Kaupapataka

Agenda

|

Te Rā Hui:

Meeting date:

|

Thursday, 30 September

2021

|

|

Te Wā:

Time:

|

11.00am

|

|

Te Wāhi:

Venue:

|

Council Chamber

Ground Floor

Civic Administration

Building

Lyndon Road East

Hastings

|

|

Te Hoapā:

Contact:

|

Democracy

and Governance Services

P: 06 871 5000

| E: democracy@hdc.govt.nz

|

|

Te Āpiha Matua:

Responsible Officer:

|

Group Manager: Corporate - Bruce Allan

|

Operations and Monitoring

Committee – Terms of Reference

Fields of Activity

The purpose of the Operations and Monitoring Committee is to

ensure consolidated and complete reporting and monitoring of all financial and

non-financial information and performance measures against the Annual Plan,

Long-Term Plan and Council Strategies, Goals and Priorities.

Membership

·

(Mayor and 14 Councillors).

·

Chair appointed by Council.

·

Deputy Chair appointed by Council.

·

1 Heretaunga Takoto Noa Māori Standing

Committee Member appointed by Council.

Quorum – 8 members

Delegated Powers

1)

Authority to exercise all of Council’s

powers, functions and authorities (except where prohibited by law or otherwise

delegated to another committee) in relation to all matters detailed in the

Fields of Activity.

2)

Authority to exercise all of Council’s

powers, functions and authorities (except where prohibited by law) at any time

when the Chief Executive certifies in a report that;

·

the matter is of such urgency that it requires

to be dealt with

·

the matter is required to be dealt with, prior

to the next ordinary meeting of the Council.

3)

Monitor the performance of Council in terms of

the organisational targets set in the Long Term Plan and Annual Plan –

both financial and nonfinancial.

4)

Monitor operational performance and

benchmarking.

5)

Undertake quarterly financial performance

reviews.

6)

Develop the Draft Annual Report and carry

forwards.

7)

Monitor and review the performance of Council

Controlled Organisations and other organisations that Council has an interest

in.

8)

Monitor and review tender and procurement processes.

9)

Monitor major capital projects.

10) Recommend to Council on matters concerning project decisions where

these are identified as a result of the committee’s project monitoring

responsibilities.

11) Writing off outstanding accounts for amounts exceeding $6,000 and

the remission of fees and charges of a similar sum.

12) Settlement of uninsured claims for compensation or damages where the

amount exceeds the amounts delegated to the Chief Executive.

13) Guarantee loans for third parties such as local recreational organisations

provided such guarantees are within the terms of Council policy.

14) Authority to exercise the Powers and Remedies of the General

Conditions of Contract in respect of the Principal taking possession of,

determining, or carrying out urgent repairs to works covered by the contract.

15) Grant of easement or right of way over Council property.

16) Approve insurance – if significant change to Council’s

current policy of insuring all its assets.

Kaupapataka

OpenAgenda

|

Mematanga:

Membership:

|

Koromatua

Chair: Councillor Geraldine Travers

Ngā KaiKaunihera

Mayor Sandra Hazlehurst

Councillors: Councillors Bayden Barber, Alwyn Corban,

Malcolm Dixon, Damon Harvey, Tania Kerr (Deputy Chair), Eileen Lawson, Simon Nixon,

Henare O’Keefe, Peleti Oli, Ann Redstone, Wendy Schollum, Sophie Siers

and Kevin Watkins

Mike Paku - Heretaunga Takoto

Noa Māori Standing Committee appointee

|

|

Tokamatua:

Quorum:

|

8 members

|

|

Apiha Matua

Officer Responsible:

|

Group Manager: Corporate

– Bruce Allan (Lead)

Group Manager: Asset Management

- Craig Thew

Group Manager: Strategy &

Development – Craig Cameron

Financial Controller –

Aaron Wilson

Chief Information Officer

– Andrew Smith

|

|

Te Rōpū Manapori me te Kāwanatanga

Democracy & Governance Services:

|

Christine Hilton (Extn 5633)

|

Te Rārangi Take

Order of Business

|

1.0

|

Opening

Prayer – Karakia

Whakatūwheratanga

|

|

|

2.0

|

Apologies

& Leave of Absence – Ngā Whakapāhatanga me te Wehenga ā-Hui

At the close of the agenda

no apologies had been received.

At the close of the agenda

no requests for leave of absence had been received.

|

|

|

3.0

|

Conflict

of Interest –

He Ngākau Kōnatunatu

Members need to be vigilant to stand aside from

decision-making when a conflict arises between their role as a Member of the

Council and any private or other external interest they might have.

This note is provided as a reminder to Members to scan the agenda and assess

their own private interests and identify where they may have a pecuniary or

other conflict of interest, or where there may be perceptions of conflict of

interest.

If a Member feels they do have a conflict of

interest, they should publicly declare that at the start of the relevant item

of business and withdraw from participating in the meeting. If a Member

thinks they may have a conflict of interest, they can seek advice from

the General Counsel or the Manager: Democracy and Governance (preferably

before the meeting).

It is noted that while Members can seek advice and

discuss these matters, the final decision as to whether a conflict exists

rests with the member.

|

|

|

4.0

|

Confirmation

of Minutes –

Te Whakamana i Ngā Miniti

Minutes of the Operations &

Monitoring Committee Meeting held Tuesday 27 July 2021.

(Previously

circulated)

|

|

|

5.0

|

Requests

Received under the Local Government Official Information and Meetings Act

(LGOIMA) Update

|

7

|

|

6.0

|

Horse

of the Year (HB) Ltd Draft Financial Statements for year ended 31 May

2021

|

13

|

|

7.0

|

Exemption

of Council Controlled Status for Hawke's Bay Local Authority Shared Services

Limited and the Te Mata Park Trust Board

|

15

|

|

8.0

|

Draft

Financial Year End Results - 30 June 2021

|

19

|

|

9.0

|

Update

on Building Consent Processing

|

41

|

|

10.0

|

Non-Financial

Performance Report for the Year Ended 30 June 2021

|

47

|

|

11.0

|

Minor Items

– Ngā Take

Iti

|

|

|

12.0

|

Urgent

Items –

Ngā Take Whakahihiri

|

|

|

13.0

|

Recommendation

to Exclude the Public from Items 14, 15 and 16

|

49

|

|

14.0

|

Foodeast

Directors' Fees

|

|

|

15.0

|

Horse

of the Year (Hawke's Bay) Limited Director Appointment

|

|

|

16.0

|

Update

on Building Consent Processing

|

|

Hastings

District Council: Operations & Monitoring Committee Meeting

Te Rārangi Take

Report to Operations and Monitoring Committee

|

Nā:

From:

|

Louise Stettner,

Manager, Democracy & Governance Services

|

|

Te Take:

Subject:

|

Requests Received under

the Local Government Official Information and Meetings Act (LGOIMA) Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

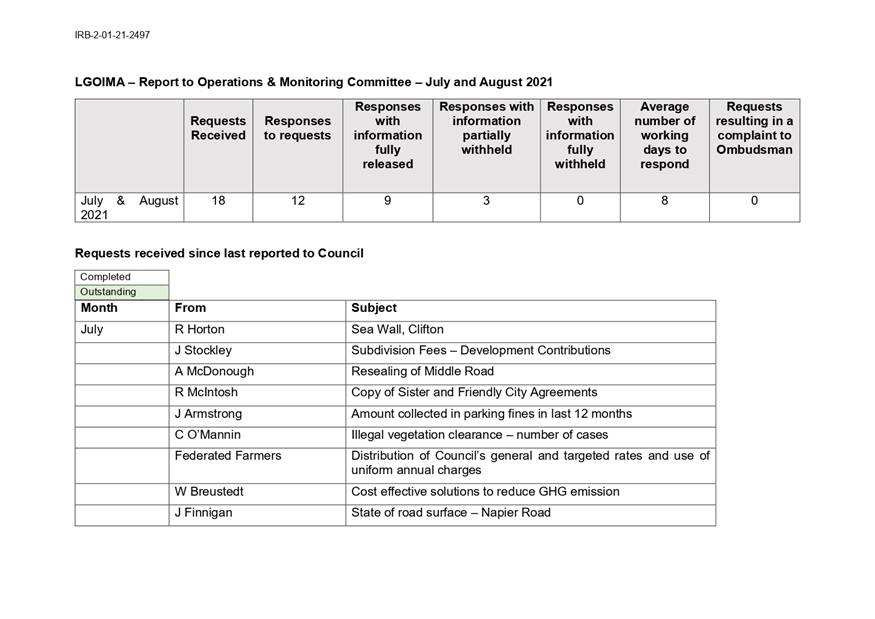

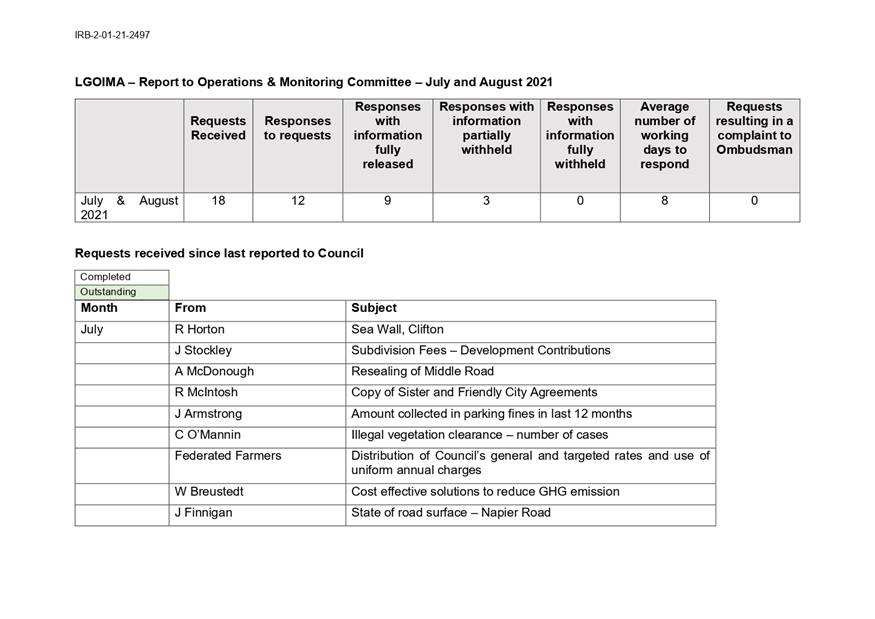

1.1 The

purpose of this report is to inform the Committee of the number of requests

under the Local Government Official Information Act (LGOIMA) 1987 received in

July and August 2021.

1.2 This issue arises from

the provision of accurate reporting information to enable effective governance.

1.3 This is an administrative report to ensure that the Council is aware

of the number and types of information requests received and to provide

assurance the Council is meeting its legislative obligations in relation to the

(LGOIMA).

1.4 This report concludes by recommending that the LGOIMA requests be

noted.

|

2.0 Recommendations

– Ngā Tūtohunga

A) That the

Operations and Monitoring Committee receive the report titled Requests

Received under the Local Government Official Information and Meetings Act

(LGOIMA) Update dated 13 May 2021.

B) That the

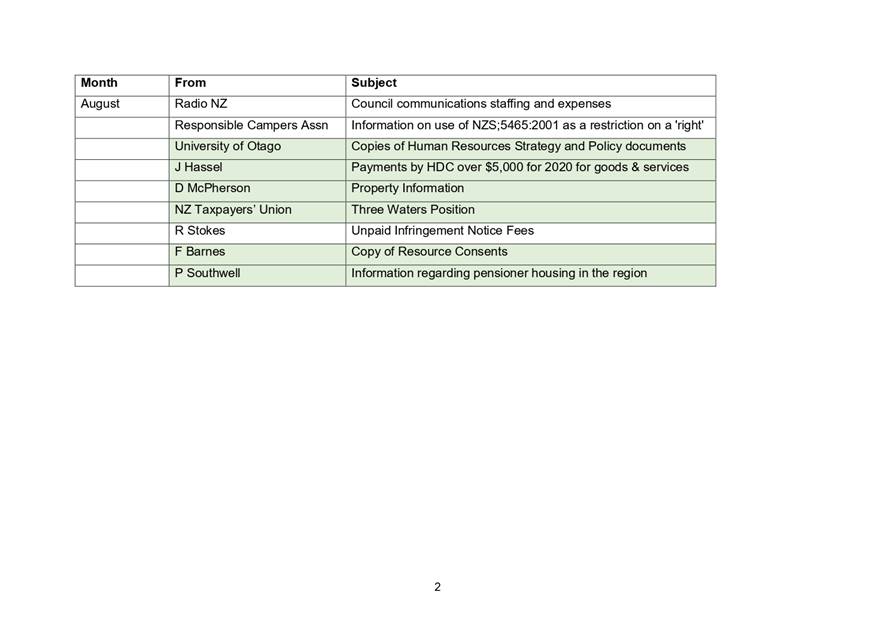

LGOIMA requests received in July and August 2021, as set out in Attachment 1

(CG-16-4-00146) of the report be noted.

|

3.0 Background – Te Horopaki

3.1 The

LGOIMA allows people to request official information held by local government

agencies. It contains rules for how such requests should be handled, and

provides a right to complain to the Ombudsman in certain situations. The

LGOIMA also has provisions governing the conduct of meetings.

Principle of

Availability

3.2 The

principle of whether any official information is to be made available shall be

determined, except where this Act otherwise expressly requires, in accordance

with the purposes of this Act and the principle that the information shall be

made available unless there is good reason for withholding it.

3.3 Purpose

of the Act

3.4 The

key purposes of the LGOIMA are to:

· Progressively

increase the availability of official information held by agencies, and promote

the open and public transaction of business at meetings, in order to:

· enable

more effective public participation in decision making;

· promote

the accountability of members and officials;

· enhance

respect for the law and promote good local government;

· protect

official information and the deliberations of local authorities to the extent

consistent with the public interest and the preservation of personal privacy.

3.5 City,

district and regional councils, council controlled organisations and community

boards are subject to LGOIMA and official information means any information

held by an agency subject to the LGOIMA.

3.6 It is not limited

to documentary material, and includes material held in any format such as:

· written

documents, reports, memoranda, letters, notes, emails and draft documents;

· non-written

documentary information, such as material stored on or generated by computers,

including databases, video or tape recordings;

· information

which is known to an agency, but which has not yet been recorded in writing or

otherwise (including knowledge of a particular matter held by an officer,

employee or member of an agency in their official capacity);

· documents

and manuals which set out the policies, principles, rules or guidelines for

decision making by an agency; and

· the

reasons for any decisions that have been made about a person.

3.7 It

does not matter where the information originated, or where it is currently

located, as long as it is held by the agency. For example, the

information could have been created by a third party and sent to the agency.

The information could be held in the memory of an employee of the agency.

What

does a LGOIMA request look like?

3.8 There

is no set way in which a request must be made. A LGOIMA request is made

in any case when a person asks an agency for access to specified official

information. In particular:

· a

request can be made in any form and communicated by any means, including

orally;

· the

requester does not need to refer to the LGOIMA; and

· the

request can be made to any person in the agency.

3.9 The

Council deals with in excess of 14,000 service requests on average each month

from written requests, telephone calls and face to face contact. The

LGOIMA requests dealt with in this report are specific requests for information

logged under formal LGOIMA procedures, which sometimes require collation of

information from different sources and/or assessment about the release of the

information requested.

Key Timeframes

3.10 An

agency must make a decision and communicate it to the requester ‘as soon

as reasonably practicable’ and no later than 20 working days after the

day on which the request was received.

3.11 The

agency’s primary legal obligation is to notify the requester of the

decision on the request ‘as soon as reasonably practicable’ and

without undue delay. The reference to 20 working days is not the de facto

goal but the maximum unless it is extended appropriately in accordance with the

Act. Failure to comply with time limit may be the subject of a complaint

to the ombudsman.

3.12 The

Act provides for timeframes and extensions as there is a recognition that

organisations have their own work programmes and that official information

requests should not unduly interfere with that programme.

4.0 Discussion – Te Matapakitanga

Current Situation

4.1 Council has requested

that official information requests be notified via a monthly report.

5.0 Options – Ngā Kōwhiringa

Not applicable.

Attachments:

|

1⇩

|

LGOIMA Report July and August 2021 to Operations and

Monitoring Committee 14 September 2021

|

CG-16-4-00146

|

|

|

Summary of

Considerations - He Whakarāpopoto Whakaarohanga

|

|

Fit

with purpose of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-Rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural wellbeing of communities in the present and for

the future.

|

|

Link to the Council’s Community Outcomes – Ngā Hononga ki Ngā Putanga ā-Hapori

N/A

|

|

Māori

Impact Statement -

Te Tauākī Kaupapa Māori

N/A

|

|

Sustainability

- Te

Toitūtanga

N/A

|

|

Financial

considerations -

Ngā Whakaarohanga Ahumoni

N/A

|

|

Significance

and Engagement - Te

Hiranga me te Tūhonotanga

N/A

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto / ā-waho

N/A

|

|

Risks:

Legal - Ngā

Tūraru: Ngā Ture

N/A

|

|

Rural

Community Board –

Te Poari Tuawhenua-ā-Hapori

N/A

|

|

Item 5 Requests

Received under the Local Government Official Information and Meetings Act

(LGOIMA) Update

|

|

LGOIMA

Report July and August 2021 to Operations and Monitoring Committee 14

September 2021

|

Attachment 1

|

Hastings

District Council: Operations & Monitoring Committee Meeting

Te Rārangi Take

Report to Operations and Monitoring Committee

|

Nā:

From:

|

Bruce Allan, Group

Manager: Corporate

|

|

Te Take:

Subject:

|

Horse of the Year (HB)

Ltd Draft Financial Statements for year ended 31 May 2021

|

1.0 PURPOSE AND SUMMARY - TE

KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to update the Committee on the performance of the

Horse of the Year (Hawke’s Bay) Limited (HOYHB) for the year ended 31 May

2021, Attachment 1, and present to Council the Company’s draft

Statement of Intent for 2021/22.

2021 Financial

Result

1.2 HOYHB

was prepared to deliver a very successful 2021 event, the first since bringing

the event management in-house but unfortunately had to make the very difficult

decision to cancel the show with COVID Level 3 restrictions in Auckland and

Level 2 restrictions elsewhere in New Zealand in place.

1.3 The

Chair of HOYHB and the Hastings District Council appointed director, Mr Tim

Aitken, will be in attendance at the meeting to present the Statement of Intent

and year end result and answer any questions.

1.4 Despite

the cancellation of the 2021 show, HOYHB has experienced significant goodwill

from competitors, trade exhibitors and sponsors which has enabled them to post

an event surplus primarily due to sponsors and equestrian participants not

requesting refunds but instead leaving their money in for the 2022 show. This

has equated to a revenue retention from sponsors of $360k and $314k from

equestrian participants. The impact of this will be felt in the 2022 event

financial results.

1.5 The

2021 show also had the benefit of receiving a one off $187k grant from the

Domestic Event Fund which enabled the HOYHB to post a $49k surplus despite not

running the 2021 event.

1.6 This

is an extremely good financial result in the circumstances, however, it must be

reiterated that this surplus was only due to the generosity of sponsors and

event participants which will have a negative impact on the 2022 show and the

one off contribution from the Domestic Event Fund.

1.7 Also

attached as Attachment 2 is the 2021 Show report.

2021/22 Statement

of Intent

1.8 The

Statement of Intent (SOI) is the first SOI prepared

with the event to be delivered in-house and forecasts an improved financial

result primarily due to reduced operational costs. The draft SOI meets the

needs as set out in the Shareholders Agreement. It notes the impact financially

from the income carried over from the 2021 show not delivered and specifically

makes mention of the risks associated with COVID-19 and any potential COVID-19

restrictions that could be in place. Attached as Attachment 3 is the

2021/22 Statement of Intent.

1.9 The

Board has requested that the timing of the delivery of the draft statement of

intent be reviewed. Currently the shareholders agreement states that a draft

statement of intent be provided to shareholders three months prior to the start

of each financial year which is 28 February each year, just before the current

year’s event. The Board has requested that this be changed to one month

after the end of the financial year with shareholders given one month to

provide any comments with the final statement of intent to be adopted at the

Company’s AGM in August/September.

1.10 This

requested change enables the HOYHB Board time to reflect learnings from the

show just completed in the new statement of intent and is a much more practical

timeline for the approval of a statement of intent. This request was raised at

the Company’s AGM on 15 September and representatives from the other

shareholders; Show Jumping Hawke’s Bay and Equestrian Sport New Zealand

were both supportive of this request.

|

2.0 RECOMMENDATIONS

- NGĀ TŪTOHUNGA

A) That the Operations and

Monitoring Committee receives the report titled Horse of the

Year (HB) Ltd Draft Financial Statements for year ended 31 May 2021.

B) That

the Committee receives the Horse of the Year (Hawke’s Bay) Limited

Financial Statements for the year ended 31 May 2021.

C) That

the Committee receives the Horse of the year (Hawke’s Bay) Limited

draft 2021/2022 Statement of Intent with and feedback or requested changes

delivered back to the Horse of the Year (Hawke’s Bay) Limited Board.

D) That

the Committee approve the request to alter the timing of the statement of

intent and for the draft statement of intent to be made available by 1 July

each year.

|

Attachments:

|

1⇨

|

HOY (HB) Ltd Financial Statement and Overview for year

ended 31 May 2021

|

EXT-10-20-21-111

|

Under Separate Cover

|

|

2⇨

|

HOY (HB) Ltd - 2021 Show Report

|

EXT-10-20-21-110

|

Under Separate Cover

|

|

3⇨

|

Statement of Intent 2021/22 - HOY

|

EXT-10-20-21-119

|

Under Separate Cover

|

Hastings

District Council: Operations & Monitoring Committee Meeting

Te Rārangi Take

Report to Operations and Monitoring Committee

|

Nā:

From:

|

Jess Noiseux, Financial

Improvement Analyst

|

|

Te Take:

Subject:

|

Exemption of Council

Controlled Status for Hawke's Bay Local Authority Shared Services Limited and

the Te Mata Park Trust Board

|

1.0 Purpose and

Summary – Te Kaupapa Me Te

Whakarāpopototanga

1.1 The

purpose of this report is to seek decisions in regards to exempting

Hawke’s Bay Local Authority Shared Services Limited (HBLASS) and the Te

Mata Park Trust Board from being a Council Controlled Organisation (CCO) under

the Local Government Act.

1.2 The exemption will

continue to allow a reduced reporting requirement for both the Te Mata Park

Trust Board and HBLASS.

1.3 The Council is

required to give effect to the purpose of local government as set out in

section 10 of the Local Government Act 2002. That purpose is to enable

democratic local decision-making and action by (and on behalf of) communities,

and to promote the social, economic, environmental, and cultural wellbeing of

communities in the present and the future.

1.4 This report concludes

by recommending that both the Te Mata Park Trust Board and HBLASS continue to

have exemption from being a CCO under the Local Government Act 2002.

2.0 Background

2.1 Te Mata Park Trust

Board has been granted exemption since May 2018, and HBLASS since March 2018,

from the requirements imposed on CCOs under section 7 of the Local Government

Act (LGA). Section 7(6) (a) of the LGA stipulates that Council must review any

exemptions granted under section 7 within 3 years after it was first granted.

2.2 The LGA allows a Local

Authority to exempt organisations from being CCOs. The following are the

relevant sections of the LGA:

“7 Exempted organisations

(3) A local authority may, after

having taken account of the matters specified in subsection (5), exempt a small

organisation that is not a council-controlled trading organisation, for the

purposes of section 6 (4)(i).

(4) An exemption must be granted by

resolution of the local authority.

(5) The matters are –

(a)

the nature and scope of the activities provided by the organisation; and

(b)

the costs and benefits, if an exemption is granted, to the local authority, the

council-controlled organisation, and the community.”

2.3 The LGA identifies

monitoring and requirements for CCOs which include half yearly and annual

reports plus an annual Statement of Intent.

2.4 The Te Mata Park Trust

Board is a charitable trust that owns and manages Te Mata Peak.

2.5 The Trust Board is a

CCO due to the fact that under the trust deed the Hastings District Council

appoints all the trustees. This means that the Council has effective control of

the Trust Board and its assets, however in practical terms the Trust Board is

allowed to get on with the maintenance and development of Te Mata Park.

2.6 HBLASS is a dormant

company whose shareholders are the five Hawke’s Bay Councils. It was

first incorporated in 2012 with a purpose of identifying functions and

analysing opportunities for shared services and joint procurements across the

Hawke’s Bay Councils.

2.7 In 2018 the five

Councils proposed an alternative structure to save time and resources, the

Chief Executive Forum. The purpose of which continues to be to work together on

improving Service and Value for the Hawke’s Bay region through

collaboration. Subsequently HBLASS was made a dormant company in 2018 and

exempted from the requirements imposed on CCOs under section 7 of the LGA.

3.0 Current Situation

3.1 The Te Mata Trust

Board is a small entity with limited turnover. For the year ended 30 June 2020

the Trust Board generated income of $169,339 before donations and other

fundraising income related to capital projects. Income received included rental

income, grants and interest.

3.2 HBLASS is a dormant

company with no plans to reactivate it at this stage.

4.0 Options

4.1 Council can resolve to

continue the exemption for both the Te Mata Park Trust Board and HBLASS or it

can revoke the exemption, requiring the entities to report as required under

the LGA.

|

5.0 Recommendations -

Ngā Tūtohunga

A) That the Operations

and Monitoring Committee receive the report titled Exemption of Council

Controlled Status for Hawke's Bay Local Authority Shared Services Limited and

the Te Mata Park Trust Board dated 30 September 2021.

B) That the

Committee approve pursuant to Section 6(4)(i) and Section 7 of the Local Government

Act 2002, the Te Mata Park Trust Board be exempted from being a Council

Controlled Organisation for three years to 30 June 2024.

C) That the

Committee approve pursuant to Section 6(4)(i) and Section 7 of the Local Government

Act 2002, the Hawke’s Bay Local Authority Shared Services be exempted

from being a Council Controlled Organisation for three years to 30 June 2024.

|

Attachments:

There are no attachments for this report.

|

Summary of

Considerations - He Whakarāpopoto Whakaarohanga

|

|

Fit

with purpose of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-Rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural wellbeing of communities in the present and for

the future.

|

|

Link to the Council’s

Community Outcomes – Ngā Hononga ki Ngā Putanga ā-Hapori

N/A

|

|

Māori

Impact Statement -

Te Tauākī Kaupapa Māori

N/A

|

|

Sustainability

- Te

Toitūtanga

N/A

|

|

Financial

considerations -

Ngā Whakaarohanga Ahumoni

N/A

|

|

Significance

and Engagement - Te

Hiranga me te Tūhonotanga

This decision/report has been assessed under the Council's

Significance and Engagement Policy as being not of significance.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto / ā-waho

N/A

|

|

Risks

Opportunity: N/A

|

REWARD – Te Utu

|

RISK – Te Tūraru

|

|

[State the benefit, opportunity, innovation of the

outcome & whether it benefits; Safety (public/ staff/ contractors),

Finances, Service Delivery, Legal compliance, Reputation.]

|

[State the significant risks or threats (4 or 5 max) to

the objective & whether they affect; Safety (public/ staff/ contractors),

Finances, Service Delivery, Legal compliance, Reputation.]

|

|

|

Rural

Community Board –

Te Poari Tuawhenua-ā-Hapori

N/A

|

|

Thursday, 30 September 2021

|

Te Hui o Te Kaunihera ā-Rohe o Heretaunga

Te Hui o Te Kaunihera ā-Rohe o Heretaunga

Hastings

District Council: Operations & Monitoring Committee Meeting

Te Rārangi

Take

Report to Operations and Monitoring Committee

|

Nā:

From:

|

Aaron Wilson, Financial

Controller

|

|

Te Take:

Subject:

|

Draft Financial Year End

Results - 30 June 2021

|

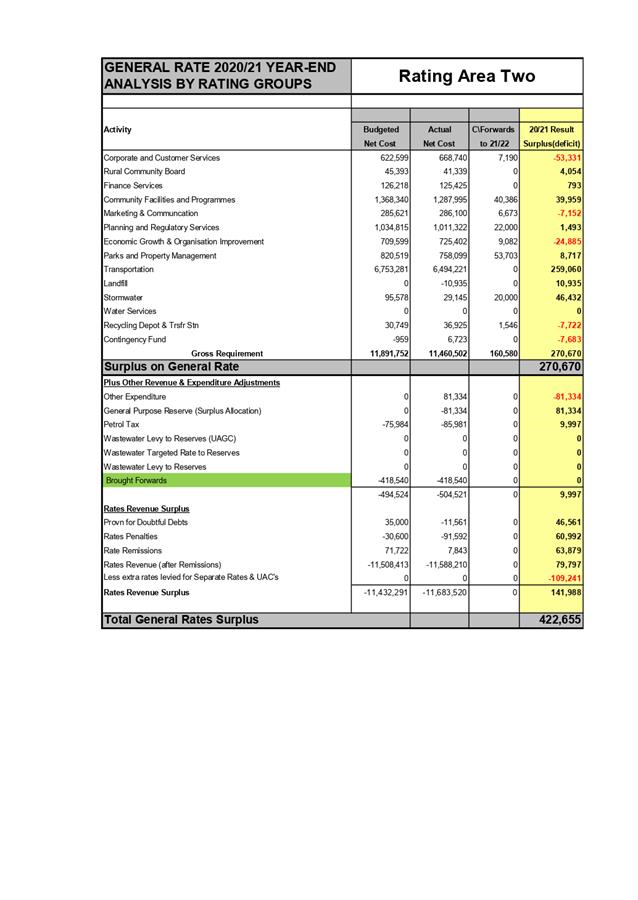

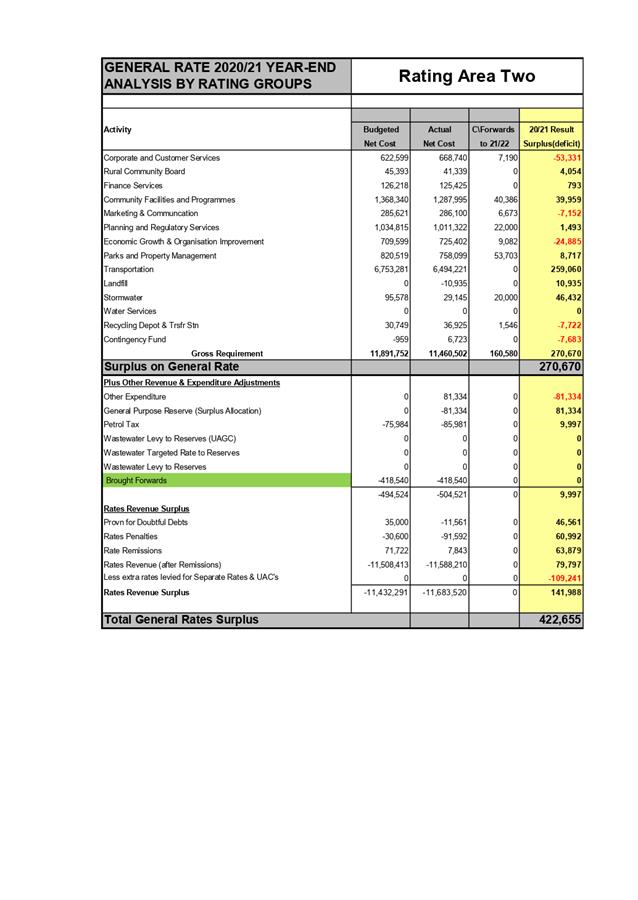

1.0 PURPOSE

AND SUMMARY - TE KAUPAPA ME TE WHAKARĀPOPOTOTANGA

1.1 The

purpose of this report is to inform the Committee of the unaudited accounting

and rating result for the year ended 30 June 2021 and for the Council to

approve the allocation of the rating result. It also seeks the approval from

Committee to carry forward project budgets. The Hastings District Rural

Community Board has approved the recommendations submitted to it on 6th

September 2021 relating to the year-end rating result for Rating Area 2 (RA 2)

1.2 The

rating result is a surplus to budget. The result in RA1 is a

consequence of higher than budgeted revenue and interest rate savings and

offset by increasing cost pressures within areas of Council along with a number

of approved but unbudgeted spends in the financial year. RA2 has benefited in

addition from favourable budgeted rates remissions, penalties and rates

revenues.

1.3 The

unaudited rating result for the 2020/21 year is as follows:

|

Rating Area 1

|

$443,366

|

Surplus

|

|

Rating Area 2

|

$422,655

|

Surplus

|

|

Total for the District

|

$866,021

|

Surplus

|

1.4 In

addition to the Rating Result, Council also generated a surplus from the

Landfill operation, the report recommends that these surpluses be allocated as

follows:

1.5 The report also recommends that budget

allocations proposed to be carried forward from 2020/21 to 2021/22 to enable

project completion be approved.

1.6 Council

is provided with quarterly financial reports during the year with the unaudited

year-end result presented annually at the September Finance and Risk Committee

meeting.

1.7 Officers

report on the operating financial result (operating surplus/deficit) as well as

the rating result. The operating (accounting) financial result is reported on

quarterly during the year and, at year end, a report is prepared on the rating

result in addition to the accounting result.

1.8 The

rating result differs from the accounting result in respect of non-cash items

such as depreciation, gains or losses on interest rate swaps, vested assets,

impairment of assets and investments and development contributions income which

have no impact on setting rates and are therefore excluded from the rates

calculations. The rating result is also affected by the extent of rates-funded

carry forwards that are approved. The rating result reports on the variance of

rates collected and net total expenditure (including capital and reserve

transfers) for Council.

1.9 The

Financial Reports attached to supplement this report include:

Attachment 1 – Interim

Rating Result for the year ended 30 June 2021

Attachment 2

– Dash Board Summary of Financial Performance

Attachment 3

– Draft Unaudited Financial Statements

Attachment 4 –

Carry Forwards 2020/21

1.10 The

financial reports contain summarised information. Please feel free to

contact the report writer or the Group Manager: Corporate directly on any

specific questions from the reports before the meeting. This will ensure

that complete answers can be given at the meeting on the detail that forms the

basis for these reports.

2.0 CURRENT SITUATION

2.1 The

start of the 2020/21 financial year saw a continuation of a strong

Hawke’s Bay economy, with a number of Council areas that experienced

operational cost pressures in responding to those strong economic conditions.

2.2 This

financial year saw a strong bounce back from the first COVID 19 lockdown in

April/May 2020. This has been shown by favourable revenues to budget

lines, in particular in Fees & Charges along with Subsidies and

Grants. Some areas due to the strength of the Hawke’s Bay economy

still continue to be under pressure, with adequate resourcing to meet demand

still a challenge.

2.3 The

net effect was revenues were higher to budget, somewhat offset by higher

expenditure due to the strong demand for services along with some approved but

unbudgeted spend. In light of the environment and challenges faced the rating

result $866k was a good outcome.

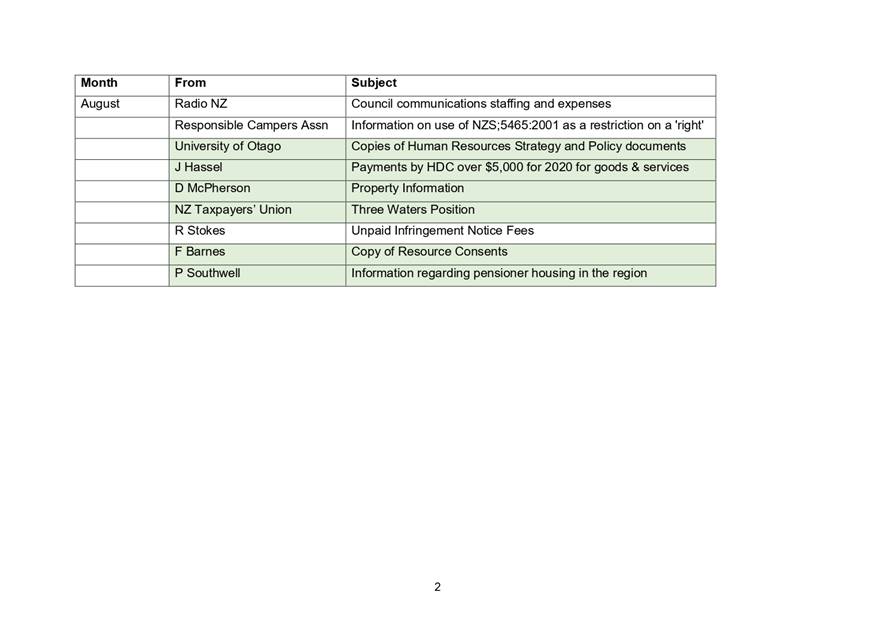

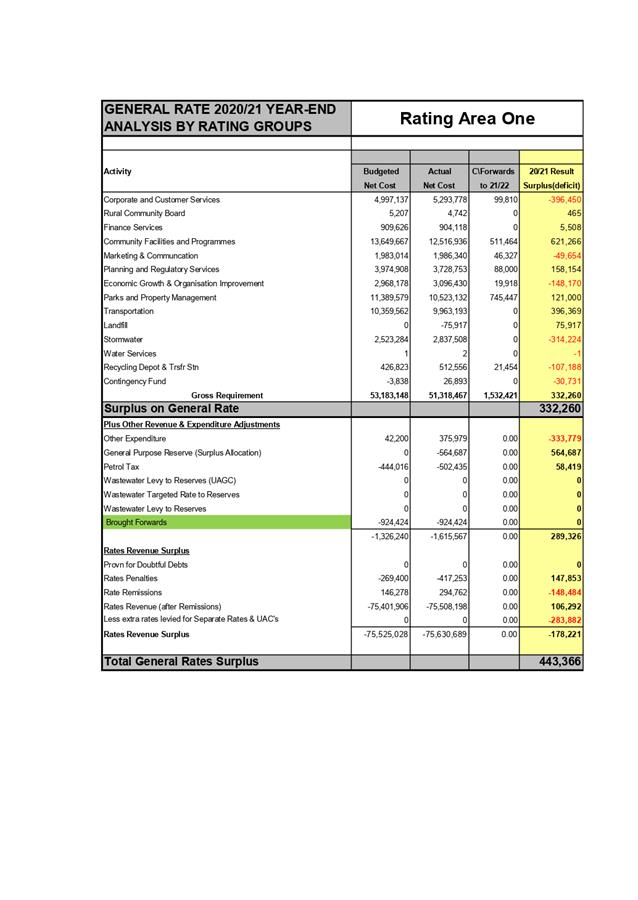

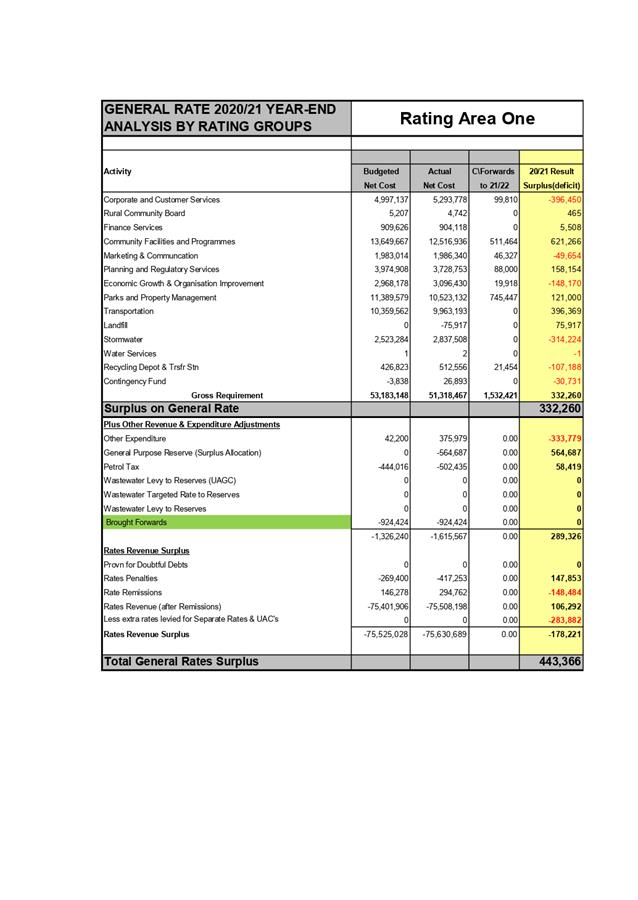

3.0 THE RATING AND

LANDFILL RESULT

3.1 Council

adopts strong financial management practices and prepares a balanced budget to

deliver Council’s desired programme, including high levels of fiscal

tensioning and stretch targets.

3.2 This

year the overall general rating result for 2020/21 is a surplus to budget as

shown below by rating area.

|

Rating Area 1

|

$443,366

|

Surplus

|

|

Rating Area 2

|

$422,655

|

Surplus

|

|

Total for the District

|

$866,021

|

Surplus

|

3.3 In

addition to the general rating result, the Council’s share of the

available surplus from the Landfill operations is $1.997m.

3.4 It

should be noted that the Landfill operates on a “whole of life”

cost recovery model, that is based on recovering all costs associated with the

landfill from development to operations being recovered over the landfills life

which includes care after it has been fully utilised. The cost recovery model

utilises assumptions to inform gate rates to reach that full cost recovery. The

higher volumes and changes to the composition of waste including special waste

types means that in some years a surplus is made and development of new valleys

may come on earlier than anticipated.

3.5 Council

resolved last year to apply the 2019/20 landfill surplus of $1.64m to the

repayment of the Landfill Gas Plant debt ($646k), with the balance allocated to

the General Purpose reserve in RA1 ($869k). In RA 2 the balance was allocated

to the Capital reserve ($125k). This now leaves the Council with a decision on

how to allocate the 2020/21 Landfill surplus.

3.6 In

addition to the above, which is after all necessary reserve transfers have been

made, there are a number of significant activities where surpluses or deficits

are ring fenced and/or transferred to reserves and include water supply, waste

water and refuse & recycling.

3.7 In

allocating surpluses and reserves, Council’s prudent financial policy

approach has traditionally focused on debt repayment or borrowing reduction. In

Rating Area 2, priority has been given to replenishing the Rural Flood and

Emergency Event Reserve.

3.8 The

total of the 2020/21 Landfill Surplus is recommended to be put to the Landfill

Development Reserve, with significant capital spend about to start with resource

consent hearings and development of the next valley to follow. Carry

forwards of $6m along with $30m budgeted spend in the LTP for the development

of Valley B is expected to total $36m over the next 10 years.

3.9 It

should however be noted and considered, Council has embarked on an ambitious

programme of delivery in 2021/22 and the impacts of Covid-19 are creating many

uncertainties for the delivery of that programme and on the operations of the

organisation. It is recommended that whilst allocating the Landfill surplus to

the Landfill Development Reserve is the right thing to do, it would be prudent

to allow for Council to access these funds for operational matters should

Council require additional funding to deliver the 2021/22 programme and meet

any unforeseen operational impacts from the Covid-19 alert level lockdowns.

3.10 In

determining priorities for the Rating Area 2 general rate surplus and

Council’s share of the Landfill surplus, the Rural Community Board have

recommended the following allocations:

|

2020/21 RA2 Rating

Surplus

|

Surplus

|

|

RA2

Surplus on General Rate

- Contingency

Reserve

- Allocation

to Rural Flood & Emergency Event Reserve

|

$422,655

$110,841

$311,814

|

|

2020/21 Landfill

Operating Surplus

|

Surplus

|

|

RA2

Surplus on Landfill Operations

- Allocation

to Landfill Development Reserve

|

$251,465

$251,465

|

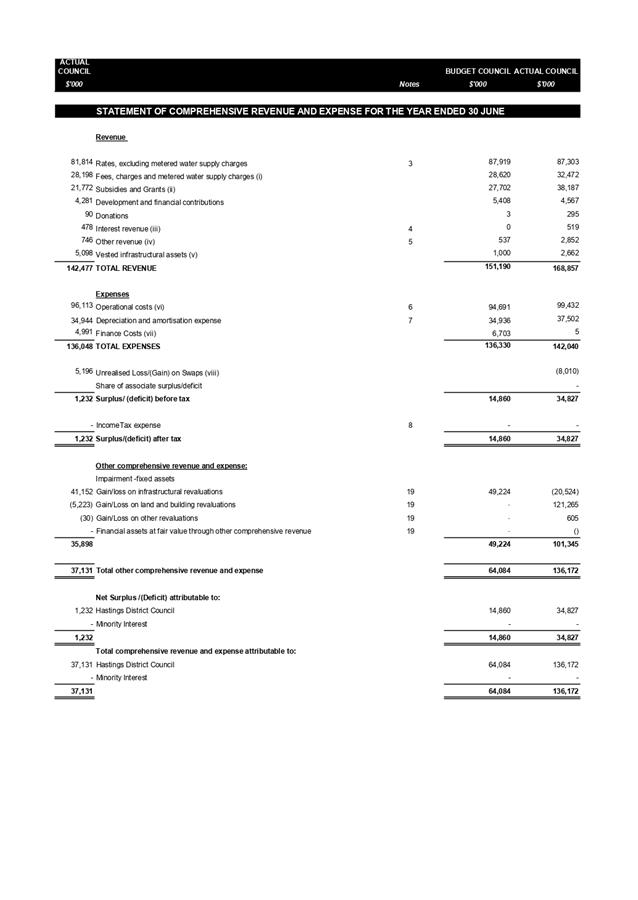

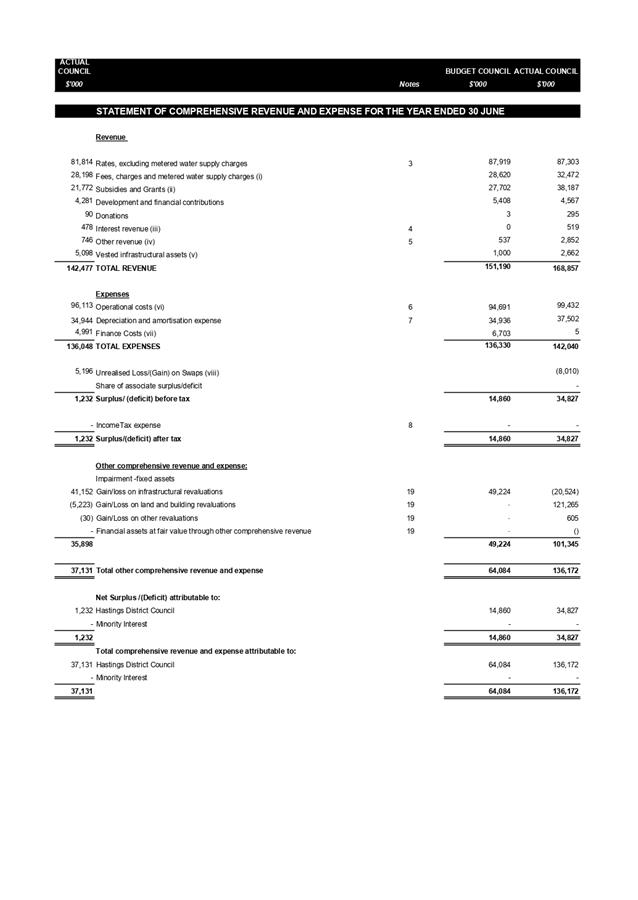

4.0 THE UNAUDITED

ACCOUNTING RESULT

4.1 Draft

Unaudited Operating Accounting Result compared to Annual Plan

4.2 Set

out below is a summary of the 2020/21 financial year. Please note that this is

not the same as the rating result.

|

Unaudited

Operating Accounting Result

|

Budget

Council

$'000

|

Actual

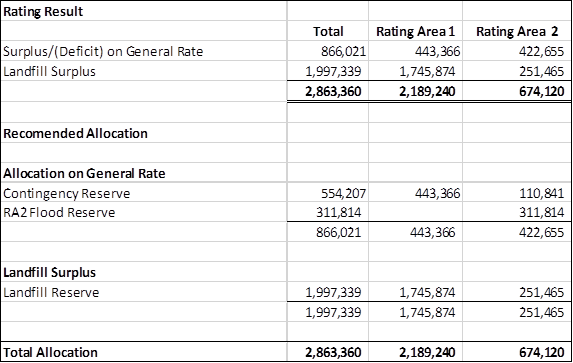

Council

$'000

|

Variance

|

|

Operating Revenue

|

151,190

|

168,857

|

17,667

|

|

Less: Operating Expenditure

|

136,330

|

142,040

|

5,710

|

|

Net Surplus/(Deficit)

|

14,860

|

26,817

|

11,957

|

|

Unrealised movement on Swaps

|

-

|

(8,010)

|

(8,010)

|

|

Net Surplus/(Deficit) after

Swaps

|

14,860

|

34,827

|

19,967

|

|

Gain/(Loss) on Revaluations

|

49,224

|

101,345

|

52,121

|

|

Net Surplus after accounting

gains and losses

|

64,084

|

136,172

|

72,088

|

4.3 The

draft unaudited financial result for the year ended 30 June 2021 before gains

or losses on revaluations and losses on interest rate swaps is a surplus of

$26.8m with a favourable variance to the budget of $11.9m.

4.4 It

is important to note that budget variances noted in the table above, refer to

variances against the Annual Plan excluding carry forwards or any other budget

adjustments as this is what Council is required to report against in the Annual

Report. By comparison, the attached dashboard reports include budgeted

information that includes all budget adjustments including carry forwards from

previous year.

4.5 The

unrealised gain on interest rate swaps of $8m is an accounting entry and

reflects the potential cost to Council of replacing all of its interest rate

swaps at the prevailing swap interest rates on 30 June 2021. Council is,

however, extremely unlikely to do this and the gain is therefore recognised as

an ‘unrealised gain’.

4.6 Council

has interest rate swaps in place to hedge against interest rate exposure by

reducing uncertainty of future cashflows. This is in line with Council’s

prudent financial approach and meets the requirements of Council’s

treasury policy. Market conditions have changed from several years ago when

many of these swaps were taken out.

4.7 In

addition to this there were three main revaluations this year. These were

roading, land and buildings, and parks. The total increase in asset value for

these three classes was $101m.

5.0 REVENUE

5.1 Revenue

has a favourable variance to revised budget of $11.2m, prior to the

non-realised gain on interest rate swap movements of $8m. The large favourable

variance in revenue has driven by three main areas, additional funding received

in terms of Grants and Subsidies, Fee and charges, along with higher than

budgeted vested assets and assets sold.

5.2 Fees

and Charges finished the year above budget by $2.3m. The main drivers for this

increase in revenue have been:

o Splash Planet Revenue is $944k

favourable with significantly higher volumes of people through the gate along

with higher than budgeted revenue in sales of food and gifts.

o Council’s share of

Landfill revenue is $1.563m favourable to budget due to higher volumes.

o Higher than budgeted

connection fees revenue in wastewater $357k along with higher than budgeted

water meter charges of $284k.

o Planning and Regulatory

services are unfavourable to budget by $608k driven by lower than budgeted

building control consent fees ($753k) offset by higher LIM fees ($60k) along

with higher infringement revenue of $128k in parking. It should be noted that

whilst the revenue is lower than budget in building control, the expenditure

was also lower than budget.

o Heretaunga House is $398k

unfavourable to budget due to its earthquake prone closure and ensuing loss of

lease revenue.

5.3 Subsidies

and grants are $4.9m favourable to revised budget with the main drivers being

unbudgeted government funding received for 3 Waters infrastructure of $7.7m,

offset by lower than budgeted capital grants for the Municipal project ($3m).

5.4 Development

contributions are unfavourable to YTD budget by $841k. Phasing of budgets in

relation to when contributions occur is difficult, and creates timing

differences as it is not always known in advance in what month a developer will

make payments and when it will occur when the budget is being set

5.5 Interest

revenue earned is favourable to budget by $519k due to investment of funding

held for capital projects and prefunding of maturing debt.

5.6 Infrastructure

vested assets are above budget by $1.6m. Vested assets are infrastructure

assets that have been constructed by developers and then vested to Council at

the completion of the development.

5.7 Summary

of additional revenues received:

Additional revenue received from the government sources is

as follows:

|

PGF Funded Projects

|

Govt Funding per agreements

|

Funding Received as at 30 June 2021

|

|

Tarbet Street

|

$2m*up to

|

$1.847m

|

|

Jobs for Heretaunga

|

$9.3m

|

$9.3m

|

|

3 Waters projects

|

$15.3m

|

$7.681m

|

6.0 EXPENDITURE

6.1 Overall

operational expenditure is tracking higher than budget by $3.2m. Note that

Council have received additional revenues along with releasing contingencies

where approved, offsetting these higher levels of expenditure. Key drivers are:

6.2 Finance

costs are favourable by $1.5m which is a reflection of lower levels of debt

than phased in the budget and lower actual interest rates compared with those

assumed in the budget. Additional funding received from the Government for

water infrastructure in advance of it being required has delayed the

requirement for additional debt funding.

6.3 Plant

maintenance and asset costs are $511k above budget driven by higher than

budgeted plant hire costs ($265k), along with vehicle R&M costs ($208k).

Both of these costs are HDC’s share of Landfill expenditure and relate to

major maintenance costs relating to the Compactor.

6.4 Contracted,

expert and consultancy advice services are $1.5m above budget. This is primarily

in the areas of infrastructure where there have been and are large capital

projects underway, along with operational impacts from approved but unbudgeted

projects such as the move from Heretaunga House, security contract increase,

and new lease costs (Warren Street). It should be noted that there have been a

number of contingencies released to offset some of the impact of unbudgeted but

approved expenditure. This is summarised in the section below.

6.5 The

negative variance to budget for non-cash entries in terms of depreciation

($2.5m) are driven by higher asset values due to prior year revaluations in 3

Waters, along with increased spend in infrastructure projects in water,

roading, and with buildings.

Summary of areas of unbudgeted but approved spend in the

current financial year:

6.6 In the 2020/21 financial year, it is important to be aware

of what unbudgeted expenditure has already been approved by Council.

Municipal Building:

6.7 Council has approved an additional $5.5m spend in

order to complete the Municipal building project. A significant portion of this

unbudgeted expenditure will be incurred in the 2021/22 financial year.

Heretaunga House

6.8 Due

to the unexpected earthquake prone status of

Heretaunga House, Council has been faced with unbudgeted expenditure to

quantify the cost involved to strengthening the building, and provide

alternative accommodation for staff displaced from the building. In addition to

these extra costs, there has been a loss of revenue from tenants that there

were leasing space in Heretaunga House.

6.9 In

order to understand the work required to strengthen Heretaunga House, Officers

have commissioned consultant reports through The Building Intelligence Group

who are providing project management support. The approach has been to spend

sufficient to achieve the necessary level of confidence on the estimated works

and costs to make sound future decisions. As a result the total estimate

cost of approximately $50k. This work has been peer reviewed in the 2021/22

financial year.

6.10 Revenue

for the full year is below budget by $383k due to the loss of tenants that were

leasing space. Operational expenditure excluding depreciation is $346k above

budget due to the additional unbudgeted but approved costs associated with

moving to 100 Warren Street. These costs include the setup and establishment

costs including partitioning, data and electrical work.

6.11 As

can be seen in the general contingency summary below, $250k contingency was

released for Heretaunga House in addition to $150k for the lease of Warren

Street.

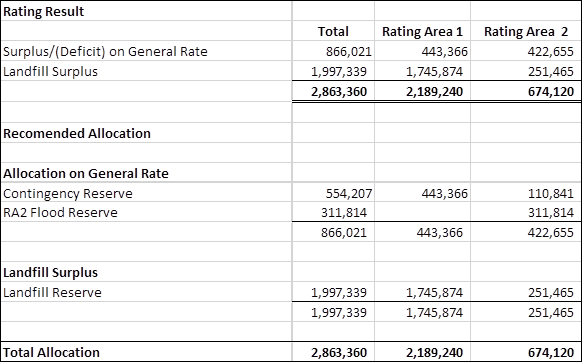

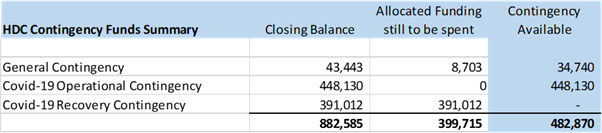

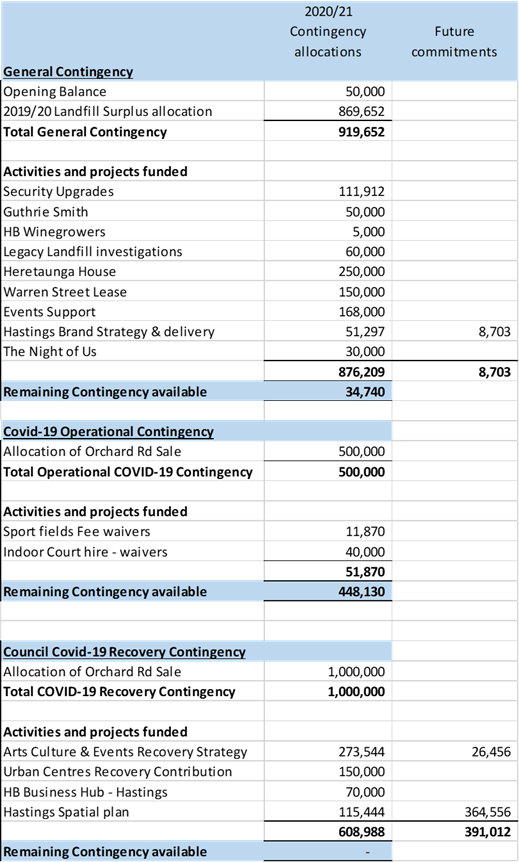

Summary

of Contingencies

6.12 As

was noted in paragraph 6.4 there were a number of contingencies approved and

released to offset the impact of decisions taken during the financial year.

6.13 The

following table is a summary of the three contingency funds, their closing

balances and any commitments currently held against them. At the start of the

financial year there is contingency balances of $482,870 which are exclusive of

those allocations or commitments in place. The most significant of those

commitments is the remaining funding of $364,556 for the Hastings Spatial Plan

which was allocated from the Covid-19 Recovery Contingency.

6.14 The

following table details those three contingencies and how allocations have been

made from them during the year to fund activities and unforeseen events and

opportunities and where those future commitments lie.

6.15 Those

remaining contingency balances may be required during the 2021/22 financial

year with the current risks being presented through the Covid-19 Alert Level

restrictions and the need to resource up and respond to an ambitious programme

of delivery this year and going forward.

7.0 SUMMARY

BY AREAS OF ACTIVITY OF COUNCIL

Strategy

and Development

7.1 The

Strategy and Development Group had an overall rating requirement group result

of $148k unfavourable to budget. The key drivers were in a number of projects

that were unbudgeted but approved and were then offset by contingency reserve

funding. In addition, the unbudgeted initial capital contribution of $200k in

Food East was approved by Council.

Corporate Services

7.2 Corporate

services had a deficit in terms of rate requirement of $268k. In terms of cost,

this is driven by the impact of moving out of Heretaunga house along with the

move into the Warren street offices. In addition, there was a cessation of

lease revenue from Heretaunga house.

Community Facilities &

Programmes

7.3 This

group of activities has a favourable rating requirement of $1.26m primarily

driven by very strong revenue in Splash Planet of $944k. Operational costs for

the group overall were higher personnel costs particularly in Splash Planet

($180K), however, this is a reflection of the “busyness” and high

traffic volumes over the summer period.

Planning & Regulatory

Services

7.4 Planning

and Regulatory Services had an overall rating result of ($283k) favourable to

budget. Revenue was $611k unfavourable to budget. Building control consent fees

were $753k unfavourable offset by higher LIMs ($60k) and infringements ($121k).

7.5 Revenues

from consents have not reached budgeted levels partly due to vacancies within

the building team unable to be filled. This has meant a corresponding drop in

operational expenses related to the processing of consents. In addition,

this area has absorbed additional unbudgeted costs of $122k related to

compliance and investigation costs. With continued high demand and pressure on

limited resources challenges remain in this area for the medium term.

Asset Management

7.6 Landfill

revenue was favourable to budget by $1.569m, with higher volumes contributing

to the favourable revenue variance. This increased revenue has translated into

a HDC share of the surplus of $1.97m.

7.7 The

surpluses generated from the Landfill are released to the shareholding Councils

and it is up to the two Councils as to what they decide to do with those funds.

In previous years, HDC has previously repaid landfill debt with those

surpluses, however, with all landfill debt now repaid Council can decide how it

wishes to allocate those funds. It is recommended that with the Valley

development imminent, that surplus funds are set aside in a Landfill

Development Reserve as a contribution to those significant development costs.

7.8 Parks

revenue was favourable to budget by $462k, this is mainly due to a capital

grant from Waka Kotahi in relation to the CBD. Operational expenditure was $69k

unfavourable across a wide range of expense lines. Overall, Parks have a

favourable rating requirement of $923k, with carry forwards applied for.

7.9 Water Services: Council continues to respond to the water change

programme with elevated expenditure supply activity through 2020/21 including

both capital and operational expenditure. This activity is funded by way

of a targeted rate and accounted for in a separate water account which is

designed to either accumulate reserves or run in deficit depending on

expenditure needs and Council decision making. This allows Council to spread

the impact of “lumpy” expenditure in this activity.

8.0 CAPITAL

EXPENDITURE

8.1 Council’s

total capital revised budget (including carry forwards, renewals, new works,

and growth projects) for 2020/21 was $146m. This level of expenditure is

a significant increase on what had been delivered previously by Council and

there was risk associated with the ability of Council to deliver on this

programme.

8.2 The

large capital budget was made up of :

· Annual

Plan $102m

· PGF

funding for Jobs for Heretaunga $9m

(added into Annual Plan )

· Carry

forwards from 2020 $30m

· Tarbet

Street Project $2m

· HB

Museum Storage $3m

8.3 Additionally

there will be further government funding received through 2020/21 and 2021/22

totalling $29m for housing infrastructure and three waters that is not

currently included in the Annual plan.

8.4 Of

the 3 Waters $15.3m government funding, Council has already received $7.3m in

the first tranche with the remaining funds to be received as expenditure is

incurred and claimed back. It is likely that projects relating to this

funding will start in the 2021/22 financial year.

8.5 Capital

spend for the year to date is $94.8m, against year to date budget of $146m.

Capital spend was forecasted to be $93.9m by year end and represents the

largest ever delivery of capital works by Council. Whilst there are a large

number of projects out to tender a significant number of those projects were

not completed by year end.

8.6 It

needs to be noted that there have been a significant number of factors

impacting on Council’s ability to complete what is in the plan. The

Government’s need to provide stimulus to support the COVID-19 recovery

has led to significant funding for Council to embark on projects outside of the

original Annual Plan. The PGF funding for Jobs for Heretaunga was for $9m and

was added to the Annual Plan at a very late stage, giving officers no time to

consider delaying other projects and adjusting the budgets accordingly.

8.7 Whilst

the Jobs for Heretaunga project was be completed in May, like some of the other

government funded projects, this has placed pressure on resources where other

projects had already been budgeted within the programme.

|

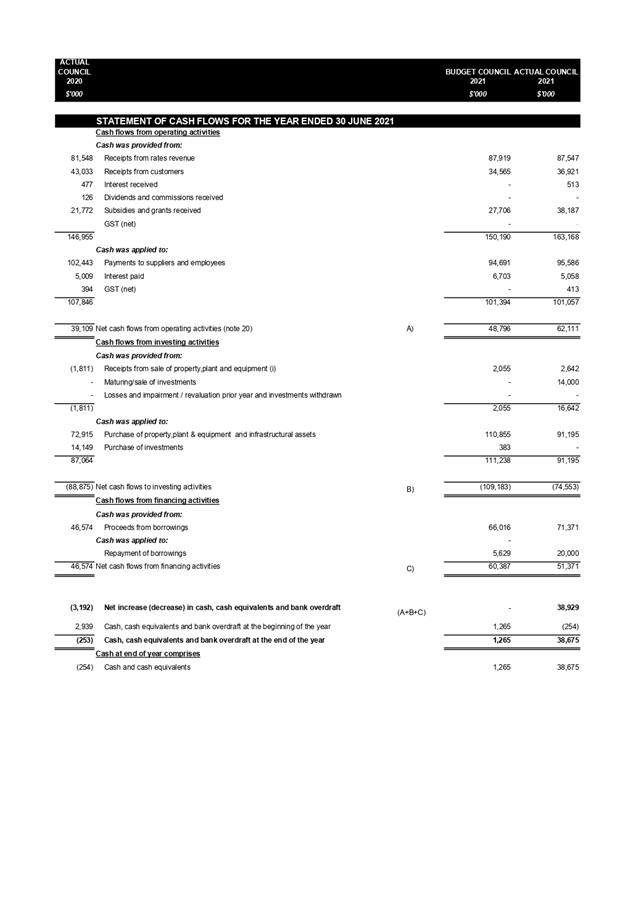

Capital Year End Report

2020/2021

|

|

|

|

|

YTD Actuals

|

YTD Budgets

|

YTD variance

|

|

|

COUNCIL

CAPITAL

|

|

|

|

|

|

Renewals

|

37,066,995

|

54,786,584

|

17,719,589

|

|

|

New Works

|

53,356,025

|

78,125,342

|

24,769,316

|

|

|

Growth

|

4,385,161

|

14,021,383

|

9,636,223

|

|

|

|

94,808,181

|

146,933,309

|

52,125,128

|

|

|

SUMMARY

|

|

|

|

|

|

RENEWALS

|

|

|

|

|

|

Stormwater Services

|

773,982

|

1,425,000

|

651,018

|

|

|

Wastewater Services

|

4,765,080

|

10,177,000

|

5,411,920

|

|

|

Water Services

|

3,549,057

|

4,288,329

|

739,272

|

|

|

Transportation RA 1

|

13,575,231

|

15,421,500

|

1,846,269

|

|

|

Parks

|

1,338,949

|

1,293,653

|

(45,296)

|

|

|

Building services

|

3,045,037

|

5,049,295

|

2,004,258

|

|

|

Rest of Council

|

10,019,658

|

17,131,807

|

7,112,149

|

|

|

|

37,066,995

|

54,786,584

|

17,719,589

|

|

|

NEW WORKS

|

|

|

|

|

|

Stormwater Services

|

1,110,706

|

7,127,000

|

6,016,294

|

|

|

Wastewater Services

|

709,988

|

1,552,000

|

842,012

|

|

|

Water Services

|

22,936,260

|

26,887,125

|

3,950,865

|

|

|

Transportation

|

16,362,575

|

15,991,130

|

(371,445)

|

|

|

Parks

|

3,994,249

|

7,462,666

|

3,468,417

|

|

|

Building services

|

200,785

|

1,551,000

|

1,350,215

|

|

|

Rest of Council

|

8,041,462

|

17,554,421

|

9,512,959

|

|

|

|

53,356,025

|

78,125,342

|

24,769,316

|

|

|

GROWTH

|

|

|

|

|

|

Stormwater Services

|

244,085

|

3,339,000

|

3,094,915

|

|

|

Wastewater Services

|

233,786

|

2,477,000

|

2,243,214

|

|

|

Water Services

|

1,504,365

|

3,430,000

|

1,925,635

|

|

|

Transportation RA 1

|

2,378,814

|

4,068,000

|

1,689,186

|

|

|

Parks

|

24,110

|

707,383

|

683,273

|

|

|

|

4,385,161

|

14,021,383

|

9,636,223

|

|

|

Total

Capital

|

94,808,181

|

146,933,309

|

52,125,128

|

|

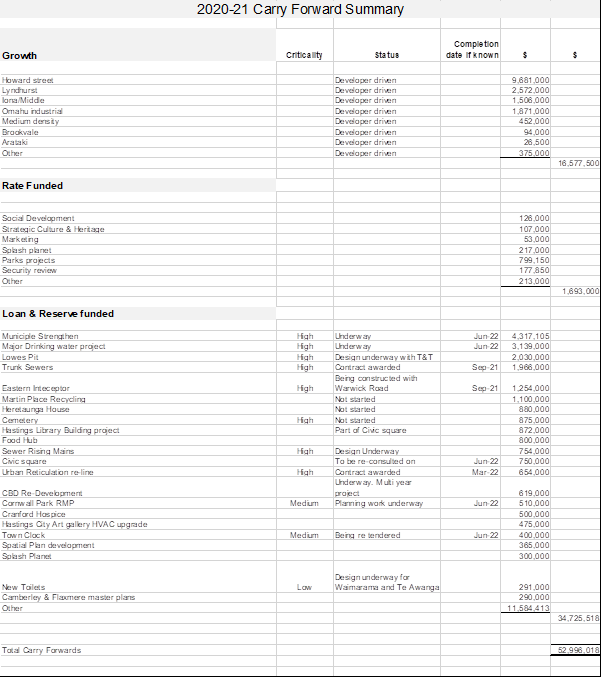

9.0 CARRY FORWARD

SCHEDULE

9.1 Included

in Attachment 4 is a Schedule of Projects and budget amounts that

officers have requested to be carried forward to the 2020/21 year

9.2 As

noted in the previous section on capital, total Capital spend was $94.8m

against the revised budget of $146.9m. This leaves a balance of budget

not spent of $52m. Officers have reviewed the 2020/21 unspent capital of

$52m and also compared them to project budgets in the 20/21 year to ensure that

the appropriate amount is being carried forward.

9.3 The

budget for the 2021/22 year is set at $127.9m and is a challenging budget in

itself without adding the 2020/21 capital underspend of $52m. Particularly in

the current environment with supply chain and workforce issues.

9.4 It

must be remembered that Council are working in an extremely “tight”

market where resources are concerned in terms of personnel and contractors

along with the challenges of the current supply chain constraints. Level

four lockdown within the Auckland region has already made access to materials

an additional factor.

9.5 However,

the carrying forward of budget is the accepted mechanism to allow those capital

projects to be delivered and reported on, in the following year or to

enable re-budgeting in future years.

9.6 Of

the 2020/21 carry forward of $52m officers believe that $31m will go ahead in

the 2021/22 as many of these projects are either underway or about to start.

This leaves the remaining carry forwards of $20m to be re-budgeted into the

2022/23 Annual Plan.

9.7 The

level of carry forwards from rates funding is $1.69m ($1.31m last year). While

the table provides a summary of the major carry forward items, the $213k of

rates carry forwards classified as other is made up of a number of smaller

carry forward projects across Council groups.

9.8 Included

in the Loan Funded carry forwards is $3.1m for the major drinking water

project. In addition, there is a range of carry forwards across a number of

Council activities, from the Municipal Strengthen ($4.3m) through to the CBD

redevelopments of $619k.

9.9 Below

is a table of the analysis split out by capital type:

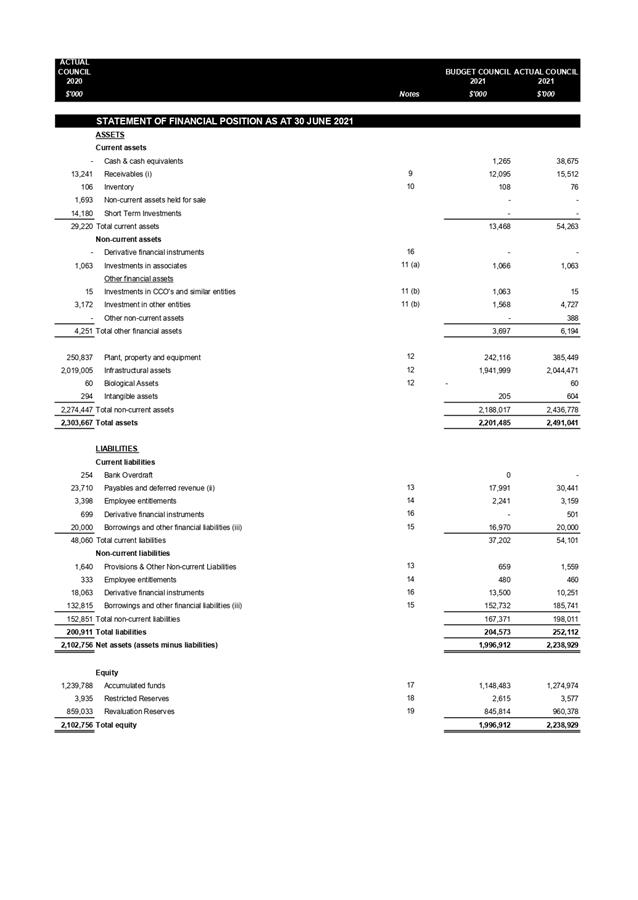

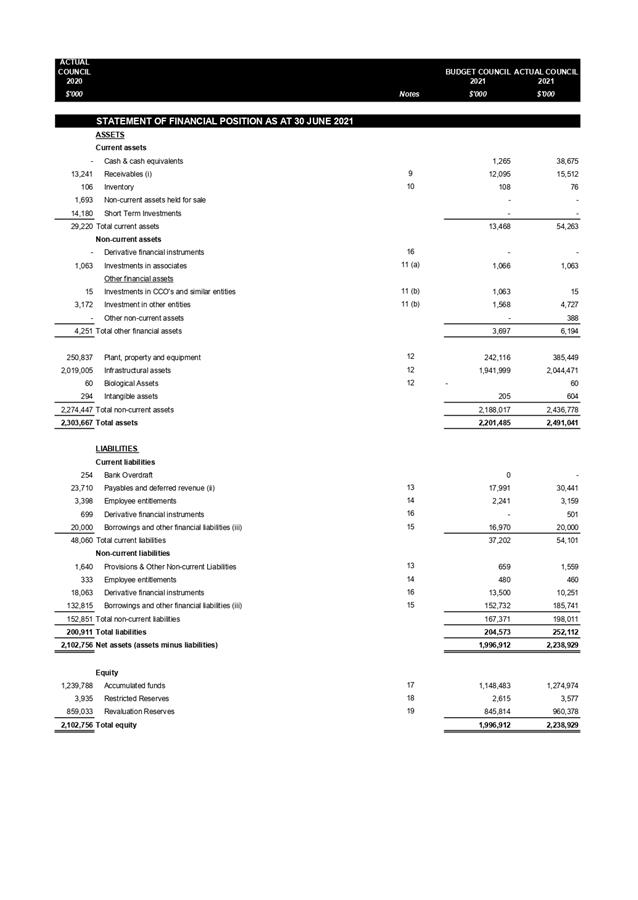

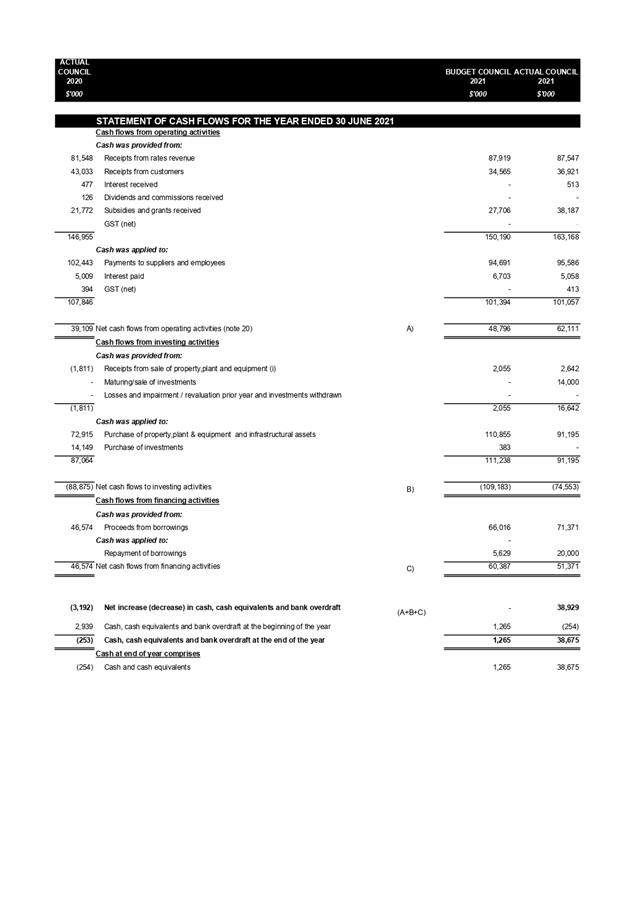

10.0 EXTERNAL DEBT

10.1 Total net

borrowing as at the end of June 2021 is $165.7m, an increase from last year

($150.2m). This is in line with projected debt in the 2018-28 Long Term Plan

(LTP) which had forecast debt levels of $162.5m at this time. Committed

borrowing facilities in place are $220.7m, along with $38m in term deposits,

providing headroom of $53.7m. The liquidity ratio is at 126% in line with the

policy minimum of 110%.

|

30 June 2021

($000)

|

|

Borrowing

at start of year

|

150,740

|

|

New

Loans Drawn

|

75,000

|

|

Loan

Repayments

|

(20,000)

|

|

Gross

borrowings at end of period

|

205,740

|

|

Plus

unutilised facilities

|

15,000

|

|

Total

borrowing facilities available

|

220,740

|

|

Funds

held on deposit

|

38,000

|

|

Total

Net borrowings

|

165,740

|

|

Liquidity

Ratio

|

126%

|

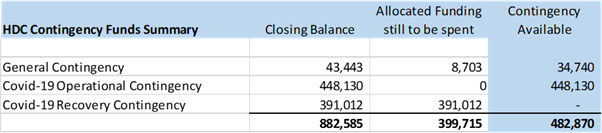

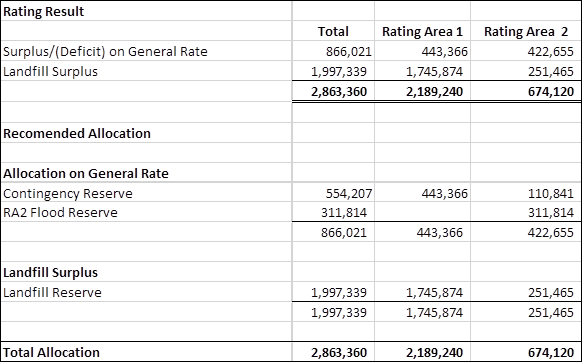

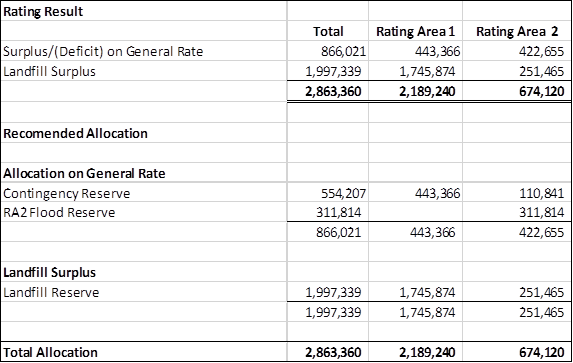

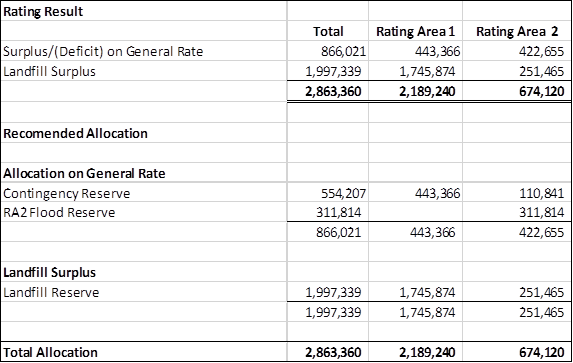

11.0 ALLOCATION OF RATING SURPLUS

11.1 Council’s

Treasury Policy states the following on the allocation of surpluses:

“The funds from all asset sales and operating surpluses

will be applied to the reduction of debt and/or a reduction in borrowing

requirements, unless the Council specifically directs that the funds will be

put to another use.”

11.2 There is still a great deal of uncertainty with regards the

ongoing impact on Council by COVID-19 and there is considerable pressure on

Council to deliver an ambitious programme of works and programmes. It is

therefore recommended that in both Rating Area 1 (RA 1) and Rating Area 2

(RA 2) the surplus be transferred to the Contingency reserve, while

maintaining the appropriate rating splits for this activity. Officers believe

this is in keeping with a prudent financial management approach.

11.3 The total recommended transfer to the Contingency Reserve

is $554,204, being all of the RA 1 surplus of $443,366 and $110,814 from RA 2

representing 20% of that transfer in line with the rating split for that

activity.

11.4 Whilst

RA 2 currently has debt of $2.453m, incurred for capital works, the

recommendation of the Rural Community Board and supported by a resolution of

Council to build the Rural Flood and Emergency Event Reserve up to a level of

$2m is considered a prudent one.

11.5 In determining

priorities for the RA 2 general rate surplus, the Rural Community Board

recommends to Council that the RA 2 Rating Surplus of $422,655 be allocated as

follows:

|

2020/21 RA 2 Rating

|

Surplus

|

|

RA2 Surplus on General Rate

- Allocation to

the Council General Contingency Reserve

- Allocation to

Rural Flood & Emergency Event Reserve

|

$422,655

$110,841

$311,814

|

Landfill additional surplus

allocation

11.6 Last

year the Landfill surplus was in the first instance applied to repaying debt

associated with the Landfill Gas to Energy Plant with the

balance of RA 2 share of the Landfill surplus put towards the RA 2 Capital

Reserve ($125,259) with the RA 1 share put towards the Council Contingency

Reserve ($869,652).

11.7 The

allocation of both the RA 1 and RA 2 share of the 2020/21 Landfill Surplus of

$1.997m is recommended to be put to the Landfill Development Reserve, with

significant capital spend about to start with resource consent hearings and

development of the next valley to follow. Carry forwards of $6m along with $30m

budgeted spend in the LTP for the development of Valley B is expected to total

$36m over the next 10 years.

11.8 As

mentioned earlier in the report, Council has embarked on an ambitious programme

of delivery in 2021/22 and the impacts of Covid-19 are creating many

uncertainties for the delivery of that programme and on the operations of the

organisation. It is recommended that whilst allocating the Landfill surplus to

the Landfill Development Reserve is the right thing to do, it would be prudent

to allow for Council to access these funds for operational matters should

Council require additional funding to deliver the 2021/22 programme and meet

any unforeseen operational impacts from the COVID-19 alert level lockdowns.

11.9 The

recommendation of this report, taking into consideration the recommendations to

the Hastings District Rural Community Board, is to allocate the rating

surplus/deficit as per the table below:

|

12.0 RECOMMENDATIONS - NGĀ TŪTOHUNGA

A) That

the Operations and Monitoring Committee receives the report titled Draft Financial Year End Results - 30 June 2021.

B) That the funds arising from the Rating Area 2 surplus for the

2020/21 financial year, as recommended by the Hastings Rural Community Board,

be allocated as follows:

|

2020/21 RA2 Rating Surplus

|

Surplus

|

|

RA2 Surplus on General Rate

- Contingency

Reserve

- Allocation

to Rural Flood & Emergency Event Reserve

|

$422,655

$110,841

$311,814

|

|

2020/21 Landfill Operating Surplus

|

Surplus

|

|

RA2 Surplus on Landfill

Operations

- Allocation

to Landfill Reserve

|

$251,465

$251,465

|

C) That the

rating allocation be allocated as per the following table:

D) Noting that while the

Landfill surplus is allocated to the Landfill Development Reserve, it is

acknowledged that for the balance of the 2021/22 financial year this landfill

surplus is available for Council to meet any requirements to meet the

delivery of the 2021/22 budget and any unforeseen Covid-19 related impacts.

E) That the

budgets as per the schedule of Carry Forwards funded by rates and loans be

approved to be carried forward to the 2021/22 financial year.

|

Attachments:

|

1⇩

|

Rating Surplus 2021 RA1 & RA2

|

FIN-09-01-21-198

|

|

|

2⇨

|

Quarterly Dashboard June 2021

|

FIN-09-01-21-200

|

Under Separate Cover

|

|

3⇩

|

Draft Unaudited Financial Statements

|

FIN-09-01-21-199

|

|

|

4⇨

|

Carry Forwards 2021

|

FIN-09-01-21-201

|

Under Separate Cover

|

|

Item 8 Draft

Financial Year End Results - 30 June 2021

|

|

Rating

Surplus 2021 RA1 & RA2

|

Attachment 1

|

|

Item 8 Draft Financial

Year End Results - 30 June 2021

|

|

Draft

Unaudited Financial Statements

|

Attachment 3

|

Hastings

District Council: Operations & Monitoring Committee Meeting

Te Rārangi Take

Report to Operations and Monitoring Committee

|

Nā:

From:

|

John O'Shaughnessy,

Group Manager: Planning & Regulatory

|

|

Te Take:

Subject:

|

Update on Building Consent

Processing

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1

The purpose of this report is to provide Council with an update report on the

Building Consent activity.

1.2 The Building Control

area of Council presently reports its performance quarterly to Council’s

Operations & Monitoring Committee. Additionally, the Building Control

area is required under the Building Act, to have a system to run and maintain a

quality assurance regime for its performance of its building control functions

including policies, procedures and systems. This includes meeting the

statutory timeframes for consent processing.

However the focus of this report is on

the processing of Building Consents.

1.3 Currently our building

consents are running behind our statutory (and ideal) processing

timeframes. While there are a number of contributing factors, the two

main reasons for this are firstly, the sheer growth in volume of consents (a

20% increase in consent numbers between 2019/20 and 2020/21) and secondly, we

continue to struggle to employ additional staff, which means these increasing

consent numbers have to be absorbed by existing staff. This has resulted

in the processing times and inspection timeframes increasing. Unlike

other businesses, Council cannot turn away consents of an acceptable standard,

as Council is required by law to process these.

|

2.0 Recommendations -

Ngā Tūtohunga

A) That the Operations

& Monitoring Committee Meeting receive the report titled Update on

Building Consent Processing dated 30 September 2021.

B) That another

update report on the Building Consent area be provided to Council in early

2022.

|

3.0 Background – Te Horopaki

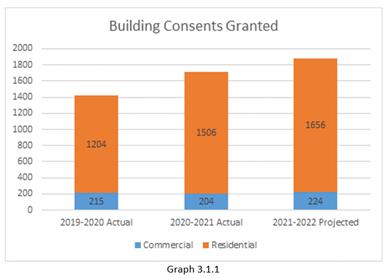

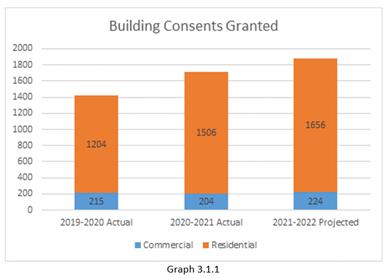

3.1 The graph below

outlines actual building consent numbers for the 2019/20 and 2020/21 years with

a forecast for the 2021/22 year (+10% increase).

The number of

commercial building consents for 2020/21 reduced from the 2019/20 year, however

the complexity and scale of these increased this last year (as an example two

hospitals and a number of large scale horticultural cool stores / industrial

buildings were processed).

For the 2021/22

year, we have forecast a 10% increase in consent numbers, with the majority

being residential consents. This is considered appropriate with what

Council know from subdivision / resource consent approvals.

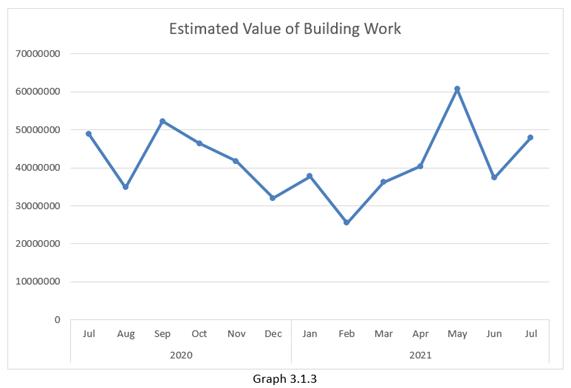

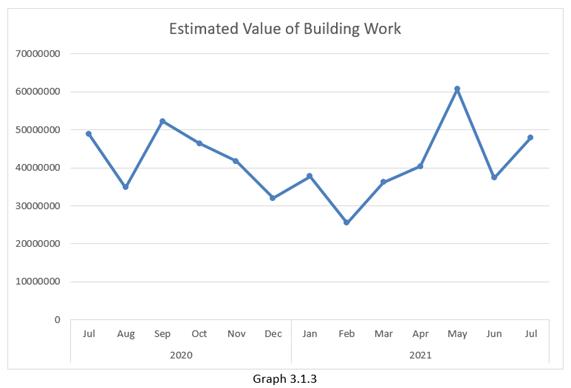

The graph below

demonstrates that we had particular peaks in consent numbers that in many ways

we are still working hard to recover from.

In addition to

fluctuating consent numbers, a standout feature of the past 12 months has been

an increase in consent complexity on a scale that, historically, Hastings has

not seen.

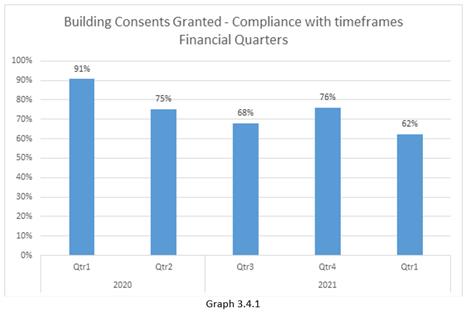

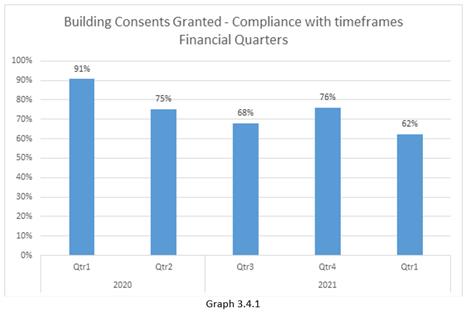

3.2 Consent Processing

Timeframes

These features have unfortunately had

an impact on our ability to consistently comply with October statutory

timeframes as the chart below demonstrates.

As a regulatory

authority, HDC do not have the ability to turn away work like most businesses,

it has to process all consents submitted to it of an acceptable standard.

As can be seen from Graph 3.1.1, we have been experiencing growth year on year

in volume. Additionally, we have seen an increase in complex consents.

3.3 Initiatives

The Building Consent Team have looked

at ways to increase productivity involving streaming internal reviews, updating

checklists, reduction of manual entries, a Building Bulletin, an online

tracking application (The Progression Bar), and other technologies such as

remote inspections.

Additionally, the Council has

established a Building Advisory Group which is looking at a number of

initiatives in the building consenting area.

These initiatives, plus maintaining an

active recruiting presence, show Council is endeavouring to reduce building

consent processing times.

Attachments:

There are no attachments for this report.

|

Summary of

Considerations - He Whakarāpopoto Whakaarohanga

|

|

Fit

with purpose of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-Rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural wellbeing of communities in the present and for

the future.

|

|

Māori

Impact Statement -

Te Tauākī Kaupapa Māori

The employment of additional resources in the Building

Consent area will help with the processing and inspections of papakainga

housing and other iwi led housing developments like Waingākau in

Flaxmere.

|

|

Sustainability

- Te

Toitūtanga

Not applicable:

|

|

Financial

considerations -

Ngā Whakaarohanga Ahumoni

Not applicable:

|

|

Significance

and Engagement - Te

Hiranga me te Tūhonotanga

This decision/report has been assessed under the Council's

Significance and Engagement Policy and as an update report, it does not

trigger any Significance or Engagement Policy.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto / ā-waho

The Council were updated on the

performance of the building consent area in May this year and we have sent

out a newsletter informing the industry of delays occurring in processing and

inspections.

|

|

Risks

|

REWARD – Te Utu

|

RISK – Te Tūraru

|

|

Service Delivery, Legal compliance, Reputation

|

Service Delivery, Legal compliance, Reputation

|

|

|

Rural

Community Board –

Te Poari Tuawhenua-ā-Hapori

These proposed changes identified in this

report will go to the next Rural Community Board meeting.

|

Hastings

District Council: Operations & Monitoring Committee Meeting

Te Rārangi Take

Report to Operations and Monitoring Committee

|

Nā:

From:

|

Lex Verhoeven, Strategy

Manager

|

|

Te Take:

Subject:

|

Non-Financial

Performance Report for the Year Ended 30 June 2021

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this

report is to update the Committee on achievement against its non-financial

performance management framework as contained within the 2018-2028 Long Term

Plan.

1.2 The performance

management framework forms part of the 2018-2028 Long Term Plan which the

Council is legally required to report against annually. This is the third

and last year of reporting against the 2018-2028 plan. Note: The 2021/22

financial year represents Year 1 of the newly adopted 2021-2031 Long Term Plan

which will be reported against in 2022.

1.3 This report is for

information only, and contains unaudited information. The audited version

will be incorporated in the Council’s Annual Report for Council adoption

in October 2020.

1.4 A summary of Council

performance is contained at the beginning of Attachment 1, and provides a

high level overview of performance. Generally the Council performance has

met its targets as set out in its performance framework, and in some cases such

as the Water Supply activity, the rollout of the Council’s drinking water

capital programme is on target to fully comply with the mandatory performance

measures.

1.5 The Council’s

Performance Management Framework has 3 levels as follows:

§ Future Aspirations (what we

are trying to achieve over time – trends and shifts)

§ Today’s Commitments

(levels of service we have committed to the community)

§ Smart Business (internally

focused on continuous improvement)

1.6 Level Two

(Today’s Commitments) is the primary focus of this report. It

captures the performance information contained within the Long Term Plan and

has three separate reporting components as follows:

1) Levels

of Service

2) Customer

Experience

3) Key

Actions

1.7 In regard to the 65