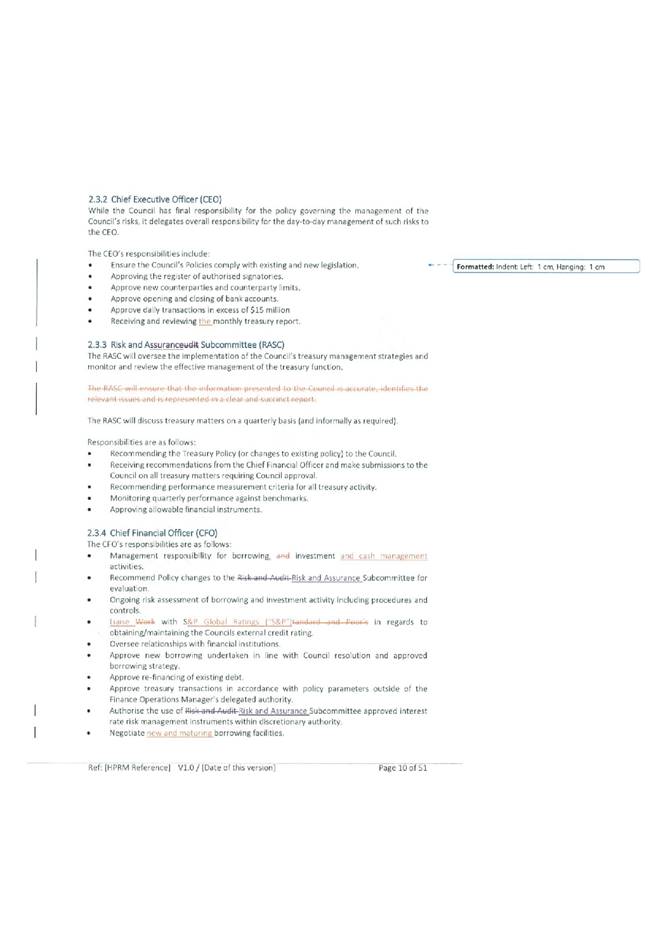

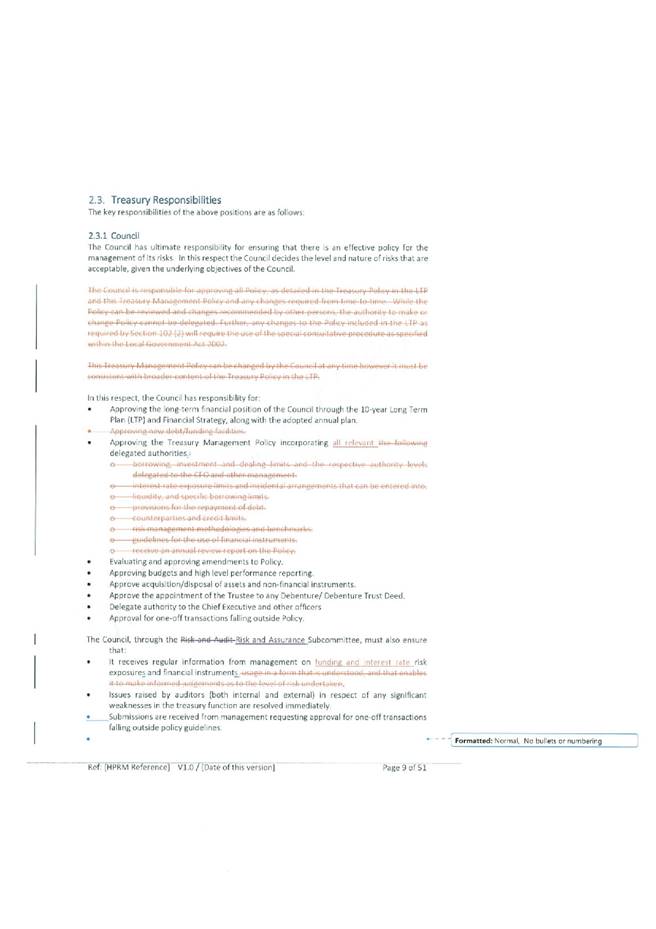

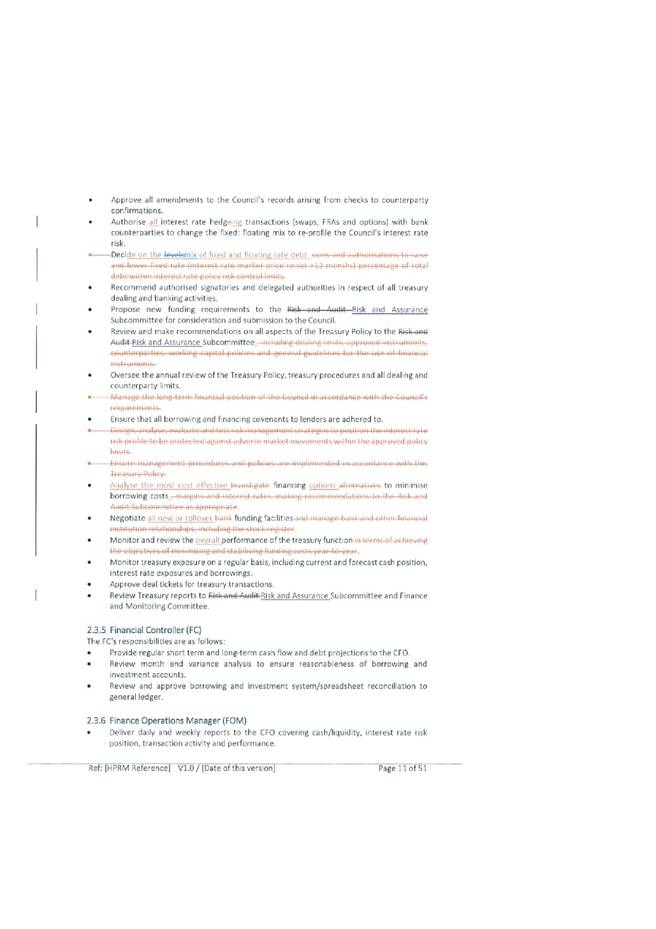

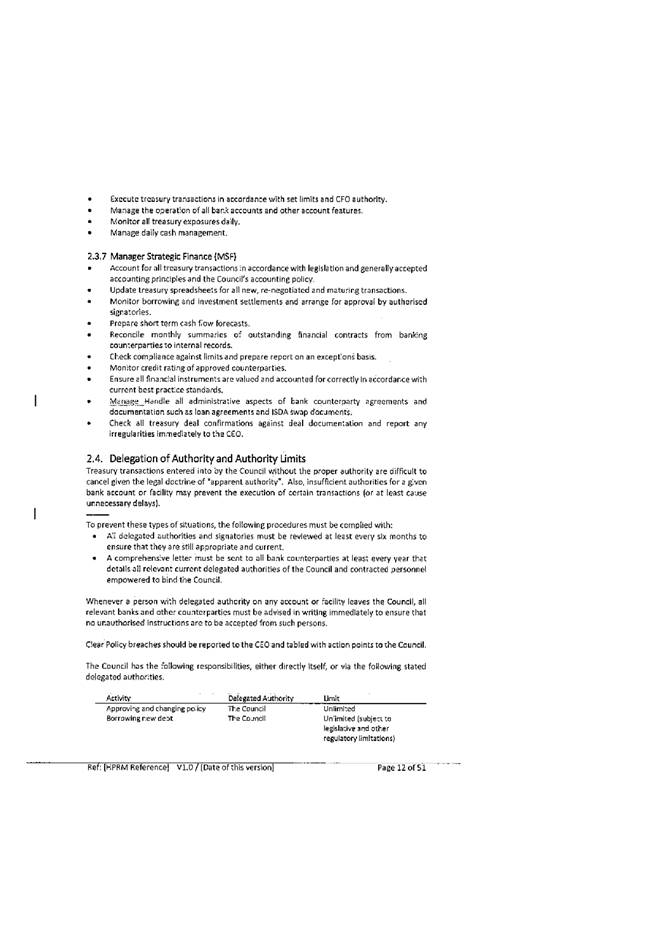

2.4 Delegation of Authority and Authority Limits

The Maximum daily

transaction limit has been increased to $40m to reflect what has been happening

in reality anyway. With the LGFA debt rollovers often hitting $20m on a single

date, Officer’s often find themselves extinguishing one $20m debt and

drawing a new $20m replacement debt the same day which totals $40m of

transactions before any other business is conducted.

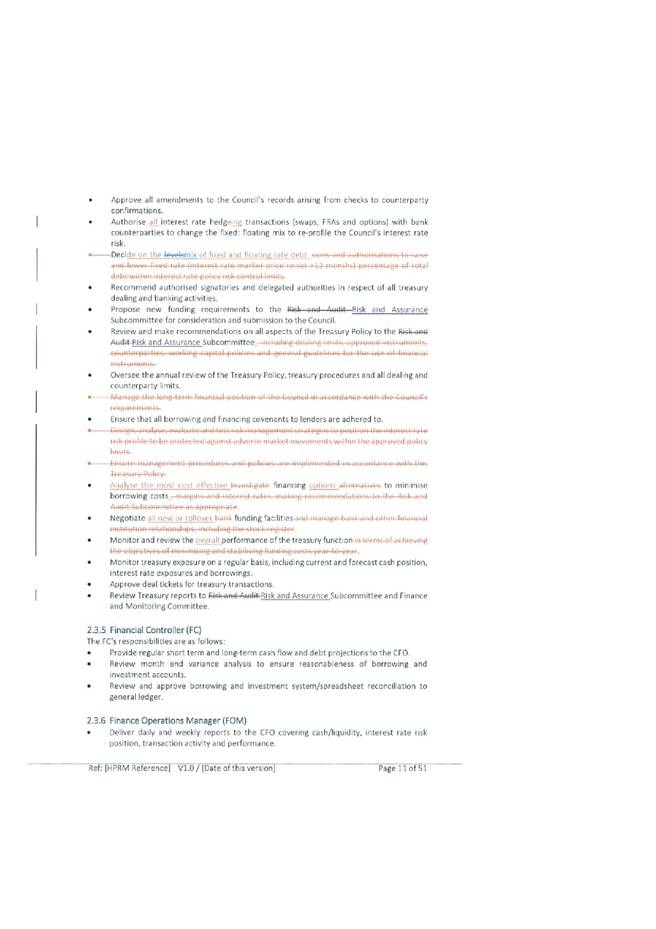

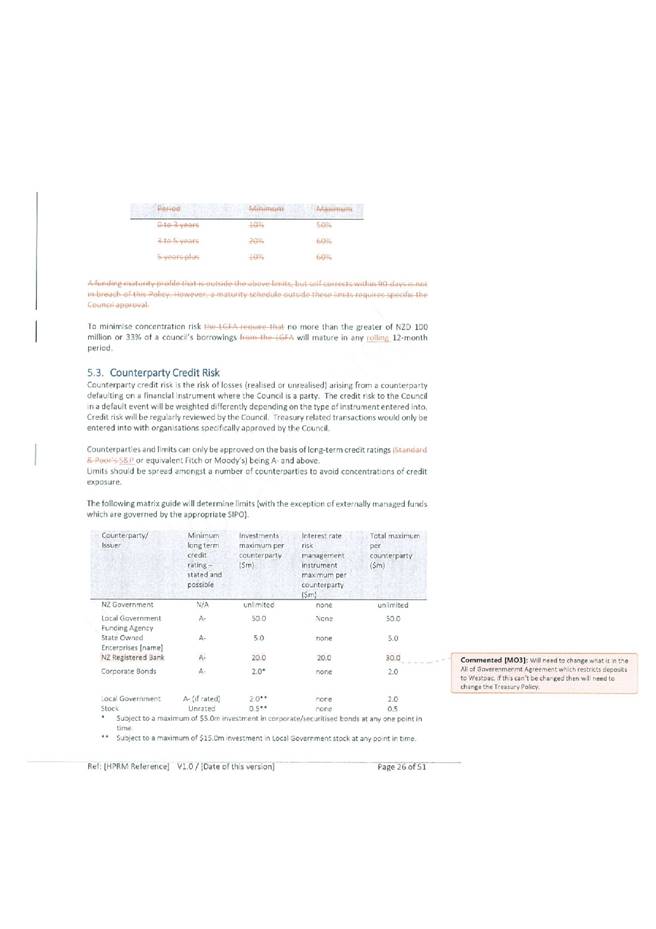

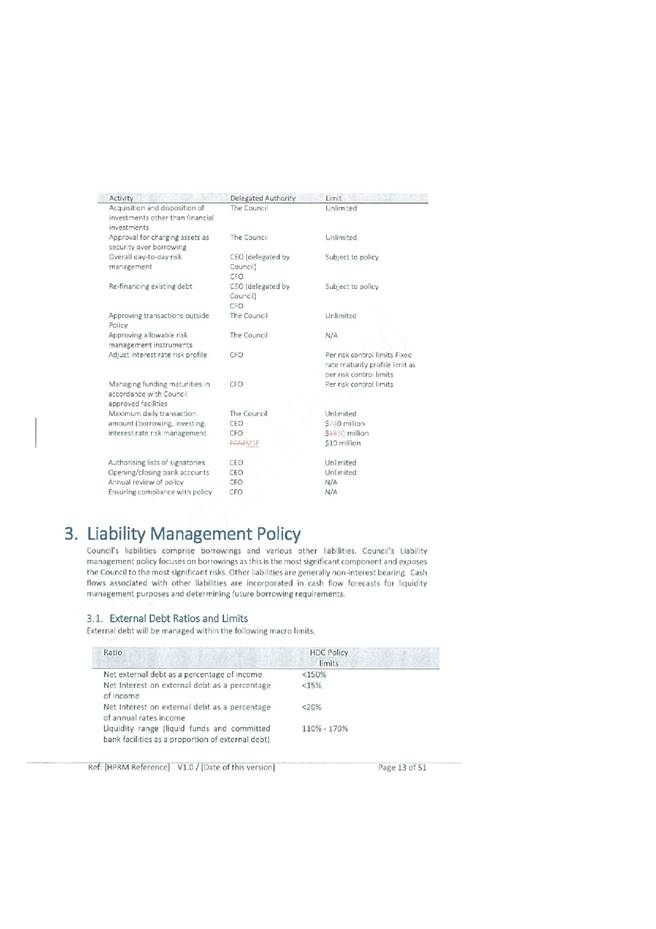

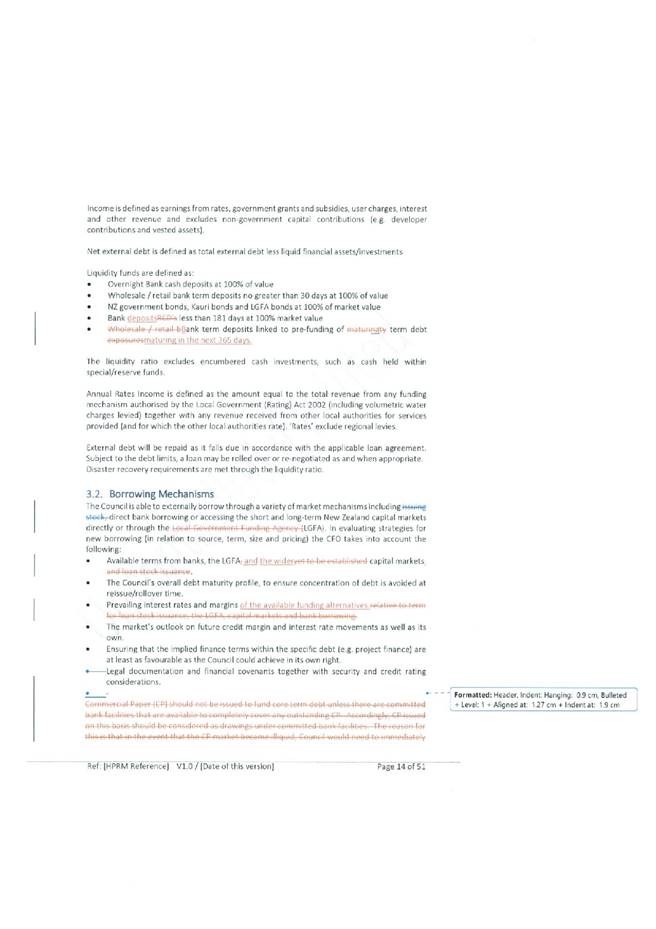

3.1 External

Debt Ratios and Limits

The definition of

Liquid Assets has been broadened to include pre-funding of term debt maturing

in the next 365 days, and term deposits maturing in less than 181 days.

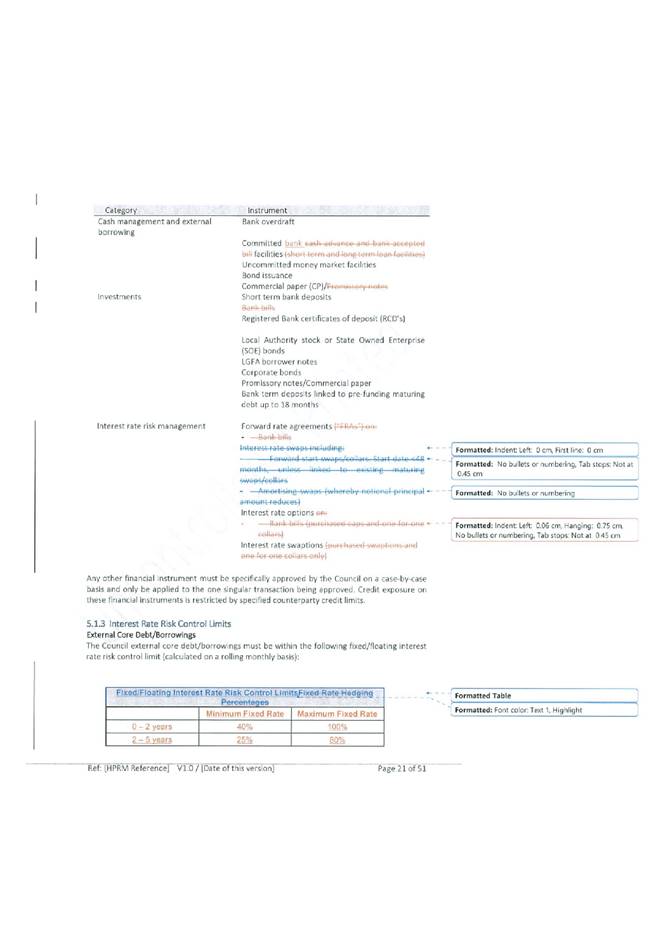

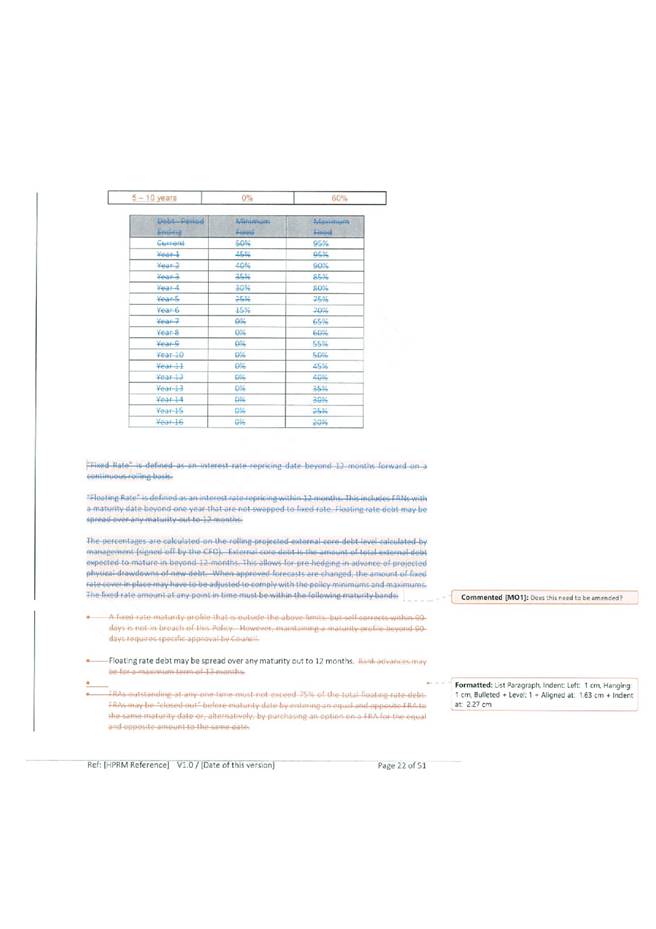

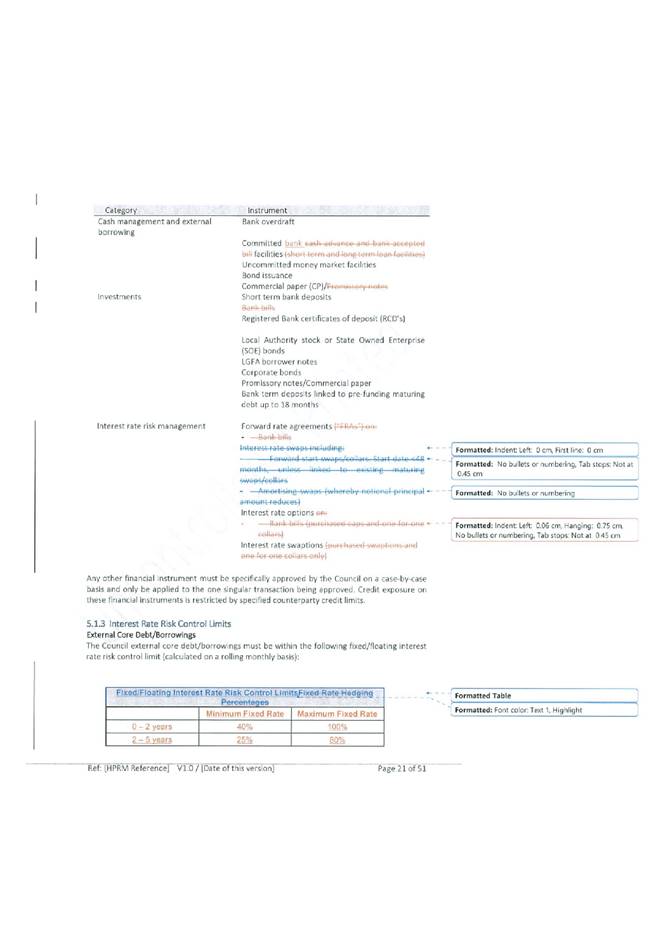

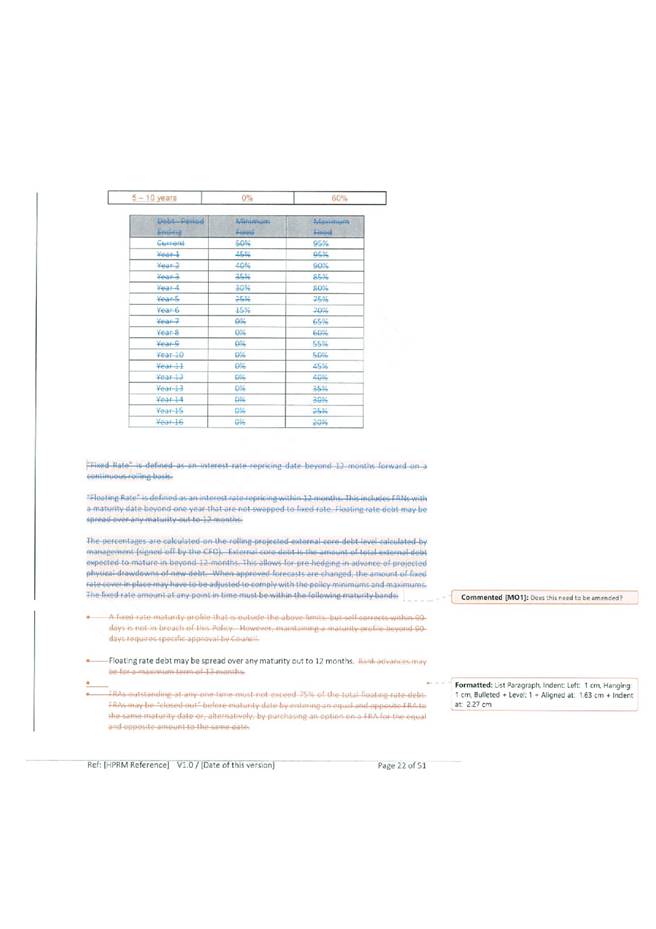

5.1.3 Interest Rate Risk Control Limits

This section deals

with Interest Rate Risk Control Limits or stated another way the percentages of

fixed and floating rate debt. The section that is being amended had 16 separate

one year time bands compared to the proposed 3 time bands. Bancorp’s view

is that 16 bands is too complex and means that interest rate exposures have to

be micro managed merely to comply with the policy but which in reality produces

little or no economic benefit to Council. The current bands extend out to 16

years which means that HDC could fix its interest rate out to a 16 year

horizon. Bancorp’s analysis indicates that fixing exposures that far in

the future does not provide any tangible benefit and in many cases actually

costs the borrower in terms of interest expense compared to the situation

where exposures had not been fixed that far.

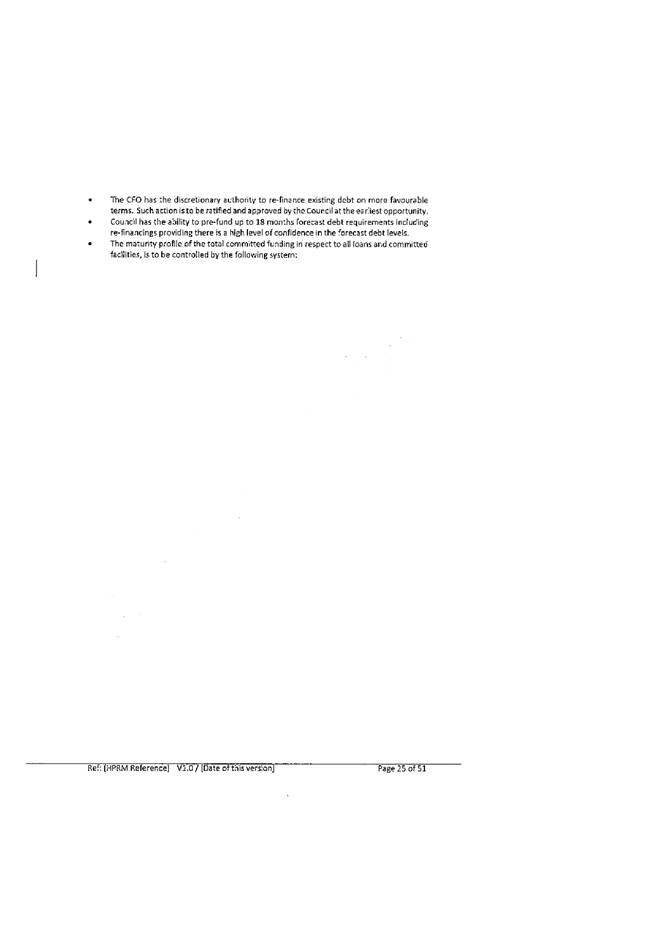

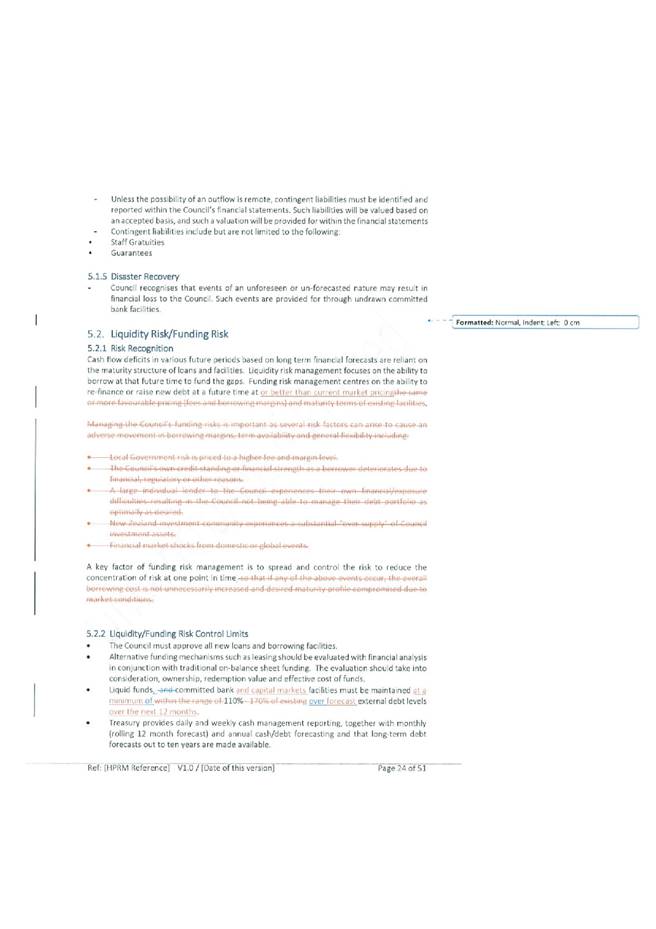

5.2.2

Liquidity/Funding Risk Control Limits

Section 5.2.2 deals

with Funding/Liquidity risk control limits with the table which contains three

time bands replaced with one requirement stating that no more than $100 million

of 33% of a councils borrowings will mature in any rolling 12 month period.

This simplifies the management process and provides greater flexibility when

managing funding maturity exposures.

6.2 Management

of Debt and Interest Rate Risk

Section 6.2 deals with

management of Debt and Interest Rate Risk and replaces the existing benchmark

which refers to only one interest rate (the wholesale 7 year rate) with a new

benchmark which incorporates 7 separate interest rates which are directly

related to new risk control bands contained in Section 5.1.3. The new benchmark

will provide a more appropriate comparison and one which is not unduly affected

by distortions in one rate (which the old one is as it only refers to the 7

year rate).

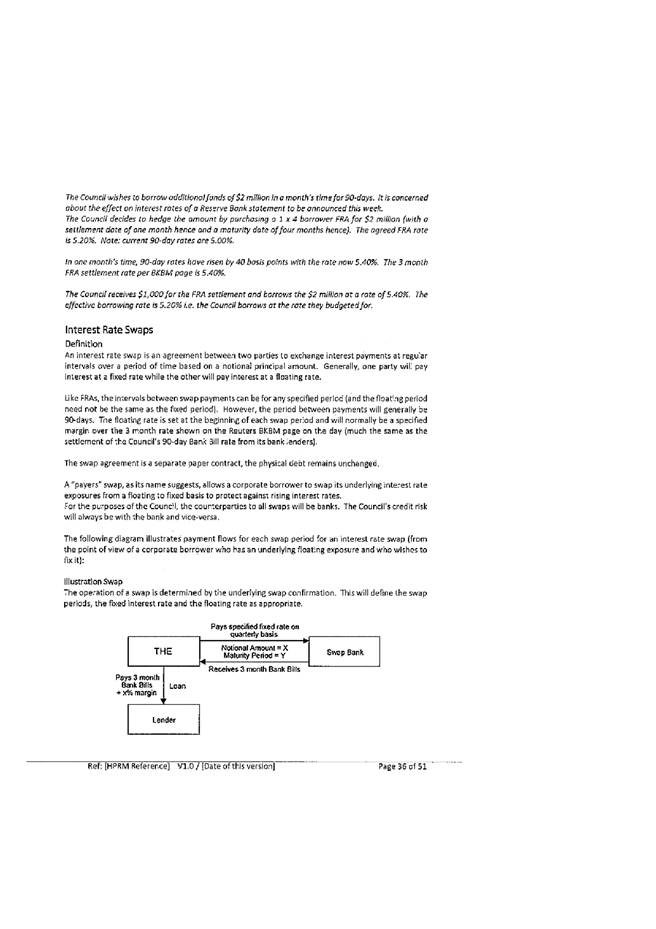

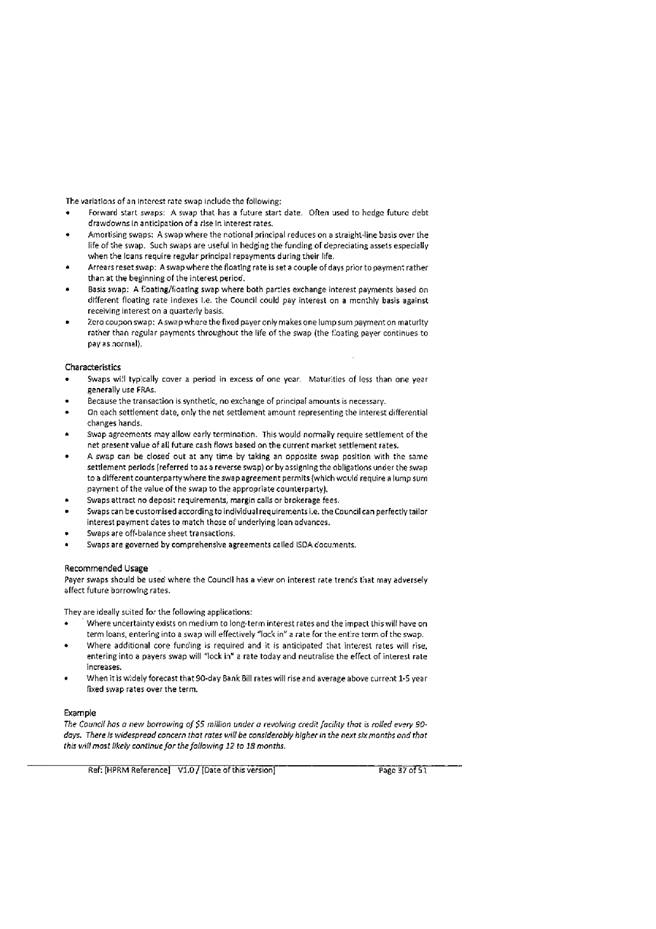

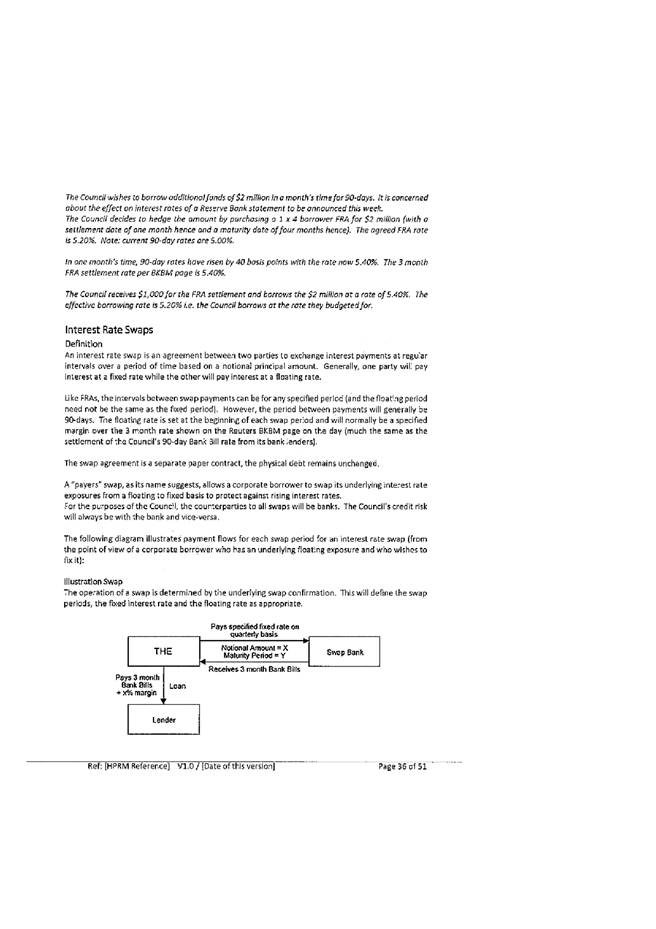

Appendix I

– Definition of Financial Instruments, and Appendix II – Glossary

of terms Corporate Treasury Management

This whole section

(while nice to have) doesn’t add any value to the policy and is

recommended to be removed and put into a separate document to be used for

training purposes.

5.0 OPTIONS - NGĀ

KŌWHIRINGA

Option One -

Recommended Option - Te Kōwhiringa Tuatahi – Te Kōwhiringa

Tūtohunga

5.1 The

Risk and Assurance Subcommittee can choose to adopt the proposed changes in

part or in full.

Advantages

· The

proposed changes are a simplification of the policy, without significantly

changing the risk profile of the policy. They are easier to understand and less

stringent to work within allowing officers a slightly greater degree of

flexibility, while maintaining the necessary controls.

Disadvantages

· The

previous policy was very detailed and prescriptive which made treasury

management very black and white but sometimes prevented officers from making

decisions that an informed investor might make.

6.0 NEXT STEPS - TE ANGA

WHAKAMUA

6.1 The

updated policy will be taken to Operations and Monitoring Committee for

ratification and adoption.

Attachments:

|

1⇩

|

Treasury Management Policy - Risk and Assurance

|

FIN-15-01-20-17

|

|

|

SUMMARY OF CONSIDERATIONS - HE

WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose of Local

Government - E noho hāngai pū ai ki te

Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future.

|

|

Link to the Council’s

Community Outcomes - E noho hāngai pū ai ki te rautaki matua

This proposal promotes the economic well-being of communities in the present and for the

future.

|

|

Māori Impact Statement - Te

Tauākī Kaupapa Māori

There are no

know impacts on Tangata Whenua of adopting the revised Treasury Management

Policy.

|

|

Sustainability - Te

Toitūtanga

There is no

impact on sustainability of adopting the revised Treasury Management Policy.

|

|

Financial considerations - Ngā

Whaiwhakaaro Ahumoni

There is no

financial impact of adopting the revised Treasury Management Policy.

|

|

Significance and Engagement - Te

Hiranga me te Tūhonotanga

This report has been assessed

under the Council's Significance and Engagement Policy as being of minor significance.

|

|

Consultation – internal

and/or external - Whakawhiti Whakaaro-ā-roto, ā-waho

Apart from

consultation between officers and Council’s treasury advisors there has

been no other consultation occur on this matter.

|

|

Risks: Legal/ Health and

Safety - Ngā Tūraru: Ngā Ture / Hauora me te Haumaru

No implications

|

|

Rural Community Board - Ngā

Poari-ā-hapori

No implications

|

|

Treasury Management Policy - Risk and

Assurance

|

Attachment 1

|

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Health and Safety Manager

Jennie

Kuzman

SUBJECT: Health

& Safety Risk Management Update

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to provide an update to the Committee in regards to

the management of Health and Safety risks within Council.

1.2 This

issue arises due to the Health and Safety at Work Act 2015 and the requirement

of that legislation for Elected Members to exercise due diligence to ensure

that Council complies with its Health and Safety duties and obligations.

1.3 Due

diligence is defined in section 44(4) of the Health and Safety at Work Act 2015

as (Elected Members) taking reasonable steps to:

· “Acquire

and update knowledge of health and safety matters.

· Gain an

understanding of the operations carried out by the organisation, and the

hazards and risks generally associated with those operations.

· Ensure the

PCBU has, and uses, appropriate resources and processes to eliminate or

minimise those risks.

· Ensure the

PCBU has appropriate processes for receiving and considering information about

incidents, hazards and risks, and for responding to that information in a

timely way.

· Ensure

there are processes for complying with any duty, and that these are

implemented.

· Verify that

these resources and processes are in place and being used”.

1.4 Please

note that the term ‘PCBU’ or Person Conducting a Business or

Undertaking, is a legal term that applies to one person (sole trader) or more

than one person (organisation) and in this context can be interpreted as

referring to Hastings District Council as the organisation.

1.5 The

publication ‘Health and Safety Guide: Good Governance for

Directors’ published in March 2016 provides useful information for

Elected Members and can be found online at: https://worksafe.govt.nz/managing-health-and-safety/businesses/guidance-for-business-leaders/

1.6 The

guide states that directors (or in this case Elected Members) “must exercise

the care, diligence, and skill that a reasonable director would exercise in the

same circumstances. What is considered reasonable will depend on the particular

circumstances, including the nature of the business or undertaking, and the

director or officer’s role and responsibilities”.

1.7 “Directors,

may seek health and safety advice from experts or others within their

organisation, such as managers. Where they choose to rely on this advice, the

reliance must be reasonable. Directors should obtain enough health and safety

knowledge to ask the right questions of the right people and to obtain

credible information”.

1.8 Currently,

in order to assist Elected Members with their due diligence duties, a high

level summary report is provided on a quarterly basis to meetings where full

Council are in attendance. This report focuses on the overall Health and Safety

Performance of Council against organisational objectives.

1.9 Additionally,

regular detailed reports are provided to the Risk and Assurance Committee

(formerly the Risk and Audit subcommittee) regarding the management of

Council’s Health and Safety Risks.

1.10 Report

Contents

1.11 This

report provides information regarding the areas of:

· Health and Safety Training for Elected Members

· Health and Safety Policy Update.

· Contractor Health and Safety Management.

· ISO/NZS 45001:2018 (External Health & Safety Audit)

Implementation Update.

1.12 Health and Safety Training

for Elected Members

1.13 A training workshop

will be provided to Elected Members within the next few months in order to

provide further guidance with regards to Health and Safety responsibilities,

this will be of particular importance to those Elected Members who are new to

Council.

1.14 Health and Safety

Policy Update

1.15 Council updated its

Health and Safety Policy in 2018, this policy was formally ratified by Council

and signed by the then Chief Executive and Mayor on behalf of Council.

1.16 An update to this

policy has recently been drafted for approval by the Chief Executive and it is

proposed that this Policy also be ratified by Council.

1.17 A copy of the updated

policy is attached as Attachment 1 for Committee members to review prior

to this policy going to the Operations and Monitoring Committee for

ratification on the 27th February 2020.

1.18 Contractor

Health and Safety Management

1.19 Under

the Health and Safety at Work Act 2015, Council has a primary duty of care to

ensure as far as reasonably practicable, the Health and Safety of workers who

work for Council and workers whose activities are influenced or directed by

Council. The legal term ‘worker’ applies to any individual

who carries out work in any capacity for Council (this includes Employees,

Volunteers, Contractors and the employees of contractors).

1.20 Additionally,

Council will often share Health and Safety duties with other organisations (in

relation to the same matter) when activities form part of a contracting chain

or work in a shared workplace. This is usually referred to as

‘overlapping duties’ and Council has a duty under the Act to

consult, cooperate with and coordinate activities with all other organisations

that it shares overlapping duties with, so far as is reasonably practicable.

1.21 WorkSafe (the

Regulator) has set out its expectations for the Principal (this is Council when

it contracts others to undertake work) in a contracting chain within its

reference document ’Good Practice Guidelines: PCBU’s working

together – Advice When Contracting, June 2019’. Which can be found

online at https://worksafe.govt.nz/managing-health-and-safety/getting-started/understanding-the-law/overlapping-duties/pcbus-working-together-advice-when-contracting/

1.22 WorkSafe

expects the principal in a contracting chain to be a Health and Safety leader

and WorkSafe also expects principals to :

· “Set clear Health and Safety expectations and incorporate

these into contracts with contractors.

· Work with designers to eliminate risks so far as is reasonably

practicable, or minimise risks if they cannot be eliminated (this is a concept

commonly known as ‘safety in design’).

· Choose the best contractors and site managers for the job using

Health & Safety prequalification measures, not simply choosing them based

on cost.

· Check health and safety records of potential contractors.

· Put clear and effective reporting procedures in place so they can be

confident all duties are being met.

· Set up a clear framework for information sharing for the duration of

the project”.

1.23 Additionally,

where Council staff manage projects, WorkSafe expects that Council staff will:

· “Work with Contractors to ensure an appropriate Health and

Safety plan is in place.

· Monitor the work practices of Contractor and subcontractor workers.

· Put clear and effective reporting procedures in place so they can be

confident all duties are being met”.

1.24 Council

manages its Contracts and Contractors in-line with the principles of these Good

Practice Guidelines and has done so for the past several years. There are

processes in place regarding procurement to ensure that there is a non-price

evaluation (including an evaluation of tenderers’ Health and Safety

systems and practices) as well as a lowest price evaluation during tenderer

selection.

1.25 To assist Elected

Members in undertaking their due diligences requirements in regards to the

management of Contractors it was proposed at the September 2019 Risk and Audit

Subcommittee Meeting, that a high level contractor performance report (for the Contractors

working under Council’s 10 highest risk term contracts) be provided to

the Committee on a quarterly basis. It is intended that the first report be

provided for the meeting scheduled for the 4th May 2020.

1.26 This report will

include performance indicator scores for each of the Contractors working under

Council’s 10 highest risk term contracts, covering management of Health

and Safety, quality, contract delivery and finances.

1.27 The

10 contractors in alphabetical order are:

· Armourguard Ltd (Noise Control Contract)

· City Care Ltd (Water Services Maintenance Contract)

· Downer Ltd (Urban Road Maintenance Contract)

· Fulton Hogan Ltd (Rural Road Maintenance Contract)

· Gemco Ltd (Opera House Redevelopment Contract)

· Greensky Ltd (Recycling Collection Contract)

· HSM Security Ltd (Night Security and Animal Control After hours

Contracts)

· M.W. Lissette Ltd (Landfill Civil Works Contract)

· Recreational Services Ltd, (Parks, Open Spaces and Amenities

Maintenance Contract).

· Waste Management Ltd (Municipal Waste Collection Contract)

1.28 Attachment 2

sets out a draft template for this report.

1.29 Implementation

of ISO/NZ Standard 45001:2018 (Health and Safety Management Systems)

Accreditation

1.30 As

previously advised to the Risk and Audit Subcommittee, following the

disestablishment of the ACC Workplace Safety Management Practices (WSMP)

accreditation scheme in 2018, the then Acting Chief Executive authorised

implementation of the international Health and Safety standard ISO 45001:2018

which has also been adopted by the New Zealand Standards Authority.

1.31 Telarc

NZ has been engaged to undertake an initial assessment of what is required to

meet the standard (essentially a gap analysis). Unfortunately the assessment

which was scheduled for late 2019, has had to be rescheduled for the 25th

February 2020 due to auditor unavailability. A report will be provided to the

Risk and Audit Subcommittee following this assessment.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Health & Safety Risk Management Update

B) That the

Committee recommend to Council that the updated

Health and Safety Policy be ratified.

|

Attachments:

|

1⇩

|

Draft HDC Health and Safety Policy 2020

|

HR-03-02-2-20-35

|

|

|

2⇩

|

Draft Contractor Quarterly Performance Report

Template

|

HR-03-01-20-334

|

|

|

Draft HDC Health and Safety Policy

2020

|

Attachment 1

|

HEALTH

AND SAFETY POLICY 2020

Proposed

changes are highlighted in yellow

•

OUR COMMITMENT:

Hastings District Council is committed

to keeping workers (employees, volunteers and

contractors) and the community safe through living a strong Health and

Safety culture.

TO ACHIEVE THIS, HASTINGS DISTRICT

COUNCIL MANAGERS WILL:

• Maintain

and continuously improve our Health and Safety management system.

• Set

targets for improvement and measure, appraise and report on our Health and

Safety performance.

• Take

a proactive approach to managing Health and Safety risk by actively identifying

hazards and unsafe behaviour within the workplace, and take steps to reduce the

risks to an acceptable level.

• Build

and maintain a workplace environment and culture that supports good health and

Wellbeing.

• Increase

awareness, participation and learning through active communication

consultation, training and collaboration with workers with regard to Health,

Safety and Wellbeing matters.

• Assess

and recognise the Health and Safety performance of employees and contractors.

• Accurately

report and learn from our incidents (including near misses).

• Support

the safe and early return to work of injured employees.

• Ensure

that we design, construct, operate and maintain our assets so that they

safeguard the community.

• Require

our contractors to demonstrate a strong Health and Safety culture within their

organisations.

• Comply

with all relevant legislation, regulations, and codes of practice and industry

standards.

EVERYONE'S

Responsibilities:

We believe that whilst senior management have ultimate

accountability, we all have responsibility for Health and Safety. All workers (employees, volunteers and contractors)

must observe our safety rules, policies, procedures and instructions.

They shall ensure their own Health and Safety at work and ensure that no action

or inaction on their part causes harm to others. This includes the

responsibility to stop any work that they believe is unsafe or cannot be

conducted in a safe manner.

|

Draft Contractor Quarterly Performance Report Template

|

Attachment 2

|

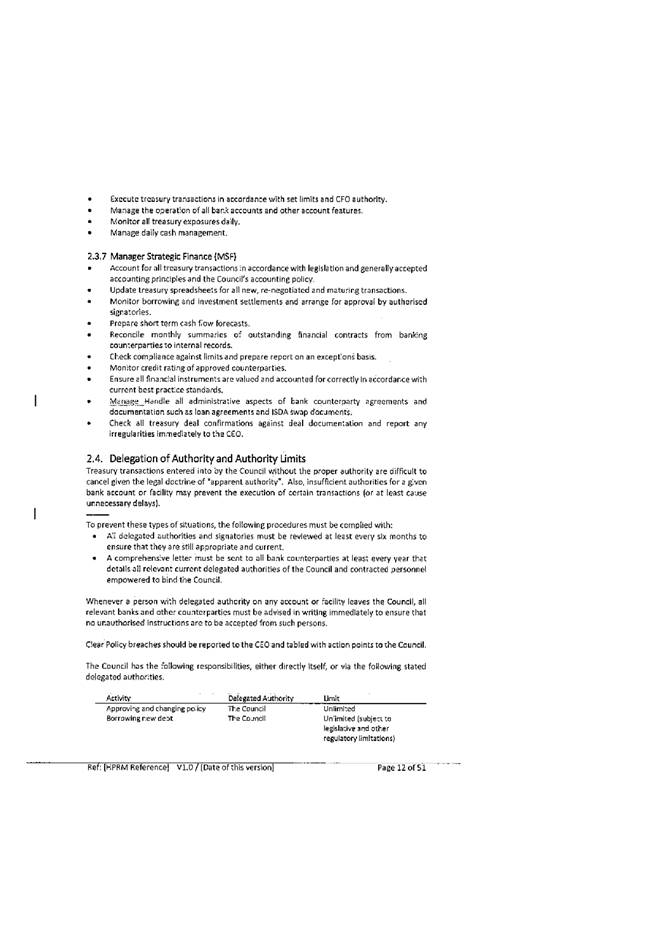

Contractor Quarterly Performance

Report

Indicator Report –

Quarter 3, 2019/2020

·

Summary

This

report provides a high level indication of contractor performance on

Council’s ten highest risk term Contracts for members of the Risk and

Assurance Committee. There are four categories which are monitored: Health and

Safety Management, Quality Management, Contract Delivery and Financial

Management.

·

·

OPTION ONE: Based on Standard

Contract Management Delivery Criteria

·

Key:

|

·

Traffic Light

|

·

Score

|

·

Health & Safety

·

Criteria

|

·

Quality

·

Criteria

|

·

Contract Delivery

·

Criteria

|

·

Financial

·

Criteria

|

|

|

Good Performance

|

· Less than 5% of Safety Observation scores Poor or Fair

· No WorkSafe notifiable/ serious incidents, injuries or

illnesses

· Proactive management of Safety and Health risks

|

Criteria to be developed regarding:

· Specifications

· Rework

|

Criteria to be developed regarding:

· Delivery on schedule

· Delays /issues

|

Criteria to be developed regarding

· Budget

· Variations

|

|

|

Average Performance

|

· 6-20% of Safety Observation scores Poor or Fair

· No WorkSafe notifiable / serious injuries, illnesses or

incidents which were reasonably preventable

· Reasonable management of Health and Safety risks

|

|

|

|

|

|

Poor Performance

|

· Greater than 20% of Safety Observation Scores Poor or Fair

· Occurrence of WorkSafe notifiable /serious injury or illness

which were reasonably preventable

· Unsatisfactory/poor management of Health and Safety risks

|

|

|

|

·

·

Contractor Name

Insert brief description of contract works and contract term

|

·

Indicator Status

|

·

Performance Category

|

·

Comments

|

|

|

Health & Safety

|

25 % of safety observation scores are poor

|

|

|

Quality

|

|

|

|

Contract Delivery

|

|

|

|

Finances

|

|

·

Commentary

Commentary

A number of issues with regards

to traffic management observed within the quarter.

Meeting held with Contractor to

discuss ways to make improvements

·

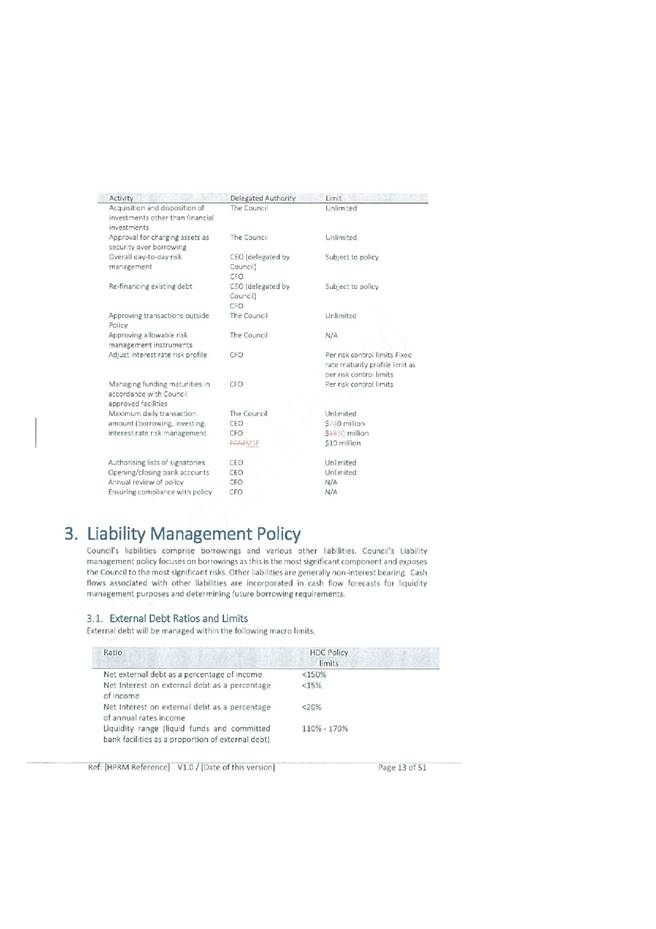

OPTION TWO: Based on Risk Impact

Scales

·

Key:

|

·

Traffic Light

|

·

Score

|

·

Health & Safety

·

Criteria

|

·

Financial

·

Criteria

|

·

Service Delivery

·

Criteria

|

·

Compliance

·

Criteria

|

·

Reputation

·

Criteria

|

|

|

Good Performance

|

· Less than 5% of Safety Observation scores Poor or Fair

· No Worksafe notifiable or serious incidents, injuries or

illnesses

· Proactive management of Safety and Health risks

|

· Less than 10% or $200,000 variation on approved budget

including variations

|

· Less than 10% variation in service delivery timeframe or

quality standard.

|

· No detected material non-compliance with legislative

obligations.

|

· No media attention or attention of a few individuals

|

|

|

Average Performance

|

· 6-20% of Safety Observation scores Poor or Fair

· No Worksafe Notifiable or serious injuries, illnesses or

incidents which were reasonably preventable

· Reasonable management of Health and Safety risks

|

· Variation of between 10% and 25% or $200,000 - $1,000,000 from

approved budget including variations

|

· Variation of between 10% and 25% in service delivery timeframe

or quality standard

|

· Formal warning, or adverse public exposure, for a legislative

non-compliance.

|

· Local media attention or adverse feedback from an organised

local group or community.

|

|

|

Poor Performance

|

· Greater than 20% of Safety Observation Scores Poor or Fair

· Occurrence of notifiable injury or illnesses which were

reasonably preventable

· Unsatisfactory/poor management of Health and Safety risks

|

· More than 25% or $1,000,000 variation on approved budget

including variations.

|

· More than 25% variation in service delivery timeframe or

quality standard.

|

· Fine or prosecution for a legislative non-compliance.

|

· Significant regional or national adverse public interest or

media attention.

|

·

Contractor Name

Insert brief description of contract works and contract term

|

·

Indicator Status

|

·

Performance Category

|

·

Comments

|

|

|

Health & Safety

|

25 % of safety observation scores are poor

|

|

|

Financial

|

|

|

|

Service Delivery

|

|

|

|

Compliance

|

|

|

|

Reputation

|

|

·

Commentary

Commentary

A number of issues with regards

to traffic management observed within the quarter.

Meeting held with Contractor to

discuss ways to make improvements

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Risk and Corporate Services Manager

Regan

Smith

SUBJECT: Council

Risk Appetite Statements

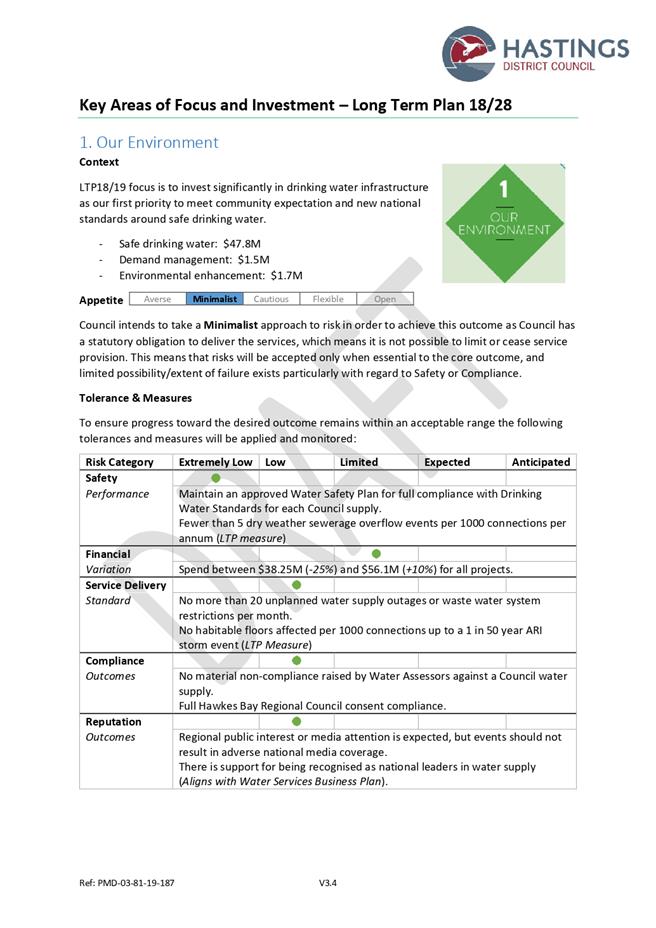

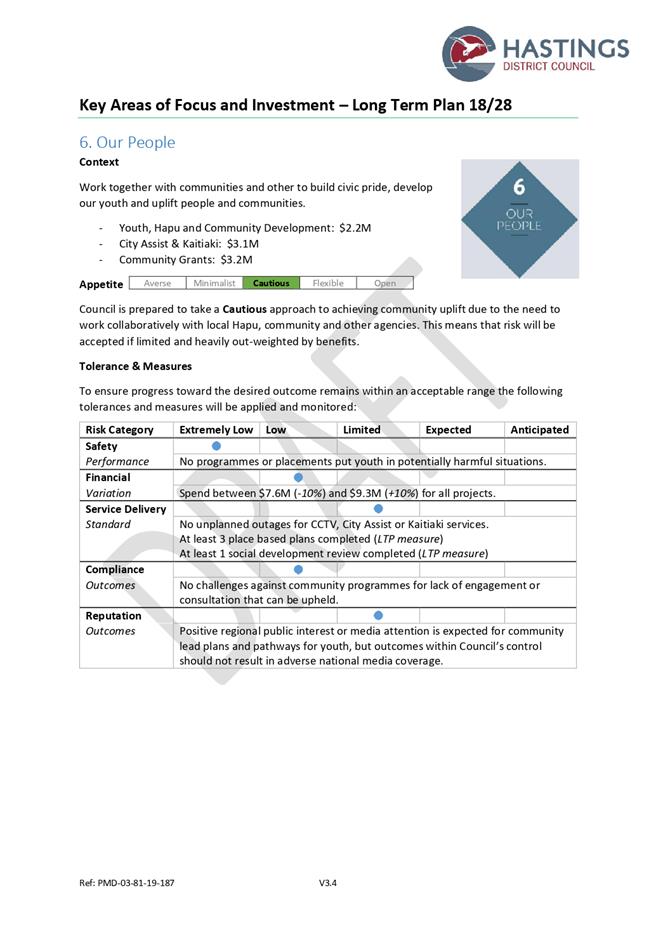

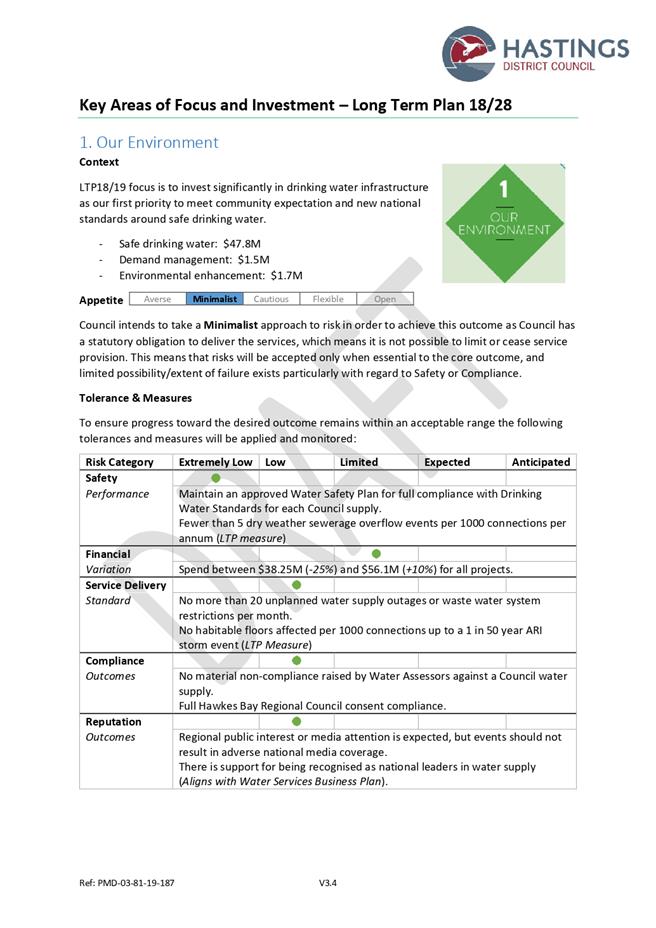

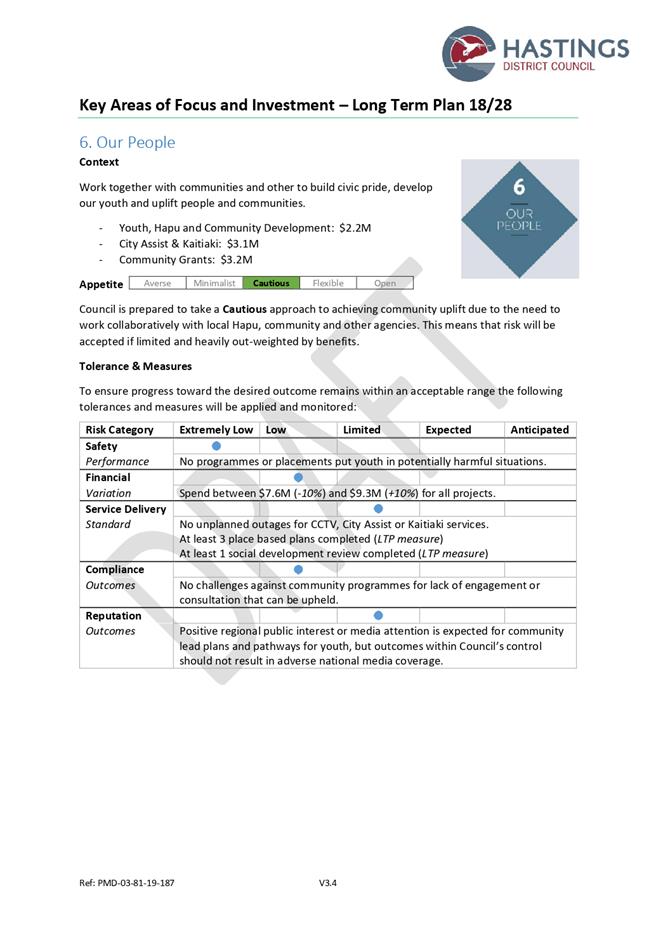

1.0 EXECUTIVE SUMMARY - TE

KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to present a revised Hastings District Council (HDC)

Risk Appetite statement for the Committee to approve, and subsequently

recommendation to Council for adoption.

1.2 This

proposal contributes to the purpose of local government by promoting successful implementation of all Council Long Term Plan

focus areas.

1.3 Based on feedback from the Risk and Audit Subcommittee on 2 July 2019

regarding the original draft Risk Appetite Statement the following changes

should be noted:

· Risk

Appetite Terminology has been refined.

· The

overarching risk appetite statement has been expanded upon by providing

specific statements of risk appetite and tolerance for each of the focus areas

in 2018/2028 Long Term Plan (LTP), plus an additional area covering Council

core business.

· The

Council risk appetite is recognised to vary depending on the strategic outcome,

and ranges from Minimalist to Flexible.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Council Risk Appetite Statements.

B) That the

Committee:

i. Approve the Risk

Appetite Statement as a fair reflection of the Council’s attitude

toward risk, and subsequently,

ii. Recommend to the Council that the Risk Appetite

Statement be adopted as a means for communicating risk taking tolerances and

monitoring risk taking behavior.

iii. Recommends to Council that reviewing the Risk Appetite

Statement should be a key step within the Long Term Plan process.

|

3.0 BACKGROUND – TE HOROPAKI

3.1 In order to develop a Risk Appetite Statement for Council, a survey

of Elected Members and Council Officers was undertaken. The results of these

surveys where incorporated in to a draft Risk Appetite Statement presented to

the Risk and Audit Subcommittee on 2 July 2019.

3.2 Based on feedback from the Subcommittee as this meeting, a revised

draft Risk Appetite Statement was tabled at the 2nd September Risk

& Audit Subcommittee meeting. This draft better reflected the variation in

risk appetite across the range of services that Council provides.

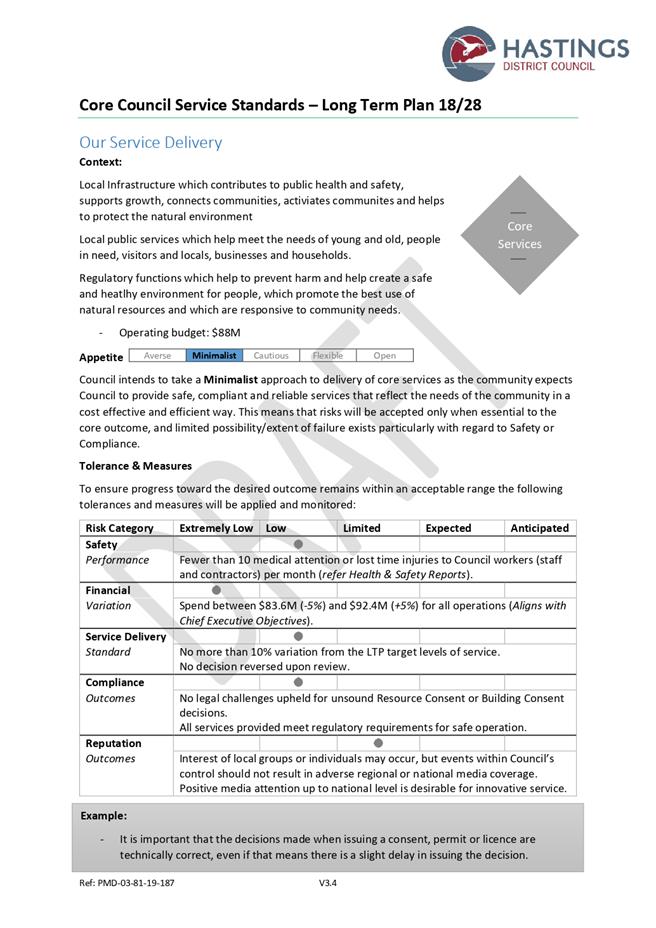

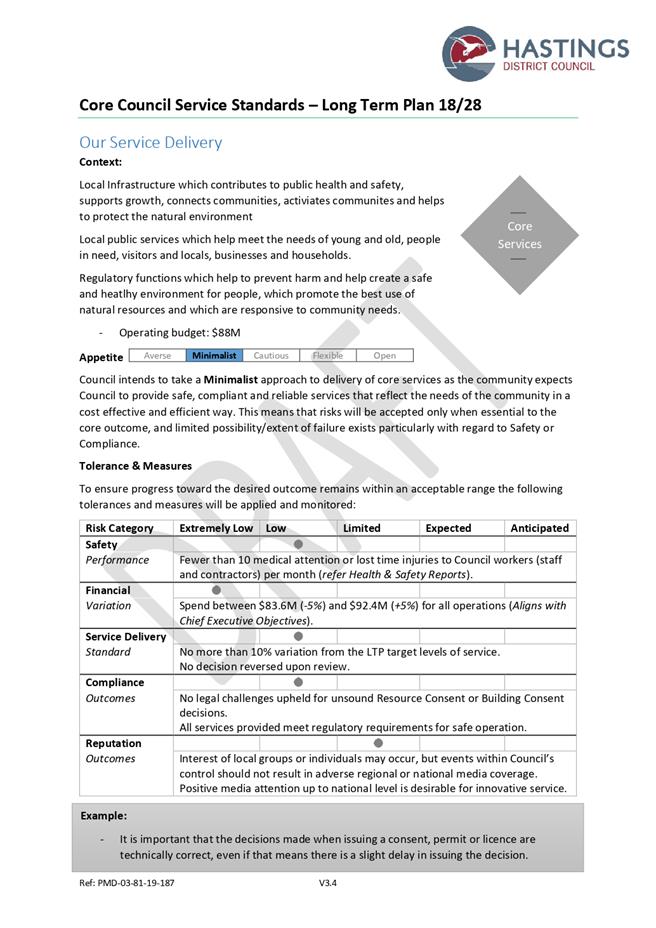

3.3 The current draft Risk Appetite Statement (Attachment 1) now covers

the Council approach to risk for each of the key focus areas in the 2018/2028

LTP, plus an additional focus area to capture Council’s core service

areas of regulatory oversight, provision of infrastructure and community

well-being.

4.0 DISCUSSION - TE MATAPAKITANGA

4.1 It is considered best practice to include a statement of risk

appetite as part of a risk management framework. The ISO31000 risk management

standard recommends defining risk criteria, the equivalent of risk appetite,

before undertaking risk identification and analysis processes.

4.2 The Institute of Risk Management defines risk appetite as the

“amount of risk that an organisation is willing to seek or accept in

pursuit of long-term objectives”. Put another

way, risk appetite can be considered the value the organisation

is willing to put at risk in order to deliver strategic goals.

4.3 A good risk appetite statement should include the acceptable

tolerances for variation in delivery of the organisation’s objectives.

These tolerances should be measurable so that they can be effectively

monitored. In this way, defining risk appetite should assist with managing the

organisation’s total risk exposure.

4.4 Because risk appetite is a tool to managing the organisation’s

total risk exposure, it is vital that the statement is defined by the

organisation’s governing body. As a result, the draft Risk Appetite

Statement for HDC is presented to the Risk and Assurance Committee for

consideration.

4.5 Risk Survey Key Discussion Points

4.6 The

risk appetite survey results identified four key areas of difference between

Elected Members, Executive Management and Officers that warrant further

discussion. Those are tabled for consideration by the Committee:

· How

much focus should be put on protecting the community when seeking to achieve

progress.

· How

much focus to apply to compliance when trying to deliver responsive service.

· How

much effort to put in to partnership and communication/consultation when that

might affect the speed of service or perceived bureaucracy.

· Should

speed of service or cost effectiveness be the key service driver.

OPTIONS

- NGĀ KŌWHIRINGAOption One - Recommended Option - Te

Kōwhiringa Tuatahi – Te Kōwhiringa Tūtohunga 5.1 Approve

the draft Risk Appetite Statement, with or without amendment.

Advantages

· Sets

a foundation for communicating appropriate risk taking behaviour within

Council.

· Defines

a set of tolerances that can be used to monitor whether Council’s total

risk exposure is within acceptable limits.

· Implements

a key component of a best practice Enterprise Risk Management system.

Disadvantages

· Requires

Council to report against the tolerances and therefore creates some additional

administrative overhead.

Option Two

– Status Quo - Te Kōwhiringa Tuarua – Te Āhuatanga o

nāianei

5.2 Reject

the draft Risk Appetite Statement, with or without requesting further work.

Advantages

· May

save some administrative overhead associated with reporting against risk

tolerances.

Disadvantages

· Council

Officers will be left to make their own conclusions regarding the level of risk

taking that is appropriate, which is likely to result variable outcomes and

potentially overly conservative approach.

6.0 NEXT STEPS - TE ANGA

WHAKAMUA

6.1 Should

the Committee approve the draft Risk Appetite Statement, the next steps will

include:

· Communicating

the approved risk tolerances within Council.

· Monitoring

performance against the defined risk tolerances.

6.2 In

order to keep the Risk Appetite Statement relevant, it is recommended that a

review of the Council’ risk appetite is a key step within the LTP

process.

Attachments:

|

1⇩

|

DRAFT HDC Risk Appetite Statement V3.4

|

PMD-03-81-19-198

|

|

|

SUMMARY OF CONSIDERATIONS - HE

WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose of Local

Government - E noho hāngai pū ai ki te Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future.

This report contributes to the purpose of Local Government

by promoting successful implementation of all Long Term Plan focus areas to

achieve the wellbeing and strategic outcomes set by Council.

|

|

Link to the Council’s

Community Outcomes - E noho hāngai pū ai ki te rautaki matua

This proposal does not directly

contribute to delivery of a specific well-being, but will promote greater

understanding of the attitude to risk to increase confidence that any

specific well-being outcome is delivered as expected.

|

|

Māori Impact Statement - Te

Tauākī Kaupapa Māori

There

are no known impacts for Tangata Whenua.

|

|

Sustainability - Te

Toitūtanga

There

are no implications for sustainability.

|

|

Financial considerations - Ngā

Whaiwhakaaro Ahumoni

There are no direct financial

implications of the proposal.

It should be noted that the

purpose of risk appetite is to assist understanding of risk taking, including

how much value can be put at risk. Therefore, this proposal should assist

with reducing unexpected financial variations.

|

|

Significance and Engagement - Te

Hiranga me te Tūhonotanga

This decision has been

assessed under the Council's Significance and Engagement Policy as being of

low significance to the community.

It is of some operational

importance to Council, as a good understanding of risk appetite supports

effective operational delivery and reduces unexpected outcomes.

|

|

Consultation – internal

and/or external - Whakawhiti Whakaaro-ā-roto, ā-waho

No external

engagement or consultation has been undertaken.

|

|

Risks: Legal/ Health and

Safety - Ngā Tūraru: Ngā Ture / Hauora me te Haumaru

Definition of

Risk Criteria, or Risk Appetite, is not a legislative compliance requirement

but is considered industry best practice, and is included in ISO31000 the

standard on Risk Management.

There are no

other specific risks associated with this proposal.

|

|

Rural Community Board - Ngā

Poari-ā-hapori

There are no

specific implications for any Community Boards.

|

|

DRAFT HDC Risk Appetite Statement V3.4

|

Attachment 1

|

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Risk Assurance Advisor

Dean

Ferguson

SUBJECT: Risk

Assurance Insurance Review

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to provide an update to the Committee in regards to

the Risk Assurance review of Council’s Insurance programme.

1.2 The

purpose of this review was to assess and evaluate the effectiveness of

insurance as a control for a number of strategic risks. The review found that

that the insurance programme is well managed and insurance as a control is

fully effective.

1.3 The

review also took into consideration the changing landscape around insurance to

establish whether Council was prepared for future risks to the insurance

industry. This included considering what insurance cover may look like going

forward, and options around alternate forms of mitigation i.e. self-insuring.

1.4 The

main points are:

· Insurance

is one of the key mitigations to manage the risk of assets not being available

in the future to provide services.

· Council

has an open and transparent relationship with their insurance brokerage firm,

Marsh. An officer is assigned to manage the insurance portfolio who in turn

works with the various business units to ensure their needs are accounted for.

· The

insurance market has changed since the recent earthquake events and an increase

in significant weather events, not just in New Zealand but globally.

· Insurance

companies are now looking at risk profiling regions opposed to taking a

holistic view of the country.

· Loss

modelling now plays a significant role in how insurance is applied, what type

of cover is suitable and how much that insurance will cost (and then pay out).

· Lloyds

recently undertook a survey which named New Zealand as the second riskiest

country in major global insurance report, behind Bangladesh.

· Hawke’s

Bay region’s risk profile has increased in recent years due to the risk

around the Hikurangi Subduction Zone, Coastal Erosion and an increase in

significant weather events.

· Council

is not currently covered for any cyber-attack related incidents. Due to cyber

security continually being reported as a top 10 risk to an organisation, the

need for some form of cover will be discussed at the next insurance renewal

discussions between Council and their broker, Marsh.

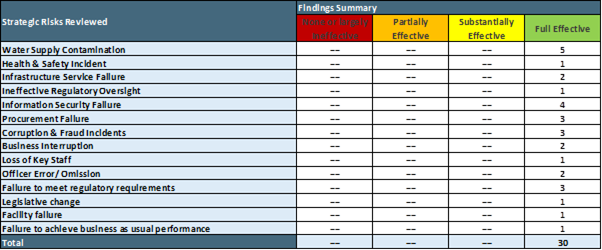

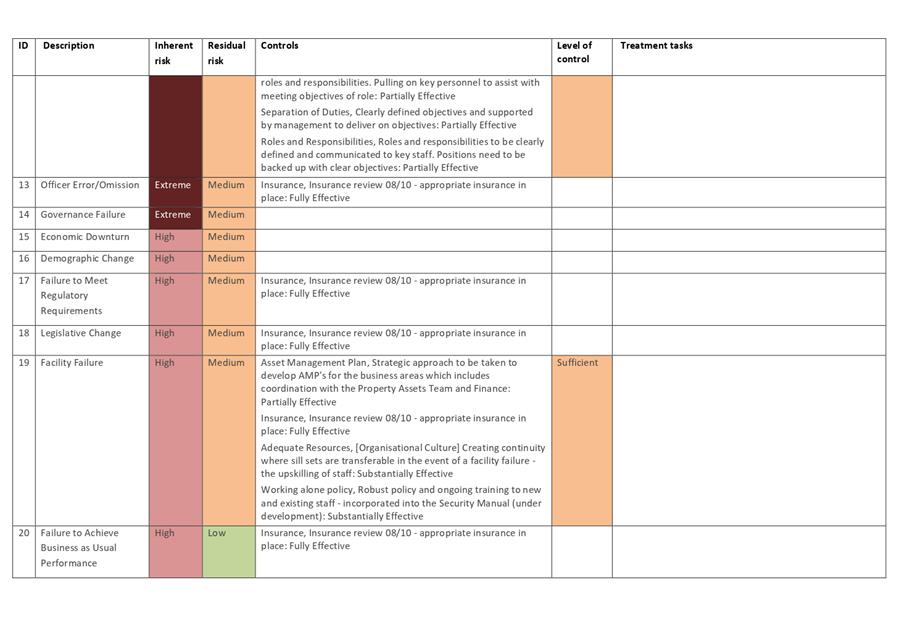

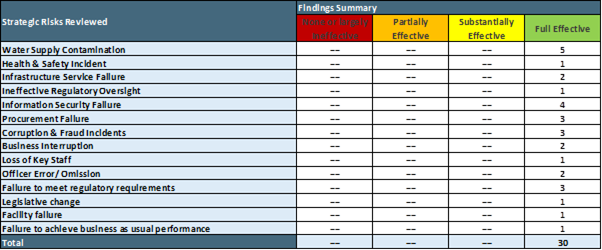

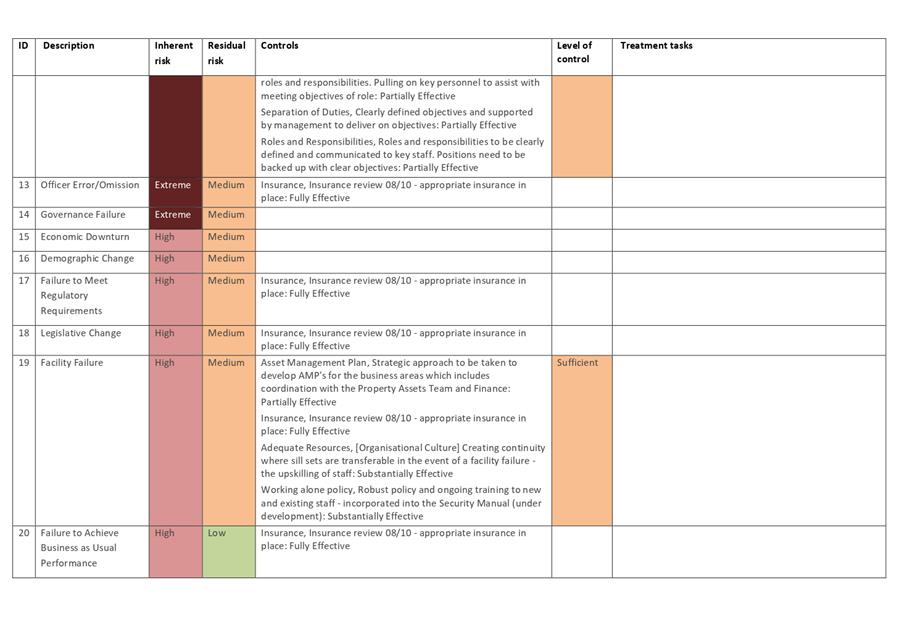

2.0 Review

Findings

2.1 Based

on the work performed, it was found that the overall management control

environment around insurance was fully effective.

2.2 However,

as set out in 1.4, there are a number of factors that will have an impact on

the effectiveness of those controls in the future. Council will need to be in

a position to be adaptable to change and review options around how

insurance is applied, what type of cover is suitable and how much certain

insurance will cost before the premiums outweigh the value or likelihood of a

claim.

2.3 The

below strategic risks were identified as having insurance as either a

mitigation or prevention. Each of the controls were reviewed against their

respective strategic risk and the insurance type they best aligned with. The

overall rating was fully effective.

3.0 Emerging

issues – 5 year view

3.1 Reduced

market access – insurers either pulling out of high risk countries or

raising premiums to a level where they will become unaffordable.

3.2 Contract

Insurance (third party liability limitation) – specified or tagged

insurance putting the onus on Council to compromise on types of contract

insurance.

3.3 Loss

modelling becoming business as usual – understanding the risk from a

micro level.

3.4 Climate

change – more frequent weather events, coastal erosion and inundation

zones.

3.5 Cyber

risk – a greater reliance on cloud hosted and artificial intelligence

systems.

3.6 Business

Continuity – a greater reliance on being resilient and having a strong

business continuity framework and culture to support insurable assets.

|

4.0 RECOMMENDATIONS - NGĀ

TŪTOHUNGA

A) That the Committee receives the report titled Risk Assurance Insurance Review

|

Attachments:

There are no

attachments for this report.

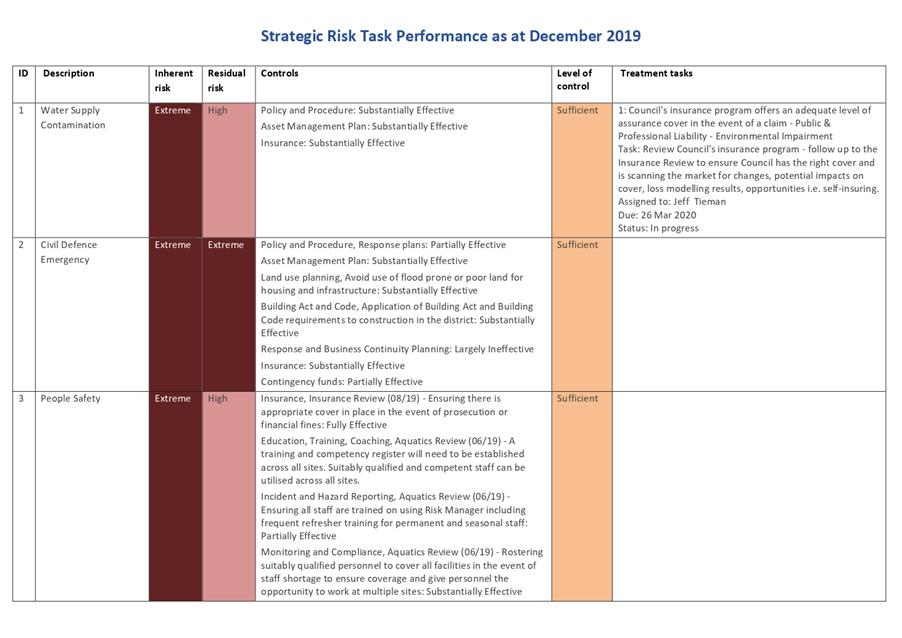

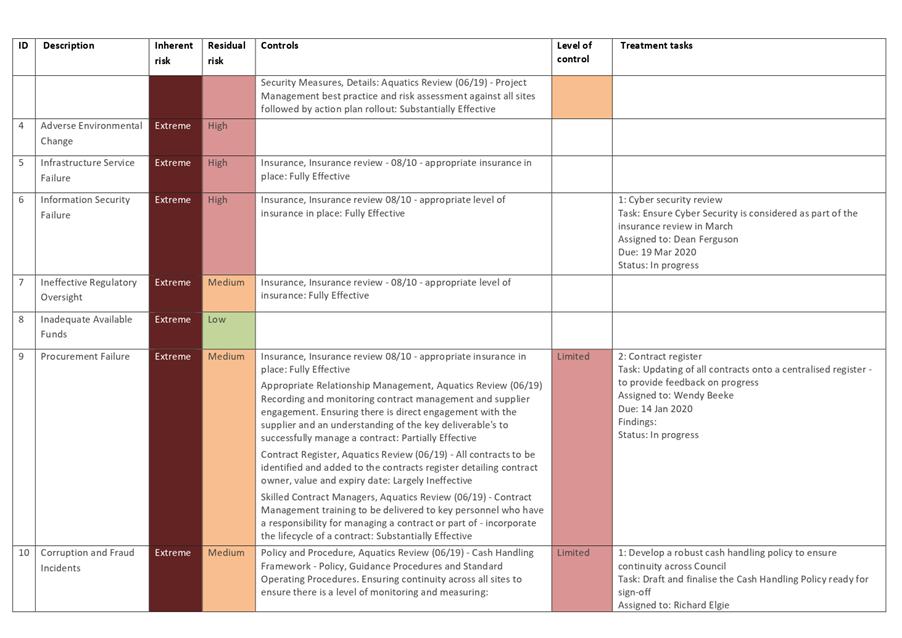

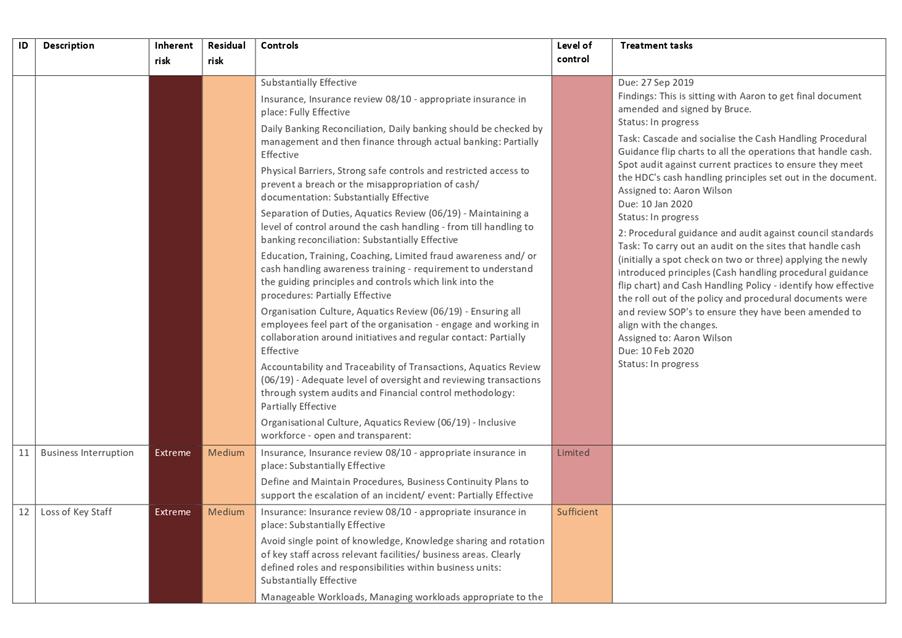

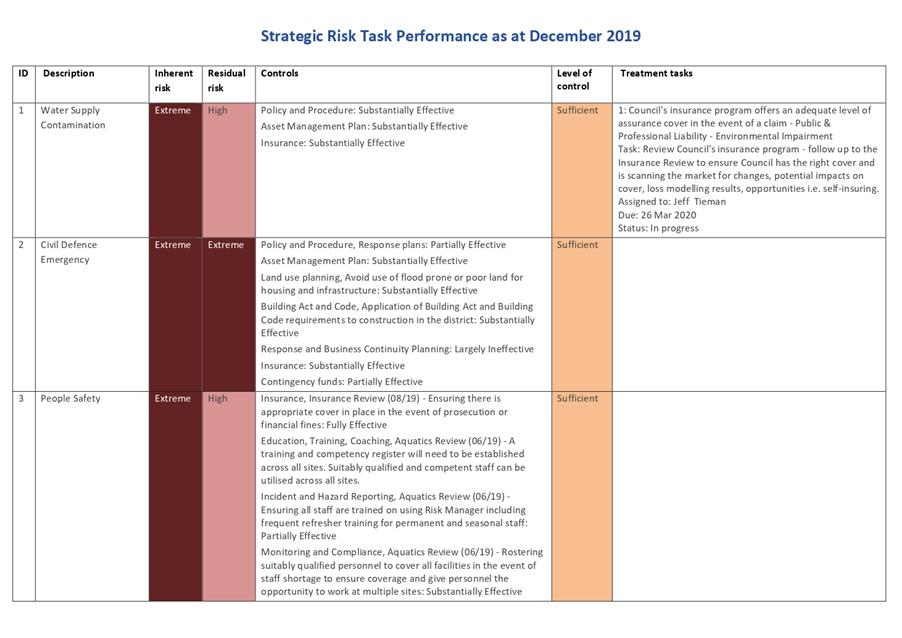

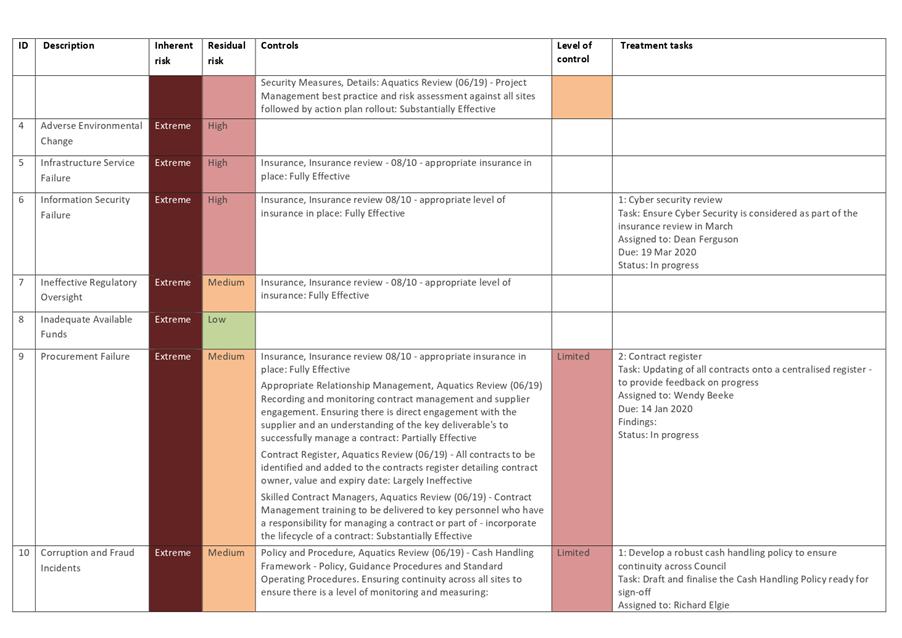

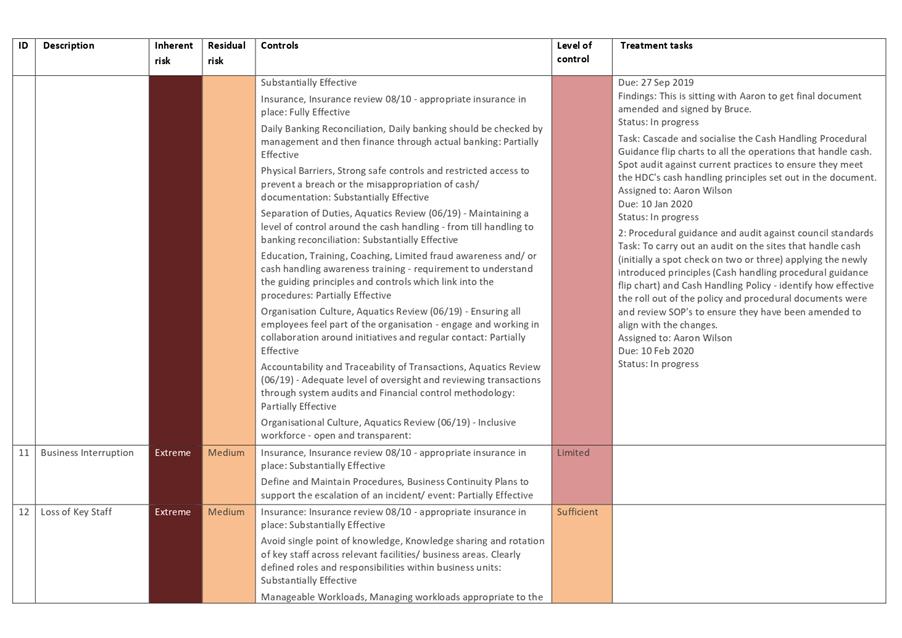

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Risk and Corporate Services Manager

Regan

Smith

SUBJECT: Risk

Assurance Action Status

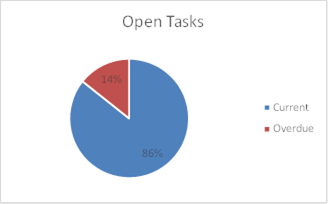

1.0 EXECUTIVE

SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to provide the Committee with assurance that

improvement opportunities raised during Risk Assurance Reviews are being

progressed.

1.2 This

report contributes to the purpose of local government by primarily promoting effective operation of the Council.

1.3 The main points are:

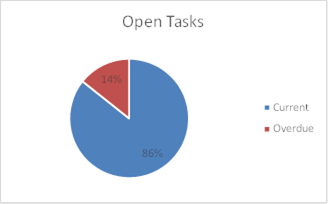

· The majority of risk assurance tasks are being satisfactorily

progressed.

· The only overdue action relates to finalising a Cash Handling Policy.

This work is substantially complete waiting final amendments and approval.

· 93 Resource Consents with which Council must comply have been loaded

in to Lutra Infrastructure Data (ID) system for management.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Risk Assurance Action Status

|

3.0 BACKGROUND

– TE HOROPAKI

3.1 The

Risk Assurance Review programme involve assessing how well the critical

controls identified for each of the Council’s strategic risk are working.

3.2 As a

result of these assessments improvement opportunities may be identified, which

are raised as Tasks for business unit managers to implement.

3.3 This

report provides a status summary for Tasks from all

Assurance Reviews.

4.0 DISCUSSION - TE MATAPAKITANGA

4.1 Risk

Assurance Task Summary:

· Completed Tasks.

|

Previous

Quarter

|

Current

Quarter

|

|

2

|

4

|

· Open Tasks

|

In

Progress

|

Count

|

|

Current

|

6

|

|

Overdue

|

1

|

|

Total

|

7

|

Refer

to Appendix 1 for a full list of tasks.

· Overdue Tasks.

|

Team

|

Task

|

Due Date

|

Strategic

Risk

|

|

Finance

|

Draft and

finalise the Cash Handling Policy ready for sign-off

|

27/9/19

|

10. Corruption

and Fraud Incidents

|

|

Comment: The policy is substantially complete. Minor

amendments are required so the policy can be approved and then implemented.

|

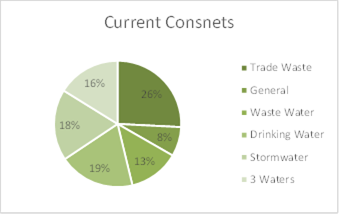

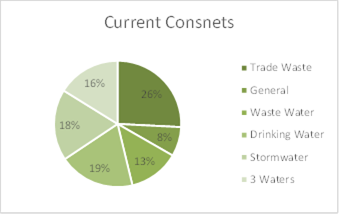

4.2 Resource

Consent Compliance Summary:

· The following table lists consents issued by other authorities to

HDC that have conditions with which Council must comply.

|

Team

|

Number

|

|

3 Waters

|

15

|

|

Drinking

Water

|

18

|

|

Waste Water

|

12

|

|

Stormwater

|

17

|

|

Trade Waste

|

24

|

|

General

|

7

|

|

Total

|

93

|

5.0 NEXT STEPS - TE ANGA

WHAKAMUA

5.1 A

work programme is being developed with Finance to support implementation of the

cash handling policy.

5.2 Work

is underway to capture Resource Consent compliance data to support compliance

monitoring and reporting.

Attachments:

|

1⇩

|

Strategic Risk Task Performance December 2019

|

PMD-9-3-19-7

|

|

|

SUMMARY

OF CONSIDERATIONS - HE WHAKARĀPOPOTO WHAIWHAKAARO

|

|

Fit with purpose

of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural well-being of communities in the present and for

the future.

This report contributes to the purpose of

local government by supporting effective operation of the Council.

|

|

Link to the

Council’s Community Outcomes - E noho hāngai pū ai ki te

rautaki matua

There is no specific contribution to

Community Outcomes

|

|

Māori Impact

Statement - Te Tauākī Kaupapa Māori

There are no known impacts for Tangata

Whenua.

|

|

Sustainability - Te

Toitūtanga

There are no implications for sustainability.

|

|

Financial

considerations - Ngā Whaiwhakaaro Ahumoni

There are no financial implications.

|

|

Significance and

Engagement - Te Hiranga me te Tūhonotanga

This decision/report has been assessed

under the Council's Significance and Engagement Policy as being of low significance.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto,

ā-waho

There has been no external engagement.

|

|

Risks: Legal/

Health and Safety - Ngā Tūraru: Ngā Ture / Hauora me te

Haumaru

Failure

to implement risk control improvements leaves Council open to criticism

should a risk event materialise.

|

|

Rural Community

Board - Ngā Poari-ā-hapori

There are no implications for Community

Boards.

|

|

Strategic Risk Task Performance

December 2019

|

Attachment 1

|

REPORT TO: Risk

and Assurance Committee

MEETING DATE: Monday 3

February 2020

FROM: Chief Financial Officer

Bruce

Allan

SUBJECT: Chief

Financial Officer Update

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The purpose of this report

is to provide the subcommittee with updates on other initiatives that are

currently underway and to provide an update on outstanding actions from

previous meetings.

Electronic Purchase Order Project (Procure to Pay (P2P))

1.2 The P2P

module has now been implemented into the financial system, and has been fully

rolled out across Council. This roll out was staged group by group, and

was a significant logistical exercise, involving a total of four finance staff

operating as trainers, and involved around 200 staff members being trained over

a three month period.

1.3 The

new electronic purchase order system has now gone fully live across Council and

has generally been well received. Where issues have arisen, these are

being resolved both with the users and the finance team.

1.4 Ongoing

adjustments and improvements are expected and will be part of the long term

business improvement strategy. One of the outcomes of the new purchase

order system will see finance working to reduce the number of working days

before close off.

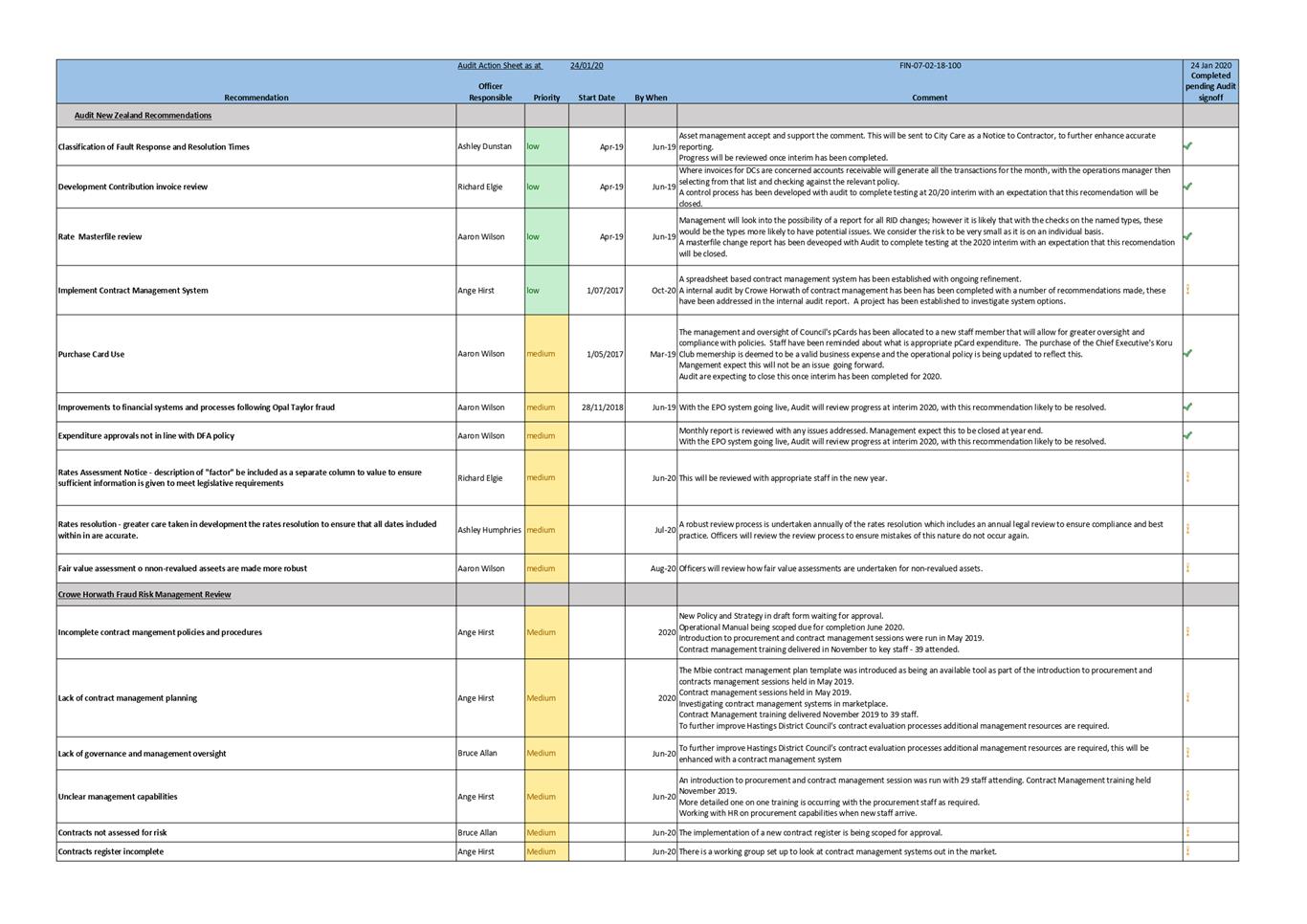

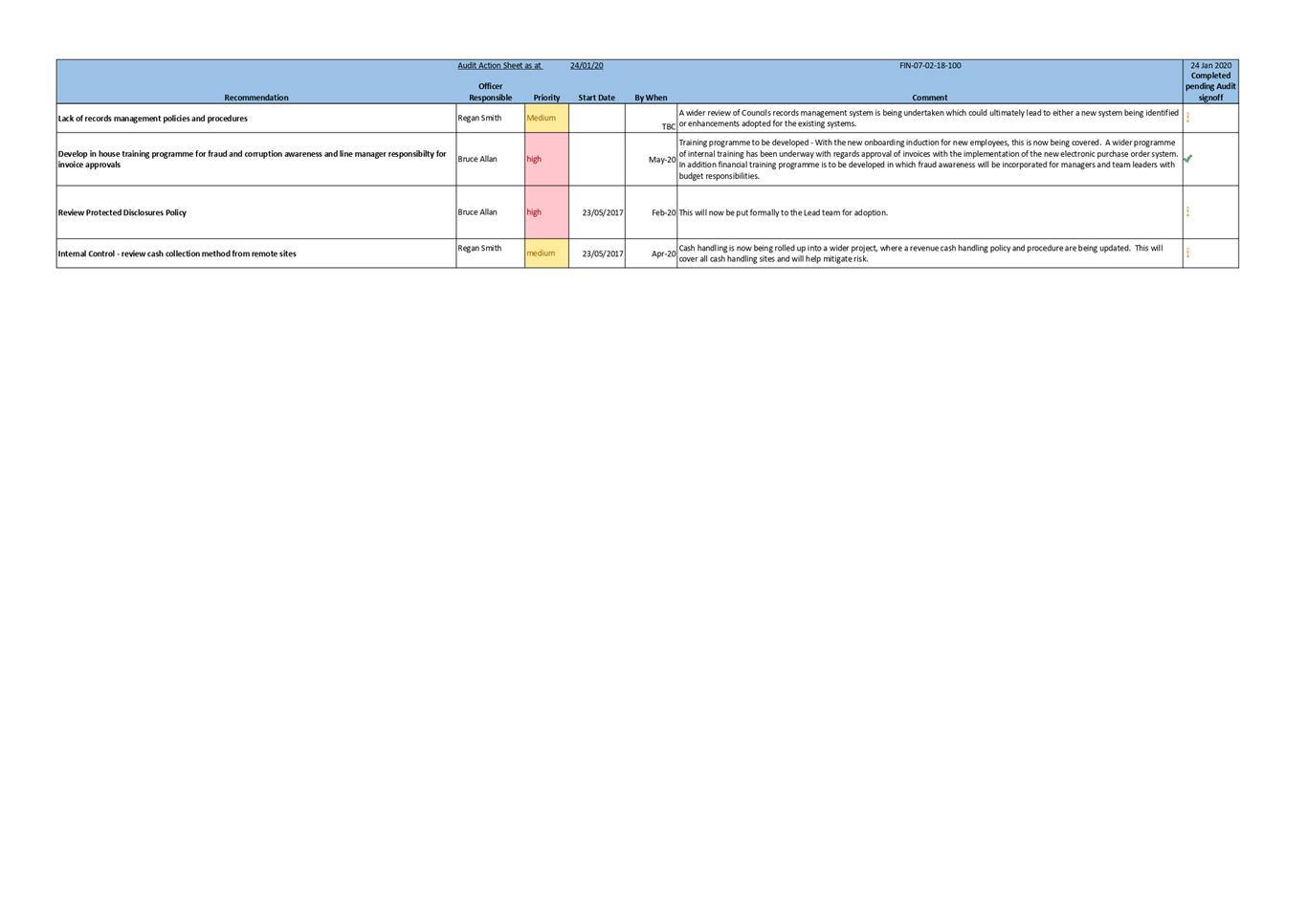

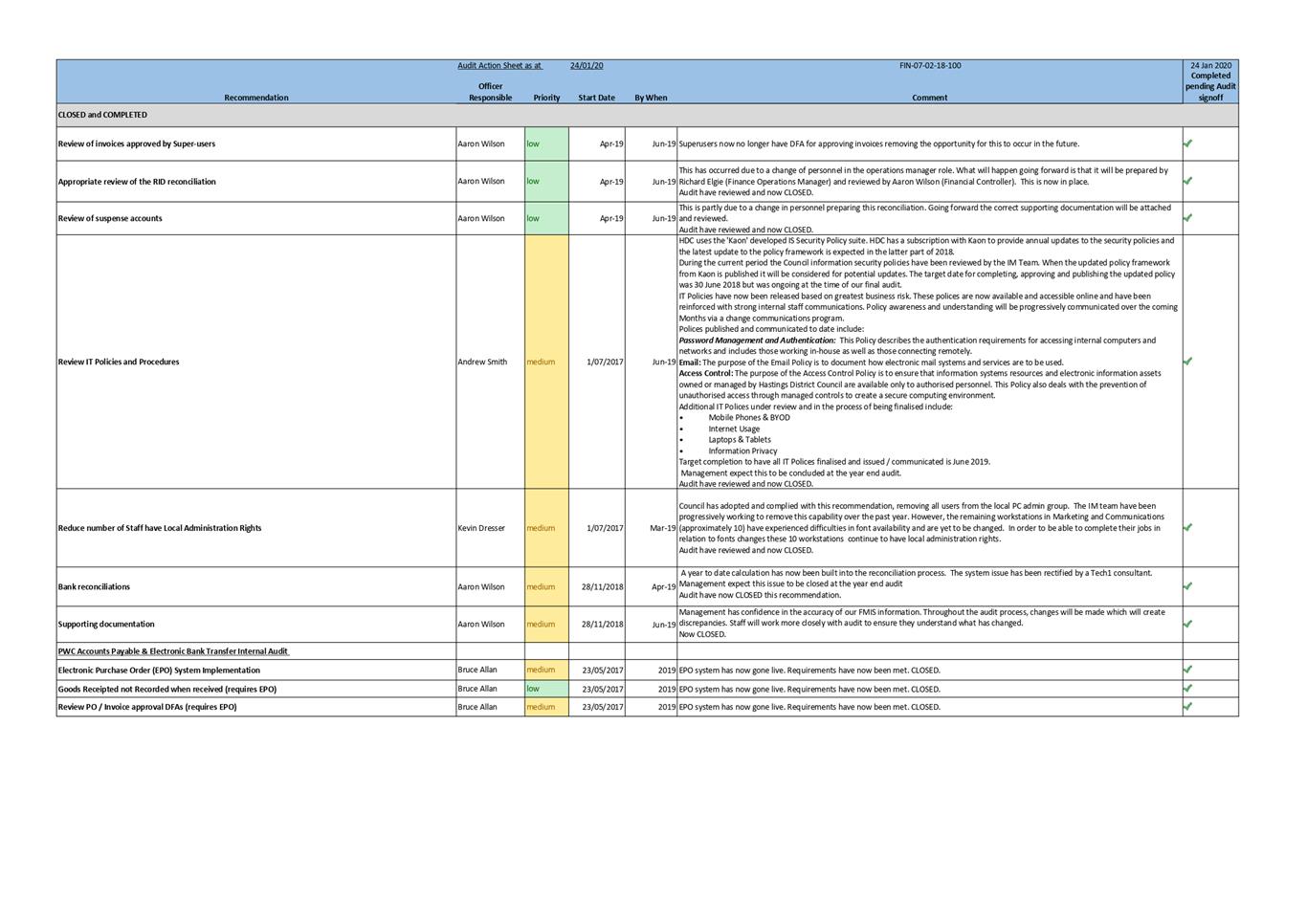

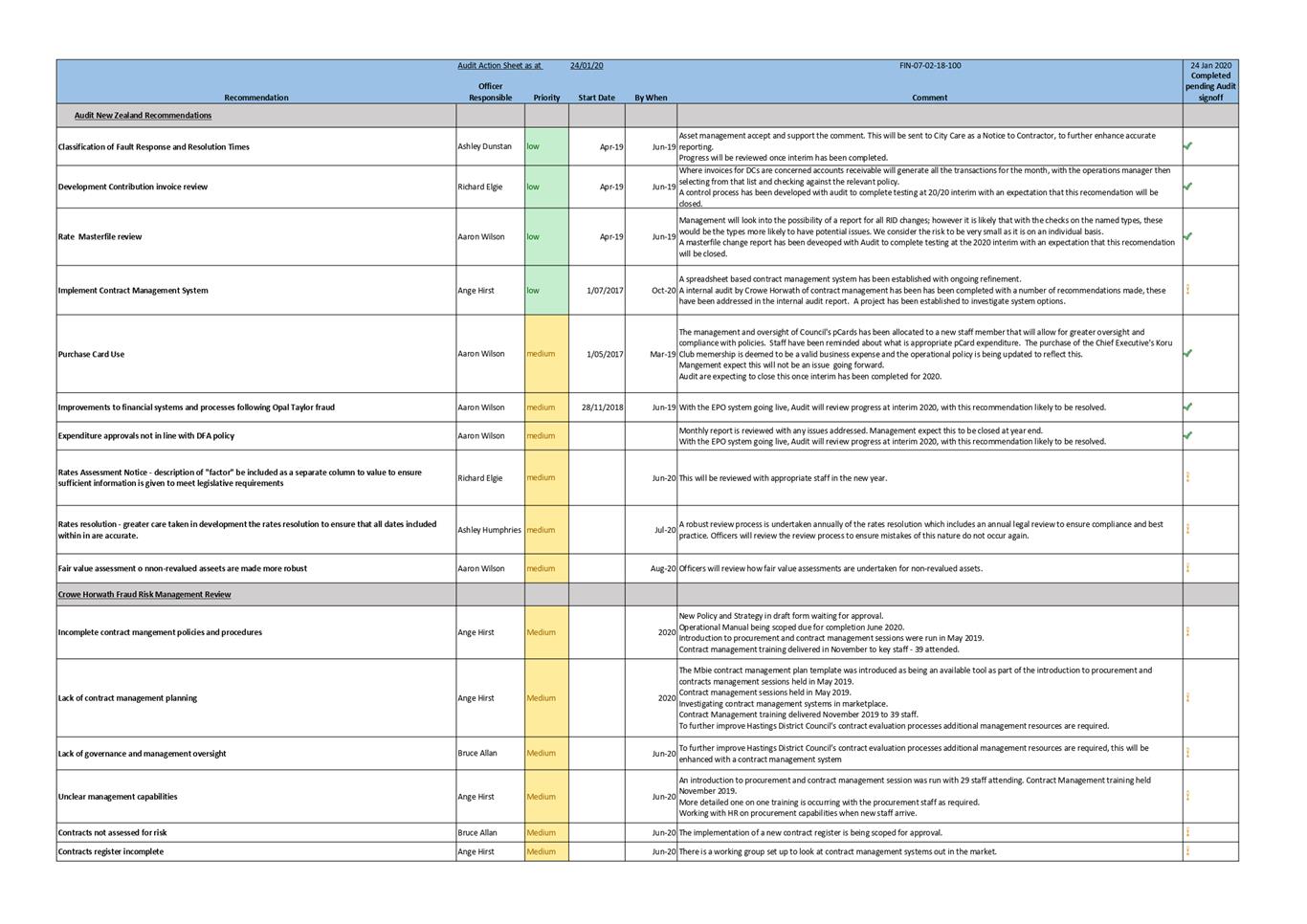

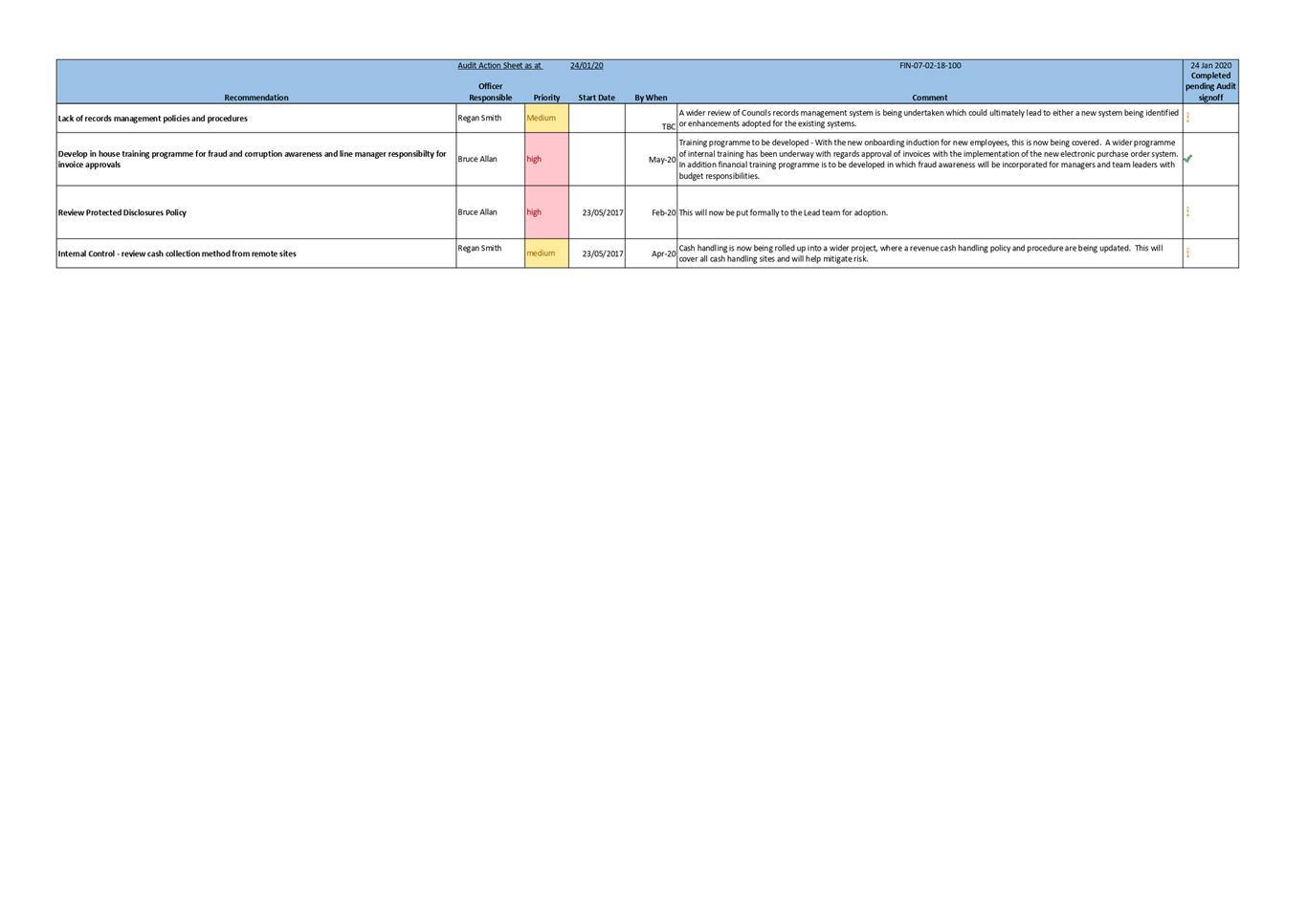

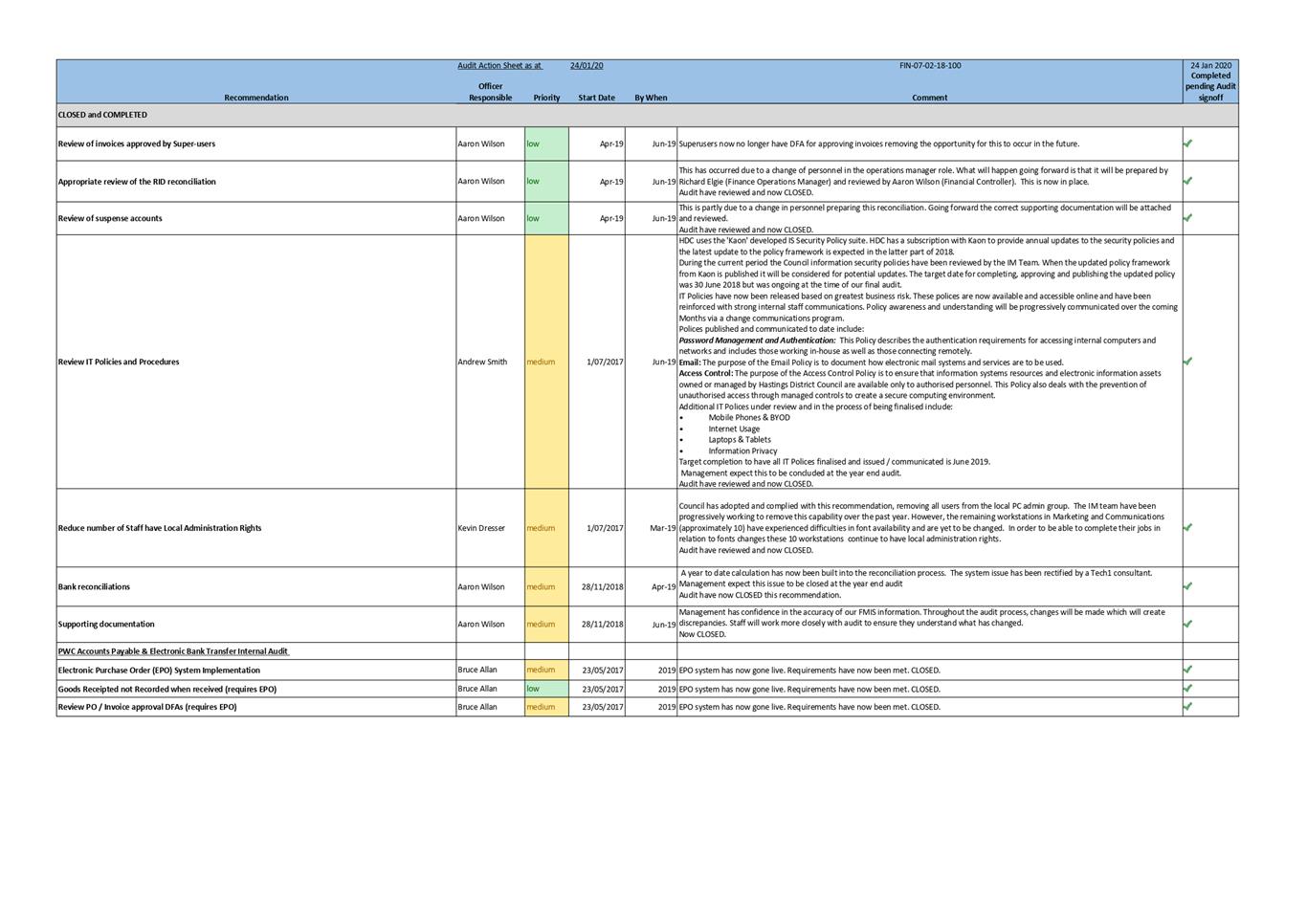

Audit Report for the financial year ended 30 June 2019

1.5 The

report to Council from Audit New Zealand on the audit of Hastings District

Council and the group for the year ended 30 June 2019 has been received and is

attached as Attachment 1.

1.6 Audit

New Zealand have issued an unmodified opinion, and were pleased to note

continued improvement in the delivery of the draft Annual Report and the

progress that Council have made in clearing previous recommendations. Of

the previous 15 open recommendations 7 have now been implemented and closed,

with another 4 likely to be closed off at the interim audit in 2020. The

remaining 4 open recommendations include two that will be resolved due to the

implementation of the new EPO system and one that relates to the implementation

of a contract management system which has a project underway.

1.7 There

were three new recommendations that were raised, none of which were of an

urgent priority. These can be viewed as part of the audit action sheet

attached as Attachment 2.

1.8 Audit

New Zealand state that the financial statements are free from material

misstatements, including omissions. During the audit any misstatements

other than those which were clearly trivial, that were found were discussed

with officers. There were no significant misstatements identified during

the audit that were not corrected.

Internal Audit

1.9 As

per the 2019/20 internal audit plan, an audit of payroll compliance covering

procedures and practices to assess whether the controls and processes ensured

complete, accurate and timely processing of payroll information has been

completed in December 2019.

1.10 Currently the report

is being drafted by Crowe (formally Crowe Horwath) with an update of findings

to be reported to the next risk and assurance committee meeting.

1.11 The audit action sheet

Attachment 2 is an update from both external and internal audit

recommendations, with updated comments on progress.

Risk Assurance Update

1.12 Over the last six

months the Risk Assurance team has established a firm foundation as a centre of

expertise and support for risk management activities across Council. The team

successes include provision of risk management support to the following

strategic projects:

- WMMP Project (Kerbside collection)

- Procurement manual update project

- 10 year water strategy project

- Cape Kidnappers

- Karamu Master Plan

1.13 In addition, the Risk

Assurance Advisor has been the lead officer in the following special projects:

- Landfill review

- Forestry slash management

- Caroline Rd cool store response

- Civil Defence Emergency Management Controller activities

1.14 Due to this proactive

risk management workload, there has been an impact on the review programme

previously reported to the committee in July 2019. The programme originally set

out to complete eight reviews by the end of the 2019/2020 Financial Year (FY).

At present one of those reviews on Strategic Risk Critical Controls, has been

completed and it is unlikely the remaining planned reviews can be completed by

the original target date. As a result, the intention is to focus on two areas

of material risk in the current FY programme, which are reviews on Transportation

and Policies, Procedures and Training. A revised review programme for the

2020/2021 FY will be provided at the next Risk Assurance Committee meeting.

Enterprise Risk Management Framework

1.15 The HDC Enterprise

Risk Management Framework was due for review in January 2020. With the

agreement of the Chair for the Risk Assurance Committee, the review has been

delayed until the Council risk appetite statement has been adopted so this can

be incorporated in to the next revision of the Framework.

Forestry Slash Management

1.16 Over the last eighteen

months the Risk Assurance team have been reviewing and assessing the risk and

potential impacts to our assets and communities through the forestry activity

and slash management. As a result, HBRC have recently recruited a Compliance

Monitoring Officer in which HDC jointly funds 50% FTE. As part of the joint

funding and providing assurance to Council, Risk Assurance have led the

discussions around setting up an action plan and refining KPI’s to ensure

the proper monitoring of forestry harvesting (pre, during and post) is carried

out and to ensure Council’s key objectives are met. This has included

producing an interactive risk based map detailing all forestry locations, key

lifeline roads, bridges and culverts, MPI erosion susceptibility heat map,

archaeological sites, flood risk areas, consented bore locations to name a few.

1.17 Other initiatives to

provide assurance around forestry activity include ensuring the new FTE has

access to certain Council records and systems pertaining to notifications and/

or known forestry activity, access to key Council officers (Environmental

Consents, Transportation, and Compliance) and is fully apprised of the risk

profile of the district. A reporting suite has been generated in order to

capture key information and inform relevant staff of any breaches or

observations.

1.18 Further to that, an

audit will be conducted on the last ten forestry harvest plan notifications

that have been submitted to both HBRC and HDC to identify gaps and ensure full

compliance between the TA and Regional.

Three Waters Update

1.19 The water safety plan

(WSP) for the main Hastings urban supply has been updated using the latest

Ministry of Health guidance. This was submitted for Drinking Water Assessor (DWA)

assessment on the 8th November 2019. Prior to submission it

underwent various internal and external reviews. The DWA are currently

progressing their adequacy assessment of this new plan. If approved officers

understand it would be the first WSP approved under the new framework.

1.20 As part of the urban

supply upgrade programme an assessment has been undertaken to consider whether

there were any interim upgrades works required. The focus was to consider

whether there were any interim works that would deliver fully compliant water

in a shorter timeframe. The assessment concluded that any interim works

would add circa $1m of cost to the programme and would not substantially reduce

the time to provide compliant water. The monitoring and assessments of protozoa

risks at Frimley are considered to be very low, therefore this option provides

little benefit and the focus should remain on the final solution.

Review

of Aquatics Delivery Model

1.21 The Group Manager of

Community Facilities and Programmes has undertaken an internal review of the

delivery model for Council’s aquatics facilities including formalising

the roles and responsibilities between Councils Assets Group and the facility

operators. The review has also utilised the skills and expertise of an external

aquatics facility operator in improving practices at our facilities.

Appointment

of Independent member of Risk and Assurance Committee

1.22 The Finance and Risk

Committee on 17 September 2019 received a report recommending that Council

follow best practice and appoint a second independent member of the Audit and

Assurance Committee, the resolutions of that meeting are detailed below.

“That the

Committee receives the report titled “Appointment of Independent member to the Risk & Audit Subcommittee”.

That the

Committee recommend to the incoming Council following the 2019 triennial

elections that:

i. Mr Jon Nichols be reappointed as the independent

chair of the Risk & Audit Subcommittee for a further three years.

ii. A second independent member of the Risk & Audit

Subcommittee be appointed for a period of three years with a preference for

that member to have asset management experience.”

1.23 Guidance is sought

from the Committee members on the recommended approach to identifying and recommending

a preferred candidate to Council.

Action List

1.24 Attached as Attachment

3, is the updated action list.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Committee receives the report titled Chief Financial Officer Update.

|

Attachments:

|

1⇩

|

Financial Management - Audits - External audit -

Audit NZ's Summary Letter to Audit and Risk Committee 2019

|

FIN-07-01-20-440

|

|

|

2⇩

|

Audit Action Sheet as at 3 Feb 2020

|

FIN-07-02-20-109

|

|

|

3⇩

|

Status of Actions Sheet

|

CG-14-118

|

|

|

Financial Management - Audits -

External audit - Audit NZ's Summary Letter to Audit and Risk Committee 2019

|

Attachment 1

|

|

Audit Action Sheet as at 3 Feb 2020

|

Attachment 2

|

|

Status of Actions Sheet

|

Attachment 3

|

Hastings

District Council

Risk and Audit Subcommittee

Status of Actions Sheet – 3 February 2020

|

Item No.

|

Meeting Date

|

Action

|

Reporting Officer

|

Progress as at 22 October 2019

|

Complete

|

|

1

|

19/6/17

|

Building

Control Liability Issues

· The Subcommittee would take a watching brief and

1. Officers would report back regularly in order to update the

Subcommittee.

|

Building Control Manager

|

Ongoing, last update provided at 2/7/19 meeting

|

|

|

2

|

15/11/18

|

Performance

of Contract Post Tender

· Need to develop a mechanism to monitor contract performance post

implementation

|

Chair/CFO

|

Chair to supply CFO an example of how this monitored in other

industries

|

|

|

3

|

06/05/19

|

Review

of Aquatics delivery model

· Mayor asked

for a review of service delivery model

|

GM CF&P

|

Review of Resourcing and Management Structure underway. Cover off

with CFO overview.

|

|

|

4

|

06/05/19

|

Electronic

Purchase Order Project

· FC to take

Jon Nichols, Crs Kerr and Travers through the P2P process once it is ready to

be implemented

|

FC

|

Completed 31 January 2020.

|

|

|

5

|

02/07/19

|

Governance

Oversight of Finances

· Finance to

develop a inhouse training package

|

CFO

|

Programmed with Induction

First tranche to be delivered 13/2/20

|

|

|

6

|

16/09/19

|

Risk

Appetite Statement

· Draft Risk

Appetite Statement to be modified and circulated to Risk and Audit

|

CFO/Regan Smith

|

On agenda

|

|

|

7

|

02/07/19

|

Internal

Audit

· Summary

of progress to be presented to next Risk and Audit Meeting

|

FC

|

Included in CFO update report

|

|

|

8

|

02/07/19

|

Closed

Landfills

· A report to

be developed to Risk and Audit on the locations and integrity of closed

landfills within HDC boundaries and other areas required.

|

GM:AM

CT

|

Ongoing

|

|

|

9

|

16/09/19

|

Treasuring Activity and Funding

· Invite Bancorp

Treasury advisors to subcommittee

· Convey options if

interest rates go below zero

· Advise savings by using swaps

|

BC

|

Invited to 3/2/20 meeting

Bnacorp to discuss

TBC

|

|

|

10

|

16/09/19

|

Risk Assurance Reviews

· Update to Council

· Transportation

review

|

DF

|

Proposed fo 2nd qtr of 2020

Programme for 2nd qt of 2020

|

|

|

11

|

16/09/10

|

Health & Safety Risk Management

· Next report to committee to incorporae traffic light reporting

· Dashboard

reporting to be developed – include contractor performance

|

JK

|

Reporting updated

|

|

|

12

|

16/09/19

|

General Action Review

· CFO and Chair to

review actions outstanding.

|

BA

|

Completed

|

|

Hastings District

Council

Hastings District

Council