Kaupapataka

Agenda

|

Te Rā Hui:

Meeting date:

|

Monday, 18 November 2024

|

|

Te Wā:

Time:

|

10.00am

|

|

Te Wāhi:

Venue:

|

Council Chamber

Ground Floor

Civic Administration

Building

Lyndon Road East

Hastings

|

|

Te Hoapā:

Contact:

|

Democracy

and Governance Services

P: 06 871 5000

| E: democracy@hdc.govt.nz

|

|

Te Āpiha Matua:

Responsible Officer:

|

Chief Financial Officer - Graham Watson and Chief Risk Officer -

Regan Smith

|

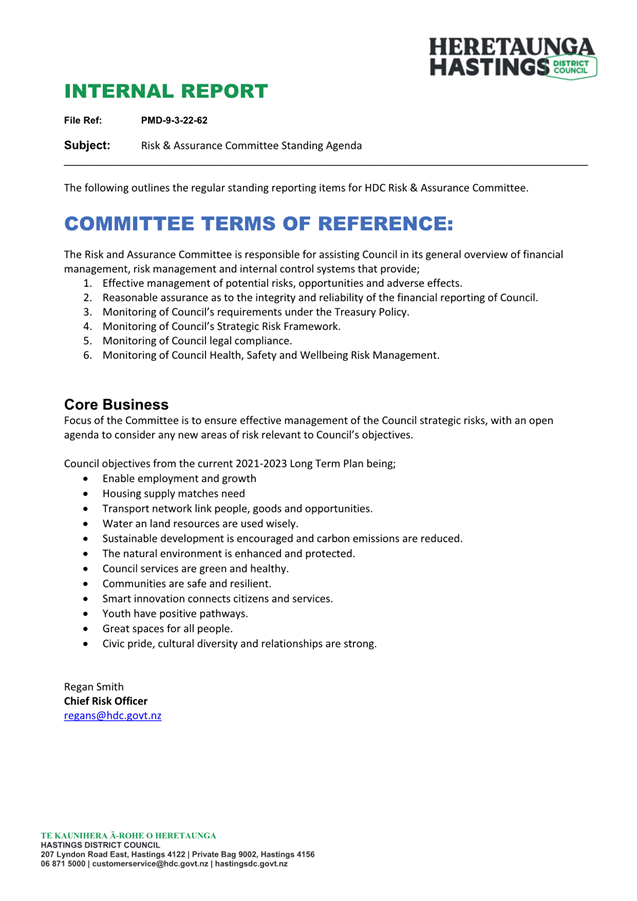

Risk and Assurance Committee – Terms of Reference

Fields of Activity

The Risk and Assurance

Committee is responsible for assisting Council in its general overview of

financial management, risk management and internal control systems that

provide:

• Effective management of

potential risks, opportunities and adverse effects.

•

Reasonable assurance as to the integrity and reliability of the reporting on financial

performance of Council, including quality of audit services.

• Monitoring of

Council’s requirements under the Treasury Policy.

• Monitoring of

Council’s Strategic Risk Framework.

• Monitoring of

Council’s legal compliance.

• Monitoring of

Council’s health and safety compliance.

•

Monitoring significant projects, programmes of work and procurement focussing

on the appropriate management of risk.

•

Oversight of preparation of the Long Term Plan, Annual Report, and other

external financial reports required by statute.

In light

of the impacts Cyclone Gabrielle has had on the communities in the district,

the Committee will pay particular attention to activities affected within its

Fields of Activity, including but not limited to and always in support of the

work of Council and the Standing Committees:

•

Oversight of cyclone-related insurance claims and issues.

• Monitor funding implications associated with recovery

costs, including oversight of the process for recoveries from government.

• Monitor valuation process for cyclone-damaged assets,

including impairments particularly relating to roading.

•

Support post-cyclone expenditure planning by ensuring good process is applied.

Membership – 8 (including 5 Councillors)

·

5 Councillors - with one being the Chair of

Performance and Monitoring and one being the Chair of Strategy and Recovery, or

their equivalents.

·

Deputy Chair appointed by Council.

·

2 external independent members appointed by

Council, with one being appointed as the Chair.

·

1 Heretaunga Takoto Noa Māori Standing

Committee Member appointed by Council

Quorum – 4 members

|

DELEGATED POWERS

Authority to consider and make

recommendations on all matters detailed in the Fields of Activity and such

other matters referred to it by Council.

|

Kaupapataka

Agenda

|

Mematanga:

Membership:

|

Koromatua

Chair: Graeme McGlinn – External Independent

Appointee

Nga Kai Kaunihera

Councillors: Simon Nixon (Deputy Chair), Alwyn Corban,

Tania Kerr, Michael Fowler (Chair of Performance & Monitoring Committee)

and Councillor Schollum (Chair of Strategy & Recovery Committee)

Mayor Sandra Hazlehurst

External Independent Appointee: 1x Vacancy

Heretaunga Takoto Noa Māori Standing Committee appointee:

Tom Keefe

|

|

Tokamatua:

Quorum:

|

4 members

|

|

Kaihokoe mo te Apiha

Officers Responsible:

|

Chief Risk Officer – Regan

Smith

AND

Chief Financial Officer –

Graham Watson

|

|

Te Rōpū Manapori me te Kāwanatanga

Democracy & Governance Services:

|

Christine Hilton (Extn 5633)

|

Te Rārangi Take

Order of Business

|

1.0

|

Apologies

– Ngā

Whakapāhatanga

At the

close of the agenda no apologies had been received.

At the

close of the agenda no requests for leave of absence had been received.

|

|

|

2.0

|

Conflict

of Interest –

He Ngākau Kōnatunatu

Members need to be vigilant to stand aside from

decision-making when a conflict arises between their role as a Member of the

Council and any private or other external interest they might have.

This note is provided as a reminder to Members to scan the agenda and assess

their own private interests and identify where they may have a pecuniary or

other conflict of interest, or where there may be perceptions of conflict of

interest.

If a Member feels they do have a conflict of interest,

they should publicly declare that at the start of the relevant item of

business and withdraw from participating in the meeting. If a Member

thinks they may have a conflict of interest, they can seek advice from the

General Counsel or the Manager: Democracy and Governance (preferably before

the meeting).

It is noted that while Members can seek advice and

discuss these matters, the final decision as to whether a conflict exists

rests with the member.

|

|

|

3.0

|

Confirmation

of Minutes –

Te Whakamana i Ngā Miniti

Minutes of the

Risk and Assurance Committee Meeting held Monday 14 October 2024.

(Previously circulated)

|

|

|

4.0

|

Insurance

Update

|

7

|

|

5.0

|

Treasury

Activity and Funding Update

|

11

|

|

6.0

|

Project

Genesis - Supplier Technology1

|

15

|

|

7.0

|

Assurance

Activity Update

|

19

|

|

8.0

|

Health,

Safety & Wellbeing Update

|

47

|

|

9.0

|

Risk

and Assurance Committee Status of Actions and Work Programme

|

51

|

|

10.0

|

Risk

Deep Dive - Climate Action

|

57

|

|

11.0

|

Rates

Update

|

61

|

|

12.0

|

2023/24

Audit Report on Control Findings and issues identified

|

67

|

|

13.0

|

Minor Items

– Ngā Take

Iti

|

|

|

14.0

|

Urgent

Items –

Ngā Take Whakahihiri

|

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Jeff Tieman, Management

Accountant

|

|

Te Take:

Subject:

|

Insurance Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

Renewal

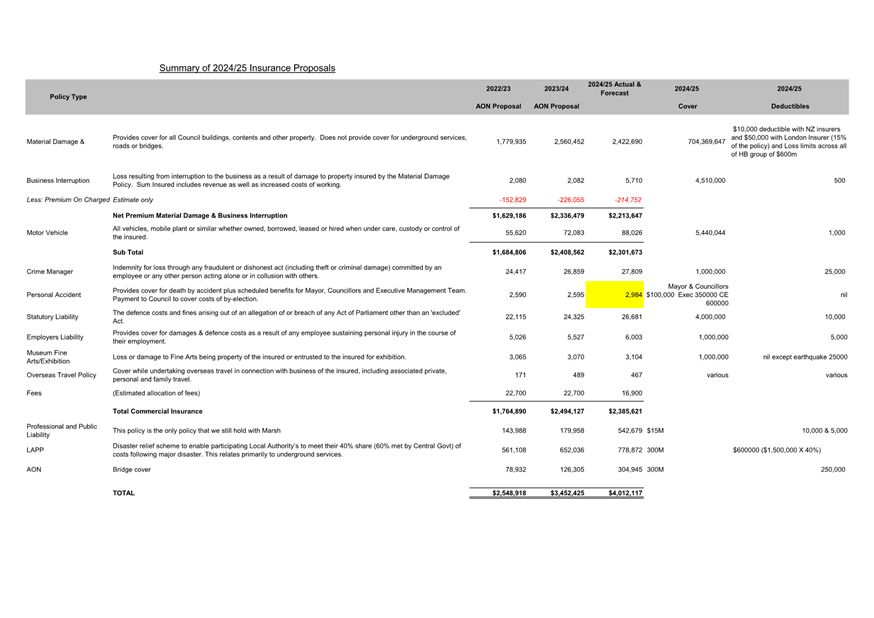

1.1 All terms for 1st

November renewal have now been received (at time of writing), except Personal

Accident. Attached is the 2024/25 insurance renewal summary spreadsheet

outlining the policy and premiums.

1.2 The Material Damage,

Business Interruption (MDBI) policy saw a small reduction in premiums. This was

a combination of a decrease in insure value ($716m in 2023 to $705m 2024). The

lead NZ insurers were flat with their pricing at this renewal and the London

markets reduced their pricing by 5%. The London markets cover 15% of the

portfolio.

1.3 The motor vehicle

policy saw the NZ insurers offer the same pricing as last year for the

Hawke’s Bay group. However, Hastings District council had an uplift in

value within the group of 14%. It was agreed that the group premiums should be

split based on vehicle values and this saw an increase of $16,000 for the

council.

1.4 Professional Indemnity

and Public Liability had already been confirmed and was reported on in the

insurance update on the 14th October.

1.5 Infrastructure

policies in general have seen some large reductions on a like for like

valuation. However, due to valuation changes (Bridge policy) and loss limit

changes (3 waters with LAPP and Bridge policy) total premiums have gone up. The

changes in valuation and loss limits were reported on in the insurance update

on the 14th October.

1.6 Other minor policies

as per the attached schedule are either flat or had small premium increases.

1.7 The overall insurance

budget for 2024/25 is $4,449,511. This compares to the final renewal program of

$4,012,117. A savings of $437,394.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Insurance Update dated 18

November 2024.

|

Attachments:

|

1⇩

|

Insurance Renewal Summary 2024/25

|

CG-13-7-00123

|

|

|

Item 4 Insurance

Update

|

|

Insurance

Renewal Summary 2024/25

|

Attachment 1

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Aaron Wilson, Financial

Controller

|

|

Te Take:

Subject:

|

Treasury Activity and

Funding Update

|

1.0 Executive Summary – Te Kaupapa Me Te Whakarāpopototanga

1.1 The

purpose of this report is to update the Risk and Assurance Committee on Treasury

activity and Funding issues.

1.2 Since the last

update on 5th August 2024, Council has not needed to borrow any

further funding. This is in line with the LTP Year One and current cash forecast,

where it is expected, Council will need to borrow in December 2024.

1.3 Officers

put a short-term deposit of $20m with BNZ for 1month at 4%, this earned

interest of $86,858.59.

1.4 Council’s

total external debt on 30th October 2024 is $412.7m, with debt

forecasted to rise to $489m by 30 June 2025. Based on the 2024-25 LTP budgets

Council will need to increase the total borrowings by $96m this financial year.

1.5 Council

has facilities of $45m with the cost of these facilities 0.3%.

1.6 As

was reported at the last treasury update officers are intending to target

further cover as it becomes financially efficient to do so. With the

Reserve bank now in a cutting cycle and Council cover within policy, officers

in conjunction with Council Treasury advisors Bancorp, watching the market

pricing of swaps to ensure the purchasing of further cover is financially

efficient to do so.

1.7 With

this in mind, officers have not engaged in any further swaps at this time and

are looking to take opportunities as they present themselves.

1.8 Council’s

Treasury advisors will be attending the Risk and Assurance meeting and will be

presenting to the meeting aspects of treasury that relate to debt and cover to

enable a clearer understanding of Council treasury strategy and what the market

looks like over the next 12 – 18 months.

1.9 Council

is currently compliant with its existing Treasury Management Policy for the

2024-34 debt profile.

1.10 The

Reserve Bank of New Zealand’s (RBNZ) Official Cash Rate (OCR) has now

dropped to 4.75% which is a further drop from its review on 14 August 2024. Its

next review is 27 November 2024. The following is a summary of the RBNZ’s

points in arriving at the decision to cut rates further:

· Business

investment and consumer spending have been weak.

· Excess capacity

has dampened inflation expectations, and price and wage changes are now more

consistent with a low inflation environment.

· Global economic

growth remains below its long-run trend and is expected to remain so for the

year ahead.

· The economic

environment provided scope to further ease the level of monetary policy

restrictiveness, consistent with its mandate of low and stable inflation.

|

2.0 Recommendations - Ngā Tūtohunga

That the Risk and

Assurance Committee receive the report

titled Treasury Activity and Funding Update dated 18 November 2024.

|

3.0 Background

– Te Horopaki

3.1 The

Hastings District Council has a Treasury Policy which is a summarised version

of the Treasury Management Policy and forms part of the 2024-2034 Long Term

Plan. Under these policy documents, responsibility for monitoring treasury

activity is delegated to the Risk and Assurance Committee.

3.2 Council

is provided with independent treasury advice by Bancorp Treasury Services and

receives daily and monthly updates on market conditions.

3.3 Under

the Treasury Policy, formal reporting to Council occurs quarterly and regular

more in-depth treasury reporting is provided for the Risk and Assurance

Committee. The Treasury Policy has been updated to reflect the current

financial situation and in support of the 2024-34 Long Term Plan.

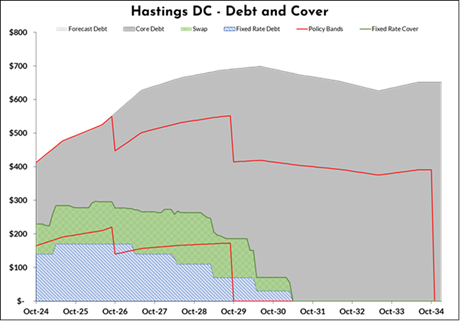

3.4 The

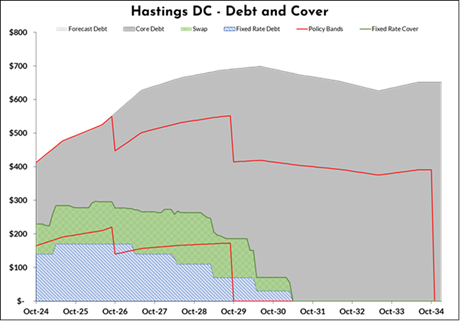

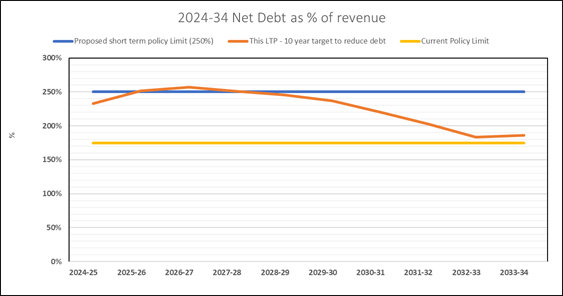

following graph shows Council’s level of cover and is within the treasury

policy bands for cover.

3.5 As

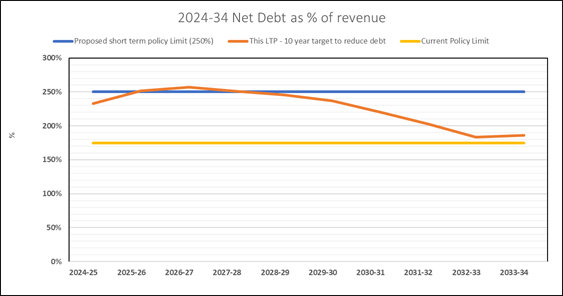

was noted in the previous treasury update, Council remains fiscally constrained

due to its forecasted debt profile in the coming years. June 2025 is

forecasted to exceed the debt to revenue ratio limit as per the Treasury policy

of 250%. As at 30th October Council remains on track with the

Net debt as a % of revenue.

|

|

Forecast

Debt

|

Forecast

Debt to revenue ratio

|

|

June

2025

|

$489m

|

251.84%

|

|

June

2026

|

$573m

|

256.94%

|

|

June

2027

|

$640m

|

251.10%

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Maree Goldie, Senior Digital

Project Manager

|

|

Te Take:

Subject:

|

Project Genesis -

Supplier Technology1

|

1.0 Purpose and

summary - Te Kaupapa

Me Te Whakarāpopototanga

1.1 This

report provides a brief overview of project Genesis progress.

Objective: Project Genesis

aims to modernise and enhance the current digital platform by replacing the out

of support Technology1 system (on premises) with Technology1 One Council (Cloud

environment), streamlining processes by removing the 260 customisations and

improving user experience.

This project

intends to increase operational efficiency and future proof HDC with a modern

system that can be built on later. HDC can become more customer centric and

provide a more robust, secure, and user-friendly digital environment.

· Senior

Project Manager – Maree Goldie – started late August 2024.

· Senior

Change Manager – Janet Sullivan – started October 2024.

· The

budget has been reviewed and finalised for the next 2 years.

· Staffing

requirements have been reviewed. Internal staff will work on the project, with

five to be backfilled and one Business Analyst to be advertised on fixed term

2-year contract. The team are enthusiastic and ready to help.

· The

Project plans have been completed and updated as required.

· The

communication and engagement plan, business readiness assessment, change impact

assessment and training needs analysis are all underway.

· Agile

Scrum methodology is being used for task planning and review. Training for the

team is underway. This will run with a fortnightly planning meeting and daily

standup meetings.

· The

implementation will occur in two phases – Finance will move to the cloud

first, completion estimated to be late May 2025. Property and Rating will then

start and is a reimplementation to cloud Ci Anywhere. This is estimated to end

in 2027.

· Technology1

has very recently been far more responsive; they have an experienced Technical

Account Manager and Technical SaaS Manager assigned to Council’s finance

move. The Project Manager is working closely with Council’s Project

Manager and delivering on time.

2.0 Risk Register

HDC have registered via the Risk

Quantate System several risks of which the following are at an extreme or high

level with limited controls: (please refer to report via Quantate attached):

· Project

Staff - The project staff may have existing

challenges that could impact their health and wellbeing and hinder the project

progress. Controls are limited due to confidential programs that individuals

may not follow.

· Supplier lack of knowledge - Due to loss of staff and

project fatigue the supplier may not have the configuration knowledge to

support an effective implementation for HDC. Controls are limited due to the

unknown internal workings of the supplier. CVs on the project staff from Techology1

does show several relatively new staff – however they do have extensive

other experience.

· Budget/Scope - This is a project that has a high impact

on people, process, and technology - any change to scope could impact one or

more of the following: budget, staff, community, time and delivery. PM

will be working very closely with the supplier to monitor all time spent on

each issue, allocating an agreed number of hours to work. If work is shifted

from one consultant to another HDC will not pay for the training of Technology1

staff.

|

3.0 Recommendation– Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Project Genesis dated 18

November 2024.

|

Attachments:

|

1⇩

|

Attachment Risk and Compliance 7_11 Project Genesis

|

CG-17-6-00152

|

|

|

Item 6 Project

Genesis - Supplier Technology1

|

|

Attachment

Risk and Compliance 7_11 Project Genesis

|

Attachment 1

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Steffi Reeves-Bird, Risk

Manager

Regan Smith, Chief Risk

Officer

|

|

Te Take:

Subject:

|

Assurance Activity

Update

|

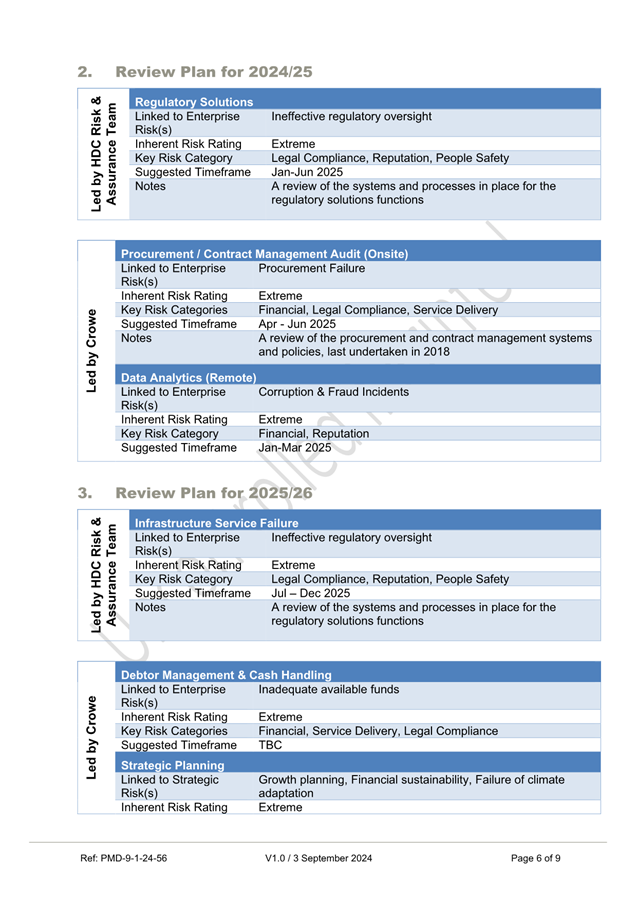

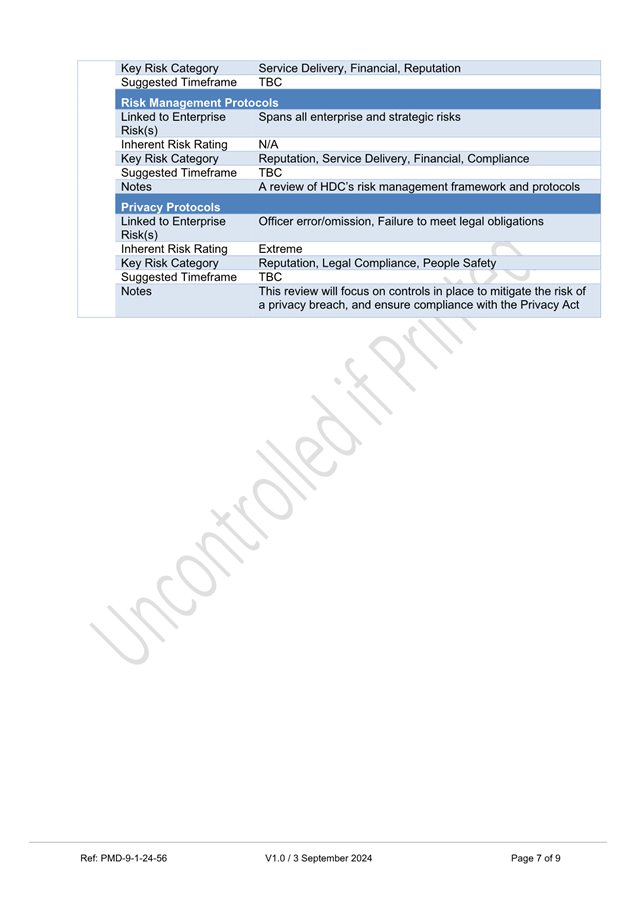

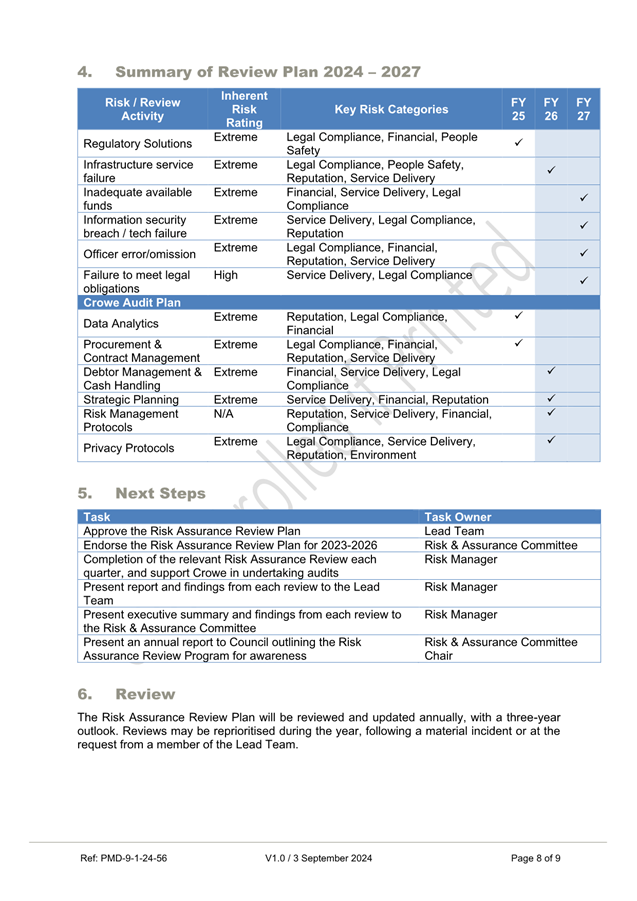

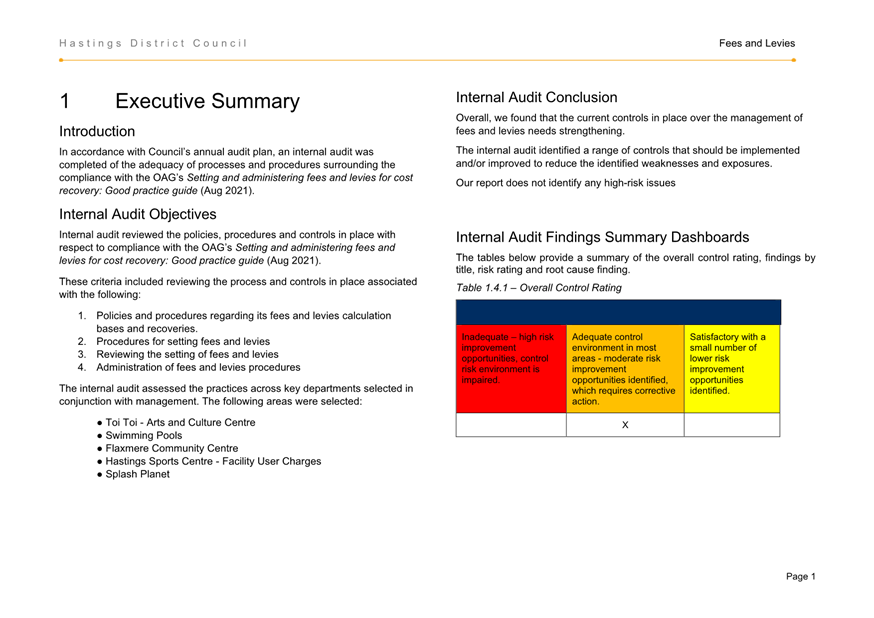

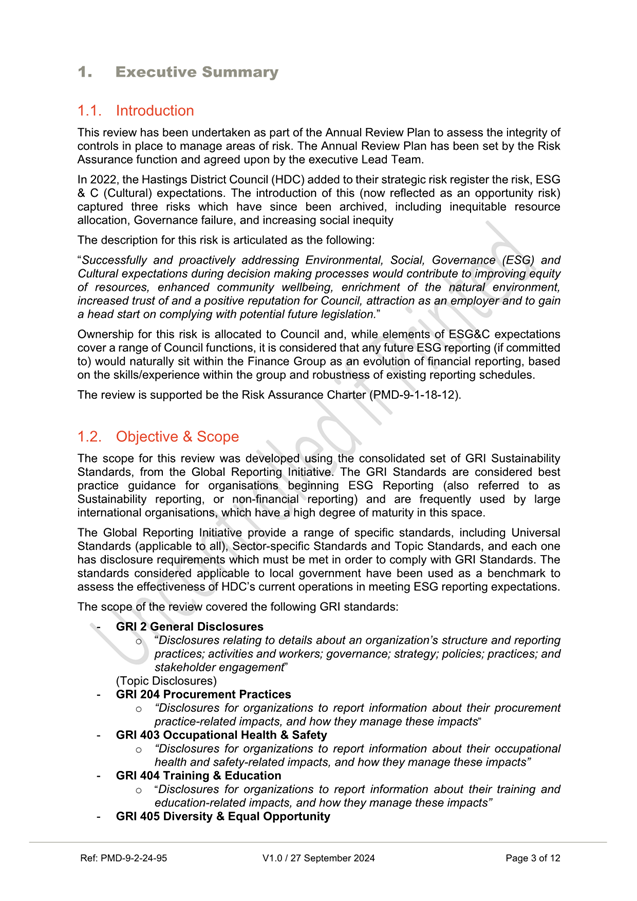

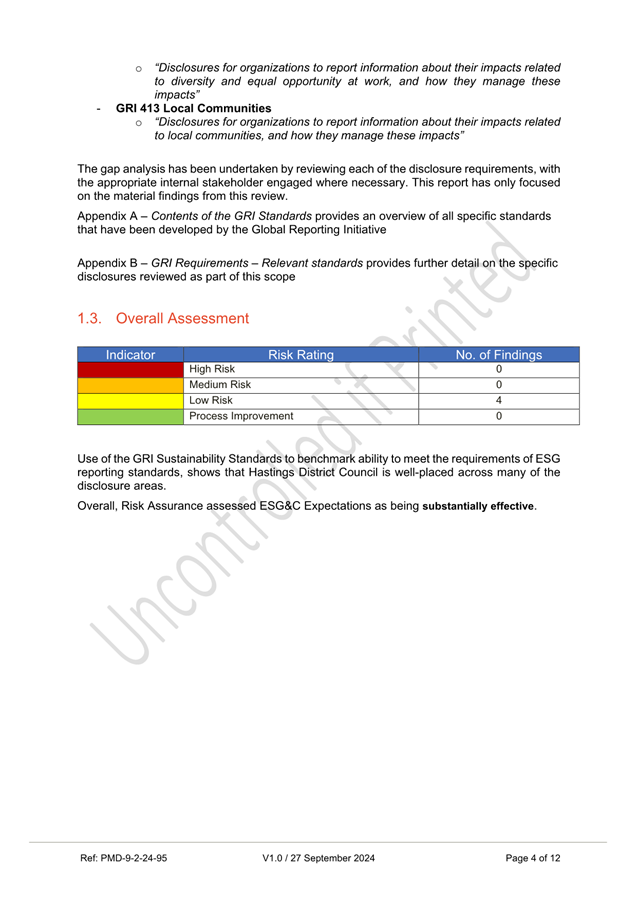

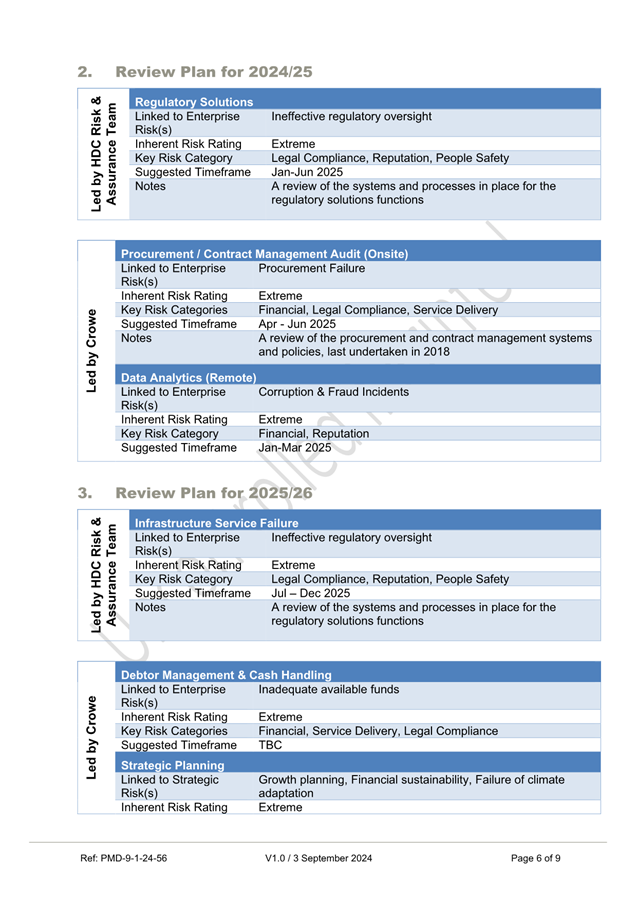

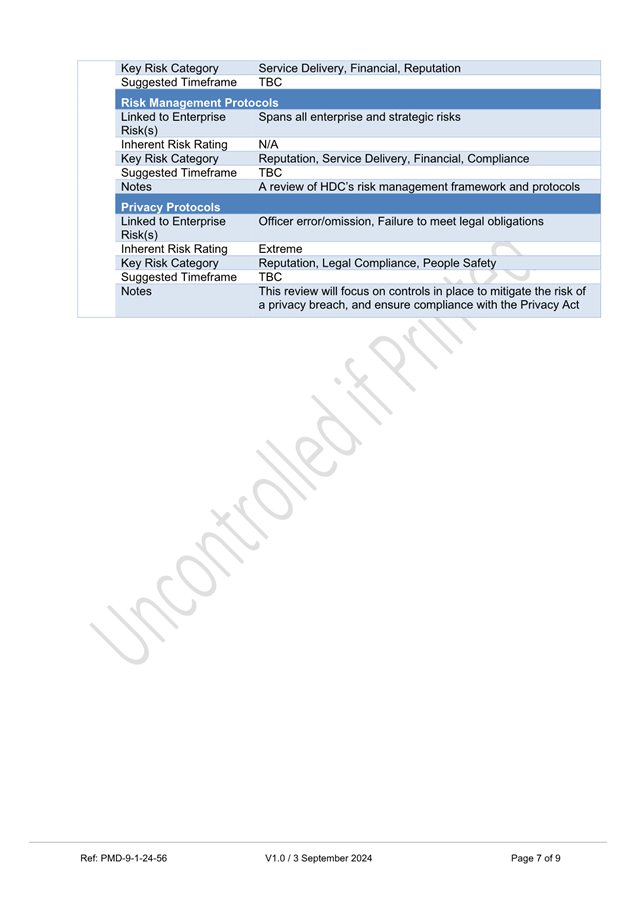

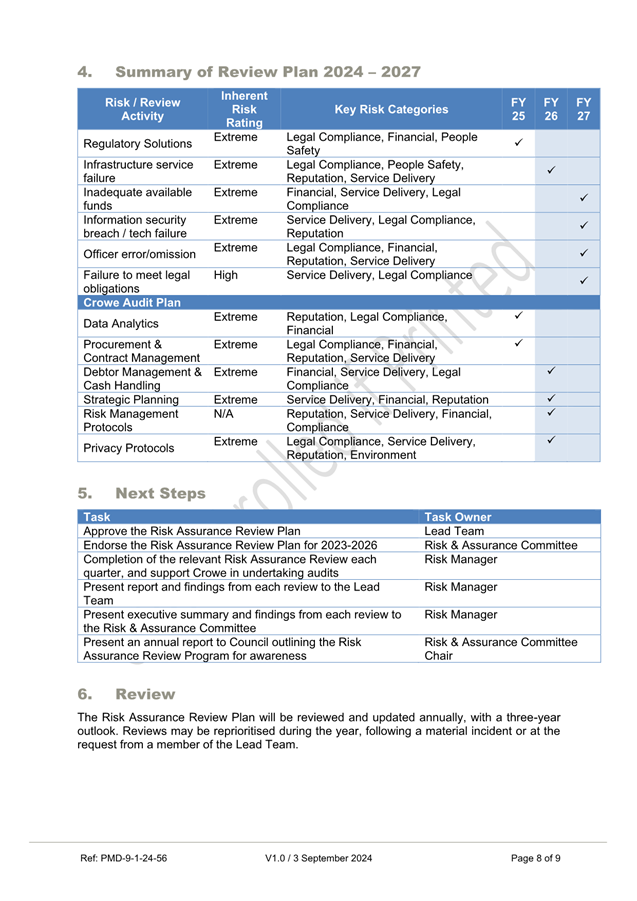

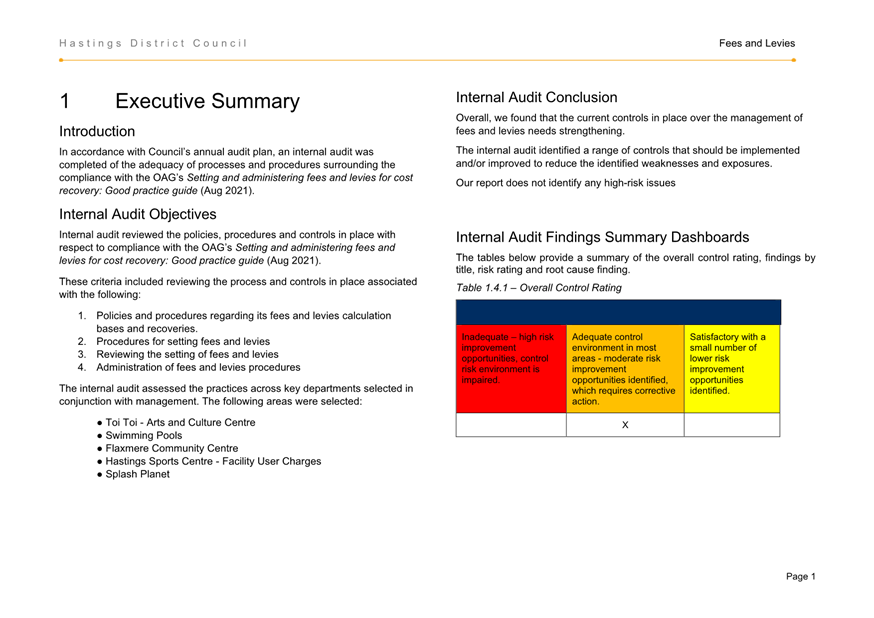

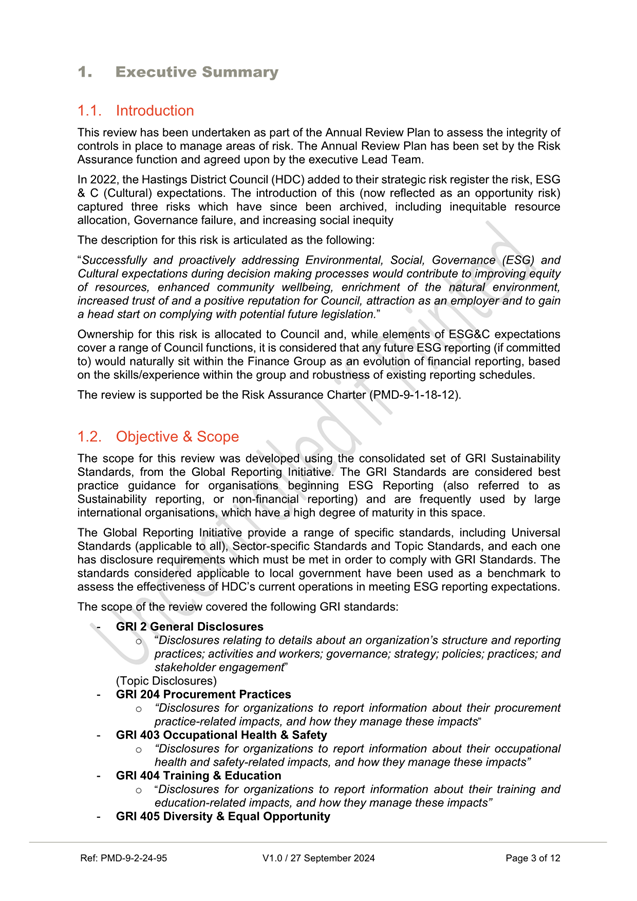

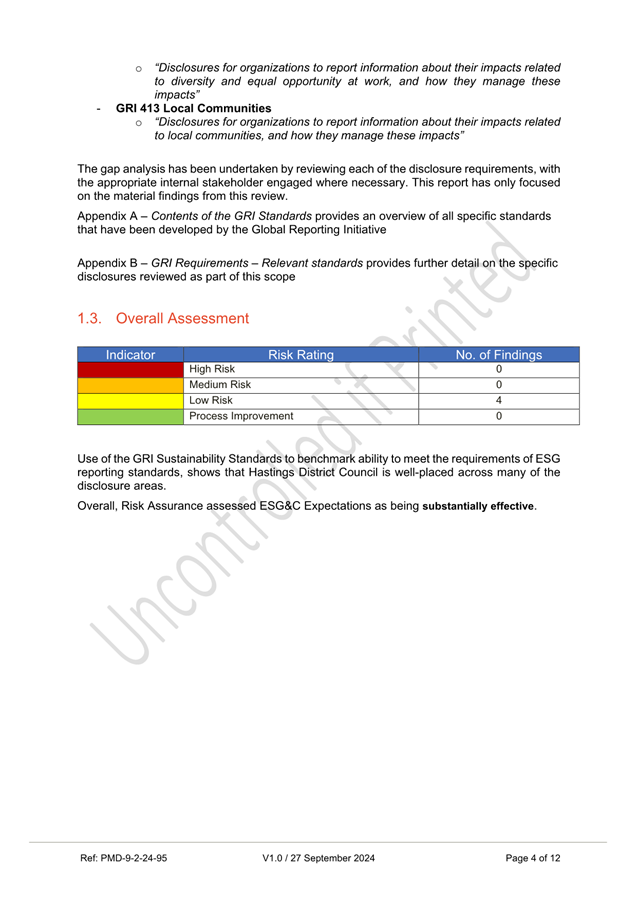

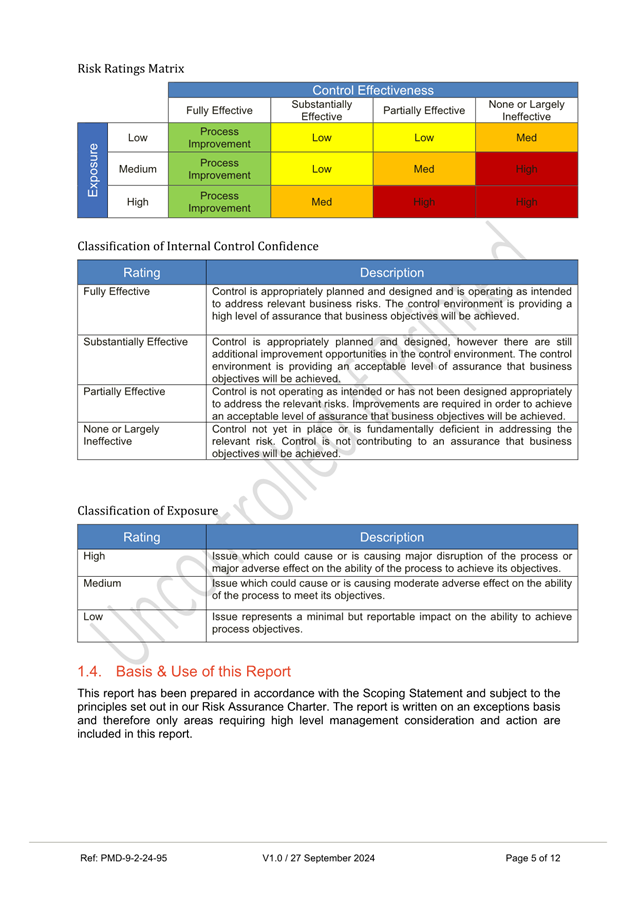

1.0 Executive Summary

– Te Kaupapa Me Te Whakarāpopototanga

1.1 The

purpose of this report is to provide the Committee with an update on the

following assurance activities at Hastings District Council (HDC):

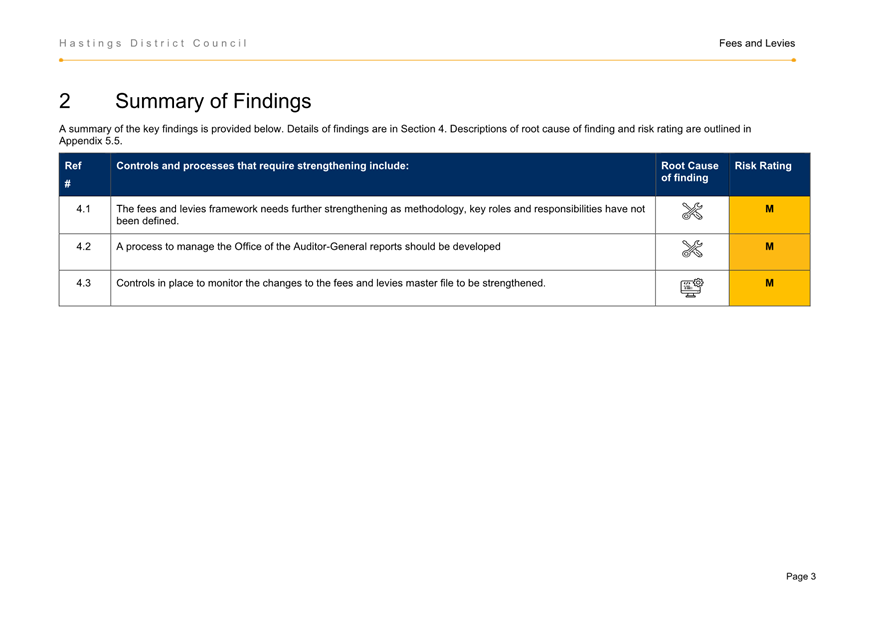

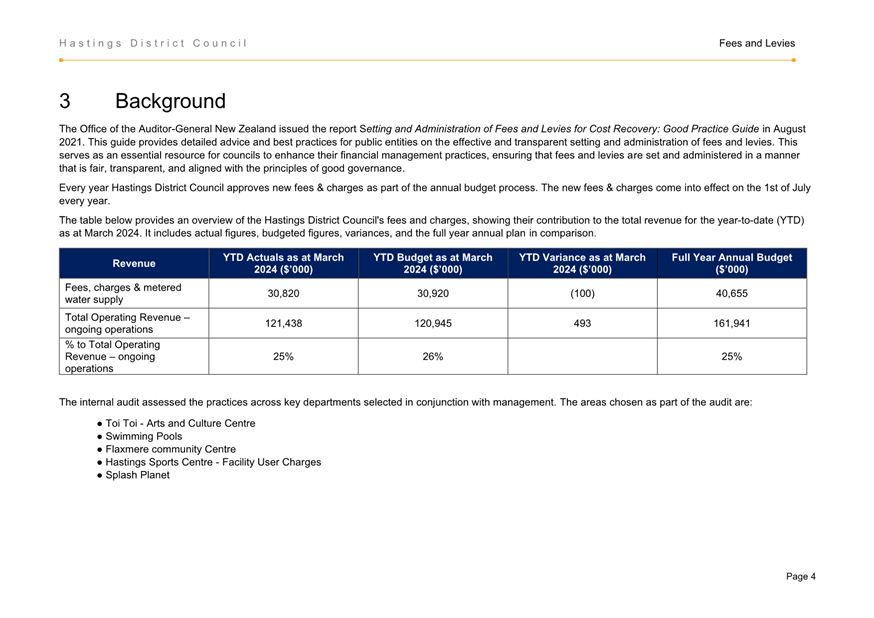

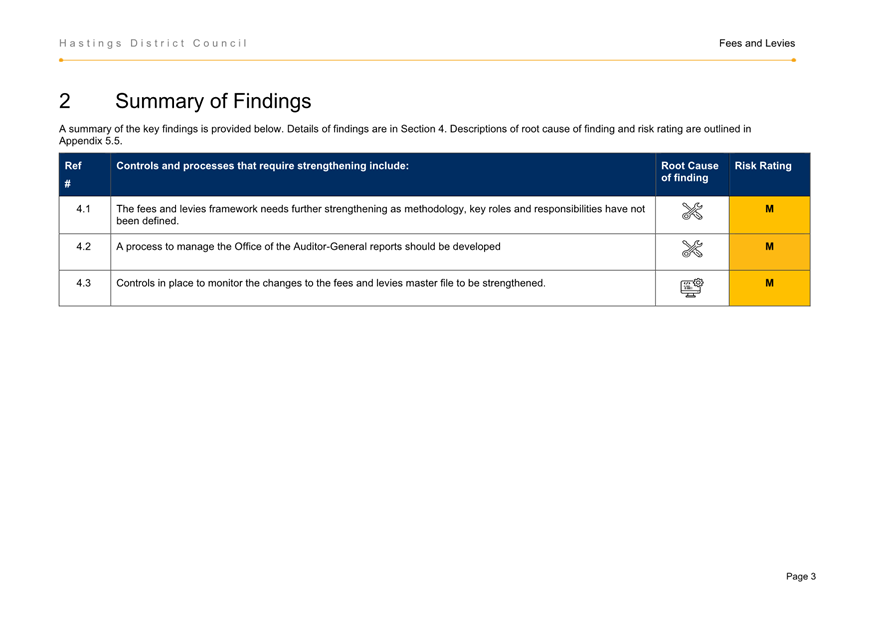

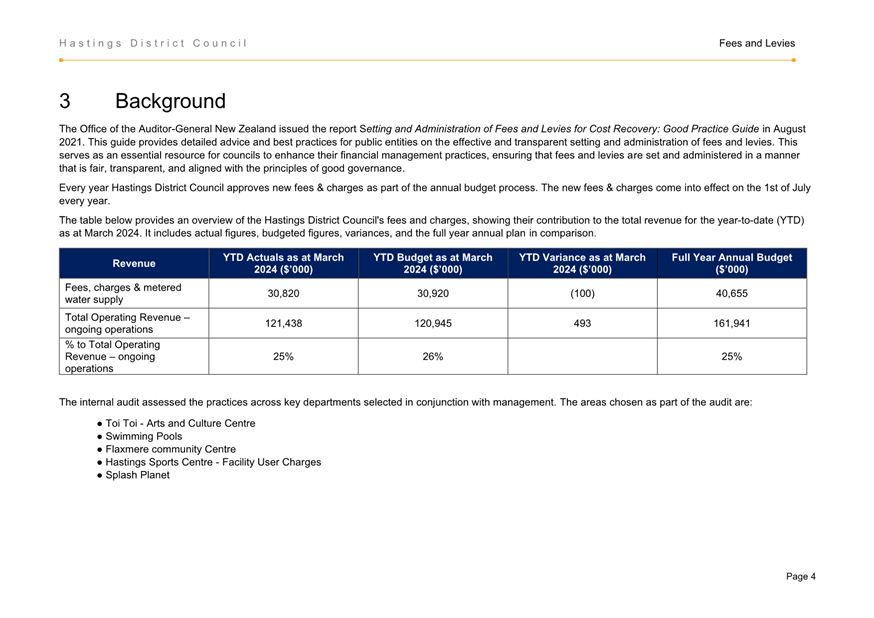

· Assurance

Review Plan 2024-2027

· Fees

& Levies Audit Report (undertaken by Crowe)

· Environmental,

Social & Governance Review Report (undertaken by HDC’s internal

assurance function)

1.2 Assurance Review

Plan 2024-2027

· The

Lead Team have approved the Assurance Review Plan 2024-2027 (Attachment 1)

which outlines the audits and reviews proposed to be undertaken over the next

three financial years, internally and by the externally appointed, internal

auditor, Crowe.

· With

a focus on assurance over the enterprise (tier 2) risks, this plan has been

developed by the Risk Manager with consideration of HDC’s assurance map,

discussions with management and Crowe, and trends observed in both the internal

and external environments.

· The

following reviews have been prioritised for completion during the 2024/25

financial year:

- Regulatory

solutions review (led by HDC Risk & Assurance Team)

- Data

analytics audit (led by Crowe)

- Procurement

and contract management audit (led by Crowe)

· An

executive report for each of these reviews and audits will be provided back to

the Committee upon completion.

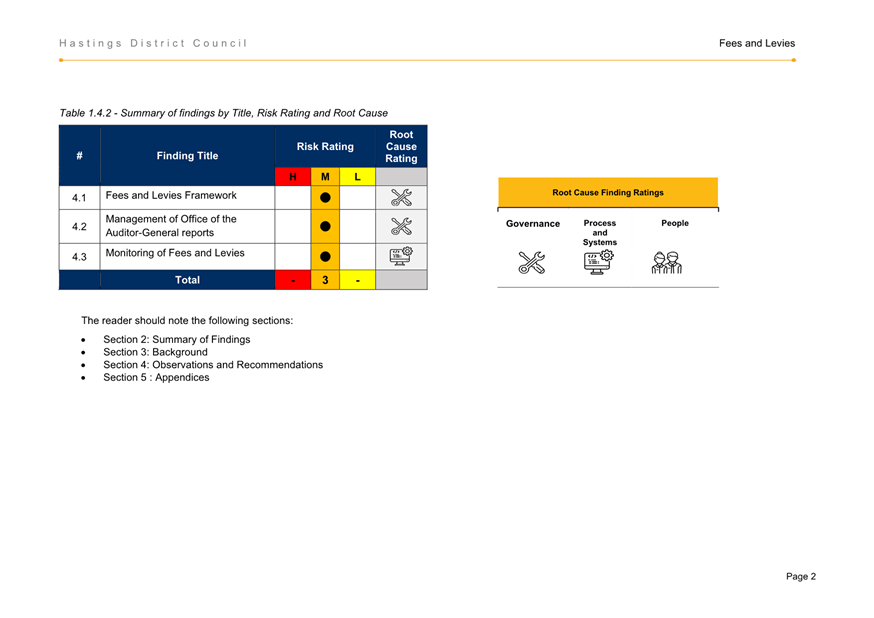

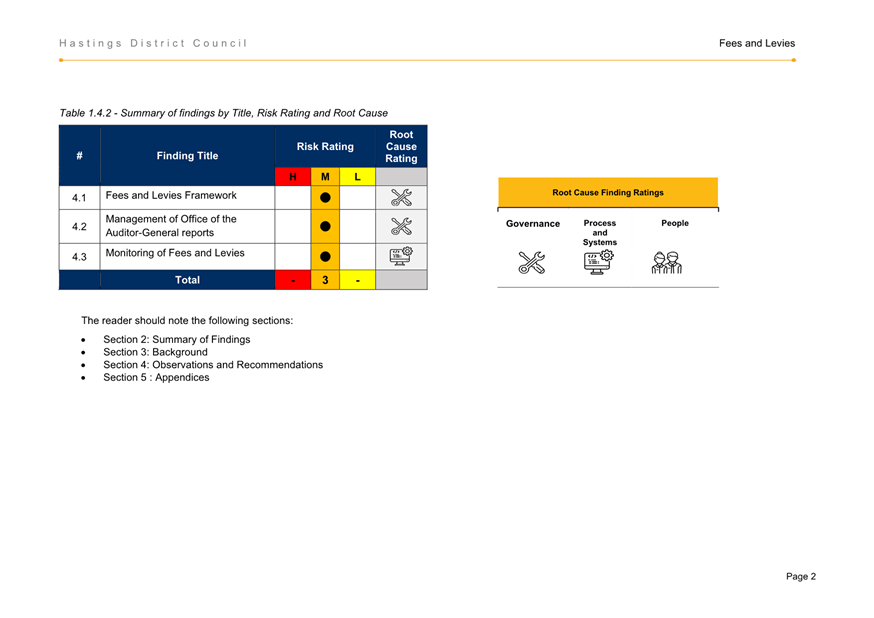

1.3 Fees & Levies

Audit Report

· Crowe

have undertaken an audit of the setting and administering of fees and levies in

the Community Wellbeing & Services (CW&S) area (Attachment 2).

· The

audit was based upon good practice guidance from the Office of the Auditor

General, with a focus on the processes and principles applied when setting fees

across a range of CW&S activities.

· The

audit resulted in an overall control rating of Moderate, with three

findings (all moderate) and four subsequent recommendations. All

recommendations have been allocated to the responsible officer and have either

been completed or are in progress.

|

Recommendation

|

Rating

|

|

Management needs to

develop the operating framework to support the setting and management of the

fees and levies.

This should include developing

documented operating procedures that outline roles and responsibilities and

key tasks performed.

An overarching methodology

for setting fees and levies needs to be adopted by Council. (e.g. is the

approach to be full or partial cost recovery, profit making, defined subsidy

etc)

This framework should

be allocated a review period and be approved to ensure that the processes

performed remain current and complete.

|

Moderate

|

|

Management to implement

a process for monitoring, evaluating, and responding to OAG and other

integrity agency reports that specifically relate to local government to

ensure the council is informed about relevant findings and recommendations.

|

Moderate

|

|

A response to

interagency reports relating to local government should be provided to

Executive and the Audit Committee as appropriate.

|

Moderate

|

|

Management should

implement a systematic approach for monitoring

and reviewing changes to the master

file. Evidence of this review to be maintained.

|

Moderate

|

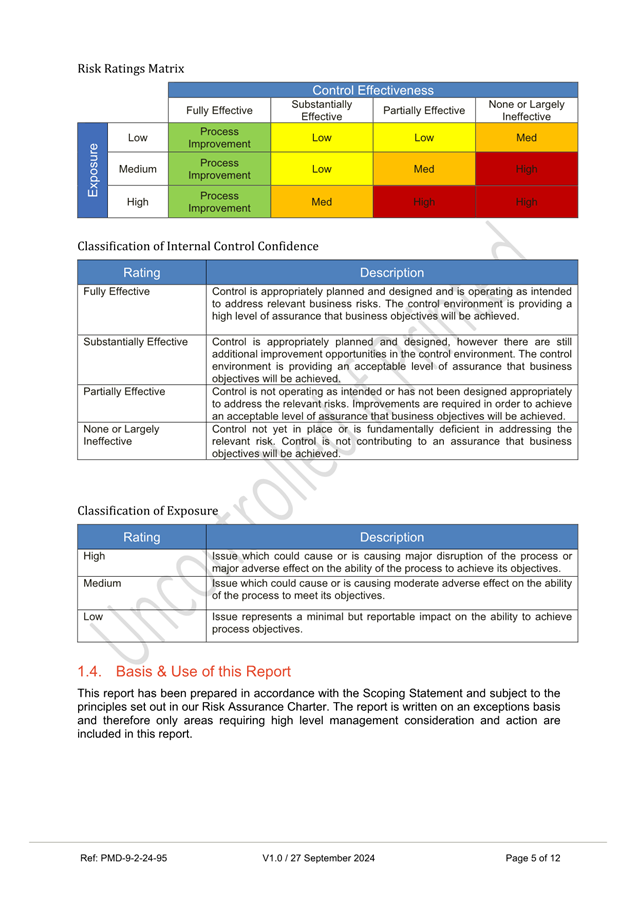

1.4 Environmental,

Social & Governance Review Report

· HDC’s

Risk Assurance function has undertaken a review of Council’s current

ability to achieve Environmental, Social & Governance (ESG) reporting

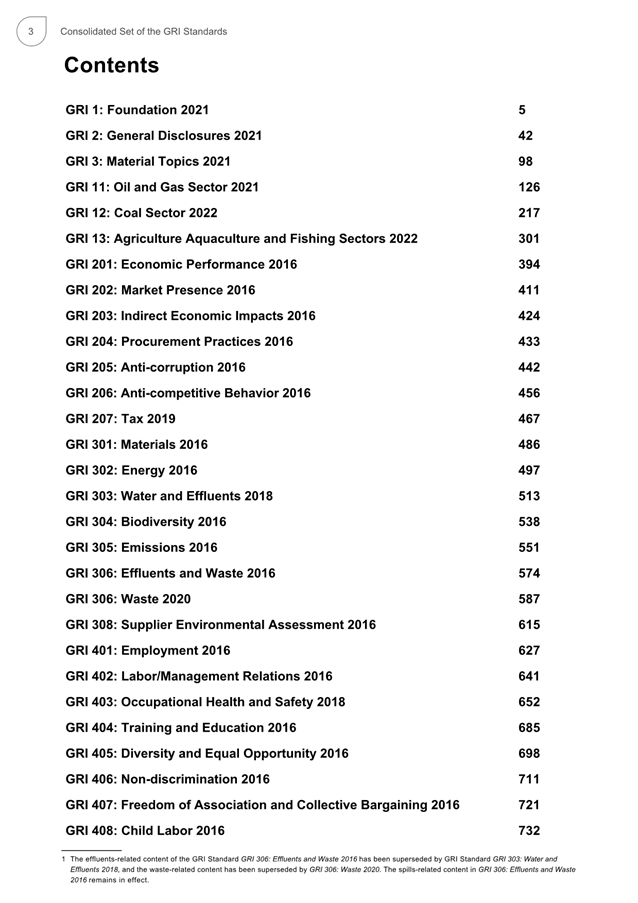

requirements (Attachment 3).

· This

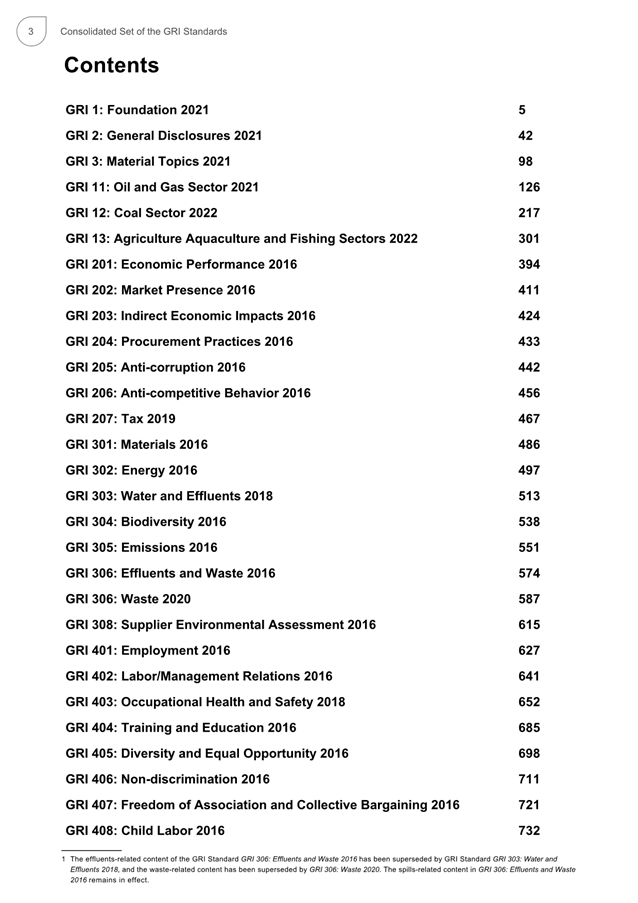

review was carried out as a gap analysis and utilised Sustainability Standards

from the Global Reporting Initiative (GRI), which are considered best practice

globally for sustainability or ESG reporting purposes and are used by many

large corporations already completing non-financial reporting each year. A copy

of the full GRI Standards is provided (Attachment 4)

· Additionally,

there are organisations voluntarily reporting on ESG standards already, which

may include disclosures relating to climate risks and/or impacts, their

workforce diversity, equity and inclusion (DE&I), impacts to the wider

community, and a raft of other topics.

· HDC

is not currently required to make non-financial disclosures, compared to other

entities which are mandated to make climate-related disclosures under

legislation. There are a small number of New Zealand Councils who are included

in this group of entities already.

· Given

the absence of any legislative requirement at this point in time, the focus of

this review was to assess the ability of Council’s current operations in

meeting ESG reporting requirements. The review did not assess whether the

content of any such report would meet community expectations.

· The

review resulted in an overall rating of substantially effective, with

four low risk findings and five subsequent recommendations.

· These

five recommendations are all associated with the collection and storage of

relevant information at an organisational level, which would enable a

centralised approach to compiling a potential ESG report, should it be either

required or pursued voluntarily in future.

|

Recommendation

|

Rating

|

|

Consideration could be

given to a central register for recording any known instances of

non-compliance across the organisation.

|

Low

|

|

Consideration could be

given to developing a mechanism which records membership associations of

staff members and Council Groups (e.g. Taituarā, industry bodies).

|

Low

|

|

Consideration should be

given to developing a mechanism that can capture all suppliers and

contractors that Council engages with, including the nature of the

engagement, to ensure that organisation-wide reporting can be compiled

easily.

|

Low

|

|

Greater utilisation

(through directive, or encouragement) of the myHR platform for recording

training attendance and performance planning would result in increased

accuracy of the reporting output.

|

Low

|

|

Consideration could be

given to proactively seeking disclosure from elected members on any social or

interest groups that they represent.

|

Low

|

· These

recommendations have been allocated to the responsible officers for review of

feasibility and priority. It is worth highlighting that the completion of these

recommendations would be providing Council with a head start for future

reporting.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Assurance Activity Update

dated 18 November 2024.

|

Attachments:

|

1⇩

|

HDC Assurance Review Plan 2024-2027

|

PMD-9-3-24-94

|

|

|

2⇩

|

Executive Summary - Fees & Levies Report (Crowe)

|

PMD-9-3-24-96

|

|

|

3⇩

|

Executive Summary - ESG&C Expectations Assurance

Review Report

|

PMD-9-3-24-97

|

|

|

4⇩

|

Contents of the GRI Standards

|

PMD-9-3-24-98

|

|

|

Item 7 Assurance

Activity Update

|

|

HDC

Assurance Review Plan 2024-2027

|

Attachment 1

|

|

Item 7 Assurance

Activity Update

|

|

Executive

Summary - Fees & Levies Report (Crowe)

|

Attachment 2

|

|

Item 7 Assurance

Activity Update

|

|

Executive

Summary - ESG&C Expectations Assurance Review Report

|

Attachment 3

|

|

Item 7 Assurance

Activity Update

|

|

Contents

of the GRI Standards

|

Attachment 4

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Jennie Kuzman, Health,

Safety and Wellbeing Manager

|

|

Te Take:

Subject:

|

Health, Safety &

Wellbeing Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1 The purpose of this

report is to provide information to the Risk and Assurance Committee about the

management of Health, Safety and Wellbeing risks within Council.

1.2 This issue arises due

to the Health and Safety at Work Act 2015 and the requirement of that

legislation for Elected Members to exercise due diligence to ensure that

Council complies with its health and safety duties and obligations.

1.3 This report provides a

summary update on the Health, Safety & Wellbeing activities, and

initiatives underway or planned to be undertaken within the 2024/2025 financial

year.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Health, Safety &

Wellbeing Update dated 18 November 2024.

|

3.0 Discussion – Te Matapakitanga

3.1 This

report provides a summary update on Health, Safety & Wellbeing activities,

and initiatives underway during the 2024/2025 financial year.

3.2 Policy

Development / Review

|

HSW Policy

|

Status

|

|

Overarching

Asbestos Management Plan

|

Completed.

New version issued October 2024.

|

|

Rehabilitation

& Fit-for-work Policy

|

Consultation

with staff completed October 2024. Feedback being reviewed.

Final

version to be provided to Lead Team to review in December 2024

|

|

Impairment

Policy

|

Consultation

with staff completed October 2024. Feedback being reviewed.

Final

version to be provided to Lead Team to review in December 2024

|

|

Health,

Safety & Wellbeing Policy

|

Draft

Policy reviewed by Lead Team October 2024.

Draft Policy to go to Performance and Monitoring Committee in

2025.

|

|

Mauri

tū Mauri Ora (Wellbeing) Framework and Work-related Stress Policy

|

Scheduled

to be reviewed following the receipt of the Psychosocial (Wellbeing)

Assessment Report.

|

|

Health,

Safety & Wellbeing Manual

|

Review

Underway.

Currently

being reviewed by HSW team.

|

|

Respiratory

Protection Policy and Programme

|

Scheduled

to be reviewed in 2025

|

|

Hearing Protection Policy & Programme

|

Scheduled

to be developed in 2025

|

|

Menopause

Policy

|

Scheduled

to be developed in 2025

|

3.3 Audits

and Assessments

3.4 The Psychosocial Risk

Assessment is currently being undertaken by an external party (Umbrella). The

survey portion has been completed and focus group interview are in

progress. A report is expected in December 2024.

3.5 Inspections

are currently being undertaken by an external party (Envirohaz) for renewal of

Council’s Hazardous Substances location test certificates at:

· Ōmarunui

Landfill

· Clive

Wastewater Treatment Plant

· Splash

Planet

3.6 Exposure monitoring is

scheduled to be undertaken by an external party (Air Matters) in November 2024

with the following teams:

· Ōmarunui

Landfill

· Water

Operations

· Tomoana

Showgrounds

· Splash

Planet

· Cemetery

& Crematorium

Attachments:

There are no attachments for this report.

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Regan Smith, Chief Risk

Officer

|

|

Te Take:

Subject:

|

Risk and Assurance

Committee Status of Actions and Work Programme

|

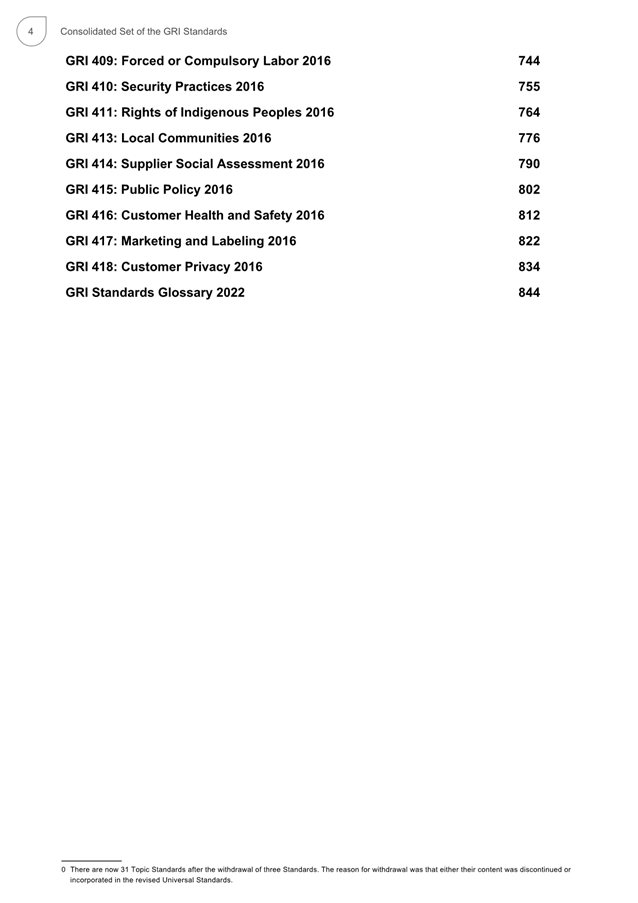

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this

report is to present the status of actions and a revise annual work programme

to the Risk & Assurance Committee for feedback and adoption.

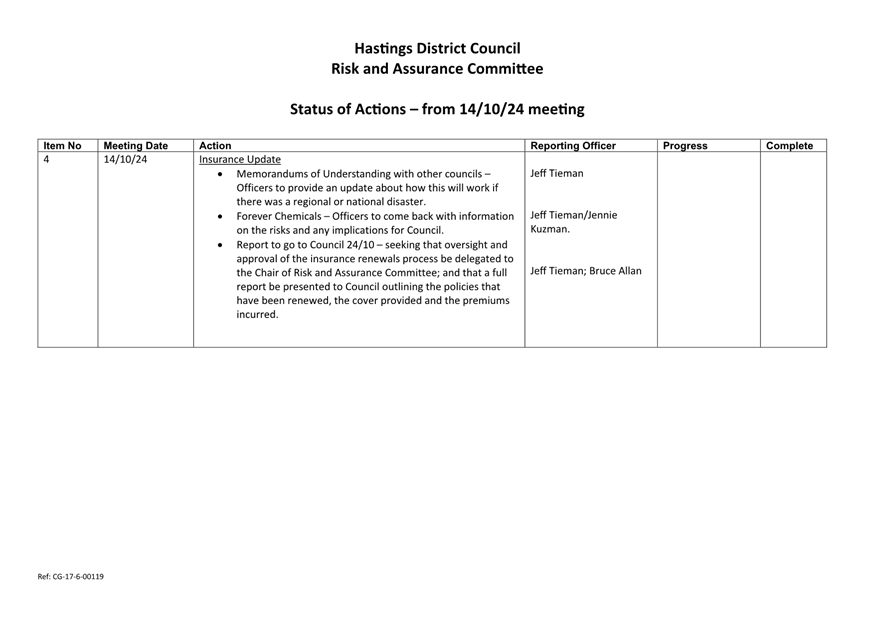

1.2 The Status of Actions

is included for reference (Attachments 1 and 2). Updates on several

items are included on the agenda for the current meeting. Since the last

meeting the following actions have been progressed:

· Progress is being

made on improving the timeliness of reporting financial information through to

Performance and Monitoring Committee.

· An inventory of

Council assets and infrastructure that may be affected by a subduction zone

event has been complied. A summary is being developed for reporting to the

Committee.

· The effects of a

change in Council credit rating has been covered at a Council workshop.

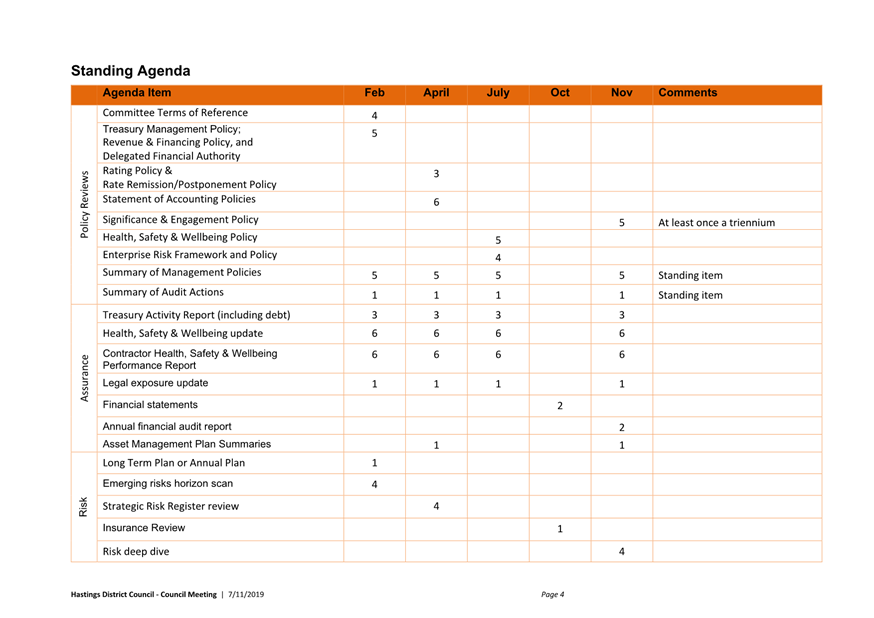

1.3 A revised work

programme has been developed that matches the Committee responsibilities under

the Terms of Reference to the programme of activities planned for the year (Attachment

3).

1.4 The intention is to

enable the Committee to verify the intended annual work programme covers a

suitable range of activities to fulfil the Committee’s responsibilities.

1.5 Due to the Local

Government election next calendar year, it will be necessary to adjust the

standard meeting cycle to enable the out-going Council to adopt the Annual

Report prior to the election. To achieve this the Finance team is working with

the Council auditors to have the audit report completed in time for a meeting

in late September or early October.

|

2.0 Recommendations -

Ngā Tūtohunga

A) That the Risk

and Assurance Committee receive the report titled Risk and Assurance

Committee Status of Actions and Work Programme dated 18 November 2024.

B) That the

Committee adopt the revised work programme (IRB-3-15-24-126) and Standing

Agenda items.

|

Attachments:

|

1⇩

|

Status of Actions from Risk and Assurance Committee

meeting held on 5 August 2024

|

IRB-3-15-24-125

|

|

|

2⇩

|

Status of Actions from Risk and Assurance Committee held

on 14 October 2024

|

CG-17-6-00156

|

|

|

3⇩

|

Committee Standard Work Programme 2024

|

IRB-3-15-24-126

|

|

|

Item 9 Risk

and Assurance Committee Status of Actions and Work Programme

|

|

Status of

Actions from Risk and Assurance Committee meeting held on 5 August 2024

|

Attachment 1

|

|

Item 9 Risk

and Assurance Committee Status of Actions and Work Programme

|

|

Status of

Actions from Risk and Assurance Committee held on 14 October 2024

|

Attachment 2

|

|

Item 9 Risk

and Assurance Committee Status of Actions and Work Programme

|

|

Committee

Standard Work Programme 2024

|

Attachment 3

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Graham Palmer, Climate

Action Officer

Steffi Reeves-Bird, Risk

Manager

|

|

Te Take:

Subject:

|

Risk Deep Dive - Climate

Action

|

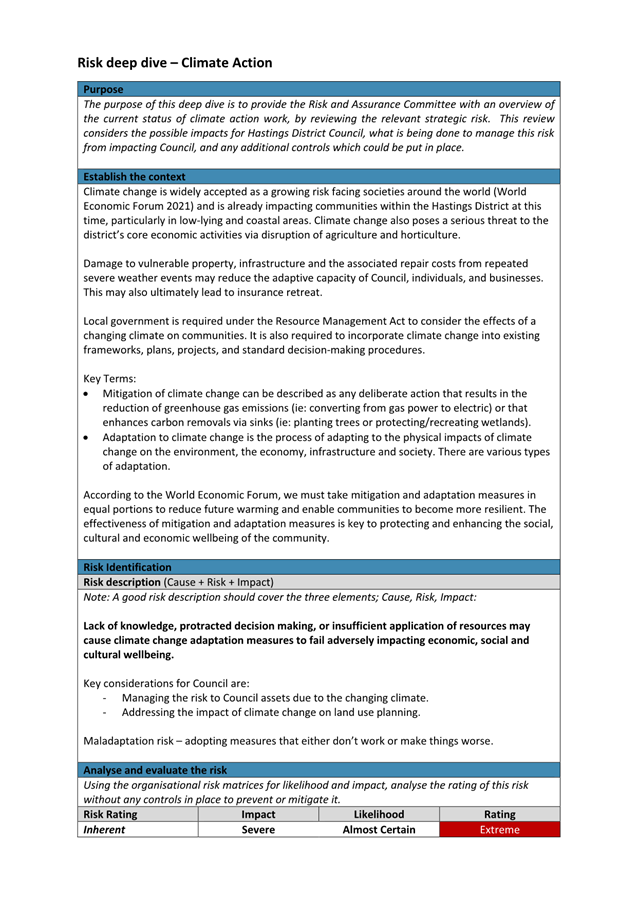

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

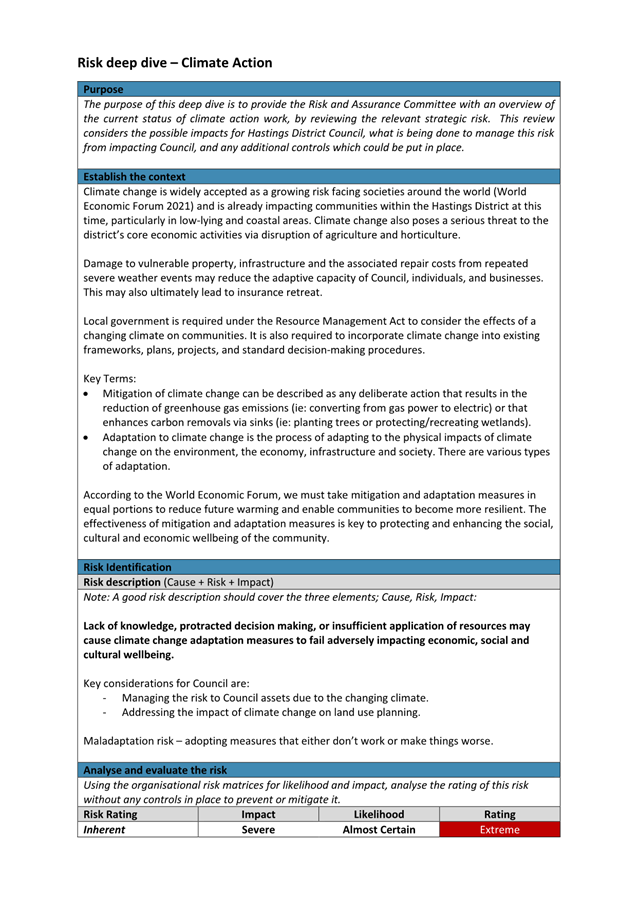

1.1 The purpose of the

report is to provide the Committee with an update and overview of the current

risk profile for climate change risk, through a risk deep dive.

1.2 Council’s

strategic risk register includes the identified risk of ‘Failure of

climate adaptation’ and the attached deep dive is primarily focused on

this risk, along with highlighting recent work led by Council’s Climate

Action Officer.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk

and Assurance Committee receive the report titled Risk Deep Dive - Climate

Action dated 18 November 2024.

|

Attachments:

|

1⇩

|

Risk Deep Dive

|

CG-17-6-00149

|

|

|

Item 10 Risk

Deep Dive - Climate Action

|

|

Risk Deep

Dive

|

Attachment 1

|

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Megan Taylor, Finance

Operations Manager

|

|

Te Take:

Subject:

|

Rates Update

|

1.0 Executive Summary

– Te Kaupapa Me Te

Whakarāpopototanga

1.1 The

purpose of this report is for Officers to provide the Risk and Assurance

Committee an update of the Hastings District Council’s policy on rates

arrears, along with details of the total overdue rates and some trends over

time.

1.2 Rates Update

Summary overview of rates

· Total rates

charged for the 2024/25 financial year: $152,457,903.28

· Total properties

34,291

· Total rates left

owing for the 2024/25 financial year as of 31st October $109,935,128.63

including rates arrears and instalments not yet due.

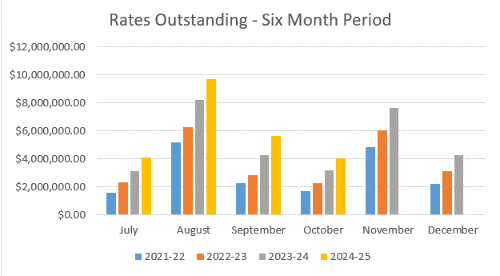

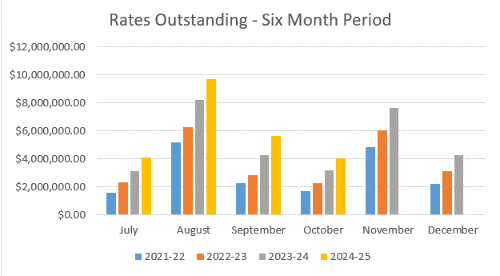

1.3 Below is a comparison

of rates outstanding for July-December for the last four financial years.

This year’s increase can be partly attributed to the rates increase;

however, we have seen a significant increase in rate payers struggling to meet

all their financial commitments.

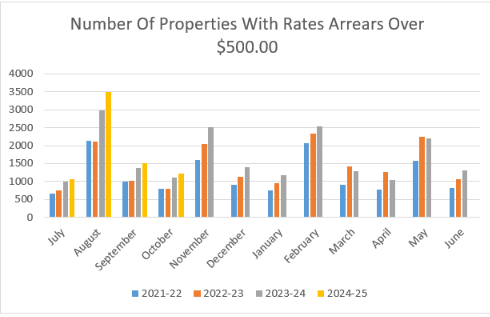

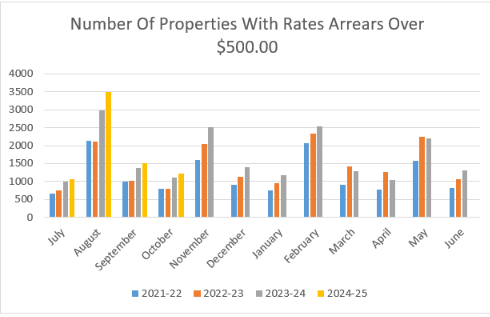

1.4 Below is a comparison

of the number of properties with rates arrears over $500.00 over a twelve-month

period for the last four financial years. The number of properties in

arrears increased in August however they have significantly decreased since our

new Credit Controller has started.

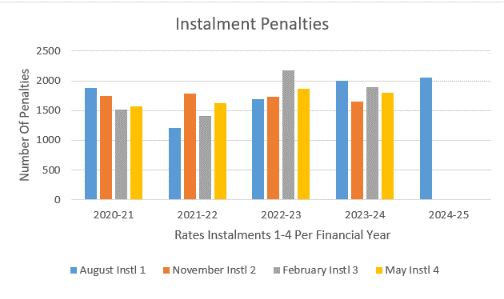

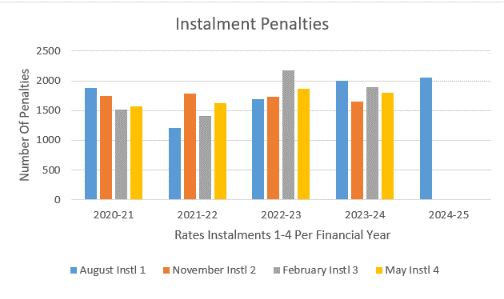

1.5 Below is a comparison

of the number of penalties that have been applied for each instalment over the

last four financial years. We are hoping with the introduction of the

bulk texting in the new year, we will see the number of penalties reduce.

Impact

Of Credit Controller

1.6 The Credit Controller

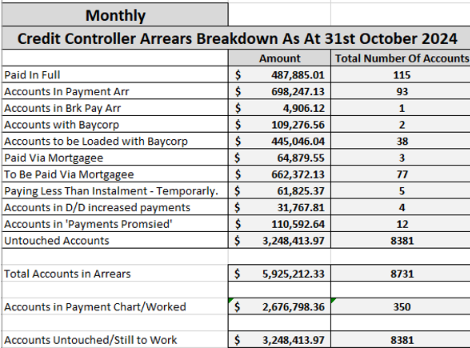

started on the 9th September and has already made a significant difference to

overdue rates. Numerous rate payers have been contacted to discuss their

overdue accounts.

1.7 Summary overview of

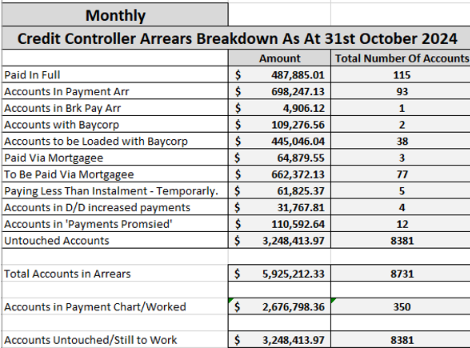

what the Credit Controller has recovered

· By 31st October

115 accounts had been paid in full totalling $487,885.01 after being actively

followed up by the Credit Controller.

· 77 Mortgage

demands will have been sent by the end of February totalling $662,372.13 which

will be paid by the mortgagees.

· 93 rates payers

have had payment arrangements put in place totalling $698,247.13. We have

a further 12 accounts totalling $110,592.64 which we have been advised will be

paid within the next six weeks.

· A total of

$445,046.04 is to be lodged with Council’s debt collection agency.

Below is a table showing what the

Credit Controller has achieved so far:

2.0 Processes for collection

and enforcement of rates

2.1 Rates Due Dates

Rating

by Instalments - HDC provides for rates to be paid in four three-monthly

instalments. The due dates for payment falling on the third Friday in August,

November, February and May.

2.2 Penalties

Instalment penalties - are applied

three working days after the due date.

Arrear’s penalties - are applied

to arrears owing in July and January.

We are currently looking into a

bulk e-text process that will be send out a txt to rate payers, who

haven’t made payment by the due date. We will look to send these

reminders one day before the penalty is applied as a reminder to those that

have forgotten to pay.

2.3 Arrears on

properties with a mortgage

Where a mortgage exists, Council

can recover unpaid rates from a mortgagee under legislation. There is a

minimum time in which this can be used, the earliest being the 1st November in

the financial year after first assessment of the rates (e.g. rates first

assessed in the 2023/24 financial year cannot be recovered from a mortgagee

until 1st November 2024).

To collect from a mortgagee, Council

must first send them a notice stating that the rates on the rating unit are

unpaid, and the local authority has the power to recover the rates from

them. Recovery cannot take place until at least three months after

delivery of the notice (through the mortgagee can make a voluntary

payment). These notices should be sent in July-September so that any

collection can occur in November and December.

In cases where a local authority

recovers from a mortgagee, the amount of the rates must be added to the

mortgage and is subject to all of the terms of the mortgage, i.e. the mortgagee

can charge interest on that amount.

Before Council proceeds with

recovering unpaid rates from a mortgagee, a phone call is made to the rate

payers to discuss arrears owing from previous

financial year/s. Officers will discuss payment options available and

will offer payment arrangement if needed. If unable to get the rate payer to

make payment in full or set up payment arrangement, then a letter of intention

is sent.

2.4 Arrears on

properties with no mortgage

If there is no mortgage on the

property a phone call will be made to the property owner advising of arrears

owing. The property owner will need to be make payment in full or set up

a payment arrangement. The property owner will be advised of the consequences

of non-payment and/ or sticking to the agreed payment arrangement. If

they still don’t pay in the required time frame, then a letter will be

sent to the property owner advising the debt has been lodged with a debt

collection agency for further collections.

2.5 Judicial

proceedings

To recover rates through the courts,

proceedings for recovery this way cannot be lodged until the debt has been

unpaid for at least four months. At the time you can also add any other

rates that are overdue by at least one month.

2.6 Abandoned

Land

Abandoned Land is any rating unit on

which rates have not been paid for three years or more, and where the

ratepayer:

· Is unknown, or

· Cannot be found

after due inquiry and has no known agent, or

· Is deceased and has

no known agent, or

· Has given notice

that they have abandoned the land or intend to abandon the land

We currently have one property

where both the owners are deceased, there is no probate. The site is vacant

with no dwelling, HDC’s current debt collection agency has recommended

treating this as abandoned land.

|

3.0 Recommendations

- Ngā Tūtohunga

That the Risk

and Assurance Committee Meeting receive the report titled Rates Update dated 18

November 2024.

|

Attachments:

There are no attachments for this report.

Hastings

District Council: Risk and Assurance Committee Meeting

Te Rārangi Take

Report to Risk and Assurance Committee

|

Nā:

From:

|

Jess Noiseux, Strategic

Financial Advisor

Aaron Wilson, Financial

Controller

|

|

Te Take:

Subject:

|

2023/24 Audit Report on Control

Findings and issues identified

|

1.0 Purpose and summary - Te Kaupapa Me Te Whakarāpopototanga

1.1 The purpose of this

report is to present the Report on Control Findings for the year ended 30 June

2024 from Council’s auditors Ernst & Young (EY) from their audit of

the Council’s controls and processes as well as the full 2023/24 Annual

Report.

1.2 Attachment 1

(which will be circulated at the meeting) is the Report on Control Findings to

Council for the year ended 30 June 2024 from Council’s auditors EY.

|

2.0 Recommendations -

Ngā Tūtohunga

That the Risk and Assurance

Committee receive the report titled 2023/24 Audit Report on Control Findings

and issues identified dated 18 November 2024.

|

3.0 Discussion

3.1 Officers have received

and made comments on the observations raised by EY for the 2024 audit. At the

time of writing this report, EY were in the process of finalising the report.

Officers will provide copies of this final report at the meeting.

3.2 There were four

matters raised that were either a slight variation from the 2022/23 report or

the matter has not yet been resolved. These issues included:

· Performance

Information in relation to Customer Complaints

Council have been qualified on this

matter since 2020. Officers have worked to significantly improve the reporting

of customer calls received through Council’s internal Customer Call

Centre and EY concluded last year that Council is collecting and recording

customer calls correctly. There are still issues with the way the after-hours

provider reports their data through to Council. Palmerston North City Council

(PNCC) who provide the after-hour services, are moving to a new phone system

which may provide different reporting options. Officers hope that this will

resolve the issue going forward, however the change will not be in time for the

full 2024/25 financial period.

· Tracking

the cost to repair infrastructure

With the impact of Cyclone Gabrielle

on the roading network, there were complex accounting difficulties that were

encountered in both 2023 and 2024.

Last year the complexities lay in

assessing the damage to the roading network, determining impairment values and

classifying costs correctly in regard to restoration versus repair. Officers

are pleased to report that these matters were materially resolved through the

2023/24 audit process.

In 2024, while it still remained

difficult to ensure costs were correctly classified, Officers also had to

ensure the costs were appropriately categorised for funding eligibility

purposes (i.e. NZTA subsidies or Crown Infrastructure Partners).

Officers have been working closely

with Council asset managers to ensure works are being appropriately coded based

on the nature of those works, which in turn drives the recognition of those

costs as either operational or capital in nature, as well as whether they are

funded by NZTA subsidies (at various rates) or CIP at 100%.

Throughout the year, there were

changes to what was and wasn’t eligible under various funding streams for

subsidies or reimbursements. This meant multiple journals in the finance system

to ensure final costs ended up in the correct place from both an accounting

treatment point of view, and a funding point of view. At times this was complex

to detail to the auditors and Officers needed to work closely with them to show

how the evidence tied in. Ultimately Officers were able to demonstrate that

costs had been correctly categorised, coded and claimed under the correct

funding streams, albeit in a roundabout way due to the changing environment.

As we progress through the recovery

phase, Officers expect this to settle and that less re-coding will be required

which reduces the risk for inaccuracies within the financial ledger and allows

for an easier audit trail.

· Valuation

of Three Waters assets

In 2023 EY raised an issue around

how Councils Three Waters assets are valued. All prior valuations have been

completed in house and then externally reviewed. EY recommended Council move to

an external valuer given the scale of three water assets as well as the access

that an external professional valuer has to full asset construction cost

databases to give a wider view than just that of Council.

Officers are working with the

Regional Recovery Agency to enable an external party valuation over all the

Hawkes Bay Councils three water assets as part of the business case for Three

Waters Done Well.

· Management

of Accounts Receivable Utilising Systems Based Reports

This matter was first raised in 2023

and speaks to the shortcomings of the current Property & Rating system

which includes Councils Accounts Receivable functions. EY raised the issue due

to the limited reporting functionality within the system which requires

significant management time and intervention to provide effective insights from

the reporting available.

Council is the in the process of

upgrading the finance system as part of Project Genesis, with the Property and

Rating system to follow. Officers will work with providers to see what new

reports may be available to address concerns raised.

3.3 EY also raised two new

moderate matters, and three new low risk matters. With the EY report being

finalised at the time of writing this report, Officers will speak to these new

matters as part of the presentation of this paper.

Attachments:

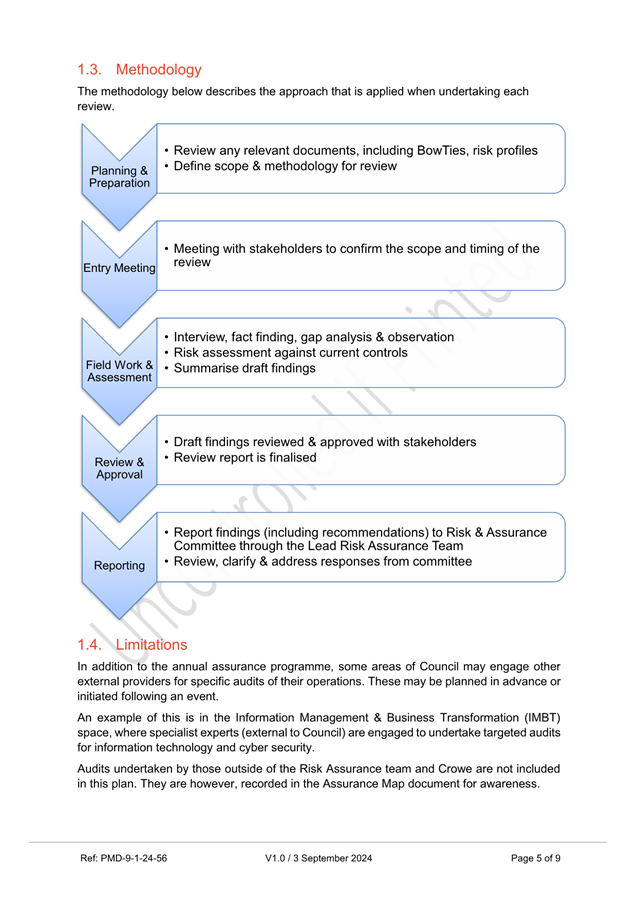

There are no attachments for this report.