Kaupapataka

Agenda

|

Te Rā Hui:

Meeting date:

|

Monday, 13 February 2023

|

|

Te Wā:

Time:

|

9.00am

|

|

Te Wāhi:

Venue:

|

Council Chamber

Ground Floor

Civic Administration

Building

Lyndon Road East

Hastings

|

|

Te Hoapā:

Contact:

|

Democracy

and Governance Services

P: 06 871 5000

| E: democracy@hdc.govt.nz

|

|

Te Āpiha Matua:

Responsible Officer:

|

Group Manager: Corporate - Bruce Allan

|

Risk and Assurance Subcommittee

– Terms of Reference

Fields of Activity

The Risk and Assurance Committee is

responsible for assisting Council in its general overview of financial

management, risk management and internal control systems that provide;

·

Effective management of potential risks,

opportunities and adverse effects.

·

Reasonable assurance as to the integrity and

reliability of the financial reporting of Council.

·

Monitoring of Council’s requirements under

the Treasury Policy.

·

Monitoring of Council’s Strategic Risk

Framework.

·

Monitoring of Council’s legal compliance.

·

Monitoring of Council’s health and safety

compliance.

Membership – 7 (including 4 Councillors)

·

Independent Chair appointed by Council.

·

Deputy Chair appointed by Council.

·

2 external independent members appointed by

Council.

·

1 Heretaunga Takoto Noa Māori Standing

Committee Member appointed by Council

Quorum – 4 members

|

DELEGATED POWERS

Authority to consider and make

recommendations on all matters detailed in the Fields of Activity and such

other matters referred to it by Council.

|

Kaupapataka

Agenda

|

Mematanga:

Membership:

|

Koromatua

Chair: Jon Nichols – External Independent

Appointee

Nga Kai Kaunihera

Councillors: Simon Nixon (Deputy Chair), Alwyn Corban,

Tania Kerr, and Michael Fowler

External Independent Appointee: Jaun Park

Heretaunga Takoto Noa Māori Standing Committee appointee:

To be appointed.

|

|

Tokamatua:

Quorum:

|

4 members

|

|

K aihokoe mo te Apiha

Officer Responsible:

|

Group Manager: Corporate

– Bruce Allan

|

|

Te Rōpū Manapori me te Kāwanatanga

Democracy & Governance Services:

|

Christine Hilton (Extn 5633)

|

Te Rārangi Take

Order of Business

|

1.0

|

Apologies

– Ngā

Whakapāhatanga

At the

close of the agenda no apologies had been received.

Leave of

Absence had previously been granted to Councillor Kerr

|

|

|

2.0

|

Conflict

of Interest –

He Ngākau Kōnatunatu

Members need to be vigilant to stand aside from

decision-making when a conflict arises between their role as a Member of the

Council and any private or other external interest they might have.

This note is provided as a reminder to Members to scan the agenda and assess

their own private interests and identify where they may have a pecuniary or

other conflict of interest, or where there may be perceptions of conflict of

interest.

If a Member feels they do have a conflict of interest,

they should publicly declare that at the start of the relevant item of

business and withdraw from participating in the meeting. If a Member

thinks they may have a conflict of interest, they can seek advice from the

General Counsel or the Manager: Democracy and Governance (preferably before

the meeting).

It is noted that while Members can seek advice and

discuss these matters, the final decision as to whether a conflict exists

rests with the member.

|

|

|

3.0

|

Confirmation

of Minutes –

Te Whakamana i Ngā Miniti

This is the first meeting following the 2022 Triennial Elections

and so there are no previous minutes to be confirmed.

|

|

|

4.0

|

GM

Corporate Update

|

7

|

|

5.0

|

Insurance

Update

|

15

|

|

6.0

|

Treasury

Activity and Funding Update

|

19

|

|

7.0

|

Annual

Report and Audit Wrap-up

|

25

|

|

8.0

|

2023

Risk Horizon Scan

|

29

|

|

9.0

|

Risk

Assurance Update

|

33

|

|

10.0

|

Three

Waters Reform Risk Update

|

35

|

|

11.0

|

Health,

Safety & Wellbeing Risk Management Update

|

39

|

|

12.0

|

Minor Items

– Ngā Take

Iti

|

|

|

13.0

|

Urgent

Items –

Ngā Take Whakahihiri

|

|

|

14.0

|

Recommendation

to Exclude the Public from Item 15

|

43

|

|

15.0

|

Health

& Safety Contracts - Contractors' Health & Safety Performance

Report

|

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Bruce Allan, Group

Manager: Corporate

|

|

Te Take:

Subject:

|

GM Corporate Update

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 Legislative Reform

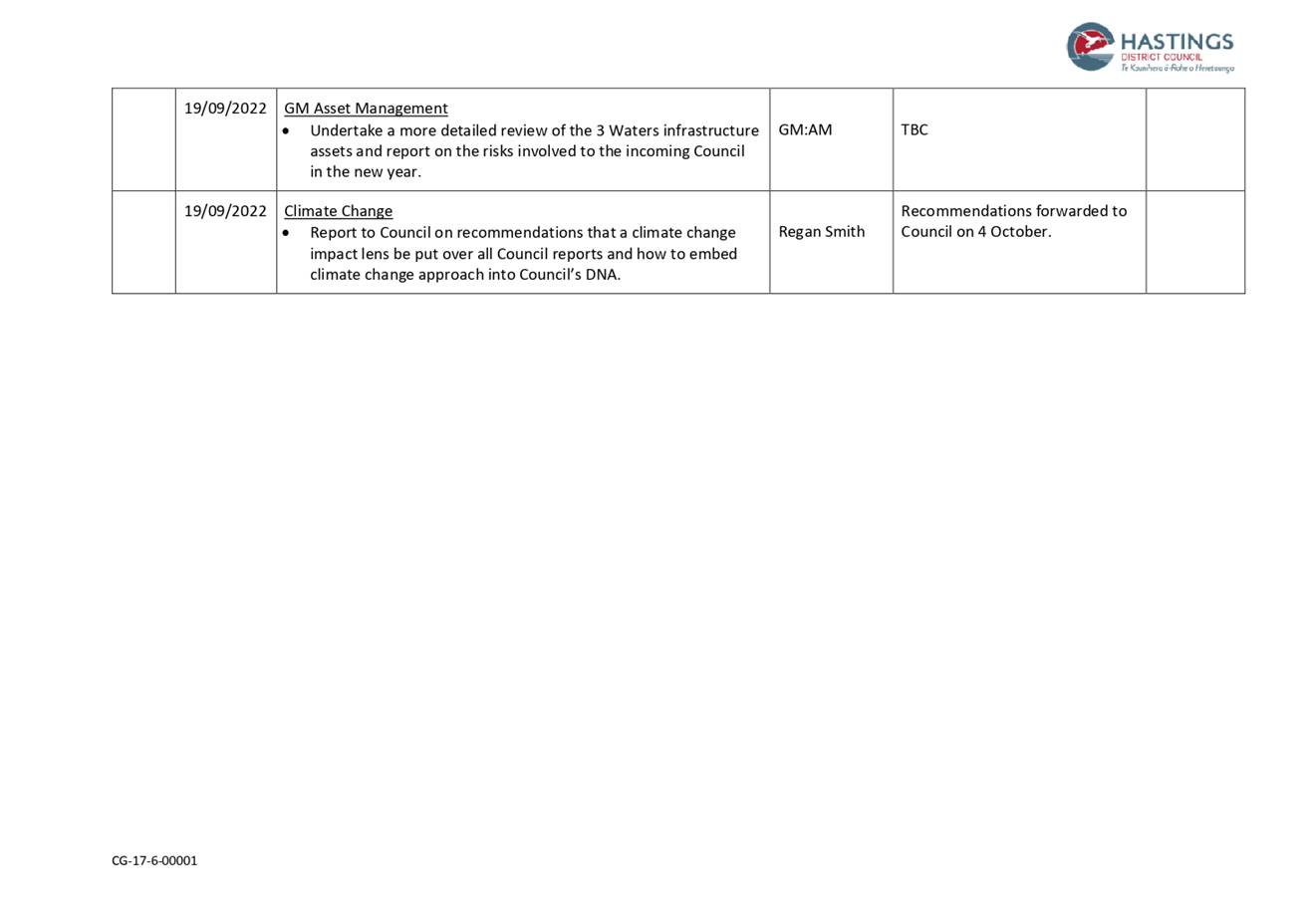

1.2 The beginning of 2023 has

created some interesting times for the Governments reform programme. Given the

uncertainties that prevail following the change of Prime Minister and the

signalling of a potential slow down or reprioritisation of some reforms, it is

not currently known what impact that these decisions may have. Officers will

provide a verbal update to the Committee based on what is known at that time. A

summary of the key reform streams is shown in Attachment 2, which was

the known status at the time of writing.

1.3 Climate Change Response

Update

1.4 At the Risk and Assurance

Committee on 19 September 2022 a range of additional steps were discussed to

respond to the challenges of climate change. Following is an update on progress

made on implementation of these measures.

· The

approach to climate action falls in to the following two main streams:

- Mitigation:

Actions to mitigate climate change focus on reducing carbon emissions, or

increase in sequestration. The purpose is to reduce/mitigate climate warming

before it causes disruption to natural ecosystems and built environments.

Examples of mitigation actions include building energy efficiency or electric

vehicles.

- Adaptation:

This stream of work focuses taking action to adapt to the current, and expected,

impacts of climate change. This stream assumes a level of climate change is

inevitable despite actions to mitigation global warming. Therefore, adaption

actions focus on preparing communities to cope with future climate change

impacts, such as more frequent high intensity rain fall events or storm surges.

· Climate

Risk Assessment for Adaptation: Through collaboration with other local

authorities the opportunity to participate in a regional climate change risk

assessment led by Hawke’s Bay Regional Council has been identified.

Considering that the effects of climate change will have region wide impacts, a

regional risk assessment should provide more robust information for Hastings

District Council planning than an independent Hastings District centric study.

Therefore, Council has agreed to participate in the regional assessment in

order to understand the impacts of climate change on Council activities.

· Regional

Joint Climate Committee has been established by Hawke’s Bay Regional

Council to provide forum for planning regional emissions reduction and

adaptation. Participation in this committee is key to HDC contributing

effectively to the regional climate change activities.

· Carbon

Footprint for Mitigation: An agreement with EKOS has been signed to survey and

calculate Council’s own carbon footprint. To support this process an

internal project team has been established to gather the information required

for the assessment.

· Council

Decision Making to promote Adaptation and Mitigation: A two phase approach is

being applied to strengthen the focus on climate change related issues in

Council decisions. The first phase is to develop and provide training on

climate change related guidance material for Council staff to apply when

developing Council reports and business cases. Once this guidance and training

have been delivered, the review process for Council reports will be expanded to

include a check that climate change issues have been considered when they are

relevant.

· With

the frequency of rain events that have the potential to cause flooding Officers

are preparing information for a workshop with Councillors in regards to the

flooding risks across the urban area, our procedures and approach to response

and preparedness for events. The purpose of this first workshop is to increase

awareness and understanding.

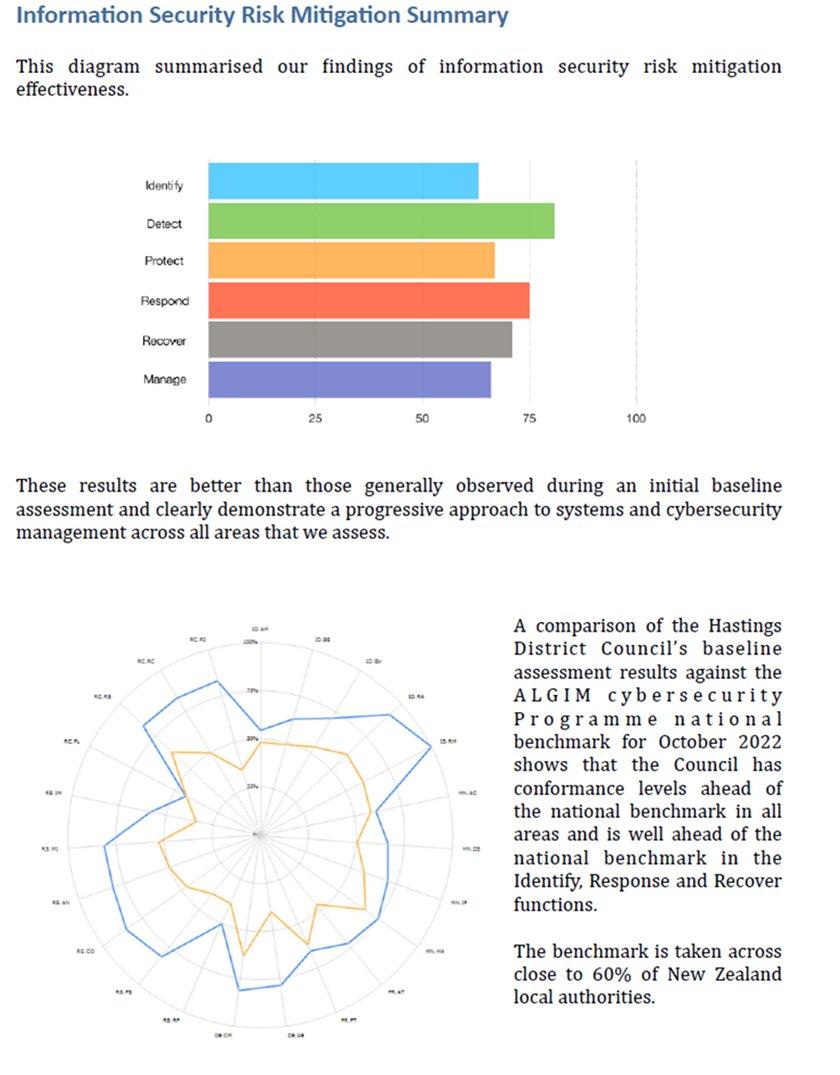

1.5 Cyber Security

1.6 In October 2022, an external

cyber security review was conducted by a subject matter expert. The report

confirmed Council’s continuous cyber security improvement with conformance

levels ahead of the national benchmark in all areas.

1.7 Officers within Information

management and business transformation are working through the key

recommendations made in the report.

1.8 Priority focus areas are

multi-factor authentication and further development of Council’s

cybersecurity training programme.

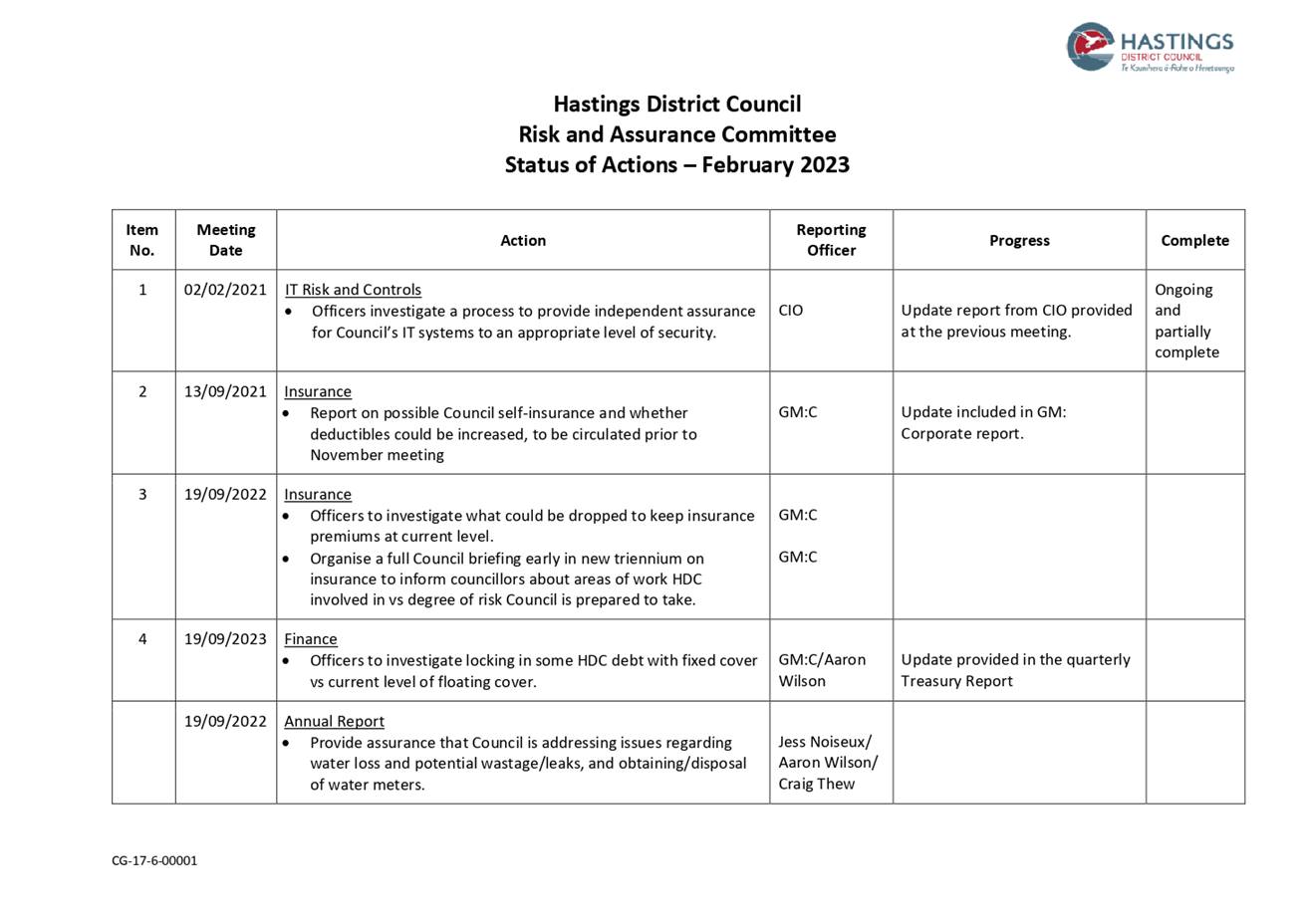

1.9 Outstanding Actions

1.10 Attached as Attachment 1 is the

schedule of outstanding actions for the Committee.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled GM Corporate Update dated 13

February 2023.

|

Attachments:

|

1⇩

|

Status of Actions - February 2023

|

CG-17-6-00001

|

|

|

2⇩

|

Statutory Change Timeline - Updated as at 19 Jan 2023

|

PMD-9-3-23-72

|

|

|

Item 4 GM

Corporate Update

|

|

Status of

Actions - February 2023

|

Attachment 1

|

|

Item 4 GM Corporate Update

|

|

Statutory

Change Timeline - Updated as at 19 Jan 2023

|

Attachment 2

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Jeff Tieman, Management Accountant

Bruce Allan, Group

Manager: Corporate

|

|

Te Take:

Subject:

|

Insurance Update

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this report

is to advise the Risk and Assurance Committee of the insurance arrangements for

2022/23.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Insurance Update dated 13

February 2023.

|

3.0 Background – Te Horopaki

3.1 AON are the lead insurance

brokers for Hastings District Council and cover material damage, business

interruption, motor vehicles, travel (international only) and all liability

policies, except public liability and professional indemnity, which are still

covered by Marsh.

3.2 Risk and Assurance would

ordinarily recommend the placement of Council insurance renewals, however due

to the election and impact that has on the meeting schedules and the delays in

getting renewal confirmations from AON and the insurers we were unable to take

the preferred approach with consulting with the Committee. The Chair of Risk

and Assurance was kept appraised as the renewal process was concluded.

3.3 Sitting outside of the

contract mentioned in 3.1 are the infrastructure policies and they are with AON

and LAPP.

4.0 Discussion – Te Matapakitanga

4.1 Historically,

the insurance market cycle was referred to as either being “hard”

or “soft”. A hard market was when insurers increased premiums to

recover losses from a major event from the previous year or years. A soft

market was when the insurers had recovered these losses and competition was

driving premiums back down.

4.2 The markets

are now changing and are moving to a risk-based premium for the region. In our

situation, this means we are exposed to risks such as earthquakes, tsunami,

liquefaction and some weather events.

MATERIAL DAMAGE

4.3 Back in May

2022 the five Hawke’s Bay councils engaged AON to conduct a loss

modelling exercise (Attachment 2) to identify potential losses for each

individual council and as a group. The modelling indicated in a one in 500 year

event, the HB group would sustain losses of $382m and Hastings District Council

would incur losses of $142m. For a one in 1000 year event, the losses for the

HB group (Attachment 1) increases to $454m and HDC $171m. A demand surge

of 30% was added to the expected loss of $454m to give the group a loss limit

to take to the market of $600m.

4.4 HDC

conducted a formal valuation for the 2021 renewal period. This process is

conducted every 3 years, with and inflationary adjustment allowed for in the

subsequent years. Based on the advice of our valuers and AON, an inflationary

figure of 12% was applied for 2022 renewal process.

4.5 To help

reduce the pressure on premiums, officers elected to remove certain buildings

that were set for demolition within the renewal period and all the toilet

blocks in the district.

4.6 With the

adjustment for new valuations, removal of items mentioned in point 4.5 and

additions of new assets, the valuation of the schedule increased by 11.7%

($545.3m, increased to $609.0m).

4.7 Due to the

increases in valuations across the entire renewal market, capital within the

insurance industry has been put under pressure. This resulted in our brokers,

AON unable to obtain cover for the HB group with for full valuations of their

material damage schedules. There was only sufficient capital in the market to

obtain cover for the HB group for the loss limit of $600m.

4.8 Premiums for

material damage cover increased from $1.525m to $1.780m, or 16.7% increase.

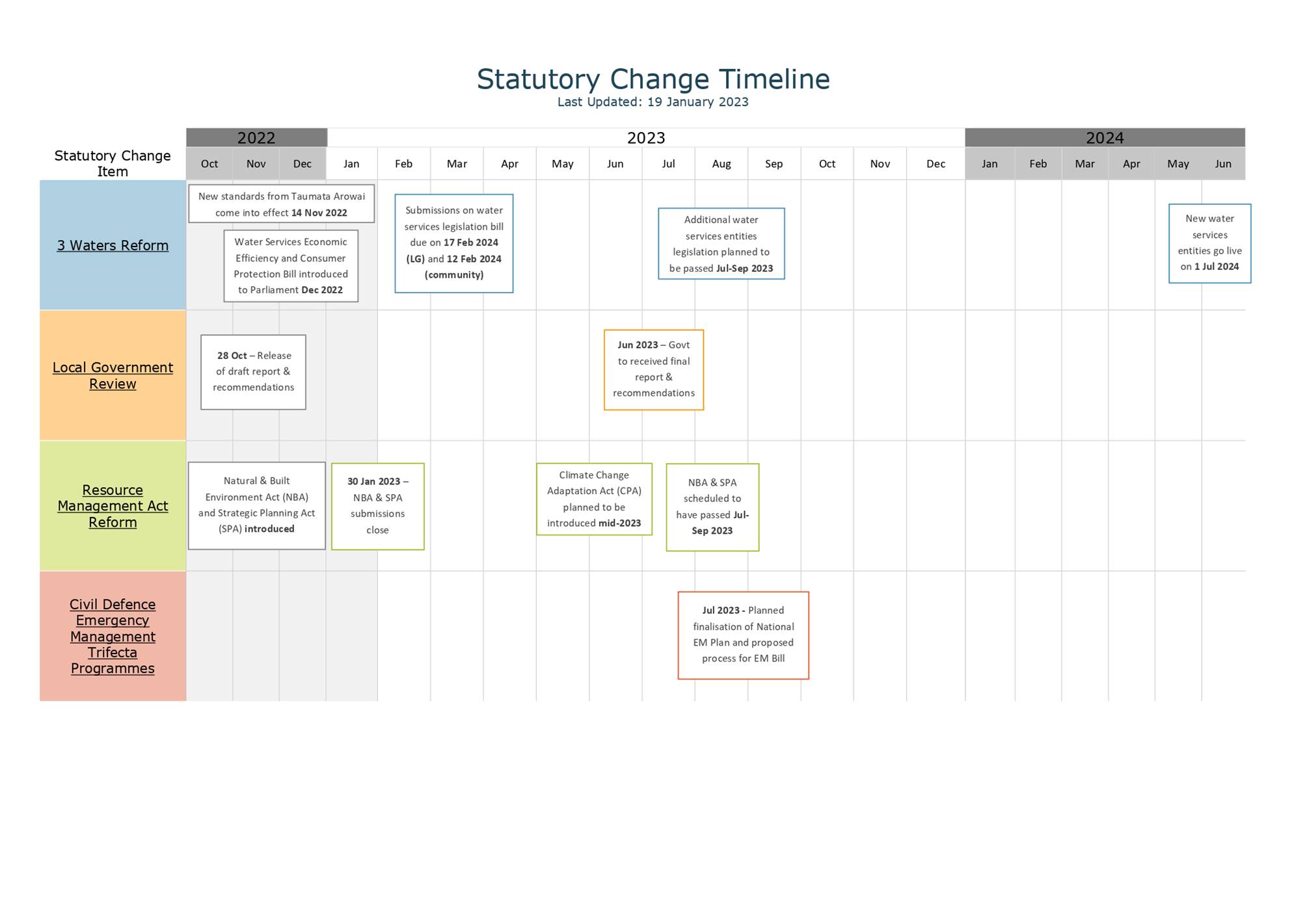

4.9 Officers

requested AON for pricing should the deductible excess increase from its

current $10k to $100k, $250k and $500k. This is to explore possible savings on

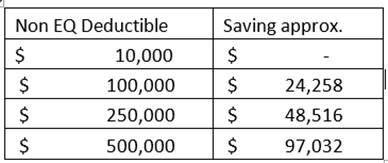

the premiums. Below is a table showing the possible savings.

CATASTROPHE

INSURANCE

4.10 LAPP are our insurers

for the underground infrastructure. This year there has been a substantial

increase due to a 55% increase in asset value ($1.163b to $1.798b). The

premiums for 2022/23 renewal are $561,108, up from 2021/22 premium of $340,275.

The claim levels remains the same at $65m, $105m and $150m (Attachment 3).

4.11 AON are our brokers

for the policy covering the bridges. This year’s valuation increased by

19% at $141.9m up from $118.5m. The premiums were up 19% also to $78,932.

LIABILITY POLICIES

4.12 Employers, statutory

and crime policies have has small increases in this renewal period, with only

the public liability and professional indemnity incurring higher premium

increases (24%). This has been driven by claims exceeding premiums, pressures

on the building industry, insurers withdrawing from the market for this

particular cover, pressures on council’s consenting process and to free

up marginal land for development.

Attachments:

|

1⇨

|

AON HB Group loss modelling analysis

|

IRB-3-20-23-104

|

Under Separate Cover

|

|

2⇨

|

AON HDC Loss Modelling Analysis

|

IRB-3-20-23-105

|

Under Separate Cover

|

|

3⇨

|

Insurance Renewal Summary 2022/23

|

IRB-3-26-23-77

|

Under Separate Cover

|

Te

Hui o Te Kaunihera ā-Rohe o Heretaunga

Hastings

District Council: Risk and Assurance Committee Meeting

Te

Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Aaron Wilson, Financial

Controller

|

|

Te Take:

Subject:

|

Treasury Activity and

Funding Update

|

1.0 Executive Summary – Te Kaupapa Me Te

Whakarāpopototanga

1.1 The

purpose of this report is to update the Risk and Assurance Committee on

treasury activity and funding issues.

1.2 Since

the last update in July 2022, in November 2022 Council has borrowed $15m

additional funds to continue to fund 2022/23 capital expenditure and in

February 2023 has borrowed a further $20m to continue to fund capital spend.

1.3 Officers

have added an additional standby funding facility through the LGFA of $15m,

giving Council total facility access of $30m. This will allow Council to

stay within Treasury policy liquidity limits of between 110% – 170%.

1.4 The

Council’s current total external debt is $272m as at 13th February 2023.

Offsetting this is $20m of bank deposits, giving a net external debt position

of $252m.

1.5 Officers

have reviewed the Treasury Policy (Attachment 2) and have not

recommended any changes.

1.6 Council

is currently compliant with its Treasury Management Policy.

1.7 The

Reserve Bank of New Zealand (RBNZ) raised its Official Cash Rate (OCR) to 4.25%

at its last review, with a further rise in February 2023 likely.

|

2.0 Recommendations - Ngā Tūtohunga

A) That

the Risk and Assurance Committee receive the report titled Treasury Activity

and Funding Update dated 13 February 2023.

B) That

the Committee endorse the recommendation that no changes be made to the

Treasury Policy, as reviewed by council officers.

|

3.0 Background – Te Horopaki

3.1 The

Hastings District Council has a Treasury Policy which is a summarised version

of the Treasury Management Policy and forms part of the 2021-2031 Long Term

Plan. Under these policy documents, responsibility for monitoring treasury

activity is delegated to the Risk and Assurance Committee.

3.2 Council

is provided with independent treasury advice by Miles O’Connor of Bancorp

Treasury Services and receives daily and monthly updates on market conditions.

3.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in-depth treasury reporting is provided for the Risk and Assurance

Committee.

4.0 Discussion – Te Matapakitanga

4.1 Council’s

debt portfolio is managed within macro limits set out in the Treasury Policy.

It is recognised that from time to time Council may fall out of policy due to

timing issues. The Treasury Policy allows for officers to take the necessary

steps to move Council’s funding profile back within policy in the event

that a timing issue causes a policy breach.

4.2 Council’s

current total external debt is $272.7m as at 13 February 2023 ($237.7m as at

30th June 2022). Offsetting this are $20m of bank deposits ($32m as at 30th

June 2022), giving a net external debt position of $252m. This is presented in

the Treasury Position 13th February 2023 Report (Attachment 1).

4.3 Officers

regularly forecast cash flows needed in light of Council’s large capital

programme underway. In consultation with Bancorp treasury advisors, Council

borrowed $15m in November 2022, with a mix of fixed and floating maturities,

with a further $20m borrowed February 2023. This is itemised in the table below:

|

Type

|

Deal Date

|

$(‘000)

|

Maturity Date

|

Rate

|

|

Floating

|

14th

November 22

|

5.0

|

20

April 29

|

BKBM

+ 65.0 B.P

|

|

Floating

|

14th

November 22

|

10.0

|

15

April 30

|

BKBM

+ 66.7 B.P

|

|

Floating

|

7th

February 23

|

20.0

|

1st

July 24

|

BKBM

+ 31.3 B.P

|

4.4 It

should be noted that the $20m debt drawn down in February 2023 has a maturity

date of 1st July 2024. This debt has been linked to the 3

waters capital spend and the maturity date was taken out knowing that the 3

waters entity will repay the portion that is 3 waters debt of Council debt as

it matures.

4.5 The

3 waters National Transition Unit is expecting to supply Councils with their

assessed settlement statements shortly which will include the assessed levels

of debt associated with 3 waters and therefore set to be transferred to the new

water entity. There will be a negotiation process to settle on the 1 July 2022

balance and that is likely to take place later in February.

4.6 With

the increasing level of debt, it is important that Council remain within

treasury limits as set out by Council’s treasury policy. Liquidity

is one of the metrics that is required by Treasury policy to be between 110

-170%. Currently, Council has a $15m standby banking facility with

Westpac which along with any terms deposits has been enough to maintain

liquidity within the required parameters.

4.7 With

capital spend now matching the budgeted spend in the current financial year,

any cash reserves have been used up, and with additional debt of $35m drawn

down in the current financial year, the level of facility is not enough to

maintain the required amount of liquidity.

4.8 Officers

are working through adding a $15m facility from the LGFA, and whilst unlikely

to be drawn on is to maintain the level of liquidity as required by the

Treasury policy. As Council debt reduces over time, especially the 3

waters debt portion, officers can review the facilities available and reduce if

necessary.

4.9 Officers

have also had discussions with Council treasury advisers over the level of debt

cover that is currently in play. With the current cycle of OCR increases

coming close to a peak, it has been agreed to review the cover in May 2023, as

swap rates will likely fall. This is already playing out in the markets with

forward starting swaps being priced at lower rates compared to current date

swaps.

4.10 Whilst

Council is well covered in the short/medium term, the other factor affecting

the longer term strategy is the 3waters transfer of debt to the 3waters

entity. As the debt falls the requirement for cover will also fall.

4.11 It

should also be noted on the Treasury position dashboard, Council’s cost

of funds is now at 4.35%, which is a reflective of the rising finance costs

within the debt market.

4.12 As

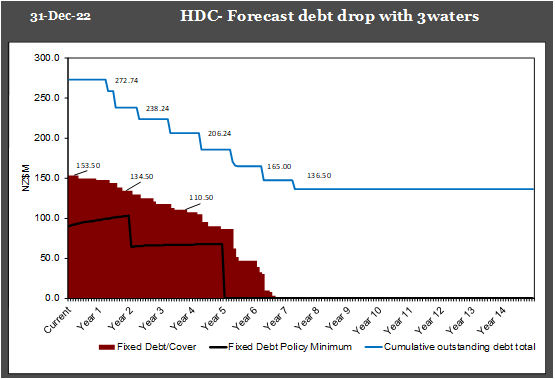

was requested at the previous Risk and Audit Subcommittee meetings, officers

have created a graph that forecasts the future level of debt cover that would

be in place if the water reform was to take place and 50% of Council debt due

to water was to be taken over by the new water entity.

4.13 It

is now expected that as each tranche of debt matures, it has been indicated by

the NTU that the portion of that tranche of debt that relates to 3 waters will

be taken over by the new entity. This will happen each year for around five

years. Any holding costs for the debt that Council will hold until it

becomes due will be paid will be bourne by the water entity.

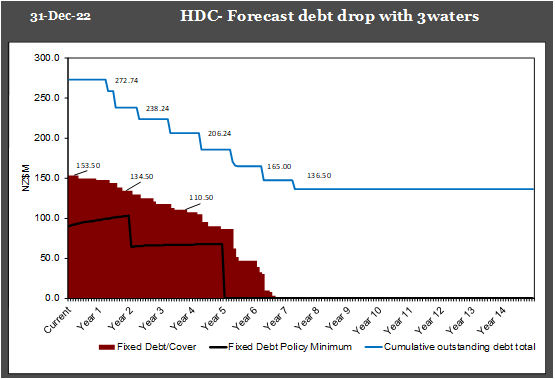

Graph: Forecast

4.14 The

light blue line shows council’s debt and how it is forecasted to fall in

relation to the portion of the 3waters debt falling off. The brown block

is the fixed debt cover that council already has in place. As can be seen

from the level of cover in place over the next five years ranges between 56%

-53% cover.

4.15 Every

year officers review the treasury policy, to ensure that it meets requirements

and that reflects best practice. This year officers have reviewed the

policy and have not recommended any changes to the committee.

4.16 The

Reserve Bank of New Zealand (RBNZ) raised its Official Cash Rate (OCR) to 4.25%

at its last review, with a further rise in February 2023 likely.

5.0 Next steps – Te Anga Whakamua

5.1 Council

officers will continue to work with Bancorp Treasury Services to keep

Council’s financing costs to a minimum, maintaining adequate liquidity,

while maintaining compliance with Council’s Treasury Policy.

Attachments:

|

1⇨

|

Treasury Dashboard 7th February 2023

|

FIN-15-01-23-29

|

Under Separate Cover

|

|

2⇨

|

Treasury Policy Reviewed 2023

|

FIN-15-01-23-31

|

Under Separate Cover

|

|

Summary of

Considerations - He Whakarāpopoto Whakaarohanga

|

|

Fit

with purpose of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-Rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural wellbeing of communities in the present and for

the future.

Link to the Council’s

Community Outcomes –

Ngā Hononga ki Ngā Putanga ā-Hapori

This proposal promotes the economic

wellbeing of communities in the present and for the future.

|

|

Māori

Impact Statement -

Te Tauākī Kaupapa Māori

There are no known impacts for Tangata

Whenua.:

|

|

Sustainability

- Te

Toitūtanga

This report promotes sustainable financing costs ensuring

the economic wellbeing of communities in the present and for the future.

|

|

Financial

considerations -

Ngā Whakaarohanga Ahumoni

This report will ensure that

financing costs are kept within Council’s existing budgets.

|

|

Significance

and Engagement -

Te Hiranga me te Tūhonotanga

This decision/report has been assessed under the Council's

Significance and Engagement Policy as being of minor significance.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto / ā-waho

There has been no external engagement:

|

|

Risks

The purpose of this report and the Treasury Policies it

refers to, assist officers to manage Council’s treasury risk.

|

REWARD – Te Utu

|

RISK – Te Tūraru

|

|

To assist officers to manage Council’s Treasury

risk; Finances, Reputation.

|

Cashflows and finance costs; Finances, Service Delivery,

Reputation.

|

|

|

Rural

Community Board –

Te Poari Tuawhenua-ā-Hapori

There are no implications for the Rural

Community Board:

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Aaron Wilson, Financial

Controller

Jess Noiseux, Financial Improvement

Analyst

|

|

Te Take:

Subject:

|

Annual Report and Audit

Wrap-up

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this report

is to present the Closing Report from Council’s auditors Ernst &

Young (EY) and report in more detail some of the technical aspects of the

report presented to Council at the adoption of the 2021/22 Annual Report and

2021/22 Summary Annual Report in December 2022.

1.2 Attached as

Attachment 1 is the Closing Report to Council for the year ended 30 June

2022 from Council’s auditors EY.

Finalisation of

the 2022 Annual Report

1.3 The adoption of the 2022

Annual Report was later than normal due to staff shortages with our former

auditors Audit New Zealand and the late change to our new auditors Ernst Young

(EY). The level of engagement required from officers was significantly higher

than in prior years due to the nature of a first time audit, as well the

unusual circumstances where the change in auditors occurred in the middle of an

annual audit cycle.

1.4 Council adopted the Annual

Report and Summary 2021/22 at the 8th of December 2022 Council

meeting subject to minor amendments. The 2021/22 Annual Report and Summary

Annual Report were subsequently signed off and published on the 15th of December.

Qualified audit opinion

1.5 In 2021 Council received a

qualified audit opinion over the activity groups’ statement due to issues

in two separate performance measures. Those measures were the Number of

complaints – issue around completeness of data and Water loss

– issue around reliance of reported data

1.6 Officers worked through the

year to try and resolve these so as to avoid another qualified opinion.

However, as detailed below, this was not attainable and Council received

another qualified opinion over the water performance for the one performance

measure issue that remained.

Number of complaints – issue

around completeness of data

1.7 This was an issue across

several councils in both the 2021 and 2020 financial years, partly due to the

ambiguity in some of the guidance from the Department of Internal Affairs (DIA)

and how this was interpreted. In August 2020, Council implemented a number of

changes to resolve the issue identified by Audit NZ. However, Council is also

reliant on Palmerston North City Council’s (PNCC) system and processes

for recording complaints received after hours and limitations in this process

resulted in another qualification in the 2020/2021 Annual Report.

1.8 From initial discussions

with PNCC, Officers were confident that appropriate after hours call centre

data from PNCC had been obtained for the 2021/22 financial period. The call

data is now correctly categorised into appropriate activities.

1.9 However, when scrutinised,

it became difficult to prove that the reporting provided by PNCC was complete.

Reporting to Council remains focused on service request calls as opposed to

calls where a complaint has been made.

1.10 Officers also ran into issues with

pulling some of the reports from the HDC Call centre system, gaps in the data

were identified. When Customer Service staff were migrated to a new version of

MiCollab to enable remote working during Covid, the call history was lost.

Summary data was still available, and Officers used this to produce the annual

report disclosure, but the loss in the audit trail meant EY couldn’t

easily test the underlying data for accuracy.

1.11 Officers are continuing to work with

PNCC and Micollab to try and resolve these issues for the 2022/23 financial

year.

Water loss – issue around

reliance of reported data

1.12 As discussed at the previous Committee

meeting, Council do not have sufficient water meters installed on residential

connections to report a statistically reliable water loss percentage.

1.13 Officers investigated the alternative

method allowable by the DIA for measuring water loss (minimum night flow

analysis - MNF), and unfortunately it was concluded that the MNF methodology

results were not reliable. Because both methods are considered statistically

unreliable, officers chose not to report any results for this measure in the

Annual Report and to instead disclose what work is being done to improve the

accuracy of the data for this measure.

1.14 On the basis that what Officers

disclosed was accurate, EY did not qualify on this performance measure for the

2021/22 Annual Report. However, because comparative information from the

2020/21 Annual Report was included (as required), EY were required to highlight

this in their audit opinion.

1.15 New water meters continue to be

installed; however, it is unlikely that sufficient meters will be in place by

June 2023 to enable Officers to report a statistically reliable water loss

percentage for the 2022/23 financial year.

Asset Valuations

1.16 Infrastructure assets are the most

significant balance on Council’s balance sheet. Last year, 3 water assets

were due for revaluation and in the course of assessing fair value it became

evident that roading assets would need revaluing as well.

1.17 The revaluations for infrastructure

assets resulted in an overall gain of $551m across roading and 3 waters.

Roading

1.18 Roading assets were significantly

affected by the increasing cost of construction and in particular the impact of

increased oil prices on bitumen. The impact of these increasing replacement

costs resulted in an uplift of $163m in roading asset value.

1.19 While roading assets value increased

significantly, there was very little increase in asset useful lives. This

indicates that renewal expenditure is not keeping up with the ageing of these assets,

i.e. roading assets are on average further through their expected useful life.

Current renewals expenditure is not high enough to keep roading assets at a

stable point of asset conditioning.

3 Waters

1.20 3 waters had an uplift of $388m on an

asset base pre-valuation of $671m, a 58% increase overall. This was

significantly higher that what has been seen at other Councils. However

underlying values provided by Officers were supported by recent contract

pricing and third party pricing indices and EY were satisfied with the evidence

provided and accepted Councils position.

1.21 EY have strongly recommended Council

obtain an external valuation this year. Officers plan to implement this as part

of the 2022/23 annual report process.

Effect on depreciation

1.22 With such substantial valuation

increases over the last two years (Park assets were revalued in 2021), and

without useful lives increasing as much, there is a significant increase in

depreciation in the 2022/23 financial year. Officers have calculated an $11.6m

impact from the 2022 valuation uplifts on infrastructure depreciation for the

2022/23 financial period.

The valuations undertaken also provide

updated depreciation rates, based on useful lives that reflect the condition of

the assets at the time of valuation. Officers are currently working through the

recommended changes to depreciation rates from these valuations. The potential

impact for the 2022/23 financial period is a further $5m should all recommended

depreciation rate changes be implemented.

The below table illustrates the

potential impact on depreciation for the 2022/23 financial year (noting that

$6m out of the $16m total is already reflected in December quarterly financial

reporting). $11.6m of this is unavoidable and is purely reflective of valuation

uplifts.

|

Asset Class

|

Total impact on 2022/23 depreciation

|

Due to change in useful lives

|

Due to valuation uplifts (already committed)

|

|

Roading

|

$4,745,397

|

48%

|

$2,255,584

|

52%

|

2,489,812

|

|

Stormwater

|

$2,368,143

|

18%

|

429,432

|

82%

|

1,938,711

|

|

Wastewater

|

$6,082,613

|

3%

|

198,192

|

97%

|

5,884,421

|

|

Water Supply

|

$2,403,219

|

45%

|

1,080,763

|

55%

|

1,322,455

|

|

Parks

|

$1,097,155

|

100%

|

1,097,155

|

0%

|

0

|

|

Total

|

$16,696,526

|

|

5,061,126

|

|

11,635,399

|

1.23 At the time of writing EY were yet to

release their draft management letter for management’s response and

action. This will be provided to the Risk and Assurance Committee in due course

when it has been finalised and released.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Annual Report and Audit

Wrap-up dated 13 February 2023.

|

Attachments:

|

1⇨

|

Auditors Closing Report to Council for the year ended 30

June 2022

|

FIN-07-01-22-471

|

Under Separate Cover

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Steffi Bird, Risk

Assurance Advisor

Regan Smith, Risk &

Corporate Services Manager

|

|

Te Take:

Subject:

|

2023 Risk Horizon Scan

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1 The

purpose of this report is to provide the Committee with an opportunity to

review the Council’s current strategic risk register and undertake a risk

horizon scan.

1.2 The

current risk register (Attachment 1) summarises the top nine (9) risks

in relation to Council achieving the objectives set out in the Long Term Plan.

In addition to the strategic risk register, it is noted that:

· Risks

relating to the achievement of business as usual activities, are held in a

separate enterprise risk register which is managed by the Lead Team.

· The

full register of enterprise risks mentioned in the above bullet point,

aggregate to the single strategic risk ‘Significant operational service

failure’.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled 2023 Risk Horizon Scan

dated 13 February 2023.

|

3.0 Discussion – Te Matapakitanga

3.1 The

strategic risk register was most recently updated and approved by Council on 24

February 2022.

3.2 The

most recent update introduced the risks ‘Environmental, Social,

Governance (ESG) and Cultural failure’, ‘Cyber security

threat’ and ‘Truth decay’, an alteration to ‘Spatial

& asset management planning’ becoming ‘Growth planning’.

3.3 The

following documents are provided to the Committee for the purpose of discussing

any new or emerging risks to Council’s objectives:

· Executive

Summary of the World Economic Forum’s (WEF) 2023 Global

Risk Report (Attachment 2). Key points relevant to

Council’s goals from this report are; Cost of Living Crisis (inflation)

and how this could drive food insecurity, and impacts of changing climate.

· Extract

from the PwC Annual

Global CEO Survey for 2023 (Figure 1). Key points from this

summary relevant to Council are; regulation change, labour shortage and

technology disruption.

· Figure

1 below illustrates which of the top 10 short term risks (less than 2

years) from the WEF Global Risk Report (shown in green and red) could have an

impact on Council’s strategic objectives (shown in white). Note: for

the purpose of simplicity, the connections have been limited to a maximum of

the top three goals impacted by each risk.

Attachments:

|

1⇨

|

Executive Summary - WEF Global Risks Report 2023

|

PMD-9-3-23-66

|

Under Separate Cover

|

|

2⇨

|

PwC Annual Global CEO Survey 2023 (extract)

|

PMD-9-3-23-67

|

Under Separate Cover

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Steffi Bird, Risk

Assurance Advisor

Regan Smith, Risk &

Corporate Services Manager

|

|

Te Take:

Subject:

|

Risk Assurance Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1 This

report is provides the Committee with a copy of the final reports for the

following risk assurance reviews completed during 2022:

· Loss

of key knowledge

· Asset

management improvement plans

1.2 Loss of key knowledge

assurance review

· Council’s

enterprise (tier 2) risk register includes the risk, loss of key knowledge,

which is aggregated to the strategic (tier 2) risk, significant operational

service failure.

· The

review’s scope was based upon the critical controls identified within the

risk’s bowtie assessment, including:

- Use

of documentation and procedures relevant to roles

- Management

of single points of knowledge

- Wellbeing

support, including EAP and flexible working arrangements

- Performance

planning, including adequate resourcing and managing poor performance

- Process

for ensuring appropriate remuneration levels

· The

review resulted in one medium risk finding and two low risk findings, with an

overall assessment of substantially effective.

· As

is stated in the final report (Attachment 1), the review identified the

areas of wellbeing support and performance planning as being highly effective

controls.

· Recommendations

and respective due dates have been agreed to with relevant members of the Lead

Team. These will be tracked through to completion by the Risk Assurance Team.

1.3 Asset management

improvement plans assurance review

· Asset

Management Plans (AMP) are identified as a key control in the Infrastructure

Service Failure enterprise risk. In light of the importance of asset planning

to meet the demand for housing and growth in industrial activities, the Council

recognises the need for robust AMPs.

· Because

the technical detail in the Council AMPs has been independently reviewed at

various times, the current review focused on implementation of AMP improvement

plans to deliver continuous improvement in asset management planning practices.

· The

effectiveness of the improvement plan process was evaluated by considering the

following key areas:

- The

status of the relevant asset management plans, including whether the plan has

been formally endorsed, and the date of next review.

- Review

the AMP improvement plans and any associated register.

- Confirm

that there is evidence showing how improvement plans are being formally managed

and adapted as required.

· It

was clear from external reviews of the Council AMPs that improvement in

planning practices are being implemented. In particular the Transportation AMP

showed marked improvement in the recent assessment by the national Road

Efficiency Group.

· The

main opportunities for improvement identified in the review relate to

development of a systematic approach to approving, implementing and monitoring

the AMP improvement plans (Attachment 2).

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Risk Assurance Update dated

13 February 2023.

|

Attachments:

|

1⇨

|

Executive Summary - Loss of key knowledge review report

|

PMD-9-3-23-68

|

Under Separate Cover

|

|

2⇨

|

Executive Summary - Asset management improvement plans

review report

|

PMD-9-3-23-69

|

Under Separate Cover

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Regan Smith, Risk &

Corporate Services Manager

Craig Thew, Group

Manager: Asset Management

Carly Price, 3 Waters

Transition Manager

|

|

Te Take:

Subject:

|

Three Waters Reform Risk

Update

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this report

is to provide the Committee with an update on the provisions in place to

support seamless transitions of water services to the new water entity under

the Three Waters Reform programme, in order for the Committee to determine

whether the material risks have been identified and that suitable mitigations are

in place.

2.0 Current Situation

2.1 At the time of writing the

recent central Government political changes have not resulted in a formal

announcement or change to the Three Waters Reform programme. As a result, the

underlying legislation driving the transition programme remains the same.

2.2 In addition, there has been

no change in proprieties communicated to officers through the National

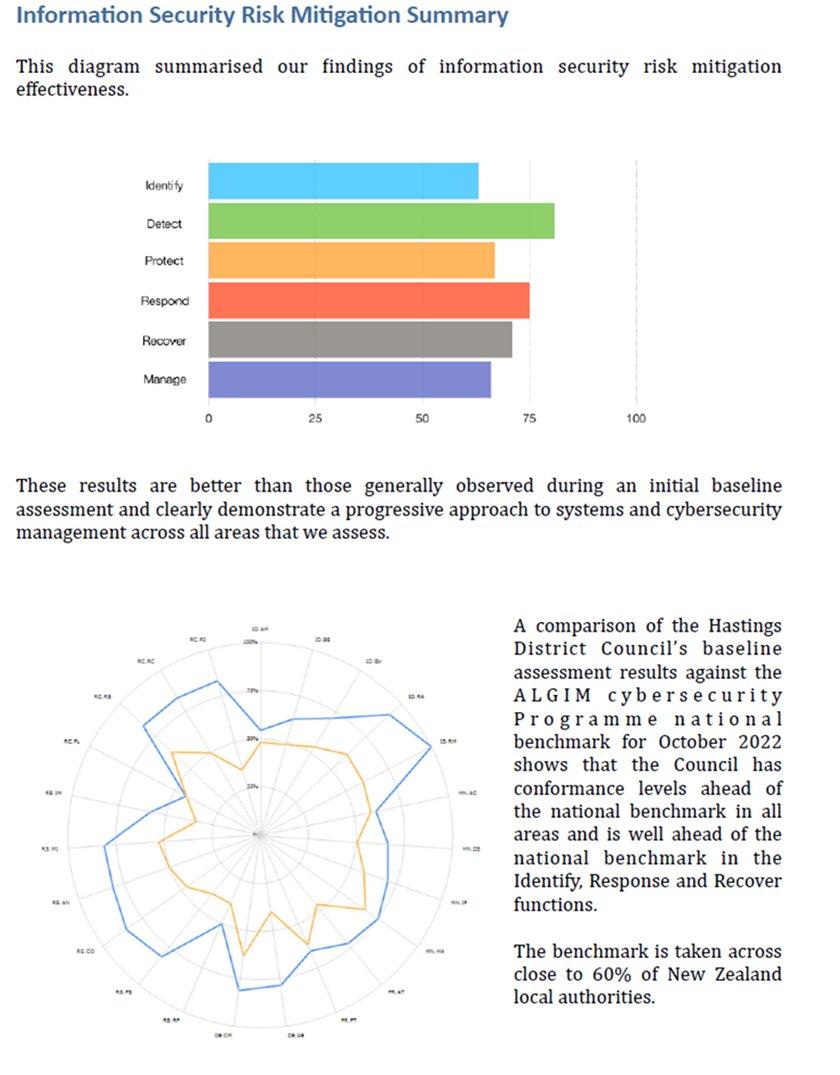

Transition Units (NTU) responsible for establishing the new water entities.

Therefore, work continues to prepare Hastings District Council (HDC) services

for transition by the established target date of 30 June 2024.

3.0 Water Transition

3.1 To manage the transition to

the new water entity a 3 Waters (3W) Transition Manager has been appointed who

has developed a Water Transition Strategy and associated Implementation Plan.

3.2 The Water

Transition Strategy objective is to “ensure reliable and quality service

provision now, throughout and after the transition for ratepayers, including

ensuring:

· Service provision (both 3W and other HDC services such as Transport)

is not disrupted significantly or provided at a lower LoS because of the

Reform.

· HDC’s 3W team, assets and systems are best placed for

incorporation into a new entity, so ratepayers get best service from the new entity

from the start.

· HDC’s non-3W services are prepared for working with the new

entity in place of the HDC 3W’s service.”

3.3 The Water Transition

Strategy identifies the following areas that need to be managed to ensure

reliability and quality of services is maintained during the transition.

Actions to address each of these areas are then defined the implementation

plan.

· Business as usual delivery maintained.

· People supported.

· Commercial/legal considerations managed.

· System data and interfacing integrity maintained.

4.0 Risk Summary

4.1 The risks to successfully

achieving the transition objectives are summarised in (Attachment 1).

This risk profile is based on the original 3 Waters Reform Risk Analysis

workshop undertaken in April 2021, which has been reviewed and updated in

consultation with the 3W transition team. To support the Risk Profile summary a

detailed table of tactical risks identified by the transition project is

provided in (Attachment 2).

4.2 Key points from the risk

profile are:

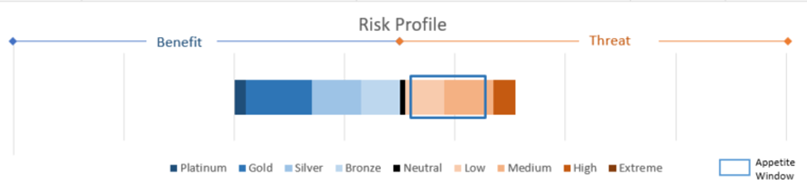

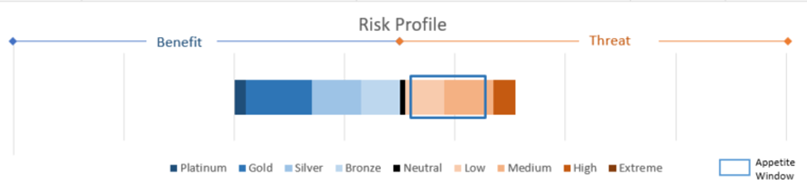

· The

level of benefit (opportunity risk) that can be expected from the transition is

considered to outweigh the potential downsides (threat risks).

This can be seen in the Risk Profile bar chart below, as the chart shows the

Benefit bar (in blue) extending further to left of the Neutral point (black

line), than the Threat bar (in orange) extends to the right.

· The

significant benefits identified relate to having a strong service partner and

reduced Council service responsibilities. These are balanced against the

material risks of inability to deliver growth plans including provision of

sufficient water capacity, and problems created by the uncertainty around

Government requirements which will probably cause a protracted transition.

· However,

while the balance of benefit compared to threat is favourable, the level of

threat does sit outside of the Conservative risk appetite Council would

normally apply to core services (represented by the blue rectangle). Because

the transition requirements are mandated Council is not able to implement

preventative controls or opt out of this change. Therefore, the exceedance of

Council’s risk appetite can only be managed through mitigation controls

based on monitoring and respond to issues as they arise. This is the purpose of

the transition team.

|

5.0 Recommendations -

Ngā Tūtohunga

A) That the Risk and

Assurance Committee receive the report titled Three Waters Reform Risk Update

dated 13 February 2023.

B) That the

Risk and Assurance Committee confirm that the material risks to a successful

transition of 3 Waters services to the new water entity have been identified,

and that the mitigation plans for these risk are suitable and likely to be

effective.

|

Attachments:

|

1⇨

|

Three Waters Reform Strategic Risk Profile February 2023

|

PMD-9-3-23-70

|

Under Separate Cover

|

|

2⇨

|

Three Waters Detailed Risk report February 2023

|

PMD-9-3-23-71

|

Under Separate Cover

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Jennie Kuzman, Health,

Safety and Wellbeing Manager

|

|

Te Take:

Subject:

|

Health, Safety &

Wellbeing Risk Management Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1 The purpose of this report

is to provide an update to the Risk and Assurance Committee in regards to the

management of Health and Safety risks within Council.

1.2 This report provides

information on:

· Health &

Safety at Work Reform Progress

· Health, Safety

& Wellbeing Objectives 2023-2025

· Health, Safety

& Wellbeing Critical Risk Profile – Conflict and Violence

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Health, Safety &

Wellbeing Risk Management Update dated 13 February 2023.

|

3.0 Background – Te Horopaki

3.1 The

purpose of this report is to provide information to the Committee in regards to

the management of Health and Safety risks within Council.

3.2 This

issue arises due to the Health and Safety at Work Act 2015 and the requirement

of that legislation for Elected Members to exercise due diligence to ensure

that Council complies with its Health and Safety duties and obligations.

4.0 Discussion – Te Matapakitanga

4.1 Health and Safety at

Work Reform Progress

4.2 As

previously advised to the committee in the February 2022 meeting, the

Government announced in late 2021 impending changes to a range of Health and

Safety at Work Act Regulations in relation to plant and structures (this covers

a wide range of topics: work machinery, equipment and tools, mobile plant such

as tractors, quad bikes and elevated work platforms, existing regimes for

pressure equipment, cranes, and fairground rides, working at heights and

excavations). This has an obvious impact upon Council operations in particular

construction and infrastructure projects.

4.3 To date this reform has not

progressed further and is currently sitting with the Ministry of Business,

Innovation and Employment (MBIE) whom advise that proposed regulations will be

released in 2023 for feedback. Further information can be found online at: https://www.mbie.govt.nz/business-and-employment/employment-and-skills/health-and-safety/health-and-safety-reform/

4.4 Health, Safety &

Wellbeing Objectives 2023-2025

4.5 Organisational

Health, Safety and Wellbeing objectives have been set by the Lead Team for the

three year period (1 January 2023 – 31 December 2025), a copy of these

are attached for your information (Attachment 1). Progress towards these

objectives will be tracked through existing regular health and safety

reporting.

4.6 Health,

Safety & Wellbeing Critical Risk Profile – Conflict and Violence

4.7 Council

has 12 critical health, safety and wellbeing risks which impact upon the

organisation. In no particular order, these are listed below:

· Risk

of serious health and/or safety effects from manual handling of loads or

repetitive or forceful movements

· Risk

of fatality when working at height, resulting from a fall from height or a

falling object

· Risk

of fatality from exposure to plant and machinery

· Risk

of adverse physical and mental health effects from exposure to aggression,

physical violence and verbal abuse from members of the public and service users

· Risk

of fatality when working in excavations

· Risk

of fatality from loss of containment and/or exposure to a hazardous substance

· Risk

of fatality from exposure to a moving vehicle

· Risk

of fatality or serious health effects from exposure to harmful levels of noise,

vibration, dust, or biological hazards

· Risk

of serious health effects from exposure to asbestos

· Risk

of fatality when working in confined spaces

· Risk

of serious health effects from exposure to factors causing stress

· Risk

of serious health and/or safety effects from fatigue and working while fatigued.

4.8 A

bowtie risk analysis was completed for each of these 12 critical health, safety

and wellbeing risks in the years 2015-2017. These bowtie analyses are currently

being fully reviewed and subsequently a critical risk profile will be created

for each. The intention of the critical risk profile approach is to provide a

simple (and concise) mechanism to convey the key components of the risk and

mitigations.

4.9 The

conflict and violence risk was selected as the first risk profile to be

developed, following the review of the working alone policy and the current

review of the conflict and violence policy. A copy of this profile is

attached for your information (Attachment 2).

Attachments:

|

1⇨

|

Objectives 2023-2025 (Approved 1 February 2023) - (No

personal information included)

|

HR-03-5-1-23-26

|

Under Separate Cover

|

|

2⇨

|

Critical Risk Profile - #1- Conflict & Violence - 1

February 2023 - (No personal information included)

|

HR-03-6-3-23-70

|

Under Separate Cover

|

HASTINGS DISTRICT COUNCIL

Risk and Assurance Committee

MEETING

Monday, 13 February 2023

RECOMMENDATION TO EXCLUDE THE PUBLIC

SECTION 48, LOCAL GOVERNMENT OFFICIAL INFORMATION AND MEETINGS

ACT 1987

THAT the public now be excluded from the following part of

the meeting, namely:

15 Health

& Safety Contracts - Contractors' Health & Safety Performance Report

The general subject of the matter to be considered while the

public is excluded, the reason for passing this Resolution in relation to the

matter and the specific grounds under Section 48 (1) of the Local Government

Official Information and Meetings Act 1987 for the passing of this Resolution

is as follows:

|

GENERAL SUBJECT OF EACH

MATTER TO BE CONSIDERED

|

REASON FOR PASSING

THIS RESOLUTION IN RELATION TO EACH MATTER, AND

PARTICULAR INTERESTS

PROTECTED

|

GROUND(S) UNDER

SECTION 48(1) FOR THE PASSING OF EACH RESOLUTION

|

|

|

|

|

|

15 Health

& Safety Contracts - Contractors' Health & Safety Performance Report

|

Section 7 (2) (b) (ii)

The withholding of the

information is necessary to protect information where the making available of

the information would be likely to unreasonably prejudice the commercial

position of the person who supplied or who is the subject of the information.

The report contains

sensitive Health & Safety information relating to third party

activities..

|

Section 48(1)(a)(i)

Where the Local Authority is

named or specified in the First Schedule to this Act under Section 6 or 7

(except Section 7(2)(f)(i)) of this Act.

|