Kaupapataka

Agenda

|

Te Rā Hui:

Meeting date:

|

Monday, 5 August 2024

|

|

Te Wā:

Time:

|

10.00am

|

|

Te Wāhi:

Venue:

|

Council Chamber

Ground Floor

Civic Administration

Building

Lyndon Road East

Hastings

|

|

Te Hoapā:

Contact:

|

Democracy

and Governance Services

P: 06 871 5000

| E: democracy@hdc.govt.nz

|

|

Te Āpiha Matua:

Responsible Officer:

|

Deputy Chief Executive - Bruce Allan

|

Risk and Assurance Committee – Terms of Reference

Fields of Activity

The Risk and Assurance

Committee is responsible for assisting Council in its general overview of

financial management, risk management and internal control systems that

provide:

• Effective management of

potential risks, opportunities and adverse effects.

•

Reasonable assurance as to the integrity and reliability of the reporting on financial

performance of Council, including quality of audit services.

• Monitoring of

Council’s requirements under the Treasury Policy.

• Monitoring of

Council’s Strategic Risk Framework.

• Monitoring of

Council’s legal compliance.

• Monitoring of

Council’s health and safety compliance.

•

Monitoring significant projects, programmes of work and procurement focussing

on the appropriate management of risk.

•

Oversight of preparation of the Long Term Plan, Annual Report, and other

external financial reports required by statute.

In light

of the impacts Cyclone Gabrielle has had on the communities in the district,

the Committee will pay particular attention to activities affected within its

Fields of Activity, including but not limited to and always in support of the

work of Council and the Standing Committees:

•

Oversight of cyclone-related insurance claims and issues.

• Monitor funding implications associated with recovery

costs, including oversight of the process for recoveries from government.

• Monitor valuation process for cyclone-damaged assets,

including impairments particularly relating to roading.

•

Support post-cyclone expenditure planning by ensuring good process is applied.

Membership – 8 (including 5 Councillors)

·

5 Councillors - with one being the Chair of

Performance and Monitoring, or its equivalent

·

Independent Chair appointed by Council.

·

Deputy Chair appointed by Council.

·

2 external independent members appointed by

Council.

·

1 Heretaunga Takoto Noa Māori Standing

Committee Member appointed by Council

Quorum – 4 members

|

DELEGATED POWERS

Authority to consider and make

recommendations on all matters detailed in the Fields of Activity and such

other matters referred to it by Council.

|

Kaupapataka

Agenda

|

Mematanga:

Membership:

|

Koromatua

Chair: Jon Nichols – External Independent

Appointee

Nga Kai Kaunihera

Councillors: Simon Nixon (Deputy Chair), Alwyn Corban,

Tania Kerr, Michael Fowler (Chair of Performance & Monitoring Committee)

and a vacancy

Mayor Sandra Hazlehurst

External Independent Appointee: Graeme McGlinn

Heretaunga Takoto Noa Māori Standing Committee appointee:

Tom Keefe

|

|

Tokamatua:

Quorum:

|

4 members

|

|

Kaihokoe mo te Apiha

Officer Responsible:

|

Deputy Chief Executive – Bruce

Allan

|

|

Te Rōpū Manapori me te Kāwanatanga

Democracy & Governance Services:

|

Christine Hilton (Extn 5633)

|

Te Rārangi Take

Order of Business

|

1.0

|

Apologies

– Ngā

Whakapāhatanga

An apology

from Jon Nichols has been received.

At the

close of the agenda no requests for leave of absence had been received.

|

|

|

2.0

|

Conflict

of Interest –

He Ngākau Kōnatunatu

Members need to be vigilant to stand aside from

decision-making when a conflict arises between their role as a Member of the

Council and any private or other external interest they might have.

This note is provided as a reminder to Members to scan the agenda and assess

their own private interests and identify where they may have a pecuniary or

other conflict of interest, or where there may be perceptions of conflict of

interest.

If a Member feels they do have a conflict of interest,

they should publicly declare that at the start of the relevant item of

business and withdraw from participating in the meeting. If a Member

thinks they may have a conflict of interest, they can seek advice from the

General Counsel or the Manager: Democracy and Governance (preferably before

the meeting).

It is noted that while Members can seek advice and

discuss these matters, the final decision as to whether a conflict exists

rests with the member.

|

|

|

3.0

|

Confirmation

of Minutes –

Te Whakamana i Ngā Miniti

Minutes of the

Risk and Assurance Committee Meeting held Monday 20 May 2024.

(Previously circulated)

|

|

|

4.0

|

Executive

Overview and Status of Actions

|

7

|

|

5.0

|

Cyclone

Gabrielle Recovery Risk overview

|

11

|

|

6.0

|

Treasury

Activity and Funding Update

|

13

|

|

7.0

|

Insurance

Update

|

21

|

|

8.0

|

Annual

Risk Management Policy and Framework Review

|

25

|

|

9.0

|

Enterprise

Resource Planning (ERP) System move to the cloud - Project Genesis

|

55

|

|

10.0

|

Health,

Safety & Wellbeing Update

|

59

|

|

11.0

|

Minor Items

– Ngā Take

Iti

|

|

|

12.0

|

Urgent

Items –

Ngā Take Whakahihiri

|

|

|

13.0

|

Recommendation

to Exclude the Public from Items 14 and 15

|

63

|

|

14.0

|

Health

& Safety Contracts - Contractors' Health & Safety Performance

Report

|

|

|

15.0

|

Cyber

Security Update

|

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Regan Smith, Chief Risk

Officer

Bruce Allan, Deputy

Chief Executive

|

|

Te Take:

Subject:

|

Executive Overview and

Status of Actions

|

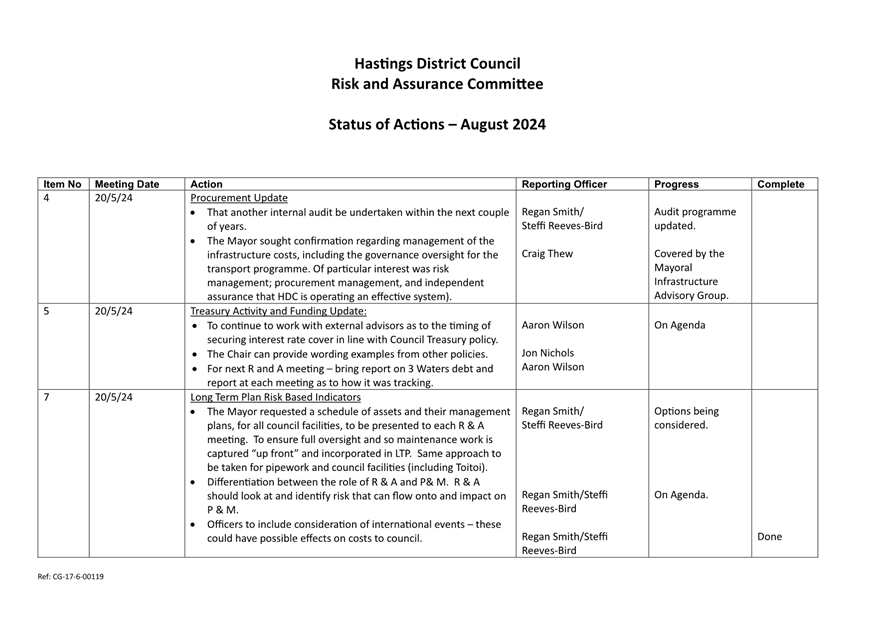

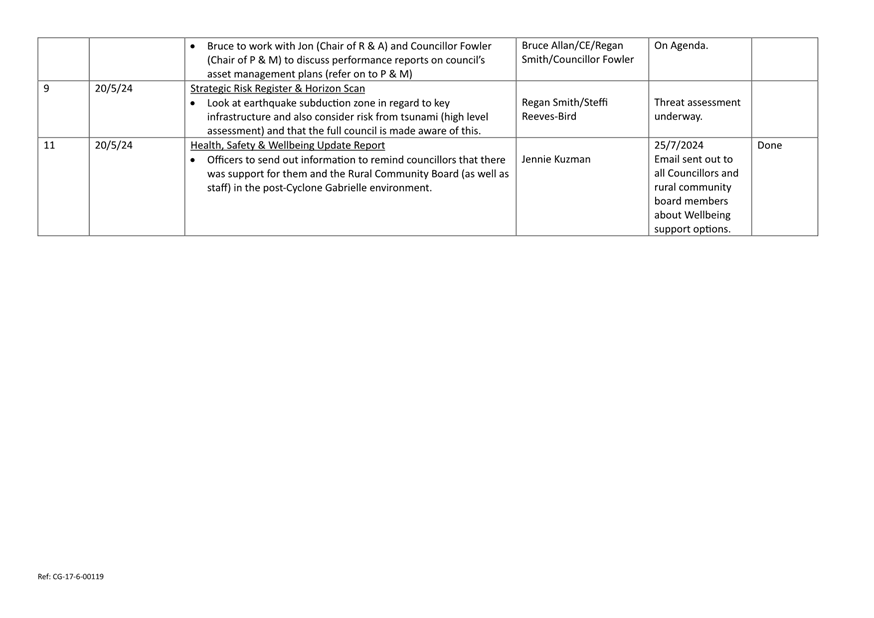

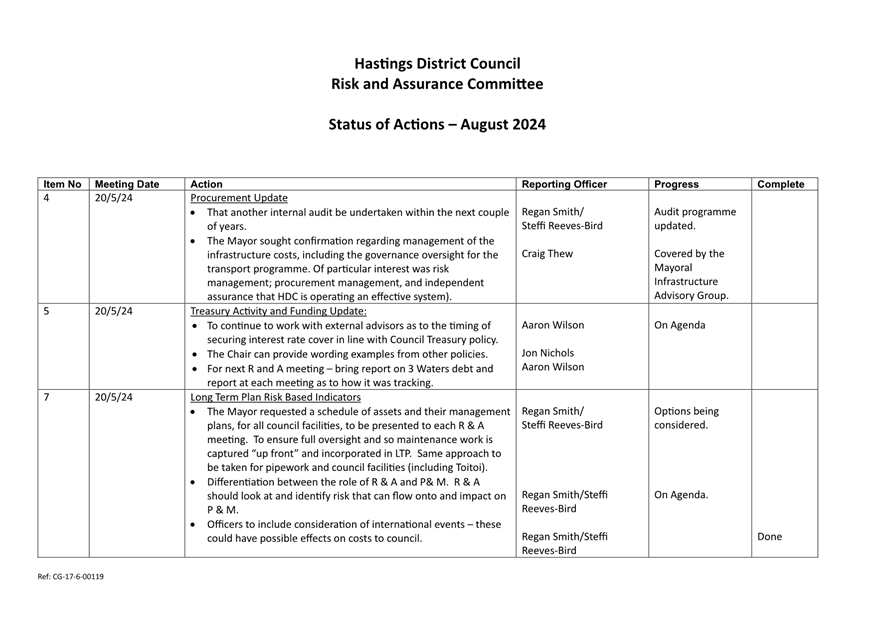

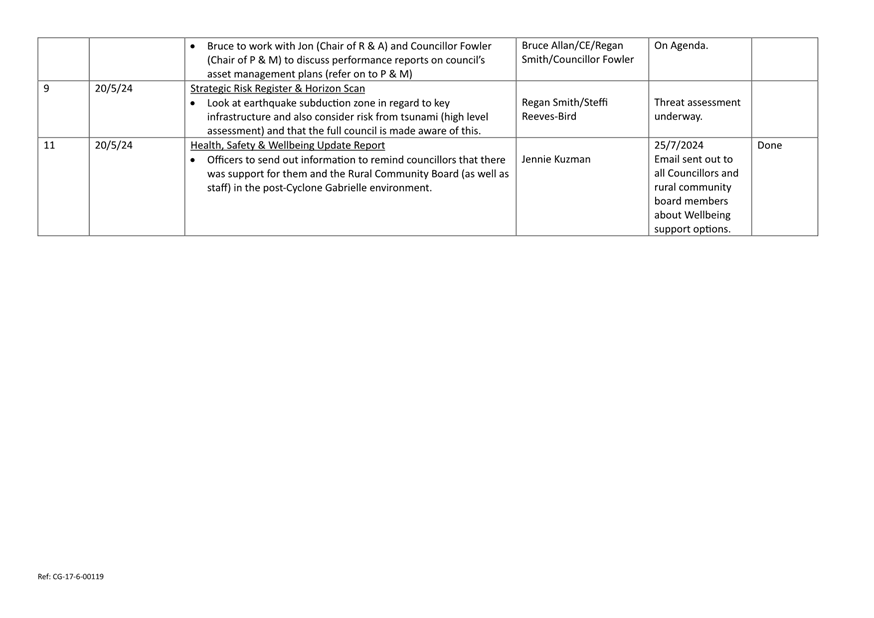

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 For this meeting of

the Risk and Assurance Committee this report has been prepared as a covering

report in order to present the status of actions attachment to the meeting.

1.2 Attached as Attachment

1 are the current outstanding actions from

this Committee.

2.0 Long Term Plan Risk Based Indicators

2.1 Officers have held

discussion on the best way to provide the Committee with risk indicators

relating to delivery of the financial strategy that underpins the Long Term

Plan as requested at the last meeting.

2.2 These discussions have

highlighted the need for full Council to maintain oversight of, and

responsibility for, delivering the financial strategy. Therefore, to avoid

duplicating effort and creating uncertainty over responsibility for overseeing

financial performance a wholistic approach to reporting financial information

is needed.

2.3 Therefore, officers recommend following the approach for

reporting risk indicators relating to delivery of the Long Term Plan financial

strategy:

· Performance & Monitoring Committee, being a committee

of full Council, should monitor all actual vs target financial performance

indicators. This includes monitoring any material changes in the underlying

assumptions used in the financial model to develop the financial strategy (e.g.

interest rates).

· Risk

& Assurance Committee, which includes expert external members, undertakes

reviews of key technical financial matters in greater

detail than the wider Council (e.g. similar to current treasury management),

and monitors overall delivery of the financial strategy including emerging

threats to the Council financial position.

2.4 Based on this approach, Officers propose that the following

additional areas on top of Treasury monitoring would benefit from more detailed

oversight by Risk & Assurance Committee:

· Management of depreciation to cover asset renewals.

· Recovery of Development Contributions to cover Council

growth related commitments.

2.5 Feedback on this

approach is welcomed form the Committee members to help inform the reporting

programme.

|

3.0 Recommendations -

Ngā Tūtohunga

That Risk and

Assurance Committee receive the report titled Executive Overview and Status

of Actions dated 5 August 2024.

|

Attachments:

|

1⇩

|

Status of Actions - August 2024

|

CG-17-6-0123

|

|

|

Item 4 Executive

Overview and Status of Actions

|

|

Status of

Actions - August 2024

|

Attachment 1

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Bruce Allan, Deputy

Chief Executive

|

|

Te Take:

Subject:

|

Cyclone Gabrielle

Recovery Risk overview

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this

report is to allow the Committee to have a discussion with Council Executive

and the Recovery Manager in regard to risks currently being managed through the

Voluntary Buy-out Office and the roading recovery works and to determine what

further reporting is appropriate for this committee.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Cyclone Gabrielle Recovery

Risk overview dated 5 August 2024.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Ross Franklin, Finance

Special Projects Officer

|

|

Te Take:

Subject:

|

Treasury Activity and

Funding Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1 The

purpose of this report is to update the Risk and Assurance Committee on

treasury activity and funding issues.

1.2 Since

the last update on 20 May 2024, Council has borrowed a further $79m. This

comprises Floating rate debt of $39m and fixed rate debt of $40m. In

addition, $80m of new interest rate swaps have been added. That means Council

has hedged interest rates for a further $120m worth of debt.

1.3 Council’s

total external debt on 12 July 2024 was $413m, with debt forecasted to rise to

$489m by 30 June 2025. Based on the 2024-25 LTP budgets Council will need to

increase the total borrowings by $96m this financial year.

1.4 Council’s

adopted 2024-34 LTP forecasts peak debt of $711m by June 2030. This is

higher than the forecast in the draft LTP due to council’s decision to

reduce the 2024/25 rates increase and adopt a 5 year, rather than 3 year,

strategy to lift revenue levels. This has necessitated additional

borrowing to make up the revenue shortfall. This higher debt forecast

requires a heightened level of hedging activity for Council to remain in policy.

1.5 Our

advisers consider that an interest rate swap at or under 4% will represent good

long-term value for Council.

1.6 While

the recent swaps have been sightly, above the 4% target area they were

necessary to ensure Council is closer to being fully within policy based on the

projected new debt profile. Council is currently within policy in all areas.

1.7 Going

forward Officers will target further cover when it becomes financially

efficient to do so.

1.8 Council

is currently compliant with its existing Treasury Management Policy for the 2024-34

debt profile.

1.9 With

the appointment of the new CFO effective 15thJuly the delegations in

the Treasury policy is required to be updated.

1.10 The

Reserve Bank of New Zealand’s (RBNZ) Official Cash Rate (OCR) remains at

5.5% following its last review on 10 July 2024. Its next review is 14 August

2024. The following is a summary of the RBNZ’s points.

· Restrictive

monetary policy has significantly reduced consumer price inflation.

· The decline in

inflation reflects receding domestic pricing pressures.

· Current and

expected government spending will restrain overall spending in the economy.

· Some domestically

generated price pressures do remain strong.

· The Committee

agreed that monetary policy will need to remain restrictive. The extent of this

restraint will be tempered over time consistent with the expected decline in

inflation pressures.

|

2.0 Recommendations -

Ngā Tūtohunga

A) That the Risk

and Assurance Committee receive the report titled Treasury Activity and

Funding Update dated 5 August 2024.

B) That the

Risk and Assurance Committee recommend Council approve the changes to the

delegations as detailed in the Treasury Policy.

|

3.0 Background – Te Horopaki

3.1 The

Hastings District Council has a Treasury Policy which is a summarised version

of the Treasury Management Policy and forms part of the 2024-2034 Long Term

Plan. Under these policy documents, responsibility for monitoring treasury

activity is delegated to the Risk and Assurance Committee.

3.2 Council

is provided with independent treasury advice by Bancorp Treasury Services and

receives daily and monthly updates on market conditions.

3.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in-depth treasury reporting is provided for the Risk and Assurance

Committee. The Treasury Policy has been updated to reflect the current

financial situation and in support of the 2024-34 Long Term Plan.

4.0 Discussion – Te Matapakitanga

4.1 Current

Situation:

4.2 Council’s

total external debt at 30 June 2024 was $393.7m, of which 206m relates to

3waters. The cash balance as at 30 June was $13m. In addition,

Council has an undrawn bank facility of $45m.

4.3 On

1 July 2024, $20m of existing debt matured and on 8 July a further $39m of

floating rate debt was raised through the LGFA tender. The total external

debt as at 12 July is $412.7m.

This

includes:

Fixed

rate debt $140.0m

Floating

rate debt $272.7m

On

12 July, Council held $247.5m of interest rate hedging instruments, including:

“Live”

swaps of $78.5m

Forward

starting Swaps of $169m

Forward

starting fixed interest contracts of $30m

4.4 Since

the last report to the committee, Officers in conjunction with Council’s

advisers, have implemented the following:

· Borrowed $79m

through: (refer table in 4.7 for detail)

o Floating rate debt $39m

o Fixed rate debt $40m

In addition to the

fixed rate debt Council has entered into $80m worth of new interest

rate swaps.

4.5 The

following graph shows the borrowing and hedging activity since the beginning of

2024.

The

green dots show drawdowns of floating rate debt, and

The

red dots show where we have either borrowed fixed rate debt or entered into

interest rate swaps to hedge our interest costs.

4.6 Floating

Rate Debt Drawdowns:

4.6 Floating

Rate Debt Drawdowns:

4.7 Cover

transactions this year including fixed debt:

4.8 The

following graph shows Council’s level of cover and is within the treasury

policy bands for cover.

Update

to Treasury policy:

4.9 With

the appointment of the new CFO, there is a need to update the

delegation’s portion of the Treasury policy. Below is a table of

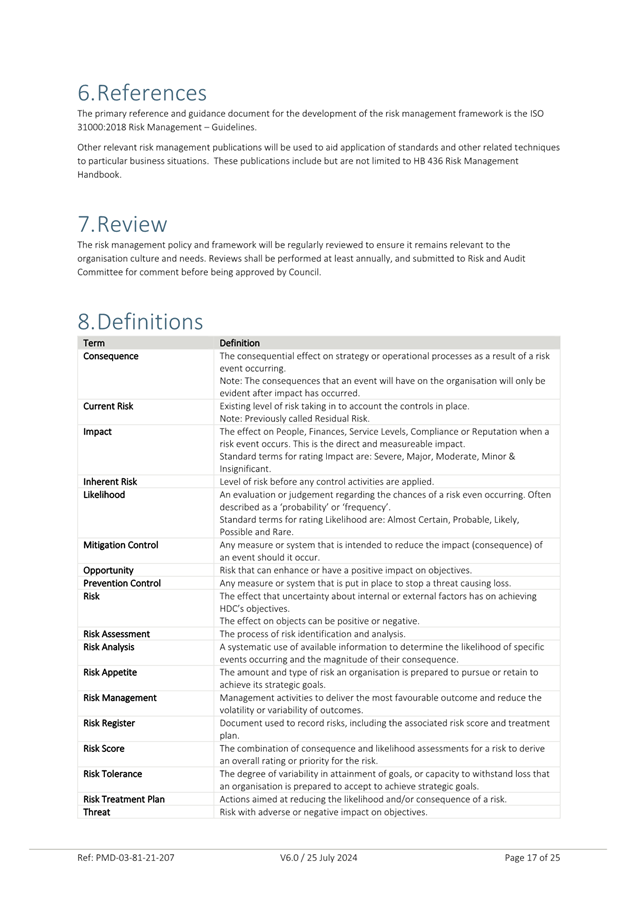

the proposed changes:

|

Activity

|

Current Delegated Authority

|

Proposed

Delegated Authority Change

|

Limit

|

|

Overall day-to-day risk

management

|

CEO (delegated by

Council) GMCS

|

CEO (delegated by

Council) CFO

|

Subject to policy

|

|

Re-financing existing debt

|

CEO (delegated by

Council) GMCS

|

CEO (delegated by

Council) CFO

|

Subject to policy

|

|

Adjust interest rate risk profile

|

GMCS

|

CFO

|

Per risk control limits

Fixed

rate maturity profile

limit as per risk

control limits

|

|

Managing funding maturities in

accordance with Council approved facilities

|

GMCS

|

CFO

|

Per risk control limits

|

|

Maximum daily transaction

amount (borrowing, investing, interest rate risk management

|

The Council Unlimited

CEO $40 million

GMCS $30 million

FC $15 million

|

The Council Unlimited

CEO $40 million

Deputy CE $30 million

CFO

$30 million

FC

$15 million

|

|

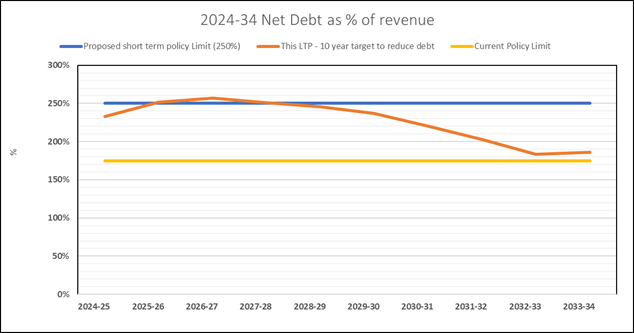

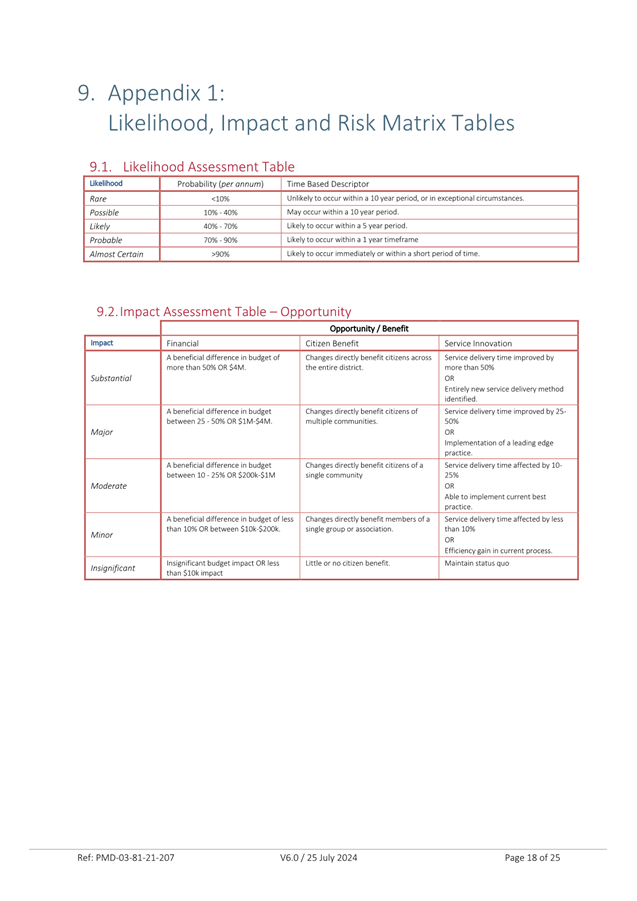

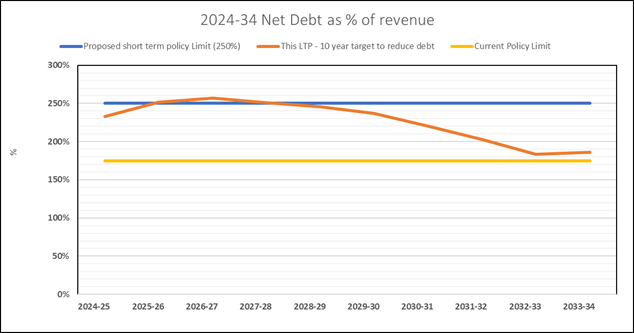

Looking forward –2024-34 LTP

debt forecasts

4.10 The

2024-34 LTP has introduced new policy limits. These are reflected in the

updated Treasury policy presented to the last committee meeting.

· The key measure is

the Debt to revenue limit of 250%

4.11 Total

council debt is forecast to reach $711m by June 2030 before dropping to $663m

in June 2034

4.12 Following

Council’s decision to reduce the year 1 rate increase and therefore the

income collected, the adopted LTP forecasts Council will breach its 250% debt

to revenue ratio over the first 3 years of the plan as shown in the following

table. This therefore requires a very disciplined approach to financial

management by Council over the next few years to keep within the debt to

revenue limit. The graph shows the forecast track for the ratio

over the term of the LTP.

|

|

Forecast

Debt

|

Forecast

Debt to revenue ratio

|

|

June

2025

|

$489m

|

251.84%

|

|

June

2026

|

$573m

|

256.94%

|

|

June

2027

|

$640m

|

251.10%

|

Attachments:

There are no attachments for this report.

|

Summary of

Considerations - He Whakarāpopoto Whakaarohanga

|

|

Fit

with purpose of Local Government - E noho hāngai pū ai ki te

Rangatōpū-ā-Rohe

The Council is required to give effect to the purpose of

local government as set out in section 10 of the Local Government Act 2002.

That purpose is to enable democratic local decision-making and action by (and

on behalf of) communities, and to promote the social, economic,

environmental, and cultural wellbeing of communities in the present and for

the future.

Link to the

Council’s Community Outcomes –

Ngā Hononga ki Ngā Putanga ā-Hapori

This proposal promotes the financial wellbeing

of communities in the present and for the future.

|

|

Māori

Impact Statement -

Te Tauākī Kaupapa Māori

There are no known impacts for mana

whenua / iwi / tangata whenua above and or beyond the general community

population in relation to information in this report.

|

|

Sustainability

- Te

Toitūtanga

This report is a requirement of the

Treasury policy to report to the Risk and Assurance Committee:

|

|

Financial

considerations -

Ngā Whakaarohanga Ahumoni

This report has significant impact on

the cost of debt and how Council is working to minimise the overall average

cost of funds.

|

|

Significance

and Engagement - Te

Hiranga me te Tūhonotanga

This decision/report has been assessed under the Council's

Significance and Engagement Policy as being of low significance.

|

|

Consultation

– internal and/or external - Whakawhiti Whakaaro-ā-roto / ā-waho

This is an information report as per the

Treasury Policy.

|

|

Risks

Opportunity:<Enter text> :

|

REWARD – Te Utu

|

RISK – Te Tūraru

|

|

Ensuring Council cost of funds and treasury management

is within Treasury policy.

|

Finance

|

|

|

Rural

Community Board –

Te Poari Tuawhenua-ā-Hapori

This report covers both the rural and

urban rating areas

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Bruce Allan, Deputy Chief

Executive

Jeff Tieman, Management

Accountant

|

|

Te Take:

Subject:

|

Insurance Update

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

Market renewal update

1.1 The market is showing

signs of softening. The New Zealand market is still struggling with capacity

but the London markets capacity has increased, leading to smaller premium

increases. Material damage policies on a same value comparison are around 5%

higher, motor vehicles between 5 – 7.5% and infrastructure is around 5%.

1.2 A more complete market

analysis will be provided to the next Committee meeting prior to placing any

insurance renewals.

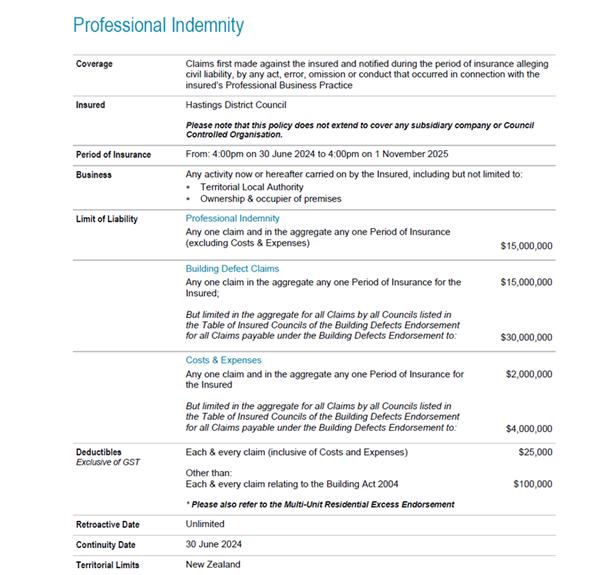

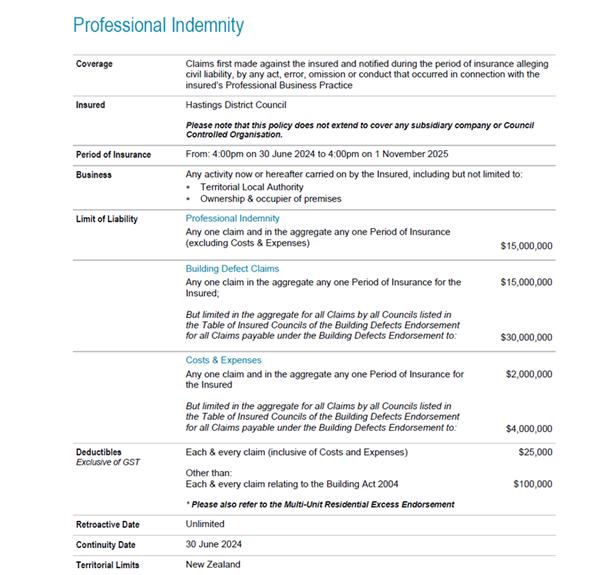

Public Liability Professional

Indemnity

1.3 The Council’s

PI/PL policy has been delivered through Marsh Ltd for a number of years. This

policy had a June 30th renewal date. In April of this year, Council

was notified by our brokers that the London underwriters were no longer

participating in the New Zealand market, this was due to the court rulings with

the Napier City Council case verses Risk Pool. Marsh had 13 Council which had

there PI/PL policies with them and 22 Councils for which they looked after

their entire insurance portfolio. In the interest of looking after their 22

councils, which had all their insurance cover with them, Marsh advised the 13

Councils that only had their PI/PL policy with them, that they could no longer

support them.

1.4 Aon were already in

the process of quoting for Hastings District Council when this news became

public. This unfortunately delayed our quote as we could no longer just fit

within their existing PI/PL programme as there was now 12 other Councils

looking for cover. Aon managed to find an underwriter to lead this policy which

has the following terms.

1.5 A restriction with

this policy is with the building defects claims where there is a limitation to

$30m aggregate for all Councils in the table. This policy has 17 Councils in

the group, the 13 that Marsh initially advised they could no longer provide

cover for, plus 4 other Councils. Aon have assured Officers that they endeavour

to work on this policy and want to get to a point where there is no $30m limit,

but this was all they could do in the short timeframe they had to ensure cover

could be put in place. The annual premium is $572,230.

1.6 The 2023/24 premium

under Marsh was $180,000.

1.7 Marsh where able to

put together a policy for their existing clients that they retained and due to

losing 4 Councils to Aon, were able to quote on their policy, which had

variations to the Aon policy. The main difference was the $15m limit was solely

ours and not shared with other Councils and had no total limit of $30m. This

however came at a cost, with the premium quoted around $750,000.

1.8 Discussion were had

with senior Planning & Regulatory staff to assess their risk profile to

ascertain which policy was suitable. It was agreed to go with the Aon policy

and that Officers will work with Aon to improve the terms and conditions within

the policy to better fit within the Council’s requirements.

1.9 Marsh have been

supplied a list of around 15 potential claims before the policy lapsed with

them in case something came of them. This was to protect council should

anything happen and there was an issue we hadn’t notified the insurer

prior to the ending of our policy with them. It also protects Council from any

potential dispute between the insurers on who is liable should a claim be made.

Bridge Insurance

1.10 The 2023 valuation for the bridges was

$123m. This was conducted in May/June of that year, not long after the cyclone.

Since then there has been a lot of learnings and reassessment of the true costs

for replacing a bridge and especially in a situation where multiple bridges are

lost. This has reflected in the new valuation for 2024 coming in at $441m. With

this in mind, Officers have also reassessed the loss limit, which was $10m and

have asked Aon to quote premiums for loss limits of $40m and $50m. Officers

will report back to the committee once we have this information.

1.11 Material Damage and Business

Interruption (MDBI)

1.12 The material damage schedule was

revalued this year on its three year cycle. In years 2 and 3 an inflationary

adjustment is applied based on advice from both our insurance brokers and Added

Valuation whom conduct the 3 yearly valuation. Years 2 & 3 of the last

cycle officers had implemented a 12% inflationary increased based on advice

received, which increased the asset schedule to $716m. This year’s

revaluation resulted in this asset scedule reducing to $689m. Feedback from the

markets that have had earlier renewal dates indicate that capacity has returned

in the MDBI market, resulting in competitive pricing with only slight increases

of around 5%.

1.13 3 years ago, Council elected to

self-insure the stand alone toilet blocks due to their low risk nature. During

the valuation process this year, a few more assets have been identified as low

risk and consideration should be had regarding the removal of them from the

schedule for further premium savings. Officers have identified the following

assets and seek approval to remove these from the schedule.

1.14 Frimley pool – Due to the

viability of this facility, if an event occured that destroyed this facility,

would it be replaced? This facility has an insured value of $15,850,500. Last

year’s premium was $54,487. There is the option to cover this facility

for demolition costs only, Aon have quoted an approximate cost of $1,300.

1.15 The following changing rooms at various

parks in the district are all constructed of concrete, steel and concrete block

structure. These buildings are deemed low risk as per the standalone toilet.

Last year’s premiums for these facilities were $34,300.

· Changing shed 35

Te Mata Rd $1,407,400

· Changing Shed 9

Moori Rd $338,500

· Changing Shed

Frimley Park $932,500

· Changing shed

Chatham Rd, Giorgi Park $1,291,300

· Changing rooms

Wilson Rd $1,397,100

· Changing rooms

Kiwi Rd $1,282,700

· Changing room Te

Aute Rd $2,058,700

· Changing room Bill

Mathewson Park $1,219,700

1.16 The removal of the above assets would

reduce premiums (based on current pricing) by $87,487.

LAPP

1.17 Late in 2023, LAPP gathered information

from their 22 member councils to conduct a loss modelling exercise to get a

better understanding of the limits for their 3 levels of events (current event

limits are ($65m, $105m and $150m). This was long overdue as there have been a

dramatic increase in the value of the infrastructure over the last 5 years, but

these levels only changed a small amount. (top end in 2021 was $140m, currently

$150m). The modelling has been completed and the findings for a 1 in 1000 year

event now shows that a top level event needs to be $400m.

1.18 Ian Brown (LAPP Administration Manager)

has acknowledged that this information is late for this year’s renewal and

for any council to allow for it in their budgets and has capped the increase in

premiums for 2024/25 to a 30% increase, which for HDC will be a total

contribution of approximately $848k. The budget is $750k.

Update on Insurance claim positions

– Cyclone Gabrielle.

1.19 Material damage – to date Council

has received advance payment of $950,000. Damage to assets outside of the 3

waters group have now been repaired and this totals $834,526. 3 waters had

damage to a number of pump stations around the district with the major loss

being the Whirinaki water treatment plant. To date the 3 waters team has spent

just over $1.3m on repairs and costs to temporarily getting services back up

and running. A lot of these costs will fall under our business interruption

cover and a schedule is maintained and has been supplied to our loss assessor

to scrutinise as to whether the expense is cover by this policy. The Whirinaki

treatment plant was insured for $1.5m and officers in the 3 waters team

enlisted BECA to produce a report on potential replacement options. All options

for replacement exceed the insured value of the plant and a like for like

replacement is not a viable option because of the risk with the location.

|

2.0 Recommendations -

Ngā Tūtohunga

A) That the Risk

and Assurance Committee receive the report titled Insurance Update dated 5

August 2024.

B) That the Committee

make recommendations to Council on the removal of assets from the Material

Damage asset schedule for the purpose of reducing the associated insurance

premiums.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Regan Smith, Chief Risk

Officer

|

|

Te Take:

Subject:

|

Annual Risk Management

Policy and Framework Review

|

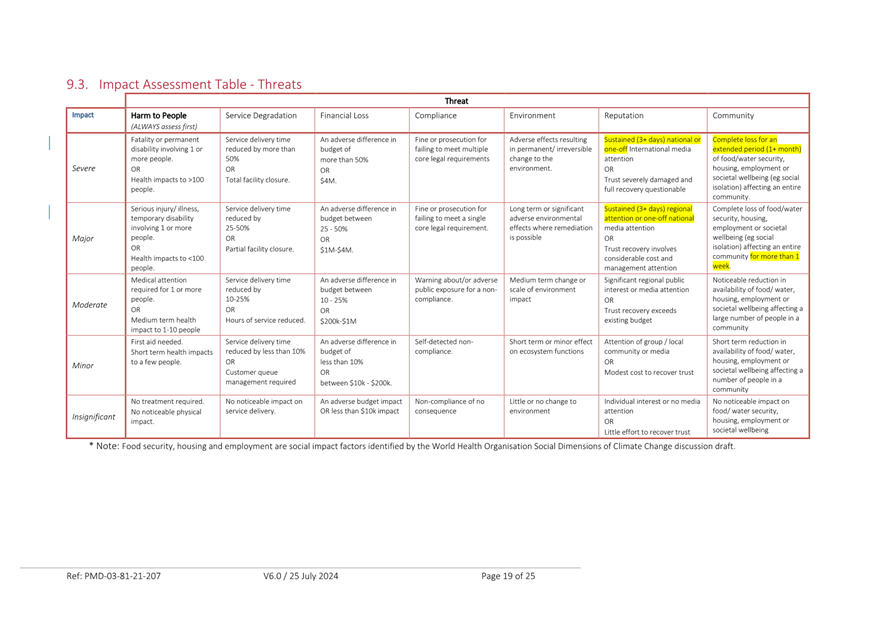

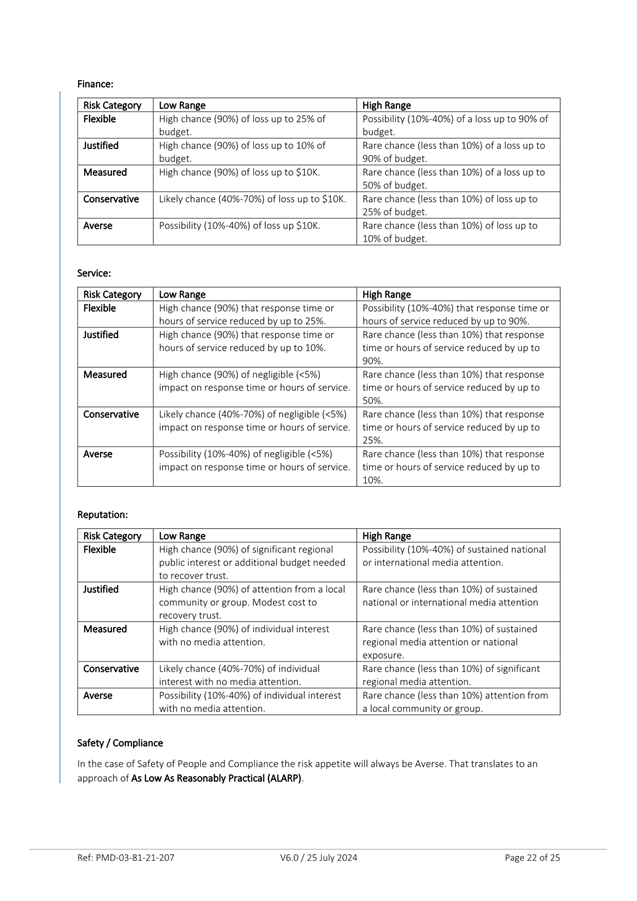

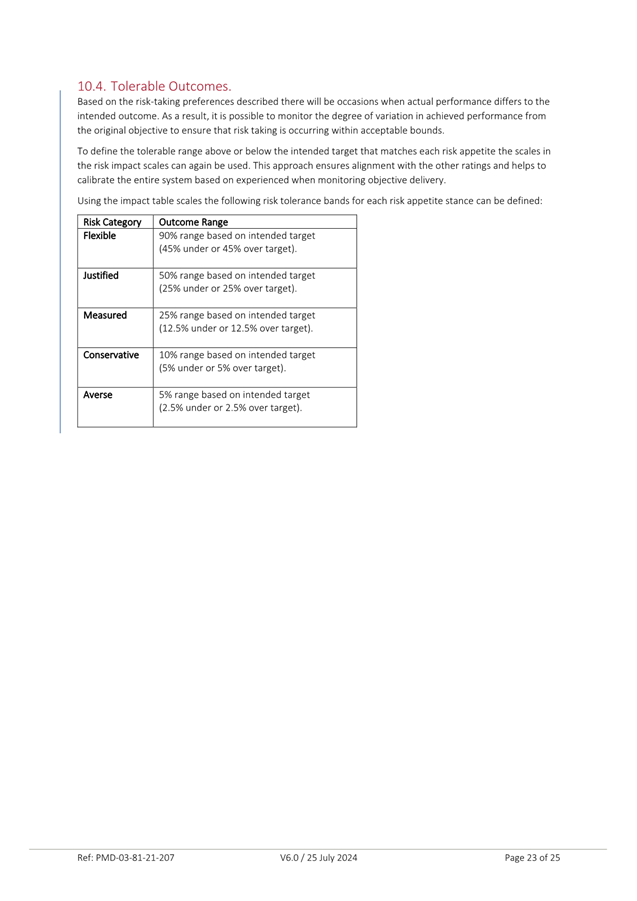

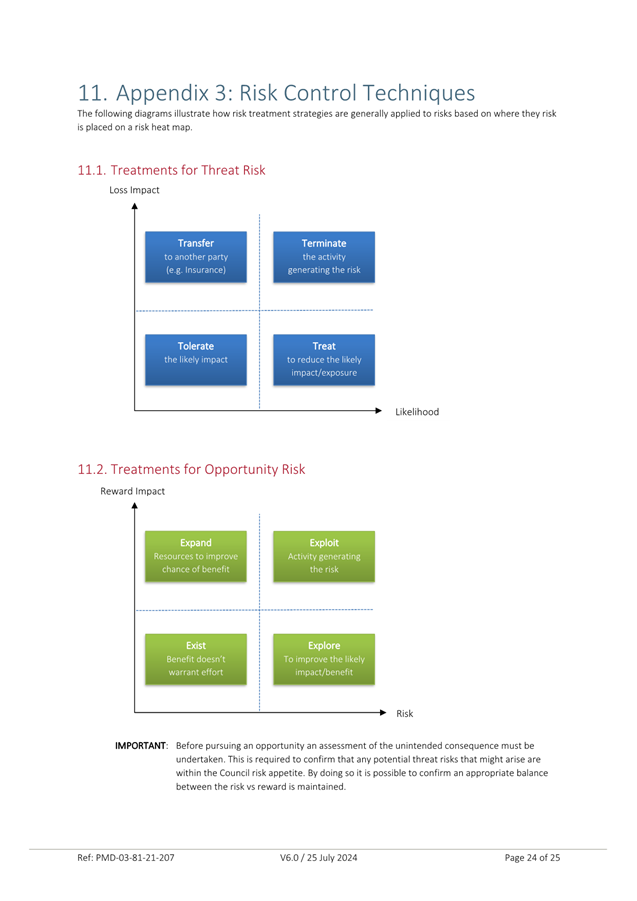

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this

report is to present the annual review of the Hastings District Council (HDC)

Enterprise Risk Management Policy and Framework, including the Tier 1 Strategic

Risk register, for review and endorsement by the Risk and Assurance Committee.

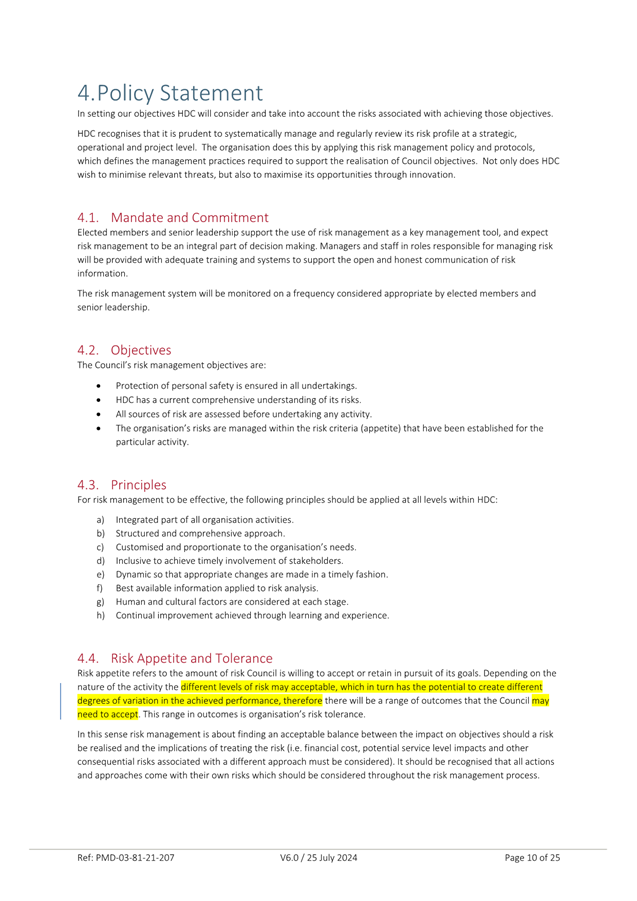

2.0 Enterprise Risk Management Framework

& Policy

2.1 The annual review of

the HDC Enterprise Risk Management Framework and Policy has been undertaken (Attachment

1). This has resulted in the following changes:

· The

frequency of executive Lead Team meetings relating to risk management and

oversight of the risk management programme has been changed. Risk management

activities will now be reported to the monthly Lead Team Operations meeting,

and a dedicated quarterly meeting of the Lead Team will be held to provide

oversight and direction to the Health & Safety and risk management

programmes.

· The

3 Lines model used to describe the risk management roles and responsibilities

within Council has been updated to a contemporary version.

· The

section on risk appetite has been updated, and the risk appetite statements for

each LTP focus area have been replaced by a framework for setting risk

appetite. This change has been made to reflect the experience gained when

applying the previous LTP Focus area risk appetite statements, and the risk

appetite work done for the Category 3 Voluntary Buy-out Office (VBO). The key

challenge when applying the LTP Focus area risk appetite statements was the

broad scope of the focus areas, which encompassed many specific outcomes. As a

result, the stated risk appetite was not always suitable for all objectives

within the focus area. Whereas, the programme specific risk appetite statement

developed for the VBO enabled more helpful guidance and much easier identification

of measures to monitor achieved performance. As a result, the intention is to

retain an overarching risk appetite stance that may be modified for a specific

programme of work or project based on the value placed on the objective for

that programme/project. Each of these programme specific appetite statements

would be accompanied by a suitable measure that can be monitored by the Lead

Team and Governance if required.

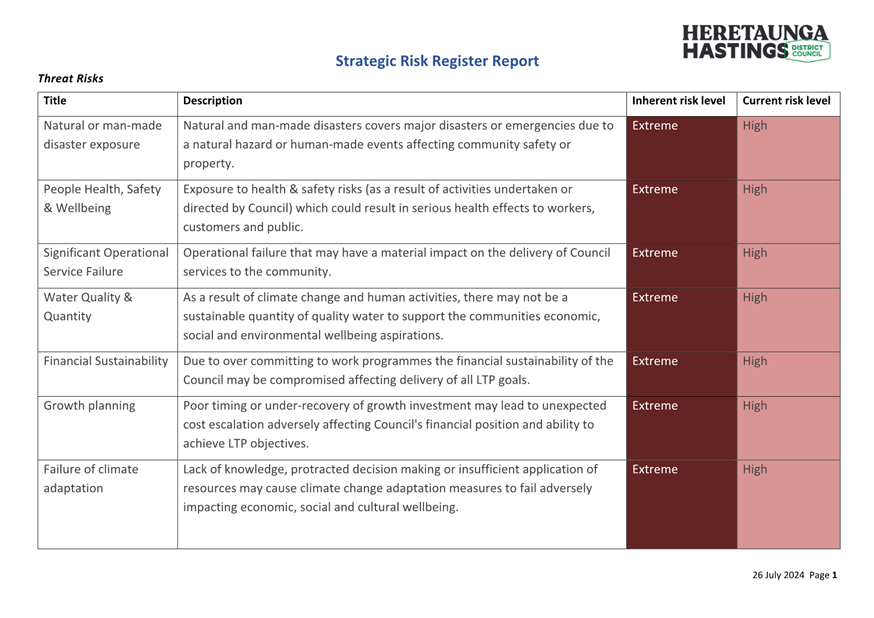

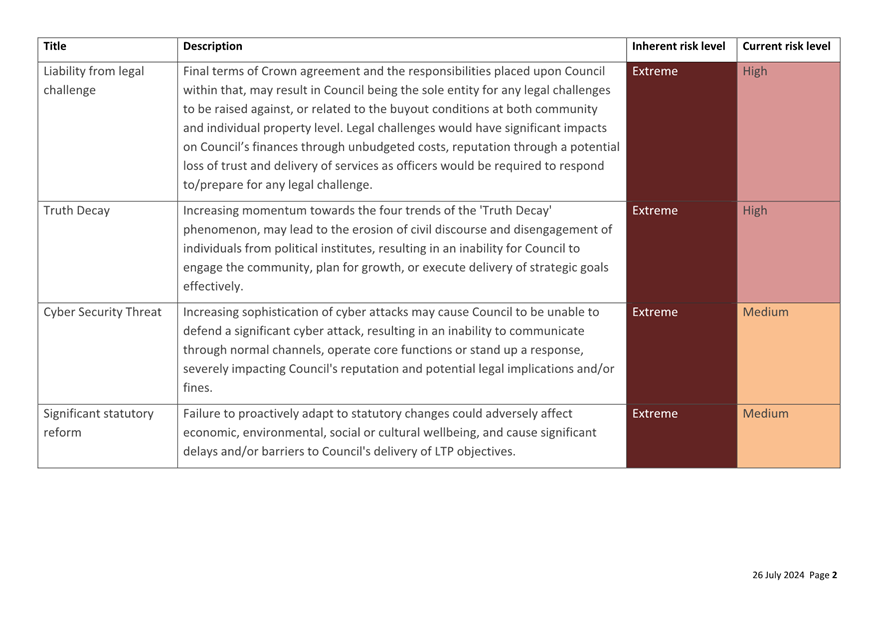

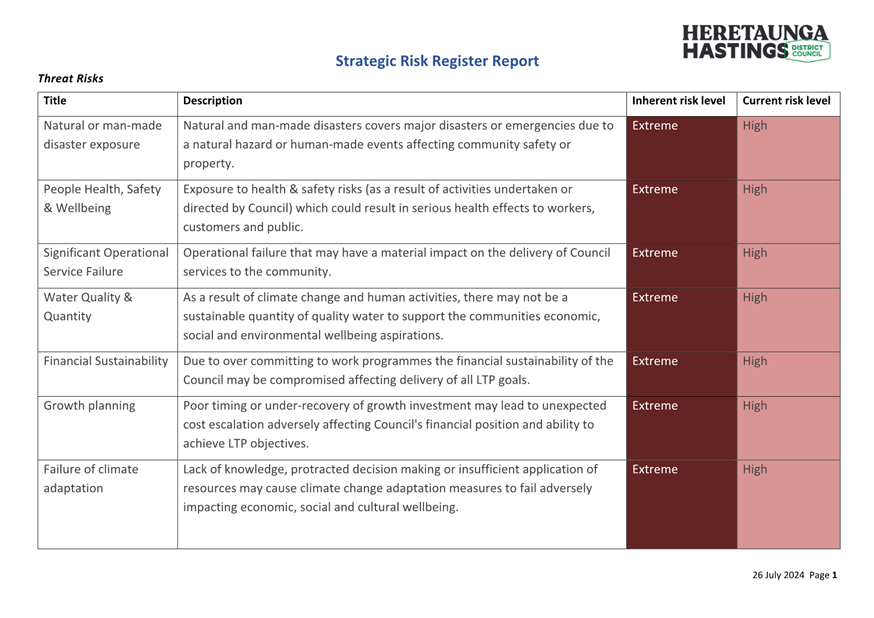

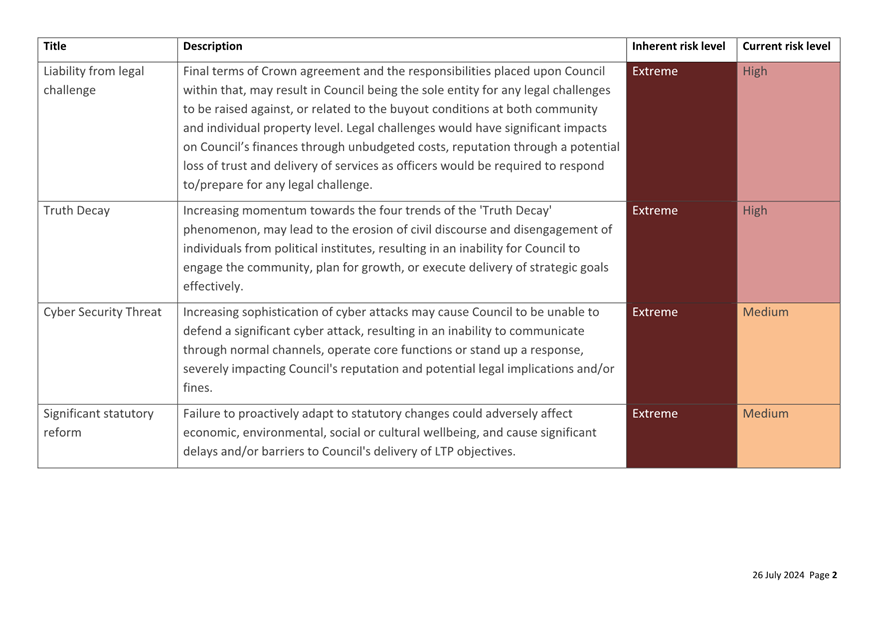

3.0 Strategic Risk Register

3.1 The Tier 1 register of

Council’s strategic risks has been updated based on feedback from the

previous meeting. The current register is provided as Attachment 2.

3.2 Key changes include:

· Environmental,

Social, Governance & Cultural considerations now assessed as an opportunity

to create enhanced trust in Council.

· Natural

or man-made disaster exposure has been elevated to the Tier 1 risk register

reflecting the significant impacts of Cyclone Gabrielle and the Category 3

Voluntary Buy-out programme to address risk to life.

|

4.0 Recommendations -

Ngā Tūtohunga

A) That the Risk and Assurance Committee receive the

report titled Annual Risk Management Policy and Framework Review dated 5

August 2024.

B) That the

Committee endorse the following documents and recommend that they be

presented to Council;

i. HDC

Enterprise Risk Management Policy & Framework V6.0

ii. HDC

Tier 1 Strategic Risk Register as at 26 July 2024.

|

Attachments:

|

1⇩

|

DRAFT HDC Enterprise Risk Management Policy and Framework

V6

|

PMD-9-3-24-89

|

|

|

2⇩

|

HDC Strategic Risk Register as at 26 July 2024

|

PMD-9-3-24-90

|

|

|

Item 8 Annual

Risk Management Policy and Framework Review

|

|

DRAFT HDC

Enterprise Risk Management Policy and Framework V6

|

Attachment 1

|

|

Item 8 Annual

Risk Management Policy and Framework Review

|

|

HDC

Strategic Risk Register as at 26 July 2024

|

Attachment 2

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Warren Perry, Chief

Information Officer

|

|

Te Take:

Subject:

|

Enterprise Resource

Planning (ERP) System move to the cloud - Project Genesis

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 Council’s ERP

solution which is used for Property and Rating as well as Finance is being

phased out and will no longer be supported for on-premises installations.

Council has commitment moving the solution to the cloud-based version to remain

in support.

1.2 Council has used the

ERP solution (TechnologyOne Ci) since July 2004. During this time, the platform

has been considerably customised to meet Councils requirements.

1.3 These customisations

come at a huge resource cost to Council due to the ongoing maintenance and

testing which is required because of the deviation from the standard

product.

1.4 Due to over 260

customisations, a standard migration to the new cloud-based platform is not

feasible.

1.5 Council has been

working closely with the vendor (TechnologyOne) to determine the best route to

migrate to the cloud. After a year of analysis, it was determined Council

should redeploy to a new TechnologyOne environment and migrate Councils’

data to the standard product.

1.6 The re-implementation

allows Council to adopt best practices and standardisation of business

processes as used across all local government.

1.7 The re-implementation

and migration of Council’s ERP solution is deemed high risk due to the

amount of organisational change, the complexity of the project and resourcing

required to complete the project.

1.8 The re-implementation

comes at a significant financial and resource cost. To-date budgets have been

set to undertake this project with $3.7m set aside to cover this work. The

budget includes technical support from TechnologyOne and salaries for 8 full time

project resources for 3 years.

1.9 A number of New

Zealand councils have led the way with this move to the Cloud and significant

lessons have been learned which have been captured in the planning of this

project. The change will be resource heavy and will impact on the IT Teams

ability to deliver other important upgrades and technology improvements unless

these IT roles are backfilled. Both the impact on budgets and resources will be

carefully monitored, reported in the first instance to the Executive IT

Governance Board and then to Risk and Assurance.

2.0 Risks and mitigation

2.1 No Vendor support

– TechnologyOne cease all support for the current platform from October

2024.

2.1.1 Council has secured ongoing support of the

current ERP solution with TechnologyOne while the cloud-based solution is

implemented, and migration is completed. This is expected to take 3 years.

2.2 Project complexity

– Due to the complexity of system integrations, the key metrics of the

project need to be carefully managed.

2.2.1 A senior dedicated project manager is in the

final stages of being employed to manage the project to ensure key metrics are

closely monitored, reported on and controlled.

2.3 Organisational

change – The new cloud-based solution will require numerous areas of

Council to change the way they operate.

2.3.1 A senior dedicated change manager is in the

final stages of being employed to ensure all organisational changes are

carefully managed.

2.4 Resource management

– Workloads across Council are high with numerous high priorities.

Project Genesis will add significant workloads to an already stretched

workforce.

2.4.1 Additional resources are being employed for

Project Genesis. Certain roles across Council are being identified to ensure

business as usual roles are back filled to allow sufficient project resourcing.

2.5 Reputation –

Numerous Councils who adopted the cloud solution early have experienced

reputational damage.

2.5.1 Councils who have completed this migration

have been consulted and lessons learnt documented. There is ongoing

consultation with Councils who are also on this journey as well as 3rd

party vendor support.

2.6 Customisation –

Over 20 years the ERP solution has been customised to provide Council with a

bespoke solution. This had led to a significant increase in support and

maintenance required for the solution.

2.6.1 A key principle of Project Genesis is to use

“out-of-the-box” functionality. The cloud-based solution will allow

for configuration changes, but no customisations will be done. This ensures

ongoing support and maintenance is simplified.

|

3.0 Recommendations -

Ngā Tūtohunga

A) That the Risk and Assurance Committee receive the

report titled Enterprise Resource Planning (ERP) System move to the cloud -

Project Genesis dated 5 August 2024.

B) That the Committee note that it will continue to

receive updates throughout the duration of this project on a quarterly basis.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Jennie Kuzman, Health,

Safety and Wellbeing Manager

|

|

Te Take:

Subject:

|

Health, Safety &

Wellbeing Update

|

1.0 Purpose and

summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The

purpose of this report is to provide information to the Risk and Assurance Committee

about the management of Health, Safety and Wellbeing risks within Council.

1.2 This

issue arises due to the Health and Safety at Work Act 2015 and the requirement

of that legislation for Elected Members to exercise due diligence to ensure

that Council complies with its health and safety duties and obligations.

1.3 This

report provides a summary update on the Health, Safety & Wellbeing

activities, and initiatives underway or planned to be undertaken within the

2024/2025 financial year.

|

2.0 Recommendations

- Ngā Tūtohunga

A) That

the Risk and Assurance Committee receive the report titled Health, Safety

& Wellbeing Update dated 5 August 2024.

B) That

the Committee endorse the action that the Safeplus assessment be undertaken

in the 2025/26 financial year.

|

3.0 Discussion

– Te Matapakitanga

3.1 This

report provides a summary update on the Health, Safety & Wellbeing

activities, and initiatives underway or planned to be undertaken during the

2024/2025 financial year, across policies, risk review, audits and assessments.

3.2 Policy

Development / Review

3.3 There

are several policies currently under review or due to be reviewed in this

financial year:

|

Policy

|

Status

|

|

Overarching

Asbestos Management Plan

|

Review completed

and feedback received, no major changes.

Updated version to

be issued in August 2024.

|

|

Rehabilitation

& Fit-for-work Policy

|

Review underway.

Consultation with

Managers & Team Leaders completed.

Updated draft to be

provided to Lead Team to review in August 2024.

|

|

Impairment Policy

|

Under Development

Received legal

review of the current draft – reviewing.

Updated draft to be

provided to Lead Team to review in August 2024.

|

|

Health, Safety

& Wellbeing Manual

|

Review Underway

Currently being

reviewed by HSW team.

Estimate an updated

draft to be completed for Group Manager Review at the end of August 2024 and

Lead Team review in September 2024.

|

|

Mauri tū Mauri

Ora (Wellbeing) Framework and Work-related Stress Policy

|

Scheduled to be

reviewed following the receipt of the Psychosocial (Wellbeing) Assessment

Report.

|

|

Health, Safety

& Wellbeing Policy

|

Scheduled to be

reviewed in 2025

|

|

Respiratory

Protection Policy and Programme

|

Scheduled to be

reviewed in 2025

|

|

Menopause Policy

|

Scheduled to be

developed in 2025

|

3.4 Critical

HSW Risk Reviews (12 Critical Risks)

3.5 As

previously reported to the committee, Council has identified 12 Critical Health

and Safety risks (an overview of these critical risks can be found on the hub).

All these critical Health, Safety and wellbeing risks have bowtie risk

assessments, which were reviewed in the 2022/23 financial year.

3.6 Following

feedback from the committee in 2023, a template for critical HSW risk profiles

was developed to summarise the risk and its critical controls. A critical risk

profile for the Conflict and Violence critical risk was completed and this was

shared with the committee in 2023.

3.7 The

following critical risks will be further reviewed, and summary risk profiles

developed by the end of this new financial year:

· Asbestos.

· Hazardous

Substances.

· Work-related

Stress.

· Working at

Height.

· Driving a

Vehicle.

3.8 The

remaining six risks (that still need reviewing and summary risk profiles

developed) will then be reviewed in the 2025/26 Financial Year.

· Manual

Handling.

· Fatigue.

· Confined

Spaces.

· Plant and

Machinery.

· Excavations.

· Exposure to

Health hazards.

3.9 Audits

& Assessments

3.10 The

following internal audits and assessments will be undertaken by the HSW team

and are scheduled for the 2024/25 financial year:

· Safeplus

self-assessment, scheduled to begin in October 2024.

· Significant

contractor audits – scheduled for February/March 2025.

3.11 The

following external audits and assessments will be undertaken by external

parties and are scheduled for the 2024/25 financial year:

· Psychosocial

Risk Assessment – underway August/September.

· Annual

Office and Facility Inspections – scheduled for April 2025.

· Exposure

Monitoring

is scheduled to be undertaken for: Ōmarunui Landfill (Noise, Vibration and

Hazardous Substances), Aquatics and Splash Planet (Noise, and Hazardous

Substances), and Water Operations (Noise, Vibration and Hazardous Substances).

· Occupational

Health Monitoring

is scheduled to be undertaken for all employees enrolled in Council’s

Health Monitoring programme.

3.12 The

external Safeplus assessment has been deferred to the 2025/26 Financial year in

order to give priority to the psychosocial risk assessment and any learnings

and recommendations that may result from this assessment. Noting that the

psychosocial risk assessment was discussed with the committee at the May 2024

meeting.

Attachments:

There are no attachments for this report.

HASTINGS DISTRICT COUNCIL

Risk and Assurance Committee

MEETING

Monday, 5 August 2024

RECOMMENDATION TO EXCLUDE THE PUBLIC

SECTION 48, LOCAL GOVERNMENT OFFICIAL INFORMATION AND

MEETINGS ACT 1987

THAT the public now be excluded from the following part of

the meeting, namely:

14 Health

& Safety Contracts - Contractors' Health & Safety Performance Report

15 Cyber

Security Update

The general subject of the matter to be considered while the

public is excluded, the reason for passing this Resolution in relation to the

matter and the specific grounds under Section 48 (1) of the Local Government

Official Information and Meetings Act 1987 for the passing of this Resolution

is as follows:

|

GENERAL SUBJECT OF

EACH MATTER TO BE CONSIDERED

|

REASON FOR PASSING

THIS RESOLUTION IN RELATION TO EACH MATTER, AND

PARTICULAR INTERESTS PROTECTED

|

GROUND(S) UNDER

SECTION 48(1) FOR THE PASSING OF EACH RESOLUTION

|

|

|

|

|

|

14 Health

& Safety Contracts - Contractors' Health & Safety Performance Report

|

Section 7 (2) (b) (ii)

The withholding of the

information is necessary to protect information where the making available of

the information would be likely to unreasonably prejudice the commercial

position of the person who supplied or who is the subject of the information.

The report contains

sensitive Health, Safety & Wellbeing information relating to third party

activities..

|

Section 48(1)(a)(i)

Where the Local Authority is

named or specified in the First Schedule to this Act under Section 6 or 7

(except Section 7(2)(f)(i)) of this Act.

|

|

15 Cyber

Security Update

|

Section 7 (2) (b) (i)

The withholding of the

information is necessary to protect information where the making available of

the information would disclose a trade secret.

Sharing of security elements

which protect Council's Information systems.

|

Section 48(1)(a)(i)

Where the Local Authority is

named or specified in the First Schedule to this Act under Section 6 or 7

(except Section 7(2)(f)(i)) of this Act.

|

4.6 Floating

Rate Debt Drawdowns:

4.6 Floating

Rate Debt Drawdowns: